Significance, content and life cycles of investment projects in modern conditions

Бесплатный доступ

Investment is a very complex and complex process, which includes a number of sub-processes, phases and individual activities. It contains two very important and interconnected dimensions - time and uncertainty. The time period from the appearance of the idea of the need to invest to the realization of the investment is usually very long. The next step is the preparation for the realization of the investment, followed by the realization of the investment and finally the preparation of the production. A special group consisting of investment projects focused on the construction and equipping of facilities of various purposes are the subject of this paper.

Investments, investing, risks, project, investment project, life cycle

Короткий адрес: https://sciup.org/170203959

IDR: 170203959 | УДК: 005.8:336; 005.41 | DOI: 10.5937/ekonsig2302143D

Текст научной статьи Significance, content and life cycles of investment projects in modern conditions

Taking into account the needs of accelerated economic and social development, investment capital is often a limited resource, so part of the missing funds is provided from other sources, i.e. other sources. Investing is a condition of an existing company, the purpose of which is to achieve certain effects - growth and development of the company, better position in the socio-economic environment, maintenance or better competitive advantage.

Business systems must look at all the circumstances and conditions that affect the achievement of their strategic goals and find answers to changes in the environment, which will certainly initiate changes within the systems themselves, in order to survive on the market. In order to operate profitably in such an environment, the company/in-vestor must analyze the environment, position itself in the selected market segment, define its strategy, assess its financial consequences and then implement it effectively through project selection, resource allocation and project implementation in in accordance with the defined strategy. It is the only way to create conditions for further development and growth of a company's Ekonomski signali 144

performance. It is no longer enough to just formulate a strategy, but to materialize it. The way of its materialization is precisely through projects as ways to solve the problems faced by the actors, that is, the bearers of economic activity on the market scene, and in the function of achieving business goals. A necessary condition for this is the investment of money or any other assets in the present moment in order not to realize the benefit in the future. Thus, the investment process itself is parallel to the process of renouncing a part of consumption.

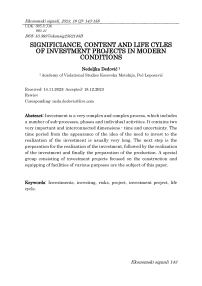

As in the economic sense, investments represent an investment in goods that are used with the aim of creating wealth in the future (e.g. building a factory or investing in education) and whose financial meaning implies the use of monetary assets that will bring income in the future (e.g. buying bonds, shares and real estate), making a series of investment decisions, each of which practically represents a project, is the most complex and difficult task of the management of a business system. On the other hand, wrong investment decisions or the consequences of bad investment can slow down and set back the development of a company and imply numerous negative consequences not only for the company and employees, but also for the wider social community. For this reason, in all complex, uncertain and risky business ventures, as they are today, there is a need for projects and the need for managing projects and investments as important segments on the way to realizing the development goals of business systems. The purpose of these processes is the rational harmonization of resources, the coordination of individual activities and the achievement of set goals within the planned time, costs and scope.

Every project is an indispensable element of investment, in addition to the investor as the entity that invests, market interest rates and discount rates as required rates of return. In this direction, in recent decades, a growth in the use of project management has been observed, which is a tool used to plan, organize, manage and control all elements of the project for the reason of the successful realization of the project and more efficient solution of current problems.

-

1. What is the specificity of the investment project?

The general definition is that a project represents a process that has its own time frame, has concrete goals, that is, it is implemented for the purpose of previously defined goals, has various resources for realization, has a defined budget and criteria for evaluating validity and implementation. It is a complex, unique and unrepeatable business venture aimed at final goals in the future, and is carried out with limited human and material resources in a limited time.

Each project is unique and therefore its outcome cannot be predicted with complete certainty. Projects are ventures that contain risk. 1

"A project means any undertaking that needs to be completed in a certain time, with a certain goal within the given resources and with certain validity evaluation criteria." 2

From the time dimension, the project represents a continuous process of realization, which consists of four phases:

-

1. project identification,

-

2. project preparation

-

2 Губеринић, С. и други: ( 1970), Управља-ње системима, системске дисциплине, технике и методе, Институт ''М. Пупин'', Београд

-

-

3. project assessment,

-

4. implementation and supervision of project implementation.

