Some Results on Optimal Dividend Problem in Two Risk Models

Автор: Shuaiqi Zhang

Журнал: International Journal of Information Engineering and Electronic Business(IJIEEB) @ijieeb

Статья в выпуске: 2 vol.2, 2010 года.

Бесплатный доступ

The compound Poisson risk model and the compound Poisson risk model perturbed by diffusion are considered in the presence of a dividend barrier with solvency constraints. Moreover, it extends the known result due to [1]. Ref. [1] finds the optimal dividend policy is of a barrier type for a jump-diffusion model with exponentially distributed jumps. In this paper, it turns out that there can be two different solutions depending on the model’s parameters. Furthermore, an interesting result is given: the proportional transaction cost has no effect on the dividend barrier. The objective of the corporation is to maximize the cumulative expected discounted dividends payout with solvency constraints before the time of ruin. It is well known that under some reasonable assumptions, optimal dividend strategy is a barrier strategy, i.e., there is a level b_{1}(b_{2}) so that whenever surplus goes above the level b_{1}(b_{2}), the excess is paid out as dividends. However, the optimal level b_{1}(b_{2}) may be unacceptably low from a solvency point of view. Therefore, some constraints should imposed on an insurance company such as to pay out dividends unless the surplus has reached a level b^{1}_{c}>b_{1}(b^2_{c}>b_{2}) . We show that in this case a barrier strategy at b^{1}_{c}(b^2_{c}) is optimal.

Optimal dividend, solvency constraints, compound Poisson risk model, compound Poisson risk model perturbed by diffusion

Короткий адрес: https://sciup.org/15013053

IDR: 15013053

Текст научной статьи Some Results on Optimal Dividend Problem in Two Risk Models

Published Online December 2010 in MECS

The optimal dividend problem pioneered in [2]. Since then, there has been a wave of research focusing on finding the dividend payment strategy for the diffusion model and the compound Poisson risk model. In the present papers, the authors provided the solutions of the optimization problems where the companies control their risk before the cash reserves hit or fall below 0 .

For the optimal dividend problem of the compound Poisson risk model perturbed by diffusion, many papers focus on integro-differential equations for the expected discounted penalty function, as well as some ruin related functional such as the probability of ultimate ruin, the time of ruin and the surplus before ruin and the deficit at ruin. In these papers, the authors considered the problems

Footnotes:

Manuscript received July 1, 2010; revised September 1, 2010;

accepted September 20, 2010.

Corresponding author: Shuaiqi Zhang within the framework that the dividend strategy is the so-called threshold dividend strategy or the barrier strategy or the multi-layer strategy. Ref.[1] studied the optimality of the dividend policy for the jump diffusion process. In this paper, some further results on the optimal dividend strategy are obtained in section III. Specifically, it turns out that there can be essentially two different solutions depending on the model's parameters. If

-("2" £ в + c ) + в — 0 , the initial capital should be paid out as dividend immediately, and the ruin occurs. If 1 2

- ("2 £ в + c ) + в < 0 , the optimal strategy is to pay everything in excess of the optimal dividend barrier, whenever the reserve reaches the barrier, and the process continues. The paper also extends the controlled model with considering the existence of the proportional transaction costs. It is shown that the amount of the dividend increases as the proportional rate 1 — k decreases. What is also interesting is that the dividend barrier in the solution of this problem is the same as the barrier without proportional costs. In other words, proportional costs factor has no effects on the dividend barrier.

As for the dividend problems with constraints, [3] considered diffusion process under the restrictions that that the dividends should not be paid out unless the surplus has reached a level b0 > b . It is shown that in this case a barrier strategy at b0 is optimal. This inspires us to think a question of main interest: can we find the optimal dividend strategy of the compound Poisson risk model with solvency constraints? Or can we find the optimal dividend strategy of the compound Poisson risk model perturbed by diffusion with solvency constraints?

