Socially oriented taxation and how it is perceived (case study of a survey of economists-to-be)

Автор: Lvova Nadezhda Alekseevna, Pokrovskaya Natalya Vladimirovna, Ivanov Viktor Vladimirovich

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Social development

Статья в выпуске: 4 (52) т.10, 2017 года.

Бесплатный доступ

The article discusses the prospects for adapting unconventional tax mechanisms to tax administration in a secular multicultural state. The purpose of the study is to identify significant factors which determine the advisability of establishing socially oriented taxes as perceived by economists-to-be that do not possess enough information about alternative tax practices and mechanisms for their implementation. Scientific novelty of the research consists in the fact that it considers socially-oriented taxation in more detail; this type of taxation is suggested to be considered in conjunction with religious tax practices, which significantly complements existing ideas about the specifics of functioning of modern tax systems. The research methodology includes the use of the questionnaire method. The respondents are future economists - students of Saint Petersburg State University. At the first stage, we test the level of awareness of respondents about alternative tax practices...

Cially oriented taxes, religious taxes, islamic taxes, zakat, tax mechanisms, alternative tax arrangements, islamic tax system, islamic financial system

Короткий адрес: https://sciup.org/147223960

IDR: 147223960 | УДК: 336.22 | DOI: 10.15838/esc.2017.4.52.11

Текст научной статьи Socially oriented taxation and how it is perceived (case study of a survey of economists-to-be)

Figure 1. The structure of respondents

□ Women □ Men

Source: compiled by the authors.

to the administrative and territorial structure of modern countries. In addition, Muslims pay double taxes: zakat and traditional taxes in relevant tax jurisdiction. Zakat is part of the state tax system in Yemen, Libya, Malaysia, Pakistan, Saudi Arabia and Sudan. In nine more Muslim countries (Bangladesh, Bahrain, Egypt, Indonesia, Jordan, Iran, Kuwait, Lebanon and the United Arab Emirates), the state supports the institution of zakat by providing benefits to its payers (including mitigation of double taxation), as well as by taking part in spending the raised funds and (or) controlling their redistribution. In other Muslim countries zakat administration is carried out without state participation [3]. This situation is especially typical for countries where Islam is a predominant religion. It is easy to assume that in Russia zakat is not part of the tax system. However, it is voluntarily paid by Muslims to non-state funds.

Methodology and data

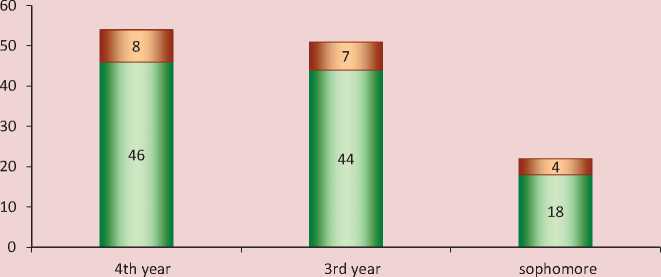

For the research purposes we conducted a survey of economists-to-be – Ph.D. sophomore, third- and forth-year students in Economics at Saint Petersburg State University4. All in all, 127 people answered the questionnaire. The sampling amounts to 870 people. The survey was conducted in April, 2015. The structure of respondents is presented in Figure 1 .

The questionnaire includes 20 statements comprising two semantic blocks: the first concerned the perception of social justice; the second – the respondents’ awareness about religious taxation with an emphasis on Islamic tax practice in the context of Islamic financial system functioning, which reflects the research subject ( Tab. 1 ). Data was collected by the authors through questionnaires in paper form.

Note that the statements of the questionnaire can be structured in two groups:

-

1) depending on the content – into four blocks: a) the ethical framework of financial relations (1–5); b) mechanisms of support for socially vulnerable population groups (6–10); c) awareness of religious taxes and fees (11– 15); d) awareness of Islamic finance (16–20);

-

2) by level of importance of the subjective factor – into two blocks: a) statements

Table 1. Content of the questionnaire

Each statement implies the ranking of respondent’s attitude from negative (“completely wrong”, “rather not true”) to positive (“rather true”, “true”). In addition, the option “no answer” was also available. The distribution of answers is presented in Table 2 .

The first phase of the study was to test the hypothesis that low resp ondents’ awareness about alternative tax practices, including

Islamic tax, which is a significant phenomenon of the modern Islamic financial system.

