Spatial Organization of Gas Resources Development on the Arctic Shelf of the Russian Federation

Автор: Shchegolkova A.A.

Журнал: Arctic and North @arctic-and-north

Рубрика: Social and economic development

Статья в выпуске: 49, 2022 года.

Бесплатный доступ

Being strategic, the Arctic shelf is a region with an extremely low level of exploration. The undiscovered hydrocarbon resources on the Russian Arctic shelf exceed 90%. The long-term development of strategic programs and projects for the development of gas production on the shelf are constrained by insufficient technical accessibility of industrial development, as well as the difficulty of assessing the actual volume of initial potential oil and gas resources. The reproduction of free gas reserves has been assessed, the level of parity between production and growth of explored reserves has been determined. The state of the gas resources of the Arctic shelf was studied taking into account localization in oil and gas regions, which allowed to make a conclusion about the degree of exploration of the resource base and to identify the basis for the gas potential. The factors restraining the development of offshore projects were identified and analyzed. It was determined that offshore projects should be presented to investors with more attractive operational, technological and economic indicators than alternative onshore projects. The lack of tested methods for the development of hydrocarbons at superdeep depths under severe ice conditions does not allow to fully assessing the economic efficiency of offshore gas projects in the Arctic. It is concluded that within the resource base of Arctic offshore fields, it is necessary to allocate the static (probabilistic) potential of hydrocarbon resources of the Arctic region. The need to transform the Arctic foreign policy is identified.

Reproduction of natural gas reserves, oil and gas fields of the Russian Arctic shelf, productivity of deposit, probabilistic potential of natural gas

Короткий адрес: https://sciup.org/148329265

IDR: 148329265 | УДК: [332.12+622.2](985)(045) | DOI: 10.37482/issn2221-2698.2022.49.86

Текст научной статьи Spatial Organization of Gas Resources Development on the Arctic Shelf of the Russian Federation

The problem of stable, efficient and safe reproduction and industrial development of the Arctic hydrocarbon resources has been identified as a priority for the sustainable development of the Arctic zone of the Russian Federation (AZRF), since this region is the main hydrocarbon resource base in Russia. The Arctic shelf, where the main reserve of the oil and gas industry is con-

-

∗ © Shchegolkova A.A., 2022

centrated, is a powerful strategic resource for the development of the Russian economy in general and the northern regions, including the Northern Sea Route, in particular. In the long term, the elaboration of strategic programs and projects for the development of gas production on the Arctic shelf will ensure “sustainable reproduction of natural gas reserves, maintain a fairly high competitive position of Russia in the global hydrocarbon market” [1, p. 133]. However, the scale and pace of development, additional exploration of offshore fields will depend on a number of constraining factors.

The spatial organization of the economic development of the oil and gas resources of the Russian Arctic, sustainable development and strategic management of the oil and gas complex are used as a methodological approach in scientific papers [2, Agarkov S.A., Saveliev A.N.], [3, Kozmenko S.Yu., Saveliev A.N., Teslya A.], [4, Kozmenko S., Saveliev A., Teslya A.], [5, Kozmenko S., Teslya A., Fedoseev S.], [6, Fadeev A.M., Cherepovitsyn A. .E., Larichkin F.D.] and others.

Scientists and specialists made a great contribution to the study of the geology and gas and oil presence of the Arctic region, the development of geophysical methods for prospecting and exploration of oil and gas resources, technical and technological processes for the development of hydrocarbons [7, Ananenkov A.G., Mastepanov A.M.] , [8, Laverov N.P., Bogoyavlenskiy V.I., Bo-goyavlenskiy I.V.], [9, Kontorovich A.E.], [10, Kontorovich V.A., Kontorovich A.E.], [11, Skorobo-gatov V.A., Kabalin M .Yu.] and others.

A significant but not fully resolved problem in studies of the spatial organization of gas production centers in the Arctic region of the Russian Federation is the assessment of reproduction and substantiation of the value and structure of the initial potential and undiscovered natural gas resources in the fields of the Arctic shelf.

The reformatting of approaches to international energy cooperation in the context of sanctions pressure, the presence of restrictive and deterrent factors for the development of oil and gas projects in the Arctic region determine the relevance of the problem of a reasonable determination of the volume of recoverable hydrocarbon resources.

The purpose of the study is to solve the scientific problem of analyzing the spatial organization of hydrocarbon potential development, determining the sector of technical availability of industrial development of hydrocarbons in the Arctic, which will allow to identify the static (probabilistic) volume of natural gas, which can be taken into account when developing strategic programs and projects for the development of gas production in the Arctic shelf.

The goal set requires solving the following tasks: assessment of the equilibrium correlation between production and reproduction of natural gas reserves, study of the spatial organization of gas production centers in the Russian Arctic, analysis of the influence of constraining factors on the industrial development of hydrocarbon deposits of the Arctic shelf.

The factual basis of the study is provided by the official data of the state balance of mineral reserves of the Federal Agency for Subsoil Use and the Federal State Statistics Service. The study was conducted using comparative-analytical, statistical methods of economic analysis.

Natural gas reserves replacement rate

The Arctic zone includes deposits of the South Kara oil and gas region (OGR), Prednovo-zemelskaya OGR, Yamalskaya OGR, Gydanskaya OGR, Nadym-Purskaya OGR, Pur-Tazovskaya OGR, Shtokman-Luninskaya OGR, South Barents OGR, Finnmarkenskaya OGR, Pechoro-Kolvinskaya OGR, Khoreyverskaya OGR, and Yenisei-Khatangskaya OGR.

