Taxation as the mechanism of regulation of the population's inequality

Автор: Kostyleva Lyudmila Vasilevna

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Social development

Статья в выпуске: 3 (15) т.4, 2011 года.

Бесплатный доступ

The article contains the analysis of the population’s taxation in the countries with the flat and the progressive rates of taxation. The information for the research was taken from the materials of periodical press concerning the subject of the research, and also federal and regional statistical data on wages, incomes and taxes paid by the population of the Vologda oblast were used. It was shown, that the redistributive mechanisms existing in Russia do not only reduce the population’s inequality, but to the opposite, promote its increase. The author offers the directions of adjustment of the mechanisms of redistribution.

Population's inequality in incomes, redistributive mechanisms, taxation of individuals, flat and progressive rates of taxation, tax burden of the population

Короткий адрес: https://sciup.org/147223267

IDR: 147223267 | УДК: 330.59:336.228(470.12)

Текст научной статьи Taxation as the mechanism of regulation of the population's inequality

Nothing demands so much wisdom and mind, as definition of those parts, which are taken from the citizens and what are left for them.

S. Montesquieu

Nowadays it is characteristic for the Russian society to have a high degree of stratification into rich and poor that is admitted at the official level and is one of the most actual social problems of the country. Modern researches have revealed, that the excessive population’s inequality is not only a destabilizing factor which creates the potential for conflicts’ occurrence, but also negatively influences economic and demographic parameters of the country, influencing industrial motivation and causing dysfunction of human behavior.

The problem of the considerable population’s inequality in incomes, observed in today’s Russia, long ago was overcome by the advanced states, but still exists in the majority of developing and transforming countries. The advanced countries’ experience shows, that the certain degree of equality in incomes can exist even at the market economy, and in many respects it is achieved due to the corresponding social policy of a state based on the essential share of social charges into the budget and the progressive population’s taxation.

Tax policy of the countries with the progressive rates of taxation. Nowadays in the world more than 200 states exist. In fifteen of them there is

Table 1. Tax policy characteristic in some countries with the progressive rates of taxation [2]

|

Country |

Income tax’s rates, % |

Income tax’s share, % |

|

|

In the federal budget, % |

In GDP |

||

|

The USA |

10 – 33 |

40.5 |

11.7 |

|

Canada |

17 – 29 |

37.8 |

14.1 |

|

Great Britain |

20 – 50 |

27.5 |

10.2 |

|

Germany |

15 – 43 |

25.0 |

9.3 |

|

Japan |

10 – 50 |

18.8 |

5.3 |

|

Denmark |

5.3 – 61 |

51.6 |

25.7 |

Table 2. The list of the countries using the flat rates of taxation [12]

|

Year of introduction |

Country (territory) and the income tax rate, % |

|

Before 1990 |

Jersey (20), Hong Kong (16), Guernsey (20), Jamaica (25) |

|

1994 – 1995 |

Estonia (26), Latvia (25), Lithuania (33) |

|

2001 |

Russia (13) |

|

2003 – 2004 |

Serbia (14), Iraq (15), Slovakia (19), Ukraine (15) |

|

2005 – 2006 |

Georgia (12), Kirghizia (10), Romania (16), Turkmenistan (10), Trinidad and Tobago (25) |

|

2007 |

Albania (10), Kazakhstan (10), Mongolia (10), Montenegro (15; 9 in 2010), Macedonia (12; 10 in 2008), Iceland (35,7; in 2010 the progressive rates were restored) |

|

2008 – 2009 |

Mauritania (15), Bosnia and Herzegovina (10), Bulgaria (10), Belarus (12), Czechia (15), Belize (25) |

no income tax, and more than in 150 countries the progressive rates of taxation is accepted. Arguments “pro” for the progressive rates of taxation’s use are the following: 1) one ruble’s loss by a needy person is not equivalent to the one ruble’s loss by a rich person; 2) the progressive rates of taxation can result in inequality decrease; 3) the unbalanced distribution of state services: the rich receive more benefits. In a result the progressive rates frequently plays a role of stabilizer which reduces economic processes’ volatility [12].

Let’s pay attention to some aspects of tax policy in some advanced countries with the progressive rates of taxation (tab. 1). The population’s income tax in the considered countries is the main or one of the main sources of the state budget, sometimes making up half of its volume. The share of income tax’s collecting to the gross national product in these countries makes 8.5 – 14.0% [2]. One of the factors promoting this are high rates of tax for wealthy layers of population; in some countries this rate can be 50 or 60%, as, for example, in Denmark, Japan and Great Britain.

