Specialties of the practice of consumer credit in Russia during the period of economic instability

Автор: Atroshko M.A.

Журнал: Экономика и бизнес: теория и практика @economyandbusiness

Статья в выпуске: 4-1 (86), 2022 года.

Бесплатный доступ

The article discusses the main trends and features of consumer lending in the modern period of economic instability. The structure and dynamics of consumer lending to the population in 2020-2021 and the first quarter of 2022 are considered. Multidirectional factors influencing on the "debt load" of the population are characterized. On the basis of published data, the volume and structure of savings of the population are shown. The actions of the Bank of Russia aimed at reducing the overdue debt of the population on consumer loans are considered.

Consumer lending, bank of Russia, key rate, household savings, overdue loans, lending limit

Короткий адрес: https://sciup.org/170193773

IDR: 170193773

Текст научной статьи Specialties of the practice of consumer credit in Russia during the period of economic instability

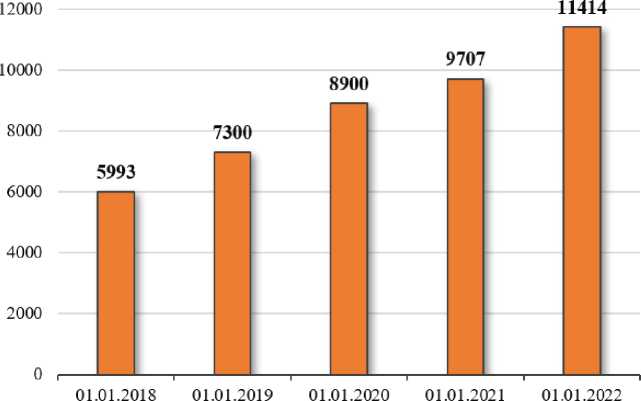

The current state of the sector of bank lending to the population is largely influenced by certain negative factors: the COVID-19 pandemic, the decline in real disposable incomes of the population, the introduction of anti-Russian sanctions, etc. The volume and types of bank lending to the population in the country are also related to the number of operating credit organizations. The number of functioning banks in fig. 1.

Fig. 1. The number of functioning banks in Russia for 2018-2021, units [10]

According to the fig. 1 the number of credit institutions in 2021 decreased by 76 banks or 17% compared to 2020. And the number of banks for four years has decreased by 1.5 times.

The dynamics of liabilities on credits and loans of the population of the Russian Federation is shown in fig. 2.

Fig. 2. Dynamics of liabilities on loans and borrowings of individuals in the Russian Federation for 2018-2021, billion rubles [10]

The data of fig.2 show that in dynamics the volume of lending to the population for the study period has a growth trend. In 2021, the growth in lending to the population amounted to 23.1% compared to 2020.

In order to maintain the financial condition of banks and reduce the negative effect of the COVID-19 pandemic, the Bank of Russia implemented a number of stabilization measures, for example, it encouraged credit institutions to develop borrower debt restructuring programs, the adoption of federal law No.106-FZ dated April 3, 2020, which al- lowed to provide a certain category of citizens with credit holidays [1].

Consumer lending in August 2021 accelerated to 2.2% from 1.7% in July, which is largely due to seasonal factors - high spending before the new school year, as well as vacation spending. To mitigate systemic risks, from October 1, 2021, surcharges will be further increased. In this case, direct restrictions would be a more effective mechanism.

On fig. 3 shows the dynamics of consumer lending in the Russian Federation.

Fig. 3. Dynamics of consumer lending in the banking sector of the Russian Federation, billion rubles [11]

The data in the fig.3 show in dynamics the growth of consumer lending to the population of Russia for the period 2018-2021. In 2021 the volume of consumer lending increased by 17.6% compared to 2020.

Thus, the dynamics of changes in the main indicators of bank lending for the analyzed period is mostly positive, which is associated with an increase in lending volumes. However, the presence of significant arrears reduces the efficiency of the bank lending process [2].

