Shared values in the formation of a modern techno-economic paradigm

Автор: Romanova Olga Aleksandrovna, Akberdina Iktoriya Viktorovna, Bukhvalov Nikolai Yuvenalevich

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Innovation development

Статья в выпуске: 3 (45) т.9, 2016 года.

Бесплатный доступ

The article presents the evolution of the concept of techno-economic paradigm. It points out that the concept of transformative investments (impact investing) has a significant impact on the formation of a modern techno-economic paradigm. In the framework of this concept, “shared values” are considered as a central element in the development strategy of any state. The ideology of shared values is based on pragmatic principles that create economic value to meet the interests of society. It is based on “three pillars of sustainable development”: planet, people and profit. The authors identify three main types of impact investing - responsible investing, development investing, localizing investing. The paper highlights the most important areas of impact investing and substantiates the expediency of promoting the ideas of impact investing at the level of individual business entities, which formulate a specific approach to the management of socio-economic systems of the micro-level, the authors call this approach “impact management”...

Techno-economic paradigm, transformative investments (shared values), inclusive development, structural inclusion, spatial inclusion, impact management, agglomeration

Короткий адрес: https://sciup.org/147223835

IDR: 147223835 | УДК: 338.27 | DOI: 10.15838/esc.2016.3.45.10

Текст научной статьи Shared values in the formation of a modern techno-economic paradigm

Introduction.

Geopolitical reality which has formed as a result of transformational changes in the system of international relations has specified the emerging of the phenomenon called “security-development-nexus”, i.e. interdependence of security and development [10].

In these circumstances, the significance of increasing levels of socio-economic development of the state will be determined not only by the possibilities of improving the quality of life, rising the level of human well-being and developing human capital, but also by the country’s possibility to hold a worthy position in the international community, ensuring its national security. The matter of particular importance is the dominance of best practices in global economic development which form the so-called techno-economic paradigm in the economic space of a particular country. The paradigm is often considered as universally recognized scientific achievements that “within a given time give scientific community a model of statement of problems and their solutions” [12, p. 11].

In modern economy the concept of paradigm is also actively used. It is used both in the theory of long waves and in the description of certain stages of society development (for example, the paradigm of post-industrial society). Any techno-economic paradigm, the emergence of which is characterized by a new key factor acting as a core of the system of technological and administrative innovations, results not only in more intensive use of the key factor, but also in the change of the quality of labor resources, forms of production management. The institutional structure of the society is also frequently changed in different hierarchical levels.

During this period, investments in new infrastructure increase, which creates conditions for the development of industries that produce and consume the key factor [7, p. 143].

The concept of “techno-economic paradigm” is also used from the perspective of considering industrial restructuring as a triune process of technological, sectoral and institutional adjustment [15, p. 10; 11, p. 48].

The reducing potential of the dominant techno-economic paradigm indicates the break of structural crisis, which is one of the factors predetermining the need for a new paradigm formation.

Among numerous interpretations of the concept of techno-economic paradigm the most complete is suggested by C. Perez. Its definition allows distinguishing the essential basis of techno-economic paradigm, which is regarded as a “model of best business practice, consisting of universal general technological and organizational principles that reflect the most effective way of putting a particular technological revolution into effect and the use of the revolution for reviving and modernizing economy. When these principles become generally accepted they define “common sense” – the basis of any activity or institution” [14, p. 40].

It has been established that changes caused by the emergence of a new techno-economic paradigm are not limited by the economy and penetrate both political sphere and social ideology [21]. When approving a new techno-economic paradigm certain consolidation of general principles takes place on the one hand. These principles regulate the relations between the participants of economic development. On the other hand, the compatibility of changes in the institutional system of the country is set.

The concept of transformative investing (Impact Investing). The concept of transformative investing (Impact Investing) has a significant influence on the formation of modern techno-economic paradigm. Under this concept “shared values” are considered as a central element of the development strategy of any state. Shared values are not synonymous with the terms “social responsibility”, “charity” and “sustainable development”. The ideology of shared values is based on pragmatic principles that create economic value to meet social interests.

Under the new techno-economic paradigm, business must not only serve the interests of society, but “this service must be based not on charity but on keen understanding of mechanisms of competition and value creation” [27].