Maintaining a balance between production and reproduction of hydrocarbons is a strategic task for the Russian gas industry. In recent years, serious prospects for the discovery of high-potential deposits and deposits of hydrocarbon raw materials, including those unique in terms of recoverable resources, are associated with five Arctic OGRs of the West Siberian oil and gas field (Yamalskaya, Nadym-Purskaya, Pur-Tazovskaya, Gydanskaya and Yuzhno-Karskaya) [12, Shchegolkova A.A.].

Table 1 presents an assessment of the equilibrium ratio between production and the growth of natural reserves for 2017–2021.

Table 1

Assessment of the replacement of free gas reserves in the Russian Federation 1,2

|

Year |

Production, bcm*, |

Increase in free gas reserves **, bcm |

Parity level, bcm |

K r |

Proven reserves, trillion m3 *** |

Share in global volume *** |

R/p***** |

|

2017 |

690 |

890 |

+200 |

1.29 |

35 |

18.1 |

55 |

|

2018 |

725 |

673 |

-52 |

0.93 |

38.9 |

19.8 |

58.2 |

|

2019 |

738 |

560 |

-178 |

0.76 |

38 |

19.1 |

55.9 |

|

2020 |

693 |

747 |

+54 |

1.08 |

37.4 |

19.9 |

58.6 |

|

2021 |

762 |

1017 |

+255 |

1.33 |

48.9**** |

23.7**** |

64.2 |

Average reproduction rate for the period 2017-2021 at the level of 1.08 illustrates the parity between production and growth, indicates the preservation of this balance and ensuring the reproduction of natural gas in the future (for the period 2012-2021, the same coefficient was 1.207).

For the period under study, the increase in free gas reserves outstrips its production, but in 2018 and 2019, the parity was not in favor of reproduction. The recorded decline in recoverable natural gas reserves in categories A+B1+C1 was due to a recalculation of the gas recovery factor. In 2019, there was a decrease in recoverable natural gas reserves at the Zapadno-Tarkosalinskiy oil and gas condensate field, the Severo-Kamennomysskiy gas condensate field, as well as on the Kara Sea shelf. Despite the overall decline in reserves, the natural gas resource base of the Yamal Gas Production Center (GPC) has increased significantly due to the discovery of two new fields on the Priyamalskoe shelf — V.A. Dinkov and Nyarmeiskiy, with total reserves of more than 500 billion m3. Additional exploration was carried out on the reserves of the Bovanenkovskaya and Tambeyskaya fields; the results of test drilling of exploration wells also corrected the data on higher productivity of the Leningradskoe field compared to earlier geological exploration data. The recoverable free gas reserves of the Leningradskoe gas condensate field are currently estimated at 1.9 trillion m3, which makes the field unique. Thus, the Yamal gas production region, the center of which is the Bovanenkovo cluster, will eventually replace the depleting gas fields of the Nadym-Purskaya and Pur-Tazovskaya oil and gas fields.

In the last two years, the explored reserves of free natural gas have been growing at the expense of increased exploration rates in the Russian Arctic, mainly in the area of the Yamal Peninsula and on the continental shelf, which makes it possible to maintain the “produc-tion/reproduction” parity. In particular, according to the Federal Agency for Subsoil Use, 33 hydrocarbon fields were discovered in 2020. The main growth in current recoverable natural gas reserves occurred in the Arctic region. For example, on the Kara shelf within the Prednevo-zemelskaya OGF, the Marshal Zhukov field, with total reserves of over 800 billion m3 and classified as unique, and the Marshal Rokossovsky field, with estimated gas reserves of 514 billion m3 and condensate of 53 million tons, were discovered. Earlier in 2014, the Pobeda field was discovered in the Kara Sea, Prednovozemelskaya OGF, with 130 million tons of oil reserves in category C1 + C2, 21.7 billion m3 of gas category A +В1+С1, 477.5 billion m3 — В2+С2, classified as unique. Oil reserves were found in Jurassic sediments and gas reserves — in Aptian-Albian and Cenomanian Cretaceous sediments. Drilling of the world’s northernmost well Universitetskaya-1 took place in record time, and in September 2014, the first oil was obtained — ultra-light, with density and sulfur content surpassing the benchmark grades Brent, as well as WTI and Siberian Light. In total, more than 30 promising structures have been identified on the shelves of the Kara Sea by the Prednovo-zemelskaya OGF. The results of exploration show their high prospects. According to experts (Rosneft), the new province may surpass the largest provinces of the Middle East, the Brazilian shelf, the Gulf of Mexico and the Arctic shelf of Alaska and Canada in the volume of recoverable hydrocarbon reserves. A gas field “75 Years of Victory” was discovered on the Priyamalskiy shelf of the Kara Sea within the South Kara OGF with a preliminary estimate of natural gas reserves of 202.4 billion m3.

Assessment of the gas potential of the Arctic shelf

The recoverable hydrocarbon reserves of the Arctic region are estimated by experts in terms of liquid hydrocarbons at 245 billion tons, while the Western Arctic shelf accounts for 50 billion tons of fuel equivalent. The Arctic shelf is predominantly gas-bearing. The share of gas resources in the total hydrocarbon potential is about 90% [7, Ananenkov A.G., Mastepanov A.M.], [11, Skorobogatov V.A., Kabalin M.Yu.].

Table 2 presents an assessment of free gas reserves of the West Arctic shelf according to the state balance of mineral reserves of the Federal Agency for Subsoil Use, PJSC Gazprom, PJSC Rosneft.