The second phase we carried out modeling of tolerance to socially oriented taxation in the case of conditional tax resembling zakat.

The research hypotheses were formulated as follows:

H0 : tolerance to the introduction of a particular tax does not depend on subjective (perception of social responsibility) and objective (gender, course of studies) factors.

H1 : tolerance to the introduction of a particular tax depends on the factors under review.

Table 2. Distribution of respondents’ answers

|

No. of statement |

Undecided |

Completely wrong |

Rather wrong |

Rather true |

Completely true |

|

1 |

1% |

3% |

20% |

59% |

17% |

|

2 |

0% |

2% |

13% |

47% |

38% |

|

3 |

0% |

2% |

2% |

39% |

57% |

|

4 |

0% |

4% |

48% |

39% |

9% |

|

5 |

0% |

3% |

36% |

48% |

13% |

|

6 |

2% |

17% |

46% |

29% |

6% |

|

7 |

0% |

4% |

18% |

48% |

30% |

|

8 |

0% |

16% |

41% |

37% |

6% |

|

9 |

1% |

6% |

44% |

45% |

4% |

|

10 |

2% |

43% |

27% |

11% |

17% |

|

11 |

1% |

50% |

29% |

14% |

6% |

|

12 |

6% |

1% |

14% |

39% |

40% |

|

13 |

9% |

13% |

17% |

51% |

10% |

|

14 |

15% |

8% |

21% |

49% |

7% |

|

15 |

8% |

9% |

15% |

29% |

39% |

|

16 |

5% |

35% |

17% |

34% |

9% |

|

17 |

16% |

2% |

13% |

32% |

37% |

|

18 |

14% |

3% |

24% |

45% |

14% |

|

19 |

4% |

44% |

25% |

22% |

5% |

|

20 |

13% |

39% |

35% |

11% |

2% |

|

Source: compiled by the authors. |

|||||

The modeling was implemented in the program Stata 11.

Our research is based on assumptions about low respondents’ awareness of the research subject. This hypothesis has fully confirmed.

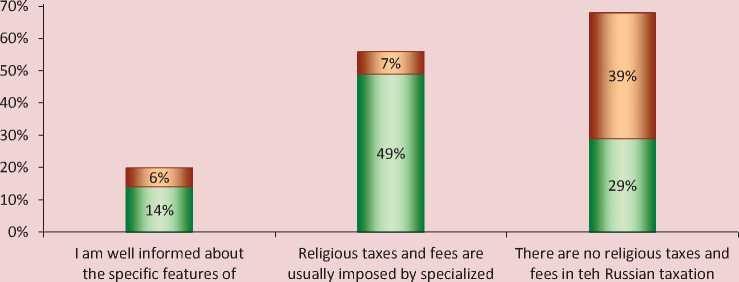

In particular, more than half of the students admit that they are not well informed about religious taxes and fees ( Fig. 2 ).

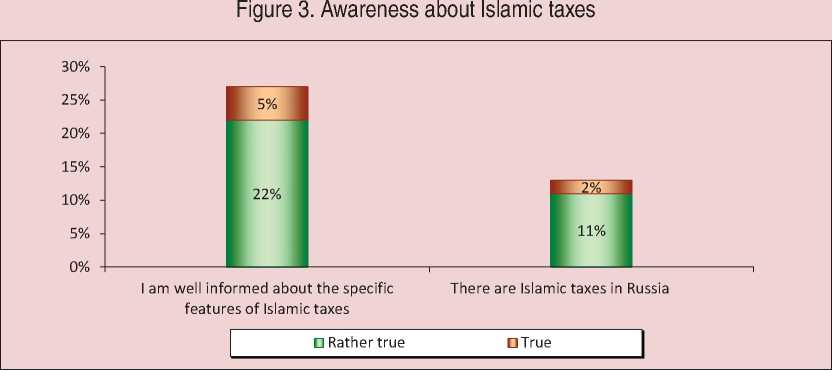

The lowest awareness is noted in terms of Islamic taxes. Only 5% of respondents believe they are aware of the issue. At the same time, it is noteworthy that they mistakenly admit that these taxes do not exist in Russia. Thus, subjective assessment of awareness can be legitimately disputed ( Fig. 3 ).

