Scenario modeling and forecast of the degree of depreciation of fixed assets at manufacturing enterprises in Russia’s regions

Автор: Naumov Ilya V., Nikulina Natalya L.

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Science, technology and innovation studies

Статья в выпуске: 4 т.15, 2022 года.

Бесплатный доступ

In a deteriorating geopolitical situation and under the pressure of sanctions on the Russian economy, its manufacturing enterprises are facing significant restrictions in the import of high-tech equipment and materials necessary for technical re-equipment and modernization of the fixed assets they use. These restrictions contribute to increasing the degree of their deterioration and will do so in the future as well. The hypothesis of our study consists in the assumption that the dynamics of fixed assets depreciation at enterprises is influenced not only by the volume of attracted investments, but also by other factors, and that the degree of their impact in different groups of regions is differentiated. The aim of the work is to design forecast scenarios that would show the changes in the degree of fixed assets depreciation at manufacturing enterprises, taking into account the differentiated influence of factors. The study presents a methodological approach based on statistical and regression analysis using panel data and autoregressive integrated moving average (ARIMA) model to identify factors affecting the dynamics of fixed assets depreciation at manufacturing enterprises in various regions and design a system of forecast scenarios for its changes in the future. We group the regions according to the degree of depreciation of fixed assets of manufacturing enterprises (we identify groups of regions with an extremely high level of fixed assets depreciation, and the levels above and below the Russian average). Using regression models we identify the differentiated influence of factors on the dynamics of fixed assets depreciation: in the first and third groups of regions, the key factor in increasing depreciation is the difficult financial situation of enterprises; in the second group - insufficient volume of attracted investments in fixed assets. For each group of regions, autoregressive modeling of the dynamics of these factors is carried out using a moving average to form the most likely forecast scenarios for changes in the degree of fixed assets depreciation at manufacturing enterprises until 2024. As a result of forecasting, we identify regions with the most likely dynamics of further increase in the degree of depreciation of fixed assets of enterprises; these regions should become a priority in obtaining state support for the implementation of industrial policy in Russia.

Depreciation of fixed assets, manufacturing industry, scenario modeling, forecasting, regression analysis, arima modeling, russia’s regions

Короткий адрес: https://sciup.org/147238475

IDR: 147238475 | УДК: 332.14 | DOI: 10.15838/esc.2022.4.82.10

Текст научной статьи Scenario modeling and forecast of the degree of depreciation of fixed assets at manufacturing enterprises in Russia’s regions

The state of fixed assets of industrial enterprises in Russia’s regions has approached a critical level. The depreciation degree of fixed assets of manufacturing production in the Russian Federation at the end of 2020 was 51.9%, and the share of fully worn out fixed assets in the total volume of fixed assets was 20.3%. S.D. Bodrunov noted: “Over the previous 25 years, both the commissioning of new fixed assets and the disposal of especially outdated, worn-out funds have been happening at a completely insufficient pace. The whole period is characterized by a low level of investment in the renewal of fixed capital, which stems from the overall low level of gross accumulation in the economy”1. In the studies of E.A. Panova2, E.V. Lyadova (Lyadova, 2017), L.I. Lugacheva (Lugacheva, 2001), D.V. Rozov3, E.V. Vylegzhanina, V.A. Roslyakov (Vylegzhanina, Roslyakov, 2018), N. Karlova, E. Puzanova, I. Bogacheva (Karlova et al., 2019), E.K. Prokhorova (Prokhorova, 2019), M.A. Pechenskaya (Pechenskaya, 2020) and others, the researchers focus on the need to update fixed assets of industrial production, since “the worn-out state of fixed assets and technological lag do not allow enterprises to produce new types of technological products and make the equipment of enterprises less competitive”4. Studies of F. Freiberg and P. Scholz have shown that investments in modern production equipment provide cost savings, reduced production cycle time, balanced use of equipment capacity and improved product quality (Freiberg, Scholz, 2015). Also, the work of R. Boucekkine and B. de Oliveira Cruz considered the relationship between the technological renewal of fixed assets and investments (Boucekkine, Oliveira Cruz, 2015).

The renewal of worn-out, outdated production assets requires financial state support and active attraction of investments in fixed assets of other institutional sectors. In order to identify regional priorities for attracting investments in the renewal of enterprises’ fixed assets, it is necessary to assess the factors influencing their depreciation degree and to form forecast scenarios for its further change, which is the purpose of our work. In the course of the study, we have set the following tasks: to assess the depreciation degree of fixed assets of manufacturing enterprises in Russia’s regions; to determine the factors influencing the depreciation degree of enterprises’ fixed assets in the selected groups of regions; to conduct ARIMA modeling of the dynamics of established factors; to form forecast scenarios for the dynamics of depreciation of enterprises’ fixed assets taking into account the identified factors; to determine the regions in need of priority state support within the framework of the industrial policy implemented in Russia for the renewal of worn-out funds.

Theoretical review of studies on the assessment of the impact of factors on the depreciation of fixed assets of industrial enterprises

Theoretical review of works in the field of assessing factors, influencing the depreciation degree of enterprises’ fixed assets in various territorial systems, shows that researchers mainly use statistical data analysis methods (relative indicators, averages and dynamics indicators) and regression modeling methods. For instance, G.Y. Gagarina and L.S. Arkhipova have used statistical methods. As a result of the research, the authors found that the main factors for the renewal and modernization of the production potential of enterprises are “investments in fixed assets, innovation and improvement of the labor capital quality” (Gagarina, Arkhipova, 2017). M.S. Saprykina used statistical methods to analyze and predict the depreciation dynamics of enterprises’ fixed assets in the electricity production and distribution industry (Saprykina, 2020), E.S. Dzhevitskaya used them to assess the state of fixed assets of enterprises and required investments in their renewal (Dzhevitskaya, 2017), and T.Yu. Kovaleva – for the study of the state of fixed assets of the Russian economy and the effectiveness of management decisions taken by central and regional authorities in the investment sphere (Kovaleva, 2010).

