Tax administration in the forest management system and its influence on the budgets of northern territories

Автор: Lazhentsev Vitalii N., Chuzhmarova Svetlana I., Chuzhmarov Andrei I.

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Environmental economics

Статья в выпуске: 1 т.13, 2020 года.

Бесплатный доступ

The subject of the paper is related to the need to eliminate the discrepancy between the theory of taxation in terms of forest management tax administration and forest resources rational use. The purpose of the paper is to present the results of the research on tax administration in the forest management system and its influence on the budgets of the Northern territories. Scientific novelty of the research consists of the development of the theory of tax administration in forest management and the determination of its impact on the budgets of the Northern territories: the concepts of “tax administration in forest management” and “tax potential of forest management” are specified; the necessity of highlighting the special role of tax administration in forest management in the forestry sector development programs is substantiated; the classification of fiscal payments in forest management is proposed; the criteria and indicators for assessing the effectiveness of tax administration in forest management are defined. Theoretical and practical significance of the research lies in the fixing of urgent current problems of tax administration in forest management, interrelated with the management of forests in the Northern regions; the grouping of tax authorities’ control measures in the forest sector, which makes it possible to identify tax law violations systematically; the analysis and evaluation of the effectiveness of tax administration in forest management and its influence on the budgets of Russian Northern territories (the case of the Republic of Komi); the analysis of domestic and foreign practices (USA, UK, Finland) of tax administration through information technologies; the systematization of problem areas of tax administration in the field of forest management in the Northern regions of Russia (geographical, infrastructure, socio-economic, organizational, information technology); the development of ways of improving tax administration of the forest usage in the Northern territories, based on the introduction of information technologies, state and public control over forest usage, and support services for taxpayers. The research methodology is based on the theories of taxation, environmental economics, and regional economics. To achieve the goal of the study, the methods of dynamic and static analysis of the effectiveness of tax administration in forest management were used. It allowed us to identify urgent problems.

Tax administration, tax and non-tax payments, corporate income tax, value added tax, budget, forest management, northern regions, information technologies

Короткий адрес: https://sciup.org/147225432

IDR: 147225432 | УДК: 336. | DOI: 10.15838/esc.2020.1.67.7

Текст научной статьи Tax administration in the forest management system and its influence on the budgets of northern territories

The model of tax administration used in Russia [1, 2] is often the target of fair criticism. Currently, tax administration in the forest management system is based on the general provisions of the Tax code of the Russian Federation. However, this document does not reflect the specific features of this type of activity that are taken into account in taxation. In addition, the Forest code of the Russian Federation establishes a number of non-tax payments the administration of which is outside the tax authorities’ competence. Insufficient elaboration of the legal framework and low level of tax culture cause the usage of various tax evasion schemes and, thus, prevent the budget from being fully filled.

Based on the factual material, collected in the course of the research, we tried to introduce the analysis of current tax administration problems in forest management, related to problems influencing budgets of the Northern territories, into the mainstream of existing tax theories from the point of view of the necessity to improve tax policy.

The key purpose of the paper is to present the results of the research on tax administration in the forest management system and its influence on the budgets of the Northern territories. The objectives are the following: definition of theoretical and methodological bases of the research; determination of the deficiency of forest management as a factor contributing to the tax gap; analysis of strategic documents of forest sector development and taxes reflection as a result of their successful implementation; analysis of fiscal payments for forests use, their classification; systematization of tax authorities’ control measures in the forest sector; analysis of domestic and foreign practices of tax administration in forest management using information technologies, identification of areas for improvement.

Scientific novelty of the research consists of the development of the theory of tax administration in forest management and the determination of its influence on the budgets of the Northern territories: the concepts of “tax administration in forest management” and “tax potential offorest management” are specified ; the necessityof highlighting the special role of tax admini-stration in forest management in the forestry sector development programs is substantiated ; the classification of fiscal payments in forest management is developed ; the criteria and indicators for assessing the effectiveness of tax administration in forest management and its influence on the budgets of the Northern territories are proposed ; the grouping of the tax authorities’ control measures to assess the performance of forest sector organizations, helping to systematically identify the violations of the tax legislation, is proposed ; problem areas of tax administration in the field of forest management in the Northern regions of Russia (geographical, infrastructural, socio-economic, organizational, information technology) are systematized ; directions for improving tax administration of forest usage are developed .

Theoretical and practical significance of the research is in the fixing of urgent current problems of tax administration in forest use interrelated with forest management in the Northern regions of Russia as an objective basis for taxation and budget formation; systematization of tax authorities’ control measures in the forest sector; analysis and evaluation of the effectiveness of tax administration in forest management and its influence on the budgets of the Northern territories of Russia (the case of the Republic of Komi); development of the ways of the improvement of tax administration in forest use in the Northern territories, based on the introduction of information technologies, state and public control over forest use and support services for taxpayers.

Research methods: the research is based on the theories of taxation, environmental economics,and regional economics. To achieve the goal of the study, the methods of dynamic and static analysis of the effectiveness of tax administration in forest management were used.

Problem setting

The results of the analysis of the theory and practice of tax administration in the forest management system show an increasing trend of imbalances in forest management and tax administration which affected the budgets of the Northern territories of Russia.

The conducted research allowed us to identify organizational and financial problems caused by the lack of a unified forest management system in the country including interrelated management elements, i.e. forest management, and admini-stration of tax and non-tax payments for the use of forest resources which affected the lack of budget revenues needed to finance public goods in the Northern territories.

Losses of forest resources and uncontrolled forest use influence the shortfall of budget revenues. In our opinion, the judgments made on the basis of the analysis of specific situations (in addition to the overall socio-economic assessment of forests) may be useful for revising main theoretical positions in terms of forest management, interrelated with the tax administration in forest use.

One of the examples of such analysis [5] allows making the following theoretical assump-tions:

– forest use management, interrelated with tax administration, includes the whole complex of measures on protection, use and reproduction of biological resources affecting the tax base of the territories;

– capitalization of biological resources covers not only tangible assets (as a basis of taxation), but also the forests’ ecological function (therefore, it is necessary to consider taxes’ ecological potential when forming tax policy);

– the transition to a recovery model of conservation of forests’ natural capital (causing the transformation of economic potential into tax potential) is possible only within the boundaries of a relatively large areas of the taiga territories (not less than 10 sq km) where the (taxable) economic activity may be arranged on a geosystem basis;

– the territorial dimension of forestry activities (of taxpayers) assumes the presence of a relevant administrative center for forest management (which in the past, up to 20062, was a forestry enterprise of leskhoz) which would interact with the tax authorities and help improve the performance of tax administration in forest management.