The history of impact investing dates back to 2007 – the moment when the Rockefeller Foundation established the “Impact investing Initiative”. Since that moment methods and financial instruments for transformative investing have been developing and proper standards and institutions have been emerging. In 2009 the Global Impact Investing Network (GIIN) was opened. Over the last years the concept of impact investing has been increasingly globalized. Individual projects along with government programs of impact investing are carried out in Australia, Brazil, the Netherlands, India, Mexico etc. Classifications, databases and standards of projects evaluation have been developed and are currently being put into practice.

“Impact investing” is a concept of a new wave of financial technologies, which has been forming during the latest decades. Unlike laws that do not have retroactive effect, the concept of impact investing is aimed at active learning of the past, consumption and reinterpretation of its financial inventions and practices. The main classification instrument of impact investing is a matrix representing a 3x3 table, which is based on the previously developed Triple bottom line concept (TBL or 3BL). This concept assumes that owners and management of a company should consider financial indicators as well as the results of the company’s activities in social sphere and ecology. The concept was developed in 1994 by an American economist and entrepreneur John Elkington [17]. The ideology of impact investing is based on “three pillars of sustainable development”: Planet, People and Profit. The basis which has predetermined the development of impact investing is the interaction of the following four key factors [25]:

-

• expanding list of practices that demonstrate the possibility of investing in large-scale business models, implementation of which leads to socially significant results;

-

• growing awareness of critical lack of resources amid growing poverty, inequality, environmental destruction and other complex global issues;

-

• in-depth risk analysis of investment decisions initiated by the financial crisis of 2008–2009;

-

• the transition of wealth in industrialized countries to a new generation of prosperous individuals willing to achieve their personal ambitions and resources in the form of public projects.

Systematizing the research in the field of impact investing has allowed identifying its three main types directly related to the new developing techno-economic paradigm:

-

• Impact investing of the first type (“Determinant Investing”) – development of new financial technologies, instruments and standards and formation of a new layer

of management bodies and intermediaries to provide access to investors of “the Global North” to those sectors of the economy of “the Global South” that were previously unavailable to them ;

-

• Impact investing of the second type (“Developmental Investing”) – the use of new investment instruments to solve social and environmental problems, reduce poverty, and involve local investors and communities in joint participation in activities aimed at accelerating socioeconomic development ;

-

• Impact investing of the third type (“Localizing Investing”) – development of guidelines, technologies and instruments of economic policy for governments interested in attracting a new class of investment to a particular territory .

Regardless of the type of Impact Investment, a complementary goal of investing is always Shared Value, sometimes referred to as Blended Value. The process of impact investing involves several agents: investors, recipients and intermediaries between them. Each of the participants has their own goals and values. At least one of the participants (an investor, as a rule) consciously accommodates the goals and values of other participants and contributes to their achievement in order to reach their goals. This promotes, along with the commercial effect, many other effects that can be characterized by the following performance indicators:

-

1. Social efficiency instead of social consequences. Social consequences is the target of organizations that are engaged in business activities in the field of social and environmental projects. Social efficiency is a concept of a wider sense. It includes a complex of results, such as improving the quality of general welfare for lower-income people, mitigation of the consequences of climate change etc. As social outcomes are often influenced by external factors, they are extremely difficult to be attributed to the activities of a particular company.

-

2. Social return on investment (SROI). The ideology of SROI is a shift of goals from return on investment to the understanding of the social effects from the project implementation. SROI allows outlining a concept of how value is created when decision-making process is based on the integration of social, environmental and economic costs as well as on resulting benefits.