In Russia intensive growth in consumer lending continues. At the beginning of December 2021 the volume of loans issued increased by almost 30% compared to the same period in 2020. According to the Central Bank, the Equifax credit bureau and the National Association of Professional Collection Agencies, since January 2021, the amount of overdue debts of Russians has grown by 9.2% by the beginning of October and for the first time reached 970 billion rubles [3]. About 7.1 million loans are in default. According to the Central Bank, the share of such loans in the largest banks is especially high – it reaches 50%.

Thus, such restrictions are necessary and long overdue. The effect of the introduction of limits should lead to a reduction in borrowing by citizens whose credit burden is already high. At the same time, in order to protect groups of borrowers - over-indebted and low-income, aggressive advertising of affordable loans without collateral, as well as credit cards with supposedly profitable cashback and credit cards with supposedly profitable cashback should be limited. At the same time, there are fears that the new measures of the Central Bank may lead to an increase in shadow lending, hidden under the guise of private loans from one individual to another.

When applying for a loan product, the borrower signs the terms of the loan agreement, which contains references to the general terms and conditions of the loan. That is, in fact, if the borrower wants to get acquainted with all his rights and obligations under the loan agreement, as well as find out all the rights and obligations of the creditor, he needs to study many laws, the Civil Code, the Arbitration Procedure Code (based on judicial practice) and the above laws from paragraph 1 of this chapter.

Any person may need funds, the bank's clients are diverse. They are of different ages and social status, they have different levels of knowledge, income, education, but each of them is a person. The goals of lending are also individual, someone needs housing, someone takes money for treatment, and someone for entertainment or, for example, for education. It is beneficial for the bank that each of them was a client and brought income for as long as possible (within the terms of the loan agreement).

Some clients know the laws well and apply them skillfully, while others are completely opposite.

As part of the loan agreement, if necessary and desired, all participants in the transaction should have the opportunity to study the legislation in the framework of lending. There are a lot of laws regulating lending in a bank, therefore, drawing up a Banking Code within the framework of lending to individuals will allow: to systematize information on current legislation in the field of lending, to provide an opportunity for self-study of the legislation.

In such a Code, borrowers will be able to get acquainted not only with their rights and obligations, but also learn a lot of useful information, for example, about payment deferrals, encumbrances, collateral and much more. Also, the Code will be useful to bank employees, lawyers and legal consultants, credit institutions, because everyone is equal before the law, so everyone must comply with them.

The efficient and profitable operation of a bank largely depends on its ability to work with a large number of clients – including new ones who have not previously applied for a loan. It is necessary to check each potential borrower, analyze his creditworthiness and how his past loans were repaid.

The scoring system is a computer program that includes questions and answers to them. The program carries out the ratio of the borrower's answers to the algorithm and determines the chance of obtaining a loan. When a potential borrower applies for a loan, he is asked to fill out a questionnaire. Based on the answers to the questions of the questionnaire, as well as the data of the credit history and the submitted documents, a scoring score is set. For each answer, the options of which contain increasing or decreasing coefficients, the client is assigned a certain number of points. The final result is determined automatically today, although earlier this function was carried out by bank employees. The scoring system for assessing creditworthiness today has a number of significant advantages.

One of the main advantages is the speed of decision making. Previously, the analysis of the borrower's solvency was carried out by bank employees, which took a lot of time to check each parameter, manually enter the result and summarize. Thanks to modern scoring systems for assessing creditworthiness, data is processed quickly, and therefore a decision is made promptly. Another notable advantage is objectivity, because even an experienced and qualified specialist has the risk of making mistakes in the calculations or forming a prejudiced opinion due to a personal relationship with the client. The borrower's rating, which is formed by the scoring system, is a much more objective indicator of creditworthiness due to the automation of the system. In addition, a bank employee does not have the opportunity to use the algorithm.

An important advantage is a noticeable reduction in the share of defaults due to the use of a scoring model for assessing creditworthiness. The scoring system is customizable, which means it can be changed to suit the bank's credit policy, which may change during the course of business. If it is possible to increase the level of risk, then it is enough just to lower the threshold score.

