Scientific and theoretical foundations of formation and management of investment powers

Автор: Galimova F.R., Asrakulov J.R.

Журнал: Форум молодых ученых @forum-nauka

Статья в выпуске: 4 (80), 2023 года.

Бесплатный доступ

In this article, the author summarized the methodological and scientific-theoretical aspects of enhancing investment activity in the regions of our country. In particular, investment activity and investment activity of the Tashkent region were considered.

Return on investment, investment activity, investment horizon, diversification, sources of passive income, market liquidity

Короткий адрес: https://sciup.org/140299568

IDR: 140299568 | УДК: 632

Текст научной статьи Scientific and theoretical foundations of formation and management of investment powers

These tasks are of great importance in the development of scientifically based proposals and recommendations for the effective management of investment potential. Therefore, the study of investment potential and new factors affecting it is emerging as a new and complex research subject of modern science. At the same time, the theoretical-methodological basis for researching the directions of effective management of investment potential has not yet been sufficiently systematized, and it is mainly based on the concepts of production complexes, economic zoning, development and placement of production forces. This shows the need to study the methodological and practical aspects of this issue from the point of view of developing a strategic vision and programmatic measures for the modernization and diversification of the economy.

Thus, the chain reaction of leading and lagging industries can ultimately lead to an increase in economic indicators not only for a certain region, but for the entire economy, that is, the development of a regional growth pole becomes a source of economic growth in the country.

On the other hand, investment potential is a set of available production factors (for example, a high level of consumer demand or various sectors for the deployment of capital investments) that satisfy the need for investment resources without attracting debt.

Thirdly, investment potential is the adequacy of conditions for business registration and operation, taking into account these investment risks, as well as profitability indicators of investment projects. This definition is given by the rating agencies that carry out annual assessment of each investment potential.

The fundamental basis of a new approach to the scientific research of investment potential formation and effective management, taking into account the requirements of the present time and real life needs, should be based on this, in which, taking into account the development prospects of our country, within the framework of the new investment policy in the conditions of modernization and liberalization of the economy, taking into account the current tasks of socioeconomic development taking into account the formation of investment potential and the systematic research of the directions of effective management, and the development of its improved mechanism by coordinating and harmonizing the proportions of vital determining factors such as "investment environment", "investment activity", "business environment" in its focus should lie down.

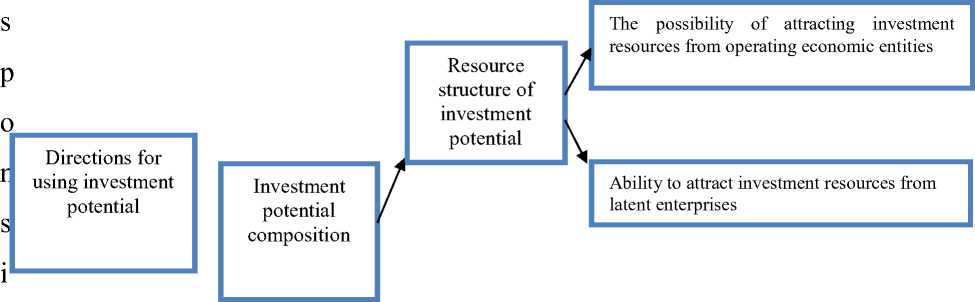

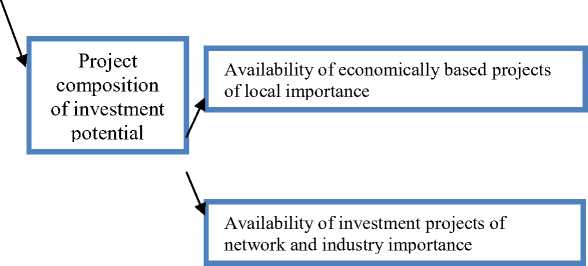

Constantly monitoring the directions and composition of the investment potential and determining the prompt measures to manage this process imposes huge r

e

i

Investments in the economy of the regions of the country will have a positive effect on the rate of production of the country's gross domestic product in the near and medium term. Therefore, we can see a correct correlation between changes in GNP and indicators of investment activity.

