Selection of economically rational investments through cost benefit analysis

Бесплатный доступ

Business decision making is an act of choosing between at least two competing simultaneously available investment alternatives. Cost benefit analysis enables direct and indirect measurement of all relevant costs and benefits expected in the future based on a given investment project. It enables the justification of investments and the expediency of redirecting capital to investment projects. However, cost benefit analysis is not a method of general optimization because it deals with the comparison of two or more alternatives, neither of which has to be the economic optimum. The goal of cost benefit analysis is the careful selection of alternatives that best meet the set objectives in the field of relevant constraints. The choice of economically rational investments through cost benefit analysis is the topic of this paper.

Cost benefit analysis, investment, constraints, investment rationality, optimization, costs and benefits

Короткий адрес: https://sciup.org/170204024

IDR: 170204024 | DOI: 10.5937/ekonsig2202095D

Текст научной статьи Selection of economically rational investments through cost benefit analysis

Cost benefit analysis quantifies the monetary value of all effects and costs related to the implementation of the investment pro0ect, or investment planning in general, on the basis of which the calculation of net profit.

(ll offered alternatives are evaluated, on the basis of which the option that achieves the highest profit and the lowest realization costs is selected. [Dedović, 2004]

Cost benefit analysis is a method of economic analysis that compares and evaluates all the advantages and disadvantages of an investment pro0ect by cost-benefit analysis. The main goal of cost benefit analysis is the cost identification of the most cost-effective solution for a given investment goal, in order to determine the financial viability of the pro0ect, measuring total investment, costs and revenues. This reflects all the relevant factors that management takes into account in the ranking phase of alternative directions of activity.

1. Cost and Benefit (nalysis of Investment Pro0ects

Cost benefit analysis is used for those investment pro0ects that bring significant and immeasurable effects. Therefore, it is not possible to make correct, cost-effective and economically 0ustified decisions if this method is not applied to business entities before carrying out investment activities.

Benefit and cost analysis means measuring and comparing all costs and benefits of an investment pro-0ect, as follows:

-

- specification of the investment pro0ect;

-

- description of pro0ect inputs and outputs;

-

- assessment of social utility;

-

- comparing costs and benefits.

In order to realize an investment pro0ect, it is necessary to make a decision on the pro0ect study, as well as to define the elements of the pro0ect (location, groups, course of realization, time, etc.).

The second step of the Cost benefit analysis is a quantitative description of the inputs and outputs of the investment pro0ect in order to get an indicator of how the total costs are deducted from the total benefits and the net benefit is obtained.

Cost benefit analysis is an analytical approach to solving the problem of choice that requires defining goals and appropriate alternatives that give the greatest benefit at a given cost or that give a given benefit for the lowest cost.

Cost benefit analysis enables cost analysis, evaluates the profitability of the introduction of a new product, controls the outflow of funds, measures the profitability of investments and realistically considers the benefits that have an impact on the business of economic entities.

The basic rules on which Cost benefit analysis is based are:

- Cost benefit analysis considers that there is a difference in the contribution of different investment pro0ects, as well as their effects;

- Cost benefit analysis should take into account all costs and benefits;

- lost costs should be taken into account as costs, and costs reduced as benefits;

- Cost benefit analysis is suitable for pro0ects that bring multiple effects;

- Cost benefit analysis contributes to the optimal allocation of economic resources;

- Some of the groups of costs can be: contingencies, upfront costs, transfer payments, etc.

2. (ssessment of Weaknesses and Strengths of Offered Investment (lternatives

(fter determining the costs and benefits that an investment pro0ect brings, it is necessary to evaluate and express those same costs and benefits in monetary terms. For the measurement of the effects brought by the investment pro0ect, the calculation prices or shadow prices are used, which differ from the market prices.

In Cost benefit analysis, the weakness and strength of all offered alternatives are assessed, on the basis of which the option that generates the highest profit with the lowest realization costs is selected.

Cost benefit analysis is a systematic approach to assessing the strengths and weaknesses of alternatives used for specific options and providing the best approach to achieving benefits while preserving savings. Cost benefit analysis is used to compare potential stock flows or to estimate value in relation to the cost of a decision.

Cost benefit analysis is an important method in the decisionmaking process or in the correction of investment pro0ects. The key areas of its application are: financial transactions, managerial decision making, pro0ect selection, selection of the most profitable investment.

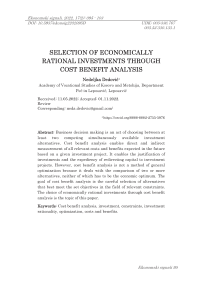

Figure 1. Current strengths, weaknesses and future opportunities

The stages of cost benefit analysis are:

- defining the investment pro0ect to be analyzed;

- defining the time period to which the analysis refers;

- determining the costs and benefits for a given investment pro-0ect;

3. Choosing the BestInvestment (lternative

determining costs and benefits in value (money) form;

determining the method used;

determining the discount rate;

calculating and comparing the values of individual criteria for the investment pro0ect with certain definitions of measures as well as additional criteria;

decision making.

Cost benefit analysis provides insight into whether investments (and by how much) exceed costs, ie the total expected costs and benefits are compared. It presents an analysis of the expected balance of costs and benefits and, based on that, ranks investment alternatives.

