Taxation of digital services: theory, international practice and domestic prerequisites

Автор: Koroleva Lyudmila P.

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Critical economic issues

Статья в выпуске: 3 (63) т.12, 2019 года.

Бесплатный доступ

Reforming corporate taxation taking into account customer value creation concept is a necessary stage in the transformation of the Russian tax system. It will help make it just and efficient in the context of the digital economy in which major IT corporations gain super profits from the use of big data and provision of digital services, the cost of which largely depends on the participation of customers. The goals of the present research are as follows: to substantiate theoretical prerequisites for increasing the tax burden on the companies that use big data as a factor of production, to identify trends and patterns in the modern stage of reforming the taxation of revenues resulting from the provision of digital services in foreign countries, and to substantiate the presence of potential for its application in Russia. In the course of our research we identify features of big data as a factor of production; they demonstrate the need for a special approach to the taxation of income from its use and are important for the identification of the object of taxation. In the light of the European tax reform aimed to create a fair and effective tax system in the digital economy we make an overview of the current practice of introducing digital services tax in the EU member states; we also consider some polemical provisions that require further research. Having analyzed the financial performance and tax burden of the largest IT companies Yandex N.V. and Mail.Ru Group for 2013-2018, we reveal the trend of outstripping growth of gross income and profit in comparison with the amount of tax paid. We also find out that the structure of income is dominated by the items falling under digital services taxation, as well as factors contributing to the reduction of the tax burden. We conclude that Russia has the potential to introduce digital services tax in the medium term.

Digital services tax, big data, digital capital, digital rent, customer value creation, gafa tax, google tax, multinational it company

Короткий адрес: https://sciup.org/147224189

IDR: 147224189 | УДК: 336.22:654.072.7 | DOI: 10.15838/esc.2019.3.63.6

Текст научной статьи Taxation of digital services: theory, international practice and domestic prerequisites

The digital economy is changing the structure of capital as a factor of production, and the sources of wealth accumulation are changing along with it. “Digital capital not only replaces different types of human labor, but also reproduces itself easily and cheaply at minimal costs of other factors. Through integration of existing sources of labor and capital and creation of new products, services and business models, new “digital” technologies displace labor and material and intellectual capital” [1, p. 11]. A striking example of this effect can be found in the displacement of small producers and traders from local markets while the network of digital platforms in the field of the Internet of things is expanding.

The digital economy enhances the market concentration, monopoly power and revenues (among other things through government subsidies and tax incentives) of IT companies and companies in other industries in which digitalization becomes a competitive advantage. In 2018, 50% of the world’s major companies gained their revenues from the use of big data. The volume of the global big data market will increase fourfold by 2025 compared to 2015 and will amount to 90 billion USD1.

The theory and practice of taxation of new sources of income and wealth lags far behind the pace of development of the digital economy. On the one hand, traditional and well-developed rent taxation instruments (here we mean digital rent) are quite applicable in the context of digitalization. On the other hand, the specific object of taxation – revenue from the use of big data and a wide range of possible taxpayers engaged in the processing of personal data and content – require special tax structures that help assess objectively, as well as remove fairly and effectively part of the digital rent, without slowing down the pace of economic development. Thus, the agenda of the thirteenth G20 Summit raised fundamental questions about “how the digital economy generates value; when value is created; and how it is possible to report and collect taxes fairly and effectively, without impeding innovation”2 (Buenos Aires, 2018).

In view of the above, the hypothesis of our study is based on the statement that corporate taxation reform, taking into account the concept of customer value creation, is a necessary step in the transformation of the Russian tax system to ensure its fairness and efficiency in the digital economy, allowing the largest IT corporations to gain super profits from the use of big data as a factor of production and from the provision of digital services, the cost of which largely depends on the participation of users.

