Status and specifics of the housing market in the Arctic regions of Russia

Автор: Emelyanova Elena E., Chapargina Anastasiya N.

Журнал: Arctic and North @arctic-and-north

Рубрика: Social and economic development

Статья в выпуске: 40, 2020 года.

Бесплатный доступ

This paper aims to analyze and identify the specifics of housing industry development in the regions of the Arctic zone of the Russian Federation using methods of comparative, analysis, statistical methods of grouping indicators, the method of scoring points. In the course of the work, an analysis of economic indicators of the housing market development, an assessment of the population's effective demand for housing. The main trends in the housing market development in the arctic regions were identified. The results show insufficient and uneven rates of construction of housing, a high share of emergency housing, and low investment in the housing industry in some regions. A disparity was observed between real estate prices and the population income because the population debt burden on the housing credit is quite high. According to the developed by the authors’ method of assessing the housing market based on selected indicators, the main problems are characterized and the development of the housing market in the arctic regions is assessed. It was found that in some regions the level of economic indicators of housing market development and the population's solvency significantly lags the Russian trends. The results have practical significance for the federal and regional authorities in creating housing policies and the implementation programs of national projects in the sphere of housing affordability, the main directions which should be demographic to attract and increase the resident population in the Russian Arctic, as well as the regulatory functions of the housing market by reducing interest rates and stimulating the construction industry development.

Housing market, arctic regions, solvency of population, trends of development

Короткий адрес: https://sciup.org/148318375

IDR: 148318375 | УДК: 332.85(985)(045) | DOI: 10.37482/issn2221-2698.2020.40.26

Текст научной статьи Status and specifics of the housing market in the Arctic regions of Russia

The development of cities and regions is the most important task of modern society [1, Kirby A., pp. 3–8], dictated by the tendencies of resettlement from rural areas to urban agglomerations [2, Krzemin´ska A.E., Zareba A.D., Dzikowska A., Jarosz K.R., pp. 8362-8370; 3, Hoffmann B., pp. 425-441], in connection with which there is a need to meet the housing needs of the population, provided by the real estate market. The housing market to a large, or even a decisive extent, depends on regional conditions and has a pronounced local character [4, Łaszek J., Olszewski K., pp. 41-51]. Therefore, the specifics of the functioning of cities and regional features also determine the features of housing construction and the level of the housing market development.

Kinder's studies are devoted to modern problems and prospects for the development of the housing market abroad. The author linked housing construction with the problem of the quality of life [5, Kinder T.]. Studies by Butrin et al. reflect current trends in housing markets that affect the socio-economic development of cities [6, Butryn K., Jasin'ska E., Kovalyshyn O., Preweda E.].

∗ For citation:

Maalsen was the first to introduce the concept of “smart housing” equipped with modern technologies to achieve environmental, economic and socio-cultural sustainability, which is a new type of housing market, formed due to the growth of “smartness” of cities [7, pp. 1-7]. Tomal's works [8, pp. 2–25] reflect modern trends in the development of the real estate market, including innovative models and types of housing construction, i.e. the concept of “smart housing” and “smart city” based on indicators such as demand, income level, unemployment, etc.

In Russia, despite the emergence of the so-called “smart houses”, where intelligent devices and technologies are used for the functioning of things inside the house, in some cities of the country, [9, Imran, Ahmad S., Kim D.; 10, Gu W., Bao P., Hao W., Kim J.], the traditional housing market still prevails. The housing market in Russia is very unstable and depends on many factors, e.g. changes in the effective demand of the population; high and volatile lending rates; insufficient and uneven volumes of housing construction, depending on regional affiliation [11, Zainakova S.R., pp. 58–62]. The management of the housing market of the Russian Federation is carried out considering the priority goals of the state, i.e., the creation of conditions for improving the living conditions of the population and the affordability of housing, which is one of the most significant indicators of the quality of life of the population in the country. In addition, the housing market is interconnected with the economic policy of the state, as it is linked with the development of transport, engineering, and social infrastructure [12, Vanina T., Obolonkova A., pp. 29-35].

The housing market is one of the indicators characterizing the development of economic and social processes not only on a national scale but also at the regional and municipal levels. The dynamic development of the housing construction sector demonstrates certain progress in the territories, the development of the construction industry, the population's ability to pay, the level of investment activity, entrepreneurship, and the social sphere. Where housing construction is actively going on, all the spheres of the industry are developing dynamically. These are mainly large cities, central regions of the country, and large resort centers, which are considered as “points of growth”. At the present time, economic growth in Russia is associated precisely with large urban centers and urban agglomerations [13, Kolomak E.A., Kukushkin R.G., pp. 55–63].

The purpose of this study is to assess the level of development and identify the specifics of the housing market in regions that are fully and partially included in the Arctic zone of the Russian Federation. The assessment of the housing market includes a number of indicators - the quality of the housing stock, the volume of housing construction and the level of investment in the housing sector, the cost of real estate, and the effective demand of the population. In accordance with the purpose of the study, the following tasks were set: to analyze the data of state and municipal statistics and official websites in the housing sector; to determine the most significant indicators for assessing the state of the regional housing market, characterizing the level of its development in this macroregion; to assess the level and identify the specifics of the development of the housing market in the Arctic regions, depending on the degree of belonging of the constituent entity of the Russian Federation to the Arctic zone.

To achieve the goal and solve the set research tasks, the article was structured as follows: assessment and analysis of the dynamics of economic indicators of the housing market development; assessment of the solvency and demand of the population in the regional housing market; determination of the main trends in the development of the housing market in the regions of the Russian Arctic in two directions: economic development and solvency.

Within the framework of the study, the following hypothesis was put forward: the paying capacity and demand of the population are the main factors that can change the state of regional housing markets and significantly affect the dynamics of their development.

Regions and municipalities of the Arctic zone of the Russian Federation, having a certain specificity of their functioning, social and economic development [14, Emelyanova E.E., pp. 79– 93], determine the peculiarities of the development of the housing market in the region. The relevance of the study is dictated by state development priorities for the long term, one of which is the development of the housing industry and the availability of housing for citizens of the country. The study area included 9 subjects of the Russian Federation, 4 of which are fully included in the Arctic zone (Murmansk Oblast, Nenets, Yamal-Nenets, and Chukotka Autonomous Okrugs), the rest of the regions are partly included in the Arctic zone of the Russian Federation. However, it should be noted that all the studied subjects of the Russian Federation, with the exception of the Krasnoyarsk Krai, represented in the Arctic zone by the only Arctic city - Norilsk, and two municipal regions - also fully belong or are equated to the regions of the Far North.