"The project is a one-time and complete process, special and unique (due to different goals, scope, deadlines, costs, required perso-nnel, etc.), goal-oriented, with cer-tain at the beginning and requires the organization of the performance during its duration until the final and set goal is achieved." 3

"The project represents a goal-directed and final process of the development of some activities, which are directed towards the achievement of the final goal." 4

"The project is a logical and physical category. It is logical because it means a logical whole (project) and physical because it means a technical and shaped whole (design)." 5

All the above definitions of the project essentially come down to the formulation that it presents a detailed and clearly explained idea in a way that gives the investor a clear picture of why he should invest his money in a certain project.

"Thus, the company's activities are viewed as the sum of all projects that strive for profitability and sustainable growth." 6

As a project is a job that has its own beginning and end, a predefined result with a given level of quality and budget, the conclusion is that the basic phases of every project are planning and implementation, and that it would take place through the mentioned phases with limited resources and with limited time, taking taking into account the risks and uncertainty arising from the decision-making process of embarking on a specific project, as well as the time factor, it is necessary to manage the project, i.e. undertake certain activities, coordinate them and control them with the aim of constantly adapting the project to its users and the changing environment, in order to it led to its final realization.

The bottom line is that every project must be financially profitable in order to cover the incurred expenses and all incurred obligations and so

-

5 Матасовић Љ. (1983), Примјена елек-тронских рачунара у изведби инвестици-оних пројеката, Информатор, Загреб,. стр. 146.

-

6 Драшковић, В. и др. (2006), Основи про-јект менаџментаса примјерима, Котор: Фа-култет за поморство

-

2. Characteristics and content of the investment project

that the owners or investors of the project who have directly invested capital will realize the appropriate benefit.

An investment project has its own specific features that distinguish it from other types of projects. The basic characteristics of investment projects are:

-

• If they are long-lasting,

-

• Very complex,

-

• For implementation, they require a large amount of resources and knowledge - from the basic elements

- means of work and objects of work until the engagement of several companies as contractors and subcontractors,

-

• spend large financial resources,

-

• Realization is long and takes longer than preparation

-

• Application of standard software is mandatory, project management is performed by the project team and implementation by someone else, which means that management and implementation functions are separated,

-

• Requires long-term monitoring and control, and

-

• It consists of a large number of interconnected activities that requ-

- ire coordination, which means that the implementation is staged.

-

3. Who can participate and with what tasks in the implementation of the investment project?

Picture 1 . Project characteristics

When it comes to the long-term nature of investment projects, it is a common feature of all investments, regardless of the subject of the project - the purchase or replacement of existing equipment or the construction or reconstruction of an object or other fixed asset, which require time. Second, from the idea of the need to invest to the final realization of the investment project, a number of years may pass. For this reason, there is a gap in time from the investment period to the realization of the financial effects of the investment. The goal is to shorten the investment period as much as possible because the investment project itself will bring the expected cash flows faster.

Third, market conditions today are such that investment cash flows must be carefully planned and all potential risks must be reasonably assessed. Of course, the financial effectiveness of the investment project will also be significantly higher, the longer the period of economic duration of the investment. As investment projects consume considerable financial resources.

It is necessary to provide adequate financial resources. In this direction, the development of the capital market is important, as well as the choice of the form of financing precisely because of the time gap between investment and the realization of the expected rate of return. Financial resources should be engaged not only in the procurement of the necessary material, parts, equipment, but also for the engagement of a large number of workers, which regularly follows every investment project. This means that numerous activities and a large number of phases that intertwine with each other require a coordinated network of mutual relations between the participants in the implementation, which also makes this type of project a complex undertaking.

Since the execution of works, the construction of an investment facility, the installation of equipment, etc., is carried out in the implementation part, this phase also lasts longer than the phase in which the project is being prepared.

All the mentioned activities and procedures require, among other things, appropriate executors who, in the domain of their knowledge, skills, their field of activity and on the basis of the assumed powers, should carry out a series of tasks in the implementation of the investment project. In order for them to succeed in this and for the project to be effectively managed, it is necessary to have a feedback loop between all participants. Any improper communication or non-distribution of relevant data and information between project managers and physical workers in the field can lead to serious problems.

All participants in the implementation of investment projects are called stakeholders by the American organization PMI. It defines them as individuals or as organizations that are actively involved in the project and whose interests are connected with the realization of the project itself. They can have different influence on the outcome of the investment project as well as different interests, regardless of whether they are indirectly or as a direct participant, i.e. parties interested in the project. Each of them contributes to the success of the project.