Table 2

Assessment of the free gas reserves of the West Arctic shelf 3

|

Deposit |

Category by reserves |

Free gas, bcm |

Degree of development |

Subsoil user |

|

|

А+В 1 +С 1 |

В 2 +С 2 |

||||

|

Kara Sea, including the Ob and Taz Bays |

|||||

|

Yuzhno-Karskaya OGF |

|||||

|

GCF Rusanovskoe |

unique |

240.4 |

538.6 |

explor. |

PJSC Gazprom |

|

GCF Leningradskoe |

huge |

71.0 |

980.6 |

explor. |

PJSC Gazprom |

|

GF named after Dinkov |

unique |

>150 |

>300 |

explor. |

PJSC Gazprom |

|

GF 75 years of Victory * |

large |

72.7 |

129.7 |

explor. |

PJSC Gazprom |

|

GF Nyarmeiskoe * |

large |

>80 |

>60 |

explor. |

Department for Subsoil Use in the North-Western Federal District, on the shelf and the world ocean of PJSC Gazprom |

|

Prednovozemelskaya OGF |

|||||

|

OGCF Pobeda |

unique |

21.7 |

477.5 |

explor. |

PJSC Rosneft |

|

GF named after m. Zhukov ** |

unique |

>800 |

explor. |

PJSC Rosneft |

|

|

GCF named after m. Rokossovskiy ** |

unique |

>514 |

explor. |

PJSC Rosneft |

|

|

Yamalskaya OGF |

|||||

|

GF Kamennomysskoe (sea) |

unique |

555.0 |

- |

devel. explor. |

Department for Subsoil Use in the North-Western Federal District, on the shelf and the world ocean, OOO Gazprom dobycha Yamburg |

|

GF Kamennomysskoe (shelf) |

average |

1.2 |

- |

devel. |

Department for Subsoil Use in the North-Western Federal District, on the cont.shelf and the world ocean |

|

GF Obskoe |

average |

4.8 |

- |

explor. |

OOO Gazprom dobycha Yamburg |

|

GCF Severo-Obskoe |

unique |

>320 |

explor. |

Arctic LNG 3 |

|

|

GCF Kruzenshternskoe (shelf) |

unique |

731.9 |

- |

explor. |

Department for Subsoil Use in the North-Western Federal District, on the shelf and the world ocean, PJSC Gazprom |

|

GCF Kharasaveyskoe (shelf) |

unique |

92.9 |

250.0 |

devel. |

Department for Subsoil Use in the North-Western Federal District, on the shelf and the world ocean, OOO Gazprom dobycha Nadym |

|

GCF Yuzhno- Tambeyskoe (shelf) |

unique |

82.0 |

35.7 |

explor. |

OAO Yamal LNG, OOO NOVATEK-Yurkharovneftegaz |

-

3 Source: compiled by the author * according to PJSC Gazprom; ** according to PJSC Rosneft.

Gydanskaya OGF

GCF Severo-Kamennomysskoe

large

404.9

27.1

devel.

OOO Gazprom dobycha Yamburg

GF Antipayutinskoe (shelf)

large

>300

explor.

PJSC Gazprom

GF Semakovskoe (shelf)

large

>320

devel.

Department for Subsoil Use in the North-Western Federal District, on the cont.shelf and the world ocean, RusGazAlliance LLC

GF Tota-Yakhinskoe (shelf)

large

>100.5

explor.

PJSC Gazprom

GCF

Chugoryakhinskoe

average

4.4

46.9

explor.

OOO Gazprom dobycha Yamburg

Total for Gydanskaya OGF

>1203.8

Nadym-Purskaya OGF

OGCF

Yurkharovskoe

unique

346.5

67.5

devel.

OOO NOVATEK-Yurkharovneftegaz

Total Kara Sea

>2900

>3000

Barents Sea

Shtokmanovsko-Luninskaya OGF

GCF

Shtokmanovskoe

unique

3939.4

-

explor.

PJSC Gazprom

GF Ludlovskoe

large

80.1

131.1

explor.

PJSC Gazprom

GCF Ledovoe

unique

91.7

330.4

explor.

PJSC Gazprom

Yuzhno-Barentsevskaya OGF

GF Murmanskoe

large

59.1

61.6

explor.

Department for Subsoil Use in the North-Western Federal District, on the shelf and the world ocean

Finmarkenskaya OGF

GF Severo-Kildinskoe

average

5.1

10.5

explor.

Department for Subsoil Use in the North-Western Federal District, on the shelf and the world ocean

Total Barents Sea

4175.4

533.6

Pechora Sea

Pechoro-Kolvinskaya OGF

GCF Pomorskoe

average

6.0 \

15.9 \

explor.

PJSC Rosneft

Khoreyverskaya OGF

OGCF Severo-Gulyaevskoe

large

10.4

41.4

explor.

PJSC Rosneft

Total Pechora Sea

16.4

57.3

Total

>7100

>3600

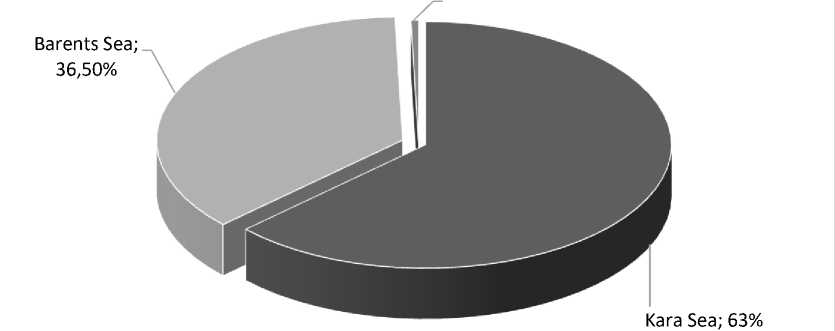

The assessment of the potential natural gas reserves of the Western Arctic shelf indicates a low level of exploration of the resource base. The degree of exploration, taking into account the newly discovered deposits of the Kara Sea shelf, does not exceed 20%, while most of the discovered deposits are classified as unique and large. However, discovered deposits need additional research due to the low degree of exploration. The best indicator of exploration of gas reserves was recorded in the fields of the Barents and Pechora Seas and is over 80%. The highest gas content is predicted on the shelf of the Kara Sea — about 63% (Fig. 1).