Obviously, it is not entirely correct to compare the indicators of the level of development of the housing market by regions with different belonging to the Arctic zone due to the presence of a certain specificity of their functioning. However, given the complexity of the allocation and division of state statistical information into “arctic” and “non-arctic” [15, Pilyasov A.N., pp. 35-54], and also bearing in mind that for the adoption of federal decisions by the authorities, the region is considered as a whole, and, taking into account the fact that almost all regions included in the study (with the exception of the Krasnoyarsk Krai), at the same time, completely belong to the regions of the Far North, a decision was made in favor of the analysis and assessment of all Arctic regions of the Russian Arctic, which, ultimately, made it possible to formulate a number of conclusions regarding the influence of the Arctic factor on the development of the housing market in the regions.

The time interval of the study was 18 years (2000 - 2018). The information base was theoretical and practical scientific research of foreign and domestic specialists, developed by the authors of the database [16, 17], data of state statistics and reporting.

Analysis of economic indicators of the housing market in the Arctic regions of Russia

The housing market is a kind of indicator of the social and economic situation in the city and the region, which reflects the level of attractiveness and development prospects of a particular territory. At the same time, real estate prices, formed by the general demand, reflecting the paying capacity of the population, and the supply, characterizing economic activity, are an important indicator of the income of the population and the prospects for the development of cities and regions [13, Kolomak E.A., Kukushkin R.G., pp. 55–63].

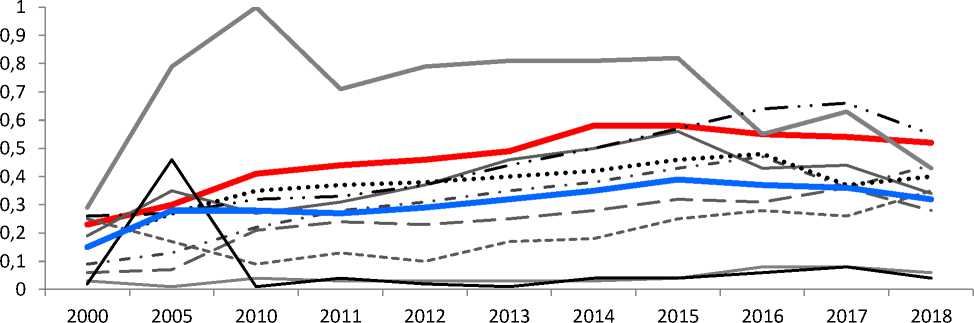

One of the most important indicators of the development of the housing market and the territory as a whole is housing construction. Based on the monitoring of the data on the commissioning of residential buildings (Fig. 1), it was established that, in general, the indicator had a positive trend until 2016, after which there is a certain decline in most regions of the Arctic, as well as in the country, which is associated with the consequences of the crisis 2014–2016. In 2018, only one Arctic region had indicators for the construction of housing stock above the national average -the Republic of Sakha (Yakutia). The worst indicators are in the Chukotka Autonomous Okrug and the Murmansk Oblast, in the territories of which, during the period under study, there is practically no housing construction. In general, in the regions of the Russian Arctic, the volume of housing construction lags behind the average Russian values by 1.5 times or more. This means that the housing stock is being renewed at a slower pace, and the real estate market is dominated by secondary housing. The main volume of commissioning of residential buildings is concentrated in the administrative centers of the constituent entities of the Russian Federation.

— : Russian Federation

Komi Republic

Nenets Autonomous district

Yamalo-Nenets Autonomous district

Republic of Sakha (Yakutia)

^^^^^wThe average by region of the Russian Arctic

Republic of Karelia Arkhangelsk region

Murmansk region Krasnoyarsk territory Chukotka Autonomous district

Fig. 1. Dynamics of the indicator of commissioning residential premises, sq.m/person.

The highest indicator for the commissioning of residential premises until 2016 was demonstrated by the Nenets Autonomous Okrug, on the territory of which there was a significant amount of housing to be resettled, and the program for resettlement from dilapidated and hazardous housing was actively implemented. According to official statistics, in 2005 - 2015, the share of hazardous housing in the total area of the housing stock of the region decreased by half from 12% to 5.9%. A high share of emergency housing is also in another Arctic region - Sakha (Yakutia), where a high rate of commissioning of housing was also noted in comparison with other Arctic regions, which in 2015–2016. accounted for 16.5%. The share of emergency housing in the Yamal-Nenets Autonomous Okrug is also one of the highest (about 11% until 2016). That is why in these regions in 2005–2016 and there was a higher rate of housing construction. The rest of the regions of the Russian Arctic, although they are not characterized by such high rates of housing accidents as in the regions mentioned above, nevertheless have a much larger share than the national average, and, moreover, it tends to grow at a lower rate of housing construction (Fig. 2).

Fig. 2. The share of emergency housing in the total housing stock.

Analysis of the indicators of housing commissioning and the share of emergency housing allows us to assert that at a much higher rate of wear and tear of fixed assets, including residential buildings, during operation in unfavorable climatic conditions in the Far North, as a result of which the proportion of emergency housing is much higher than in the more “southern” regions of the country (almost 6 times) and with a lower rate of housing construction compared to the average Russian indicators (1.5-2 times), the housing stock is aging, which clearly affects the real estate market, which is mainly represented by secondary housing and does not solve the problem of improving the living conditions of the population.

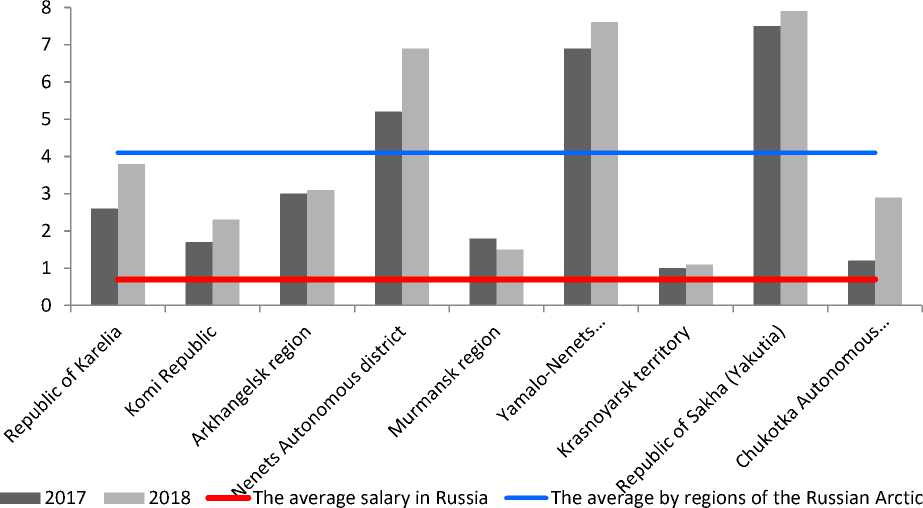

An analysis of the level of investment in the housing sector in the regions of the Russian Arctic in comparison with the general Russian dynamics demonstrates significant differences depending on the time. The volume of investment per capita in the Arctic regions significantly exceeded the indicators for the country up to 2015. At the same time, since 2000, there has been a steady systematic increase in the volume of investments in fixed assets of residential buildings in the country. The Arctic regions show a “jump” behavior of this indicator, the peak of which falls on the year 2012, and since the crisis of 2014, the volume of investments in the Arctic regions has significantly decreased and at the end of 2018 fell below the average Russian values by almost 20%