-

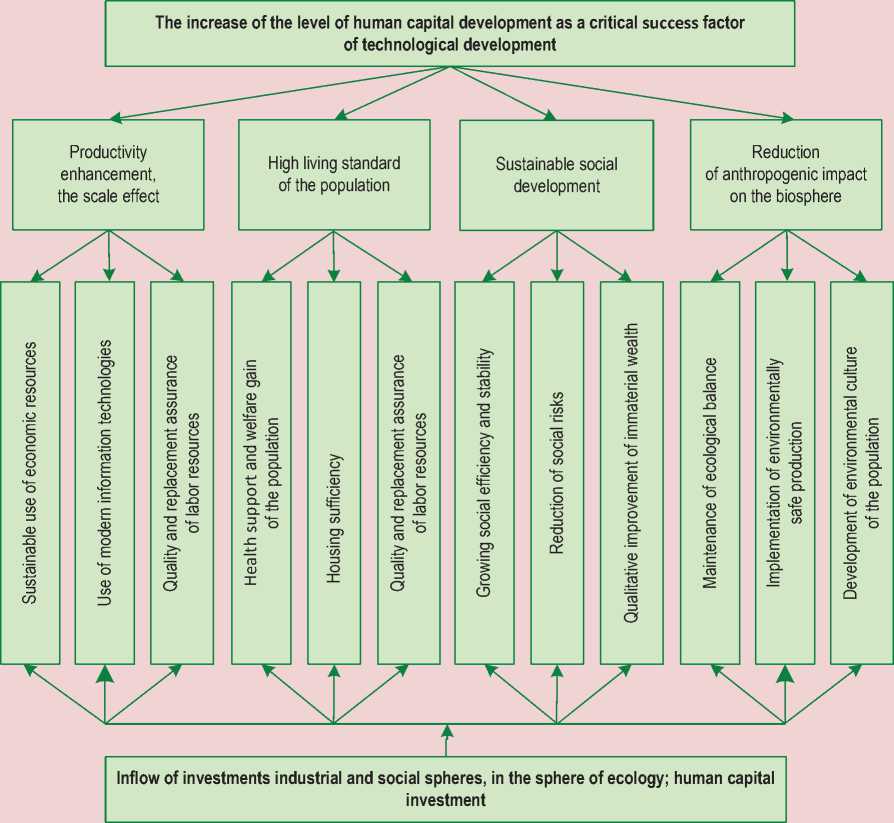

3. Impact investing instead of business responsibility to the society. Social responsibility has historically developed in the form of business ethics (restriction of activities in the sphere of production of alcohol, tobacco, gambling, etc.). In contrast, impact investing generates flows of money, which not only lead to better financial returns, but also have a positive impact on a wide range of participants of investment activity. The “Tree of Objectives” of impact investing can be represented schematically ( fig. 1 ).

Figure 1. “Tree of objectives” of impact investing

Among the most important areas of impact investing is, first of all, human capital investment. This area is connected with investments for reasons of human capital reproduction: the increase in real income of the population and improvement of the quality of life and the standard of living; the development of government guarantees in terms of labor remuneration that ensure the reproduction of human capital. As far as demographic development is concerned, the improvement of government population policy may be noted, which is aimed at leveling the country’s depopulation, reducing the rate of mortality, increasing life expectancy and lowering morbidity.

Not least important is the environmental area of impact investing, which helps decrease the anthropogenic burden on the environment, providing national ecological safety along with a decent standard of living and health of the population with the conservation of natural resources. The financial area of impact investing is assuming more and more importance. It is the formation of incentives system of social investments for a long period: assurance of a decent standard of living by means of the growth of social capital at the macro-and micro-levels, efficient human capital formation and development of financial technologies resulting in a positive social effect.

Impact investing is also developing in the production area, which allows expanding investment in the development of new technologies under the conditions of humanization of production and labor conditions. The most favorable condition for impact investing development is positive institutional environment, which increases the importance of its institutional area. Impact investing, as any type of activity, depends largely on the level of infrastructure development as the main component of its organizational area. The importance of innovation and information area is incontestable. This area includes transformations in the system of research and technical development (RTD) and an increase of innovation in economic growth: namely, the formation of necessary and sufficient conditions for sustainable functioning of RTD as a sphere that represents a valuable national intellectual asset.

To sum up, the characteristic feature of modern techno-economic paradigm is the development of the concept of “shared value” resulting from impact investing.

Impact investing at the level of economic entities. The conceptual framework of impact investing includes not only goals, objectives and principles of its implementation at macro- and meso-levels. It seems advisable to develop the ideas of impact investing at the level of individual economic entities. The theoretical foundations of transformative investing offer the opportunity to consider the term not only in the context of investment, but also in terms of management in general. Such specific approach to the management of economic and socio-economic systems, in our opinion, can be called impact management [5]. The concept of creating shared value has evolved in the works of M. Porter and M. Kramer [26]. It is conclusively proven there that companies which develop close links between their business strategies and corporate social responsibility have achieved major success. It is particularly important to note that such phenomenon is typical not only of investment but also of all management aspects of socio-economic systems.

