Sovereign bonds of the cis countries: integration dynamics of debt markets in the context of external instability

Автор: Romashkina G.F., Andrianov K.V., Yukhtanova Yu.A.

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Public finance

Статья в выпуске: 2 т.17, 2024 года.

Бесплатный доступ

The paper examines development specifics of sovereign bond markets in the CIS countries. The sample includes Russia, Kazakhstan, Uzbekistan and Azerbaijan, since only these countries, among the CIS members, possess enough sovereign bonds included in the global debt market. The relevance of the study is due to the increasing financial uncertainty, which attracts attention to relatively reliable means of public debt; the need to understand the functioning of debt markets against the background of antiRussian sanctions and the increasing influence of the State. The aim of the work is to empirically verify the connectivity, integration and predictability of the sovereign bond markets of Russia, Kazakhstan, Uzbekistan and Azerbaijan. Empirical data include daily refinancing rates of national central banks, indices of total sovereign bond yields, G-spreads of international bonds of the countries in relation to the conditionally risk-free US bond yield curve for 2019-2023. The effects of market development features are divided into local, regional and global, such as the reaction to COVID-19 and anti-Russian sanctions after 2022. We use the following methods: dynamics analysis, correlation, factor and regression analysis. The novelty of the research lies in introducing new empirical data into scientific discourse, testing a methodology that allows us to assess the interaction of monetary policies and the functioning of sovereign bond markets, common features and differences in the behavior of these markets before and after the imposition of sanctions against the Russian financial system. We conclude that the integration of the considered markets within the CIS is violated, which poses risks to the effective economic development of the region. We consider the relatively developed and integrated, but poorly predictable markets of Russia and Kazakhstan. Unlike Russia, Kazakhstan has more connectivity regarding its monetary policy, sovereign bond yields and risks. The yield of Azerbaijan’s sovereign bonds is influenced by a more developed market of Kazakhstan, especially in terms of risk assessment, but the market itself is developed poorly. Uzbekistan’s market is even less integrated and developed.

Market, bonds, yield, behavior, connectivity, predictability, government, crisis

Короткий адрес: https://sciup.org/147243851

IDR: 147243851 | УДК: 339.9 | DOI: 10.15838/esc.2024.2.92.8

Текст научной статьи Sovereign bonds of the cis countries: integration dynamics of debt markets in the context of external instability

The scientific problem of our study is related to the fact that rapidly changing global economic processes affect a variety of circumstances in the lives of people, countries and entire regions. These processes are widely discussed in the scientific and expert community, but there are very few scientific studies based on specific empirical data. It is especially difficult to conduct empirical research in an unstable external environment. Besides, the issue is important due to the lack or insufficiency of data for comparative studies.

The subject matter of the study is concretized with the help of examples of interactions between countries and financial markets in the context of rapidly changing external circumstances of 2019– 2023. The state in a market economy traditionally acts both as a regulator and as an agent of market relations. An analysis that takes into account economic, institutional and behavioral factors (Wallis, North, 1986) demonstrates, for example, how fiscal and monetary policy determines the behavior of the financial market; how institutions influence the market and its functions; and how people’s non-optimal behavior adjusts prices, profitability and the general situation in the markets. D. North received the Nobel Prize for research in the field of new institutional economics (North, 2016). His arguments about mental models, traditions and limitations remain relevant today as well. A. Laplane and M. Mazzucato argued that the role of the state is better understood as the joint creation and formation of markets, and not just their fixation (Laplane, Mazzucato, 2020). Understanding the behavior of markets is not limited to formal models, it should include other factors.

The relevance of the specific formulation of the problem is determined by global, regional and local factors, including increasing financial uncertainty, which draws attention to relatively reliable means of public debt; interest in the countries and markets that historically interact with Russia; the need to understand the functioning of debt markets against the background of anti-Russian sanctions and growing state influence. According to official data, the CIS currently includes 10 countries1. The ranking of CIS member states in terms of GDP is headed by Russia, Kazakhstan, and Belarus. All countries in the region have significant differences in the level of development, and the processes of their interaction are ambiguous. This region is currently critically important for the Russian economy; this fact determines the practical significance of our research. The presence of developed and efficient financial markets contributes to more sustainable development, reduces financial risks, and creates new opportunities for interaction, including through debt instruments and mutual investments. In this regard, it is important to understand how predictable the behavior of debt markets is under the influence of government policy, external risk assessments and information from the market itself.

The aim of this work is to empirically verify development features of sovereign bond markets in the CIS countries in terms of their integration, local connectivity and predictability, as well as the reaction of these markets to new shocks such as

COVID-19 and anti-Russian sanctions. The sample includes Russia, Kazakhstan, Uzbekistan and Azerbaijan. The period under consideration is 2019–2023, includes two crises – the global one related to COVID-19, and the introduction of sanctions in 2022. We assume that the imposition of sanctions on the Russian financial system could affect the nature of interaction between financial management policies and the placement of government (sovereign) bonds of the CIS countries. Almost simultaneously, after the 1990s, the market began to develop in these countries, primarily the financial one. If bond markets have not developed enough, trading on them is represented by a very small number of transactions and high volatility, which makes comparative studies difficult. Local financial markets in the rest of the CIS countries that were not included in the sample do not have a sufficient number of sovereign bond issues.

Market capitalization of international bond markets is much higher than that of international stock markets. However, compared to the large amount of literature on international interactions in stock markets, few empirical studies have been conducted on the systemic risk of bonds or joint movements in the international bond market. Interconnectedness in the international bond market is noteworthy because it can have important implications for the cost of financing budget deficits, monetary policy independence, modeling and forecasting long-term interest rates, and bond portfolio diversification.

The novelty of our research lies in the introduction of new empirical data into scientific discourse; testing of a methodology that allows us to assess the interaction of monetary policies and the functioning of sovereign bond markets, the behavior of these markets before and after the imposition of sanctions against the Russian financial system. Conclusions are drawn about the violation of the integration of the considered markets within the CIS, which creates risks for the effective economic development in the region. The main reason for the violation of integration at the level of empirical data is weak predictability of market behavior for investors.

Literature review

Over the past 20 years the scientific literature has witnessed an increased interest in analyzing the dynamics of stock market indices based on an econometric approach that includes analysis of mutual impacts, joint changes and market connectivity. An important part of these studies was the inclusion of institutional variables in the structure of econometric data. For example, a comparison of stock prices over a long period showed how the provision on fair disclosure of information reduced spreads and costs of adverse selection almost 3-fold (Jiang, Kim, 2005). La Porta and co-authors studied securities legislation in 49 developing countries and confirmed that disclosure laws benefit stock markets through liability rules (La Porta et al., 2006). R. Duncan used a dynamic log-linear model on the example of 56 countries between 1984 and 2008 and showed that the volatility of financial markets in emerging economies was driven by the support or instability of monetary policy (Duncan, 2014). A. Abramov and co-authors assessed the integration of the regulatory and supervisory system as a measure of effectiveness of financial market regulation in Russia in 1999–2013 and made a forecast on the classification of Russia into one or another group in a sample of 50 countries (Abramov et al., 2014). This work contributed to the development of knowledge about the Russian financial market, but it does not consider the government securities market; the analysis is carried out only on the basis of aggregated indicators, crisis periods are not highlighted. Our work tests this method of evaluating effectiveness, but new empirical data on the sovereign bond market are being introduced into scientific discourse and the analysis methodology is being modernized.