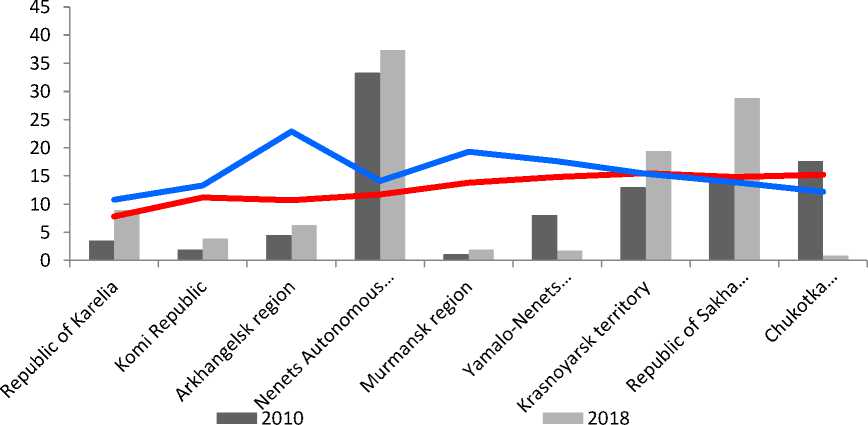

At the same time, there is a significant differentiation of this indicator among the Arctic subjects of the Russian Federation themselves (Fig. 3). The largest volume of investments in residential buildings in the Nenets Autonomous Okrug, the level of which reached 45 thousand rubles per person in 2017 and 37 thousand in 2018, which is 2.5 times higher than the national average. In two other Arctic regions - the Republic of Sakha (Yakutia) and the Krasnoyarsk Krai - the level of investment per capita in the housing sector was higher than the average Russian values in 2018. The rest of the AZRF regions are significantly below the national average. The smallest volume of investment in 2018 is in the Murmansk Oblast, Yamal-Nenets, and Chukotka Autonomous Okrug, where it is only 10% of the national average.

Fig. 3. Investments in fixed assets by type of fixed assets “dwelling” in the regions of the Russian Arctic in 2010-2018. (in actual prices), thousand rubles/person.

The obtained results of the analysis of the volume of investments in most cases correlate with the level of housing accidents. That is, with a large share of emergency housing in the total volume of housing stock, the level of investment in its maintenance is quite high (Nenets Autonomous Okrug, Republic of Sakha (Yakutia) and Karelia, Arkhangelsk Oblast), and, conversely, a low percentage of emergency housing is typical for low investment (the Komi Republic, Murmansk Oblast). The Yamal-Nenets Autonomous Okrug is out of the general trend, which, having one of the largest indicators of the share of emergency housing, is in the penultimate place in terms of investment in the housing industry per capita, and the Krasnoyarsk Krai, with an inverse relationship, is one of the best indicators for accidents and investments.

As for housing prices for 1 sq. m of the area in the Arctic regions, then in 2018, they varied from 47.8 thousand rubles (Republic of Karelia) up to 72.7 thousand rubles (Republic of Sakha (Ya- kutia)) with average values for the country in the region of 58 thousand rubles. By itself, the level of housing prices does not reflect the situation in the housing market, since it is closely related to the paying capacity of the population, which will be studied in the next section. More indicative is the housing price index (tab. 1).

Table 1

Price index in the primary and secondary housing market,% of the previous year 1

|

Regions of the Russian Arctic |

2000 |

2005 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

|

Russian Federation |

114.7 |

117.8 |

101.5 |

106.3 |

111.4 |

104.2 |

105.4 |

98.3 |

98.3 |

99.7 |

105.2 |

|

Republic of Karelia |

110.1 |

106.9 |

103.1 |

104.5 |

105.4 |

98.0 |

100.9 |

101.2 |

100.2 |

99.8 |

102.6 |

|

Komi Republic |

128.8 |

126.4 |

100.6 |

108.2 |

125.3 |

105.2 |

102.9 |

95.2 |

95.1 |

96.6 |

98.1 |

|

Arhangelsk Oblast |

114.2 |

110.9 |

103.3 |

109.5 |

121.6 |

96.7 |

105.2 |

98.8 |

98.9 |

101.5 |

104.6 |

|

Nenets Autonomous Okrug |

- |

109.7 |

102.5 |

100.0 |

103.8 |

101.4 |

102.8 |

107.2 |

95.6 |

94.7 |

97.3 |

|

Murmansk Oblast |

- |

112.5 |

100.7 |

113.0 |

116.4 |

108.1 |

118.8 |

92.3 |

100.5 |

93.3 |

108.4 |

|

Yamalo-Nenets Autonomous Okrug |

- |

- |

100.4 |

100.2 |

102.3 |

104.9 |

108.2 |

102.7 |

97.3 |

98.4 |

102.1 |

|

Krasnoyarsk Oblast |

145.5 |

115.0 |

107.5 |

108.1 |

114.2 |

106.3 |

103.4 |

92.2 |

97.4 |

101.5 |

105.8 |

|

The Republic of Sakha (Yakutia) |

142.9 |

124.8 |

102.9 |

103.7 |

112.2 |

108.8 |

109.8 |

101.3 |

97.1 |

95.8 |

105.5 |

|

Chukotka Autonomous Okrug |

- |

- |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

It is clear that before the crisis of 2014 in all regions of the Arctic there was a stable increase in prices, somewhere at a faster pace than in the Russian Federation (Murmansk Oblast, Komi Republic, Krasnoyarsk Krai), in other regions, mainly at the level of the national average. Starting from 2014–2015 in connection with the outbreak of the global crisis and the fall in prices on the oil market, characterized by the depreciation of the national currency and a drop in the income of the population, the real estate market suffered in the first place, where prices on the housing market in the Arctic regions "sagged" just like throughout the country. In 2017, the level of price drop by the crisis years averaged 5-9%. With the stabilization of the economy in 2018 in most regions of the Arctic, the growth in housing prices recovered, but prices for 1 sq. m did not reach the level of 2013–2014, except for the Murmansk Oblast.