L.I. Rozanova and S.V. Tishkov used the methods of horizontal and vertical analysis, detailing, grouping, comparison and synthesis, as well as graphical analysis to assess the relationship between the depreciation degree of fixed assets and the industrial applicability of innovations. The authors have concluded that “a large-scale modernization of funds is required to realize the innovative potential” (Rozanova, Tishkov, 2018).

T.V. Ogorodnikova and co-authors used the methods of correlation and regression analysis of factors influencing the depreciation degree of fixed assets to estimate the relationship of depreciation of fixed assets with a technical accelerator and an integral indicator of their physical wear (Ogorodnikova et al., 2020), E.A. Panova used them to substantiate the impact of investments in fixed assets on the reproduction of fixed assets of industrial enterprises5. In the course of econometric modeling, E.Y. Nazrullaeva confirmed the important role of investments in the technological renewal of funds6. As factors V.S. Barashkov considered not only investments in fixed assets, but also the share of technological costs per 1 ruble of innovative products7. L.H. Dikaeva analyzed the reasons for the decline in the dynamics of industrial production in the North Caucasian Federal District revealing the dependence of the renewal of fixed assets in industry on the investment volume8.

The works of M.A. Kondenkova studies the relationship between depreciation of fixed assets and the investment volumes (Kondenkova, 2017); the work of N.P. Goridko and R.M. Nizhegorodtsev – the impact of depreciation of fixed assets on the growth of inflationary processes in the economy (Goridko, Nizhegorodtsev, 2011).

Y. Kolesnik, O. Dobrovolska, I. Malyuta, A. Petrova and S. Shulyak searched for internal sources of financing for the reproduction of fixed assets of agricultural enterprises. Correlation and regression analysis allowed the authors to confirm the close relationship between the depreciation return index for effective repair of fixed assets and the investment volumes (Kolesnik et al., 2019).

E.N. Chizhova and G.G. Balabanova investigated the causes of labor productivity decline in the construction materials industry. They established the relationship between equipment wear and labor productivity growth rates (Chizhova, Balabanova, 2017).

With the help of the least squares method, D. Postigillo Garcia, A. Blasco, J. Ribal determined the necessary depreciation rate of enterprises’ fixed assets depending on the period of their use using linear, exponential and power-law regression models (Postigillo Garcia et al., 2017). The works of F.G. Alzhanova, N.K. Nurlanova and F.M. Dnisheva (Alzhanova et al., 2020), T. Franik (Franik 2007,), Lazebnik L. (Lazebnik, 2018), L. Tan, M. Hao, Ya. Zhang (Tang et al., 2013), S.N. Abieva, A.M. Kanabekova (Abieva, Kanabe-kova, 2021), S. Collings (Collings, 2016), S. Urban, A.S. Kowalska (Urban, Kowalska, 2015) also carried out the study of the relationship between investments and depreciation of fixed assets.

During the theoretical review of the works, we have revealed that the authors most often considered the volume of attracted investments in fixed assets as a factor influencing the depreciation of fixed assets of industrial enterprises. Our study assumes an assessment of the impact on the dynamics of depreciation of fixed assets and other factors.

Methodological approach to scenario modeling and forecasting of the depreciation degree of fixed assets of manufacturing enterprises in Russia’s regions

A theoretical research review in the field of assessing and forecasting the depreciation degree of fixed assets in the manufacturing industry has shown the need to develop an approach that uses statistical and regression analysis, ARIMA modeling methods in a complex to identify factors that affect the dynamics of depreciation of fixed assets in various territorial systems, and design a system of forecast scenarios for its changes in the future. Methods of statistical analysis, such as the average value and the standard deviation, at the initial stage of the study will help to identify the regions for which the problem of depreciation of fixed assets of industrial enterprises is most acute. To identify such regions, we propose to calculate the upper limit of the spread of the depreciation degree of fixed assets relative to the average level (1):

у = ц ^(S^-^2. (1) max vi ' n , where Vmax — the upper limit of the spread of the depreciation degree of fixed assets in manufacturing (at the end of 2020), %; V — the depreciation degree of fixed assets of manufacturing enterprises (at the end of 2020), %; V — average Russian level of depreciation of fixed assets of manufacturing enterprises (at the end of 2020), %.

Regions where the depreciation degree of fixed assets of manufacturing enterprises at the end of the year exceeds the limit (V > Vmax ) , will be classified as territories with an extremely high level of their deterioration. To confirm the correctness of the regions’ assignment to this group, we also propose an assessment of the complete depreciation of funds – the calculation of the proportion of fully worn-out fixed assets at the full accounting value in manufacturing. This indicator in the regions of the first group should also significantly exceed the average Russian level. Statistical indicators will also be used to search for regions with a high depreciation level of fixed assets of enterprises ( V i > V ) , exceeding the average Russian level, as well as regions with depreciation of fixed assets below the average level ( V , < V ) , for which the tasks of modernization of fixed assets are not as acute as in the regions the first and second groups.

At the next stage of the study, within the framework of the selected groups of regions, we propose to build regression models using panel data to assess the impact of factors on the dynamics of depreciation of fixed assets of manufacturing enterprises: models with fixed and random effects, using the combined least squares method and adjusted for heteroscedasticity. The construction of regression models within the selected groups will be carried out due to the high differentiation in the depreciation degree of fixed assets in different regions. This will make it possible to increase the uniformity of the distribution of data used for modeling, and to obtain more reliable models with robust estimates that are resistant to various kinds of outliers and interference.

The main factors in the models will be the investment volume in fixed assets by type of activity “Manufacturing”, the net financial result of enterprises for this activity type, the share of unprofitable manufacturing enterprises from the total number of organizations of this activity type and the number of advanced production technologies used. To build regression models, we plan to use the available statistical data of the Federal State Statistics Service for 85 Russia’s regions from 2011 to 2020. To select the optimal model, we will carry out a panel analysis using the Durbin – Wu – Hausman test and the Schwarz, Akaike and Hannan – Quinn information criteria; we will evaluate the reliability of the main parameters of the model using standard errors and P -values, to check for structural shifts in the sample of observations we will use the Chow test. We suppose to evaluate the reliability of the model using the coefficient of determination and the probability of fulfilling the null hypothesis of its insignificance ( F -value). We will pay special attention to the assessment of the presence of heteroscedasticity in the model (using the White test), autocorrelation between residuals (using Wooldridge and Durbin – Watson test), as well as the normality of the distribution of model errors. The constructed models will allow determining the factors that have a significant impact on the dynamics of depreciation of fixed assets of manufacturing enterprises in various groups of regions, and in the future, building medium-term forecast scenarios for its changes.