This paper makes the same assumptions as in [3], but differently formulated because of the model we discuss are the compound Poisson risk model and compound Poisson risk model perturbed by diffusion. The objective is to maximize the discounted dividend payment with solvency constrains before the time of ruin. We solve the problem completely when the individual claim amounts are generally distributed, rather than exponentially distributed.

The paper is organized as follows: Section II establishes the control model. In Section III, some properties of the value function are presented. Section

IV discusses some further results to the control problem when claims are exponentially distributed. In section V, the optimal dividend problem of the compound Poisson risk model with solvency constraints is solved. In section VI, the optimal dividend problem of the compound Poisson risk model perturbed by diffusion with solvency constraints is considered.

-

II. Formulation of the Control Problems

To give a rigorous mathematical formulation of the optimization problem, we start with a filtered probability space { Q ,F,{F t } t a o ,P} . We assume that in the absence of dividends, the compound Poisson risk model Xt 0 is given by

N ( t )

-

x, = x + ct -У y , ti i = 1

and the compound Poisson risk model perturbed by a diffusion is given by

N ( t )

Xb = x + ct -У Y + e W , tit i = 1

where X > 0 is the initial reserve, c > 0 is the premium rate, {N(t)} is a Poisson process with intensity X > 0 and {Yi } is an i.i.d. sequence of strictly positive random variables with distribution function F(y)and probability density function f (y). The claim sizes {Yi }and the claim arrival process N(t) are assumed to be independent. We assume that EY ] = Ц<^

W; t > 0} is a standard Wiener process that is

N ( t )

independent of the aggregate claims process St = ^ Yk k=1

and e is the dispersion parameter. X^ ( X^ ) is adapted to the smallest right-continuous filtration {F t } t > 0 . If we want to indicate that the initial capital is x , we write P x and E x for the probability measure and the expectation, respectively. Otherwise, we dismiss the letter x and write P and E .

We now enrich the compound Poison risk model (the compound Poisson risk model perturbed by diffusion). We denote by {Dt1} the aggregate dividends paid between time zero and time t . {Dt1} ({Dt2}) is càglàd, increasing and adapted process with D0 = 0 (D0 = 0) .

The dynamics of the controlled compound Poisson risk model is given by

N ( t )

X ' = x + ct -У Y - D ' .

tit i=i

The policy П 1 is said to be admissible if the process { Dt 1} is {F t } t > 0 -adapted, increasing and adapted process with D 0 1 = 0 . The class of all admissible controls is denoted by П 1 .

The time of ruin is defined by

T n : = inf{ t > 0: Xt 1 < 0}.

With each admissible control П 1 G П 1 , we associate a performance functional V п ' ( X ) defined by

T - '

V ( X ) = E x I J 0 . e d D 1 J , where ‘ is the discount rate. The objective is to find the control that maximizes the performance index. We define the value function V 1 by

V 1 ( x ) : = sup { V n ' ( x ); n 1 g П , } .

The optimal policy П 1 is a policy for which the following equality is true:

V ' ( x ) = V n * ( x ) .

If the company is not be allowed to pay dividends unless the surplus is more than bc 1 . Mathematically such restriction can be written as

Г e "I { x5< ftdD = °-

If we impose restrictions of the form that no dividends are allowed to be paid out unless surplus is at least bc1 , and the surplus immediately after payment can not be below bc1 . In this case, we denote admissible strategy by nc. We define the performance index by nc cT

V 4( x ) = E x / 0 -

The value function is defined by

V(x ): = sup{ V n c ( x ); П Gn c } .

The optimal policy П 1 is a policy for which the following equality is true:

V j( x ) = V n c ‘( x ) .

We now enrich the compound Poisson risk model perturbed by diffusion. We denote by {Dt2} the aggregate dividends paid between time zero and time t . {Dt2} is càglàd, increasing and adapted process with D02 = 0 .