The characteristic feature of modern managerial systems is the focus on systems that implement “holistic” approach which considers the phenomenon at issue from different perspectives. From our point of view impact management excludes any one-sided approach. Impact management implies management activities, the implementation of which suggests that all elements of a specific business unit as well as the entire staff of the organization are involved in the decision-making process.

It is clear that personnel management is one of the most natural subsystems in the framework of management system as a whole. The complex nature of cause-and-effect relations which determine the behavior of company’s employees allows us to consider personnel management as an object of distinct holistic character. Personnel as a strategic resource of the company largely defines its competitiveness. In the present context the importance of human capital is determined not only by individual characteristics of the staff, but also by his willingness to work for the benefit of the organization. The employee’s commitment in the company’s overall performance determines the effectiveness of his work and therefore the company’s certain position in competitive environment. That means there is a growing need to form an integrated incentive system which would consider human capital as a uniform, holistic set of abilities and needs. From this perspective, the application of impact management to personnel management is productive. The characteristic feature of this management approach is the use of both traditional outline of the remuneration system, and a number of motivating factors that go beyond material incentives.

Impact management as a management technology designed to stimulate the development of shared values and encouraging everyone’s commitment in overall final work results, is of particular importance for high-technology enterprises, especially for the military-industrial sector. A typical representative of such complex is Motovilikhinskiye Zavody PJSC. Between 2010 and 2014 one of the authors of this article (N.Yu. Bukhvalov) held office as Director General of this enterprise. During this period Motovilikhinskiye Zavody PJSC drafted, discussed and adopted the “Modernization of Employees’ Incentive System Concept” (hereinafter referred to as the Concept).

The use of best global practices in the field of motivation has allowed forming a model of employees’ incentive system based on two equivalent units, one of them defines employer branding of the enterprise, the other – a system of total compensation. Employer branding implies favorable image making of the enterprise as an employer. This image forms company’s recognition as a good workplace in the eyes of all concerned parties from different target groups. The image depends on the set of benefits (economic, professional, psychological, etc.) that is obtained or will be obtained by a worker who decides to join the team. The ways of identity construction of the enterprise are also of considerable importance, starting with basic principles and values, including how management communicates this identity to all concerned parties from different target groups (internal and external communication). Effective employer branding describes a system of “shared values” comparable to value systems of other companies and characteristic of that particular company. Employer branding implies the formation of real “work environment”, supporting both head hunting, which the company needs to achieve its goals, and further employee retention.

