Stimulation of attraction of direct foreign investments in the regions of Uzbekistan with the help of “doing business” indicators

Автор: Mamasoliev G.M.

Журнал: Экономика и социум @ekonomika-socium

Рубрика: Основной раздел

Статья в выпуске: 7 (74), 2020 года.

Бесплатный доступ

Attracting foreign direct investment is traditionally believed to lead to stimulation of domestic investment, increased competition, technological growth, improved sectoral structure of the economy and an increase in the standard of living of the population.

Foreign direct investment, technological growth, increased competition, foreign economic activity

Короткий адрес: https://sciup.org/140252815

IDR: 140252815 | УДК: 004.02:004.5:004.9

Текст научной статьи Stimulation of attraction of direct foreign investments in the regions of Uzbekistan with the help of “doing business” indicators

Each country seeks to create a favorable investment climate to attract foreign direct investment. Attracting foreign direct investment is traditionally believed to lead to stimulation of domestic investment, increased competition, technological growth, improved sectoral structure of the economy and an increase in the standard of living of the population.

As the President of the Republic of Uzbekistan Sh.M. Mirziyoyev noted: “As world experience shows, only a country that pursues an active investment policy reaches stability and competitiveness of the national economy. Therefore, it can be argued that investment is the driver of the economy, figuratively speaking, its heart. There is no doubt about it” [1], however, he emphasizes that“ In order to widely attract foreign investment we need to take measures to demonstrate the investment potential of our country” [1], which means that large-scale work to improve the investment climate requires coverage all regions of Uzbekistan.

The attractiveness of the investment climate is formed from many components: stability and transparency in the economic environment, ensuring social and legal protection, as well as freedom in foreign economic activity.

There are different approaches to assess the investment attractiveness of a country. For example, in Japan, this is determined by interviewing existing or potential foreign investors to formulate further steps in removing barriers to investors [5]. In the United States, a combination of several indicators is used, which encompasses many quantitative and qualitative indicators, such as: indicators of the development of the economic system, economic efficiency of investments, and basic indicators of tax policy [6].

The assessment is carried out on the basis of ten key indicators affecting the conduct of business in the country, such as: the creation of enterprises, obtaining building permits, connecting to the power supply system, registration of property, obtaining loans, protecting minority investors, taxation, international trade, enforcement of contracts and permission insolvency.

To identify qualitative results for each indicator, separate evaluation methodologies have been developed, based on scientific papers and proven methods for identifying realistic indicators in the study area. However, due to the scale of the deployed events around the world, one city from each country falls into the coverage of geographical locations. Therefore, indicators for Uzbekistan are based on the data of the most developed city in the country, the capital of Uzbekistan, Tashkent.

However, is this the state of the investment climate in other regions of the country? We will try to conduct a survey on two main statistical indicators of the State Committee of the Republic of Uzbekistan on statistics: the growth dynamics of enterprises with the participation of foreign capital, and the share of existing enterprises with the participation of foreign capital by region.

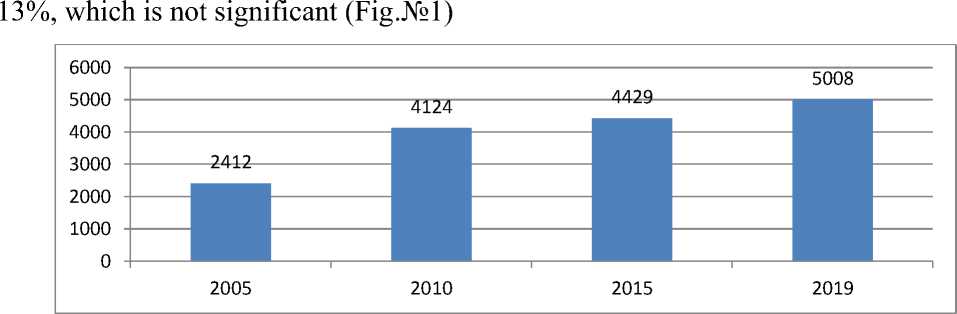

The report of the State Committee of the Republic of Uzbekistan on Statistics states that the number of operating enterprises with the participation of foreign capital in 2019 compared with 2005 increased 2.2 times. However, in the color of significant reforms being undertaken since 2015 to improve performance in the

Fig.№1. The growth dynamics of existing enterprises with the participation of foreign capital [2]

Fig. №2. The share of existing enterprises with foreign capital by region, (in percent) [2]

In this regard, in our opinion, the following is necessary:

Thirdly, the development of domestic tools based on international instruments for assessing the investment climate and improving the business environment, as well as a responsible state and / or public institution for monitoring and implementing measures taken in this area;

Fourth, the organization of a sustainable platform (electronic platform, forum or other) for the exchange of information, experience and study of existing problems in the field of investment climate.

Список литературы Stimulation of attraction of direct foreign investments in the regions of Uzbekistan with the help of “doing business” indicators

- https://president.uz/ru/lists/view/2228 - Послание Президента Республики Узбекистан Шавката Мирзиёева Олий Мажлису от 28 декабря 2018

- https://stat.uz - Государственный комитет Республики Узбекистан по статистике

- http://www.iberglobal.com/files/business_climate_eiu.pdf - специальный выпуск журнала “The economist”

- https://www.doingbusiness.org - Международный рейтинг по оценке регулирования бизнеса

- https://www.jetro.go.jp/en/invest/newsroom/2018/d7ef3781c6561471.html - Ежегодный отчет Японской организации по международной торговле JETRO “Об инвестиционном климате Японии»

- https://www.state.gov/about/about-the-u-s-department-of-state/ - Государственный департамент США