Taxation in the system of natural resource management and its influence on the economic development of northern territories

Автор: Lazhentsev Vitalii N., Chuzhmarova Svetlana I., Chuzhmarov Andrei I.

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Environmental economics

Статья в выпуске: 6 (60) т.11, 2018 года.

Бесплатный доступ

The paper considers types of taxes on and payments for the use of natural resources and shows their volume and dynamics in Northern regions of Russia. We highlight tax policy in the system of natural resource management from the point of view of coordinating private and public interests and observing social and territorial justice. The goal of the paper is to present the findings of a research on the theory and practice of taxation in the system of environmental management and its impact on economic development in the Northern territories. The objectives are as follows: to determine the types of tax exemptions for the use of non-renewable natural resources, to reveal current problems in fiscal relations, to establish general principles of taxation of environmental management and to assess its effectiveness. Scientific novelty of our study consists in the fact that we assess imbalances in the system of economic federalism in terms of taxation and the excessive gap between the places of production and consumption of natural resource revenues...

Types of taxes and payments, use of natural resources, taxation in the world and Russia, northern regions, performance assessment, volume, dynamics and structure of taxes, fiscal relations

Короткий адрес: https://sciup.org/147224105

IDR: 147224105 | УДК: 336.221; | DOI: 10.15838/esc.2018.6.60.7

Текст научной статьи Taxation in the system of natural resource management and its influence on the economic development of northern territories

We believe that the methodologically correct consideration of “Northern” taxes and payments can have a significant impact on the assessment of the state of the entire financial and budgetary system of the country. Financial relations between the center (Federation) and the Northern regions are currently becoming particularly relevant due to the aggravation of the problem of spatial gap between the created and consumed surplus product. The division of income between the state and the enterprises of the extractive industry is also connected with the difficulties in balancing their interests on the basis of a certain compromise. Our general initial premise is that the taxation of natural resources should be formed taking into account the future of resource-based regions; besides, it is necessary to perform effective transformation of natural resources into resources of direct social purpose.

Specific types of tax immunity have their own features in certain sectors of the natural resource economy; at the same time, there is a significant increase in the promising role of biological and water resources. But the current problems of regionalization of fiscal relations are largely related to the extraction of minerals, primarily hydrocarbons.

We try to analyze the current problems of distribution of taxes related to natural resources in the framework of existing theories of taxation from the point of view of the need to improve regional policy.

Content of the problem

The development and use of natural resources is the basis of socio-economic development in the Northern regions of Russia. The share of natural resource industries in their GRP ranges from 25% in Kamchatka Krai to 69% in Nenets Autonomous Okrug (2015).

The proportion of people employed in these industries is lower; for example, it is 23% in Nenets Autonomous Okrug. But the nature and dynamics of all other types of employment is determined mainly by the arrangement of the extractive industry, its institutions and the role played by the natural resource factor in the scientific and technological development of the country. Most researchers of resource-based regions are critical about the thesis of “resource curse”, “oil export dependence”, “dependence on raw materials”, etc. [1, 2, 3, 4, 5, 6, 7]. The main premise is that “resource wealth and good institutions are two fundamental factors that ensure sustainable economic growth in a long-term historical trend. In fact, it is political and economic axiom that needs no further explanation” [8, p. 88].

The question whether “to extract or not to extract” is not a problem one; the problems arise due to the existence of a variety of ways to assess resource potentials, their correct use, the inclusion of “raw materials and resources” in the system of social reproduction, the formation of end-to-end technological cycles “raw materials–semi-finished products– finished products”, the calculation and distribution of rental and other revenues, the implementation of the constitutional norm in terms of joint (Federation and subjects of the Federation) state regulation of processes and financial results of nature management. It is in this aspect that the subject of economic science comes to the fore with a focus on the formation of a new system of capitalization of labor and natural resources of society [9, 10]. In order to improve rent taxation and enhance its role in the sustainable development of regions, research is carried out on concrete mineral and fuel and energy complexes of Siberia and the European North of Russia taking into account world experience of environmental management institutionalization [11, 12, 13] and distribution of the corresponding income among the budgets of different levels and the funds of the future. Concern about the future of resource-based regions and mining centers is associated with the cyclical character of natural resources and involves the early accumulation of funds for their modernization or radical reconstruction.

We can assume that the relations in the system of environmental management are well elaborated and regulated by legal documents. And yet they still remain opaque, not sufficiently systematic, contradictory, and ultimately socially and territorially unfair. The situation here is such that we have to go back to the theoretical foundations of taxation issues and their revision under the due to the risks of depression in the regions with raw materials specialization.

Research results

The economic basis of natural resource taxation is the state ownership of subsoil, most of the land, forests, and water, as well as the need to create funds for public reproduction and national security. The principles of establishing the payments for the use of natural resources imply the necessity to harmonize private and public interests. Differences in the reproduction of mineral and biological resources are also taken into account.

From the standpoint of the laws of social reproduction and social justice, the fact that the state withdraws part of the income of specific economic entities is perfectly justified. In the system of environmental management, the need for this exemption (except for the classical approach to income taxes and environmental payments) is supported by the theory of natural resource rent (absolute and differentiated), formed in the works of the classics of political economy (A. Smith, D. Ricardo, K. Marx)

and economic scientists of the present day (J. Stiglitz, D. Ellerman, Dm. Lvov, etc.). The regional aspect of rent taxation taking into account geographical, geological and social conditions is thoroughly analyzed in the works of V.A. Kryukov, V.V. Shmat, T.E. Dmitrieva and other authors [14, 15, 16, 17, 18]. The works [19, 20, 21] emphasize the Northern specifics of the issues of socially significant approach to financial and economic relations. These works consider various options for the payments for the right to develop mineral deposits and various options for the establishment of norms to withdraw superprofits. It is shown that the “ideal” calculation, withdrawal and distribution of natural resource rent could make minor changes in the volume and structure of GRP and significant changes in the formation of incomes of people and territorial budgets. Methodological difficulties of finding an unambiguous and acceptable practical solution for the calculation and withdrawal of rental income are revealed.