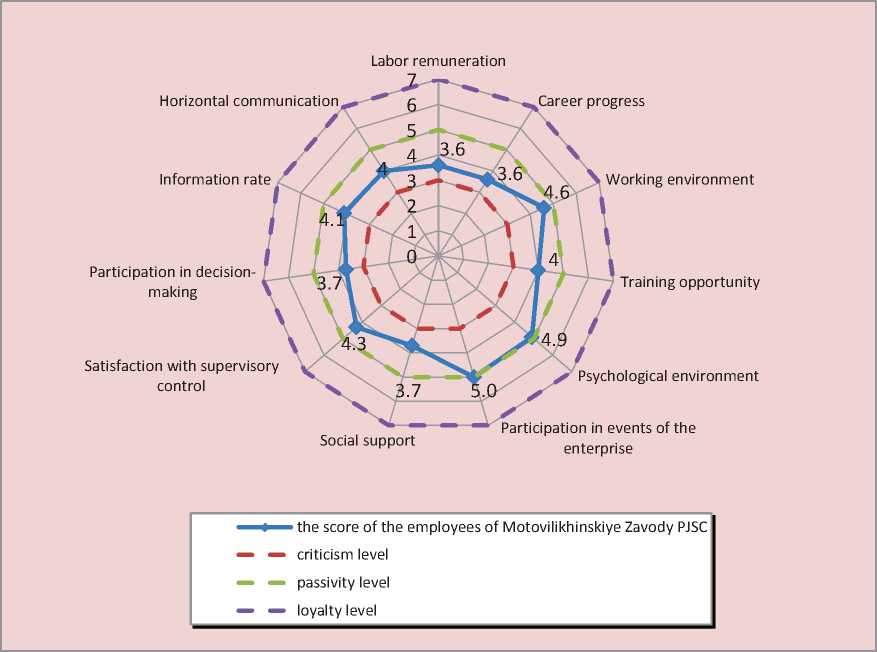

In compliance with the developed Concept, performance evaluation of incentive system of Motovilikhinskiye Zavody PJSC was estimated, which helped to appraise the level of its employees’ satisfaction. The main research tool was the eNPS (employee Net Promoter Score).The approach implemented here is based on the modernization of the renowned method of measuring customer’s loyalty to the company, the founder of which is Frederick Reichheld [16]. The feature of the eNPS method that is of great importance for impact management is its holistic nature. It lies, above all, in identifying the integral estimation of the system state as a whole, which enables to determine the influence of different aspects of activity on final results. The developed system creates a complex approach to the modernization of human resource management system and allows assessing the obtained results objectively. The satisfaction level of employees of

Motovilikhinskiye Zavody PJSC is appraised in accordance with the method of eNPS ( fig. 2 ).

Figure 2 displays that the majority of employees’ scores are located in “passivity” zone. The highest GPA have options: psychological climate (4.9), participation in events of the enterprise (5.0), working conditions (4.6). The lowest scores were obtained for options: career progress (3.6), labor remuneration (3.6) and participation in decision-making (3.7). These estimations provide an opportunity to highlight the most problematic aspects from the point of view of employee satisfaction and to determine the boundaries of target action. This situation allows noting high relevance and potential development of employer branding of the company. Given the circumstance, significant results are expected to be achieved through the use of low-cost methods of effective employer branding formation.

The study helped to identify both problem and promising areas from the perspective of the employee level of satisfaction, and to determine the boundaries of the impact areas at this level. Five basic modernization blocks of the employee incentive system are distinguished: three of them within the framework of total compensation system, and two – as part of the employer branding. In the framework of total compensation, according to the three component parts

Figure 2. Satisfaction level of employees of Motovilikhinskiye Zavody PJSC , scores [5]

of labor remuneration, there are three blocks of incentives: for qualifications, for performance and for loyalty. The reward for qualifications is calculated on the basis of the actually worked hours according to the qualification on the wage rate scale. The reward for performance is defined in accordance with monthly results of shiftday tasks. Loyalty reward is determined arbitrarily by the direct supervisor. The supervisor entirely at his/her own discretion, but within established limits decides on the amount of the incentive. The ratio of the respective blocks of payment in the structure of total remuneration is taken in equal proportion. In order to develop the incentive system for loyalty, which has required detailed regulations, funds of process owners are being established. The level of the fund depends on final results of the entire company, but the size of the individual remuneration of a particular employee and his share in the distributable fund is established by the direct supervisor at his own discretion. Within the employer branding blocks such as factors in honor and career employment are also distinguished.

The latter refers to establishing a mechanism which would provide the possibility of predicting employees’ personal and professional development, selfdetermination in terms of one-way vectors of personal development and the development of the enterprise as a whole. This mechanism allows increasing the opportunities for professional development. For this reason the scope of the wage rate scale has been extended and a more detailed subdivision of categorization levels has been introduced. It is important to note that we are referring exactly to a specific approach to the management of socio-economic and production systems, i.e. about impact management as a new development trend of impact investing. It may also be mentioned that control action in this case is transformative, contributing to the achievement of “common values” shared by the individual employee and the enterprise as a whole.

Inclusive development. The idea of impact investing, i.e. transformative investing has much in common with the ideas of inclusive development. The term “inclusion” is most often used in the field of public relations and is interpreted as a process of people’s community involvement that allows us to talk about inclusive policy, inclusive culture and inclusive practice. The centre of inclusive development is a person, which implies the priority of a development model that ensures social stability in the determinants of economic development associated with scientific and technological progress, employees’ cultural and intellectual level upgrade and the innovative nature of managerial work.

The systematization of development trends related to various aspects of inclusiveness has allowed identifying the four most important, in our opinion, aspects of inclusive development. The first aspect implies the need to democratize international relations and establish firm and fair political and economic world order. The second aspect of inclusive development is associated with the principles of state policy involving equal access to emerging opportunities and benefits of development as certain segments of the population and individual countries. Of particular importance here is the availability of quality education. The third aspect of inclusive development is an effective policy in the field of environment and climate. The fourth aspect is strong integration processes occurring inside various world territories, particularly in the Pacific Rim [8].