The disadvantage of assessing a borrower using a scoring system is that it does not consist of an assessment of a real person, but on the basis of the information available about him, which he also provides. And the client can present such information that will allow you to get a positive result when assessing the possibility of providing funds.

The essence of scoring is to determine the total credit score of the borrower as a result of an assessment based on a set of criteria. These criteria have different weights and are subse- quently aggregated into an integral indicator -a total credit score.

Creditworthiness assessment using scoring systems is mainly based on no more than 20 criteria, among which the main ones are: the level of average monthly income, frequency of job changes, age, marital status, number of dependents, education, credit history. First of all, the borrower's passport data, information about the place of residence and other contact details are checked. This is a preliminary stage at which applicants with invalid documents are excluded.

If the borrower is a payroll client or has a bank deposit, the score is likely to be increased. To determine possible contradictions, the data provided by the client is checked by the scoring system separately and correlated with each other. Having considered the scoring and the situation on the Russian market, we can say that the credit scoring system allows the bank to more carefully assess the risks for each borrower and significantly reduce the likelihood of fraud, both on the part of customers and employees themselves.

However, the scoring system for determining the creditworthiness of an individual has a significant drawback: it does not take into account changes in the current economic situation in the country and in a particular region. Some banks use in their practice of establishing the creditworthiness of a potential borrower systems based on expert assessments of the economic feasibility of granting a loan, as well as scoring systems.

The determining factors for the further development of bank lending in the future will be: monetary policy, the key rate of the Bank of Russia, the level of inflation and real incomes of the population, as well as the stabilization of the macroeconomic situation not only in Russia, but also in the world as a whole [4].

In addition, today banks, when providing a consumer loan to a borrower, are trying to impose credit insurance on the insurer. Recently, the borrower's insurance conditions have become more frequently challenged through court proceedings. This is due to the fact that banks have already established a loan application form, it is drawn up and signed in accordance with the standard conditions for a consumer loan. In such a scheme, the freedom to conclude an agreement is limited, since the borrower does not have the opportunity to change the content or agree on any other conditions.

According to Article 421 of the Civil Code of the Russian Federation, legal entities and citizens are free to conclude a contract, only any contract must comply with the rules binding on the parties established by law and other legal acts, which is determined by Article 422 of the Civil Code of the Russian Federation. According to part 3 of Art. 16 of the Law of the Russian Federation of 07.02.1992 No. 2300-1 “On Protection of Consumer Rights”, the consumer’s consent to the provision of additional paid services must be drawn up in writing, unless otherwise provided by federal law. From the foregoing, it follows that when offering services at the conclusion of a loan agreement, it is necessary to draw up a document in which the consumer's consent to such services will be drawn up in writing; in practice, such a document is the application for a loan itself.

Thus, immediately after receiving a loan, all borrowers began to refuse voluntary insurance contracts. As a result, banks lost additional income from the sale of insurance products. However, the banks did not want to put up with the current situation and did the following. The condition for obtaining a loan, according to which the borrower writes an application in which he asks the bank to join him to the collective insurance agreement concluded between the bank and the insurer, has become mandatory.

The cost of the bank's services consists of its remuneration and reimbursement of the bank's expenses for the payment of the insurance premium to the insurer. There is no connection between the application and the loan agreement, except for the equality of the loan amount and the sum insured; and also there is no fact that bank services are paid from the account to which credit funds are credited. Thus, the borrower can no longer simply refuse the service imposed on him and repay the overpaid amount.

According to paragraph 2 of Art. 16 of the Consumer Rights Protection Law, it is prohib- ited to condition the purchase of certain goods (works, services) on the obligatory purchase of other goods (works, services). In this connection, in this situation, the bank, without providing another option for issuing a loan (higher percentage), which violates this rule [5].

A mandatory requirement for the lender is to provide the borrower with the opportunity to refuse or agree to receive additional services, as well as to indicate their cost in the application. Thus, the Bank of Russia focuses on observing the interests of the borrower in terms of exercising his right to express consent or refusal to receive additional paid services from the lender and also indicates that the consumer should be aware of all the costs that he will have to incur in connection with their loan.