Pechora Sea;

0,50%

Fig. 1. Structure of the gas content of the Western Arctic shelf (compiled by the author).

Obviously, the main problem of geological exploration in the fields of the Arctic shelf is their assessment, determination and justification of the real value, as well as the structure of the initial potential natural gas resources. In recent years, despite the hard-to-recover hydrocarbon reserves, there has been an intensification of geological exploration of gas deposits directly on the shelf. However, their development is constrained by the presence of large volumes of explored and developed gas reserves on the Yamal Peninsula [12, Shchegolkova A.A., p. 63].

In the Kara-Yamal region, significant industrial hydrocarbon deposits have been recorded in a wide stratigraphic range — from the area of contact of the basement with the platform (sedimentary) cover to the Cenomanian deposits inclusively. The main reserves of hydrocarbon raw materials (mainly gas and gas condensate) of the Yamal OGF (onshore) are noted in the Albian-Cenomanian and Aptian-Albian productive complexes [13, Lyugay D.V., Soin D.A., Skorobogatko A.N.]. The main share in the structure of natural gas reserves belongs to the Cenomanian and Lower Cretaceous deposits, which are characterized as easily recoverable deposits with a relatively shallow occurrence depth of 1000–1700 m and are mainly methane accumulations. “The total reserves and resources of all fields of the Yamal OGF, including the Priyamalskaya shelf, are: explored and estimated gas reserves (A + B + C1 + C2) — about 16 trillion m3, prospective and forecast (C3 - D3) — about 22 trillion m3; recoverable condensate (A + B + C1) — more than 226 million tons; oil — 292 million tons” [12, Shchegolkova A.A., p. 64].

In previous studies, an “analysis of the distribution of the fields of the Yamal OGF (onshore) was carried out, taking into account their mining and geological characteristics, which made it possible to differentiate them according to the degree of prospects and highlight the proposed stages of the project for the development of hydrocarbon resources. At the same time, the following were taken into account: natural and climatic conditions, ecological component and presence or absence of industrial and social infrastructure (Table 3)” [12, Shchegolkova A.A., p. 68].

Table 3

Distribution of free gas by types of deposits in the Yamal gas-oil-bearing region (onshore) of the distributed fund (%) 4

|

Jurassic-Cretaceous deposits |

Paleozoic deposits |

|||

|

Alb-cenomanian |

Aptian |

Valanginian (neocom) |

Jurassic |

Carbon |

|

Fields under development |

||||

|

5.4 |

- 1 |

62.2 |

32.4 |

- |

|

1st stage of project implementation |

||||

|

30.7 |

48.4 |

11.7 |

9.2 1 |

- |

|

2nd stage of project implementation |

||||

|

45.2 |

30.7 |

13.0 |

11.0 |

0.1 |

|

3rd stage of project implementation |

||||

|

18.6 |

40.7 |

15.5 |

25.2 |

- |

|

unpromising |

||||

|

- |

- 1 |

100.0 |

- 1 |

- |

|

Total for all deposits of the distributed fund |

||||

|

32.13 |

42.83 |

15.4 |

9.6 1 |

0.04 |

The distribution of free gas by types of deposits (Table 3) showed that “according to the nature of the expressed productivity, the key dominant complex is the Albian-Cenomanian and Aptian, where the main reserves of natural gas are concentrated” [12, Shchegolkova A.A., p. 70].

Analysis of constraints in developing offshore projects

The development of new gas fields requires the solution of a complex technical tasks with high scientific intensity and, consequently, significant capital investments. “Decision on the development of new hydrocarbon deposits in conditions of high uncertainty is a strategic task that requires consideration of all components (organizational, technical and investment). The successful implementation of projects based on hydrocarbon deposits is largely due to their uniqueness. Only huge and unique fields are considered the most profitable in the Arctic region, in which more than 90% of the initial gas reserves are concentrated” [12, Shchegolkova A.A., p. 68]. Under these conditions, for their practical promotion and introduction into commercial operation, gas projects in the offshore fields of the Arctic should be presented to investors with more attractive operational, technological and economic indicators than alternative projects onshore.

The following factors are identified as determining the possibility of further development, supplementary exploration and exploitation of the Arctic offshore fields at the present stage (Fig. 2).

Developed by the author [12, Shchegolkova A.A., p. 70].

|

си . w Geological and geophysical < CD -------------------------------------------------- ^ Technological О _o Q. "to Transport and .0 infrastructure support 73 \ 73 cn | ra 73 /1--------------------------------------------- 73 CD / Level of professional E competencies CD > ---------------------------- CD 73 Geopolitical and _c economic 'ra u Ecological w -- 2 — |

Low level of exploration of the Arctic shelf subsoil Lack of the approved methods of development of hydrocarbons at superdepths under the severe ice conditions Inaccessibility of areas, lack of transport, industrial and social infrastructure at Arctic shelf fields Low level of interaction of vocational training institutions with oil and gas production companies, lack of practical-oriented algorithms Sanction pressure, export restriction, lack of economic interests in development and additional exploration Lack of effective technologies for emergency response in severe hydrometeorological and ice conditions |

Fig. 2. Factors influencing the decision-making process with regard to the opportunities for further offshore field development, additional exploration and exploitation 5.