Comparative analysis of development trends and directions of impact investing and inclusive development has allowed stating the essential integrity of these processes, which reveals the possibility to converge fundamental principles of aforementioned conceptual approaches as the key feature of the emerging new techno-economic paradigm. In the context of conveyance of the ideas of inclusive development it seems advisable to introduce such concepts as “structural inclusion” and “spatial inclusion”.

We understand structural inclusion as the inclusion in a vector of high-tech development of medium-tech sectors and the modernization of low-tech sectors. The fundamental essence of spatial inclusion is, in our opinion, the involvement of weakly and moderately technologically and economically developed areas in the replenishment cycle of economic development.

Structural development of the economy is subject to cycle fluctuations, which display the properties of self-organization, changeability and adaptability.

The process of modern techno-economic paradigms formation leads to the situation when the provisions of the obsolescent paradigm based on material factors in structural changes lose their significance. Intellectual assets become structure-determinant in the context of economy changes. Their wide use determines not only the processes of recurring change of technological modes, but also the inclusion of medium-tech sectors with high development potential in the process of formation of a high-tech basis of economy.

To sum up, technology convergence and high potential for medium-tech industries development are the prerequisites for the emergence of structural inclusion. Technology convergence involves both mutual influence and mutual penetration of industrial technology, where fundamentally new results appear at the intersection of different scientific fields, i.e. as a result of interdisciplinary research. It is necessary to remind that during the process of structural convergence the technological dynamics defines the establishment of a new technology basis as well as the inclusion of medium-tech sectors which can already become growth promoters on a short term basis.

Spatial inclusion, as it was previously noted, describes the process of including all types of territories into socio-economic and technological development of the country through convergence of their development levels. Researching the processes of spatial inclusion is becoming increasingly important, since the lowering of spatial inequality and consequent social tensions is one of the most important goals of the state. The hypothesis, which can be applied directly to spatial inclusion, prevails that despite the differences between regional economic systems they dismiss inefficient institutional forms, selecting and preserving efficient ones. For this reason all of them eventually become

Figure 3. Bases of formation of spatial inclusion

International Exchange

Structural Changes of Economy

Factor Mobility

Transfer of Technology

Spatial Inclusion

Self-Organization Mechanisms

Work-Force Quality Convergence

relatively identical after such evolutionary selection. The proponents of this hypothesis bring forward arguments that modern technology, means of communication and transport spread everywhere, creating a uniform technological basis for levelling country differences [22, 24]. Common trends and imperatives of scientific, technological and socio-economic progress determine convergence of the economies of a growing number of countries while preserving their national identities. The hypothesis allows identifying the factors that have a determining influence on the formation and development of spatial inclusion ( fig. 3 ).

We may outline some of the management actions, leading to the reduction of interregional inequality: technological progress stimulation, measure for structural adjustment of regional economies, infrastructure development, interregional and international cooperation, etc.

The actions, mentioned above, represent the theoretic framework of our hypothesis, the main idea of which is that an integral feature of spatial inclusion is structural and functional changes within regional systems. These changes, in their turn, are linked to re-proportioning and rolechanging of principal social institutions: the institution of self-organization and state regional administration. The hypothesis is based on the idea that an inherent feature of inclusion is the equivalence of dominant basic institutional orders. The process of spatial inclusion implies maximum complementarity and contingency of these institutional orders. Therefore, the main advantage of spatial inclusion is the ability to simultaneously use the capacities of different institutional forms and orders based on self-organization and state administration.

In accordance with the proposed hypothesis of spatial inclusion, effective regional policy is capable not only of setting technologically backward regions on a path of development and preventing the escalation of interregional inequality, but it is also capable of increasing the rate of national economy development. Another argument in favor of the previously mentioned hypothesis is modern ideas about efficient policy embodied in a concept of “New Economic Geography” [20, 23]. This concept makes it possible to integrate basic principles and points of scientific, technological, industrial, socioeconomic, innovative and regional policy into a single complex.