It is necessary to take into account the fact that in our country the tax load on subsoil users is the highest in comparison with other economic sectors: in 2017 in Russia – 10.8%, in the sector of fuel and energy minerals extraction – 45.4%, in the mining sector, except for fuel and energy, – 18.8%. Here, the payment of taxes is carried out both under the traditional system, including profit tax, value added tax, property tax, transport tax, export and import duties and other mandatory payments, through which the fiscal sovereignty of the country is realized, and also through special tax payments for the use of natural resources, namely mineral extraction tax, water and land taxes. Here we add fees for the use of objects of fauna and other biological resources1.

Analysis and explanation of the results

Taxes in environmental management have a significant impact on the assessment of the condition of the entire financial and budgetary system of the country. For example, in 2015, GDP in Russia was 80 trillion rubles, taxes and fees – 14 trillion, and the tax burden was only 17.5%, i.e. its level was relatively low. But “... the actual level of tax burden is significantly higher than the officially declared one. If its calculation takes into account the receipt of these payments withdrawn from the tax system, as well as oil and gas revenues (oil and gas production tax, export customs duties on oil, gas and oil products), which are not reflected in the revenues of the budget of the current year, but are sent to the state (federal) reserve stabilization funds, then the tax burden in the economy in recent years will be about...38-40% of GDP. This level roughly corresponds to the average European tax burden (ranging from 27.8% in Ireland to 48.2% in Denmark) and significantly exceeds its value in the U.S. economy (24%) and Japanese economy (28.1%). Thus, we come to an obvious conclusion: it is necessary to return customs duties, fees for harvesting raw wood (forest tax), regular payments for negative environmental impact (environmental tax) to the tax system” [22]. The example given above shows that before declaring that “our taxation in the field of raw materials and fuel is quite moderate”, it is necessary to make a clear record of all financial and budgetary flows. In addition, the monitoring of specific tax rates for the extraction of multi-component complex ores in Krasnoyarsk Krai (the rates were established on mineral extraction tax as of January 1, 2017) will make it possible to prepare recommendations for their distribution to other types of minerals, including common ones, and to other regions, and to take into account specific features of nature management related to taxation in the Northern regions [23].

Financial relations between the center (Federation) and the regions are currently coming to the fore due to the aggravation of the problem of spatial gap between the created and consumed surplus product. This problem has historical prerequisites for the development of capitalism in Russia. At the time, N.N. Baransky showed its essence on an example of a pre-revolutionary situation in the cities of Ivanovo-Voznesensk and Moscow: the former manufactured goods (fabrics), and the latter accumulated the profit from the sales of those goods. Workers in Ivanovo-Voznesensk considered such a situation as socially unfair, which greatly contributed to their revolutionary mood [24]. And at present, the geography of income and consumption reflects territorial and social injustice: Moscow and some other large centers and their surroundings benefit from the concentration of capital, while other regions – especially the North – lose. One of the reasons for this lies in undetected and undistributed natural resource rent, the great portion of which is accumulated far from where it was created. The problems of spatial gap between the created and consumed surplus product will continue after the introduction of a new tax regime for the oil sector from January 1, 2019. The tax on additional income in the extraction of hydrocarbon raw materials will be introduced, and the amount of its inflow in the budget will depend on the amount of the estimated cash flow from the activities for the development of a separate subsoil plot (taking into account global market prices for hydrocarbon raw materials) and on the capital and operating costs for its production actually incurred and paid by the taxpayer. The problems will linger because the revenues to the budget after the introduction of a tax on additional income from hydrocarbon production and the reduction of the total amount of budget revenues under the new tax regime (mineral extraction tax and export customs duty on oil) due to the dependence on gross indicators, concern only the federal level.

The division of revenues between the state and the natural resource user is connected with the difficulties of maintaining the balance of their interests on the basis of a certain compromise . But in any case, the state should not allow the user of natural resources to appropriate the unearned part of the profit. The latter should have a profit of sufficient size to develop production and maintain economic incentives to exploit not only the best or highly profitable, but also hard-to-exploit fields. Here it is necessary to take into account mutual relations between business and local authorities. For instance, in the Republic of Komi, the tendency toward strengthening the links between corporate and territorial development has become more noticeable. In 2018, corporations operating in the Komi Republic began to invest significant funds not only in production, but also in the development of territories and in social environment. LUKOIL, Gazprom, Rosneft, Transneft, Mondi SLPK, Renova, Severstal, RUSAL and other companies increased the volume of financial support to 4.2 billion rubles2 (5.5% of the consolidated budget revenues in the Republic).

Taxation of natural resource management implies taking into account the future of resource-endowed regions and effective transformation of natural resources into resources of direct social purpose. The analysis performed by T.E. Dmitrieva on the formation and distribution of funds for future generations, for example, the Alaska Permanent Fund, shows that they can be considered as territorial-resource trust funds [25]. The main points of the formation and use of this kind of trust funds are as follows: establishment of specific sources of formation, favorable placement of capital, elaboration of a dividend program, organization of management, and people’s awareness. The general idea is to increase and protect domestic financial capital, the source of which is the common resource property.

In addition to outlining the current problems of fiscal relations, the theory of taxation of natural resources allows us to understand general principles essential for the strategy of state economic management:

– legislative establishment of taxes and fees for the use of natural resources should be carried out on the basis of legal norms: universality and equality of taxation; actual ability of economic entities to pay them; inadmissibility of discriminatory taxation and manipulation of elements of taxes (differentiated rates of taxes and fees for the use of natural resources, and tax benefits) depending on the form of ownership of the taxpayer and citizenship of natural persons or the place of origin of capital;

– establishment of taxes and fees for the use of natural resources should not violate the unity of the economic space of the country and should not limit the free movement of capital;

– parity between the fiscal and regulatory functions of taxes on the use of natural resources should be maintained, taking into account national and regional interests.