For the period of 2020, another drop in oil prices, complicated by the epidemiological situation, due to the spread of coronavirus infection, and a decrease in income and the purchasing power of the population in the near future will lead to an even greater drop in prices in the housing market. However, the impact of these processes can only be assessed in 2021–2022.

The above indicators characterize rather the supply in the housing market. Further, we will consider the indicators that assess the demand for housing in the regions of the Russian Arctic.

-

1 Calculated by the authors. Source: Regiony Rossii. Sotsial'no-ekonomicheskie pokazateli [Socio-economic indicators]. 2019. Stat./Ros-stat: Moscow, 2019, 1204 p.

Assessment of effective demand for housing from the population

The effective demand is primarily determined by the level of income of the population in relation to the cost per square meter in the housing market. The largest gap in these indicators in the regions of the Russian Arctic was recorded in 2010 - 2014. [16], after which there was a tendency to decline. To determine the affordability of housing in the regions of the Arctic, we calculated an affordability index showing the ratio of the cost of 1 sq. m to the average per capita income of the population. The lower the index, the greater the purchasing power of the population to purchase housing (Table 2).

Table 2

Housing affordability index in the regions of the Russian Arctic 2 , 3

|

Regions of the Russian Arctic |

2005 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

|

Russian Federation |

2.9 |

2.9 |

2.2 |

2.3 |

2.1 |

2.0 |

1.8 |

1.7 |

1.7 |

1.8 |

|

Republic of Karelia |

2.1 |

2.6 |

2.5 |

2.4 |

2.3 |

2.1 |

1.9 |

1.9 |

1.8 |

1.6 |

|

Komi Republic |

1.8 |

1.7 |

1.8 |

1.9 |

2.0 |

1.8 |

1.7 |

1.7 |

1.7 |

1.5 |

|

Arhangelsk Oblast |

2.2 |

1.9 |

2.3 |

2.5 |

2.3 |

2.1 |

1.9 |

1.8 |

1.8 |

1.8 |

|

Nenets Autonomous Okrug |

1.1 |

1.2 |

1.1 |

1.0 |

0.9 |

1.1 |

1.2 |

1.1 |

1.0 |

0.8 |

|

Murmansk Oblast |

1.3 |

0.9 |

1.4 |

1.3 |

1.3 |

1.3 |

1.2 |

1.4 |

1.2 |

1.2 |

|

Yamalo-Nenets Autonomous Okrug |

н/д |

1.2 |

1.2 |

1.0 |

0.9 |

1.0 |

0.9 |

0.9 |

0.8 |

0.8 |

|

Krasnoyarsk Oblast |

2.6 |

2.2 |

2.2 |

2.2 |

2.1 |

2.1 |

1.7 |

1.7 |

1.7 |

1.7 |

|

The Republic of Sakha (Yakutia) |

2.0 |

2.0 |

1.9 |

1.9 |

1.8 |

2.2 |

2.0 |

1.9 |

1.7 |

1.7 |

|

Chukotka Autonomous Okrug |

н/д |

н/д |

н/д |

н/д |

н/д |

н/д |

н/д |

н/д |

н/д |

н/д |

The most affordable housing for the period 2017-2018 in terms of the ratio of income and the cost of housing on the real estate market, it was noted in the Nenets and Yamal-Nenets Autonomous Okrugs (0.8) and the Murmansk Oblast (1.2), which is 55 and 33% lower than the national values, respectively. The rest of the regions (except for the Chukotka Autonomous Okrug, where the data required for the calculation are not available) are approximately in the same accessibility category. It should be noted that, compared to 2014, the housing affordability indicator in all regions showed positive dynamics, which is associated with a drop in prices in the real estate market during the crisis. However, the higher the level of the housing affordability index, the greater the amount of borrowed funds is needed, which also depends on the income of the population and determines the level of debt burden on the payment of housing and mortgage loans.

When determining the volume of investments of the population on the purchase of the real estate, determined by the share in the structure of the population's expenses on the purchase

-

2 The ratio of the cost of 1 sq. m to the average per capita income level of the population.

-

3 Calculated by the authors. Source: Emelyanova E.E., Chapargina A.N. Baza dannykh «Rynok zhil'ya severnykh i ark-tiche-skikh regionov Rossii». Svidetel'stvo o gosudarstvennoy registratsii № 2019621181 ot 4 iyulya 2019 g. [Database “The housing market of the northern and arctic regions of Russia”]. Certificate of state registration No. 2019621181 dated July 4, 2019.

of the real estate in the total income of the population, it was established that the housing market is the most active in the Komi Republic, Yamal-Nenets Autonomous Okrug, Krasnoyarsk Krai and the Republic of Sakha (Yakutia) where the population annually spends from 140 to 205 billion rubles for the purchase of housing. And if in the Republic of Sakha (Yakutia) and Yamal-Nenets Autonomous Okrug this is partly determined by the high cost of housing, then in the Komi Republic the cost of 1 sq. m of housing is one of the lowest among the Arctic regions, which indicates the demand for housing in this region. In the Murmansk Oblast, real estate costs amount to about 95 billion rubles a year. The smallest spending on the real estate market in the Chukotka and Nenets Autonomous Okrugs is about 6-8 billion rubles a year.

At the same time, the cost of purchasing housing systematically increased until 2014, after which there was a sharp drop -1.5-2 times. In 2017-2018, this indicator exceeded the pre-crisis level in almost all regions, which indicates a more intensive development of the real estate market and an increase in public investment in real estate.

The purchase of housing is rarely done without attracting borrowed bank funds, one of the tools of which is mortgage lending, which allows the payment of the cost of housing in installments and, even taking into account the additional percentage of the premium to the cost, provides the consumer with the opportunity to purchase residential real estate [18, Kovaleva L.V., Omelyanovich A.S., pp. 23-27]. The volume of loans issued is significantly influenced by the average interest rate on housing loans, regulated by the Central Bank of Russia. This indicator varies markedly and depends on the macroeconomic indicators in the country. In 2010–2014, the rate for housing and mortgage loans was 11-14%. Currently, in the Republic of Sakha (Yakutia), within the framework of the state program for the development of the Far East, the rate for housing and mortgage loans at the beginning of this year was the lowest in the country - 5.6%. In other regions, the rate is almost the same and varies from 9.8% at the beginning of 2019 to 8.8% at the beginning of 2020. 4

The volume of housing and mortgage loans issued to the population is increasing every year, except for the post-crisis 2015, when the volume of loans issued in the Arctic regions decreased by more than 30% by 2014. According to the Bank of Russia, the largest volume of loan funds is the purchase of housing per capita of the population in the first quarter of 2020 in the Yamal-Nenets Autonomous Okrug and the Republic of Sakha (Yakutia). And if in the Far Eastern regions, it is explained by state support for mortgage lending and the highest cost of real estate in comparison with other regions of the AZRF, then in the Yamal-Nenets Autonomous Okrug, which has the best housing affordability index among the Arctic regions, this indicates the dynamic development of the housing market and the demand for real estate. population in improving housing conditions. The smallest values of this indicator are in the Republic of Karelia, the Murmansk Oblast, and the Nenets Autonomous Okrug.