To form the most likely forecast scenarios for changes in the depreciation degree of fixed assets of industrial enterprises in Russia’s regions until 2024, we assume ARIMA modeling and forecasting of the dynamics of key factors, the influence of which was established at the previous stage of the study. We propose to use the forecast values of the dynamics of changes in factors calculated as a result of ARIMA modeling, which preserve the noted past trends in the future, as well as extremely possible forecast values, at the next stage to form three forecast scenarios for changes in the dynamics of depreciation of fixed assets of manufacturing enterprises in the regions: inertial, assuming the preservation in the future of the trend of depreciation of funds noted over the previous 10 years, pessimistic and optimistic. The constructed forecast scenarios will help to determine the regions in which, under the influence of established factors, it is possible to further actively increase the worn-out fixed assets of manufacturing enterprises, as well as the regions in which this problem will be solved, and the proportion of worn-out fixed assets will decrease. The presented methodological approach to scenario modeling and forecasting the dynamics of depreciation of fixed assets will make it possible to determine the spatial priorities of solving the problem of updating fixed assets of manufacturing enterprises, which are so necessary for the implementation of industrial policy in Russia’s regions.

Research results

In order to correctly assess the depreciation of fixed assets of manufacturing enterprises in Russia’s regions and to study the factors influencing its dynamics, we have carried out a grouping of regions ( Tab. 1 ).

The first group of regions included territories with an extremely high depreciation level of enterprises’ fixed assets exceeding one standard deviation from the average Russian level (with the depreciation degree of funds of more than 60% and a specific weight of fully worn-out funds of more than 25%). Among the regions of this group, enterprises of the Komi Republic had the highest depreciation degree of fixed assets (78.2%). More than 50% of all fixed assets of enterprises in this region at the end of 2020 were completely worn out. In Sevastopol, the share of fully worn-out funds of manufacturing enterprises was 45.2%. Regions such as Astrakhan, Samara, Kostroma, Ryazan, Yaroslavl and Tambov oblasts, the Republic of Khakassia, Khanty-Mansi, Yamalo-Nenets and Chukotka autonomous okrugs were also distinguished by a high depreciation level of enterprise funds. The average depreciation level of fixed assets of enterprises in the regions of this group was 65.3%, and the average proportion of fully worn-out funds was 32.7%.

In the regions of the second group, the depreciation degree of fixed assets of manufacturing enterprises was lower than in the first group, but exceeded the national average of 51.9%. The proportion of fully worn-out enterprise funds in most regions of the second group was also higher than the national average of 19.3% (see Tab. 1). The highest proportion of fully worn-out enterprise funds at the end of 2020 was observed in the Republic of Bashkortostan, the Jewish Autonomous Oblast, Nenets Autonomous Okrug, the Chelyabinsk, Pskov, Nizhny Novgorod, Saratov and Vologda oblasts. The average depreciation level of enterprises’ fixed assets in the regions of this group was lower than in the regions of the first group (54.8%), and the average proportion of fully worn-out funds was almost two times lower (19.8%).

The third group includes regions with the depreciation level of manufacturing enterprises below the average Russian level. At the same time, regions with a high proportion of completely worn-out funds were allocated in this group. So, in the Ivanovo Oblast, 24.6% of fixed assets were considered completely worn-out by manufacturing enterprises, in the Perm Oblast – 21.6%, the Smolensk Oblast – 22.2%, the Kurgan Oblast – 21.6%, the Tyumen Oblast – 21.1%, the Republic of Buryatia – 21%. In other regions of this group, the proportion of fully worn-out funds did not exceed 19%.

Table1. Depreciation degree of fixed assets of manufacturing enterprises in Russia’s regions and share of fully worn-out funds at the end of 2020, %

|

Region |

Depreciation degree of funds |

Proportion of fully worn-out funds |

Region |

Depreciation degree of funds |

Proportion of fully worn-out funds |

|

First group of regions (with extremely high level of depreciation of fixed assets of enterprises) |

Second group of regions (with the level of depreciation of fixed assets of enterprises above the average in Russia) |

||||

|

Komi Republic |

78.2 |

53.3 |

Jewish AO |

59.7 |

23.6 |

|

Astrakhan Oblast |

67.6 |

30.3 |

Saint Petersburg |

57.5 |

20.9 |

|

Sevastopol |

67.6 |

45.2 |

Republic of North Ossetia |

57.2 |

16.1 |

|

Republic of Khakassia |

66.6 |

30.7 |

Republic of Bashkortostan |

57.1 |

26.0 |

|

Samara Oblast |

65.4 |

32.4 |

Chelyabinsk Oblast |

56.9 |

24.2 |

|

Chukotka AO |

64.0 |

23.0 |

Kaliningrad Oblast |

56.5 |

18,8 |

|

Khanty-Mansi AO |

63.2 |

30.8 |

Saratov Oblast |

56.4 |

23.1 |

|

Kostroma Oblast |

63.1 |

27.6 |

Nizhny Novgorod Oblast |

56.3 |

23.2 |

|

Yamalo-Nenets AO |

62.6 |

32.9 |

Volgograd Oblast |

56.3 |

20.7 |

|

Ryazan Oblast |

62.4 |

29.3 |

Republic of Kalmykia |

56.1 |

13.8 |

|

Yaroslavl Oblast |

62.4 |

31.4 |

Tomsk Oblast |

55.8 |

19.2 |

|

Tambov Oblast |

60.5 |

25.5 |

Vologda Oblast |

55.5 |

23.2 |

|

Third group of regions with the depreciation level of fixed assets of manufacturing enterprises below the average in Russia (other regions) |