Assessment of environmental taxation effectiveness in the Northern regions of Russia

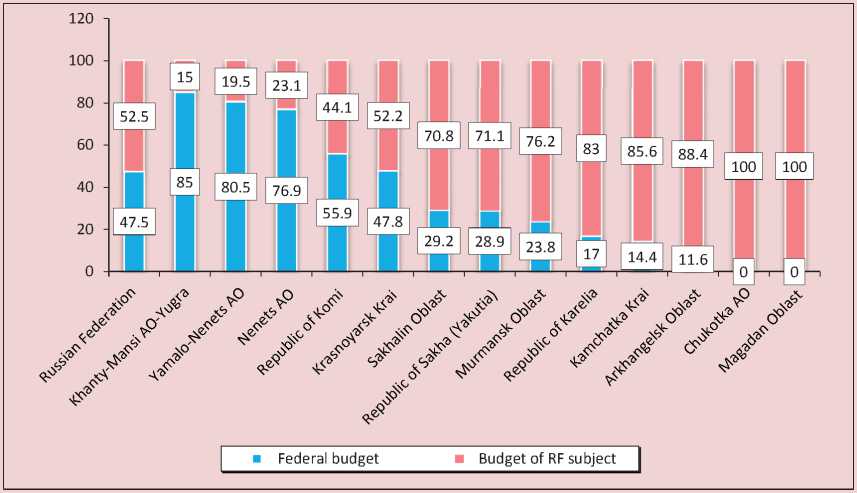

The proportion of taxes received by the federal budget and by consolidated budgets of the Northern constituent entities of the Russian Federation amounted to 47.5 and 52.5%, respectively, which is quite an acceptable proportion. But this ratio differs significantly in specific regions (Fig. 1) . For instance, in 2016, the ratio of tax revenues of the federal to territorial budgets was (as a percentage): in Khanty-Mansiysk Autonomous Okrug – 85 to 15, in Yamalo-Nenets Autonomous Okrug – 81 to 20, in Nenets Autonomous Okrug – 77 to 23, in the Komi Republic – 56 to 44 (for comparison: in 2000 – 42 to 58).

Figure 1. Proportion of taxes received by the federal budget and the budgets of Northern constituent entities of the Russian Federation in 2016, %

Source: Statistical tax reporting of the Federal Tax Service. Available at: (accessed March 14, 2018).

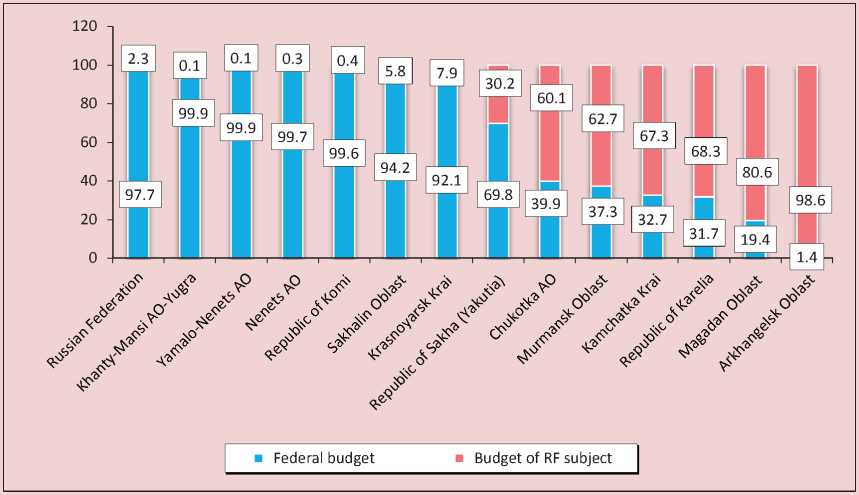

Figure 2. Proportion of taxes, fees and resource payments for the use of natural resources (total) received by the federal budget and the budgets of Northern constituent entities of the Russian Federation in 2016, %

Source: Statistical tax reporting of the Federal Tax Service. Available at: (accessed March 14, 2018).

In these constituent entities of the Russian Federation, the proportion of taxes, fees and payments for the use of natural resources (total), received by the federal budget and the budgets of constituent entities of the Russian Federation in 2016, amounted to more than 99% (Fig. 2) . At the same time, in six of the twelve Northern regions under consideration, more than 60% of the total payments for the use of natural resources was received by the budgets of the following constituent entities of the Russian Federation: Chukotka Autonomous Okrug – 60%, the Murmansk Oblast – 63, Kamchatka Krai – 67, the Republic of Karelia – 68, the Magadan Oblast – 81, the Arkhangelsk Oblast – 99%.