There is the opinion that the progressive rates of taxation operate in a law-abiding society where the laws [12] are correctly applied and are executed more effectively. Also the necessary condition of the progressive rates’ use is strong tax administration that is connected to multi-stage character of income tax (up to 9 steps1).

The countries with the flat rates of taxation. Since 1990s of the previous century one of the important features of tax system’s evolution became the increasing distribution of the flat rates of income tax. If earlier the flat rates were only introduced in rather small countries and in some offshore jurisdictions, in 1990s this practice extended.

For example, in the middle of 1990’s the flat rate was chosen by the three Baltic republics, and at very high unified rate. For the last decade the number of the countries with the flat rates of income tax has sharply increased and by the beginning of 2010 it made 29 units (tab. 2) .

However the attentive sight at the list of the countries with the flat rates of income tax will allow finding out, that it includes the countries of the former socialist block or different small states. One of the West-European countries – Iceland – tried to introduce the flat rates of taxation, but later after this experiment it refused, and returned to the progressive taxation. Now the problem of the flat rates taxation’s introduction is considered in Poland (it is planned to establish the unified rate of tax of 17%), in Croatia, Hungary, Mexico. One general feature for the states which have already introduced or plan to introduce the flat rates is the great volume of “shadow” incomes.

Taxation of individuals in Russia. New tax system’s formation in Russia in 1991 was based on the necessity of application of the progressive taxation of the citizens’ incomes in 1992. According to the Law of the Russian Federation (December, 7, 1991, № 1998-I “About individuals’ income tax”) three rates of income tax were defined: 12% at cumulative taxable income in a year up to 10 million rubles, 20% from 10 million up to 50 million rubles, 30% from above 50 million rubles. Besides, employees made the payments to the Pension fund (1%), and the employer paid the following charges on wages: to the Pension fund 28%, to the Fund of Social Insurance 5.4%, to the Fund of Obligatory Medical Insurance 3.6%, to the Fund of Employment 1.5%. For 10 years the model of income tax’s collection from the citizens was not principally changed, if so, only in view of inflationary and denominational processes.

The role of income tax in the tax system of that time in comparison both with the industrial advanced countries, and with the most successful transitive economy, was rather insignificant. In overwhelming majority of the countries at that time (1994 – 1999) the share of income tax in the total sum of tax receipts made 25 – 30% (in Denmark – about 60%). The share of income tax in Russia was at the level of 8% [13].

It is possible to allocate some principal causes, determining the fact, that the income tax was not the significant tool of the tax policy at the initial transitional stages. Among them are: 1) the low level of the population’s incomes; 2) complexity of legislation and presence of the income tax’s privileges; 3) weak administration of collecting and, as a consequence, – mass evasion from taxation; 4) high level of taxation.

One more problem in Russia at that time were extremely great volumes of “shadow economy”: according to GosKomStat of Russia, in 1995 they were estimated at the level of 20% of the volume of gross national product, in 1996 – 23%, in 2000 – 40%. The “shadow economy” also generated the population’s latent incomes’ presence. The peak of latent payments took place in 1999 (38.4%), in a pre-reform year the share of latent payments made 31.0%. Therefore the main motive of introducing in 2001 in Russia the flat rates of taxation was aspiration to remove capitals from “shadow”, that is to legalize citizens’ incomes [6].

In 2001 Russia, first of the large countries, introduced the flat rates of income tax under the low rate of 13%. Two progressive rates (20 and 30%) for people with the high rate of incomes, as well as one-percentage deduction to the Pension fund, were cancelled. Nowadays Russia as the first large state, having introduced the flat rates, is the country, which experience is analyzed and considered as the argument in the discussion of the flat taxation’s problem.

In connection with the transition to the 13% rate of income tax at the first stage the reduction of the tax receipts was expected, but in reality the volume of payments did not decreased, it even increased, and it is essential: in 2001 payments in Russia grew for 27%. But the latent payment’s reduction however didn’t occur. Usually the result of changes in the tax laws can not be observed at once, but some time later. The cases of immediate reaction to the tax indulgences are exceptions [9].