It is noteworthy that only 10% of students consider themselves aware of the specific

Figure 2. Awareness of religious taxes and fees

religious taxes and fees religious organizations system

Source: compiled by the authors.

Source: compiled by the authors.

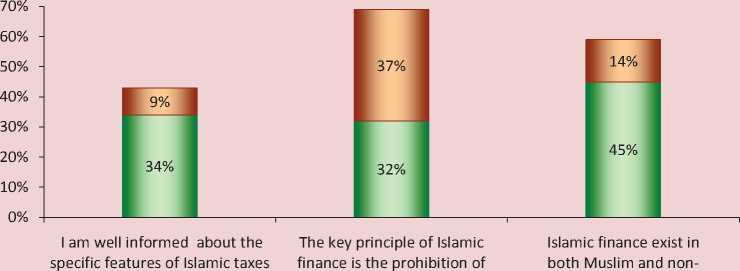

features of Islamic finance. At the same time, 32% of respondents chose the correct answer that the key principle of Islamic finance is the prohibition of interest on loans. However, only 14% believe that the Islamic financial system operates in both Muslim and nonMuslim countries ( Fig. 4 ).

Therefore, low subjective assessment of awareness in this case is only p-partly confirmed and can therefore be characterized as overly cautious. In our view, this can be explained by respondents’ dissatisfaction with their knowledge of this subject and their potential interest in its further study.

The testing of hypotheses about tolerance to socially oriented taxation in the case of conditional tax resembling zakat was carried out using the method of ordered logit.

To study the factors influencing loyalty in this matter we selected statement 6 of the questionnaire (“A special tax aimed at supporting socially vulnerable population groups should be introduced”) the attitude to which was presented as an ordered variable (Y). Under the terms of the survey the variable could take one of four possible values with the lowest being “totally agree” with the imposition of the tax, and the highest – “strongly agree”. Statements which respondents found difficult to assess were excluded from the final model. Thus, it included 122 statements out of 127.

The initial set of factors proposed for characterizing the attitude to socially oriented taxes included:

– nine discrete ordered variables taking values: “1” – disagree, “2” – rather disagree, “3” – rather agree, “4” – agree: attitude of statements 1–5 and 7–10 of the first block of the questionnaire related to perception of social justice.

Figure 4. Awareness of Islamic financial system

interest on loans Muslim countries

□ Rather true □ True

Source: compiled by the authors.

– a dummy variable corresponding to the gender of the respondent (“1” – for males, “0” – for women);

– two dummy variables corresponding to the respondent’s year of study (“1” – for third-year students, “0” – other; “1” – for sophomore students, “0” – other).

The selection of significant factors was based on Student’s t-test at five percent significance level.

The resulting model has the following form:

Y = -0,58 x X 1 + 0,50 x X 2 + 1,00 x X 3 + +0,46 x X 4 + 1,31 x X 5 .

Y – attitude to introduction of a special socially oriented tax implying one of the four options:

-

1) if Y < Y0, then “totally agree”;

-

2) Y 0 < Y < Y 1 , then “rather disagree”;

-

3) Y 1 < Y < Y2, then “rather agree”;

-

4) Y2 < Y, then “absolutely agree”;

-

X1 – agreement on financial support for socially vulnerable population groups to be an indispensable element of corporate social responsibility (Statement 4);

X2 – agreement on collection and distribution of funds to support socially vulnerable population groups to be dealt with by specialized private funds with public and transparent reporting (Statement 7);

X3 – respondent’s personal willingness to give up part of income to support socially vulnerable population groups (Statement 8);

X4 –view that expenditures to support socially vulnerable population groups should influence the individual income tax (Statement 10);

X5 – sophomore students.

Table 3. Model of tolerance to socially oriented taxation

|

Variable |

Index |

Standard error |

z-test |

Likelihood |

|

X 1 |

- .579599 |

.2680124 |

-2.16 |

0.031 |

|

X 2 |

.502654 |

.2363988 |

2.13 |

0.033 |

|

X 3 |

1.001874 |

.2457274 |

4.08 |

0.000 |

|

X4 |

.459762 |

.1670974 |

2.75 |

0.006 |

|

X5 |

1.315009 |

.4765873 |

2.76 |

0.006 |

|

Isolation point |

||||

|

Y 0 |

1.595964 |

1.064465 |

||

|

Y 1 |

4.453875 |

1.12938 |

||

|

Y 2 |

7.111679 |

1.259993 |

||

|

Likelihood function logarithm |

-121.01352 |

Pseudo-R2 |

0,162 |

|

|

LR-test |

47.02 |

|||

|

Likelihood (LR-test) |

0.0000 |

|||

|

Source: compiled by the authors. |

||||

Detailed characteristics of the model5 are presented in Table 3 .