The dynamics of the controlled compound Poisson risk model perturbed by diffusion is given by

N ( t )

X 2 = x + ct-У Y + e W - D 2 .

titt i=1

The policy is said to be admissible if the process { D2} is {F t } t > 0 -adapted, increasing and adapted process with D 02 = 0 . The class of all admissible

controls is denoted by П 2 .

The time of ruin is defined by

T71 2 : = inf{ t > 0: Xt < 0}.

With each admissible control П 2 e П 2 , we associate

x + Erf e 0 tc d t ] = x + — . x Jo о

This is the upper bound of any admissible strategy, i.e.,

V 1 ( x ) < x + - . о

Since П - is a subset of П 1 , obviously,

V j( x ) < V 1 ( x ) .

This completes the proof.

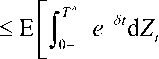

a performance functional V71 2 ( x ) defined by

V71 2( x ) = E I I 2 e'* d D 2 I .

x i Jo- t j

The value function V 2 ( x ) by

V 2 ( x ) : = sup { V” 2 ( x ); л 2 e П 2} .

The optimal policy 71 2 is a policy for which the following equality is true:

V 2( x ) = V ” 2( x ) .

If the company is not be allowed to pay dividends unless the surplus is more than bc 2 . Mathematically such restriction can be written as

C e " ° I { X — < d' = 0.

If we impose restrictions of the form that no dividends are allowed to be paid out unless surplus is at least level bc 2 , and the surplus immediately after payment can not be below bc 2 . In this case, we denote admissible

Lemma 3.2. The function V 2 ( x ) is increasing with

V 2 ( x ) - V 2 ( y ) > x — y for 0 < y < x .For any x > 0 , V 2( x ) < x + Ц + — .

о

V 2 ( x ) is differentiable with V 2 ( x ) > 1 .

Rroof. For any £ > 0 , define a strategy 77 2 satisfing V” 2 ( y ) > V 2 ( y ) — £ . 77 2 is a new strategy for x > y . While 77 2 is defined as: x — y is paid immediately as dividend and then the strategy 77 2 with initial capital y is followed. Therefore,

V 2( x ) > x - y + V71 2( y ) > x — y + V 2( y ) — £ .

From the arbitrary property of £ , we have V 2 ( x ) — V 2 ( y ) > x — y for 0 < y < x . In particular, V 2 ( x ) is increasing. It is easy to see that V 2 ( x ) > 1 .

strategy by П 2 . We define the performance index by c I T T*c I

V 2( x ) = E x К e-stD .

The value function is defined by

V I x ): = sup{ V ' c ( x ) П еП 2 }.

The optimal policy П is a policy for which the following equality is true: 2*

V - x ) = V ( x ) .

Now we prove that V 2 ( x ) < x + Ц +-- . о

The proof follows the same line as Proposition 3.1 in

[4]. Define a stochastic process Zt by

Zt = x + ct + £Wt, and

T : = inf{ t > 0: Zt < 0} .

We obtain

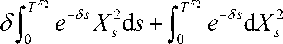

e -O s d Zs

= E

f T e - O sc d s

^

III. Some Properties of the Value Function

We start with two lemmas.

Lemma 3.1. The function V 1 ( x ) and Vc 1 ( x ) are bounded. Moreover,

V K x ) < V 1 ( x ) < x + - . о

Rroof . To get the upper bound of the value function V 1 ( x ) , we consider a strategy 77 1 defined as follows: the initial capital x is paid immediately and then the dividends are paid at rate c .Then,

Г ^ e C

< E f e ~ 8 sc d s = - .

LJ о J 0

From Itô formula,

-ST*^2 v2

e XT - 2

Since X2I^ < 0 , it follows that

T n 2

Г T" 2 X 0

— E f o e-° -dxi

T "2

— E ° f

J 0

— E

-ST*"2 v e XT- 2

< x + ^ .

Clearly, combining (1) and (2), we obtain

E Г 2 - e - 8 1 d D2

J 0- t

= - ( s 1 + P )( s 3 - s 2 ) B

( s 3 + P )( s 1 - s 2 ) 3

e -S t d X 2

c

< x + Ц +-- .