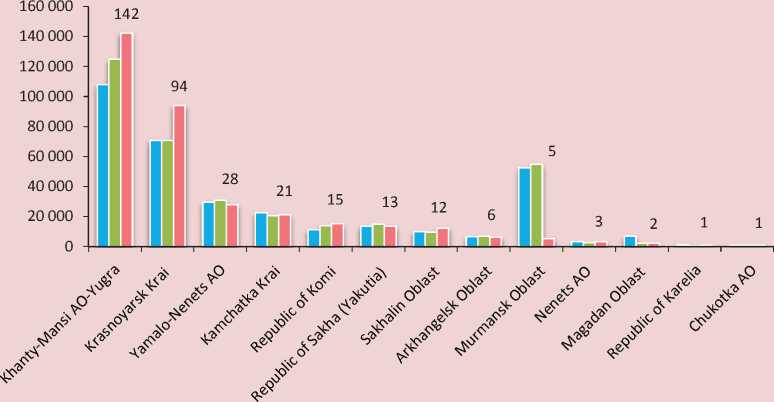

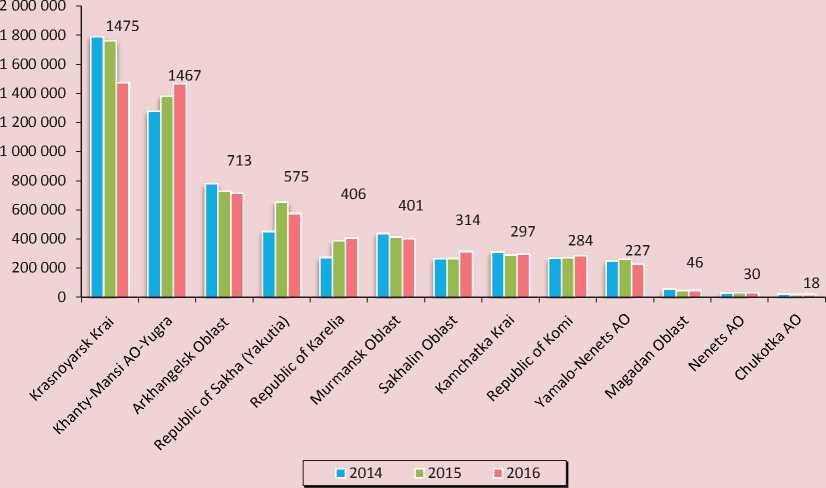

Redistribution of natural resource taxes and payments in favor of the federal budget or territorial budgets depends on the type of resources (taxes on oil, gas, coal, land, forest, water are distributed differently). Therefore, the very problem of the unsatisfactory state of territorial budgets should also be considered in a differentiated way. It is particularly acute in the areas of oil and gas specialization, but is little visible in the areas specializing in hunting, fishing, agriculture and forestry. The presence of specific types of natural resource economy determines the dynamics of budget revenues, taxes, fees and payments for the use of natural resources and the dependence of the economy on the world markets. It is for this reason that budget revenues from resource payments decreased in six of the twelve Northern constituent entities of the Russian Federation; these entities include Khanty-Mansi Autonomous Okrug, Krasnoyarsk Krai, the Republic of Komi, the Republic of Sakha (Yakutia), the Sakhalin and Magadan oblasts (Fig. 3).

Figure 3. Dynamics of revenues from taxes and fees for the use of natural resources received by the budget in the Northern regions of Russia in 2014–2016, million rubles

|

1233703 537140 121507 68344 64031 53823 25246 5099 |

5086 |

2572 |

1192 |

219 |

821 |

|||||||||

|

Khanty-Mansi AO- Yugra |

Yamalo- Nenets AO |

Krasnoyarsk Krai |

Republic of Komi |

Republic of Sakha (Yakutia) |

Nenets AO |

Sakhalin Oblast |

Magadan Oblast |

Chukotka AO |

Murmansk Oblast |

Kamchatka Krai |

Arkhangelsk Oblast |

Republic of Karelia |

||

|

2014 |

1405767 |

452470 |

118439 |

64969 |

50113 |

36609 |

26852 |

3651 |

3112 |

2134 |

1021 |

510 |

711 |

|

|

2015 |

1 459 9 |

499444 |

137274 |

78045 |

73541 |

50007 |

26003 |

5215 |

4923 |

2525 |

1092 |

1 826 |

753 |

|

|

2016 |

1233703 |

537140 |

121507 |

68344 |

64031 |

53823 |

25246 |

5099 |

5086 |

2572 |

1192 |

219 |

821 |

|

2014 2015 2016

Source: Statistical tax reporting of the Federal Tax Service. Available at: (accessed March 14, 2018).

Table 1. Structure of revenues from taxes and fees for the use of natural resources received by the budget in the Northern regions of Russia in 2016

|

■О |

% ‘Ajijua jugnjijsuoo jh jo эивцд |

g |

oq |

CD |

oq |

C\1 |

co |

CD |

to |

о |

to |

2 |

2 |

to |

2 |

5 g g g 5 to X X to о to |

|

% ‘9nU9A9J XBJ |BJOJ UI 9JB4S |

co to |

CD |

co |

g |

CD |

co co |

LO |

oo |

cd |

to |

LO co |

to LO |

oo to |

|||

|

9ПН 'U||/\| |

s |

co |

to |

§ |

LO |

to |

to |

co |

co |

g |

co |

co |

to to |

|||

|

*2 Ъ "g аз О ~ ” о £ о go оо cd аз £ Ъ О |

% ‘Ajijug jugnjijsuoo jh jo эивцд |

g |

2 |

CD |

CD |

2 |

to |

to to |

to |

to to |

||||||

|

% ‘9nU9A9J XBJ |BJOJ UI 9JB4S |

to |

g |

g |

о |

g |

О |

to |

2 |

g |

cd |

to |

” |

||||

|

ana 'U||/\| |

co CD LO |

CD |

LO |

CD to |

^r |

csi |

g |

co co |

co |

co |

^ |

cd |

LO |

|||

|

X S |

% ‘Ajijug jugnjijsuoo jh jo эивцд |

g |

CO CO |

CSI |

CD |

CD |

CD |

CD |

to |

to |

co |

о |

to |

|||

|

% ‘9nU9A9J XBJ |BJOJ UI 9JB4S |

to |

о |

g |

co |

o |

О |

g |

О |

to |

to |

to |

to |

g |

to |

||

|

ana 'uiiai |

to |

CSI |

c5 |

to |

LO |

co |

to |

to |

csl |

1- |

LO |

co |

i- |

csi |

||

|

5 |

% ‘Ajijub jugnjijsuoo jh jo эовцд |

g |

csi |

co oo |

CO cJ |

eJ |

oq |

co |

2 |

to |

to |

to |

co |

я |

||

|

% ‘9nU9A9J XBJ |BJOJ UI 9JB4S |

2 |

LO |

co co co |

to co |

co |

g |

s |

LO |

to co |

to |

co |

to |

||||

|

ana 'uiiai |

co to to CD to |

LO co co to |

co LO |

oo co to |

co го |

O> CD CO CO |

LO |

to to oo |

IO |

IO |

to |

csi |

s |

|||

|

|BJOJ ‘S9nU9A9J ХВ1 |

oo co |

co co |

co |

CD CO to CO |

§ |

to CD LO |

to |

cd to |

to oo |

to LO |

to to |

oo to to |

oo to LO to |

to to |

||

|

о 5 |

о < s XT |

о < о E 5 |

cd ^ o' |

Ё о x: 'o s |

to 'o S |

О < |

О 00 |

о 1 |

О < |

о E 5 |

О < |

'o s |

cd ^ E |

|||

The structure of inflow of taxes and fees for the use of natural resources to the budget varies considerably throughout the Northern regions (Tab. 1) , due to the difference in the types and volumes of natural resources involved in the economic turnover of the country. Namely, the total volume of production of hydrocarbons and other minerals in Khanty-Mansi, Yamalo-Nenets, Nenets and Chukotka autonomous okrugs, the Republic of Komi, Krasnoyarsk Krai and the Republic of Sakha (Yakutia) and other Northern regions of Russia allowed for collecting 2.1 billion rubles of mineral extraction tax. Thus, the Northern regions account for 72% of the total inflow of the tax into the budget. With the national average value of the proportion of mineral extraction tax being 20.4% the figure ranges from 2% in Kamchatka Krai to 84% in Nenets Autonomous Okrug. The proportion of water tax and fees for the use of wildlife objects and for the use of water biological resources in all the Northern regions is insignificant – less than 1 % (except for Kamchatka Krai – 1.89%), the proportion of land tax does not reach 2%.