The similar increase (20 and more percent a year) was typical in the Russian Federation both in 1999 and in 2000. The increase of payments to the budget a little increased in 2001, and this increase proceeded till 2003 when the maximal parameter for the whole period from 1995 to 2008 (11.0%) was observed2. This parameter of the consolidated budget in one of regions of Russia – the Vologda oblast – for the whole considered period was at a higher level, than in the country on the whole. In 2001 its share also increased in comparison with the pre-reform 2000 from 13.0 to 15.8% that was the result of the annual growth of receipts for 23%. However, the growth of volumes in 2000, in comparison with 1999, exceeded (in comparable estimation) for 40%3.

Thus, basing on the statistical information, it is possible to draw a conclusion that in 2001 there was some change in occupancy of the country’s budget due to the sums of income tax, however it could affect both tax, and non-tax factors, that especially proves to be true basing on the regional data. For this period, since 2000, the economy had developed actively, the prices for oil had increased, the credit markets had developed.

The increase in volumes of tax receipts for 2001 can be connected with the tax base’s expansion as a result of inclusion in the number of payers military men of the Ministry of Defense, employees of the Ministry of Internal Affairs, bodies of Federal Service of Tax Police, Office of Public Prosecutor and other power and law-enforcement structures [9].

Some researchers in the field of taxation have the opinion, that a determinative of increase in tax base of individuals’ incomes was the growth of nominal wages which, in turn, could be connected both to the factors of general-economic growth, and with the latent payments’ decrease. Really, among the rates of wages growth at the organizations and the tax volumes of individuals’ incomes, there is a strong direct relation (it is revealed on the basis of the statistical data analysis).

During the whole post-reform period the steady growth of the latent incomes’ volumes of the population was observed. The rates of their growth in some years even exceeded the rates of growth of total amount of monetary incomes. After 2001 the share of the latent incomes in the structure of monetary incomes decreased only for 1 item.

The scientist I.V. Gorsky, specialist in the field of tax-studying, considers, that the transition to the flat rates of taxation was erroneous step on the part of the state: “… our flat tax should be equal to the category of theoretical adventures” [3].

However there are also other opinions concerning the effect from the fulfilled reforms. So, the authors of the research “Myths and reality of the transition to the flat rates of taxation: microanalysis of evasion from taxes’ payment and well-being changes in Russia”, having become the winner of the National Premium in applied economy, approve, that as a result of tax reform, the positive effect as legalization of some part of “shadow incomes” was observed: the volume of the so-called “shadow economy” was reduced from 30 to 27%. People who received the highest incomes, and assessed before the reform by higher rates, increased declaring their incomes for 10 – 12%. The effect of the productivity growth was observed too, though considerably smaller, in comparison with the effect of reduction of evasion from tax payment [12].

According to calculations, carried by the head of Economic Expert Group, E. Gurvich, the economic benefit from introduction of the flat rates of income tax was insignificant – only 0.1% of gross national product. Moving salaries from shadow, in his opinion, could be connected to restoration after the crisis of 1998.

Introduction since 2001 of the flat rates, nevertheless, has not generated the proportional taxation in the country. The use of standard, social, property and professional deductions in the domestic model of taxation in combination with the presence of several tax rates results to that thing, when at low levels of incomes the tax system has feebly marked progressive character, further the proportional taxation actually takes place. The taxation can get regressive character depending on the scales of tax deductions’ use, incomes’ structures and other circumstances [8].

The establishment of the differentiated tax rates for various categories of incomes results in differentiation of the effective tax rate at the fixed income depending on the incomes structure. So, the higher is the share of dividends in the structure of gross revenues of the tax bearer, the lower is tax rate’s effectiveness. The similar thing: the higher is the share of interests under bank contributions to the structure of gross revenues, the lower is effective rate. Accordingly, the higher is the share of incomes from hiring employment, the higher is the effective rate.

The significant disorder of tax rates (13%, 35.0% or 9%) under the certain conditions and the presence of opportunity of the choice of kind of activity and kind of income inevitably generate tax maneuvering with the purpose of reduction of the total size of paid taxes. Moreover, the decision on the activity’s character in this case can be accepted by the tax bearer under the influence of the established tax rates, instead of proceeding from actually economic preferences.

In spite of the fact that the tax rate of individuals’ incomes in Russia is one of the lowest, the progression in taxation is practically absent, and the share of the tax in gross national product and tax incomes to the budgetary system is the lowest among the European countries, for the population this tax is a heavy burden.