Mari El Republic |

55.1 |

18.0 |

||

|

Belgorod Oblast |

54.9 |

19.0 |

|||

|

Khabarovsk Krai |

54.7 |

18.9 |

|||

|

Tver Oblast |

54.6 |

20.0 |

|||

|

Altai Oblast |

54.4 |

20.2 |

|||

|

Republic of Adygea |

54.4 |

19.3 |

|||

|

Novosibirsk Oblast |

54.3 |

20.2 |

|||

|

Moscow Oblast |

54.3 |

16.4 |

|||

|

Republic of Mordova |

53.9 |

16.1 |

|||

|

Chuvash Republic |

53.9 |

22.1 |

|||

|

Lipetsk Oblast |

53.9 |

19.4 |

|||

|

Irkutsk Oblast |

53.7 |

20.7 |

|||

|

Pskov Oblast |

53.1 |

23.5 |

|||

|

Nenets AO |

52.9 |

25.3 |

|||

|

Vladimir Oblast |

52.7 |

16.4 |

|||

|

Rostov Oblast |

52.3 |

20.5 |

|||

|

Republic of Dagestan |

52.1 |

7.8 |

|||

|

Karachay-Cherkess Republic |

52.1 |

22.3 |

|||

|

Ulyanovsk Oblast |

51.8 |

19.5 |

|||

|

Omsk Oblast |

51.8 |

16.4 |

|||

Note: own calculation according to the Federal State Statistics Service data.

To search for factors that have a significant impact on the dynamics of depreciation of enterprises’ fixed assets in the manufacturing industry in the considered groups of regions, we have carried out a regression analysis using panel data. We have used 120 observations when constructing regression models for the first group of regions (for 12 regions for the period from 2011 to 2020). After removing factors with regression coefficients insignificant in P-value and standard errors, a regression model with fixed effects was recognized as optimal:

Y = e1 - 824 x X0 - 619 ,

where Y – depreciation degree of fixed assets of manufacturing enterprises (at the end of the year), %; e 1.824 — constant in the regression model; Х – share of unprofitable enterprises by type of activity “Manufacturing”, % of the total number of organizations.

Table 2 presents the main parameters of this model and the results of assessing their statistical significance.

Parameters of the regression model with fixed effects are statistically significant, the correlation relationship between the variables is close (R = 0.78), about 61% of the data variance is explicable by the constructed model. There is homoscedasticity in the model, that is, the constancy of the variance in the observations is fixed, in addition, the model errors obey the law of normal distribution, there is no autocorrelation between the residuals, as evidenced by the Durbin–Watson statistics (1.5 < DW < 2.5) and the Wooldridge test. The Durbin – Wu – Hausman test showed that a model with random effects better explains the relationship between variables, but based on the lowest values of the Schwarz, Akaike and Hannan – Quinn information criteria, we selected a model with fixed effects, in which the P-significance of Hausman statistics is at the level of 10%. According to the constructed model, the depreciation of degree fixed assets in the first group of regions is significantly influenced by the financial situation of manufacturing enterprises. The growth dynamics in the share of unprofitable companies observed in it indicates the difficult financial situation of enterprises in this industry, the impossibility of modernization and technological renewal of production processes which contributes to an active increase in the depreciation degree of fixed assets. The financial situation of manufacturing enterprises is particularly difficult in the Astrakhan Oblast, where, according to 2020 data9, the share of unprofitable enterprises was 57.6%. More than half of the manufacturing enterprises were unprofitable in the Republic of Khakassia (57.1%), Sevastopol (50.1%), almost half – in the Khanty-Mansi Autonomous Okrug (48.1%).

In the context of the currently increasing sanctions pressure on the Russian economy, restrictions on the import of high-tech equipment and exports of products manufactured by enterprises, which resulted from the deterioration of the geopolitical situation between Russia and Western countries in 2022, further deterioration of the financial situation of enterprises in this industry and an increase in the depreciation degree of their fixed assets is inevitable. To predict its dynamics by the end of 2024, we have carried out autoregressive

Table 2. Parameters of the regression model of the dependence of the depreciation degree of fixed assets of manufacturing enterprises on the share of unprofitable organizations in the first group of regions (with fixed effects)

|

Coefficient |

St. error |

t -statistics |

P -value |

|

|

const |

1.824 |

0.208 |

8.754 |

3.32E-14*** |

|

Х |

0.619 |

0.061 |

10.158 |

2.23E-17*** |

|

LSDV R-squared |

0.607 |

Р- value ( F ) |

7.90E-17*** |

|

|

LSDV F (12, 107) |

13.798 |

Durbin–Watson stat. |

1.823 |

|

|

Schwarz crit. |

187.775 |

Akaike crit. |

151.537 |

|

|

Parameter rho |

0.514 |

Hannan – Quinn crit. |

166.254 |

|

|

Hausman test statistic: |

H = 0.081 |

0.077 |

||

|

Non-linearity test (Zero hypothesis – dependence is linear) |

Test statistics: 45.914 |

1.24E-11 |

||

|

White’s test for heteroskedasticity (Zero hypothesis – homoscedasticity is observed – observations have a common error variance) |

Chi-square (2) = 6460.7 |

0.082 |

||

|

Wooldridge test (Zero hypothesis – autocorrelation of residues) |

Test statistics: t (2) = 9.499 |

0.061 |

||

|

Chi-square test (Zero hypothesis – normal distribution of residues) |

Chi-square (2) = 143.483 |

0.069 |

||

|

Note: *** – statistical significance at the level of 1%. Source: own compilation. |

||||

9 Source: Official website of the Federal State Statistics Service.

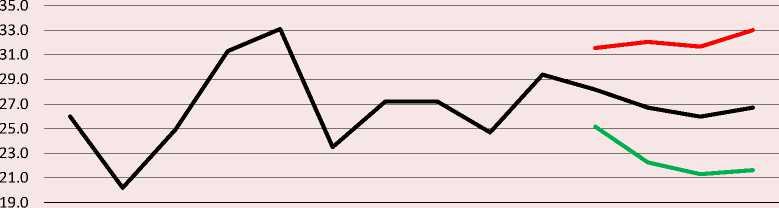

modeling of the dynamics of the key factor in the regression model presented above (the proportion of unprofitable manufacturing enterprises) using a moving average (ARIMA). This modeling method made it possible to form the most probable forecast of changes in the share of unprofitable enterprises in the regions of the first group taking into account the noted trends for the period from 2011 to 2020 (inertial) and to determine the boundaries of its possible fluctuations in the future. As an example, we present the results of the ARIMA model and forecasts of changes in the dynamics of the share of unprofitable manufacturing enterprises in one of Russia’s regions – the Samara Oblast (Tab. 3, Fig. 1).