It should be noted that tax administration and forest management in the Republic of Komi were previously connected territorially and informationally. Thus, in terms of location, the forestry enterprises were equivalent to the forest economic districts, organized on the principles of forests’ cyclical reproduction, taking into account the configuration of population settlement, and served as a standard of life of the taiga territories where tax control, carried out by territorial tax authorities, contributed to the growth of tax collection, and the standard of living of the population and financing public goods attracted able-bodied population (currently, the emigration reduced the number of taxpayers more than by one third). It is necessary to improve the interrelated tax administration and forest management (based on the experience of forestry enterprises’ activities and other subordinate lower structures of forest management) for the creation of obstacles to the predatory deforestation3 and tax evasion too. Such system would improve the current effectiveness of tax administration in forest management in terms of control over taxpayers and increase tax potential of the Northern territories.

One should also take into account theoretical thesis, confirmed by calculations, that account of the deterioration of natural resources (including forest) radically changes the assessment of the results of economic development in most regions of Russia [8] and their fiscal security. A combined evaluation of natural capital deterioration and forest resources marketability in the most valuable forest areas (slices) allows setting the amount of the income underpaid to a particular region or municipality [9], including those in the form of taxes and non-tax payments from timber producers.

Attempts to apply theory to practice are immediately unsuccessful, since the current practice is not compatible with the basics of rational forest management itself. The practice is unsatisfactory, especially in terms of accounting, assessment, and capitalization of forest resources, as a basis for taxation and their protection at the expense of the budget. In addition, there is an excessive fragmentation of organizational forms of logging allowing to report on the “volume” of small businesses successfully (using special preferential tax regimes), but violating the rules and regulations of forest management, leading to budget losses. There is no correlation between the interests of entrepreneurs (taxpayers) and the local population (recipients of public goods from budget tax revenues), as well as territorial planning, aimed at forest reproduction (growth of the tax potential of forest use) and their socio-environmental functions.

Theoretical and methodological basis of the research

We revealed that the works of domestic and foreign scientists present separate issues of forest management and forest utilization fees [10], the interpretation of the concept of forest rent as an income received from forest use, reduced by the cost of wood harvesting and transportation, with considering a number of factors affecting the processes occurring during forest use. For example, in Finland, the economic organization and management of forests is based on the principle of commensuration of costs and results obtained from forest management. [11]. Perhaps, forest rents should have included land rent, as the quality of forest depends on the quality of land – bonitet, the quality of which affects the price of harvested timber, and, accordingly, the price of taxable income. The lack of a clear conceptual framework of tax regulations and the difficulty of determining the amount of forest rent as a basis for taxation, related to the issues of state control, affected the current system of forest use tax administration.

In the scientific economic literature, there is no uniform interpretation of the concept of “tax administration”. We have established the similarity of interpretations of domestic and foreign economists: tax administration is the daily activity of tax bodies and their officials to ensure timely payment of taxes and fees [12, p. 35]; the practical activities of the competent authorities, primarily the tax ones, to ensure the collection of mandatory payments to the budget system of the state [13–16].

At the same time, there is no clear understanding of the concept of “tax administration in forest management” in scientific papers. In this study, we propose the following definition. Tax administration in forest management is a part of forest taxation management system in the country, including the development of legislation on taxes and fees taking into account the peculiarities of activities of the forestry sector taxpayers, methodological tax support, authorized bodies’ control over their implementation, aimed at the formation of budget revenues.

Any state should be interested in the development of its economy, growth of tax revenues, and the increase of taxable capacity. Taxable capacity is interpreted almost in the same way in economic literature: according to Chernick H., it is the ability of the government to transform the results of economic activities, which are localized within certain limits, into the expenditure of the public sector [17]; according to Barro S.M., it is the ability of the territory to obtain tax revenues from its own sources, regardless of the level of fiscal effort under given conditions of taxation [18]. The authors offer the following definition: taxable capacity of forest management is the transformation of the results of forest users’ economic activities into tax revenues of different budgets, necessary for the funding of public goods, under given conditions of taxation.

Results of the research

The research determined the following initial points:

– tax system management of forest use should be interrelated with forest management consistent with principles of sustainability which, in turn, are determined by the multifunctional purpose of forests and their value as a public good;

– development of tax administration includes increasing control over the observance of tax legislation, as well as organizational, methodological and analytical support of control activities exactly in the direction of its strengthening given the current critical situation in the use and protection of Russian forests4;

– introduction of new information technologies in the field of tax administration is first of all advisable to coordinate with the task of improving of accounting and integrated assessment of forest resources as a tax base, and secondly with the formation of the taxable capacity of forestry sector and tax revenues of the Northern territories.

The results of the research are recorded to reflect tax revenues as the efficiency of forest sector programs development, the evaluation of the effectiveness of tax administration in forest management, in the implementation of control measures by tax authorities and tax administration in the field of forest management in the Northern regions of Russia through information technologies.

Analysis and explanation of the obtained results

Taxes treatment in the strategic documents on forest sector development

The conducted content analysis of several documents, including the Strategy of Development of the Forest Complex of the Russian Federation until 2030, the State Program “Forestry Development” for the period of 2013–2020, the Forest Plan of the Komi Republic, etc., allowed stating that the increase of tax revenues is recorded as one of the expected results of their (the Strategy, the State programs, the Plan) successful implementation.

The implementation of the Strategy of Development of the Forest Complex of the Russian Federation until 2030 (approved 20.09.2018) should result in the increase of tax revenues in budgets of the budgetary system of the Russian Federation twice (from 91 to 189 billion rubles), as well as the growth of value added, the increased contribution of the forest complex in GDP from 0.5% to 1%, the increase of the number of personnel in the forestry sector from 500 to 820 thousand people. Moving in the direction of economic instruments for sustainable forest management the application of which is reflected in tax revenues, can be traced in the State Program “Forestry Development” for the period of 2013–2020.