Taxation of mineral extraction . Mineral extraction tax has the largest share among resource payments. Its dynamics in the Northern regions of the country varies considerably (Tab. 2) .

Budget revenues from mineral extraction tax in Russia over the past 10 years increased in 2.4 times. In 2016, compared with the previous year, tax revenues decreased by 9.2%; this also happened in five (out of twelve) Northern subjects of the Russian Federation: in Khanty-Mansi Autonomous Okrug – by 15.5%, in Krasnoyarsk Krai – by 11.5%, in the Republic of Komi – by 12.4%, in the Republic of Sakha (Yakutia) – by 12.9%, in the Magadan Oblast – by 2.2% (Fig. 4). At the same time, the significance of the Northern subjects of the Russian Federation for the country as a whole is different. Despite the decrease in the absolute value of the tax, Khanty-Mansi Autonomous Okrug has the largest share – 42.1% of the total amount of mineral extraction tax in the country. The following factors influenced the decline in budget revenues from mineral extraction tax: the dynamics of world oil prices,

Table 2. Mineral extraction tax in the Northern regions of Russia in 2014–2016, million rubles

|

Constituent entity |

2014 |

2015 |

Yearly dynamics, 2015 to 2014, % |

2016 |

Proportion, % |

Yearly dynamics, 2016 to 2015, % |

|

Russian Federation |

2 904201 |

3226831 |

111.1 |

2929408 |

100 |

90.8 |

|

Khanty-Mansi AO-Yugra |

1405651 |

1459803 |

103.9 |

1233552 |

42.1 |

84.5 |

|

Yamalo-Nenets AO |

452436 |

499408 |

110.4 |

537107 |

18.3 |

107.6 |

|

Krasnoyarsk Krai |

118344 |

137177 |

115.9 |

121384 |

4.1 |

88.5 |

|

Republic of Komi |

64954 |

78027 |

120.1 |

68325 |

2.3 |

87.6 |

|

Republic of Sakha (Yakutia) |

50085 |

73507 |

146.8 |

63997 |

2.2 |

87.1 |

|

Nenets AO |

33879 |

47504 |

140.2 |

52014 |

1.8 |

109.5 |

|

Sakhalin Oblast |

4034 |

8925 |

221.4 |

8994 |

0.3 |

100.8 |

|

Magadan Oblast |

3546 |

5164 |

145.6 |

5050 |

0.2 |

97.8 |

|

Chukotka AO |

3022 |

4891 |

161.8 |

5044 |

0.2 |

103.1 |

|

Murmansk Oblast |

1802 |

2199 |

122.0 |

2250 |

0.1 |

102.3 |

|

Arkhangelsk Oblast |

420 |

1747 |

416.0 |

2117 |

0.1 |

121.2 |

|

Republic of Karelia |

658 |

703 |

106.8 |

771 |

0.03 |

109.7 |

|

Kamchatka Krai |

553 |

594 |

107.4 |

602 |

0.02 |

101.3 |

Source: Statistical tax reporting of the Federal Tax Service. Available at: (accessed March 14, 2018).

underestimation of promising opportunities for the development of the manufacturing sector of the Russian economy, and tax administration.

Water tax. Its role in the budget revenues of the country and the Northern regions is insignificant (Tab. 3) . The share of the

Figure 4. Dynamics of mineral extraction tax receipts in the budget of the Russian Federation from the Northern regions of Russia in 2014–2016, million rubles

|

1233552 |

||||||||||||||

|

537107 |

||||||||||||||

|

121384 |

||||||||||||||

|

■ Ill |

68325 ■■■ |

63997 52014 8994 |

5050 |

5044 |

2250 |

2117 |

771 |

602 |

||||||

|

Khanty-Mansi AO- Yugra |

Yamalo-Nenets AO |

Krasnoyarsk Krai |

Republic of Komi |

Republic of Sakha (Yakutia) |

Nenets AO |

Sakhalin Oblast |

Magadan Oblast |

Chukotka AO |

Murmansk Oblast |

Arkhangelsk Oblast |

Republic of Karelia |

Kamchatka Krai |

||

|

2014 |

1 405 6 |

452 436 |

118344 |

64954 |

50085 |

33879 |

4034 |

3546 |

3022 |

1802 |

420 |

658 |

553 |

|

|

2015 |

1459803 |

499408 |

137177 |

78027 |

73507 |

47504 |

8925 |

5164 |

4891 |

2199 |

1 747 |

703 |

594 |

|

|

2016 |

1233552 |

537107 |

121384 |

68325 |

63997 |

52014 |

8994 |

5050 |

5044 |

2250 |

2117 |

771 |

602 |

|

2014 2015 2016

Source: Statistical tax reporting of the Federal Tax Service. Available at: (accessed March 14, 2018).