One of the ways to increase profits and reduce production costs is the experience of providing new enterprises with state subsidies in the form of exemption from paying interest on bank loans for a period of up to 3 years. This proposal can be used for manufacturers operating in the Southern pole of growth (Urgut district) in order to develop a competitive situation in the region. From the manufacturer's point of view, interest-free bank loans lead to a decrease in the share of costs and an increase in the profitability of sales in production, the activation of market competition and an increase in the profitability of enterprises.

Table 1

Measures to increase the participation of economic growth poles and points in the investment potential

|

№ |

Fields of application |

Classification of the proposed measures at the level of national and regional economy |

|

|

1. |

Economy in general |

1.1 |

Priority financing of enterprises that form growth poles |

|

1.2 |

Nomination for the annual rating of investment potential |

||

|

2. |

Industrial sector Agricultural sector |

2.1 |

Strengthening the mechanism for reducing customs fees for imported equipment |

|

2.2 |

Development of public-private partnership policy |

||

|

2.3 |

Ensuring the interests of participants in attracting investments in order to increase investment potential |

||

|

3. |

Industrial sector Agricultural sector |

3.1 |

Provision of state investment subsidies within the framework of the developed "Agrobusiness-2025" state program |

|

3.2 |

Promotion of public policies to ensure that agricultural producers receive their products from the state at set prices |

||

|

4. |

Service area |

4.1 |

Development of measures to provide state subsidies for exemption from paying interest on bank loans for up to 3 years. |

|

4.2 |

Provision of government long-term rental incentives in the form of rental incentives |

||

|

4.3 |

Stimulation of the state policy on covering part of the costs of paying interest on loans to certain entities from the funds of the republican budget |

The next proposed measure to increase the investment potential of the growth pole is, according to the state program, a long-term preferential lease as an exemption from paying rent for initial producers for up to 3 years, from 4 years -15% of the annual sum and from 5 years - 20% of the annual rent is given. This method is one of the ways to stimulate production in this investment area. By using this mechanism, it is possible to help reduce production costs and thereby increase sales profitability and business profits.

In conclusion, we can add that a promising way to encourage the inflow of domestic and foreign capital into the country and to maintain its outflow is to remove certain restrictions related to the work of local producers by the state.

At the same time, in the article, we proposed a complex of measures to increase the investment potential based on the mutual development of production and infrastructure facilities and the provision of investment activity by creating a favorable administrative environment for potential and prospective investors through the more dynamic development of economic growth poles and points. As a result of the implementation of this complex of activities, the participation of potential and promising investors in creating new jobs increased by 15.8%, and their participation in capitalized investments increased by 16.2%.

Список литературы Scientific and theoretical foundations of formation and management of investment powers

- Alekseycheva, E. Yu. Economics of an organization (enterprise): Textbook for bachelors / E. Yu. Alekseycheva, M. D. Magomedov, I. B. Kostin. - 5th ed., sr. - Moscow: Publishing and Trade Corporation "Dashkov and K", 2021. - 290 p.

- Bobrova, O. S., Tsybukov, S. I., Bobrov, I. A. Bobrova, O. S., Tsybukov, S. I., Bobrov, I. Organization of commercial activity: textbook and workshop for secondary vocational education. - Moscow: Yurayt Publishing House, 2021. - 332 p.

- Djurabaevich D. O., Shavkat A. Organization of Enterprise Management and its Efficiency in Conditions of Economic Modernization //American Journal of Economics and Business Management. - 2023. - Т. 6. - №. 1. - С. 173-177.

- Djurabaev O. D., Allaberganova S. Modern Management System in Large Companies of the Republic of Uzbekistan //American Journal of Economics and Business Management. - 2023. - Т. 6. - №. 1. - С. 146-151.

- Djurabaevich D. O. FEATURES OF MANAGEMENT AND CLUSTERING OF BEEKEEPING FARMS //INTERNATIONAL JOURNAL OF SOCIAL SCIENCE & INTERDISCIPLINARY RESEARCH ISSN: 2277-3630 Impact factor: 7.429. - 2022. - Т. 11. - №. 05. - С. 206-215.