The constituent entities of the Russian Federation also approved program documents of the forest sector development which include tax and non-tax revenues from forests use. Thus, the Forest plan of the Komi Republic provides the total income from forests use in the amount of 27986 million rubles in 2020– 2029, including 20250 million rubles (72% of all revenues), incoming to the Federal budget, and 7735 million rubles (28%) for the budget of the Komi Republic [19].

The estimated nationwide dynamics of the forest complex development is interesting because of the correlation of forest exploitation and tax revenues: the area of deforestation (clear cutting) will increase by 20%, the production of forestry complex per unit of commercial forests area, and value added of the forestry industry, as well as tax revenues from the forest complex enterprises and payment for forests use to the budget system, will increase to 50%5. However, the “Strategy” barely addresses the issues of reforestation, causing the growth of economic and taxable potential. Meanwhile, there is a problematic situation, especially in terms of artificial forest restoration. For example, in 2016, 1153 thousand hectares of forest were carved, and only 995 hectares were restored, including 179 of artificial plantings. If you take into account the forest area exterminated by fires, and a large amounts of forest sites cut but not restored, it would be useful to provide forests restoration at the rate outpacing the scales of cutting areas that would affect the growth of tax revenues in subsequent periods.

A positive trend is also evident. It is achieved (if you look at the current situation in the forest sector) mainly through the increase of coefficients of payment rates indexation (nontax payment) per unit of forest resources volume (2.17 in 2018; 2.62 in 2020) and payment rates for forest land area unit (1.57 in 2018; 2.26 in 2020)6. This, of course, is a positive process, if we take into account the need of forest resources capitalization in accordance with their increasing public value and budget revenues from forest management.

According to the authors, the Strategy of Development of the Forest Complex of the Russian Federation, the State Program “Forestry Development”, the Forest Plan of the Komi Republic and other subjects of the Russian Federation ought to highlight the role of the forest management tax administration. Since the control measures of tax authorities reveal the use of various schemes of tax evasion by unfair taxpayers. They are mostly based on fraud connected with value added tax, tax on organizations’ profit, the simplified system of taxation – one of special tax regimes types. It usually happens in the sphere of shadow economy. According to calculation methods, proposed by D.Yu. Fedotov, the level of shadow economy in the Komi Republic was 47.5% in 2013, 74.7%. in the Sakhalin Oblast [20, p. 144–145].

Thus, in the strategic documents on the development of forest sector, the growth of tax revenues is reflected as a result of their

Table 1. The dynamics of taxes and fees in the consolidated budget of the Russian Federation by the type of economic activity of “forestry and logging” in 2015–2018, mill. rub.

|

Indicators |

2015 |

2016 |

2017 |

2018 |

Share, % |

2018 in % to 2015 |

|

Payments received into the consolidated budget of the Russian Federation, total, including: |

11697 |

14585 |

15797 |

21007 |

100 |

180 |

|

Federal taxes and fees, total, including: |

8520 |

11383 |

12025 |

15999 |

76 |

188 |

|

- tax on profit of organizations |

1897 |

2410 |

2673 |

4184 |

20 |

221 |

|

- personal income tax |

5689 |

6633 |

6537 |

7748 |

37 |

136 |

|

- value added tax |

913 |

2309 |

2776 |

4029 |

19 |

441 |

|

- taxes and fees for using natural resources |

22 |

30 |

39 |

38 |

0 |

173 |

|

Regional taxes, total, including: |

1211 |

959 |

861 |

1169 |

6 |

97 |

|

- tax on property of organizations |

632 |

576 |

511 |

790 |

4 |

125 |

|

- transport tax |

578 |

382 |

349 |

379 |

2 |

66 |

|

Local taxes and fees |

289 |

235 |

404 |

700 |

3 |

242 |

|

Taxes envisaged in special tax regimes |

1677 |

2008 |

2508 |

3139 |

15 |

187 |

Source: compiled by the authors according to the statistical tax reporting the Federal Tax Service of Russia [Electronic resource]. Available at: (accessed 14.06.2019)

Table 2. Dynamics of income taxes in the consolidated budget of the Russian Federation in the Komi Republic by kind “forestry and logging” economic activity in 2015–2018, mill. rub.

Indicators 2015 2016 2017 2018 Share, % 2018 in % to 2015 Payments received into the consolidated budget of the Russian Federation, total, including: 387 515 507 303 100 78 Federal taxes and fees, total, including: 325 444 424 183 60 56 - tax on profit of organizations 81 124 210 144 48 178 - personal incomes tax 155 160 188 233 77 150 - value added tax 89 160 25 - 193 - - - taxes and fees for using natural resources 0 0 1 0 - - Regional taxes, total, including: 22 25 23 42 14 191 - tax on property of organizations 11 15 13 32 11 291 - transport tax 12 11 10 10 3 83 Local taxes and fees 2 2 3 3 1 150 Taxes envisaged in special tax regimes 38 43 57 75 25 197 Source: compiled by the authors according to the statistical tax reporting the Federal tax service of Russia [Electronic resource]. Available at: (accessed 14.06.2019)

implementation. However, the low reliability of data on forest resources and their utilization is one of the problems hindering the development of the forest sector as an objective basis of taxation and formation of tax and non-tax revenues. Therefore, in our opinion, it is necessary to highlight the special role of forest management tax administration in these documents.

Evaluating performance of tax administration in forest management

We found out that the current system of fiscal payments from forest users, including tax and non-tax payments, is divided between different subjects and objects of taxation little related to the forests’ ecological functions, and it is administered by various authorities, including tax authorities, forests committees, Ministry of natural resources of the constituent entities of the Russian Federation.

A study of the regulatory framework allowed making a classification of fiscal payments for forest use including:

– taxes from the general tax system (profit tax of organizations, value added tax (VAT), fees for the use of fauna objects, tax on property of organizations, transport tax, land tax, personal income tax), and taxes envisaged in

Table 3. Dynamics of revenues for forest use in the budget system of the Russian Federation in the Republic of Komi in 2015–2018, mill. rub.