Table 3. Results of ARIMA modeling of the dynamics of the share of unprofitable manufacturing organizations in the Samara Oblast

|

Coefficient |

St. error* |

Z |

P -value |

|

|

const |

3.3 |

0.004 |

844.0 |

0.0000*** |

|

phi_1 |

0.647 |

0.214 |

3.025 |

0.0025*** |

|

phi_2 |

-0.864 |

0.133 |

-6.523 |

6.90e-11*** |

|

theta_1 |

-1.911 |

0.617 |

-3.095 |

0.0020*** |

|

theta_2 |

1.000 |

0.418 |

1.619 |

0.011*** |

|

R -square |

0.859 |

Akaike crit. |

-7.571 |

|

|

Fixed R -square |

0.788 |

Schwarz crit. |

-5.755 |

|

|

Hannan – Quinn crit. |

-9.562 |

|||

|

Effective part |

Imaginary part |

Module |

Frequency |

|

|

AR |

||||

|

Root 1 |

0.3742 |

-1.0084 |

1.0756 |

-0.1934 |

|

Root 2 |

0.3742 |

1.0084 |

1.0756 |

0.1934 |

|

MA |

||||

|

Root 1 |

0.9554 |

-0.2954 |

1.0000 |

-0.0477 |

|

Root 2 |

0.9554 |

0.2954 |

1.0000 |

0.0477 |

|

Note: * – standard errors are calculated based on the Hessian; *** – statistical significance is at level 1%. Source: own compilation. |

||||

Basic forecasts of the dynamics of the share of unprofitable manufacturing organizations in the Samara Oblast until the end of 2024, %

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

^^^^^w Inertial : Pessimistic г Optimistic

Source: own compilation.

The results of ARIMA modeling and regression analysis formed the basis for the forecast scenarios formed regarding changes in the depreciation degree of fixed assets of manufacturing enterprises. Calculations of the expected values of depreciation of fixed assets by the end of 2024 within the framework of the inertial forecast scenario taking into account the persistence of the noted trends, showed a high probability of further increase in worn-out funds in such regions as the Komi Republic, Astrakhan Oblast and Sevastopol ( Tab. 4 ). These regions had the highest depreciation level of fixed assets of manufacturing enterprises and a high level of unprofitability of enterprises in this industry.

According to the constructed inertial scenario, by the end of 2024, an increase in the degree of worn-out fixed assets is possible in the Komi Republic from 78.2 to 78.8%, in the Astrakhan Oblast – from 67.6 to 71.3% and Sevastopol – from 67.6 to 78.5%. Further deterioration of the financial situation of enterprises in these regions, and such a scenario is currently more realistic, will lead to the impossibility of technological renewal of production processes and more serious depreciation of the funds used (in the Komi Republic up to 90.9%, the Astrakhan Oblast – 80.6% and Sevastopol – 93.1%). The implementation of this scenario will jeopardize the functioning of the entire manufacturing industry in these regions. The high proportion of unprofitable manufacturing enterprises in the Republic of Khakassia and the projected lack of positive dynamics of its changes in Chukotka Autonomous Okrug will not contribute to reducing the depreciation degree of fixed assets in them. By the end of 2024, the most likely implementation of the most pessimistic forecast scenario is that in the Republic of Khakassia, the depreciation degree of fixed assets of enterprises of this type of economic activity will reach 76.2%, and in Chukotka Autonomous Okrug – 91.6%. With such depreciation level of fixed assets, manufacturing enterprises will be unable to successfully develop and produce competitive products; therefore, industrial policy implemented at the federal and regional levels should consider these regions as priorities for attracting investment and upgrading fixed assets used by enterprises. The marked depreciation level of fixed assets of enterprises is critical and poses threats to the development of the manufacturing industry in these regions. If in the first group of regions the high depreciation level of fixed assets in the manufacturing industry was due to the difficult financial situation of enterprises, their high level of unprofitability, then in the second

Table 4. Depreciation degree of fixed assets of manufacturing enterprises in the regions of the first group in 2020 and forecast scenarios of its change by the end of 2024, %

Y = e4-11 X X-0-032, (3)

where Y – depreciation degree of fixed assets in manufacturing (at the end of the year), %; e4.11 — constant in the regression model; Х – investments in fixed assets by type of activity “Manufacturing”, million rubles.

When constructing the model, we have used 320 observations (for 32 regions for the period from 2011 to 2020). Panel diagnostics of Hausman and Breus – Pagan, assessment of the statistical significance of regression parameters and information criteria of Schwarz, Akaike and Hannan – Quinn confirmed the optimality of the regression model with fixed effects (Tab. 5). According to it, a decrease in the volume of attracted investments in fixed assets of enterprises of this economic activity type in the regions of the second group contributed to an increase in the depreciation degree of their fixed assets by 0.03%. The results of the study of the dynamics of attracted investments indicate that not all regions of the second group observed the marked trend. For example, in Saint Petersburg, the Republic of Bashkortostan, the Chelyabinsk, Kaliningrad, Nizhny Novgorod, Vologda, Moscow, Vladimir oblasts, an increase in the volume of attracted investments was noted.

The conducted autoregressive analysis using a moving average ( ARIMA ) made it possible to predict a further increase in the volume of attracted investments in these regions by the end of 2024 compared to 2020 and to generate forecast scenarios according to which a significant decrease in the depreciation degree of fixed assets of manufacturing enterprises is expected ( Tab. 6 ). The active development of the manufacturing industry in these regions will help attract investment even in the face of more pessimistic scenarios and will make it possible to modernize production processes and technologies in some manufacturing enterprises. In some regions, such as Khabarovsk Krai, Nenets Autonomous Okrug and the Republic of Kalmykia, a steady decline in the volume of attracted investments in fixed assets of manufacturing enterprises was observed during the study period.