The taxation of incomes at the rate of average wages in Russia (under the effective rate of 12.8%) is higher, than in the USA (11.5%), and also in Switzerland, Spain, Netherlands, Japan, Austria, Germany, Canada, Belgium, where the progressive taxation models operate. It means, that the basic burden of individual income tax in Russia is given to the category of the population with the incomes at the level by the average wages in the country (in 2009 this sum made 18 795 rubles a month), n comparison with the countries where the burden is given to the groups of the population with higher, than average, incomes [8].

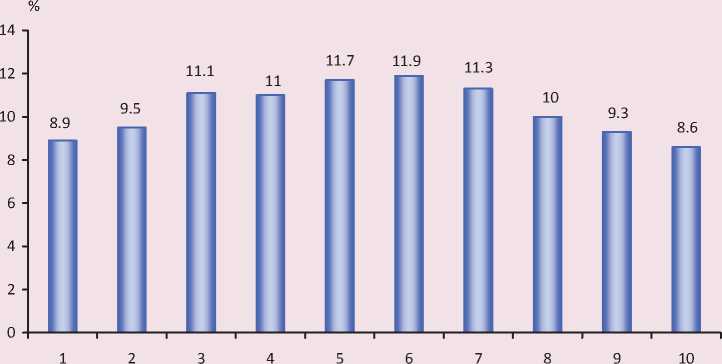

According to the selective inspection of the domestic facilities, which have been carried out in the Vologda oblast, we calculated the ratio of the sums of taxes, gathering and payments and monetary incomes of various social and economic groups of the population for the period from 2007 to 2009 (fig. 1) .

The generated parameter in the indirect mean (indirect – because besides the sum of income tax it includes taxes for land and property, transport and agricultural taxes, penalties, insurances, etc.) characterizes tax burden for the population. However, the parameter allows revealing, that the most significant tax burden is born by average in income groups from 3d to 7th. The share of taxes, gathering and payments of the wealthiest population is even lower, than the same parameter at the least wealthy. The found distinctions once again confirm a hypothesis about imperfection of the existing distributive mechanisms.

The found distinctions at the level of tax loading can be explained by the distinctions in the structure of monetary incomes of various decile groups of the population. The incomes of wealthy people on the average in Russia for 2/3 will consist of “other” monetary incomes, which the incomes of different kinds of property, dividends, interests and other receipts from the financial system concern.

Figure 1. The share of the sums of taxes, gathering and payments in monetary incomes of various socioeconomic groups of the population of the Vologda oblast in decile groups, average for 2007 – 2009, %

At the same time the level of the taxation rates of dividends, bank interests and rent (accordingly equal to 9%, 6% and 13%) is much lower than the level of the double wages’ taxation (the worker gives practically 40% of the incomes, paying the Unified social tax4 from the fund of payment – 26.2% and income tax from wages – 13%) [14]. That is, the incomes of labor activity appear to be in loss, in comparison with the investment incomes.

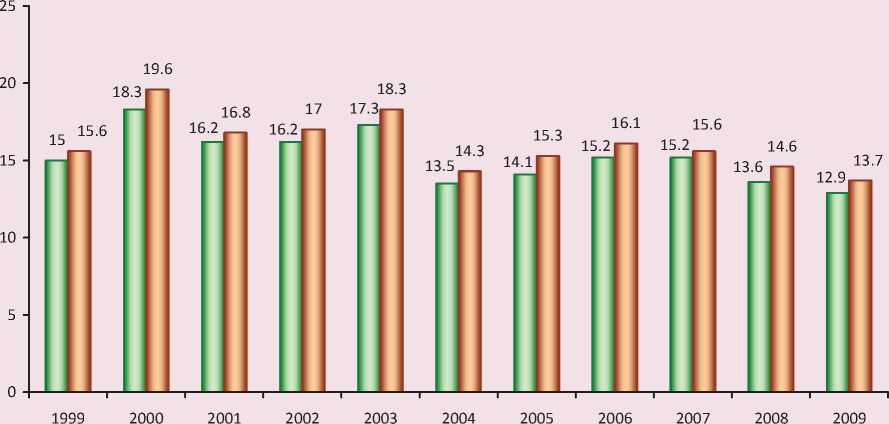

For revealing the influence of the redistributing mechanisms on the population’s inequality the factors of funds before taxation and after it were calculated (fig. 2). During the whole considered period the factor of funds under “pure” incomes is a little bit higher.