A study by M. Shah and co-authors (46 countries in 2000–2019) shows that formal institutions such as property rights, financial freedom and government regulation play a crucial role in the development of the stock market in emerging market economies (Shah et al., 2023). However, the question remains whether this dependence is determined only by local political factors or is formed under the influence of some general trends.

According to D. North’s postulates, institutions are formed historically and are largely influenced by cultural traditions. For example, the countries of English-speaking culture have been interdependent for quite a long time. The markets of such countries remain influenced by larger and more developed markets. There are many studies devoted to the interconnectedness of the financial markets of these countries. In addition, issues of effective interaction between government institutions, markets and end users of financial instruments are important.

The development of the government bond market (GBM) is largely due to the availability of institutional and private investors willing to invest their funds. In addition to the willingness of residents to invest, important factors include economic stability and the condition of the state’s main cash flows. After a radical change in the financial system of the countries that were previously part of the USSR, for some new developing economies a combination of factors led to the development of the sovereign bond market; for other countries the formation of public debt is provided by a more expensive tool such as attracting foreign currency loans.

The effectiveness and institutional conditions of government interactions with GBM creditors are discussed in the literature on new institutional economics, behavioral economics, and econometric research. An econometric analysis of bond yields from 131 countries in the course of 240,000 transactions on the primary market between 1990

The yield spreads we use to model expectations or risk have proven themselves well. A. Ang, M. Piazzesi, M. Wei assured that the so-called “short calendar spread” has greater predicting power than any other time-bound spread for forecasting GDP, but their model did not allow for arbitrage and did not take into account the endogeneity of factors. It is clear that the spread itself does not cause GDP growth, but demonstrates investors’ expectations. The authors also proposed using yield models for bonds with the longest maturity to measure the slope of the curve (Ang et al., 2006).

In modern economics, it is not enough to consider purely economic variables to explain processes. Thus, the concept of behavioral finance examines how individuals and organizations acquire and allocate resources, taking into account the associated risks (Baker, Nofsinger, 2010). Preference models show the pricing of capital assets in markets (Hirshleifer, 2015). It has always been clear to researchers that risky assets should be valued in such a way as to receive, on average, higher returns than less risky ones, as compensation for risk. Behavioral factors have determined the efficient market hypothesis, which postulates that asset prices reflect information, so excess returns cannot be obtained on a permanent basis (Rau, 2010). The validity of the efficient market model is debated by those proponents of behavioral finance who argue that individual irrationality affects market outcomes. Sovereign bonds can play not only a stabilizing part when they act as an institutional background, but also a direct investment part (Glushkov et al., 2018).

Behavioral factors in investors’ activities on the example of the financial market of the Republic of Belarus were considered by S.S. Osmolovets. The analysis was carried out on the basis of correlations between the indicators on average in the Republic, but risks and target values were not taken into account (Osmolovets, 2022). The conclusion about the weak effectiveness of the financial market of the Republic of Belarus is declared in terms of behavioral finance, but the author does not provide evidence that would be based on the hypothesis of financial market effectiveness.

The dynamics, structure and mechanisms of the bond market in Russia for 2012–2019 were studied by S.D. Ageeva. It is concluded that already in 2021, the government took a predominant position in the financial market (Ageeva, 2022). However, S.D. Ageeva simply pointed out the inequality of access to securities for private companies, but did not analyze the profitability of these securities or consider quantitative indicators of state participation.

The existence of a global monetary policy factor in GBM yields is considered by D. Malliaropulos and P. Migiakis on the example of nine major economies. Asset purchases by global central banks during the COVID-19 crisis balanced the impact of the growing budget deficit on international bond yields, which declined as a result, and investors rebalanced their portfolios toward riskier assets (Malliaropulos, Migiakis, 2023). The same authors have shown how country-specific factors affecting the yield of sovereign bonds, such as the risk of sovereign default, can be taken into account. For example, how the probability of default, the total assets of central banks and the duration of their interaction affect the level of integration.

The predictability of bond yields using real-time macro variables based on a non-linear model was shown by D. Huang and co-authors (Huang, 2023). Moreover, bonds generate significant economic values, and their predictability is not limited by the yield curve. The authors have shown that bond yields and the degree of predictability increase during economic downturns, which provides empirical support for well-known theories of macro financing.

There are publications on developing countries, in which a very important issue in studying the interconnectedness of yield dynamics is the analysis of the relative influence of fundamental variables on their behavior (Cifarelli, Paladino, 2006), as well as on the secondary effects of volatility in international bond markets (Panchenko, Wu, 2009), etc.

One can read about the sources of joint movement in the sovereign bond markets in the European context in the works of R. Abad and co-authors. For example, to analyze the impact of the Economic and Monetary Union (EMU) on the integration of the European debt market, the GBM yield of each country was divided into three components: local effect (own country), regional (eurozone) and global (world). It is concluded that the markets of countries that have decided not to join the EMU demonstrate higher vulnerability to external risk factors (Abad et al., 2010; Abad et al., 2014).

The dynamics of bond market integration under the influence of financial crises over long periods was studied in the works of E.J. Abakah, W. Qin and co-authors (Abakah et al., 2021; Qin et al., 2023). It seems obvious that developed markets have a much higher level of market integration than developing ones. In most developed markets, the level of market integration is increasing, while in developing markets it is not. Crisis periods demonstrate a strong imbalance; therefore, we find it important to clarify the method used by the authors, separating periods and groups of countries, as well as effects on bond maturities. The classification by region is as follows: North and South America are the most integrated ones, followed by Europe. Integration of Asia-Pacific markets is the lowest (Qin et al., 2023).

Thus, stock market analysis is widely presented in the world literature, but there is very little research on the bond market. The available works on bond analysis focus to a greater extent on the markets of the European Union, America, and the largest developing countries. There are enough studies of the stock market in Russia in the Russian-language literature, but we have not found any scientific publications that analyze the Russian sovereign bond market with the disclosure of model data and an econometric approach. There are enough commercial analytical reviews aimed at supporting a qualified investor, but they do not have a research context. Perhaps, due to limited access to information, the integration of CIS sovereign bond markets has remained virtually unexplored.

Analyzing Russia’s balance of payments until 2016, N.A. Dementiev pointed out that Russia acts as a large balance creditor to the rest of the world (Dementiev, 2018). We should recognize that in seven years the situation has changed only in a geographical aspect. Partial reorientation of Russian capital from the west to the southeast has aroused interest in alternative risk assessments in the Russian economic and political space, for example, based on the Chinese rating. This problem is being actively discussed. A.V. Kuznetsov believes that the Big Three rating agencies artificially underestimate the ratings of developing countries, limiting their access to capital markets, and suggests encouraging the creation of national rating agencies (Kuznetsov, 2022).