The problem of reforming the taxation of digital services is caused by the fact that neither theoretical studies nor world practice has an adequate generally recognized tool (tax), which provides for imposing fair tax burden on the revenue derived from the provision of digital services:

-

1) the modern international system of value added taxation levies taxes on the revenue generated from the sales of services rendered in electronic form, according to the European model (depending on the segment in which the services are provided at the place of the main activity of the buyer or at the place of the buyer’s location) or the New Zealand model (at the place of actual consumption of services). In Russia, VAT is levied according

to the European model since 2017 if foreign organizations provide services in electronic form. Since 2019, the Federal Tax Service of Russia has tightened the regulations regarding mandatory registration of foreign organizations. However, the current procedure for taxation of Russian e-service providers, involving a number of exemptions from payment in order to stimulate the domestic IT industry, is often used by transnational companies to optimize the tax burden, which allows them to reduce the effective tax rate. According to the calculation of the actual effective rate of VAT levied on foreign and Russian IT companies providing services in the field of digital content, the increase in the profitability of their activities by 1 % entails a 0.1525% decrease in the VAT accrued for payment to the budget [2];

-

2) the modern international corporate taxation system involves taxation of income in countries where business creates value. However, this principle is not effective in relation to those business models for which value creation depends in part on the involvement and participation of customers who may be located in another country. This makes it necessary to transform the corporate taxation system taking into account customer value creation. However, this is a long-term perspective, the effective implementation of which is possible only in countries that apply the rules of consolidated income taxation to transnational companies. As we know, Russia has a moratorium on the creation of consolidated groups of taxpayers, even within the country.

In this regard, the so-called GAFA tax – an indirect tax on the income from certain types of digital activities – is the only possible tool that Russia can use to form a fair tax burden on transnational organizations that provide services in electronic form. GAFA tax is currently being discussed in the EU countries; our paper considers it as well. In case of its adoption in Russia, it can make the distribution of tax revenues between Russia’s constituent entities more fair, depending on where the profit from digital services is generated (taking into account the location of the customer when receiving the service).

The proposed model of GAFA tax in European countries can be integrated into Russian tax legislation, which is formed in the image and largely in the likeness of the European. However, this initiative has not received wide coverage in Russia. Currently, much attention is paid only to streamlining the procedure of VAT collection from digital services, the so-called Google tax. Our study draws the attention of the scientific community, tax authorities and other interested groups to the discussion on reforming the taxation of revenues generated from the provision of digital services in the context of customer value creation; this circumstance determines practical importance of the present research.

The goals of our study are as follows: to substantiate theoretical prerequisites for increasing the tax burden on IT companies that use big data as a factor of production, to identify trends and patterns inherent in the modern stage of reforming corporate taxation of revenues generated from the provision of digital services in the context of customer value creation, and to substantiate the presence of the potential for its application in Russia.

Research data and methodology

Theoretical and methodological basis of our research is formed by the works of D.S. Lvov [3], S.A. Kimel’man [4], E.A. Kuklina [5], S.V. Chernyavsky [6], V.V. Ponkratov [7] and other economists engaged in the study of rent taxation of natural resources [8]. The phenomenon of “digital” rent is used in the works by T.N.

Yudina [9]. The initial information base of the study consisted of the publications in foreign scientific literature on optimal taxation in the digital economy, taking into account the following features: large network effects, bilateral platforms, collection and use of personal data, and erasing the boundaries for economic activity [10-15]; the works on international taxation by a team of authors supervised by M.R. Pinskaya [16], and as a number of publications on the taxation of operations for the provision of electronic services [17-19].

However, according to the analysis of the above mentioned works of Russian scientists, it is concluded that the improvement of taxation of digital business in the context of customer value creation is not given enough attention. In modern scientific literature, the range of issues related to taxation, including the allocation and identification of the object of taxation (property, turnover or profit), determination of taxpayer category (business (corporation), digital rentier, consumer of digital services) and the moment of the obligation to pay the tax (when certain scale of activity is achieved), is recognized as one of the most relevant [20, p. 124]. However, we could not find examples of research on improving the taxation of major IT-holdings’ revenues generated from the processing of big data in the context of customer value creation, and examples of research on modern foreign taxation practice in this field. We agree with researcher A.N. Kozyrev who points out that “while the debate on the digital economy is dominated by discussion of its opportunities, prospects, new forms of business based on digital platforms and blockchain technology, we can say that the issues concerning taxation and those related to the creation and destruction of value remain in the background, even though they affect the interests of all economic entities, including the population, business and the state”3. Our study is devoted to filling these gaps, and this is what constitutes its scientific relevance.