Thus, the system of distributive relations existing nowadays in Russia does not only promote the decrease of the socio-economic inequality, but also strengthens disproportions existing in the society.

The financial and economic crisis a little “smoothed” the population’s inequality, having negatively affected the level of incomes of the most solvent citizens.

However, the unfortunate trends in the structure of the society remained: the share of the population, which incomes were enough for only the purchase of food stuffs, increased to 40%. Thus the basic tax burden falls at the population with the average income that is potentially “middle class”.

Proposals on reforming redistributing mechanisms in Russia. For the whole decade of using the flat rates (from 2001 to 2010) the question on the necessity of the progressive taxation’s return in Russia has repeatedly risen. And, if in 2004 – 2008 the necessity of introduction of the progressive rates could be explained by the growing social injustice, since 2009 the basic motive of such offers was filling the budgets - both federal, and regional ones. The financial and economic crisis aggravated the given problem: from 2007 to 2009 total transfers to the regions from the center were doubled, and in 2009 the growth of their volume was especially fast.

Figure 2. Funds’ factors according to the population’s incomes in the Vologda oblast before and after taxation, 1999 – 2009

□ Before taxation □ After taxation

According to the budgetary strategy of the Russian Federation till 2023, developed by the Ministry of Finance of the Russian Federation, every year the deficiency of the consolidated budget of the country will increase, up to the level of 2.9% of gross national product in 2023. It was supposed, that the Reserve fund begins to be used for repayment of the formed deficiency and will be spent not earlier 2020. However, now, in connection with the sharp falling of incomes during the economic crisis and the budgetary deficiency’s growth up to 5.9% of gross national product (2009), it is expected, that the Reserve fund will be completely used up already in 2010 [1].

The international experience testifies that the income tax can be the major source of the state budget’s completion. So, in the USA the income tax brings about 40% of all incomes of the federal budget and 30% of incomes of the consolidated budget. In Russia the receipts from the tax for individuals’ incomes make about 10% of incomes of the consolidated budget that testifies to the significant potential of the tax receipts’ growth. As a result of the progressive tax rate introduction the growth of incomes of the regional budgets will prevent the occurrence of macroeconomic instability.

In I.V. Gorsky’s opinion, “… today the crisis makes the updating incomes’ taxation inevitable. Now the government has the moment which is favorable from the economic and political point of view to proceed from correct words to real affairs and to return, in particular, to the tax which is tested by world practice and effectively works” [3].

So, the necessity of introduction of the progressive rates of taxation is now caused by three points. First, the world practice shows, that the flat rates of taxation is the destiny of the backward countries with weak economy, not capable effectively to administer and collect taxes. The second basis for introducing the progressive rates of taxation is sharp falling of incomes of budgets in the subjects of the Russian Federation, threatening their financial stability.

For the recent 10 years the dependence of regions on the financial transfers from the federal center increased. The third basis is prompt growth of the stratification degree of the Russian society according to the incomes.

While introducing the progressive rates of taxation the most discussed question, undoubtedly, is the level of the tax rates. Scientists’ and politicians’ opinions in this case differ. So, the scientific supervisor at the Institute of Economics of the Russian Academy of Science, academician L.I. Abalkin offers the following division of the population into groups according to the income and the rates corresponding to them (tab. 3) .

L.I. Abalkin considers expedient to raise the level of the living wage up to 6 thousand rubles and not to assess with the income tax the incomes below the living wage. The maximal rate of the tax will be referred to the population with the monthly incomes, exceeding halfmillion rubles [10].

The first deputy head of the fraction of the Communist Party of the Russian Federation in State Duma S.N. Reshulsky in the co-authorship with the fraction comrades I. Melnikov, V. Kuptsov and V. Romanov developed and presented for discussion at the State Duma the bill “About the changes of Chapter 23 of Part Two of the Tax Code of the Russian Federation” (tab. 4) .

The maximal rate of income tax in S.N. Reshulsky’s offers is a little bit lower, than in L.I. Abalkin’s offers (20%), but at realization of such offers the maximal taxation will touch the population, whose incomes exceed 150 thousand rubles a month.

In our opinion, introduction of such actions will be negatively reflected in the position of the middle class – representatives of small business and highly skilled experts.

S.N. Reshulsky promises, that the changes offered by him in legislation will touch only one third of the most provided population, and the effect from their introduction will make 63.5 billion rubles (that is equal to 4% of the receipts’ volume in the consolidated budget of the Russian Federation or to charges of the federal budget of the Russian Federation for agriculture in 2009).