Geological and geophysical factor. The level of subsurface exploration of the Arctic shelf is low, particularly by means of drilling. However, in recent years, exploration by PJSC Gazprom and PJSC Rosneft has increased through seismic surveys (CDPM-2D and 3D) 6. The highest degree of exploration of hydrocarbon fields is in the Priyamalskaya shelf, as well as in the Ob and Tazovskaya Bays. Geological-geophysical and drilling knowledge of the Arctic shelf decreases from west to east. At the moment, 28 gas and gas condensate fields have been identified (Table 2): both directly offshore and at the land-sea boundary. The current ranking classifies most of them as unique and large. However, at the moment, the Yurkharovskoye OGCF is the actual offshore field which is directly under development and where the production is performed by means of horizontal wells from the shore.

Technological factor. Involvement in the industrial circulation of the hydrocarbon resources of the Western Arctic is possible if technological, innovative and infrastructural problems in the field of exploration are solved, which is currently difficult due to the technical and technological backwardness of the oil and gas industry in the Russian Federation, primarily this applies to the formation of a system of geological exploration, drilling and hydrocarbon production. One of the factors limiting access to hydrocarbon resources is ice conditions — compression and intense drift of ice, ice intrusion into the production area, earlier ice formation, etc., which requires ensuring hydrometeorological safety in the area of exploration and development of hydrocarbon deposits. Among other things, severe hydrometeorological conditions, difficult ice conditions and a sea depth of more than 50 m reduce the range of technical and technological solutions, which limits exploration activities and complicates further development of offshore hydrocarbon fields in the Arctic. In modern oil and gas production practice, there is no successfully tested arsenal of technical and technological methods for solving the problem of industrial production of hydrocarbons at a sea depth of more than 50 m in difficult hydrometeorological and ice conditions. Russian scientists offer two possible approaches to solve this problem: the use of stationary offshore platforms and the construction of underwater production complexes [15, Vyakhirev R.I., Nikitin B.A., Mirzoev D.A.], [16, Nazarov V., Krasnov O., Medvedeva L.]. For offshore hydrocarbon fields, options of deep drilling and development of gas resources from the shore using onshore drilling equipment are considered; an example is the Yurkharovskoe oil and gas condensate field, where production is carried out through horizontal wells from the shore. The lack of proven methods for the development of hydrocarbons at superdeep depths under severe ice conditions does not allow fully assessing the economic efficiency of offshore gas projects in the Arctic, determining the level of operational and capital costs, evaluating geological and economic solutions and analyzing capital intensity.

Transport and infrastructure support. Estimation of economic efficiency of the offshore gas fields development involves taking into account the transport and infrastructure support of the Arctic oil and gas provinces. The state of the transport and logistics system of the Arctic mainland, as well as the lack of industrial, service and social infrastructure necessary for the development of offshore hydrocarbon facilities, is a factor hindering the development of new fields and the adoption of strategic decisions on the implementation of oil and gas projects, and also does not fully meet the requirements of the Arctic territories and national security [17, Tutygin A.G., Korobov V.B., Gubaidullin M.G., Chizhova L.A.].

In modern gas production practice, there are several ways of transport and logistics support of offshore oil and gas projects applied to coastal hydrocarbon fields. Among them:

-

• shipment of hydrocarbons directly from production platforms to oil tankers (gas carriers), similar to oil and gas condensate shipment from the Prirazlomnaya oil platform, liquefaction of natural gas from an offshore production platform or from a technological platform located in the vicinity with subsequent shipment;

-

• deep drilling and development of hydrocarbon deposits from the offshore using onshore drilling equipment through horizontal wells, similarly to the Yurkharovskoe oil and gas condensate field;

-

• transportation of hydrocarbons to onshore technological complexes by means of a pipeline system, integration of the offshore gas transportation infrastructure into the existing or newly created one, following the example of the gas projects being implemented in the Ob and Tazovskaya Bays;

-

• transportation of natural gas from offshore fields via pipeline to shore with subsequent liquefaction and further supply of LNG using tankers, following the example of the Norwegian gas project at the Snevit (Snow White) field in the Barents Sea. The operator of this project is Statoil. The gas and condensate produced in the Snevit field is piped to the liquefaction plant on the Melkøya peninsula near Hammerfest by an underwater production unit operated from the shore [15, Vyakhirev R.I., Nikitin B.A., Mirzoev D. A.], [18, Dmitrievskii A.N., Eremin N.A.].

Due to the inaccessibility of areas, the complete lack of transport, industrial and social infrastructure, the commissioning of new offshore fields in the Russian Arctic has been repeatedly postponed. In this regard, the basis for the development and implementation of transport, logistics and infrastructure projects necessary for the effective development of hydrocarbon fields on the Arctic shelf is the creation of a complex of coastal technological bases for the provision of oil and gas projects, including the associated oil and gas transport infrastructure and auxiliary production and social facilities focused on the development and commercial operation of specific offshore fields.

Level of professional competencies. The possibility of further development, additional exploration and exploitation of offshore Arctic fields depends to a large extent on the level of professional competence of the personnel. At the moment, the structure of the system of professional training for work in the offshore Arctic fields is presented at an insufficient competence level, in comparison with the training of personnel for work in the fields of the continental part of the Arctic. There is a low level of interaction between vocational training institutions and oil and gas companies, the lack of practice-oriented algorithms used in the training of specialists in LNG technologies, the implementation of underwater work on the shelf in the extreme Arctic conditions, as well as other competencies necessary for professional activities in deposits of the Arctic shelf.