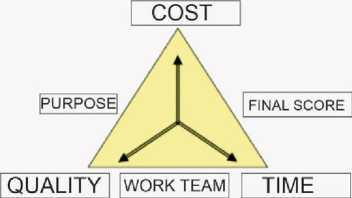

The main participants in each project are (picture 2):

-

• Investor and/or user,

-

• General contractor or contractor,

-

• Subcontractor, subcontractor,

-

• Consultant,

-

• Designer,

-

• Expert supervision and within it,

-

• Design supervision,

-

• Financial institutions and

-

• Influential organizations that are not direct participants in the implementation of the project, but can positively or negatively influence its course.

gement of

Picture 2 : Participants in the investment project

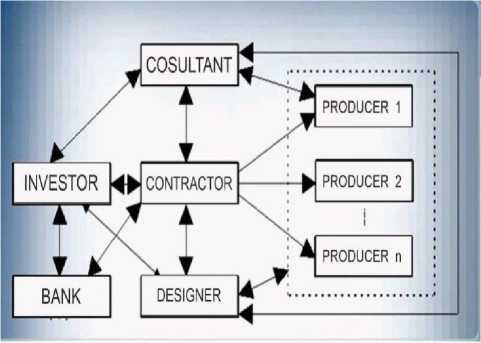

The degree of engagement of each of the above participants is subject to change over time depending on their needs, their expertise and their interests. Also their responsibility and authority may vary during the life cycle of the project.

An investor is an organization, an individual or a company that has a need to build a building and has the necessary financial resources for its realization. As a legal or physical person who invests his own or borrowed funds in a business in the present expecting profit in the future, it is important for the investor to conclude an appropriate contract with all other participants in order to realize his goals. They require control over the quality, deadlines and price of the project and mana-the work in each of the phases of project implementation. For these reasons, a large number of investors cooperate with specialized consulting companies that perform an economic and financial assessment of the possibility of building a building or some other business activity, whi- le taking into account various regulations.

Consultants primarily have an advisory role, but investors can authorize them to represent them in certain tasks. Consultants protect the interests of investors and the project itself. In addition to investors, contractors can also be hired in certain phases of project implementation, so there are often several consulting firms that, on the one hand, protect the interests of both within their contractual relationships, but certainly also the investment venture itself.

The types and scope of services provided by consultants are numerous. All are defined by the corresponding legal acts. In our country, it is the Law on Planning and Construction, carefully adapted to the needs of clients and bidders on the market.

Professional services of consultants are divided into five major categories:

-

• Advisory services - advice in management, production, supervision, quality control, in the area of representation before the competent authorities in case of disputes in order to present expert opinions and evidence and other advice;

-

• Pre-investment services, i.e. preinvestment studies that precede the decision on whether to proceed with the realization of the invest-

- ment, where all relevant indicators important for the execution and justification of the project are considered through the main features of the specific project, the selection of the construction site, for example - depending on the investment undertaking word, and economic and financial analysis, as well as the calculation needed for project evaluation;

-

• Services of design and supervision of the investment undertaking, which include four stages:

-

A) Pre-project ■ in the framework of which works related to the justification study, topographical and other measurements and research are carried out, analysis of existing capacities is carried out, schemes are drawn up, etc.

-

B) Preliminary solutions, which include the assessment and definition of the customer's requirements, elaboration of the concept and examination and research of all other factors and conditions concerning the project;

-

C) The stage of making detailed solutions and drawings with the costs of the complete investment project;

-

D) Special services ■ those for which a special need arises. It is the supervision of an invest-

- ment undertaking. When it comes to the construction of an object, supervision includes the services of consultants who always have a chief supervision engineer on the construction site. It's the resident engineer.

-

E) Project management on behalf of the investor is one of the most responsible roles that an investor can entrust to a consultant. Investors who are not professional and qualified or do not have the ability to monitor all investment and project activities and make decisions independently, can leave that work and entrust it to consultants.

The purpose of consulting companies and their professional services is to help the successful and profitable completion of an investment project.

The designer's role is to, at the request of the investor or consultant, consolidate all input data concerning the appearance, content, functioning of the project, technology and materials that are necessary for its realization, that is, the designer is responsible for the preparation and control of technical documentation. The designer must possess certain knowledge and skills and his engagement during the realization of the project is continuous. He plans to use all ava- ilable techniques in order to make the realization of the investment venture successful.