Non-tax budget revenues 2015 2016 2017 2018 Share, % 2018 in % to 2015 Federal budget, total, including: 980 1083 1141 1602 71 163 Fee for the use of forests in terms of the minimum size of payment under the contract of forest plantations sale 70 75 104 146 7 209 Fee for use of forests in terms of the minimum size of a rent 890 987 1008 1421 63 160 Monetary penalties (fines) for the violation of forest legislation in forest areas 9 14 23 30 1 333 Monetary penalties (fines) for the violation of the legislation of the Russian Federation on fire safety 1 1 2 1 0 100 Other revenues from financial penalties (fines) and other sums in damages 10 5 3 4 0 40 Budgets of the constituent entities of the Russian Federation, total, including: 366 451 507 661 29 181 Fee for the use of forests in terms of exceeding the minimum amount of payment under the contract of purchase and sale 166 202 267 331 15 199 Fee for the use of forests in terms of exceeding minimum rent 184 226 221 309 13 168 Fee for the use of forests in terms of payment under the contract of sale and purchase of forest plantations for own needs 14 15 16 17 1 121 Fee for the provision of the information, documents contained in state registers maintained by state bodies, agencies by the public authorities and state agencies of the constituent entities of the Russian Federation 0 1 2 1 0 - Other revenues from financial penalties (fines) and other sums in damages payable to the budgets of constituent entities of the Russian Federation 1 6 0 2 0 200 Monetary penalties (fines) for the violation of the legislation of the Russian Federation on fire safety 1 1 2 1 0 100 Total 1345 1533 1648 2263 100 168 Source: own compilation according to the Ministry of natural resources and environmental protection of the Komi Republic [Electronic resource]. Available at: (accessed 15.10.2019)

special tax regimes (simplified tax system); insurance contributions to the Pension Fund of the Russian Federation, Social Insurance Fund of the Russian Federation, Federal Compulsory Medical Insurance Fund;

– non-tax fees provided by the Forest Code of the Russian Federation in the form of specific payments (lease of forest land; contract of forest plantations sale; for the use of forests located on forest fund lands; for the use of forests located on lands of other categories, being the federal property; for the use of forests located on lands of other categories, owned by the constituent entities of the Russian Federation; for the use of forests located on municipal lands).

To evaluate the performance of tax administration in forest management and its impact on the budgets of the Northern territories (the case of the Komi Republic) the following criteria were defined: growth of taxes (federal, state and local taxes at special tax regimes), growth of non-tax payments to the budget, reduction of tax debt. The composition and analysis of dynamic and static indicators are given in tables 1–5.

On tax payments

The data reflect the set of taxes that enterprises of forest sector of the economy pay to the state. The growth of this type of payments to the budget of the Russian Federation is evident (80% in 2018 compared to 2015), although their share in the total amount of taxes is not significant (0.1% in 2018 in the RF).

We should note that the overall tax burden (the ratio of taxes to GDP given the fiscal burden on insurance fees) is insignificant in the forestry sector of the economy and amounted to 16.8%; for comparison, it makes up 45.1% in the mining sector, 14.3% by all types of economic activity.

In the Komi Republic, tax revenues from forestry and logging decreased by 22% in 2018 in comparison with 2015 ( Tab. 2 ). The share of taxes in the forest sector of the Republic specializing in the management of natural

Table 4. Dynamics of tax debts, duties, insurance contributions, fines, and other sanctions by the “forestry and logging” economic activity in the budget system of the Russian Federation in 2015–2018, mill. rub.

|

Indicators |

2015 |

2016 |

2017 |

2018 |

Share, % |

2018 in % to 2015 |

|

Total tax debts, including: |

5512 |

5942 |

4623 |

4315 |

100 |

78 |

|

- uncollected taxes |

3428 |

3326 |

3372 |

1715 |

40 |

50 |

|

- debts on fines and tax penalties. |

2084 |

2313 |

1250 |

886 |

21 |

43 |

|

Arrears on taxes, fees, fines, and penalties, total, including: |

2353 |

2919 |

2524 |

2363 |

55 |

100 |

|

- tax on profit of organizations |

278 |

302 |

307 |

595 |

14 |

214 |

|

- value added tax |

1741 |

2239 |

1738 |

1392 |

32 |

80 |

|

- payments for using natural resources |

1 |

0 |

3 |

1 |

0 |

100 |

|

- other Federal taxes and duties |

333 |

378 |

476 |

375 |

9 |

113 |

|

Arrears on regional taxes, total, including: |

317 |

201 |

92 |

515 |

12 |

162 |

|

- tax on property of organizations |

106 |

125 |

44 |

386 |

9 |

364 |

|

- transport tax from organisations |

76 |

75 |

47 |

127 |

3 |

167 |

|

Arrears on local taxes and duties, total, including: |

105 |

79 |

64 |

87 |

2 |

83 |

|

- land tax from organisations |

66 |

77 |

61 |

81 |

2 |

123 |

|

Arrears on taxes in special tax regimes |

126 |

127 |

175 |

212 |

5 |

168 |

Source: own compilation according to the statistical tax reporting of the Federal Tax Service of Russia [Electronic resource]. Available at: (accessed 14.06.2019)

Table 5. Dynamics of payable taxes, duties, insurance contributions, fines and other sanctions by the type of economic activity of “forestry and logging” in the budget system of the Russian Federation in the Republic of Komi in 2015-2018, mill. rub.