The agreement contains practical recommendations aimed at achieving dominance in the Arctic in the face of strategic rivalry and everyday competition.

Geopolitical and economic factor. Recent events confirm the thesis that geopolitical factors are decisive in the process of evolution of the modern architecture of the global economy. In modern conditions, geopolitical and geo-economic risks are an integral part of the activities of Russian oil and gas companies, as they affect the structure of relationships in the field of geologi-

SOCIAL AND ECONOMIC DEVELOPMENT

Asya A. Shchegolkova. Spatial Organization of Gas Resources Development… cal exploration, field development, production of hydrocarbon raw materials, their processing, storage and transportation.

Analysis of the strategic documents of the United States 7 and its NATO allies, which determine the Arctic as the region of “growing uncertainty” 8 and strategic competition 9, defines the character of interrelations between the Arctic countries as “strategic competition” 10, and mentions the necessity of “restoring the Arctic dominance” 11 and achieving dominance in the conditions of uncertainty and strategic competition 12 , which allows to state that activities of the NATO and their satellites in the Arctic are based on opposition to the Russian presence in the Arctic region [19, Shchegolkova A.A.]. In order to limit the activities of Russia in the economic development of the Arctic, the countries of NATO and the European Union are taking steps to challenge the legal status of the NSR, to expand the military presence of the NATO bloc in the Arctic, including by joining the military alliance of the countries of the Arctic Council — Finland and Sweden, the implementation of unprecedented sanctions pressure on the Russian economy in general and on energy companies in particular. The introduction of anti-Russian sectoral sanctions led to the refusal of participation of foreign oil and gas producing and service companies in Russian projects on the Arctic shelf, despite the fact that the oil and gas sector of Russia is currently limited in its activities due to dependence on the equipment and oilfield services of countries that have become unfriendly. Sanctions restrictions are aimed at hindering Russia’s activities in the development of the Arctic shelf, while Western countries have ceased to hide the fact that these measures are based on competition for energy markets.

The global gas market was influenced by the unfavorable situation caused by the political confrontation between Russia and Western countries. Export and sanctions restrictions in the first half of 2022 led to a decrease in Russian gas production by 5%. Pipeline gas supplies to non-CIS countries decreased by 38.8% (according to the results of the first three quarters of 2022), with the exception of natural gas supplies to China via the Power of Siberia gas pipeline (growth was over 60%).

Unprecedented sanctions pressure is forcing Russia to asymmetrically respond to geopolitical and economic threats, including the modernization of the export model of hydrocarbons, changes in the structure of supplies and approaches in the world energy markets. In the current geopolitical and economic conditions, the gas industry is faced with the following tasks: diversification of supply lines, including at the expense of the domestic market and development of gasification of the country; diversification of natural gas transportation means (further development of the LNG industry, construction of new and integration of existing gas pipelines into the Unified Gas Supply System); revision of existing sales models, modification of price mechanisms and conditions of supply.

Despite rising prices on the world market and increased income from natural gas supplies, it is not rational to increase production in the context of export restrictions, especially in the development and exploration of offshore fields. These geopolitical conditions should be taken into account when designing strategic programs for the development of offshore gas projects in the Arctic.

Ecological factor . In the process of expanding the resource and transport potential of the Arctic, developing offshore and onshore deposits, the ecosystem of the Arctic region is quite vulnerable, and therefore requires taking into account environmental risks, attention to possible emergency situations of a man-made and natural nature [20, Kokko K.T., Buanes A., Koivurova T.]. In the process of solving the problem of spatial organization of hydrocarbon resources development, it is necessary to timely assess the risk of impact and identify areas most exposed to pollution in order to effectively deploy means of responding to environmental threats [21, Lokhov A.S., Gubaidullin M.G., Korobov V.B., Tutygin A.G.]. An assessment of the investment attractiveness of a particular project for the development of offshore or onshore hydrocarbon deposits should take into account the costs of environmental protection throughout all stages of work, the prevention of environmental accidents, as well as compensation for possible damage. The Arctic shelf is the most sensitive to anthropogenic impact, requires a longer recovery time, which is exacerbated by the current lack of effective technologies for dealing with emergency situations in hydrocarbon production under difficult hydrometeorological and ice conditions.

Conclusion

-

1. Most of the hydrocarbon potential is offshore in the Arctic, but at the same time the degree of exploration of this strategically important region remains very low, not only in Russia, but also in other subarctic countries. According to experts, the volume of unexplored oil and gas resources of the Russian Arctic is over 90% on the Arctic shelf and about 50% on land, but, despite these limitations, the explored reserves on the Arctic shelf, according to the Ministry of Natural Resources of the Russian Federation dated January 1, 2016, amount to 585 million tons of oil and

10.4 trillion m3 of gas in categories A+B+C1+C2. The only oil and gas project currently being implemented on the Russian Arctic shelf is an offshore ice-resistant stationary platform at the Prirazlomnaya field. The industrial development of this field began at the end of 2013, which required the development and subsequent implementation of a unique set of modern engineering and geological surveys and technical solutions, taking into account extreme natural and climatic conditions and drifting ice fields. Within the framework of the Prirazlomnoe project, all technical and technological operations are carried out: production drilling of wells using vertical and horizontal methods (Arctic Oil — ARCO oil); extraction and preparation of oil for shipment; shipment of oil to the tanker through a complex of direct shipment units; generation of heat and electricity. The timing of the implementation of other offshore projects, including the Shtokman gas condensate field, has not been determined. For coastal fields, there are options for deep drilling and development of gas resources from the coast using land-based drilling equipment.