The interconnectedness of the Russian economy with the economies of other countries is demonstrated by Russia’s net international investment position over the past five years – an upward trend against the background of an outstripping decrease in liabilities compared to assets. The aggravation of the geopolitical situation in February 2022 and the sanctions imposed against the Russian Federation had a serious impact on the financial market and on Russia’s international investment position in 2022–2023. The largest Western stock exchanges announced the termination of trading in securities of Russian companies, foreign funds were forced to urgently sell Russian assets. In this situation, the Russian Federation is a net importer of capital. Thus, as of January 1, 2023, external financial assets twice exceeded external financial liabilities, and Russia’s investment income as of 2022 is more than twofold less than the income of other countries from investments in Russia.

Taking into account the current situation, the nature of Russia’s investment cooperation within the CIS acquires a special role. CIS countries are its strategic partners. In order to explore the interconnectedness of CIS sovereign bond markets within the region, it is necessary to assess the degree of economic cooperation, expressed in the intensity of investment interaction. The most significant for the analysis is the consideration of Russia’s ties with Kazakhstan, Uzbekistan and Azerbaijan in terms of mutual direct investments according to the data provided by the Bank of Russia ( Tab. 1 ).

According to the official data, during the period under consideration there were no drastic changes in the volume of accumulated direct investments of the three countries with the Russian Federation. The structure of relationships and their orientation significantly depend on the size and power of the economy. In the case of Kazakhstan, the Russian Federation acts as a net investor, and this gap increased slightly by January 1, 2022. In relations with Uzbekistan and Azerbaijan, the Russian Federation takes the position of a net borrower.

Kazakhstan, the second major economy after the Russian Federation in the considered group of countries, significantly surpasses the rest ones in terms of mutual accumulated direct investments. The volume of accumulated investments of Kazakhstan and Russia in the form of direct investments is approximately the same, it has a slight upward trend.

Uzbekistan and Azerbaijan, as economies of a smaller scale, have significantly smaller volumes of mutual investments with the Russian Federation. The volume of direct accumulated investments in Azerbaijan and Uzbekistan from Russia is more than two times less than investments in Russia from these countries. We can argue that the volume of mutual investments in the form of direct investments (balances on a specific date) is slightly

Table 1. Mutual accumulated direct investments of Russia (RF), Kazakhstan (KAZ), Azerbaijan (AZ), Uzbekistan (UZ), million USD

|

Date |

Accumulated direct investments to RF |

Accumulated direct investments from RF |

||||

|

KAZ |

AZ |

UZ |

KAZ |

AZ |

UZ |

|

|

January 1, 2019 |

2900.19 |

572.39 |

853.68 |

3340.57 |

246.17 |

65.41 |

|

April 1, 2019 |

3180.43 |

611.99 |

913.66 |

3412.06 |

272.28 |

70.87 |

|

July 1, 2019 |

3336.67 |

631.67 |

937.96 |

3590.14 |

245.87 |

100.61 |

|

October 1, 2019 |

3258.39 |

631.53 |

892.69 |

3698.48 |

241.53 |

114.7 |

|

January 1, 2020 |

3520.13 |

642.45 |

838.66 |

3684.06 |

343.53 |

127.08 |

|

April 1, 2020 |

2881.58 |

526.4 |

679.1 |

3345.19 |

188.7 |

139.03 |

|

July 1, 2020 |

3242.98 |

621.72 |

763.81 |

3493.98 |

216.74 |

141.7 |

|

October 1, 2020 |

2834.31 |

548.68 |

680.98 |

3328.84 |

198.85 |

140.57 |

|

January 1, 2021 |

3042.93 |

585.64 |

758.82 |

3524.7 |

241.7 |

177.2 |

|

April 1, 2021 |

3038.13 |

599.43 |

740.3 |

3533.51 |

250.04 |

191.97 |

|

July 1, 2021 |

3033.7 |

630.36 |

775.56 |

3608.27 |

241.37 |

210.12 |

|

October 1, 2021 |

3036.27 |

632.62 |

772.22 |

3902.43 |

207.7 |

212.96 |

|

January 1, 2022 |

3310.67 |

613.47 |

756.81 |

3982.3 |

344.94 |

282.07 |

Source: Accumulated direct investments by geographical region of the world, country, instrument and type of economic activity. Available at: (accessed: February 9, 2024).

expanding, but the size of investment cooperation itself is small. The presence of mutual influence and mutual interest, according to empirical data from 2019–2022, was revealed only in relation to the Russia–Kazakhstan pair.

Thus, the theoretical and methodological foundations of our research contain elements of an econometric approach to the analysis of financial markets, institutional and global economics, and behavioral finance. Based on the literature review, we assumed that an effective market should be linked to a system of regulation and control and be moderately predictable; the effects of market development should be divided into local, regional and global. Effectiveness is manifested in the fact that excess profitability cannot be obtained on a permanent basis, and rational investors, seeking to maximize their income, will try to anticipate the behavior of the regulator as much as possible. This logic of the research determines its theoretical significance. The hypotheses we test are as follows: 1) historically interconnected economies form a regional integrated and efficient government bond market (GBM); 2) Russian sovereign bond market is locally connected and predictable.

Data and methodology

The methodology of this work is based on the techniques and models used in the analysis of the integration and connectivity of financial markets, which have been adjusted for the securities market and central bank refinancing rates, taking into account proxy risk assessments. The specific feature of the technique lies in the consistent application of correlation, factor and regression analysis, and the Granger causality test.

The following values were collected and calculated for each country in the sample:

-

1) Sn,t – local refinancing rate of the Central Bank (characteristic of the regulator’s behavior);

-

2) In,t – total return composite indices (average yield of the sovereign bond market);

-

3) Gn,t – G-spread (average risk estimates for international sovereign bonds),

where t – time from June 25, 2019 to October 31, 2023, the data are given for working days of the relevant trading platforms; n stands for country: Russia (RF), Kazakhstan (KZ), Uzbekistan (UZ), Azerbaijan (AZ)2.

If the corresponding designations have no time parameter ( t ), then vector variables are represented.

To estimate sovereign bond yield In,t , we used daily data on the yield of the full list of sovereign bonds, see formula (1).

I = Z^tD^Lt^^

ПЛ Z i D^ft t + ACI^H t , ()

where In,t – weighted average yield of selected securities (simple);

-

Yi ,t – yield of issue i at time t (simple);

ACI i,t – accrued coupon income on security i in time period t ;

Di,t – duration of emission i at time t ;

N – volume of the i-th bond issue from the i,t index list (units) at time t;

Pi,t – net market price of the bond.

All prices in the calculations of the index are given on the current date.

As a risk assessment indicator ( G ) we used n,t

G-spread/1000 – the spread on international bonds of the relevant country, calculated as the discrepancy between the yield of international sovereign bonds denominated in dollars and the yield on US sovereign bonds, which are considered risk-free. Securities with a maturity of less than five years were excluded from the calculation, and a simple average value was calculated for the remaining securities as a risk assessment measure.

The Cbonds-GBI RU YTM index calculated by the Cbonds news agency was used for the Russian Federation. For the other three countries, we calculated the indices on the basis of trading data according to a methodology similar to Cbonds-GBI RU YTM. If only one security out of all sovereign bonds in the national currency was traded on the day, the yield of trading on this security was used. If several transactions took place during the day, then the weighted average value was taken as the index value, where the weight corresponded to the volume of bond placement for that day. If there were no transactions with securities, the index value for that day was not calculated.