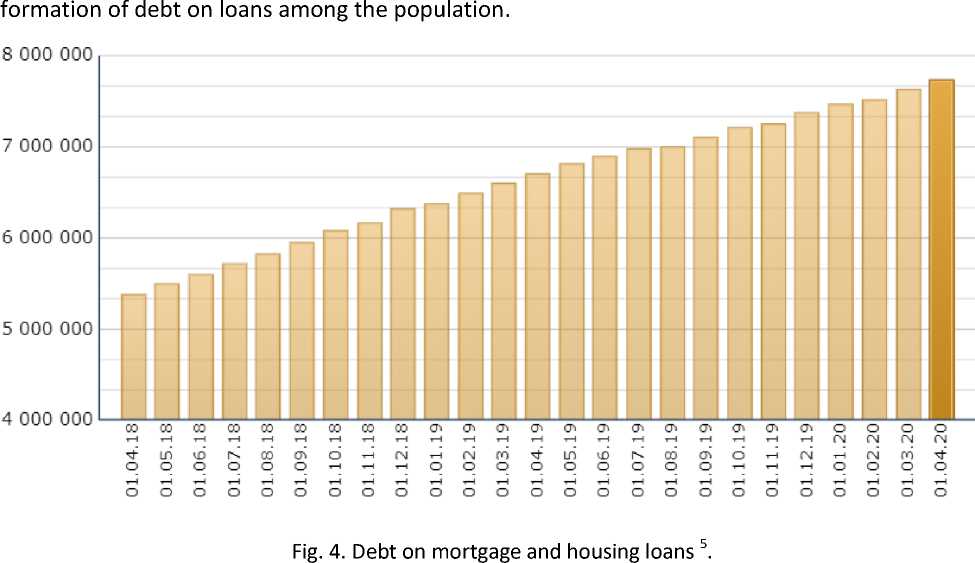

However, there is another dependence on the level of income of the population, the cost of sq m of housing, and issued mortgage and housing loans - this is arrears on housing loans, which is an indicator of a decrease in the paying capacity of the population. In contrast to the cost of housing and issued housing and mortgage loans, whose indicators are declining due to the unstable macroeconomic situation in the country, this indicator, on the contrary, has only increased over the entire study period and continues to grow (Fig. 4). In addition, the difficult epidemiological situation in the country, which has led to the suspension of many sectors of production and economic activity, as well as the service sector and small business, will further contribute to the

It should be noted that the growth rate of debt in the regions of the Russian Arctic in the post-crisis period, starting from 2015, has decreased and is about 11-12% compared to the previous year, while before this period the growth rate was at the level of 30% annually. Despite this, arrears on housing loans per capita in the Arctic regions are more than 2 times higher than in the country.

Nevertheless, an increase in this indicator only indirectly indicates a decrease in the solvency of the population since the volume of loans issued is increasing. It is confirmed by the fact that the largest amount of debt on mortgage and housing loans per capita is in the Yamal-Nenets Autonomous Okrug and the Republic of Saha (Yakutia) - the leading regions in the issuance of housing loans, and the smallest among the outsider regions - in the Murmansk Oblast and the Republic of Karelia. Therefore, we calculated the average annual level of the population's debt bur-

-

5 Zadolzhennost' po ipotechnym i zhilishchnym kreditam [Debt on mortgage and housing loans]. Bank of Russia. URL: https://cbr.ru/statistics/pdko/Mortgage/ML/ (accessed: 02 May 2020).

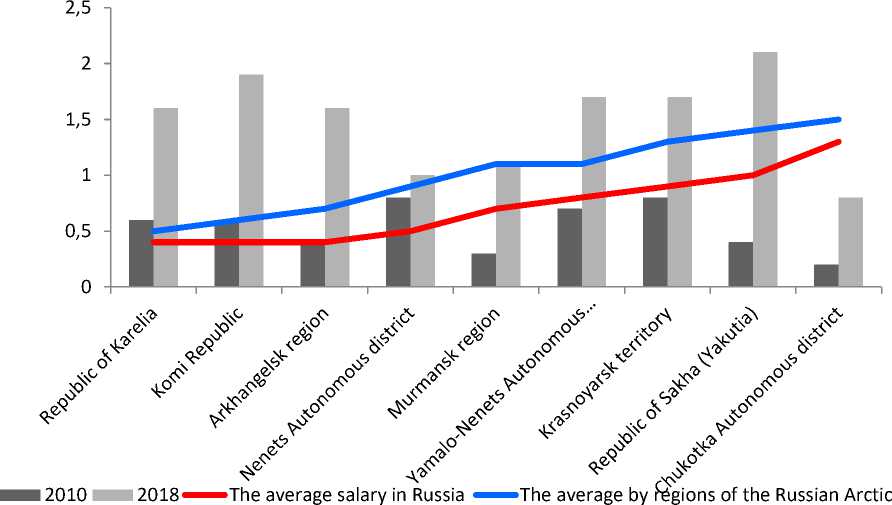

den on housing and mortgage loans, calculated as the ratio of housing and mortgage loans to the average per capita income of the population (Fig. 5).

Fig. 5. Average annual level of household debt burden on housing and mortgage loans for 2010–2018.

From the presented diagram, it is obvious that the debt burden on the population to pay housing loans is growing, and at the end of 2018, the highest-burden is in the Republics of Karelia, Komi, Sakha (Yakutia), Arkhangelsk Oblast, Krasnoyarsk Krai, and Yamal-Nenets Autonomous Okrug. It may indicate an increased debt load and a discrepancy between the incomes of the population of these regions and the situation in the housing markets, i.e. the cost of housing does not correspond to and exceeds the effective demand of the population. And only the real estate market of the three regions of the Russian Arctic - the Murmansk Oblast, the Nenets Autonomous Okrug, and the Chukotka Autonomous Okrug - is more or less balanced in relation to the income of the population.