Table 5. Regression model parameters of the dependence of the depreciation degree of fixed assets of manufacturing enterprises on the investment volume in fixed assets in the second group of regions (with fixed effects)

|

Coefficient |

St. error |

t -statistics |

P -value |

|

|

const |

4.111 |

0.147 |

27.977 |

5.56E-84*** |

|

Х |

-0.032 |

0.017 |

-1.907 |

0.058* |

|

LSDV R-squared |

0.642 |

Р -value ( F ) |

4.20E-13*** |

|

|

LSDV F (32, 287) |

4.657 |

Durbin–Watson stat. |

1.39 |

|

|

Schwarz crit. |

-191.882 |

Akaike crit. |

-316.236 |

|

|

Parameter rho |

0.786 |

Hannan – Quinn crit. |

-266.579 |

|

|

Hausman test statistic : |

H = 1.315 |

0.025 |

||

|

Non-linearity test (Zero hypothesis – dependence is linear) |

Test statistics: 22.597 |

1.998E-06 |

||

|

White’s test for heteroskedasticity (Zero hypothesis – homoscedasticity is observed – observations have a common error variance) |

Chi-square (2) = 426.372 |

0.821 |

||

|

Wooldridge test (Zero hypothesis –autocorrelation of residues) |

Test statistics: t (2) = 29.384 |

0.643 |

||

|

Chi-square test (Zero hypothesis – normal distribution of residues) |

Chi-square (2) = 1.052674 |

0.591 |

||

|

Note: * – statistical significance at the level of 10%; *** – statistical significance at the level of 1%. Source: own compilation. |

||||

Table 6. Depreciation degree of fixed assets of manufacturing enterprises in the regions of the second group at the end of 2020 and forecast scenarios of its change by the end of 2024, %

|

Region |

Depreciation degree of funds in 2020 |

Inertial scenario |

Pessimistic scenario |

Optimistic scenario |

|

Republic of North Ossetia |

57.2 |

57.2 |

61.7 |

53.1 |

|

Republic of Kalmykia |

56.1 |

58.7 |

60.2 |

57.2 |

|

Nenets AO |

52.9 |

56.0 |

58.6 |

54.1 |

|

Khabarovsk Krai |

54.7 |

64.3 |

75.8 |

54.6 |

|

Saint Petersburg |

57.5 |

43.1 |

43.8 |

42.4 |

|

Chelyabinsk Oblast |

56.9 |

42.4 |

42.8 |

42.0 |

|

Saratov Oblast |

56.4 |

44.2 |

52.7 |

37.1 |

|

Nizhny Novgorod Oblast |

56.3 |

43.5 |

44.1 |

43.0 |

|

Volgograd Oblast |

56.3 |

43.4 |

44.2 |

42.7 |

|

Vologda Oblast |

55.5 |

41.7 |

42.0 |

41.4 |

|

Belgorod Oblast |

54.9 |

44.7 |

45.2 |

44.3 |

|

Tver Oblast |

54.6 |

45.6 |

46.3 |

44.9 |

|

Altai Krai |

54.4 |

45.5 |

46.6 |

44.5 |

|

Novosibirsk Oblast |

54.3 |

44.2 |

44.8 |

43.5 |

|

Moscow Oblast |

54.3 |

42.2 |

42.7 |

41.8 |

|

Lipetsk Oblast |

53.9 |

44.0 |

44.9 |

43.1 |

|

Pskov Oblast |

53.1 |

47.6 |

48.5 |

46.7 |

|

Vladimir Oblast |

52.7 |

45.2 |

45.8 |

44.6 |

|

Rostov Oblast |

52.3 |

44.4 |

44.8 |

44.0 |

|

Ulyanovsk Oblast |

51.8 |

44.9 |

46.1 |

43.7 |

|

Omsk Oblast |

51.8 |

41.7 |

43.3 |

40.2 |

|

Source: own compilation. |

Accordingly, during the ARIMA modeling of the dynamics of this indicator, a significant decrease in the investment volumes by the end of 2024 is predicted. For instance, according to the most likely forecast, taking into account the continuation of the trend noted during 2011–2020, it is possible to reduce the volume of attracted investments by 2.9 times in Khabarovsk Krai.

As a result, the depreciation degree of enterprises’ fixed assets of this type of economic activity will increase to 64.3% (an inertial forecast scenario), and in the case of a pessimistic scenario, which is currently the most realistic, the depreciation of funds will increase to a very high level – 75.8%. ARIMA modeling allowed predicting a decrease in investments in fixed assets of manufacturing enterprises and in Nenets Autonomous Okrug (by 96.8%), as well as the Republic of Kalmykia (by 81.3%). The implementation of this forecast will negatively affect the depreciation degree of enterprises’ fixed assets in these regions; therefore, we consider it important to provide priority state support to enterprises in regions with a characteristic decline in the volume of attracted investments in fixed assets in the manufacturing industry when implementing industrial policy at the federal and regional levels.

According to the data for the end of 2020, 41 regions entered the third group of territories with a low depreciation level of fixed assets of manufacturing enterprises. The regression analysis, the results of which are presented in Table 7 , showed that the main factor influencing the dynamics of depreciation of enterprises’ fixed assets of this regions’ group, as well as the first group, is

Table 7. Parameters of the regression model of the dependence of the depreciation degree of fixed assets of manufacturing enterprises on the share of unprofitable organizations in the third group of regions (with fixed effects)

Y = e2.575 x X0'339, (4)

where Y – depreciation degree of fixed assets in manufacturing (at the end of the year), %; e 2.575 — constant in the regression model; Х – share of unprofitable organizations by type of activity “Manufacturing”, % of the total number of organizations.