S

This is the upper bound.

Since П 2 is a subset of П 2 , obviously, Vc 2( x ) < V 2( x ) .

This completes the proof.

Furthermore, we can conclude that B 1 , B 2 and B 3 satisfy

B 1 B 3 < 0, B 2 B 3 < 0, B 1 B 2>0.

Now, we claim that B 1 < 0 , B 2 < 0 and B 3 >0 . Because if B 1 > 0 , B 2 > 0 , B 3<0 , we have

V 2 ' (0) = B 1 s 1 + B 2 s 2 + B 3 s 3 .

This contradicts with the fact that V 2 ( x ) is increasing.

From V 2 ( b ) = 1 , we have

IV. The Solution of the control problem without

RESTRICTION

The dynamic programming principle helps us to derive the Hamilton-Jacobi-Bellman (HJB) equation.

To obtain the solution, we start with the HJB equation max { 2 e2 V "( x ) + cV ‘ ( x ) - ( 2 + S ) V ( x ) + 2 j 0 x V ( x - y )d F ( y ), 1 - V* ( x ) } = 0. (3)

For more detailed and complete account of the derivation, we readers should consult with [1].

In this section, we assume that the individual claim amounts are exponentially distributed, f (y) = Pe-Py, y > 0.

From some simple calculation, as in [1], the solution to the ordinary differential equation

2 e Х ' ( x ) + (2 e 2 P + c )V"(. x )

B 1 s 1 eb + B 2 s 2 es 2 b + B 3 s 3 es 3 b = 1.

Combining with the (6) and (7), we have

B =- ( s 1 + P )( s 3 - s 2 ) { _ ( s 1 + P )( s 3 - s 2 ) ses b

-

1 ( s 3 + P )( s 1 - s 2 ) ( s 3 + P )( s 1 - s 2 ) 1

+ ( s 2 + P )( s 3 - s 1 ) 2 b + 3 b } - 1 , (8)

( s 3 + P )( s i - s 2 ) 2

B = ( s 2 + P )( s 3 - s 1 ) { - ( s 1 + P )( s 3 - s 2 ) ses b

-

2 ( s 3 + P )( s 1 - s 2 ) ( s 3 + P )( s 1 - s 2 ) 1

+ (s2 + P)(s3 s1) 2b + s e3b}-1,(9 )

(s 3 + P)( si - s 2) 2 3'

B = { - ( s 1 + P )( s 3 - s 2 ) „ „ s , b + ( s 2 + P )( s 3 - s 1 ) „ p 2 2 b

3 ( s 3 + P )( s 1 - s 2 ) 1 ( s 3 + P )( s 1 - s 2 ) 2

+s3e 3b }-1 .(10)

From V 2 ( b ) = 0 , we have

+ ( c P - 2 - S ) V 2 ' ( x ) - SP V 2 ( x ) = 0

is given by

V 2 ( x ) = B 1 e1 + B 2 e 2 x + B 3 e 3 x , (4 )

-

( s 1 + P )( s 3 - s 2 )

( s 3 + P )( s 1 - s 2 ) + s 3 2 es 3 b = 0 .

2 S1b (s 2 + P)( s 3 s1) 2 s 2 b si e I s e

1 ( s 3 + P )( s , - s 2 ) 2

where s 1 , s 2 and s 3 are the roots of the characteristic equation

2 e2 x 3 + (2 e2 P + c ) x 2 + ( c P -2 - S ) x - Sp = 0 .