Determination of the main trends in the development of the housing market in the regions of the Russian Arctic

Based on the results of the analysis of indicators affecting the housing market in the regions of the Russian Arctic, we applied a scoring methodology based on assessing the parameters of the housing market on a scale from 0 to 1, where the maximum value is taken as 1; 0.5 - average; 0 is the minimum value. Intermediate values of 0.25 and 0.75 are also used, which makes it possible to reflect their level in more detail (Table 3). Indicators were divided into two groups: economic and indicators that depend on the income of the population and characterize its ability to pay. The comparison was carried out according to the average value of the indicator for the Russian Federation. The integral estimate was reduced by finding a simple arithmetic mean.

Table 3

Indicators and criteria for assessing the development of the housing market of the Russian Arctic

|

Indicators |

Assessment criteria |

Index |

|

Economic:

“home” (in actual prices), rubles/person Solvency of the population:

|

Significantly above average |

1 |

|

Above average |

0.75 |

|

|

Average |

0.5 |

|

|

Below average |

0.25 |

|

|

Significantly below average |

0 |

The results of the assessment carried out according to the given indicators in comparison with the average indicators for the country (marked on the graph with median lines), which characterize the level of economic development and the paying capacity of the population, are presented in Fig. 6, where a lighter blue tone marks the regions that are completely included in the Arctic zone, red is the only one of the studied regions, partially equated to the regions of the Far North.

Nenets Autonomous district

Yamalo-Nenets Autonomous

Murmansk region

Komi Republic

Republic of Karelia

Republic of Sakha (Yakutia)

Arkhangelsk region

Krasnoyarsk territory

Economic indicator

Fig. 6. Rating of the regions of the Russian Arctic for the development of the housing market for 2018.

According to the results of the assessment, it was established that the largest aggregate index of the development of the residential real estate market is in the Nenets Autonomous Okrug, which is in the lead with significant separation from other Arctic regions. In this constituent entity of the Russian Federation, for almost all indicators (except for a significant number of emergency housing), the values are higher or significantly higher than the national average. The Republic of Sakha (Yakutia) is in second place due to the high rates of housing construction, the best indicators of investment in the housing sector, and the volume of issued housing and mortgage loans, which is explained by the action of the state program for the development of the Far East “Far Eastern Hectare” and government-subsidized interest rates on home loans. In third place in terms of the final indicator, the Murmansk Oblast (mainly due to the effective demand of the population - the index of affordability and debt burden) and the Krasnoyarsk Krai, which has fairly average ratings (not much higher or lower than the national average) for all indicators. The worst indicators of the final assessment are in the Republic of Komi and the Arkhangelsk Oblast, which in almost all parameters lag the national average.

For some regions of the Russian Arctic, for example, the Murmansk Oblast and the Chukotka Autonomous Okrug, in which there is practically no housing construction and, at the same time, a small share of emergency housing, this indicator is not critical for the development of the housing industry, since an increase in the number commissioning of housing and is not required in the context of a constant decline in the population. The same is typical for other regions of the Arctic with a low share of emergency housing and low rates of construction - the Republic of Karelia, Komi, Krasnoyarsk Krai, for which the existing rates of housing construction are capable of replacing dilapidated housing stock.

But the Nenets and Yamal-Nenets Autonomous Okrugs, the Republic of Sakha (Yakutia), which have positive dynamics in terms of population and the highest indicators of emergency housing in the structure of the housing stock, should ensure an increased rate of housing construction. When implementing national projects in the housing industry in the Arctic regions of the Russian Federation, given the large volume of the emergency fund, more than 20% of the funding is intended for the demolition of emergency housing. However, the problem of replacement and resettlement from hazardous housing is proposed to be solved not by means of new construction due to the high cost, but by relocating people to other regions of the country, which clearly will not contribute to the development of the housing market in the Arctic6.

From the given matrix (Fig. 6), it can be seen that the most balanced housing markets in two areas of assessment are possessed by the Nenets Autonomous Okrug, the Republic of Sakha (Yakutia), and the Krasnoyarsk Krai. At the same time, all three regions have a different degree of attribution to the North Arctic territories. And if we evaluate the influence of this factor on the indicators of the development of housing markets, then it is quite obvious that the regions that are fully attributed to the AZRF have the worst indicators in terms of economic indicators of the housing market development (with the exception of the Nenets Autonomous Okrug) and at the same time, the best indicators in terms of the population's paying capacity which is due, first of all, to a fairly high level of income of the population (due to the maximum “northern” allowances and co- efficients) in these regions in comparison with the average Russian values and with the regions partly referred to the Arctic zone. At the same time, the cost of housing in these regions is comparable to the cost of square meters on average in the country and in other regions, therefore, the level of debt burden in them is the lowest (with the exception of the Yamal-Nenets Autonomous Okrug). It is due to the indicators of the population's effective demand for housing that the aggregate index of housing market development in these regions is at a sufficiently high level and is able to set benchmarks and positive dynamics for the development of regional housing markets, that is, the hypothesis put forward at the beginning of the study was confirmed.

As for the Krasnoyarsk Krai - the only Arctic region that falls out in full belonging to the regions of the Far North, but represents the Arctic zone of the city of Norilsk and two municipal regions (Taimyr, Dolgan-Nenets, and Turukhansk), and at the same time has quite favorable - climatic conditions in the rest of the vast territory of the region, it is impossible to put this region on a par with the rest of the Arctic regions of the Russian Federation. Due to the complexity of the selection of the necessary statistical information, it was not possible to carry out a full-fledged reliable analysis of the level and dynamics of the development of the housing market of the separately included Arctic territories of the region and compare them with the results of other subjects of the Arctic zone.

It was possible to partially analyze some indicators of the housing market development in Norilsk, based on which certain conclusions can be drawn. In contrast to the Krasnoyarsk Krai, Norilsk is distinguished by a significant amount of emergency and dilapidated housing, increased wear and tear of fixed assets7, at the same time, the average salary (93,129 rubles), as well as the level of investments per capita8 significantly exceed the national and regional averages, i.e. the level and specificity of the development of the housing market in Norilsk has obvious differences from the indicators of the Krasnoyarsk Krai and it can only be assumed that the development of the housing market is largely formed by the paying capacity of the population. At the same time, it is worth making a remark about the fact that Norilsk is a large industrial center with a population of more than 180 thousand people. and cannot fully reflect the development of the Arctic territories as a whole, since another modern problem of the development of territories is the enlargement and development of cities, mainly administrative centers, with a developed material and technical base and the “depopulation” of small peripheral settlements [19, Kolodina E.A., pp. 162170], which leads to significant gaps in indicators for the activity of housing construction.

More and more demand for housing in small towns and small settlements is falling, a significant amount of empty housing stock appears, and in the conditions of a significant number of cities with a single-industry structure of the economy and due to the increasing popularity of large city-forming enterprises and other industries in the transfer of employees to rotational work methods and the attraction of workers from neighboring countries in order to save on the wages fund, the development of the housing market in small towns in the regions of the Russian Arctic is unpromising.