It should be noted, that the culture of consumer lending and the formation of new types of consumer loans in foreign countries are more developed than in Russia, due to differences in the historical development of countries, Russia's later transition to a market economy.

Despite this, at present, the consumer lending market in Russia is actively developing, as evidenced by the emergence of new types of loans that require separation into separate independent groups.

Thus, lending to the population is a process of movement of funds or material values on the terms of an agreement between the lender and the borrower.

For the development of consumer lending, the volume of bank resources and bank deposits are of great importance. In 2018, the volume of funds on accounts and deposits of individuals in the whole of the Russian Federation increased by 17.55%. Then there was a decrease in dynamics for 2020, the deposit portfolio increased by 7.97%, in 2021, according to the National Rating Agency – by 2.5%. At the same time, the first quarter of 2021 was the most disastrous since the beginning of the pandemic – the outflow of funds amounted to 666.7 billion rubles (2%) [7].

Table. Average market values of the full cost of consumer loans for the period from July 1 to September 30, 2021, in percent [6]

|

№№ |

Category of consumer credits (loans) |

Average market values of the total cost of consumer credits (loans) in percentage per annum |

Limit values of the full cost of consumer credits (loans) in percentage per annum |

|

1. |

Consumer loans for the purpose of purchasing vehicles with a pledge of a vehicle |

||

|

1.1. |

pre-owned vehicles от from 0 to 1000 km |

12,978 |

17,304 |

|

1.2. |

pre-owned vehicles over 1000 km |

16,283 |

21,711 |

|

2. |

Consumer loans with a credit limit (according to the amount of the credit limit on the date of conclusion of the agreement) |

||

|

2.1. |

to 30 000 rub. |

23,801 |

31,735 |

|

2.2. |

from 30 000 to 300 000 rub. |

19,334 |

25,779 |

|

2.3. |

over 300 000 rub. |

16,311 |

21,748 |

|

3. |

Targeted consumer loans (loans) provided by transferring borrowed funds to a trade and service enterprise as payment for goods (services) in the presence of an appropriate agreement with a merchant (POS-loans) without collateral |

||

|

3.1. |

up to 1 year, including: |

||

|

3.1.1. |

to 30 000 rub. |

15,800 |

21,067 |

|

3.1.2. |

from 30 000 to 100 000 rub. |

14,816 |

19,755 |

|

3.1.3. |

over 100 000 rub. |

13,036 |

17,381 |

|

3.2. |

over 1 year, including: |

||

|

3.2.1. |

to 30 000 rub. |

13,640 |

18,187 |

|

3.2.2. |

from 30 000 to 100 000 rub. |

11,896 |

15,861 |

|

3.2.3. |

over 100 000 rub. |

12,118 |

16,157 |

|

4. |

Non-targeted consumer loans, targeted consumer loans without collateral (except for POS loans), consumer loans for debt refinancing |

||

|

4.1. |

up to 1 year: |

||

|

4.1.1. |

to 30 000 rub. |

21,089 |

28,119 |

|

4.1.2. |

from 30 000 to 100 000 rub. |

15,991 |

21,321 |

|

4.1.3. |

from 100 000 to 300 000 rub. |

14,638 |

19,517 |

|

4.1.4. |

over 300 000 rub. |

9,980 |

13,307 |

|

4.2. |

over 1 year, including: |

||

|

4.2.1. |

to 30 000 rub. |

14,376 |

19,168 |

|

4.2.2. |

from 30 000 to 100 000 rub. |

17,424 |

23,232 |

|

4.2.3. |

from 100 000 to 300 000 rub. |

16,522 |

22,029 |

|

4.2.4. |

over 300 000 rub. |

13,150 |

17,533 |

|

5. |

Consumer loans provided subject to the borrower receiving regular payments to his bank account |

12,198 |

16,264 |

Deposits up to 100 thousand rubles account for 93.3% of the total volume of accounts. The total amount of balances on them is 8% of the total amount of deposits of individuals. The average balance on such deposits is 4500 rubles. Thus, most of the population does not have savings even in the amount of the subsistence minimum, which in 2022 for the able-bodied population is 13793 rubles.