Denote the left hand side of the equation (11) by h(z), h (z) =- (s1 + P) V’ (s3 + P)( 51 - s 2)' + (s 2 + P)(s 3 - s1) (s3 + P)(s1 - s2) 2sz 2sz s2e2+ s3e3 , Moreover, s1 < -P< s2< 0 < s3. Substituting (4) in the first term of equation (3), we have BBB —— + —2— + —3— = 0. s1 + P s2+ P s3+ P From V2 (0) = 0 , we have B1 + B2+ B3= 0. So, we obtain Now we differentiate (12) with respect toz and get h,(z) = - (s1 + P)(s3 - s2) s 3esz (s 3 + P)(s1 - s 2) 1 + (s 2 + P)(s 3 - s1) (s3 + P)(s1 - s2) In view of the calculation 3sz 3sz s 2 e2 + s 3 e 3 > 0. (s2 + P)(s3 -s1)n B? =----------------B,, 2 (s3 + P)(S1 - s2) 3 lim h (z) = -to and lim h (z) = +to , z ^-to z ^|v we can see that there exists a unique b s.t. h(b) = 0 . If b > 0, such b is the optimal dividend barrier. If b< 0, then 0 is the dividend barrier. Now we calculate h(0) = - (51 + в)(53 — 52)_2 + (52 + в)(53 — 51)_2 U (53 + в)(51 - 52) 1 (53 + в)(51 — 52)2 +5 32 (51 — 53 )(52 — 53 )(51 + 52 + 53 + в) = —в • From (5), we have 51 + 52+ 53 = -(— 8 в + C) . So, the fact 51 + 52 + 53 + в = —(— 8 в + c) + в implies b < 0 ^ h(0) > 0 ^ (2 82в + C) + в > 0, b > 0 ^ h (0) < 0 ^—(2 82 в + C) + в < 0. If b< 0, the optimal dividend policy is that at time 0 , the initial capital x should be paid out. If b > 0 , whenever surplus goes above the level b , the excess is paid out as dividends. From the above analysis, the solution to the problem is given by follows. If —(2 82в + c) + в > 0, V2 (x) = x. If—(2 82 в + C) + в< 0, V2( x) 4 B1 e1 + B2e5 2 x + B3e5 3 x, x—b + V2( b), 0 < x< b, x > b. where s1, s2and s3are the roots of the characteristic equation (5), B1, B2and B3are determined by (8), (9) and (10), b is determined by (11). The above model makes stylized assumption that there are no transaction costs. Strictly speaking, the assumption is not satisfied in real applications. Now, we study the model where the transaction costs are proportional. If the company pays l as dividends, then the shareholders can get kl , k< 1 . In the meanwhile, (1 — k)l is the proportional transaction costs. In this case, we denote the value function byW(x). Repeat the procedure above, we obtain W (x) = kV2( x). Now we investigate how W(x) depends on k . — W (x, k) = Be1 + R/2 x + R/3 x dk 12 3 = V2( x) > 0. Note that the dividend barrier in the solution of this problem is the same as the barrier of the problem without proportional costs. In other words, proportional costs factor k has no effects on the dividend barrier. v. The Solution of the control problem FOR THE CLASSICAL RISK MODEL WITH SOLVENCY CONSTRAINTS An interesting discovery in [5] is the expression of the value function. That is, V*(x,b) = hx), 0 < x< b. h'(b) In what follows, we use this factorization formula that facilitates solving the optimal dividend problem with solvency constraints. The idea is inspired by [6]. Theorem 5.1. If h(x) is convex for x > b, cV1' (x) — (X + ^V\ x) +X/X x — y )dF (y) < 0. Proof. For any x > b1, b1< z< x, c Vx' (z) — (X + R)Vx( z) +XxV^X z — y )dF (y ) = 0, 0 and c V'; (z)—(X + 5)V1 (z) + X j0z Vb1 (z — y )dF (y) = c (V1' — Vx' )(z) — (X + J)(V1 — Vx)( z) +Xj0z (V1 — Vx)(z — у )dF ( у ) = c (V1'— Vx")(--) — 5CV!— V')(--) —Xj; (Kb, — V,')( z) — (V.1 — Vx')( z — У )dF (У) < c (V1 ' — Vx" )(z). (13 ) In fact, h (x) is convex on[bc, w) , therefore, (V1"V,')'(У) = 1"hTy) >0, b.< y< x. b h (x) (V1—V!)'