However, if in the first group of regions the growth of the share of unprofitable enterprises in the manufacturing industry contributed to an increase in the depreciation degree of fixed assets by 0.62%, then in the second group of regions – by 0.34%

The constructed model has statistically significant parameters, despite the low coefficient of determination, there is a close correlation between the variables in the model ( R = 0.73). There is no heteroscedasticity in it, observations have a common error variance, there is no autocorrelation between residues, and their normal distribution is observed.

The ARIMA models of the dynamics of the share of unprofitable enterprises constructed for each region of this group and the regression model of its influence on the depreciation degree of fixed assets of manufacturing enterprises allowed forming the basic, most likely forecast scenarios for changes in the dynamics of this indicator until the end of 2024 (Tab. 8).

The inertial forecast scenario, taking into account the observed trends in the dynamics of changes in the share of unprofitable enterprises in the period 2011–2020, allowed identifying regions for which the problem of increasing the depreciation degree of enterprises’ fixed assets may become a deterrent to the development of the manufacturing industry in the short term. Such regions include the Kurgan Oblast, where, due to the likely growth of the share of unprofitable enterprises, it is possible to increase the depreciation degree of fixed assets to 68.9%, Krasnodar Krai (up to 52.8%), the Ivanovo Oblast (up to 51.9%), the Murmansk Oblast (up to 46.9%), the Republic of Buryatia (up to 45.1%), the Sakhalin Oblast (up to 45%), the Republic of Sakha (up to 34.3%) and the Republic of Tyva (up to 32.1%). If a pessimistic scenario is realized, the probability of which is currently the highest, a more significant increase in the share of unprofitable enterprises in the manufacturing industry and depreciation of fixed assets is also possible. The problem of increasing the depreciation degree of

Table 8. Depreciation degree of fixed assets of manufacturing enterprises in the regions of the third group at the end of 2020 and forecast scenarios of its change by the end of 2024, %

In order to reduce their depreciation degree, it is necessary to increase the financial stability of industrial enterprises operating in these regions, and to attract preferential bank loans for technological renewal and modernization of production processes, public investments for the implementation of large-scale projects involving the introduction of innovations and advanced production technologies. Since 2015, the tool of state co-financing of ongoing projects in the manufacturing industry from the Industrial Development Fund of the Russian Federation (IDF) has been actively used in Russia as part of the industrial policy implemented at the federal and regional levels. This tool of state support of enterprises is actively used only in 50 Russia’s entities out of 85. In addition, investment projects supported by the Fund are implemented mainly by actively developing, large manufacturing enterprises. Enterprises that have really worn out fixed assets and are in a difficult financial situation cannot participate in the implementation of investment projects supported by the Industrial Development Fund. When implementing industrial policy, investment support for enterprises should be carried out taking into account the depreciation of fixed assets of industrial enterprises in the regions.

Conclusion

In the study, we have confirmed the proposed hypothesis, and established the influence of not only investments in fixed assets, but also the financial situation of enterprises on the dynamics of depreciation of fixed assets of manufacturing enterprises in Russia’s regions. We present a methodological approach based on statistical and regression analysis using panel data, autoregressive modeling with a moving average (ARIMA), to identify factors that affect the dynamics of depreciation of fixed assets of manufacturing enterprises in various regions, and design a system of forecast scenarios for its changes in the future. The research result is the regions’ grouping by the depreciation degree of fixed assets of manufacturing enterprises: we have identified regions with an extremely high depreciation level of funds, regions with depreciation level above and below the average Russian level. With the help of regression modeling, we have determined the key factors in the dynamics of depreciation of fixed assets: in the first and third groups of regions, it is the difficult financial situation of enterprises, in the second group – insufficient volume of attracted investments in fixed assets. Within the selected groups of regions, we have carried out autoregressive modeling of the dynamics of these factors using a moving average to form the most likely forecast scenarios for changes in the depreciation degree of fixed assets of manufacturing enterprises until 2024: inertial taking into account the current depreciation dynamics of fixed assets, pessimistic and optimistic.

As the research result, we have identified the regions in need of priority state support within the framework of the industrial policy implemented in Russia for the renewal of worn-out funds, namely: the Astrakhan, Ivanovo, Kurgan, Murmansk, Sakhalin oblasts, the Republics of Komi, Khakassia, North Ossetia, Kalmykia, Buryatia, Sakha, and Tyva, the city of Sevastopol, Chukotka and Nenets autonomous okrugs, Khabarovsk and Krasnodar krais. These spatial priorities for solving the depreciation issue of fixed assets of enterprises are recommended to be used when financing investment programs by the Industry Development Fund in Russia and the implementation of industrial policy at the federal level.

Список литературы Scenario modeling and forecast of the degree of depreciation of fixed assets at manufacturing enterprises in Russia’s regions

- Abieva S.N., Kanabekova M.A. (2021). Investments in fixed assets in Kazakhstan. Bulletin of National Academy of Sciences of the Republic of Kazakhstan, 2(390), 139–145. DOI: 10.32014/2021.2518-1467.62

- Al’zhanova F.G., Nurlanova N.K., Dnishev F.M. (2020). Assessment of level and priority guidelines of Kazakhstan regions’ modernization. Problemy razvitiya territorii=Problems of Territory’s Development, 1(105), 124–141. DOI: 10.15838/ptd.2020.1.105.9 (in Russian).

- Boucekkine R., Oliveira Cruz B. (2015). Technological progress and investment: A non-technical survey. 2015. Available at: https://halshs.archives-ouvertes.fr/halshs-01145485/document (accessed: May 5, 2022).

- Chizhova E.N., Balabanova G.G. (2017). Productivity as a criterion of the level of development enterprises of construction materials industry. Vestnik BGTU im. V.G. Shukhova=Bulletin of BSTU named after V.G. Shukhov, 6, 172–177. DOI: 10.12737/article_5926a05a880885.91931435 (in Russian).

- Collings S. (2016). Fixed assets and investment property. In: UK GAAP Financial Statement Disclosures Manual. DOI: 10.1002/9781119283393.ch13

- Dzhevitskaya E.S. (2017). Analysis of the threat of economic safety of Russian industrial enterprises. Russian Journal of Management, 5(4), 581–585. DOI: 10.29039/article_5a5df353e63c91.52556497 (in Russian).