|

Indicators |

2015 |

2016 |

2017 |

2018 |

Share, % |

2018 in % to 2015 |

|

Taxes payable total, including: |

93 |

212 |

74 |

58 |

100 |

62 |

|

- uncollected taxes |

41 |

144 |

44 |

30 |

52 |

73 |

|

- debts on fines and tax penalties. |

52 |

68 |

29 |

13 |

22 |

25 |

|

Arrears on taxes, fees, fines, and penalties, total, including: |

49 |

139 |

56 |

30 |

51 |

63 |

|

- tax on profit of organizations |

15 |

41 |

8 |

2 |

3 |

13 |

|

- value added tax |

32 |

96 |

45 |

25 |

43 |

78 |

|

- payments for using natural resources |

0 |

0 |

0 |

0 |

0 |

0 |

|

- other Federal taxes and duties |

2 |

2 |

3 |

3 |

5 |

150 |

|

Arrears on regional taxes, total, including: |

4 |

2 |

2 |

6 |

10 |

150 |

|

- tax on property of organizations |

1 |

0 |

1 |

2 |

3 |

200 |

|

- transport tax from organisations |

2 |

2 |

0 |

4 |

7 |

200 |

|

Arrears on local taxes and duties, total, including: |

0 |

0 |

0 |

0 |

0 |

- |

|

- land tax from organisations |

0 |

0 |

0 |

0 |

0 |

- |

|

Arrears of taxes in special tax regimes |

3 |

3 |

4 |

14 |

24 |

467 |

Source: own compilation according to the statistical tax reporting the Federal Tax Service of Russia [Electronic resource]. Available at: (accessed 14.06.2019)

resources is low – 0.13 percent in 2018. The volume of logging has not decreased at the same time. To some extent this is due to the illegal forest use and tax deductions increase. Thus, the excess of VAT deductions over the amount of the assessed tax resulted in the formation of a negative index of 193 million rubles.

On non-tax payments

Non-tax payments for forest use are much more than tax payments and are described in detail by the types and objects of taxation (Tab. 3). In 2018, the total amount of non-tax payments in the Republic of Komi amounted to 2263 thousand rubles (68% increase in comparison with 2015) including 1602 million rubles of payments to the federal budget (63% increase), 661 million rubles to the Republican budget (81% increase). We should pay attention to the structural positions: the sum of total payments is dominated by the fee for the use of forests in terms of the minimum rent (incoming to the federal budget) – the forest fees for the timber – 63% and fee for forests use in terms of exceeding minimum rent (incoming to the budget of the RF entity) – 14%.

Forest sector specialists, the bodies of state, and municipal management negotiate about the choice of a “lease” or “purchase and sale”. In relations with large logging companies, “rent” is preferred; with small and medium entrepreneurship, it is usually “purchase and sale”. In this case, realization of the state’s and local communities’ interests is that these two types of forest use were interconnected. This is mainly achieved by subcontracts between large tenants with small businesses, operating in the same space. Technological scheme of forest resources development and reproduction is becoming common, and forest payments of all the participants of the “forest development” should relate to this scheme in some way.

In our opinion, control over the execution of norms and rules of forest non-tax payments should be similar to the taxes’ control: it should be carried out within the tax administration. It becomes more urgent with the increasing complexity of the specified interaction scheme and a substantial growth of payments and a high level of forest users’ taxes payable.

On tax debts

The next subject of analysis is the tax debts of forest users, one part of which is paid off, voluntarily or involuntarily, and another part becomes uncollectible ( Tab. 4 ).

By reducing tax debts of the forest sector in the budget system of the Russian Federation by 22%, its value remains high – 4315 mill. rubles, which is, approximately, 20% of all forest taxes. The largest share of debts in the forest sector of the Russian Federation on federal taxes: VAT – 32%, and 14% of organizations’ profit tax. Regional taxes (62% increase) and taxes on special tax regimes (68% increase) also have large amounts of debt.

In the Republic of Komi, with the reduction of forest sector’s tax debts by 38%, its sum in 2018 amounted to 58 million rubles: it is 19% of all forest taxes ( Tab. 5 ).

The largest share of debt in the forest sector of the Komi Republic is made on VAT – 43% (22% reduction) and on taxes on special tax regimes – 24% (4.7 times increase). Our analysis of the taxes debts, established by tax authorities, demonstrates similar trends across the country and in the entity of the Russian Federation. Arrears dominate in the structure of forest users’ tax debts; VAT debts lead according to the types of taxes.

The analysis allowed establishing the fact that, despite considerable forest resources in Russia, including the Komi Republic, the tax administration of forest management does not have a significant influence on the formation of budget revenues, i.e.: the low share of tax revenues from forestry (0.1%); the decrease of tax revenues from forest management in in the Komi Republic, despite its growth across the country; at the same time, under the current regulatory framework, the amount of forest non-tax payments (the administration of which is beyond the competence of tax authorities) is more than seven times higher than tax payments in the Komi Republic; however, there is a high level of tax arrears in the forestry sector (about 20% of all forest taxes).

Reduction of the forest sector debt, and positive dynamics of tax and non-tax payments to the budget system of the Russian Federation, in our opinion, is largely the result of tax administration and control measures of tax authorities.

Control measures of tax authorities

The conducted research made it possible to group the control measures of tax authorities in the sphere of forest management:

– the collection of evidence of dishonest taxpayers’ existence and activities, i.e. short– lived companies, technical companies;

– analysis of indicators of different accountability forms containing information directly or indirectly influencing the tax base, tax liability of the organizations – counterparties – participants of the scheme7;

– the tax authorities’ requests to regulatory authorities, and the use of information available in tax authority;

– the tax authorities’ requests to the banks about transactions in the taxpayer’s accounts;

– the analysis of movement of funds on the accounts of organizations, engaged in timber extraction, and the analysis of indicators of the purchase ledger which is used for VAT calculations;

– the collection of documents, research, and compilation of indirect information for tax purposes8;

– the interrogation and questioning of witnesses directly related to the process of logging;

– the direction of instructions demanding and requiring the submission of documents (information) to the organizations (contractors, authorities, budget organization, banks) and individuals9;

– the formation of data on activities of organizations, included into the group of interrelated (interdependent) individuals, the identification of dishonest taxpayers’ formal workflow.