To achieve the goal that we set out in the paper, we use general scientific research methods (analysis and synthesis, comparison, analogy), methods of vertical and horizontal economic analysis of organizational performance in the following stages:

– we substantiate the need to increase tax burden on the recipients of digital rent on the basis of clarifying the content of the category of “big data” as a factor of production in the digital economy;

– we consider the initiatives and experience of foreign countries in the introduction of GAFA tax and its analogues;

Resolutions of EU member states on the improvement of corporate taxation in the digital economy, retrieved from official websites of their authorities, and public financial state-ments of Yandex N.V. and Mail. Ru Group were used as information base in our study. Data on financial performance are presented in accordance with the management reporting of companies, and therefore may differ from the data based on IFRS. Some indicators of corporate financial performance for 2018 were converted to euros at the rate of 74.81 calculated as an arithmetic mean of the nominal exchange rate of the euro to the ruble at the end of each quarter of 2018 (70.56; 72.99; 76.23; 79.46)4.

Research results

Big data as a special factor of production in the digital economy

Big data has three defining properties: volume, velocity (speed of data processing and obtaining a result) and variety; additional properties of big data are as follows: veracity, viability, value (value and economic feasibility of processing), variability, and visualization. In all cases, these properties emphasize that the defining feature is not only the physical volume of big data, but also other properties that are essential for understanding the complexity of the task of their processing and analysis. These characteristics, as well as the basic properties of information, in our opinion, determine some features of big data as a factor of production:

-

1) it is a secondary resource, the result of processing and analysis of huge volumes of primary diverse, structured and unstructured information, including personal data;

-

2) it has the property of self-growth – primary information emerges every minute, is being continuously accumulated, structured and processed, which leads to the emergence of a new information product that can bring a specific profit. At the same time, for most owners, primary data or content created by them is a non-economic good that has little use and exchange value (with the exception of media personalities, bloggers and other individuals with a certain level of publicity). In contrast, big data is an economic good of a productive nature with high use and exchange value;

-

3) it has zero marginal resource costs due to voluntary, mandatory and conditionally gratuitous (if you do not take into account the fact that the owner of the data is able to use

the functionality of the digital platform, which transmits and places its data) nature of obtaining (“producing”) primary and personal data from individuals; as well as relatively low marginal costs of accumulation, processing and dissemination of big data;

-

4) it is universal, because with proper processing and analysis, big data can be useful and in demand in different production and non-production areas, which allows us to conclude that the demand for big data does not depend much on the demand in the markets of final goods and services compared to other factors of production;

-

5) it is inexhaustible and indestructible (preservation of properties in the process of consumption) and can bring income to the owner many times (most often in the form of an intangible asset);

-

6) it is partially interchangeable with other factors of production, is highly mobile and easy to replicate, which leads to the existence of stable demand in the market of final goods and services;

-

7) it produces specific income – information differential rent II associated with obtaining additional profit when using information products and services that have increased their value (usefulness) as a result of additional investments. The classic sources of big data are the Internet of things and social media, which have an opportunity to receive monopoly information rent in the form of fixed surplus income. In contrast to differential rent, monopoly information rent is stable, fixed and is obtained by the owners of particularly valuable and rare information resources [21]. Moreover, modern scientific community starts using such concepts as information-and-digital capital (big data and tools for their processing and analysis) and digital rent received by digital platforms due to the possession of the exclusive right to use unique and valuable information and digital capital [22].