All averages were calculated as a weighted average for issues, taking into account maturities. According to the recommendations of analysts, we considered local connectivity and integration of markets (Abad et al., 2014; Casarin et al., 2023).

The methodology for testing the hypotheses implies that emerging markets strive to improve their efficiency, and the behavior of investors can predict the behavior of the regulator by learning from previous examples of data from their country (predictability) and other markets (integration). Connected markets have stable and significant correlations between the corresponding indices. If there is integration, then the convergence of the behavior of international investors leads to greater predictability and increased mutual interest. The opposite effect is also true. Therefore, interaction is divided into local, when the characteristics of a given country are more closely related (local connectivity), and external (integration), when the corresponding characteristics in a group of countries are more closely related. Predictability refers to a situation where markets can predict the behavior of their regulator, and risk assessments by market participants describe the market situation quite clearly. If it is not possible to statistically significantly determine the effects of connectivity, predictability and integration for a local market at the same time, such a local market should be considered unbalanced.

Autoregression models with a distributed lag time series order, k – number of lags, q – number of exogenous variables, were used to assess the degree of predictability of the regulator’s behavior, taking into account the behavior of the dynamic series and exogenous variables with lags. The method of assessing the consistency of financial markets through models is widely used in the literature, for example, discussed in (Stoupos, Kiohos, 2022; Malliaropulos, Migiakis, 2023; Qin et al., 2023).

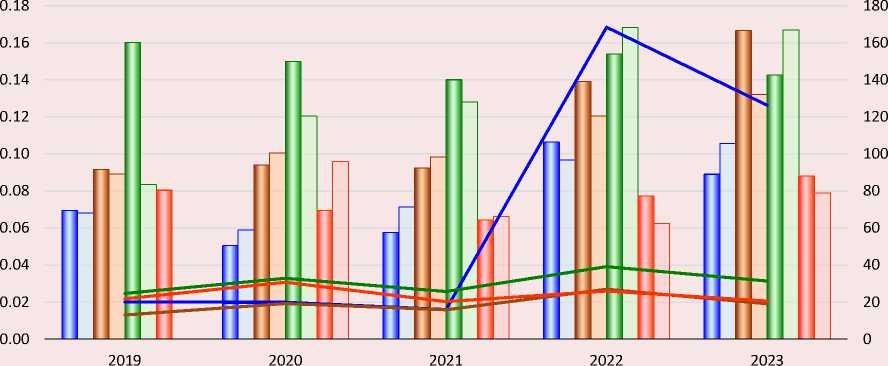

Hypothesis (1) was tested using a description of the average values (Appendix 1), analysis of dynamics (see Fig. 2–4), presence of paired correlations (according to Spearman, see Tab. 4–5) and using the principal component method (see Appendix 2). The Spearman correlations make it possible to exclude the influence of strong noises, thereby correcting strong deviations. The result of factor analysis is the grouping of indicators. The adequacy of the application of factor analysis was checked by the Kaiser – Meyer – Olkin test, F-test (see Appendix 2).

Hypothesis (2) was tested in two stages: the presence of paired correlations (integration and connectivity) and the Granger causality test (connectivity and predictability) for the Russian sovereign bond market. The predictability of the behavior of the Russian Central Bank in the market is assessed through the possibility of predicting the behavior of the Russian regulator SRF,t (refinancing rate of the Russian Central Bank) from predictors with time lags Iт,t-k , Gт,t-k , equal to 5 and 10 working days. In general, models of two related regression equations for RF ADL (T, 2, 2) were tested:

$ 1,t = ^ (1) + Z Z P n.k^k.t-k +

Z - 2 a n,k (1)G.

+

k=0;5;10

+r, /

k=0;5;10

V 4 V 1 (2)

'n,t-k + + ^^ ^^ Y n,k^ ^n—-k

П=2 k=0;5;10

4t = -^ 2) +

/4 / Pn №, n,k

Y—t n=2 _ ^—'

1n,t-k +

k=0;5;10

V 4 V (3)

^ nY )^n,t-k + / / Y nY ) ^ n,t:-k

^ n=1 k=0;5;10

k=0;5;10

where t = 0; T — moment of time; n — countries

(1) RF, (2) KZ, (3) UZ, (4) AZ; k = 0, 5, 10.

Based on a comparison of models (2) and (3), the Granger causality test is constructed, which allows us to conclude how much the presence of information about one variable improves the significant presence of a second variable in the regression series. The standard way to improve models is to use step-by-step methods that exclude insignificant and unnecessary predictors according to the criteria F, VIF, AIK, BIC. The stationarity of the time series was estimated using the Dickey – Fuller test, the length of the distributed lags was estimated by the Koyck transformation, the coefficients of the autoregressive series are maximized at n = 5, 10, |α| < 1. We should note that the time series do not represent calendar days, but working days on the relevant trading platforms, which are not always simultaneous; this explains the slight jumps in these periods. Table 6 shows the results of applying the step-by-step method of evaluating model (2), the calculations were performed in SPSS-24 on a complete data model with lags. We should point out that such step-by-step models do not allow for a direct interpretation of linear regression coefficients, but allow us to assess the degree of predictability of the process in terms of information. The result is interpreted in the presence of information from the predictor process for the target variable process (Stoupos, Kiohos, 2022). In general, complete and reduced models were evaluated at к = 1; 10.

Analysis of the results

At the first stage , let us consider the dynamics of the US government securities market, which is considered risk-free ( Fig. 1 ). Relative to this market, the risks of investing in securities of all other countries were calculated. The market fluctuates with a high degree of correlation with the rate movements of the US Federal Reserve System (FRS), almost anticipating the rate movements in advance. Such a market is effective because investors can earn money by anticipating the regulator’s policy with a more or less high degree of

Figure 1. Dynamics of the rates of the US Federal Reserve System, the weighted average yield index of US government securities, 2014–2023

Weighted average yield index of US government securities US Federal Reserve rate

Source: Cbonds. Available at: ;

probability. In a stable economy without crises, the national regulator sets the refinancing rate based on an assessment of current and projected inflation (in the case of inflation targeting). The earlier and more accurately market participants can predict the next action of the regulator, the more profit they can get. In developed economies with an active market, this leads to the fact that bond yield indices in most cases adjust to the future action of the regulator a few days before the decision is announced. Such predictable processes create a safe environment that is more effective for institutional and private investment, both in the stock market and debt market, including government market.

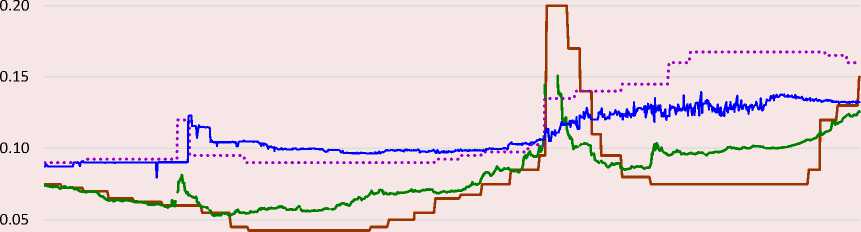

At the second stage , we consider the dynamics of sovereign bond markets in connection with the dynamics of Central Bank refinancing rates and the spreads of expected S-spread bond yields for the sample countries. Among the CIS countries,

Russia has the most developed sovereign bond market. However, it is noticeable that starting from 2022, this is the most risky and volatile market. Fluctuations in the Gn,t indicator in the period up to February 2022 and after it differ by more than 400% (see Appendix 1, Fig. 3).