In our opinion, only such integration allows to address the issue of spatial inclusion. It should be based on coordinating the pace of development of various structures within a larger macrostructure by means of diffusion or dissipation processes. The significant difference between the levels of development of adjacent territories leads to the situation when the level of development of one area serves as a background to the development of another. Therefore, slowly developing, backward municipal units and regions serve as the so-called zerobackground to quickly developing regions. The implementation of the principles of inclusion will promote the convergence of the levels of socio-economic and technological development of particular regions, increase their competitiveness within macro-regions and, in the long term, will help these regions to hold better positions in the system of national and international economic exchanges.

Creating agglomerations in the Sverdlovsk Oblast, including underdeveloped areas in their territory and increasing the mobility of labor resources will allow gaining certain benefits through the implementation of the principles of spatial inclusion. First of all, through the diversification of the agglomeration economy, the concentration of capital and resources in a particular area, the improvement accessibility of the population of remote areas to the comforts of civilization, the reduction of costs of industrial enterprises and through infrastructure facilitation due to the density of large agglomeration cores.

Conclusion. The principal feature of the formation of modern techno-economic paradigm is the development of the ideas of impact investing (transformative investing) and inclusive development as new components of technological and socio-economic development, forming a model of the best business practice. It would be reasonable to extend the practice of using impact investing to the level of business entities, which may increase the employee interest in the companies’ performance, thus strengthening their position in a competitive environment. The implementation of the principles of structural inclusion will allow involving both medium-tech and low-tech modernized industries in a vector of high-tech development. Spatial inclusion will promote the inclusion of poorly and moderately technologically and economically developed areas in the reproduction cycle of economic development.

Список литературы Shared values in the formation of a modern techno-economic paradigm

- Akaev A.A. Bol'shie tsikly kon»yunktury i innovatsionno-tsiklicheskaya teoriya ekonomicheskogo razvitiya Shumpetera-Kondrat'eva . Ekonomicheskaya nauka sovremennoi Rossii , 2013, vol. 61, no. 2, pp. 7-29. .

- Akaev A.A., Rumyantseva S.Yu., Sarygulov A.I., Sokolov V.N. O strukturno-tekhnologicheskoi paradigme tekhnologicheskoi modernizatsii ekonomiki . Kondrat'evskie volny , 2015, no. 4, pp. 23-53. .

- Babikova A.V. Gosudarstvennye promyshlennye korporatsii i formirovanie novoi tekhniko-ekonomicheskoi paradigmy: strategiya innovatsionnogo razvitiya . Vestnik Taganrogskogo instituta upravleniya i ekonomiki , 2015, vol. 22, no. 2, pp. 19-22. .

- Brazevich D.S. Sovremennyi nauchnyi diskurs po probleme innovatsii: ot tekhniko-ekonomicheskoi paradigmy k sotsiokul'turnoi . Nauchnyi zhurnal NIU ITMO. Seriya: Ekonomika i ekologicheskii menedzhment , 2014, no. 4, pp. 50-54. .

- Bukhvalov N.Yu. Impakt-menedzhment i ierarkhichnost' mul'tiintellektual'noi sistemy upravleniya vysokotekhnologichnym predpriyatiem . Zhurnal ekonomicheskoi teorii , 2016, no. 2, pp. 48-56. .

- Gureev P.M. Transdistsiplinarnaya kontseptsiya tsiklicheskogo razvitiya tekhniko-ekonomicheskoi paradigmy . Teoriya i praktika obshchestvennogo razvitiya , 2016, no. 3, pp. 55-58. .

- Glazyev S.Yu., Mikerin G.I., Teslya P.N. et al. Dlinnye volny: nauchno-tekhnicheskii progress i sotsial'no-ekonomicheskoe razvitie . Novosibirsk: Nauka, Sibirskoe otdelenie, 1991. 224 p. .

- Dmitrii Medvedev vyvel formulu inklyuzivnogo razvitiya ekonomiki Aziatsko-Tikhookeanskogo regiona . Available at: http://bujet.ru/article/126201.php. .

- Zakon Sverdlovskoi oblasti ot 21 dekabrya 2015 g. № 151-OZ “O Strategii sotsial'no-ekonomicheskogo razvitiya Sverdlovskoi oblasti na 2016-2030 gody” . Available at: http://www.garant.ru/hotlaw/sverdlovsk/679712/#ixzz46Ls3EZpx. .

- Kokoshin A., Bartenev V. Problemy vzaimozavisimosti bezopasnosti i razvitiya v strategicheskom planirovanii v Rossiiskoi Federatsii: ot tselepolaganiya k prognozirovaniyu . Problemy prognozirovaniya , 2015, no. 6, pp. 6-17. .