( y) = h (y) ( b 1 x ny h'(bT) h (У ) h' ( x) >0, y< b1. Letting z ^ x on both sides of (13 ), we obtain cV'( x) — (X + S)V„1( x) +Xj|xVb1(x—y)dF(y) < 0. Theorem 5.2 Assume the dividend policy {Dt1} has to satisfy the solvency constraints for some positive bc1. b1is the optimal barrier without restriction. Assume that h(x) is convex for x ≥ b1. Then (a) If bc1≤ b1, the optimal policy is to use the barrier strategy at b1. (b) If bc1>b1, the optimal policy is to use the barrier strategy at bc1. Proof. Part (a) is obvious since the optimal policy is feasible under the constraint. (b) For any b4>b3≥bc1, we have V1(x,b4) < V1(x,b3) Indeed, forx >b4>b3, V1 (x,b)=x-b+ 3, ,33h′(b3), V1(x,b4)=x-b4+h(b4), h′(b4) V1(x,b)-V1(x,b)=b-b+h(b3)-h(b4) ,3,443h′(b3)h′(b4) . Let h(b3) h(y) j(y)=y-b+ - 3h′(b3) h′(b4) . By simple calculation, j(b3 )≥ 0and j′(y)≥ 0for b4≥y≥b3. Hence, V1(x,b3)-V1(x,b4)=j(b4)≥0. V1(x,b)=x-b+h(b3), ,33h′(b3), V1(x,b)= h(x), 4 h′(b4) V1(x,b)-V1(x,b)=x-b+h(b3)-h(x) ,3,43h′(b3)h′(b4) =j(x)≥0. V1 (x,b3 )= V1(x,b4)= h(x) h′(b3), h(x) h′(b4), V1(x,b3)-V1(x,b4)≥0. So, V1(x) = maxV1(x,b), ∀x ≥0 . c b≥b1 If the barrier strategy bc1is used, cVc1′(x)-(λ+δ)Vc1(x) +λ xV1(x-y)dF(y)=0, 0≤x<b1. 0c c From Theorem 5.1, cVc1′(x) -(λ+δ)Vc1(x) +λ∫0xVc1(x-y)dF(y)≤0, x≥bc1. Vc1(Xt1∧Tπ)e-δ(t∧Tπ) - f =Vc1(x)+e-δs[cVc1′(Xs1)-(λ+δ)Vc1(Xs1) +λ Xs1-Vc1(Xs1--y)dF(y)]ds 0 ∫t∧Tπ 0 e-δsVc1′(Xs1)dDsc +∑ e-δs[Vc1(Xs1--ΔDs1)-Vc1(Xs1-)].(14) 0<s≤t∧Tπ Furthermore, applying the barrier strategybc1, Vc1(Xs1--ΔDs1)-Vc1(Xs1-)=-ΔDs1. t∧Tπ t∧Tπ -∫0e-δsVc1′(Xs1)dDsc=-∫0e-δsdDsc Therefore, taking expectation in (14), we have Et∧Tπe-δsdD1,c≤V1(x)-V1(X1 )e-δ(t∧Tπ). 0 tc c t∧Tπ . Now letting t →∞ , it follows from bounded convergence theorem that ∫t∧Tπ e-δsdDt1,c≤Vc1(x). The proof is completed. vi. The Solution of the control problem FOR THE CLASSICAL RISK MODEL perturbed by diffusion WITH SOLVENCY CONSTRAINTS In this section, we can use the similar argument as section V. Theorem 6.1. If h(x) is convex forx ≥ bc2, 2ε2Vc2′′(Xsπ)+cVc2′(x)-(λ+δ)Vc2(x) +λ xVc2(x-y)dF(y)≤0. 0 The proof is similar to the proof of Theorem 5.1. Thereom 6.2. Assume the dividend policy {Dt2 } has to satisfy the solvency constraints for some positive bc2. b2is the optimal barrier without restriction. Assume that h(x) is convex forx ≥ b2. Then (a) If bc2≤ b2, the optimal policy is to use the barrier strategy at b2. (b) Ifbc2>b2, the optimal policy is to use the barrier strategy at bc2. Proof. Part (a) is obvious since the optimal policy is feasible under the constraint. (b) . As the corresponding part of Theorem 5.2, we have V2(x)=maxV2(x,b), ∀x≥0. c b≥b2 If the barrier strategy bc2is used, 12ε2Vc2′′(x) +cVc2′(x) -(λ+δ)Vc2(x) +λ xV2(x-y)dF(y)=0, 0≤x<b2. 0c c From Theorem 6.1, 12ε2Vc2′′(x) +cVc2′(x) -(λ+δ)Vc2(x) +λ xVc2(x-y)dF(y)≤0. x≥bc2. Vc2(Xt2∧Tπ)e-δ(t∧Tπ) =Vc2(x)+t∧Tπe-δs[1ε2Vc2′′(Xs2)+cVc2′(Xs2) 02 X2 -(λ+δ)Vc2(Xs2)+λs-Vc2(Xs2-0 -y)dF(y)]ds+t∧Tπe-δsVc2′(Xs2)dW 0 -∫0t∧Te-δsVc2′(Xs2)dDsc +∑ e-δs[Vc2(Xs2--ΔDs2)-Vc2(Xs2-)]. (15) 0<s≤t∧Tπ Furthermore, applying the barrier strategy bc1, Vc2(Xs2--ΔDs2)-Vc2(Xsπ-)=-ΔDs2. ∫0t∧T e-δsVc2′(Xs2)dDsc=-∫t∧Tπe-δsdDsc. Therefore, taking expectation in (14), we have Et∧Tπe-δsdD2,c≤V2(x)-V2(X2 π)e-δ(t∧Tπ). 0 tc c t∧Tπ Now letting t →∞ , it follows from bounded convergence theorem that ∫t∧Tπ 0 e-δsdDt2,c ≤ Vc2(x). The proof is completed.