In crisis conditions, the yield on sovereign bonds for the Russian Federation is catching up with the Central Bank’s rates, which indicates a weak predictability of the regulator’s actions on the part of the market ( Fig. 2 ). Two crises can be clearly seen on the weighted average yield chart: COVID-19 and the crisis of February – June 2022. Estimates of Gn,t as of February 7, 2022 and February 8, 2022 rose to 1.73 and 1.25, respectively, in the wake of the panic. The second disturbance of spreads occurred in April – June 2022, when variable Gn,t fluctuated in the range of 0.4–0.8. The average annual spreads in the Russian Federation increased sharply in 2022,

Figure 2. Dynamics of Central Bank refinancing rates ( SRF, SKZ ), yield index ( IRF, IKZ ) of the Russian Federation and Kazakhstan

0.25

S RF I RF S KZ I KZ

Source: own compilation according to Cbonds. Available at: , decreased slightly in 2023, but remained at a high level (Fig. 3). Until March 2022, the trends in the Central Bank rate and the weighted average yield of the Russian sovereign bond market were in relative agreement. If the rate of return roughly corresponds to the Central Bank’s rate, the market is considered effective when there are opportunities to approach changes in the refinancing rate in advance (before the jump) (Abad et al., 2014; Abakah et al., 2021). After March 2022, the market entered a period of strong volatility, which was relatively overcome by July 2022. Further, the profitability of the market grew slowly, reflecting high risk expectations. However, neither before nor after the crises, the sovereign bond markets of the Russian Federation and Kazakhstan presumably have not behaved effectively in relation to local refinancing rates. We will check this assumption at the next stage for the Russian Federation.

L.A. Baibulekova and G.K. Lukhmanova showed that the stock market of Kazakhstan (KASE) is developing rapidly, ranking second in the CIS. In 2018, KASE was more than three times inferior to the Moscow Stock Exchange in terms of the number of instruments, and almost six times in terms of the number of issuers and corporate bonds. The exchange rate of the national currency, according to analysts, is strongly related to the inflation index, but the latter is nonmonetary (Baibulekova, Lukhmanova, 2019). Our data confirm these conclusions. We should note that investors in sovereign bonds worked in conditions of lower risk until 2022 (see Fig. 3). The risk of inconsistency increased dramatically after February 2022, then the dynamics of refinancing rates significantly exceeded the yield index, which reduced the opportunities for investment income (see Fig. 2). This behavior of the regulator can

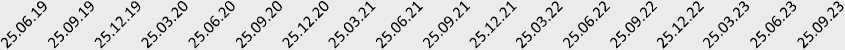

Figure 3. Average annual values of yield indices I, refinancing rates S (left axis), G-spread (right axis) for Russia (RF), Kazakhstan (KZ), Uzbekistan (UZ), Azerbaijan (AZ)

RF

I RF

■ __ ■ S KZ

S UZ

^^^^^^^м G -spread RF

^^^^^^^^м G -spread KZ

^^^^^^^^п G -spread UZ ^^^^^^^^п G -spread AZ

Source: own calculation according to Cbonds.

Figure 4. Dynamics of Central Bank rates (S), yield index (I) for Uzbekistan (UZ) and Azerbaijan (AZ)

25%

20%

I SUZ IUZ SAZ IAZ

Source: own compilation according to Cbonds. Available at: ;

Table 2. Spearman’s paired correlations in countries (local)

Coefficient / countries RF KZ UZ AZ Sn,t – In,t 0.692 0.930 -0.218 i/s Gn,t – In,t 0.413 0.525 i/s i/s Sn,t – Gn,t 0.527 0.449 0.205 i/s Note: i/s – insignificant correlations that are modulo less than 0.2, or p > 0.01, are suppressed. Source: own compilation according to Cbonds. Available at: ; ; https:// ; ;

Table 3. Spearman’s paired correlations between countries

Values of n RF-KZ RF-UZ RF-AZ UZ-AZ UZ-KZ KZ-AZ Sn,t – Sn,t 0.501 0.320 0.480 0.249 i/s 0.778 In,t – In,t 0.764 0.215 i/s i/s 0.360 i/s Gn,t – Gn,t 0.374 0.324 i/s 0.652 0.939 0.548 Sn,t – In,t 0.423 i/s i/s i/s i/s i/s In,t – Sn,t 0.833 i/s 0.699 i/s 0.306 0.649 Gn,t – In,t 0.465 i/s i/s i/s 0.477 i/s In,t – Gn,t 0.282 0.239 i/s i/s i/s i/s Gn,t – Sn,t 0.491 0.259 0.347 0.214 0.389 i/s Note: i/s – insignificant correlations that are modulo less than 0.2, or p > 0.01, are suppressed. Source: own compilation according to Cbonds. Available at: ; ; https:// ; ; be attributed to a strict non-monetary policy that increases local incoherence. G-spreads in Kazakhstan retain the lowest values in the sample, and are highly correlated with G-spreads in Uzbekistan (see Fig. 3, Tab. 3).

Let us consider the behavior of the sovereign bond markets and national central banks in Uzbekistan and Azerbaijan, which are much less developed ( Fig. 4 ). Before 2019, the volume of issues of sovereign bonds of Uzbekistan was small, as was the intensity of issues. Later, in the 2020s, there began the active issuing of sovereign bonds, the fluctuations in the yield index of which are very high due to small market capacity. The sovereign bond market in Azerbaijan is not linked to monetary policy, and the formation of a distinct yield trend is likely a matter of the future. We note the relatively low values of G-spreads in Azerbaijan (see Fig. 3). The policy of the monetary authorities of Uzbekistan is largely oriented toward the more developed market of Kazakhstan (Tab. 2, 3). But the behavior of the markets is also catching up with the Central Bank’s rates, which confirms the unpredictability of the regulator’s actions on the part of the market.

At the third stage , the Spearman correlation analysis and factor analysis were used for a preliminary analysis of market connectivity (see Tab. 2, Appendix 2). The principal component method allows combining the considered indicators into groups, demonstrating the factor structure of the relationships.

Since the distribution of the data differs from the normal one (see Appendix 1), we considered pairs of non-parametric Spearman’s correlations. In the Russian market, sovereign bond yields and the monetary policy of the Central Bank (CB) are moderately related. Fluctuations in risk assessment are very poorly related, since they are influenced by political factors, which we do not consider in this paper. In the Kazakhstan market, monetary policy and sovereign bond yields are strongly related, and risks are moderately related.

The sovereign bond markets of Russia and Kazakhstan differ from the markets of Uzbekistan and Azerbaijan in the direction of greater development and balance (see Tab. 2). The most balanced market is in Kazakhstan, where volatility and risk are significantly lower (see Appendix 1), and the correlation between rates and bond yields exceeds 0.9. The sovereign bond market of Uzbekistan is very poorly developed; it is unbalanced due to the low development of the secondary debt market. There is no significant correlation between the indicators in Azerbaijan. The market is moderately dependent on the more developed market of Kazakhstan (see Tab. 3). As a result, a sequence of mutual influences is being built: on the one hand, there are relatively integrated and developed, but poorly predictable markets of the Russian Federation and Kazakhstan; on the other hand, Uzbekistan and Azerbaijan, the predictability of which we have not checked, are relatively integrated with the market of Kazakhstan.