- Konkurentosposobnost' sotsial'no-ekonomicheskikh sistem: vyzovy novogo vremeni . Under the scientific editorship of A.I. Tatarkin and V.V. Krivorotov. Moscow: Ekonomika, 2014. 466 p. .

- Kun T. Struktura nauchnykh revolyutsii . Moscow: Progress, 1997. 300 p. .

- Malyshkin P.A., Tanina M.A. Formirovanie sistemy preobrazhayushchikh investitsii v territorial'nom obshchestvennom samoupravlenii . Nauchnye zapiski molodykh issledovatelei , 2016, no. 1, pp. 52-62. .

- Perez C. Tekhnologicheskie revolyutsii i finansovyi kapital. Dinamika puzyrei i periodov protsvetaniya . Moscow: Delo; RANKhiGS, 2011. 232 p. .

- Filatova M.G. Strukturnaya perestroika promyshlennosti: sushchnost', zakonomernosti, mekhanizm gosudarstvennogo regulirovaniya . Yekaterinburg: UrO RAN, 1999. 227 p. .

- Reichheld F., Markey R. Iskrennyaya loyal'nost'. Klyuch k zavoevaniyu klientov na vsyu zhizn' . Moscow: Mann, Ivanov i Ferber, 2012. 352 p. .

- Elkington J. Lyudoedy s vilkami . Available at: http://appli6.hec.fr/amo/Public/Files/Docs/148_en.pdf

- Yurasov I.A., Bondarenko V.V., Tanina M.A., Yudina V.A. Modelirovanie sistemy impakt-investirovaniya v razvitie informatsionno-kommunikatsionnoi infrastruktury seti territorial'nogo obshchestvennogo samoupravleniya . Upravlenie razvitiem territorii na osnove preobrazhayushchikh investitsii . Ed.by V.V. Bondarenko. Penza: Izd-vo PGU, 2015. Pp. 209-217. .

- Yurasov I.A., Bondarenko V.V., Tanina M.A., Yudina V.A. Kontseptualizatsiya ponyatiya preobrazuyushchikh investitsii v sfere territorial'nogo obshchestvennogo samoupravleniya na osnove modelirovaniya setevogo upravleniya territoriei . Izvestiya vysshikh uchebnykh zavedenii. Povolzhskii region. Obshchestvennye nauki , 2015, vol. 35, no. 3, pp. 143-160. .

- Barnes T. New economic geography. The Dictionary of Human Geography. Ed. by D. Gregory, R. Johnston, G. Pratt, M.J. Watts, S. Whatmore. 5th edition. Singapore: Wiley-Blackwell, 2009. 500 p.

- Castells M. The Information Age: Economy, Society and Culture. vol. 1 (1996), vol. 2 (1997), vol. 3 (1998). Oxford: Blackwell.

- Dinc M., Haynes K.E. Sources of regional inefficiency: an integrated shift-share, data envelopment analysis and input-output approach. The Annals of Regional Science, 1999, vol. 33, no. 4, pp. 469-489.

- Fujita M., Krugman P. The new economic geography: past, present and the future. Papers in Regional Science, 2004, vol. 83, pp. 139-164;

- Lall S.V., Yilmaz S. Regional economic convergence: Do policy instruments make a difference? The Annals of Regional Science, 2001, vol.35, no. 1, p. 160.

- Leijonhufvud C., O'Donohoe N., Saltuk Y., Bugg-Levine A., Brandenburg M. Impact Investment. J.P. Morgan Global Research, 2010. Available at: http://ventureatlanta.org/wp-content/uploads/2011/11/JP-Morgan-impact_investments_nov2010.pdf

- Porter M. E., Kramer M.R. Creating shared value: redefining capitalism and the role of the corporation in society. Harvard Business Review, 2011, January/February, vol. 89, no. 1/2, pp. 62-77.

- Porter M., Kramer M. Creating shared value. Harvard Business Review, 2011, no. 1, 17 p. Reprint R1101C. Available at: http://www.hks.harvard.edu/m-rcbg/fellows/N_Lovegrove_Study_Group/Session_1/Michael_Porter_Creating_Shared_Value.pdf