In addition to the natural population decline, there has been a tendency for migration from the regions of the North to regions more favorable for life, where the level of housing prices does not differ much from the Arctic regions, and the level of income of the population is practically at the same rates as in most regions of central Russia [20, Emelyanova E.E., Chapargina A.N., pp. 80– 98]. The largest outflow of the population to other regions is in the Murmansk Oblast, Yamal-Nenets, and Chukotka Autonomous Okrugs (about 65–80% of those who left). In the same Norilsk of the Krasnoyarsk Krai, when analyzing the migration indicators, its positive dynamics is noted due to international migration from the CIS and Baltic countries, and the migration of local residents to other regions of the country is increasing 9.

To change the existing situation and maintain the housing market, it is initially necessary to create favorable economic, social, and labor conditions for attracting the population to the Arctic regions, which implies a significant increase in the level of income of the population in comparison with the more southern regions of the country, as was the case in years of industrial development of the North, as well as the provision of a guarantee of full-fledged benefits and compensation to workers in the Far North, not only for workers in the public sector. Perhaps for these regions, it is necessary to use the investment schemes that Favstritskaya O. proposes to use on the territory of the Magadan region, which allows taking into account the specifics of the northern territories, overcome the depression of their development, improve the standard of living of the population and fix it on the territory [21, Favstritskaya O., Galtseva N., pp. 64–78]. These investment schemes differ in different degrees of state participation and depend on two key factors: the specifics of the distribution system and the level of income of the population. Another condition is the creation of a favorable urban environment and provision of the population with social facilities for health care and education. Only with an increase in the number of permanent residents in the Arctic regions is it possible to talk about the prospects for the development of housing and the real estate market.

Another problem of the real estate market in the regions of the Russian Arctic is the discrepancy between housing prices and the level of effective demand. According to the conducted research, the discrepancy between the incomes of the population and the level of housing prices is noted in 5 out of 9 studied regions of the Russian Arctic - the Republics of Komi, Sakha (Yakutia) and Karelia, Ar-Khangelsk Oblast, Krasnoyarsk Krai. With high real estate prices and inadequate incomes to meet housing needs, the population of these regions is forced to attract increased amounts of borrowed funds from banks, which also need to be provided, as a result of which these regions are leaders in the debt burden on the population in servicing housing loans. Currently, the level of debt burden for all regions will increase even more due to the suspension of the activities of many small and medium-sized enterprises and individual entrepreneurs and the release of their employees in connection with the introduced restrictions to counter the spread of the pandemic in the country. On the one hand, this should lead to a decrease in demand and a drop in property prices. In addition, an increase in unemployment, a decrease in the paying capacity of the population and the inability to fulfill their debt obligations to pay off previously taken housing and mortgage loans will lead to a likely increase in supply in the housing market due to the transfer of ownership of purchased housing by banks and individuals.

On the other hand, the influence of macroeconomic factors (falling prices on the oil market and the depreciating exchange rate of the national currency) provokes the population to invest savings in the most stable assets - real estate, which contributes to the growth of housing prices, however, rather, only in the short term perspective.

Thus, to solve the problems of the development of the housing market in the Arctic, it is necessary to develop three main directions:

-

• development of human resources by creating favorable economic, social, and labor factors to attract permanent residents to the Arctic regions;

-

• increasing the solvency and reducing the debt burden of the population by reducing interest rates on the payment of housing and mortgage loans, as well as through the implementation of special federal and regional housing programs, such as in the Far East;

-

• an increase in supply in the housing market, one of the ways out of which, given the low level of housing development in the regions of the Russian Arctic, maybe the transfer of housing stock from the state (municipal) to private to meet the housing needs of the population.

The solution of all three tasks is impossible without the active participation of the state, and not only as a regulator of the real estate market but also as a guarantor of increased income, benefits, and compensation to workers of the Far North and the main customer and developer of state target development programs.

Conclusion

Based on the results of a study of the housing market in the regions of the Russian Arctic, in terms of its dynamics and structure, the main indicators were identified that characterize the development of the regional housing market, including the low level and pace of housing construction in most Arctic regions with high rates of the share of emergency housing stock; highly differentiated volumes of investment in the housing sector, depending on the regional affiliation, with a pronounced downward trend in the indicator in all regions; the discrepancy between the solvency of the population in some regions of the Arctic and the level of housing prices, which entails an in- creased volume of housing loans and an increasing debt burden on the population to ensure mortgage loans. As a result of determining the rating of the regions of the Russian Arctic with a point assessment according to the selected indicators, the main criteria for balancing the housing market in two important areas were established: the paying capacity of the population and the development of economic indicators of the real estate market, as a result of which it was determined that the leading region is the Nenets Autonomous District outsiders - the Komi Republic and the Arkhangelsk region. At the same time, three regions (Murmansk Oblast, Yamalo-Nenets Autonomous Okrug and Chukotka Autonomous Okrug), having the best indicators in terms of housing affordability and paying capacity of the population, significantly lag behind national trends in economic indicators of housing market development. Conversely, a number of regions (Krasnoyarsk Krai, the Republic of Sakha (Yakutia)), with high levels of investment in the housing sector and commissioning of housing, do not “reach” the national average in terms of the ratio of the level of income of the population to housing prices. Based on the results of the study, it is possible to formulate the main directions for the development of the housing market for the Arctic regions, depending on their location in the ranking according to the economic indicators of the development of the construction industry and the paying capacity of the population: increasing the paying capacity of the population by reducing interest rates on housing loans and implementing special credit programs in the Arctic regions, as well as a decrease in housing prices due to an increase in supply in the housing market due to the increased rates of housing commissioning and the transfer of housing stock from state (municipal) to private. In addition, at the state level, it is necessary to develop a federal program to attract the population to the regions of the Russian Arctic by creating incentives of an economic, social and labor nature, which will contribute to the development of the territories in general and the housing market in particular. Development in all areas is possible only with the active participation of federal and regional authorities.

Acknowledgements and funding

The work was performed within the framework of the state assignment of the Federal Research Center of the KSC RAS No. 0226-2020-0027_IEP “Comprehensive interdisciplinary research and economic and mathematical modeling of the socio-economic transformation and management of regions and municipalities of the North-Arctic territories of the Russian Federation” and No. 0226-2020-0023_IEP “Scientific basis for the formation and implementation of the financial and investment potential of the regions of the North and the Arctic”.