Table 3 indicates that loyalty to the introduction of a conditional tax resembling zakat is positively related to agreement with statements 7, 8, 10 and negative – with agreement with statement 4. In other words, the level of tolerance in this case is determined by the willingness to give up part of the income to support socially vulnerable population groups, as well as by the level of trust in the relevant non-state organizations. The chances of agreement with the introduction of a socially oriented tax are significantly higher for sophomore students than for third- and forth-year students. In our view, this result can be explained by the fact that younger students associate themselves with taxpayers to a lesser extent.

The study has shown that respondents’ agreement with certain statements is statistically insignificant, including: agreement with the fact there is a need for financial relations to be complied with strict moral principles; the function of the financial system to foster socially equitable income distribution in the society; with providing financial support for socially vulnerable population groups; with responsibility of the entire society for financial support for socially vulnerable population groups; with the willingness to donate to support socially vulnerable population groups at a certain time and with a certain amount. Interestingly, tolerance to socially oriented taxation is not affected by gender differences. It is particularly noteworthy that the majority of respondents shared the view that financial relations should contribute to equitable income distribution in the society (Tab. 4).

A significant share of respondents is willing to make regular donations to support socially vulnerable population groups. However, not all of them agree with the introduction of a special socially oriented tax. In our view, this suggests that the defining feature of any tax is its compulsory nature.

Conclusions

The study has confirmed there is statistically significant correlation between certain aspects of perception of social responsibility, including the mechanisms for its practical implementation, and the level of tolerance to socially oriented taxation. According to the survey, economists-to-be from Saint Petersburg, with low awareness of specific examples of implementation of alternative tax mechanisms in practice, demonstrate their willingness to take additional social obligations. Loyalty to introduction of conditional socially oriented tax resembling zakat is positively dependent on the following factors: willingness to give

Table 4. Attitude to the social role of financial relations

The research results, developing the traditional understanding of tax mechanisms in the context of religious and socially oriented taxation, have both scientific and certain practical significance. In our view, the experience of religious taxation may find successful application in tax administration in multicultural secular states including the Russian Federation. It is noteworthy that Islamic taxation mechanisms focused on effective motivation, rather than coercion, are implemented with the use of innovative techniques. For example, in Russia advanced methods of zakat administration are implemented: the tax rate can be calculated using online calculators, fund transfers may be implemented with the use of a broad spectrum of payment tools (cash, bank transfer, credit card, cybercash, via SMS, etc.). Thus, maximum convenience is provided for the taxpayers, ensuring their involvement and interest, which in turn is the key to overcoming economic disparities in the society. A promising area for further studies in this sphere are surveys of economists-to-be repeated in various Russian regions, as well as involvement of the representatives of the academic and professional community in the discussion of alternative tax mechanisms.

Список литературы Socially oriented taxation and how it is perceived (case study of a survey of economists-to-be)

- Bekkin R.I. Islamskie nalogi v sisteme nalogooblozheniya musul'manskikh stran . Nalogovaya politika i praktika , 2007, no. 6 (54), pp. 42-47.

- Bekkin R.I. Islamskoe finansovoe pravo i ego rol' v regulirovanii islamskikh finansov . Uchenye zapiski Kazanskogo universiteta. Seriya: Gumanitarnye nauki , 2013, vol. 155, no.3-2, pp. 134-144.

- Gurnak A.V., Vishnevskaya E.N., Gurnak A.Yu. Religiya i vlast': poisk kompromissa v nalogooblozhenii musul'manskikh stran . Ekonomika. Nalogi. Pravo , 2014, no. 3, pp. 46-50.

- Eremenko E.A. Spetsial'nye nalogovye rezhimy i kontseptsiya spravedlivosti nalogooblozheniya . Finansy , 2015, no. 9, pp. 76-80.