Table 3. Water tax in the Northern regions of Russia in 2014–2016, million rubles

|

RF constituent entity |

2014 |

2015 |

Annual dynamics, 2015 to 2014, % |

2016 |

Proportion, % |

Annual dynamics, 2016 to 2015, % |

|

Russian Federation |

2201 |

2551 |

115.9 |

2270 |

100 |

89.0 |

|

Khanty-Mansi AO-Yugra |

108 |

125 |

115.7 |

142 |

6.3 |

113.6 |

|

Krasnoyarsk Krai |

71 |

71 |

100 |

94 |

4.1 |

132.4 |

|

Yamalo-Nenets AO |

30 |

31 |

103.3 |

28 |

1.2 |

90.3 |

|

Kamchatka Krai |

22 |

21 |

95.5 |

21 |

0.9 |

100 |

|

Republic of Komi |

11 |

14 |

127.3 |

15 |

0.7 |

107.1 |

|

Republic of Yakutia (Sakha) |

14 |

15 |

107.1 |

13 |

0.6 |

86.7 |

|

Sakhalin Oblast |

10 |

10 |

100 |

12 |

0.5 |

120 |

|

Arkhangelsk Oblast |

7 |

7 |

100 |

6 |

0.3 |

85.7 |

|

Murmansk Oblast |

52 |

55 |

105.8 |

5 |

0.2 |

9.1 |

|

Nenets AO |

3 |

3 |

100 |

3 |

0.1 |

100 |

|

Magadan Oblast |

7 |

2 |

28.6 |

2 |

0.1 |

100 |

|

Republic of Karelia |

1 |

1 |

100 |

1 |

0.0 |

100 |

|

Chukotka AO |

1 |

1 |

100 |

1 |

0.0 |

100 |

Source: Statistical tax reporting of the Federal Tax Service. Available at: (accessed March 14, 2018).

Northern regions ranges from 6.3% in Khanty-Mansi Autonomous Okrug to 0% in Chukotka Autonomous Okrug, due to the specifics of water use.

Water tax receipts to the budget in the Russian Federation for the period of 2007–2016 increased in 1.5 times: from 1,484 to 2,270 million rubles. Their volume and dynamics broken down by regions (Fig. 5) depend on the nature of production, number of population and tariff policy.

Among other factors, we note the following:

-

1. The authorities of the subjects of the Russian Federation lack the competence to change the elements of water tax as a federal tax. We should note that until 2005 the authorities of constituent entities of the Russian Federation were granted the right to adjust (depending on the physical-geographical, hydro-regime and other features of water

-

2. Underestimation of the ecological value of water tax. Thus, wastewater discharge is excluded from the object of taxation. A fee is charged for the discharge of pollutants into water bodies, which has no direct connection with the entire water management system.

-

3. Excessive tax administration.

bodies) federal rates of payment within their maximum and minimum values. It is expedient to restore this right.

These disadvantages are due to the lack or use of outdated measuring instruments necessary to account for the amount of water taken. Taxpayers determine this figure according to the amount of water registered in the invoices received by customers and also according to the norms of use of water by residents who do not have counters, excluding the losses during in its intake or in the networks of water pipes.

Figure 5. Dynamics of water tax receipts in the budget of the Russian Federation from the Northern regions of Russia in 2014–2016, million rubles

■ 2014 ■ 2015 2016

Source: Statistical tax reporting of the Federal Tax Service. Available at: (accessed March 14, 2018).

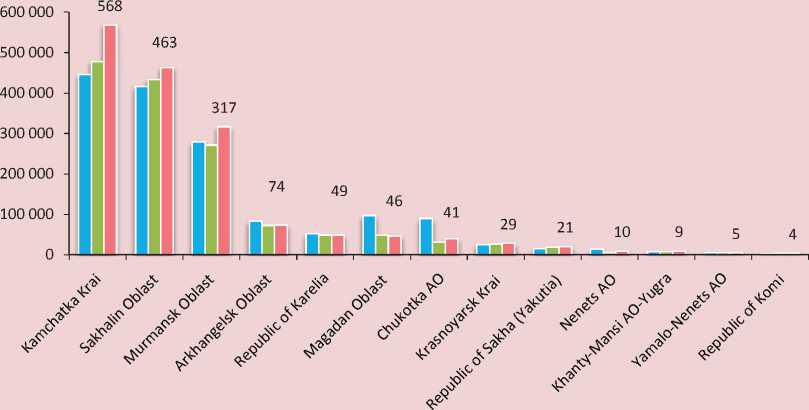

Charges for use of objects of fauna and objects due to the state ownership of natural resources. of water biological resources. They are permissive Their role in the formation of budget revenues and at the same time compensatory in nature, is insignificant (Tab. 4) .

Table 4. Charges for use of objects of fauna and for use of objects of water biological resources in the Northern regions of Russia in 2014–2016, million rubles

|

RF constituent entity |

2014 |

2015 |

Annual dynamics, 2015 to 2014, % |

2016 |

Proportion, % |

Annual dynamics, 2016 to 2015, % |

|

Russian Federation |

2386 |

2237 |

93.7 |

2593 |

100 |

115.9 |

|

Kamchatka Krai |

446 |

477 |

107.0 |

568 |

21.9 |

119.1 |

|

Sakhalin Oblast |

416 |

434 |

104.3 |

463 |

17.9 |

106.7 |

|

Murmansk Oblast |

280 |

271 |

96.8 |

317 |

12.2 |

117.0 |

|

Arkhangelsk Oblast |

83 |

72 |

86.7 |

74 |

2.9 |

102.8 |

|

Republic of Karelia |

52 |

49 |

94.2 |

49 |

1.9 |

100 |

|

Magadan Oblast |

98 |

48 |

49.0 |

46 |

1.8 |

95.8 |

|

Chukotka AO |

90 |

32 |

35.6 |

41 |

1.6 |

128.1 |

|

Krasnoyarsk Krai |

25 |

26 |

104. 0 |

29 |

1.1 |

111.5 |

|

Republic of Yakutia (Sakha) |

15 |

20 |

133.3 |

21 |

0.8 |

105.0 |

|

Nenets AO |

14 |

5 |

35.7 |

10 |

0.4 |

200 |

|

Khanty-Mansi AO-Yugra |

8 |

8 |

100 |

9 |

0.4 |

112.5 |

|

Yamalo-Nenets AO |

5 |

5 |

100 |

5 |

0.2 |

100 |

|

Republic of Komi |

4 |

4 |

100 |

4 |

0.2 |

100 |

Source: Statistical tax reporting of the Federal Tax Service. Available at: (accessed March 14, 2018).

Figure 6. Dynamics of receipts in the budget of the Russian Federation of the charges for use of objects of fauna and objects of water biological resources from the Northern regions of Russia in 2014–2016, million rubles

■ 2014 2015 ■ 2016

Source: Statistical tax reporting of the Federal Tax Service. Available at: (accessed March 14, 2018).