The fraction of the Communist Party of the Russian Federation prepared the project of the federal law “About the changes in the article 224 in Part Two of the Tax Code of the Russian Federation”.

The developer of the bill, the deputy of the fraction of Communist Party of the Russian Federation A.V. Bagaryakov considers, that the new bill providing introduction of the progressive rates of tax to individuals’ incomes, will allow to solve the problem of poverty and to fill the federal budget with additional

Table 3. The progressive rates of taxation offered by the Institute of Economics of the Russian Academy of Science

|

Income per month, thousand rubles |

Income per year, thousand rubles |

Tax rate, % |

|

Less 6 |

Less72 |

– |

|

6 – 100 |

72 – 1200 |

13 |

|

100 – 500 |

1200 – 6000 |

18 |

|

Over 500 |

Over 6000 |

23 |

Table 4. The progressive rates of taxation offered by S.N. Reshulsky [11]

|

Income per month, thousand rubles |

Income per year, thousand rubles. |

Tax rate, % |

|

Less 4.33 |

Less 50 |

10 |

|

4.33 – 50 |

52 – 600 |

13 |

|

50 – 116,67 |

600 – 1400 |

15 |

|

116.67 – 150 |

1400 – 1800 |

18 |

|

Over150 |

Over1800 |

20 |

Table 5. The progressive rates of taxation offered by A. V. Bagaryakov

|

Income per month, thousand rubles |

Income per year, thousand rubles |

Tax rate, % |

Expected effect, billion rubles |

|

Less 5 |

Less 60 |

5 |

-785 |

|

5 – 50 |

60 – 600 |

15 |

90 |

|

50 – 125 |

600 – 3000 |

25 |

60 |

|

125 – 1000 |

3000 – 12000 |

35 |

85 |

|

Over 1000 |

Over 12000 |

45 |

2650 |

Table 6. Arguments against the progressive taxation in Russia and their refutations

|

“Myths” |

Refutations |

|

1. The flat rates of taxation is the advantage of Russia before other countries, involving foreign investors. |

1. Substantial growth of volumes of foreign investments after the change in the tax laws of 2001 was not observed. |

|

2. Application of the progressive rates of taxation of individuals’ incomes will increase loading by tax bodies and will demand perfection of tax administration. |

2. Addressees of “super-incomes” (over 1800 thousand rubles one year) in Russia, by estimation, are about 420 thousand people, and the control over the finance of such quantity of the persons should not make the big difficulties. |

|

3. Introduction of the progressive rates will affect payments’ leaving in shadow (earnings in highly remunerative spheres: financial, oil-, gas and processing hydrocarbons’ spheres, power, etc.) |

3. Now in tax system the electronic databases are generated under the account of receipt of this tax in the federal budget. |

|

4. The progressive taxation will strike, first of all, the representatives of the middle class - highly paid experts and businessmen. |

4, 5. It is supposed to introduce such rates of taxation and to establish borders of profitable groups so that high rates have touched only “super-incomes”, instead of the mentioned representatives of the middle class. |

|

5. The motivation and, accordingly, labor productivity will decrease. |

means. A.V. Bagaryakov offered the following tax rates (tab. 5) . A.V. Bagaryakov approves that in total as a result of acceptance of the law in the state budget about 2.1 bln. rubles will be received, or about 5% of gross national product that will completely allow to cover the budget deficit (1.9 bln. rubles by the beginning of 2010) and to refuse external loans.

Three basic versions of introduction of the progressive rates of taxation can affect the domestic economy.

-

1. The economy will be thrown back. The supporters of this version approve, that Russia’s transition to the flat rates of income tax appeared to be justified and effective, and the return to the former, differentiated system can return the country back for seven years ago.

-

2. It will result in positive dynamics. This version is based on the experience of the western countries where the progressive rates of taxation recommended itself as a rather effective means of alignment of the social inequality.

-

3. Qualitatively it will not affect the development of the country. In the opinion of the experts, any essential changes in the

Russian economy in connection with acceptance of the progressive rates will not take place. The cancellation of the tax for poor will not improve their position much; the middle class will continue to pay the tax approximately under the same rate; and the means which are planned to be received from the taxation of the wealthy people’s incomes, appear not to be so significant [4].

The opponents of the progressive taxation of the population give the arguments submitted in table 6 .