In order to realize the investment, the investor can hire one or more contractors. In accordance with our national regulations, he performs tasks related to the realization of undertakings - eg. construction of an object.

The investor provides professional supervision during the implementation of the project. When it comes to larger, more complex and multiyear investment ventures, it is preferable to divide it into design and execution projects. Expert supervision includes control of project implementation, i.e. control of existing technical documentation, quality control of the performance of all types of activities, control of the application of regulations, standards and technical norms, verification of evidence of the quality of equipment and parts that are installed, etc. In addition to the participants within the project, important influence on the implementation of the investment project is also exerted by participants from the environment such as: state authorities that grant appropriate permits and consents, institutions that grant consent to project documentation, utility companies, banks and others.

Since the goal is to implement investment projects so that they are sufficiently financially profitable, the main issue is a realistic assessment of the available sources of funds for its financing. If the investor cannot independently provide financial resources in the necessary volume, a wide range of participants appears in the role of financier. The evaluation of the profitability of the project and the evaluation of the participants in the specific project is important from the aspect of providing additional sources of financing. In addition to banks - domestic and foreign, there are investment funds, international and local development financing banks, equipment manufacturers, contractors, buyers or users of the project, etc. When it comes to international financing, funds can be secured through numerous arrangements, that is, specific jobs.

Key interest groups, which directly influence the development of the project, are usually the following:

-

• Investor – a person or organization that provides financial resources, or a project sponsor. When it comes to the sponsor, he must ensure the proper use of the funds and resources allocated to the project, and ensure that the funds

and resources are aligned with the expected business goal.

-

• Project team: project manager, project management team and other members of the project team who work together with the aim of realizing project management activities - from budgeting, planning, reporting, control, communication, risk management, etc.

Groups whose influence on the investment project is smaller or indirect and who have an interest in the project are:

-

• Project users, i.e. customers,

-

• Vendors – external companies that provide the necessary components or services,

-

• Business partners - with whom the investor has special relations based on which a certain type of support is provided on the project,

-

• Functional managers,

-

• Program Manager,

-

• Project Management Office,

-

• Other groups (media houses, government agencies, individual citizens, lobby organizations, scientific research agencies and institutes).

INTERES PARTIES

Picture 3 . The most common interested groups and their relationship with the project

-

4. Time period from the creation of an investment project idea to its realisation - life cycle

"The more complex the project, the greater the demands for more efficient joint work of highly educated experts from various fields - designers, engineers of various professions, economists, lawyers, etc." 7

All participants in the implementation of investment pro-jects are faced with the demands and needs of the market, for which reason they must consider the influence of various factors. In every investment venture, it is necessary that persons and organizations of all professions and specialties be repr- esented, that they be competent and that they function as one harmonized unit. As the project progresses, so does the degree of their engagement, which is common to all participants.

Picture 4 . The degree of involvement of the main participants in the project in relation to the phases of the life cycle of a complex investment project.

nal Conference on Spatial Information for Sustainable Development, Nairobi, Kenya. 25 October 2001.

Every project goes through a life cycle. "The life cycle of a project is the period of time from the creation of an idea about a project to its realizati-on".8 It consists of a certain number of phases and activities, whereby the entire process of realization of a project is broken down into global and smaller parts, which makes it possible to find and determine the best opportunities for realization of the entire project management process. It starts when a certain need is noticed or when the market demands the initiation of an investment pro-ject. In the conception phase, possib-le solutions are considered, economic and technological studies of the feasibility of certain alternatives are carried out in order to make a decision on the best possible investment solution. This is followed by the preparation of project technical documentation, and on the basis of it, the procurement of the necessary services and equipment is contracted. The life of the investment project does not end with the com- pletion of the investment and its handover to the user.

It continues through its purposeful use and investment maintenance during its lifetime, i.e. until its demolition or reconstruction, modification, replacement, depending on the type of investment project in question. 9

Each project has its own life cycle composed of the following basic four phases:

-

• Project identification,

-

• Project preparation,

-

• Assessment and

-

• Monitoring and control of project implementation,

According to the type of work performed on the project, the following four phases are also distinguished:

- Conceptualizing the project - is the initial phase that represents the identification of needs and opportunities, determination of alternatives and definition of project organization, definition of scope, purpose, goals, resources, goods, time frames and project structures.