The two integral parts of the Cost benefit analysis are the financial and economic analysis on the basis of which the best investment alternative is selected. Financial analysis includes analysis of cash inflows and outflows, ie analysis of estimated cash flows during the implementation of a pro0ect or investment. (s far as economic analysis is concerned, the mathematical (statistical) method is used as an indicator of economic efficiency. One of the most commonly used methods is ROI (Return of Investment) or payback period.

The application of this method comes down to determining the payback period (expressed in months or years) in which the invested investment funds will be returned - investment costs, as well as the period in which total investments will be equated with the current value of net benefits from investment pro0ects. Therefore, since it is easily calculated, this criterion is most often used as an indicator of economic efficiency.

(s cost benefit analysis must offer the best alternatives, modern assessment of all future costs and benefits is difficult. In this regard, stakeholders may try to include (or exclude) significant costs in the analysis, in order to influence its outcome. Cost benefit analysis is aimed at maximizing the present value of future cash flows, rather than its distribution among individuals in the company. [Drury, 1996]

The use of cost benefit analysis requires consideration of several important issues, namely: [Layard, 1976, 73-74]

a) What costs and benefits should be included in the Cost benefit analysis?

b) how should they be evaluated?

c) how to ensure their correct comparison?

d) what are the relevant limitations when comparing them?

4. How to get Rational Investment through Cost Benefit (nalysis

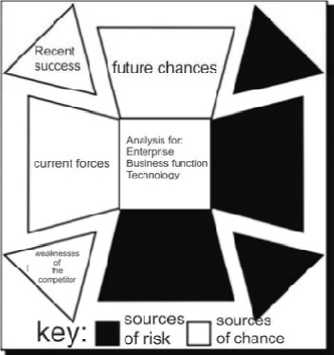

In practice, the decision-making process should take place in certain stages, avoiding bad decisions and mistakes. The decision-making process could be graphically represented as follows. [Schremerhorn, 1996]

Table No.1. The decision-making process

Cost benefit analysis is a costbenefit analysis. (dvantages and strengths, that is, costs and effects are expressed in monetary units and ad0usted for the time component expressed on a common basis in terms of net present benefit, risk-benefit analysis and social return on investment.

The criteria used in cost benefit analysis are:

-

- net present value criterion,

-

- internal rate of return criterion,

-

- cost-benefit criterion,

-

- investment return deadline criterion.

The net present value criterion implies the difference between the total discounted benefits and the total discounted costs realized by one investment pro0ect. [Rodić, 1990]

Kns = Ks - Ts where are:

Kns - net present value criterion

Ks - total discounted benefits

Ts - total discounted costs

The criterion of the internal rate of return implies that the internal rate of return is the discount rate at which the sum of discounted benefits is equal to the sum of discounted costs, ie the present value of net benefits is equal to 0 (zero), therefore:

Kns = Ks - Ts = 0

Cost-benefit ratio means the ratio of total discounted costs to total discounted benefits. It is calculated from the following formula:

K = K s /T s

The return on investment criterion is the period expressed in years for which the present value of the net benefit of the investment will repay the invested funds.

Conclusion

The investment process is characterized by one-time or multiple investments in the present as well as a series of effects expected in the future. The most common division of effects brought by one investment is economic and noneconomic. Economic effects are reflected in the value of a particular production or service. (s well as on the efficiency of investment, while non-economic effects in certain cases may be more significant than economic ones. Therefore, all the effects that one investment brings should be taken into account. Since economic and non-economic effects are very difficult to measure, most often only direct effects that can be measured and quantified are taken into account.

When it comes to the evaluation of investment pro0ects, this method of evaluation brings a cost-benefit analysis (Cost benefit analysis) which takes into account all the costs and benefits brought by one investment pro0ect.

The advantage of this analysis is that it directs responsible entities to identify possible costs and effects, in order to avoid relying on unreliable estimates. Its leading characteristic is economic efficiency, and its purpose is that through the choice of investment alternative, relevant information is provided on the price of achieving that goal.

Список литературы Selection of economically rational investments through cost benefit analysis

- Dedović, M. (2004) Planiranje i biznis. Leposavić: Viša ekonomska skola Peć

- Drury, C. (1996) Management and Cost Accounting. London: Thomson business press

- Layard, R. (1976) Cost benefit analysis. Middlesex, England: Penguin Books, Ltd

- Michael, A., Rebeca, R.L. (2013) Globalization of Cost Benefit Analysis in Environmental Policy. New York: Oxford University press

- Nikolić, M., Paunović, B. (1997) Ekonomika preduzeća. Beograd: Ekonomski fakultet

- Perović, M., Jovanović-Kisić, S. (2011) Ekonomika Preduzeća: Principi i primena. Beograd: Savremena administracija

- Rodić, J. (1990) Theory and analysis of balance. Belgrade: Economics

- Rosen, S.H., Gayer, T. (2009) Public Finance. Publishing Center of the Faculty of Economics in Belgrade

- Sandmo, A. (2011) The Evolving Economy: A History of Economic Thought. New Jersey: Princeton University press

- Schremerhorn, J. Jr. (1996) Management. New York: John Wily Son, Inc

- Welsch, R., Anthony, R.J. (1985) Fundamentals of Angement Accountig. Homewood Illinois: Irwin, Inc