The receipt of the fees for the use of objects of fauna and objects of aquatic biological resources to the budget in the Russian Federation over the past 10 years increased slightly, only by 15%, and amounted (as of 2016) 2,593 million rubles. (Fig. 6 ) . In 2016, compared to the previous year, the revenues increased or remained at the same level in eleven Northern regions of the Russian Federation out of twelve. The decrease in the fees occurred in the Magadan Oblast (by 4.2%).

The insignificant volume of receipts of the fees for the use of objects of fauna and objects of water biological resources to the budget from the Northern regions of Russia is caused by the following factors:

– lack of competence of the authorities of the subjects of the Russian Federation to change the elements of the fees, taking into account specific features of the region, including the possibility of increasing or reducing the rates of fees depending on changes in the population of wildlife in certain territories;

– problems of administration of fees associated with the complexity of accounting for the population of animals and birds and objects of aquatic biological resources;

– the list of the objects of taxation of the objects of fauna and objects of water biological resources established by Article 333.3 of the Tax Code of the Russian Federation does not contain some types of objects of hunting widespread in the Northern regions of Russia, including ducks, partridges, geese, foxes, and hares;

– unlicensed use of objects of fauna and objects of water biological resources, under which the subjects of hunting and fishing do not calculate these fees and do not pay them to the budget.

Land tax. In the North, the importance of land tax for local budgets and for the national budget is small – less than 1% (Tab. 5) .

Land tax revenues received by the budget in the Russian Federation over the past 10 years increased in 2.6 times: from 68,943 million rubles in 2007 to 176,417 million rubles in 2016. Compared to the previous year, the tax decreased by 4.7%; it also happened in the six (out of twelve) Northern subjects of the Russian Federation: in Krasnoyarsk Krai – by 16.3%,

Table 5. Land tax, broken down by the Northern regions of the Russian Federation in 2014–2016, million rubles

RF constituent entity 2014 2015 Annual dynamics, 2015 to 2014, % 2016 Proportion, % Annual dynamics, 2016 to 2015, % Russian Federation 175299 185131 105.6 176417 100 95.3 Krasnoyarsk Krai 1789 1762 98.5 1475 0.8 83.7 Khanty-Mansi AO-Yugra 1277 1381 108.1 1467 0.8 106.2 Arkhangelsk Oblast 779 726 93.2 713 0.4 98.2 Republic of Yakutia (Sakha) 451 653 144.8 575 0.3 88.1 Republic of Karelia 272 386 141.9 406 0.2 105.2 Murmansk Oblast 438 413 94.3 401 0.2 97.1 Sakhalin Oblast 264 265 100.4 314 0.2 118.5 Kamchatka Krai 309 289 93.5 297 0.2 102.7 Republic of Komi 267 270 101.1 284 0.2 105.2 Yamalo-Nenets AO 247 260 105.3 227 0.1 87.3 Magadan Oblast 56 46 81.1 46 0.0 100 Nenets AO 28 30 107.1 30 0.0 100 Chukotka AO 22 19 86.4 18 0.0 94.7 Source: Statistical tax reporting of the Federal Tax Service. Available at: (accessed March 14, 2018).

Figure 7. Dynamics of land tax receipts in the budget of the Russian Federation from the Northern regions of Russia in 2014–2016, million rubles

Source: Statistical tax reporting of the Federal Tax Service. Available at: (accessed March 14, 2018).

in the Arkhangelsk Oblast – by 1.8%, in the Republic of Sakha (Yakutia) – by 11.9%, in the Murmansk Oblast – by 2.9%, in Yamalo-Nenets Autonomous Okrug – by 12.7%, in Chukotka Autonomous Okrug – by 5.3% (Fig. 7) .

Problems of taxation of land plots are due to a number of circumstances, such as: the lack of consideration of specific features of the zones of risky agriculture; incomplete accounting of the number of land plots and shares in the right to land plots; parallel effect of the right of lifetime inheritable ownership and the right of ownership, frequent changes in the structure of the total tax base; declarative nature of the valuation of land plots on which multiapartment houses are situated; illegal use of preferential taxation at the rate of 0.3% for the land plots classified as agricultural land used for other purposes; information resources of tax authorities and other state and local authorities are often not interrelated, the issues of their use for management decisions have not been resolved.

Discussion of the results

Scientific and analytical review of different types of taxation in the system of environmental management raises the thoughts about their role in the future. It is possible to highlight the underestimation of economic work in terms of land, water and forest resources. A bioresource economy is now in the background of the mineral-raw materials and fuel and energy resources. But it will soon become of paramount importance for the organization of life in the regions of the Arctic and the North; and therefore it is necessary to create a new mechanism for the flow of capital from the mining industries to the sectors of agriculture, forestry and water management. In our opoinion, it is in this process that properly organized taxation of environmental management and improvement of budget activities can lead to the desired result of stable development.

Conclusion

Our study of the practical experience of taxation in the field of environmental management, taking into account the problems of natural resource-type regions, revealed some shortcomings both within the tax policy and in its insufficient role in stimulating the Northern territories.

We believe that it is necessary to implement the following measures:

– to conduct an “inventory” of the legislation of the Russian Federation on taxes and fees and other normative acts regulating social relations in the field of environmental management, in order to systematically link all its components;

– to develop guidelines for the definition, withdrawal and distribution of rental income using the typology of deposits, land, forest and water areas under the conditions of their development; the Ministry of Finance of Russia can be a possible organizer and form a working group with the involvement of scientists and experts;

– to assess more thoroughly the environmental component in determining the tax burden on the users of natural resources, taking into account their participation in environmental protection at the expense of their own financial resources;

– to organize a special audit and independent examination of the reliability of indicators of the general tax base and tax potential in the field of environmental management;

– to improve intergovernmental fiscal relations in order to increase revenues of the budgets of subjects of the Russian Federation and municipalities, with the use of long-term stable standards;

– to take into account specific features of the Arctic and the North as much as possible; to stimulate rational use of natural resources within the framework of tax policy in extreme and difficult climatic conditions with the use of tax regulation tools (tax rates, adjusting coefficients to the tax base, tax benefits and tax deductions, tax credit, tax sanctions).