As of December 1, 2021, there were more than 610 million accounts of individuals with an amount of liabilities of 32.7 trillion rubles. More than 99% of accounts are opened for amounts less than 1.4 million rubles (covered by the Deposit Insurance System). Accounts from 1.4 to 20 million rubles account for 0.46% of deposits, the share of accounts from 20 million rubles or more is 0.01% of the total, while the average balance is more than 97 million rubles. The distribution of funds by balance reflects the situation in the economy and shows the level of income differentiation of the population.

In 2021, banks that are among the 20 largest Russian banks continued to consolidate funds from individuals. So for 11 months of 2021 in these banks, the volume of individual deposits increased from 84.2% to 87.6%, or from 25.26 trillion rubles to 28.65 trillion rubles. The top 5 largest banks offering low interest rates accounted for 73% of account balances, while banks not included in the top hundred accounted for only 2.18%, or 713.95 billion rubles (at the beginning of 2021 - 3, 28%, or 983 billion rubles). The decrease in the share of deposits in such credit institutions can be explained by the reduction of banks in this category from 343 to 270: some banks move into the top 21 - 100, and another part of the banks lose their license.

The slowdown in the growth of the deposit portfolio of banks cannot be explained only by the decline in household incomes.

First, from January 2020 to March 2021, the key rate decreased from 6% to 4.5%, which led to a decrease in interest on deposits to a level that does not cover inflation.

Secondly, the banking system during this period had no problems with liquidity. In the first half of 2021, the inflow of funds was provided by short-term repos, as well as short-term deposits of the Federal Treasury and constituent entities of the Russian Federation. Accordingly, the banking sector had no incentives to raise interest rates on deposits due to a further decline in the lending market.

Thirdly, preferential mortgages began to operate, allowing you to get a loan for real estate with a very low, in Russian terms, rate of 6.5% per annum. Also, by 2020, they began to open individual investment accounts with the ability to issue a personal income tax deduction. But after the boom of the investment accounts in 2020, interest in them began to decline in 2021. According to the Bank of Russia, the net inflow of funds from individuals to the stock market in 2021 decreased from 464 billion rubles in the first quarter to 421 billion rubles in the third quarter; in the last quarter of 2021, the inflow of funds to the domestic stock market increased.

Fourth, the pandemic and macroeconomic uncertainty triggered an outflow of money from term deposits and an increase in current account balances. As of January 1, 2020, the share of funds in current accounts was 25% (7.4 trillion rubles), in 2020 it increased to 36% (11.5 trillion rubles), as of December 1, 2021, it was 39% (12. 49 trillion rubles), since the beginning of 2021, the increase was 8.8%. For balances on time deposits, the reverse trend is observed: their share decreased from 75% (22.5 trillion rubles) to 62%, reaching a total of 20.2 trillion rubles by December 1, 2021.

It should be emphasized that in 2020-2021 the Bank of Russia stated that the differentiation of rates on deposits should be reduced. Keeping rates below the level of inflation hinders banks from increasing their deposit portfolio. In 2021, eight out of 120 annual deposits from top 30 banks had an effective rate higher than inflation. Similar rates for banks that are not included in the top 30 in terms of assets, the maximum is 9.3%.

Further, along with the boom in IIS, the development of the deposit market was reduced by alternative products with moderate risk and their active promotion, for example, the issuance of “green” bonds of Moscow for the population (they are not traded on the stock exchange and can be sold back to the issuer at the same price at which they were bought) with a coupon rate higher than deposit rates. In addition, the tax on interest on bank deposits reduces interest. In 2022, the annual interest income not subject to personal income tax will be up to 85 thousand rubles, in 2021 this amount was 42.5 thousand.