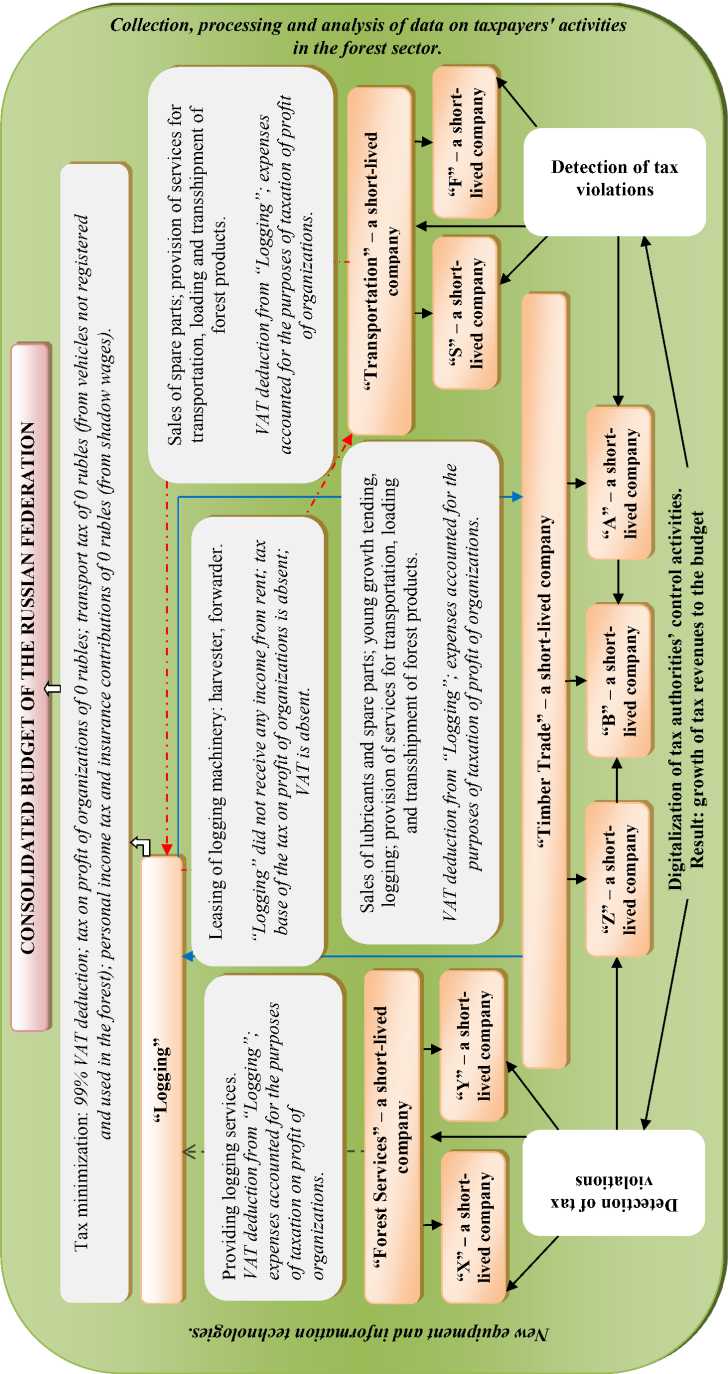

We believe that the usage of these types of tax control in the analysis of the forest sector organizations’ activity allows us to identify the violations of tax legislation more systematically. For example, we conducted the analysis of the review of activities of a certain company tentatively named “Logging”, conducted by tax inspection. The company signed agreements with three organizations (also tentatively named): Forest Services, Timber Trade, and Transportation. Their work and services:

logging, young growth tending, transporting, loading, unloading and transshipment of timber, lease of special vehicles; sales of lubricants and spare parts.

The scheme of “tax minimization” of the company and its counterparties is shown in figure . We found that the application of this type of scheme results in budget losses: the maximum possible VAT deduction of 99% and complete deliverance from tax on profit of organizations, transport tax, personal income tax, and insurance contributions.

As the case of “contractual” violations of the rules and regulations of taxes is taken from the analysis of the activities of logging companies in the Komi Republic, we considered it appropriate to complement the grouping of control measures by the systematization of tax administration difficulties in the North.

Systematization of the difficulties of forest management tax administration in the Northern territories

There are five main blocks of problems of tax administration in the field of forest management in the Northern regions of Russia .

Geographical: The Northern territories’ remoteness and inaccessibility, causing the difficulty of establishing actual use of particular vehicles, specialized logging machinery, their accessories and locations, performing certain types of work and services associated with logging.

Infrastructural: insufficiently developed infrastructure in remote Northern areas (lack of roads and bridges, cell communication, the Internet) coupled with a significant reduction of foresters who control the vast territory of the forest sector.

Socio-economic: underestimation of the local population’s capacity in the sphere of public control of forest management, ignoring their interests when granting forest plots in

Fig.1. Scheme of “tax minimization” with the participation of interrelated (interdependent) individuals revealed by the tax authorities in the forest sector

Source: own compilation according to the data obtained in the course of the research.

rent, contributing to the growth of the shadow economy in the forest sector.

Organizational: currently, the rental system of forest land for a long period (up to 50 years) leads to the tax base reduction. In particular, the natural growth of forest plantations is often not taken into account by dishonest taxpayers. In addition, there is the lack of adaptedness of tax authorities’ information resources, and other authorities’ bureaucratic methods of work, leading to the increase of terms of tax audits, the difficulty of identifying the dishonest taxpayers’ violations.

Information technology: insufficient usage of digitization opportunities in tax bodies’ control measures in the sphere of forest management. A significant amount of tax inspectors’ control work, limited tax audits terms, deficiency of attention and other factors influence the performance of tax control. The requests of taxpayers’ documents, required for specifying information about the correctness of the tax base formation, the legitimacy of tax deductions, the substantiation of expenses, which can only be confirmed during a field tax audit, are not always implemented in time.

The necessity to find solutions to mentioned problems of tax administration of forest management in northern conditions made it relevant to analyze the best practices of use of information technologies and their application.

Analysis of domestic and foreign practice of tax administration by means of information technology

The World Bank provides information on the 159 member States of the United Nations on the implementation of digital technology for tax administration [21]. For example, the UK tax authorities (HMRC – Her Majesty’s Revenue and Customs) gradually bring the time of the tax control to the real-time operations on the basis of information technologies. In

2015, they embedded a program “Making tax easier: The end of the tax return”, but three years later it was replaced with a new program (Making tax Digital). This is how quickly they improve the control technology [22]. For example, the new program reflects the need to provide access to digital tax account for small and medium business for online interaction with tax authorities. In addition, in 2020, UK taxpayers will be able to register with the tax authority, to pay taxes, to file a tax return, to update (refresh) their personal information, if necessary, anytime [23].

Internal Revenue Service of the USA (IRS) compensated for more than five billion dollars on tax returns in 2013, later established to be fraudulent. In 2016, the new items of the US information technologies allowed IRS to prevent tax fraud in the amount of 4.1 billion US dollars. Utah State identified an attempted fraud in declaring income tax: the possible damage would amount to 11 million US dollars. The expenses of the state on the introduction of new software and modified methods of tax control for analyzing the fraud income were less than 20 thousand US dollars [24].