-

2. As for the spatial organization of gas resources development in the Arctic region, in the foreseeable future, the achieved level of gas production (400–500 billion m3 per year) [12] at the fields of the Arctic region will be provided and compensated through the expansion and development of satellite fields, primarily the Yamalskaya and Gydanskaya oil and gas fields (onshore), and a number of coastal fields. In the short term, the strategy for reproducing the gas potential of the Russian Arctic “will be aimed at carrying out prospecting and exploration work in order to convert the predicted resources of continental and coastal fields into industrial reserves of natural gas” [16]. In this case, the geological, technological and environmental risks of developing the oil and gas potential will be minimal compared to the Arctic shelf, and by 2040, the increase in category B+C1 by all operating companies in the Yamal OGF, Gydanskaya OGF (onshore and coastal fields) and South Kara OGF (shelf) is projected at 17.5–18 trillion m3 [12].

-

3. The absence at the present stage of proven technological solutions for the development of hydrocarbons in the harsh conditions of the Arctic shelf, as well as effective methods for eliminating the environmental consequences of possible accidents during oil and gas production, hinders the development and exploitation of offshore fields, and, therefore, does not give the possibility to evaluate the level of recovery of gas resources. Proceeding from the above-mentioned, within the resource base of the Arctic offshore fields, it is necessary to single out the static (or probabilistic) potential of the hydrocarbon resources of the Arctic region, that is, the volume that can be developed only under certain conditions. The resource base of hydrocarbons, which is not included in the sector of technical availability of industrial development, should be excluded from further evaluation of strategic programs and projects for the development of gas production on the Arctic shelf.

-

4. The actions of NATO and EU countries require strategic decisions to reformat approaches to international cooperation in the Arctic region. The transformation of the Arctic foreign policy is based on the need to shift the vector of international energy cooperation from the European continent in the direction of mutually beneficial relations in the oil and gas sector with the BRICS

countries and promising partners of this association, despite the fact that European countries and the United States, unlike Russia, have limited geopolitical influence on these countries. In June 2022, at the last summit, the BRICS member countries expressed their interest in cooperation in the Arctic region, since the Arctic could become a promising development area for energy and new logistics routes in the future.

At the present stage, none of the Arctic states will be able to achieve the global goal of sustainable development of the Arctic independently. The expansion of multilateral cooperation with friendly countries and partners in the energy sector will not only increase the volume of oil and gas exports to these countries, but can also become an effective mechanism for solving technological, infrastructural, scientific, educational, social and environmental problems that impede development industrial production of hydrocarbons on the Arctic shelf, and will create prerequisites for the formation of a new model of sustainable development of the Arctic economic system in the format of Russia’s cooperation with the BRICS countries and friendly partners.

Список литературы Spatial Organization of Gas Resources Development on the Arctic Shelf of the Russian Federation

- Agarkov S.A., Bogoyavlenskiy V.T., Kozmenko S.Y., Masloboev V.A., Ulchenko M.V. (ed.) Global'nye tendentsii osvoeniya energeticheskikh resursov Rossiyskoy Arktiki. Chast'. I. Tendentsii ekonomich-eskogo razvitiya Rossiyskoy Arktiki [Global Trends in the Development of Energy Resources in the Russian Arctic. Part I. Trends in the Economic Development of the Russian Arctic]. Apatity, Kola Sci-ence Center RAS Publ., 2019, 170 p. (In Russ.). DOI: 10.25702/KSC.978.5.91137.397.9-1

- Agarkov S.A., Saveliev A.N., Kozmenko S.Y., Ulchenko M.V., Shchegolkova A.A. Spatial Organization of Economic Development of Energy Resources in the Arctic Region of the Russian Federation. Jour-nal of Environmental Management and Tourism, 2018, vol. 9, no. 3 (27), pp. 605–623. DOI: 10.14505/jemt.v9.3(27).21

- Kozmenko S.Y., Saveliev A.N., Teslya A.B. Global'nye i regional'nye faktory promyshlennogo osvoeniya uglevodorodov kontinental'nogo shel'fa Arktiki [Global and Regional Factors of Industrial Development of the Hydrocarbons of the Continental Shelf of the Arctic]. Izvestiya Sankt–Peterburgskogo gosudarstvennogo ekonomicheskogo universiteta [News of the Saint Petersburg State University of Economics], 2019, no. 3 (117), pp. 65–73.

- Kozmenko S., Saveliev A., Teslya A. Impact of Global and Regional Factors on Dynamics of Industrial Development of Hydrocarbons in the Arctic Continental Shelf and on Investment Attractiveness of Energy Projects. IOP Conference Series Earth and Environmental Science, 2019. 302. P. 012124. DOI: 10.1088/1755-1315/302/1/012124

- Kozmenko S., Teslya A., Fedoseev, S. Maritime Economics of the Arctic: Legal Regulation of Envi-ronmental Monitoring. IOP Conference Series: Earth and Environmental Science, 2018, no. 180 (1), p. 012009. DOI: 10.1088/1755-1315/180/1/012009

- Fadeev A.M., Cherepovitsyn A.E., Larichkin F.D. Strategicheskoe upravlenie neftegazovym kom-pleksom v Arktike [Strategic Management of the Oil and Gas Complex in the Arctic]. Apatity, Kola Science Center RAS Publ., 2019, 289 p. (In Russ.). DOI: 10.25702/KSC.978.5.91137.407.5

- Ananenkov A.G., Mastepanov A.M. Gazovaya promyshlennost' Rossii na rubezhe XX i XXI vekov: nekotorye itogi i perspektivy: monografiya [Gas Industry of Russia at the Turn of the 20th and 21st Centuries: Some Results and Prospects]. Moscow, Gazoil Press Publ., 2010, 306 p. (In Russ.)