Such an indicator as the growth of the financial literacy of the population, NRA experts refer to factors that both stimulate and stop the development of the deposit portfolio of the population. In the first case, financial literacy will encourage the population to make savings, and in the second case, to use modern investment tools to the detriment of deposits, which make it possible to obtain potentially higher returns.

As already noted, the Bank of Russia, which proposed in December 2021 to ban the differentiation of deposit rates depending on the purchase of additional financial products and services, the size of the deposit, the method of opening, the sign "new money" or " the client is already served by the bank. The implementation of this intention will narrow marketing tools, banks will have to focus on alternative opportunities to increase the deposit base. Leveling the level of rates in the market will lead to an increase in the role of non-economic factors: depositors will pay more attention to the convenience of opening a deposit and the ability to dispose of it; they will have no incentive to keep a large amount of funds on deposit in one bank.

In the context of an intensive inflation growth, a decrease in the purchasing power of money, a debt load on the population, an increase in the cost of medical services during a pandemic, the introduction of Western sanctions, an increase in deposit rates following the key rate of the Bank of Russia, the balances on the accounts of term deposits of commercial banks may grow.

In 2021, intensive growth in consumer lending continued in Russia. At the beginning of December 2021, the volume of loans issued increased by almost 30% compared to the same period in 2020. The amount of arrears on loans is also growing. The problem is the growth of debt on loans and the high credit burden of the population. In this connection, at the legislative level, a rationale for calculating the credit burden of a potential borrower has been introduced. In Russia, intensive growth in consumer lending continues. At the beginning of December 2021, the volume of loans issued increased by almost 30% compared to the same period in 2020.

The amount of overdue loans is also growing. It is important to note that, according to the Bank of Russia, about a third of Russians who have loans spend 80% of their income on their repayment. This means that more than a third of borrowers spend almost all of their income on debt repayment. According to the Central Bank, the share of such loans in the largest banks is especially high - it reaches 50%. About 7.1 million loans are in default. About 60% of problem loans are cash loans,

37% - credit cards, 1.5% - car loans, 0.5% -mortgages. This causes concern of the Bank of Russia.

About a third of Russians with loans spend 80% of their income on repaying them. The Bank of Russia has warned banks about upcoming restrictions on issuing consumer loans. The regulator plans to set limits on unsecured consumer loans, the repayment of which will eat up more than 80% of the borrower's income. For banks, the share of such loans should not exceed 25%, for microfinance organizations – 35%.

According to the Central Bank, the Equifax credit bureau and the National Association of Professional Collection Agencies, since January 2021, the amount of overdue debts of Russians has grown by 9.2% by the beginning of October and for the first time reached 970 billion rubles. About 7.1 million loans are in default. About 60% of problem loans are cash loans, 37% – credit cards, 1.5% – car loans, 0.5% – mortgages.

At the same time, according to the estimates of the Bank of Russia, 31% of loans have a debt load of more than 80% of the payer's income. For microfinance organizations, the figure is even higher – 44.2%. This means that more than a third of borrowers spend almost all of their income on paying off debts. According to the Central Bank, the share of such loans in the largest banks is especially high – it reaches 50%.

From July 1, 2022, the regulator plans to set limits on unsecured consumer loans, the repayment of which will require more than 80% of the borrower's income. For banks, the share of such loans should not exceed 25%, for microfinance organizations - 35%. Separately, the Bank of Russia plans to limit the issuance of unsecured loans for a period of more than five years: they should also not be more than 25%. A number of banks will have to amend their lending standards to comply with the macroprudential cap (MPL) of 25%. According to the conservative scenario of the Central Bank, the share of loans falling under the planned restrictions is estimated at 10% for banks and 11% for microfinance organizations.

Experts point out that such restrictions are necessary and long overdue. The effect of the introduction of limits may lead to a reduction in borrowing by citizens whose credit burden is already high. However, this is clearly not enough to protect the most vulnerable groups of borrowers - over-indebted and low-income. It is proposed to limit the advertising of credit cards, primarily for those banks in whose loan portfolio the share of unsecured loans is approaching the maximum. Aggressive advertising of easily accessible loans without collateral and passport only, as well as credit cards with supposedly profitable cashback, which in fact turns out to be not so profitable, provoke reliable borrowers to increase their debt load.