In Finland, a Strategy for Tax Administration 2019–2024 [25] was adopted. The Finnish tax administration is integrated with external business platforms. The information system of tax administration MyTax is implemented there. Taxpayers are able to log into the system using their personal online banking codes, mobile certificate, and a Katso ID. In MyTax system, taxpayers can request a tax card, pay taxes, file a tax return (personal or corporate), to obtain and clarify the necessary information (personal data, tax liabilities) [26]. Gathering of information on taxpayer’s operations is as close to real time as possible, the tax is levied simultaneously with a taxable event.

Best practices of tax administration in the Russian forest sector are also associated with the introduction of new information technology. For example, with the software USAIS Les and AIS VAT–3. They (technologies) can effectively implement control measures, conduct analysis of relationships between counterparties, follow the business chain, from the origin of timber prior to sale to the final consumer, identify tax offences, conduct additional taxes and fees payments.

Currently, it is already possible to see the positive results of the digitalization of tax administration in forest management. Thus, the basis of the proceedings in criminal cases in the sphere of taxation has become more evident. In 2018, materials on the fact of extremely serious taxes evasion by OOO “LokchinLesProm” in the amount of 160 million rubles10 were submitted to the court.

Directions of improvement of tax administration in forest management

The conducted research allowed determining the following directions of improvement of tax administration in forest management intercon-nected with the management of forests, in terms of the economy digitalization:

– information technology development. In 2018, the FTS of the Russian Federation started the final phase of the project aimed at the introduction of automated tax administration system of the third generation – AIS Nalog-3. The information system (AIS Nalog-3) administers individual entrepreneurs and natural persons. In 2019, it is planned to complete the implementation processes of the tax administration of legal entities, i.e.

the largest block of the information system of Russian FTS [27];

– formation and structuring of big data base in the field of taxation including collecting and processing information about the forests’ state and structure (species and product) as an objective basis for taxation, the activities of taxpayers in forest management, emergencies (forest fires, flooding, etc.);

– increase of tax officials’ competence in the field of information technology : preparing highly qualified economists and, IT-specialists for the tax authorities;

– improvement of tax authorities’ Internetservices, which will help raise taxpayers’ awareness and comfort of interaction with tax authorities; make electronic interaction with other authorities and government agencies; use the opportunities of digital technologies in forest management tax administration effectively; exercise caution and assess taxpayers’ integrity when choosing the contractors from the standpoint of business transparency, etc.;

– use of information technology for citizens’ participation in the tax base control. Crowdsourcing for data collection is widely used in global practice [28, p. 270]. This area of crowdsourcing has emerged as a mechanism for obtaining information from citizens for more complete picture and concepts of the community [29]. Information received from citizens on the basis of information technologies through various means (text messages, social media, programs in smartphones, websites) can be used to generate and update a number of maps such as map of forest fires, illegal logging map, map of pollutant emissions into the environment in the forest sector, etc.) This will help reduce illegal logging, identify and bring the guilty to financial responsibility for the committed illegal actions in the forest sector etc.

In addition, the digitalization of tax administration in forest management, ensuring the integrity of tax collection and authorities’ communication, will allow local governments to provide economic justification to allocate a portion of natural resource rents of loggers and users of mineral resources to finance the construction and maintenance of roads of local significance and environmental measures in the forest sector, which will reduce the financial burden on local budgets.

Discussion of the Results

Scientific recommendations for improving tax administration related to the rationalization of forest management in the regions, interested in the growth of tax revenues, do not have a destination; formally, the main part of managerial functions in accordance with the Forest code is transferred to constituent entities of the Russian Federation, but the economy of forest management and tax administration in forest management is still beyond the scope of their powers. It turns out that the issue of improving public relations in the sphere of forest management and its tax administration in connection with the territorial development has long been studied, and it is widely presented in the works of domestic and foreign researchers, but it remains “infinitely urgent” and is essentially difficult to resolve.

The overcoming of the mentioned difficulties can be contributed to by the rationalization of the forestry activities management which structurally binds public and private interests such as taxation and tax administration. It means that the formation of a new tax administration system based on the relationship of forest management and administration of tax and non-tax payments for the use of forest resources is required, the successful functioning of which will increase the budget revenues necessary to finance public goods in the Northern territories of Russia.

Conclusion

Studied practical experience of tax administration in the system of forest management and its impact on the budgets of the Northern territories, taking into account the issues of forest management, revealed some deficiencies reflected in the shortfall of tax and non-tax revenues.

The conducted research allowed determining the areas of improvement of tax administration in forest management in the Northern regions of Russia interconnected with the system of forest management, based on the results of the analysis of fiscal payments for forest use and practices of tax administration by means of information technology, fixing, while assessing the impact of the implementation of programs for the development of forest sector, changes in tax revenues, using domestic and foreign experience of tax administration.

But it requires fulfilling three conditions:

-

1) to systematize tax control over forest management, including the usage of proposed groups of control measures and their implementation conditions;

-

2) to include non-tax forestry payments into the system of tax control;

-

3) to align forestry payments with the requirements of integrated forest management, taking into account their geosystem reproduction and preservation of ecological functions.

Список литературы Tax administration in the forest management system and its influence on the budgets of northern territories

- Ilyin V.A., Povarova A.I. Shortcomings of the tax administration of large business and their impact on regional budgets. Ekonomika regiona=Economy of Region, 2017, vol. 13, no. 1, pp. 25–37. DOI 10.17059/2017–1–3(In Russian).

- Povarova A.I. Inefficient VAT administration as a threat to Russia’s economic security. Ekonomicheskie i sotsial’nye peremeny: Fakty, tendentsii, prognoz=Economic and Social Changes: Facts, Trends, Forecast, 2013, no. 2 (26), pp. 126–140. (In Russian).