The sovereign bond markets of Russia and Kazakhstan are moderately related and integrated, which is confirmed by both non-parametric correlations and the principal component method. We should note that the monetary policies of Kazakhstan and Azerbaijan are related ( r = 0.778). There is no connection for other countries. At the same time, the yields of sovereign bonds of Kazakhstan and Russia are related ( r = 0.764). The debt markets of Uzbekistan and Azerbaijan are practically unrelated to the policy of the Central Bank of the Russian Federation.

According to the results of the factor analysis, we should note that the monetary policy of Azerbaijan fell into the first factor uniting the markets of Russia and Kazakhstan. This means that the Azerbaijani market is poorly integrated with the markets of Russia and Kazakhstan in terms of the dynamics of refinancing rates. The principal component method revealed a strong correlation between the dynamics of the riskiness of the public debt of Kazakhstan, Uzbekistan and

Azerbaijan, if they are evaluated in relation to US government securities. These four indicators are combined into one factor. The third factor indicates the imbalance of the Uzbek market, since rates and yields practically fluctuate in opposition. The fourth factor highlights only the yield of Azerbaijani sovereign bonds, the dynamics of which cannot be explained within the framework of the models under consideration. The sovereign bond markets of the countries in question can be divided into two groups: the markets of Russia and Kazakhstan, moderately related and relatively integrated, and the markets of Uzbekistan and Azerbaijan, unrelated and poorly integrated with Kazakhstan.

Due to the fact that with the help of correlation analysis and the principal component allocation algorithm we cannot determine which variable provides information for predicting another variable with a good reason, at the fourth stage we applied the Granger causality test. Hypothesis 2 was tested by analyzing sequential linear regressions, the general model for which has the form (2–3). The results are shown in Table 4. The target variables are consistently SRF,t CB RF rate (models 2.1 and 2.2) and IRF,t (models 3.1 and 3.2). This method of testing market integration has been proposed by researchers and tested in a number of authoritative publications (Abakah et al., 2021; Qin et al., 2023).

In Table 4, we have left only two significant final models. Step-by-step methods generate a large number of models, but the basic information in them does not fundamentally change. First, we note the significantly worse quality of model (2) based on the Durbin – Watson test compared to model (3). For model (2), it should be concluded that there is autoregression of first-order residuals. All models have a high level of significance of coefficients for variables, the limitations are determined by the emerging multicollinearity and heteroscedasticity with a growing number of predictors. The increase in the significance of the model with the addition of predictors in each of the groups is vanishingly small, it is enough to assess the quality of models (2.1) – (2.2) and (3.1) – (3.2). Second, the mutual participation of variables SRF and IRF with lags in models 2 and 3 demonstrates the connectivity of the corresponding indicators. The contribution of information on the yields of the sovereign bond market of the Russian Federation ( IRF ) to the assessment of the dynamics of the refinancing rate of the Central Bank of the Russian Federation ( SR F)

Table 4. Regression models for SRF, t and IRF, t

|

Target variable |

Model (2) SRF, t |

Model (3) IRF, t |

|||

|

Predictors |

(2.1) |

(2.2) |

Predictors |

(3.1) |

(3.2) |

|

Const (A) |

0.020 |

0.017 |

Const (A) |

0.052 |

0.058 |

|

S RF, t-5 |

0.943 |

0.964 |

I RF, t-5 |

0.444 |

0.480 |

|

UZ, t-10 |

-0.165 |

-0.141 |

S KZ, t |

0.211 |

0.191 |

|

I RF,, t-5 |

0.107 |

0.221 |

RF, t-10 |

0.184 |

0.247 |

|

G RF,, t-10 |

no data |

-0.011 |

UZ, t-10 |

-0.262 |

-0.292 |

|

I RF,, t-10 |

no data |

-0.120 |

G AZ, t-10 |

-0.241 |

-0.268 |

|

G RF, t-5 |

no data |

-0.018 |

|||

|

S RF, t |

no data |

0.013 |

|||

|

R-square |

0.837 |

0.839 |

R-square |

0.905 |

0.909 |

|

F |

5630 |

3481 |

F |

2159 |

1881 |

|

All coefficients are significant at the level of p < 0.001. In model (2) the Durbin – Watson coefficient = 0.435. In model (3) the Durbin – Watson coefficient = 1.556. The method used: step-by-step, eliminating unnecessary and insignificant variables. Source: own compilation. |

|||||

is very small. If the model for SRF includes two lag steps, the coefficients are opposite in modulus.

Therefore, we can assume that the sovereign bond market is late in its fluctuations compared to changes in exchange rates, since it has not learned to predict the behavior of its regulator. The behavior of sovereign bond yield indices is influenced by its own trend and the rates of the Central Bank of the Russian Federation and Kazakhstan. The effect of the first predictor in all models is significantly higher than that of the second and third. None of the selected models can predict the behavior of the Central Bank of the Russian Federation qualitatively enough, but there is a weak connection with local bond yields and an anticyclical relationship with bond spreads, which is quite consistent with the theories of macroeconomics.

Thus, hypothesis 1 is confirmed only in terms of the local connectivity of the bond markets of the Russian Federation and Kazakhstan and their relative integration. The hypothesis of the coordinated behavior of regulators and sovereign bond markets at the level of the CIS region (integration and efficiency of markets) is refuted.

Hypothesis 2 has been confirmed in terms of local connectivity and refuted in terms of predictability. Therefore, by now there is no reason to conclude that the Russian sovereign bond market is operating effectively. The main reason for the efficiency violation is that the markets do not have time to predict the behavior of the regulator; fluctuations in the yield indices and rates of various countries after 2022 are poorly coordinated.

Model 2, describing the forecast of the refinancing rate of the Central Bank of the Russian Federation SRF,t, based on its own trend, the countercyclical behavior of the refinancing rate of the Central Bank of Uzbekistan with a 10-day lag and local full yield indices, demonstrates a high value of explanatory power with a very low value of the Durbin – Watson coefficient (see Tab. 4). Adding local predictors to the model does not provide any significant improvement to model (2.2). The dynamics of the CB RF rates tend to be countercyclical in relation to the rates of Uzbekistan, and information on the Azerbaijani and Kazakh markets is not significant for forecasting the behavior of the Central Bank of the Russian Federation. We can conclude that there is a weak inverse relationship between the behavior of regulators of the Russian Federation and Uzbekistan, but this relationship does not show integration. Model 3.1 demonstrates local connectivity and predictability of the Russian sovereign bond market. Model 3.2 demonstrates that taking into account the influence of local spreads and the simultaneous action of the regulator on the behavior of the Russian sovereign bond market cannot sufficiently improve the quality of the forecast. Taking into account the lag in risk response increases the explanatory power of the model, but very slightly. The reduction of the period under consideration for the period after 2022 led to the disappearance of the reliability of the forecast. This indirectly confirms the hypothesis that there is a decrease in the dynamics of the balance of the behavior of the regulator of the Russian Federation, risk assessment and profitability of sovereign bonds of the Russian Federation. Thus, the Russian sovereign bond market is moderately locally connected and integrated with the Kazakh market, and investors in the market cannot predict the behavior of the regulator.