- Franik T. (2007). Depreciation of fixed assets and efficiency of investment and operation of a mining plant. Gospodarka Surowcami Mineralnymi, 23(4), 87–100.

- Freiberg F., Scholz P. (2015). Evaluation of investment in modern manufacturing equipment using discrete event simulation. Procedia Economics and Finance, 34, 217–224. DOI: 10.1016/S2212-5671(15)01622-6

- Gagarina G.Yu., Arkhipova L.S. (2017). Regional peculiarities of using production potential of the macro-region as a factor of Russian economy sustainability. Vestnik REU im. G.V. Plekhanova=Vestnik of the Plekhanov Russian University of Economics, 4(94), 126–137 (in Russian).

- Gorid’ko N.P., Nizhegorodtsev R.M. (2011). Depreciation of fixed assets as a factor of inflation in the modern economy of Ukraine: The experience of econometric analysis. Problemi ekonomіki=Economic Problems, 3, 98–100 (in Russian).

- Karlova N., Puzanova E., Bogacheva I. (2019). Proizvoditel’nost’ v promyshlennosti: faktory rosta. Analiticheskaya zapiska [Industrial Productivity: Growth Factors. Analytical Note]. Moscow: Tsentral’nyi Bank Rossiiskoi Federatsii.

- Kolesnik Y., Dobrovolska O., Malyuta I., Petrova A., Shulyak S. (2019). The investment model of fixed assets renovation in the agricultural industry: Case of Ukraine. Investment Management and Financial Innovations, 16(4), 229–239. DOI: 10.21511/imfi.16(4).2019.20

- Kondenkova M.A. (2017). Statistical analysis of the volume of investments in fixed assets in the Russian Federation. In: Innovatsionnaya ekonomika: mat-ly IV Mezhdunar. nauchn. konf. (g. Kazan’, oktyabr’ 2017 g.) [Innovative Economy: Materials of the 4th International Scientific Conference (Kazan, October 2017)]. Kazan: Buk. Available at: https://moluch.ru/conf/econ/archive/262/12656/ (accessed: April 5, 2022; in Russian).

- Kovaleva T.Yu. (2010). Evaluation of sufficiency of the information basis for the grounded analysis of the dynamics and the state of the capital assets. Problemy sovremennoi ekonomiki=Problems of Modern Economics, 1(33), 95–100 (in Russian).

- Lazebnyk L. (2018). Renewal of fixed assets in Ukraine: Problems of their depreciation and use. Economy of Ukraine, 9, 62–74. DOI: 10.15407/economyukr.2018.08.062

- Lugacheva L.I. (2001). Formation of investment resources of mechanical engineering and their institutional support. Vestnik Novosibirskogo gosudarstvennogo universiteta. Seriya: Sotsial’no-ekonomicheskie nauki=Vestnik NSU. Series: Social and Economics Sciences, 1(2), 118–140 (in Russian).

- Lyadova E.V. (2017). Analysis of the dynamics of labor productivity in Russia: the macroeconomic aspect. Vestnik Nizhegorodskogo universiteta im. N.I. Lobachevskogo. Seriya: Sotsial’nye nauki=Vestnik of Lobachevsky State University of Nizhni Novgorod. Series: Social Sciences, 1(45), 46–53 (in Russian).

- Ogorodnikova T.V., Solomein A.A., Orlov V.E., Shipunova I.G. (2020). Technical and economic assessment of the condition of fixed assets and the criterion of the validity of recovery investments. Izvestiya Baikal’skogo gosudarstvennogo universiteta=Bulletin of Baikal State University, 30(1), 89–99. DOI: 10.17150/2500-2759.2020.30(1).89-99 (in Russian).

- Pechenskaya M.A. (2020). Contemporary problems of budget development of regional centers. Aktual’nye problemy ekonomiki i prava=Actual Problems of Economics and Law, 14(1), 40–56 (in Russian).

- Postiguillo García D., Blasco A., Ribal J. (2017). Modeling the depreciation rate of construction machinery. An Ordinary Least-Squares approach and quantile regression approach. In: 19th Edition of the Mathematical Modelling Conference Series at the Institute for Multidisciplinary Mathematics. Available at: https://www.researchgate.net/publication/329040628_Modeling_the_depreciation_rate_of_construction_machinery_An_Ordinary_Least-Squares_approach_and_quantile_regression_approach (accessed: May 5, 2022).

- Prokhorova E.K. (2019). Impact of the fixed assets state on the development of Russian industry in the context of international sanctions. Vestnik mezhdunarodnogo instituta rynka=International Market Institute, 1, 30–36 (in Russian).

- Rozanova L.I., Tishkov S.V. (2018). Limitations of industrial development of innovations in conditions of high depreciation of fixed assets. Ekonomika i menedzhment innovatsionnykh tekhnologii=Economics and Innovations Management, 5. Available at: https://ekonomika.snauka.ru/2018/05/16019 (accessed: April 3, 2022; in Russian).

- Saprykina M.S. (2020). Statistical analysis of the degree of wearing of fixed assets of enterprises of the industry of production and distribution of electric power in the Russian Federation. Vektor ekonomiki=Economy Vector, 11. Available at: http://www.vectoreconomy.ru/images/publications/2020/11/economic_theory/Saprykina.pdf (accessed: May 5, 2022; in Russian).

- Tang L., Hao M., Zhang Y. (2013). Depreciation of fixed assets to capital budgeting decision analysis of the influence of independent. Journal of Convergence Information Technology, 8(10), 429–437. DOI: 10.4156/jcit.vol8.issue10.53

- Urban S., Kowalska A.S. (2015). Investments and basic fixed assets in agriculture. The Polish Statistician, 60(9), 66–76. DOI: 10.5604/01.3001.0014.8301

- Vylegzhanina E.V., Roslyakov V.A. (2018). Problem of high degree of wearing of fundamental means at treatment companies in Russia. Mezhdunarodnyi zhurnal gumanitarnykh i estestvennykh nauk=International Journal of Humanities and Natural Sciences, 12-2, 13–16 (in Russian).