- Tsennost’ lesov. Plata za ekosistemnyye uslugi v usloviyakh “zelenoy” ekonomiki. [The value of forests. Payments for ecosystem services in a green economy]. Geneva, OON, 2014. 94 p. Available at: URL:http://www.unece.org/fileadmin/DAM/timber/publications/SP-34small_R.pdf (Transl. of: Geneva Timber and Forest Study Paper

- Available at: http://www.unece.org/fileadmin/DAM/timber/publications/SP-34Xsmall.pdf).

- Dmitrieva T.Е. The greening of the bio-resource economy of the Northern region. Ekonomicheskie i sotsial’nye peremeny: Fakty, tendentsii, prognoz=Economic and Social Changes: Facts, Trends, Forecast, 2018, vol. 11, no. 4, pp. 160–172. DOI: 10.15838/esc.2018.4.58.10 (In Russian).

- Modernizatsiya bioresursnoy ekonomiki severnogo regiona [Upgrading of bio-resource economy of the Northern region]. Syktyvkar: OOO “Komi Respublikanskaya Tipographiya”, 2018. 212 p.

- Fedichkina E.A., Lankin A.S. Analiz eksporta drevesnoy produktsii s Dal’nego Vostoka Rossii v 2015 g. Vsemirniy fond dikoy prirody (WWF). [Analysis of exports of wood products from the Far East of Russia in 2015. World wildlife Fund (WWF)]. Vladivostok: Apel’sin, 2016. 50 p.

- Chaykovskaya L.A. Evaluation of the influence of establishment and procedures of payments collection for the use of forest resources and forest fees on the level of forest revenues. Ekonomicheskiy analiz: teoriya i praktika=Economic analysis: Theory and Practice, 2007, no. 20 (101), pp. 42–54. (In Russian).

- Korobitsyn B.A. Methodological approach to the accounting for the depletion of natural resources, changes in environmental and human capital in gross regional product. Ekonomika regiona=Economy of Region, 2015, no. 3, pp. 77–88. DOI: 10.17059/2015-3-7 (In Russian).

- Noskov V.A., Shishelov M.A. Approaches to the assessment of the natural capital of forests and the prospects for modernization of forest management in the context of green economy. Ekonomicheskie i sotsial’nye peremeny: Fakty, tendentsii, prognoz=Economic and Social Changes: Facts, Trends, Forecast, 2018, vol. 11, no. 6, pp. 41–56. DOI: 10.15838/esc.2018.6.60.3 (In Russian).

- Ivlev V.A. Ekonomicheskiy mekhanizm upravleniya lesnymi resursami regiona [Economic mechanism of management of forest resources in the region]. Yekaterinburg: IE UrO RAN, 2003. 292 p.

- Petrov V.N., Katkova T.E., Karvinen S. Trends in the development of forestry in Russia and Finland. Ekonomicheskie i sotsial’nye peremeny: Fakty, tendentsii, prognoz=Economic and Social Changes: Facts, Trends, Forecast, 2019, vol. 12, no. 3, pp. 140–157. DOI: 10.15838/esc.2019.3.63.9 (In Russian).

- Goncharenko L.I. Nalogovoe administrirovanie kommercheskih bankov Rossii: monografiya [Tax administration of commercial banks of Russia: Monograph]. Moscow: Tsifrovichok, 2009. 168 p.

- Dong W. Several measures to perfect tax administration by law. Communications in Computer and Information Science, 2011, no. 210, CCIS (PART 3), pp. 227–231.

- Aberbach J.D., Christensen T. The challenges of modernizing tax administration: Putting customers first in coercive public organizations. Public Policy and Administration, 2007, no. 22 (2), p. 155–182.

- Hansford A., Hasseldine J. Best practice in tax administration. Public Money and Management, 2002, no. 22 (1), pp. 5–6.

- Besfamille M., C.P. Siritto. Modernization of tax administrations and optimal fiscal policies. Journal of Public Economic Theory, 2009, no. 11 (6).

- Chernick H. Fiscal Capacity in New York: the City versus the Region. National Tax Journal, 1988, vol. 51, no. 3, pp. 531–532.

- Barro S.M. State Fiscal Capacity Measures: A Theoretical Critique / Measuring Fiscal Capacity. Ed. by Reeves H. S. Boston: Oelgeschager, Gunn & Hain, Publishers, Inc., 1986. 60 p.

- Lesnoy plan Respubliki Komi [Forest plan of the Republic of Komi]. Vologda: Minprirody RK; Filial FGBU “Roslesinforg” “Severelesproekt”, 2019. 315 p.

- Fedotov D.Yu. Comparative analysis of tax burden and sizes of the shadow economy in Russian regions. Innovatsionnoe razvitie ekonomiki=Innovative development of the economy, 2016, part 1, no. 3 (33), pp. 142–148. (In Russian).

- Obzor i oglavlenie Doklada o mirovom razvitii “Cifrovye dividendy” [Overview and contents of the Report on world development “Digital dividend”]. DOI: 10.1596/978-1-4648-0671-1.A. Available at: https://data.gov.ru/sites/default/files/documents/vsemirnyy_bank_2016_god.pdf

- HM Revenue & Customs Making tax digital. Available at: https://www.gov.uk/govermment/publications/making-tax-digital

- Rethinking tax services: the changing role of tax service providers in SME tax compliance. Paris: OECD Publishing, 2016. P. 40.

- Now states are using tech to spot tax fraud. Available at: https://statetechma-gazine/com/article/2017/03/howstates- are-using-tech-spot-tax-fraud/

- Tax Administration Strategy 2019–2024. Available at: https://www.vero.fi/en/About-us/finnish-taxadministration/strategy/

- Finnish Tax Administration. Available at: https://www.vero.fi/en/About-us/finnish-tax-administration/

- Proekt itogovogo doklada FNS Rossii za 2018 god [The draft of the final report of the Federal tax service of Russia for 2018]. (Published 12.02.2019). Available at: https://www.nalog.ru/rn11/about_fts/og/

- Noveck B. S. Smart citizens, smarter state. The technologies of expertise and the future of governing [Transl. From English]. Moscow: Izdatel’stvo “Olymp-Bisnes”, 2016, 512 p.

- Geoffrey Barbier et al., Maximizing Benefits from Crowdsourced Data. Computational and Mathematical Organization Theory, no. 3 (September 2012), pp 2–23, URL: http://www.public.asu.edu/-hgao16/papers/CMOT.pdf