Conclusions

At first glance, the rates of the Central Bank of Russia, Kazakhstan, Uzbekistan, and Azerbaijan are poorly interconnected and are more responsive to the economic realities of each particular country. The results of quantitative studies partially confirmed these assumptions.

There is a moderate integration of the monetary policies of Russia and Kazakhstan. The trends in the monetary policies of Azerbaijan and Uzbekistan are rather aimed at reducing integration, which may be of great importance for the future situation. There is a weak inverse relationship between the behavior of the regulators in Russia and Uzbekistan; it rather refutes the integration of the markets of these countries. We can assume that a substantive study of the monetary policy of Azerbaijan and Uzbekistan requires the introduction of data on other countries into the model.

Perhaps, in order to maintain stable and predictable interactions between the CIS countries, it makes sense to hold mutual consultations, conferences and open platforms with the participation of central bank managers. If predictability is maintained, the market becomes more efficient. Market efficiency creates incentives for investors based on transparency and predictability of their behavior (Duncan, 2014; Shah et al., 2023).

The Russian debt market very adequately correlated with the Central Bank rate until 2021. After 2022, the correlation decreases against the background of increasing uncertainty. The decisions of the Central Bank of the Russian Federation turned out to be unrelated to the situation on the debt market, and the market itself has high volatility and cannot adjust to the changes of the Central Bank. The actions of the Central Bank of the Russian Federation do not correlate with the debt markets of other countries if there was no reaction from their central banks.

The sovereign bond markets of Uzbekistan and Azerbaijan are practically not connected with the Russian Federation. The sovereign bond markets of Russia and Kazakhstan turned out to be moderately connected and relatively integrated.

The dynamics of the riskiness of the public debt of Kazakhstan, Uzbekistan and Azerbaijan demonstrated a strong correlation in relation to US securities. In relation to this group of countries, Russia acts more as a source of unpredictability, which leads to the withdrawal of this group of countries beyond integration.

Among the countries considered, we can highlight the group of Russia and Kazakhstan, whose sovereign bond markets interact in a moderately coordinated manner, and the group of Uzbekistan and Azerbaijan, whose markets do not integrate with those of the first group. The yield of Azerbaijani sovereign bonds is influenced by the more developed market of Kazakhstan, especially in terms of risk assessment, but the market itself is unbalanced. The Uzbek sovereign bond market is characterized by weak connectivity, a practical lack of integration into the group of CIS countries due to poor development.

It is possible to identify a chain of relationships in the sovereign bond markets of Russia – Kazakhstan – Azerbaijan – Uzbekistan. Kazakhstan plays the role of a connecting link in this chain to a greater extent.

The results of our study have shown that the CIS securities markets have different integration capabilities. The sovereign bond market is developed to a certain extent in almost all the countries in question. A more serious degree of interconnection and potential for coordinated interaction have been identified in the Russia– Kazakhstan pair. The markets of these countries react approximately the same way to the behavior of their regulators, having a delayed nature of adaptation under the influence of changes in the rates of local central banks. That is, opportunities for effective investor interaction in these markets have not yet been created, but moderate connectivity and relative integration continue to be maintained.

We should note that according to the Strategy for the Development of the financial market of the Russian Federation until 2030 (RF Government Resolution 4355-r, dated December 12, 2022, as amended on December 21, 2023) the creation of such forms of regulation, based on the ability to adapt to rapidly changing realities, is stated as a priority in this sector of the economy, because if the relationship in the financial market begins to acquire a cross-border character, there emerges a convergence of local markets, which primarily concerns the CIS countries. In this direction, the Bank of Russia, in conjunction with regulators in other countries, is working to introduce regulation of this type of relationship in the financial market. The results of empirical research demonstrate a great potential for improvement in this area.

Under conditions of uncertainty, government securities of the Russian Federation are characterized as highly profitable and at the same time high-risk, and the bond market itself is poorly predictable and adapts to changes in the regulator for quite a long time. In this case, the actions of the Central Bank should be less abrupt and more predictable, which will enable the financial market to adapt more quickly to changing conditions.

The practical significance of the study of integration processes in the CIS sovereign bond market lies in the potential for increasing investment opportunities, forecasting and risk management in financial markets for the sustainable development of national economies.

Appendix 1

|

N |

Minimum |

Maximum |

Average |

Standard deviation |

Asymmetry |

Excess |

|||

|

Stat. |

St. error |

Stat. |

St. error |

||||||

|

SRF |

1136 |

0.043 |

0.200 |

0.075 |

0.032 |

2.086 |

0.073 |

5.022 |

0.145 |

|

I RF |

1086 |

0.053 |

0.151 |

0.080 |

0.020 |

0.537 |

0.074 |

-0.588 |

0.148 |

|

G RF |

1126 |

0.005 |

1.730 |

0.073 |

0.118 |

5.383 |

0.073 |

49.599 |

0.146 |

|

S KZ |

1136 |

0.090 |

0.168 |

0.117 |

0.032 |

0.596 |

0.073 |

-1.430 |

0.145 |

|

IKZ |

1136 |

0.080 |

0.140 |

0.109 |

0.016 |

0.352 |

0.073 |

-1.372 |

0.145 |

|

G KZ |

1098 |

0.010 |

0.044 |

0.019 |

0.006 |

1.206 |

0.074 |

1.066 |

0.148 |

|

S UZ |

1136 |

0.140 |

0.170 |

0.148 |

0.009 |

0.729 |

0.073 |

-0.691 |

0.145 |

|

IUZ |

127 |

0.068 |

0.306 |

0.136 |

0.046 |

0.252 |

0.215 |

-0.097 |

0.427 |

|

GUZ |

1096 |

0.020 |

0.065 |

0.031 |

0.008 |

1.423 |

0.074 |

2.034 |

0.148 |

|

S AZ |

1136 |

0.063 |

0.090 |

0.075 |

0.009 |

0.137 |

0.073 |

-1.061 |

0.145 |

|

IAZ |

380 |

0.010 |

0.115 |

0.070 |

0.016 |

-0.145 |

0.125 |

-0.034 |

0.250 |

|

GAZ |

1047 |

0.016 |

0.064 |

0.024 |

0.006 |

1.869 |

0.076 |

4.264 |

0.151 |

Descriptive statistics of the variables under consideration

Appendix 2

Results of the factor analysis

|

1 |

2 |

3 |

4 |

|

|

IRF |

0.916 |

i/s |

i/s |

i/s |

|

S KZ |

0.897 |

i/s |

0.254 |

i/s |

|

SAZ |

0.830 |

i/s |

i/s |

0.252 |

|

IKZ |

0.798 |

0.319 |

0.385 |

i/s |

|

S RF |

0.769 |

i/s |

-0.245 |

-0.347 |

|

G RF |

0.610 |

0.265 |

i/s |

-0.219 |

|

GUZ |

0.252 |

0.925 |

i/s |

i/s |

|

G KZ |

0.288 |

0.892 |

i/s |

i/s |

|

G AZ |

-0.229 |

0.845 |

i/s |

i/s |

|

SUZ |

i/s |

0.239 |

-0.817 |

i/s |

|

IUZ |

i/s |

i/s |

0.685 |

i/s |

|

I AZ |

i/s |

i/s |

i/s |

0.923 |

|

Note: i/s – insignificant correlations are suppressed, modulo less than 0.2. Principal component method, Kaiser normalization. The measure of the adequacy of the Kaiser – Meyer – Olkin sample (KMO = 0.685, value = 0.000) |

||||

Список литературы Sovereign bonds of the cis countries: integration dynamics of debt markets in the context of external instability