- Laverov N.P., Bogoyavlensky V.I., Bogoyavlensky I.V. Fundamental'nye aspekty ratsional'nogo osvoeniya resursov nefti i gaza Arktiki i shel'fa Rossii: strategiya, perspektivy i problemy [Fundamen-tal Aspects of the Rational Development of Oil and Gas Resources of the Arctic and Russian Shelf: Strategy, Prospects and Challenges]. Arktika: ekologiya i ekonomika [Arctic: Ecology and Econom-ics], 2016, no. 2 (22), pp. 4–13.

- Kontorovich A.E. Ways of Developing Oil and Gas Resources in the Russian Sector of the Arctic. Her-ald of the Russian Academy of Sciences, 2015, vol. 85, no. 3, pp. 213–222. DOI: 10.1134/S1019331615030120

- Kontorovich V.A., Kontorovich A.E. Geological Structure and Petroleum Potential of the Kara Sea Shelf. Doklady Earth Sciences, 2019, vol. 489, no. 1, pp. 1289–1293. DOI: 10.1134/S1028334X19110229

- Skorobogatov V.A., Kabalin M.Yu. Zapadno-Arkticheskiy shel'f Severnoy Evrazii: zapasy, resursy i dobycha uglevodorodov do 2040 i 2050 gg. [Western-Arctic Shelf of Northern Eurasia: Reserves, Re-sources and Production of Hydrocarbons until 2040 and 2050]. Neftegaz.RU, 2019, no. 11 (95), pp. 36–51.

- Shchegolkova A.A. Spatial Organisation of Gas Resources Development in the Yamal Oil and Gas Bearing Region. Arktika i Sever [Arctic and North], 2021, no. 45, pp. 61–74. DOI: 10.37482/issn2221-2698.2021.45.61

- Lyugay D.V., Soin D.A., Skorobogatko A.N. Osobennosti neftegazonosnosti poluostrova Yamal v svyazi s otsenkoy perspektiv yuzhnoy chasti Karskogo morya [Features of Oil-Gas-Bearing Capacity of Yamal Peninsular in Respect to Estimation of Prospects for a Southern Part of Kara Sea]. Vesti Gazovoy Nauki [Gas Science Bulletin], 2017, no. 3(31), pp. 29–35.

- Vyakhirev R.I. Rossiyskaya gazovaya entsiklopediya [Russian Gas Encyclopedia]. Moscow, Bol'shaya Rossiyskaya entsiklopediya Publ., 2004, 527 p. (In Russ.)

- Vyakhirev R.I., Nikitin B.A., Mirzoev D.A. Obustroystvo i osvoenie morskikh neftegazovykh mes-torozhdeniy [Arrangement and Development of Offshore Oil and Gas Fields]. Moskva, Akademiya gornykh nauk Publ., 2001, 457 p. (In Russ.)

- Nazarov V., Krasnov O., Medvedeva L. Arkticheskiy neftegazonosnyy shel'f Rossii na etape smeny mirovogo energeticheskogo bazisa [Arctic Petroleum Shelf of Russia at the Changing Period of World Energy Basis]. Energeticheskaya politika [Energy Policy], 2021, no. 7 (161), pp. 70–85. DOI: 10.46920/2409-5516_2021_7161_70

- Tutygin A.G., Korobov V.B., Gubaydullin M.G., Chizhova L.A. Ekspertnaya otsenka sootnosheniya zatrat pri stroitel'stve neftyanoy transportnoy infrastruktury v Arktike [Expert Assessment of a Ratio of Expenses at Construction of Oil Transport Infrastructure in the Arctic]. Upravlencheskoe konsul'ti-rovanie [Administrative Consulting], 2018, no. 12 (120), pp. 110–117. DOI: 10.22394/1726-1139-2018-12-110-117

- Dmitrievsky A.N., Eremin N.A., Shabalin N.A., Kondratyuk A.T., Eremin Al.N. State and prospects of traditional and intellectual development of hydrocarbon resources of the Arctic shelf. Neftegaz.RU, 2017, no. 1 (61), pp. 32–41.

- Shchegol'kova A.A. Ekonomika i politika «kholodnogo protivostoyaniya» v novoy Arktike [Economics and Politics of “Cold Confrontation” in the New Arctic]. Sever i rynok: formirovanie ekonomich-eskogo poryadka [The North and the Market: Forming the Economic Order], 2021, no. 4 (74), pp. 7–20. DOI: 10.37614/2220-802X.4.2021.74.001

- Kokko K.T., Buanes A., Koivurova T., Masloboev V., Pettersson M. Sustainable Mining, Local Com-munities and Environmental Regulation. Barents Studies: Peoples, Economies and Politics, 2015, vol. 2 (4), no. 1/2015, pp. 50–81.

- Lokhov A.S., Gubaydullin M.G., Korobov V.B., Tutygin A.G. Geografo-ekologicheskoe rayonirovanie trassy nefteprovoda po stepeni opasnosti vozdeystviya na okruzhayushchuyu sredu pri avariynykh razlivakh nefti v Arktike [Geographical and Ecological Land Zoning of Onshore Oil Pipeline Location by Level of Hazard to Environment from Emergency Oil Spills in Arctic Region]. Teoreticheskaya i prikladnaya ekologiya [Theoretical and Applied Ecology], 2020, no. 4, pp. 43–48. DOI: 10.25750/1995-4301-2020-4-043-048