At the same time, a number of experts believe that the future limitation of consumer loans will not have a significant impact on the debt burden of Russians, since it will affect only a part of the clients, new contracts. That is, the remaining 95% of loans will continue to be issued. Including a quarter of clients who pay 80% or more of their income to service existing loans. Experts consider the proposed debt burden threshold itself too high. A high level of debt load of a single person is usually considered to be already 50% of income that goes to pay off debts. But this group of payers will not be affected by the new measures. It is likely that the regulator will strive for this limit in the long term.

A debt warning can be considered a ban on issuing loans in the event that more than 30% of the borrower's monthly income goes to payments on them, and not 80%, as suggested by the Central Bank, which is already a pre-default state. In some EU countries, banks that have violated the calculation requirements debt load when issuing a loan, oblige to write off part of the client's debt. In this case, the borrowers will not return to the financial institution interest for the use of borrowed funds, and it would be right to apply similar measures in Russia. The new measures will not significantly affect the volume of consumer loans, and the illegal lending sector with super high interest rates and criminal collection methods, on the contrary, will increase.

The need for funds in case of refusal to receive a loan from a bank or an microfinance organizations does not disappear. New measures by the Central Bank may lead to an increase in shadow lending, disguised as private loans from one individual to another. And this, in turn, may again lead to the need to resolve the issues of “spontaneous” lending. In 2022, it will be more difficult for banks to increase liquidity by attracting funds from the population. According to the forecasts of the National Rating Agency, the volume of the total deposit portfolio in the first half of this year will grow by only 1%, which will be the worst result in the last five years.

In January-February 2022, the consumer, more than ever, became popular as a down payment for the purchase of housing in a mortgage. This is evidenced by data from a study conducted by Raiffeisenbank. However, if in 2021 Russians began to approach savings for a down payment more systematically than in 2020: then the proportion of those who save different amounts every month decreased by almost half (17% versus 35%), then in 2022 the situation is reversed. So, 37% of respondents sent as much as they needed to the mortgage piggy bank [8].

At the same time, compared to previous years, the share of respondents who saved up for a mortgage for five years decreased: 29% in 2020, 32% in 2021, and only 19% in 2022. But the share of those who collected the required amount for the year, again grew slightly, up to 17%. In 2021, 15% managed to do this, and 17% in 2020. In addition, in 2022, among Russians who plan to buy an apartment, 89% expect to do this with the help of a mortgage. A year earlier, 62% were going to purchase housing in this way, and 19% wanted to pay the entire cost at once. However, this year there was no one who could afford such a large purchase without leverage. A similar situation was at the very beginning of the coronavirus pandemic in 2020. Mortgages were going to take 88% of Russians.

The share of those who rely on consumer credit in recent years has been practically stable: in 2020 – 12%, in 2021 – 10%, in 2022 – 11%. It should be noted that a consumer loan as a down payment can increase the level of a potential borrower's debt load, and hence the likelihood of refusal to approve a mortgage.

In order to improve and stabilize the situation with consumer lending in the country, the

Government of the Russian Federation and the Bank of Russia and the Government of the Russian Federation adopted a number of legislative and regulatory measures.

Prime Minister Mikhail Mishustin signed a decree on the maximum amount of loans for which citizens have the right to apply to banks for the provision of "credit holidays". The decision was made as part of a set of measures to support citizens and businesses in the face of external sanctions [9].

The following limits are set for consumer loans:

-

- 300 thousand rubles for individuals;

-

- 350 thousand rubles for individual entrepreneurs;

-

- 100 thousand rubles on credit cards;

-

- 700 thousand rubles for car loans.

For mortgage loans:

-

- 6 million rubles for Moscow;

-

- 4 million rubles for the Moscow region, St. Petersburg and the regions of the Far Eastern Federal District;

-

- 3 million rubles for other regions of Russia.