-

- Planning - is a phase that includes preparation of preparatory

Арсић В., Обрадовић, В., ( 2011), Менаџ-мент и организација, Београд: Факултет организационих наука

plans and sketches, detailed design and preparation of a complete plan that enables the completion of the project, which will be managed by the project manager throughout the entire duration of the project development, who will monitor and control time, costs and quality.

- Execution or performance is the phase that signifies the execution and coordination of all activities and resources in order for the project to be completed; During the project implementation phase, the project team produces the materials needed for the work, while the project manager monitors and controls the quality of the materials that are delivered to the company for the implementation of the project.

-

- The final or final phase - includes the final activities and tasks if the project goals are not achieved.

Conclusion

The investment process includes a set of all activities in the entire period of planning, preparation and realization of an investment project, that is, the entire process of realization, from the creation of an investment idea to the final completion of the investment venture. It is a very complex process that includes a large number of subprocesses, phases and individual activities, the totality of which in efficient preparation and implementation leads to the realization of the original idea, that is, to the realization of the planned investment project. 10 From the idea of building a large production facility, which represents one of the largest and largest investments (or from the idea of introducing new machines or new technology into production), to the normal exploitation of this facility, it is necessary to realistically plan and carry out a large number of activities. The spontaneous unfolding of this complex process, without direction and guidance, certainly cannot lead to positive final effects. Obviously, it is necessary to manage this complex process in order to realize it in the best possible way. So, the management of investments, that is, the entire investment process, is a necessity derived from the enormous complexity of this process and at the same time the first condition for its efficient development and final realization. 11

11 Јовановић П., (2008), Управљање инвес-тицијама, Висока школа за пројектни

The characteristic of all serious projects, such as investment projects, is that before the start, experts of all professions must be engaged in order to make certain analyzes and create an investment study before the final decision is made. Participants of investment projects are the most important component because their interests are connected with realization of the project. Due to different interests, they have different influence on the outcome of the investment project. Since a large number of organizations participate in a complex investment venture, their correct identification is important. These are participants from different professions, profiles and knowledge.

Of all the participants, the investor is the most important and he bears the greatest consequences in case of failure. The goal of every investor is to carry out the activities according to the plan, in the given time and within the provided financial resources. As each of the participants has their own interests and engagement periods, they also develop their own project management methodology, which is necessary in order to carry out the assumed obligations and make optimal management decisions, of course with the aim of achieving the investor's goal Ekonomski signali 156

within the planned budget, time and quality.

Given that an investment project, whether it is an industrial, traffic, agricultural or construction project, is a production process that as a rule, it involves a large number of participants and implies large investments, where the projected conditions are prone to change and that these are projects that carry increased risk, and there may be deviations from the predicted and achieved results, any omission can have serious consequences. For this reason, these projects require effective management. Any investment project that was completed on time, met the goals, satisfied the quality and was implemented within the budget will be successful.

Список литературы Significance, content and life cycles of investment projects in modern conditions

- Chatfield C. & Johnson, T. (2016), “Microsoft Office Project 2016 Step by Step”, Microsoft Press.

- Dedović N., Dedović A., (2015), Investment Management, College of Economics of Vocational Studies Peć in Leposavić, Leposavić.

- Drašković V. et al., (2006), Basics of project management by examples, Kotor: Faculty of Maritime Affairs

- Guberinić S. and others: (1970), Management of systems, system disciplines, techniques and methods, Institute "M. Pupin'', Belgrade.

- Đuričin D., (2003), Project Aid Management, Belgrade

- Jovanović P., (2008), Investment Management, College of Project Management, Belgrade

- Lock, D.: (1977), Project management, Gower Press, London.

- Hanc A. and others, (1989), Project management, KIZ kultura, Belgrade

- Matasović Lj., (1983), Application of electronic computers in the execution of investment projects, Informator, Zagreb.

- Oladapo M., (2001), A framework for cost management of low-cost housing. International Conference on Spatial Information for Sustainable Development, Nairobi, Kenya. 2-5 October 2001.

- Petrović, D., Mihić, M., Žarkić- Joksimović, N., Jaško, O., Orlić, R., Bogojević-Arsić, V., Obradović, V., (2011). Management and Organization, Belgrade: Faculty of Organizational Sciences