Representatives of the financial and economic block of the Government instead of introduction of the progressive taxation system offer the other model of getting the incomes from the wealthy part of the population – by means of taxes for property. However the tax for property though it is accepted, practically does not work in view of the presence of some known ways of evasion from it.

In our opinion, the updating of redistributive mechanisms should occur in the following directions:

-

1. Introduction of the progressive rates of taxation of individuals’ incomes.

-

2. The Increase of the tax rate for the incomes as dividends: now the tax rate of the incomes as dividends make 9% that is much less, than the rate of the tax for labor incomes.

-

3. Introduction of the value-added tax for market cost for the real estate. It is necessary to remember, that at introduction of the value-added tax for the real estate one of the principles of the progressive taxation of individuals’ incomes should be observed: the raised rates should concern only to the real estate with a very high cost.

-

4. Introduction of the tax for luxury (subjects of art, jeweler ornaments, and

automobiles of extra-class, yachts, planes, helicopters and so forth). In this case it is necessary to determine legislatively – what objects, and of what cost concern to luxury.

The result of redistributive relations’ regulation should become the downturn of funds’ factor for the incomes up to values 7 – 9: such level of the parameter is not only socially fair, but also optimum in economic and strategic plans as at such parameters of distribution the most part of the population can realize the expectations in economic and reproductive behavior, preservation of the health, escalating of the human capital [14].

Список литературы Taxation as the mechanism of regulation of the population's inequality

- Bagaryakov, A.V. To take from the rich -to give to the poor: an explanatory note to the project of the Federal Law “About the changes in the article 224 in Part Two of the Tax Code of the Russian Federation” . -Available at: http://kprf.ru/dep/78088.html?print>

- Barabanov, I.V. Tax burden use with the purpose of the decrease of the social and economic differentiation in contemporary Russia: monography/I.V. Barabanov. -M., 2009. -119 p.

- Bryzgalin, А.V. To the question on the progressive taxation: to be or to not be? Or thoughts on the modern tax policy/A.V. Bryzgalin, M.V. Simononov//Taxes and the Financial Law. -№ 7. -2009.

- Vasilyeva, Ju. To take and to share. Russia can return to the progressive rate of income tax/Ju. Vasilyeva//Russian Business-newspaper. -№ 740 (7). -March, 2, 2010.

- Zhuravlyov, S. Good for the budget, neutral for the society/S. Zhuravlyov//Expert. -2010. -№ 14 (700). -April, 12.

- Quality of life and economic safety of Russia/V.A. Chereshneva, A.I. Tatarkina. -Ekaterinburg, 2009. -1184 p.

- Kostylyova, L.V. Social and economic inequality of the population of the region/L.V. Kostylyova, K.A. Gulin, R.V. Dubinichev. -Vologda, 2009. -143 pp.

- Lykova, L.N. Modern condition of the domestic tax system: some problems (the scientific report)/L.N. Lykova. -M., 2007. -66 pp.

- Medvedeva, O.V. The result of introduction of the flat rates of taxation of individuals’ incomes/O.V. Medvedeva//Financial problems of improvement of the state economy and enterprises in market conditions. -M.: Institute of economics and anti-recessionary management, 2005.

- Abalkin, L.I. About the heroes and the crowd /L.I. Abalkin//New newspaper. -№ 61. -09.06.2010. -Available at: http://www.novayagazeta.ru/data/2010/061/20.html

- Reshulsky, S.N. Nobody likes to pay taxes, especially the rich /S.N. Reshulsky. -Available at: http://kprf.ru/dep/80187.html

- Sabiryanova Peter, K. Report at the ceremony of the delivery of the national premium on applied economy for the article “Myths and the reality of the transition to the flat rates of taxation: microanalysis of evasion from payment of taxes and changes of well-being in Russia”. April, 8, 2010.

- Sinelnikov-Murylev, S. Estimation of the results of the income tax’s reform in the Russian Federation/S. Sinelnikov-Murylev, S. Batkibekov, P. Kadochnikov, D. Nekipelov//Scientific Researches № 52, the USA, 2003.

- Shevyakov, A.Ju. The problem of decrease of the rates of enequality and poverty in Russia/A.Ju. Shevyakov//Federalism. -2010. -1 (57). -Pp. 7-19.

- Russian Statistical Year-Book 2009/RosStat. -M., 2009.

- Statistical Year-Book of Vologda oblast/VologdaStat. -Vologda, 2008 -2009.