Under the terms of the program, borrowers have the right to apply for a “loan holiday” until September 30, 2022, subject to a 30% decrease in income compared to the average income in the previous year.

A grace period for servicing a loan can be obtained for a period of one to six months. "Credit holidays" apply to loans issued before March 1, 2022.

Other legislative measures in the field of consumer lending are also expected. These include the bill submitted to the Duma in December 2021. Under the bill, the term for issuing unsecured loans will be limited to five years, and banks will be required to include in the calculation of the total cost of loans any payments to the lender and offer alternative loan options without purchasing additional

The bill provides for the following main changes:

-

- Limitation of the maximum term for concluding an unsecured consumer loan to five years in order to limit the risks of excessive debt burden of the population and reduce the debt burden;

-

- Inclusion in the calculation of the full cost of the loan of any payments by the borrower in favor of the lender and (or) third parties;

-

- Additional informing the client about the conditions for changing the interest rate in percent per annum for each variant of the borrower's behavior;

-

- Extending the "cooling off period", that is, extending the period for the borrower when he can refuse additional services when concluding a loan agreement and return the money – up to the date of the first payment plus 5 days instead of 14 days from the date of consent;

-

- Obligation of the bank to offer the borrower an alternative loan option without purchasing additional services;

-

- Informing the borrower about the change in the total cost of the loan when the contract is revised;

-

- Changing the rules for advertising consumer loans - it should not contain an indication of their cost in percentage per annum, except for information about the full cost of the loan

Such a bill is planned to be adopted in the spring session of parliament. The bill caused a mixed reaction - the Ministry of Finance and the Bank of Russia support the legislative initiative. Representatives of commercial banks, in their turn, believe that the adoption of the document may lead to an increase in interest rates and reduce the availability of loans to citizens.

services.

Список литературы Specialties of the practice of consumer credit in Russia during the period of economic instability

- On Amendments to the Federal Law "On the Central Bank of the Russian Federation (Bank of Russia)" and certain legislative acts of the Russian Federation regarding the specifics of changing the terms of a loan agreement, loan agreement: Federal Law N 106-FL of April 3, 2020 // Collection Russian legislation. - 2020. - №14 (part I). - Art. 2036.

- Kosov, M.E. Consumer lending: problems and development trends / M.E. Kosov, T.M. Rogova // Bulletin of the Moscow University of the Ministry of Internal Affairs of Russia. -2021. - №1. - P. 296-305.

- Analysis of trends in the segment of retail lending in the Russian Federation [Electronic resource] // Association of Russian Banks. - Electron. Dan. - URL: https://arb.ru/.

- Pakharev, A.V. Analysis of offers of consumer loans of some banks in the context of economic security // Creative Economy. - 2021. - T. 15. - № 2. - P. 639-650.

- On consumer credit (loan): federal law of December 21, 2013 N 44-FL (as amended on September 1, 2020) // Collected Legislation of the Russian Federation. 2013. - N 51. -Art. 6673.

- Average market values of the total cost of consumer credit (loan) of the Federation [Electronic resource] // Bank of Russia: site. - Electron. Dan. - URL: https://cbr.ru/statistics/bank_sector/psk/ (date of access: 12/30/2021).

- Arapov V. The Bank of Russia wants to ban differentiated deposit rates. - Electron. Dan. -URL: https://www.vedomosti.ru. 12/20/2021.

- Komarova A. Russians increasingly began to take consumer credit for a down payment on a mortgage // Banki.ru. 02/14/2022.

- Decree of the Government of the Russian Federation of March 12, 2022 №352.

- Statistical indicators of the banking sector of the Russian Federation [Electronic resource] // Bank of Russia: site. - Electron. Dan. - URL: https://cbr.ru.

- On the development of the banking sector of the Russian Federation [Electronic resource] // Bank of Russia: site. - Electron. Dan. - URL: https://cbr.ru/analytics/bank_sector/develop/.