- Abad P., Chuliá H., Gómez-Puig M. (2010). EMU and European government bond market integration. Journal of Banking & Finance, 34(12), 2851–2860. DOI: 10.1016/j.jbankfin.2009.10.009

- Abad P., Chuliá H., Gómez‐Puig M. (2014). Time‐varying integration in European government bond markets. European Financial Management, 20(2), 270–290. DOI: 10.1111/j.1468-036X.2011.00633.x

- Abakah E.J.A. et al. (2021). Re-examination of international bond market dependence: Evidence from a pair copula approach. International Review of Financial Analysis, 74, 101678. DOI: 10.1016/j.irfa.2021.101678

- Abramov A.E., Radygin A.D., Chernova M.I. (2014). Financial markets regulation: Models, evolution, efficiency. Voprosy ekonomiki, 2, 33–49. DOI: 10.32609/0042-8736-2014-2-33-49 (in Russian).

- Ageeva S.D. (2022). Financialization and strengthening of the state influence in Russia. EKO=ECO, 3, 108–129. DOI: 10.30680/ECO0131-7652-2022-3-108-129 (in Russian).

- Ang A., Piazzesi M., Wei M. (2006). What does the yield curve tell us about GDP growth? Journal of Econometrics, 131(1-2), 359–403. DOI: 10.1016/j.jeconom.2005.01.032

- Baibulekova L.A., Lukhmanova G.K. (2019). Activation of the stock market of Kazakhstan against the background of inefficiency of its banking sector. Ekonomika. Professiya. Biznes, 1, 12–18. DOI: 10.14258/201902 (in Russian).

- Baker H.K., Nofsinger J.R. (2010). Behavioral finance: An overview. Behavioral Finance: Investors, Corporations, and Markets, 1-21. DOI: 10.1002/9781118258415

- Ballard-Rosa C., Mosley L., Wellhausen R. (2022). Coming to terms: The politics of sovereign bond denomination. International Organization, 76(1), 32–69. DOI:10.1017/S0020818321000357

- Casarin R. et al. (2023). A flexible predictive density combination for large financial data sets in regular and crisis periods. Journal of Econometrics, 237(2). DOI: 10.1016/j.jeconom.2022.11.004

- Cifarelli G., Paladino G. (2006). Volatility co-movements between emerging sovereign bonds: Is there segmentation between geographical areas? Global Finance Journal, 16(3), 245–263. DOI: https://doi.org/10.1016/j.gfj.2006.01.008.

- Dementiev N.P. (2018). External sector of the Russian economy: Low-yield investment and capital flight. EKO=ECO, 8(530), 93–112. DOI: 10.30680/ESO0131-7652-2018-8-93-112 (in Russian).

- Duncan R. (2014). Institutional quality, the cyclicality of monetary policy and macroeconomic volatility. Journal of Macroeconomics, 39, 113–155. DOI:10.1016/j.jmacro.2013.11.004

- Glushkov D., Khorana A., Pay R., Zhang J. (2018). Why do firms go public through debt instead of equity? Critical Finance Review, 7(1), 85–110. DOI: http://dx.doi.org/10.2139/ssrn.2024375

- Hirshleifer D. (2015). Behavioral finance. Annual Review of Financial Economics, 7, 133–159. DOI: http://dx.doi.org/10.1146/annurev-financial-092214-043752

- Huang D. et al. (2023). Are bond returns predictable with real-time macro data? Journal of Econometrics, 237(3). DOI:10.1016/j.jeconom.2022.09.008

- Jiang C.X., Kim J.C. (2005). Trading costs of non‐US stocks on the New York Stock Exchange: The effect of institutional ownership, analyst following, and market regulation. Journal of Financial Research, 28(3), 439–459. DOI: https://doi.org/10.1111/j.1475-6803.2005.00133.x

- Kuznetsov A.V. (2022). Imperatives for transformation of the international monetary system in the conditions of multipolarity. Finansy: teoriya i praktika=Finance: Theory and Practice, 26(2), 190–203. DOI: 10.26794/2587-5671-2022-26-2-190-203 (in Russian).

- La Porta R., Lopez‐de‐Silanes F., Shleifer A. (2006). What works in securities laws? The Journal of Finance, 61(1), 1–32. DOI:10.2139/ssrn.425880

- Laplane A., Mazzucato M. (2020). Socializing the risks and rewards of public investments: Economic, policy, and legal issues. Research Policy, 49, 100008. DOI: https://doi.org/10.1016/j.repolx.2020.100008

- Malliaropulos D., Migiakis P. (2023). A global monetary policy factor in sovereign bond yields. Journal of Empirical Finance, 70, 445–465. DOI: https://doi.org/10.1016/j.jempfin.2022.12.011

- North D.C. (2016). Institutions and economic theory. The American Economist, 61, 72–76. DOI: https://doi.org/10.1177/0569434516630

- Osmolovets S.S. (2022). Behavioral factors of investors’ activity and their importance in the development of the financial market of the Republic of Belarus. Sibirskaya finansovaya shkola=Siberian Financial School, 1, 24–31. DOI: 10.34020/1993-4386-2022-1-24-31 (in Russian).

- Panchenko V., Wu E. (2009). Time-varying market integration and stock and bond return concordance in emerging markets. Journal of Banking & Finance, 33(6), 1014–1021. DOI: https://doi.org/10.1016/j.jbankfin.2008.10.016

- Qin W., Cho S., Hyde S. (2023). Time-varying bond market integration and the impact of financial crises. International Review of Financial Analysis. 90, 102909. DOI: https://doi.org/10.1016/j.irfa.2023.102909

- Rau P.R. (2010). Market inefficiency. Behavioral Finance: Investors, Corporations, and Markets. 18, 331–349. DOI: https://doi.org/10.1002/9781118258415.ch18

- Shah M.H. et al. (2023). Exploring the interwoven relationship: Property rights, financial freedom, government regulation, and stock market fluctuations in emerging economies – a novel system GMM perspective. Heliyon, 10(1). DOI: 10.1016/j.heliyon.2023.e23804

- Stoupos N., Kiohos A. (2022). Bond markets integration in the EU: New empirical evidence from the Eastern non-euro member-states. The North American Journal of Economics and Finance, 63, 101827. DOI: https://doi.org/10.1016/j.najef.2022.101827

- Wallis J.J., North D. (1986). Measuring the transaction sector in the American economy, 1870–1970. In: Long-Term Factors in American Economic Growth. University of Chicago Press. Available at: https://www.nber.org/system/files/chapters/c9679/c9679.pdf (accessed: February 10, 2024).