- Kalimulina M.E. Sotsiokul'turnye faktory v natsional'noi modeli ekonomiki Rossii (na osnove sotsiologicheskogo issledovaniya po islamskoi ekonomike i finansam sredi naseleniya Rossii i stran SNG) . Ekonomika. Predprinimatel'stvo. Okruzhayushchaya sreda , 2010, no. 2 (42), pp. 13-20.

- Karavaeva I., Elitsur M. Sotsial'no orientirovannoe nalogooblozhenie: teoriya voprosa . Ekonomicheskaya politika , 2010, no. 6, pp. 47-58.

- L'vova N.A., Pokrovskaya N.V. Osobennosti islamskogo nalogooblozheniya v usloviyakh sovremennoi finansovoi sistemy . Finansy i kredit , 2015, no. 8, pp. 31-40.

- Panskov V.G. Printsip spravedlivosti v nalogooblozhenii: voprosy teorii i praktiki . Finansy , 2015, no. 2, pp. 26-30.

- Pushkareva V.M. Istoriya finansovoi mysli i politiki nalogov . Moscow: Finansy i statistika, 2008. 191 p.

- Voronov V.S. Sovremennye finansovye rynki . Moscow: Prospekt, 2016. 564 p.

- Abdullah N., Derus A., Al-Malkawi H. The Effectiveness of Zakat in Alleviating Poverty and Inequalities: a Measurement Using a Newly Developed Technique. Humanomics, 2015, no. 31 (3), рp. 314-329.

- Al-Qardawi Yu. Fiqh al. Zakah: a Comparative Study of Zakah, Regulations and Philosophy in the Light of Quran and Sunnah. Jeddah: Scientific Publishing Centre, King Abdulaziz University, 2000. 369 р.

- Awad M. Adjusting Tax Structure to Accommodate of Zakah Management of Zakah in Modern Muslim Society. Islamic Development Bank, 2000. Pр. 77-96.

- Islamic Finance. The UK Islamic Finance Secretariat (UKIFS) Report. -October 2013. Available at: http://www.thecityuk.com/assets/Uploads/Islamic-finance-2013-F.pdf.

- Islamic Financial Services Industry Stability Report. 2015. Available at: http://www.ifsb.org/docs/2015-0520_IFSB%20Islamic%20Financial%20Services%20Industry%20Stability%20Report%202015_final.pdf.

- Masvood Y., Lokeswara Choudary Y. Islamic Banking -a Cross Cultural Patronage Study among the Students in Chennai. Asian Social Science, 2015, no. 11 (4), pp. 310-318.

- Lvova N.A., Pokrovskaia, N.V. Ivanov V.V. The Attitude to Islamic Taxation in Russia: Does Financial Ethics Matter? Innovation management and education excellence vision 2020: from regional development sustainability to global economic growth. The 27th IBIMA conference proceedings. 2016. Pp. 294-304.

- Lvova N.A., Pokrovskaia N.V., Ivanov V.V. Unconventional tax mechanisms in a secular state: prospects of adaptation in Russia. Proceedings of the 5th International Conference on Accounting, Auditing, and Taxation (ICAAT 2016). Pp. 318-326.

- Mohd Ali A., Rashid, Z. Johari F., Aziz M. The Effectiveness of Zakat in Reducing Poverty Incident: an Analysis in Kelantan, Malaysia. Asian Social Science, 2015, no. 11 (21), pp. 355-367.

- Mohdali R., Pope J. The Influence of Religiosity on Taxpayers' Compliance Attitudes: Empirical Evidence from a Mixed-Methods Study in Malaysia. Accounting Research Journal, 2014, no. 27 (1), pp. 71-91.

- Powell R. Zakat: Drawing Insights for Legal Theory and Economic Policy from Islamic Jurisprudence. University of Pittsburgh Tax Review, 2009, no. 7 (43), pp. 43-101.

- Religious Diversity Index Scores by Country. Available at: http://www.pewforum.org/2014/04/04/religious-diversity-index-scores-by-country/

- Saleem Sh. Islamic Concept of Taxation. Renaissance, 1992, no. 2 (10).

- Shaikh S. An Alternate Approach to Theory of Taxation and Sources of Public Finance in an Interest Free Economy. MRPA Paper. 2009. 14 p.

- Yusuf M., Derus A. Measurement Model of Corporate Zakat Collection in Malaysia: A Test of Diffusion of Innovation Theory. Humanomics, 2013, no. 29 (1), pp. 61-74