Список литературы Status and specifics of the housing market in the Arctic regions of Russia

- Kirby A. Current Research on Cities and Its Contribution to Urban Studies. Cities, 2012, no. 29, pp. 3–8. DOI: 10.1016/j.cities.2011.12.004

- Krzemin´ska A.E., Zareba A.D., Dzikowska A., Jarosz K.R. Cities of the Future Bionic Systems of New Urban Environment. Environmental Science and Pollution Research, 2019, no. 26, pp. 8362–8370. DOI: 10.1007/s11356-017-0885-2

- Hoffmann B. Air Pollution in Cities: Urban and Transport Planning Determinants and Health in Cities. Inte-grating Human Health into Urban and Transport Planning. Springer International Publishing, Cham, Swit-zerland, 2019, pp. 425–441. DOI: 10.1007/978-3-319-74983-9_21

- Łaszek J., Olszewski K. Regional Development of Residential and Commercial Real Estate in PoLand and the Risk of Real Estate Cycles. Barom. Reg. Anal. I Progn, 2018, no. 51, pp. 41–51.

- Kinder T. Social Innovation In Services: Technologically Assisted New Care Models for People with Demen-tia and Their Usability. International Journal of Technology Management, 2010, no. 51, pp. 106–120. DOI: 10.1504/IJTM.2010.033131

- Butryn K., Jasin´ska E., Kovalyshyn O., Preweda E. Sustainable Formation of Urban Development on the Example of the Primary Real Estate Market in Krakow. E3S Web of Conferences, 2019, no. 86, 00010, pp. 1–8. DOI: 10.1051/e3sconf/20198600010

- Maalsen S. Smart Housing: The Political and Market Responses of the Intersections Between Housing, New Sharing Economies and Smart Cities. Cities, 2019, no. 84, pp. 1–7. DOI: https://doi.org/10.1016/j.cities.2018.06.025

- Mateusz T. Moving Towards a Smarter Housing Market: The Example of Poland. Sustainability, 2020, vol. 12, iss. 2, 25 p. DOI: 10.3390/su12020683

- Imran A.S., Kim D. Design and Implementation of Thermal Comfort System Based on Tasks Allocation Mechanism in Smart Homes. Sustainability, 2019, vol. 11, iss. 20. 24 p. DOI: https://doi.org/10.3390/su11205849

- Gu W., Bao P., Hao W., Kim J. Empirical Examination of Intention to Continue to Use Smart Home Ser-vices. Sustainability, 2019, vol. 11, iss. 19, 12 p. DOI: https://doi.org/10.3390/su11195213

- Zaynakova S.R. Rynok zhil'ya v Rossii: sovremennoe sostoyanie, problemy i prognozy [The Housing Mar-ket in Russia: Current State, Problems and Forecasts]. Sotsial'no-ekonomicheskie nauki i gumanitarnye issledovaniya [Socio-Economic Sciences and Humanitarian Studies], 2014, no. 1, pp. 58–62.

- Vanina T., Obolonkova A. Gosudarstvennoe vliyanie na rynok zhil'ya [State’s Influence on the Housing Market]. Belgorodskiy ekonomicheskiy vestnik [Belgorod Economic Bulletin], 2013, no. 3 (71), pp. 29–35.

- Kolomak E.A., Kukushkin R.G. Otsenka vliyaniya aglomeratsionnykh protsessov na rynok zhil'ya [Estimat-ing the Impact of Agglomeration on Housing Market]. Mir ekonomiki i upravleniya [World of Economics and Management], 2019, vol. 19, no. 1, pp. 55–63. DOI: 10.25205/2542-0429-2019-19-1-55-63

- Emelyanova E.E. Sistemnye problemy i napravleniya razvitiya munitsipalitetov rossiyskoy Arktiki [System Problems and Directions of Municipal Development of the Russian Arctic]. Arktika i Sever [Arctic and North], 2019, no. 35, pp. 79–93. DOI: 10.17238/issn2221-2698.2019.35.79

- Pilyasov A.N. Arkticheskaya diagnostika: plokh ne metr — yavlenie drugoe [Arctic Diagnostics: Bad is Not a Meter — This Is another Phenomenon]. Sever i rynok: formirovanie jekonomicheskogo porjadka [The North and the Market: Forming the Economic Order], 2018, no. 5 (61), pp. 35–54. DOI: 10.25702/KSC.2220-802X.5.2018.61.35-54

- Emelyanova E.E., Chapargina A.N. Baza dannykh «Rynok zhil'ya severnykh i arkticheskikh regionov Ros-sii», Svidetel'stvo o gosudarstvennoy registratsii № 2019621181 ot 4 iyulya 2019 g. [Database “Housing Market of Northern and Arctic Regions of Russia”, Certificate of State Registration No. 2019621181 of Ju-ly 4, 2019].

- Emelyanova E.E., Chapargina A.N. Baza dannykh «Naibolee znachimye pokazateli, harakterizuyushchie sostoyanie munitsipal'nykh byudzhetov, uroven' zhizni i uroven' dokhodov naseleniya gorodskikh okru-gov AZ RF po osnovnym sotsial'nym napravleniyam», Svidetel'stvo o gosudarstvennoy registratsii № 2018621190 ot 6 avgusta 2018 g. [Database “The Most Significant Indicators of Municipal Budgets, the Standard of Living and the Level of Income of the Population in Urban Districts of the AZ of the Russian Federation in the Main Social Areas”, Certificate of state registration No. 2018621190 of August 6, 2018].

- Kovaleva L.V., Omelyanovich A.S. Rynok zhil'ya i pokupatel'skoe povedenie potrebiteley [Housing Market and the Purchasing Behavior of Consumers]. Uchenye zametki TOGU [TGU ejournal], 2016, vol. 7, no. 3, pp. 23–27.

- Kolodina E.A. Issledovanie tendentsiy razvitiya mestnogo samoupravleniya v sovremennoy Rossii [Study of the Trends in Local Self-Government Development in Contemporary Russia]. Izvestiya Baykal'skogo gosudarstvennogo universiteta [Bulletin of the Baikal State University], 2017, vol. 27, no. 2, pp. 162–170. DOI: 10.17150/2500-2759.2017.27(2).162-170

- Emelyanova E.E., Chapargina A.N. Raskhody munitsipalitetov i dokhody naseleniya Rossiyskoy Arktiki [Expenditure of Municipalities Budget and Population Incomes in the Russian Arctic]. JeKO [Eco], 2019, no. 7 (541), pp. 80–98. DOI: http://dx.doi.org/10.30680/ECO0131-7652-2019-7-80-98

- Favstritskaya O., Galtseva N. Modernizatsiya zhilishchnykh rynkov depressivnykh severnykh regionov [Modernization of Housing Markets in Depressive Northern Regions]. Problemy teorii i praktiki uprav-leniya [International Journal of Management Theory and Practice], 2018, no. 1, pp. 64–78.