Список литературы Taxation in the system of natural resource management and its influence on the economic development of northern territories

- Guriev S., Plekhanov A., Sonin K. Economic mechanism of the resourcce-based model of development. Voprosy ekonomiki=Issues of Economics, 2010, no. 3, pp. 4-24..

- Auty R.M. Sustaining Development in Mineral Economies: The Resource Curse Thesis. London: Routledge, 1993. 273 p.

- Baldwin R.E. Patterns of development in newly settled regions. Manchester School of Social and Economic Studies, 1956, no. 24, pp. 161-179.

- Hirshman A.O. A generalized linkage approach to development with special reference to staples. In: M. Nash Essays on Economic Development and Cultural Change in Honor of Bert F. Hoselitz. Chicago III: University of Chicago Press, 1977. Pp. 67-98.

- Sachs J.D., Warner A.M. Natural resource abundance and economic growth/NBER Working Paper Series no. 5398. December 1995; Sachs J., Warner A. Fundamental Sources of Long Run Growth. American Economic Review Papers and Proceedings, 1997, vol. 87, no. 2, pp. 184-188.

- Shelomentsev A.G., Belyaev V.N. Assessment of the impact of the development of mineral resources on the economic security of Russia. Ekonomika regiona=Economy of Region, 2012, no. 2, pp. 144-152.

- Shelomentsev A.G., Doroshenko S.V., Choijil E. The post-soviet space-government socio-economic development through the concept of "natural recourse curse. Zhurnal ekonomicheskoi teorii=Russian Journal of Economic Theory, 2015, no. 2, pp. 17-29..

- Kuleshov V.V. (Ed.). Resursnye regiony Rossii v "novoi real'nosti" . Novosibirsk: IEOPP SO RAN, 2017. 308 p.

- L'vov D.S. Economic manifesto. Svobodnaya mysl'=Free Thought, 1998, no. 6, pp. 5-22..

- L'vov D.S. Razvitie ekonomiki Rossii i zadachi ekonomicheskoi nauki . Moscow: Ekonomika, 1999. 79 p.

- Ponkratov V.V. Oil production taxation in Russia and the impact of the maneuver. Journal of Tax Reform, 2015, vol. 1, no. 1, pp. 100-111.

- Garnaut R., Clunies-Ross A. Taxation of Mineral Rents. Oxford University Press. 1983. Available at: https://EconPapers.repec.org/RePEc:oxp:obooks:9780198284543

- Daniel P., Keen M., McPherson C. The Taxation of Petroleum and Minerals: Principles, Problems and Practice. New York: Routledge Taylor & Francis Group, 2010. 480 p.

- Kryukov V.A., Tokarev A.N., Shmat V.V. Problems of differentiation of taxation in the gas industry of Russia. In: Sbornik materialov mezhdunarodnogo nauchnogo kongressa "GEO-Sibir'-2007": Nedropol'zovanie. Novye napravleniya i tekhnologii poiska, razvedki i razrabotki mestorozhdenii poleznykh iskopaemykh . Novosibirsk: Sib. gos. geodezicheskaya akad. 2007. Vol. 5. Pp. 88-92..

- Kryukov V., Tokarev A., Shmat V. Differentiation of taxation in the gas industry: a step-by-step approach to implementation is needed. Gazovyi biznes=Gas Business, 2007, pp. 18-22..

- Sevast'yanova A.E., Shmat V.V. Situational analysis of diversification of the economy of an oil and gas region.// Region: ekonomika i sotsiologiya=Region: Economics and Sociology, 2006, no. 2, pp. 49-66.

- Lazhentsev V.N. (Ed.). Toplivnyi sektor Respubliki Komi: napravleniya i metody regulirovaniya razvitiya . Syktyvkar: Komi NTs UrO RAN, 2002. 416 p.

- Kireyeva E. Tax regulation in agriculture: current trends, selection of a state support forms. Journal of Tax Reform, 2016, vol. 2, no. 3, pp. 179-192.

- Lazhentsev V.N. Public nature of the concepts for economic development in the Northern and Arctic regions of Russia. Ekonomicheskie i sotsial'nye peremeny: faktory, tendentsii, prognoz=Economic and Social Changes: Factors, Trends, Forecast. 2016, no. 4, pp. 43-56..

- Shelomentsev A.G., Doroshenko S.V., Kozlova O.A., Belyaev V.N., Toskunina V.E., Provorova A.A., Gubina O.V., Ilinbaeva E.A. Formirovanie sotsial'no-ekonomicheskoi politiki severnykh regionov Rossii s uchetom faktora osvoeniya prirodnykh resursov: kollektivnaya monografiya . Yekaterinburg: Institut ekonomiki UrO RAN, 2011. 140 p.

- Chuzhmarova S.I. Socio-economic development of the Northern regions in terms of reforming mineral extraction taxation. Federalizm=Federalism, 2009, no. 2 (54), pp. 179-190..

- Nikulina O.M. Nalogovaya nagruzka v Rossii: osnovnye podkhody . Available at: http://1-fin.ru/?id=972 (accessed 27.05.2018).

- The main directions of the budget, tax and customs tariff policy for 2019 and the planning period of 2020 and 2021 (approved by the Ministry of Finance of Russia). Website of the Ministry of Finance of Russia. Available at: https://www.minfin.ru (accessed 19.11.2018)..

- Anuchin V.A. et al. (Eds.). Baranskii N.N. Izbrannye trudy: Stanovlenie sovetskoi ekonomicheskoi geografii . Moscow: Mysl', 1980. 287 p.

- Lazhentsev V.N., Dmitrieva T.E. Geografiya i praktika territorial'nogo khozyaistvovaniya . Yekaterinburg: Nauka, 1993. 137 p.

- Ilyin V.A., Povarova A.I. Shortcomings of the tax administration of large business and their impact on regional budgets. Ekonomika regiona=Economy of Region, 2017, vol. 13, no. 1, pp. 25-37..

- Chuzhmarova S.I., Chuzhmarov A.I. Taxation of the use of objects of fauna in the Northern (Arctic) regions of Russia: ecological and economic approach. Ekonomika i upravlenie. Izvestiya Dal'nevostochnogo federal'nogo universiteta=Economics and Management. Proceedings of the Far Eastern Federal University, 2018, pp. 146-155.