Список литературы Some Results on Optimal Dividend Problem in Two Risk Models

- M. Belhaj, “Optimal dividend payments when cash reserves follow a jump-diffusion process,” Math. Finance, vol. 20, pp. 313-325, 2010.

- B. deFinetti, “Su un'impostazione alternativa della teoria collettiva del rischio,” Transactions of the XVth International Congress of Actuaries,vol.2,pp.433-443,1957.

- J. Paulsen, “Optimal dividend payouts for diffusions with solvency constraints, ” Finance Stochast. vol. 7, pp. 457-473, 2003.

- A. Cadenillas, T. Choulli,, M. Taksar, ,and L..Zhang, “Classical and impulse stochastic control for the optimization of the dividend and risk policies of an insurance firm,” Math. Finance, vol. 16, pp. 181-202, 2006.

- H. Bühlmann, Mathematical Methods in Risk Thoery, New York: Springer-Verlag, 1970.

- Y. Fang. “Optimal dividend problem for the risk model with constant interest rate,” Doctoral Dissertation, 2009.

- H.U. Gerber, and E.S.W. Shiu, “Optimal dividends: analysis with Brownian motion,” N. Am. Actuar. J. vol.8, pp.1-20. 2004.

- D.C.M. Dickson, and H.R. Waters, “Some optimal dividends problems,” Astin Bulletin, vol. 34 , pp.49-74. 2004.

- B. Hojgaard, and M. Taksar, “Controlling risk exposure and dividends pay-out schemes: Insurance company example,” Math. Finance. vol. 9, pp.153-182. 1999.

- H.U. Gerber, and E.S.W. Shiu, “On optimal dividend strategies in the Compound Poisson model,” N. Am. Actuar. J. vol.10 , pp. 76-93, 2006.

- H. Gerber, and Shiu, E., 2006. “On optimal dividends: From refraction to refraction,” J. Comp. Appl. Math .vol. 186, pp.4-22, 2006.