These features allow owners of big data, as part of digital capital – a key factor of production in the digital economy, to be highly competitive and receive huge revenues in the form of digital rents, due to the monopoly power that arose as a result of the coverage of a large number of customers. At the same time, the dominant position of technology companies is most often explained by their leading position in the market and by the conservatism or habit of customers, for whom the transition to other digital platforms (services) is fraught with time expenditure and with the loss of data and contacts, and sometimes even impossible, for example, if corporate business (communication) is conducted on a certain platform. The limited number of consumers on the planet and their physical ability (due to time constraints) to use digital products is becoming one of the main factors impeding the entry of new actors on the market, along with the usual barriers typical of the markets in which competition is imperfect. The ability to access the data of as many customers as possible is a key factor in business competitiveness. Customers themselves “become a natural resource, the access to which (in the conditions of sovereign countries) can and should be provided on a fee-paying basis, just like the access to any natural monopoly” [1, p. 13]. We think that the payment in the form of a mandatory tax, which will be an instrument of redistribution of dividends of the digital economy, is the only one that is adequate to the scale of income received.

Initiatives of foreign countries to introduce GAFA tax

Currently, “the data economy exists not only unregulated, but untaxed, and it’s probably no surprise that in a time of massive market capitalizations (based in many cases on accumulated data held by companies) state budgets are dying”5. The effective income tax rate for digital business models ranges from 10% to 25%. On average, the income of digital business models is taxed at the rate of 10.2%, and the income of traditional business models – at the rate of 22%6. Therefore, the introduction of an additional tax on the use of personal data is currently being actively discussed in the EU.

In January 2013, France considered an initiative to levy an Internet tax on the collection of personal data – the “raw material” of the digital economy – by Facebook, Google, Amazon and other technology companies. It was proposed that tax rates would be based on the number of users an Internet firm tracked, to be verified by outside auditors7. The specific elements of the tax were not made available to the general public, but the discussion reached the EU and OECD levels. Certain alternatives were proposed back in 2017: an equalizing tax on the turnover of digital companies in the form of an independent tax or that integrated in a corporate income tax; an autonomous tax on digital transactions; a tax on the income derived from the provision of digital services or advertising8.

In March 2018, the European Commission, as part of the reform of fair taxation of the digital economy, proposed an initiative to introduce a tax on the turnover of major digital companies called GAFA (Google,

Apple, Facebook, Amazon) tax. It is proposed to introduce this tax at the rate of 3% of the income received from activities in which users play an important role in creating value and which is most difficult to take into account in accordance with the current tax rules:

– placing user-oriented advertising on the digital interface;

– providing users with a multi-faceted digital interface that allows them to find other users and interact with them, and which facilitates the provision of basic supplies of goods or services directly between users;

– transferring the data about users and the data collected and generated from user actions via digital interfaces.

Digital services, the users of which do not make a significant contribution to the creation of their value, are considered non-taxable. For example, communication services or payments via the Internet, e-commerce services, services for the supply of digital content with distribution rights, services for the collection and use of data by businesses for internal purposes, some investment and crowdfunding services, and others.

GAFA tax payers are companies whose annual turnover exceeds 750 million euros and whose revenues in the EU exceed 50 million euros. These criteria are met by 120–150 companies (technological giants, half of which are American, a quarter –Asian and a quarter – European). It is planned to create a digital portal (One-Stop-Shop), which will monitor the compliance of companies with the requirements. Under the proposed tax system, one member state would be responsible for identifying the taxpayer, collecting the tax and distributing it as needed in other member states according to the number of users in each country. At a rate of 3%, this tax will allow EU member states to collect five billion euros per year, of which France is planning to receive 500 million9.

Two objectives of the tax are officially declared. The first one is to impose a fair tax burden on digital business giants that use legitimate ways of tax optimizing within the EU, for example, such as the IP-Box regime [23]. The second objective is to avoid the concentration of wealth in the hands of digital giants, which embed into value chains as subjects of infrastructure and eventually implement the so-called disruptive scenario of digital transformation of the market, involving the capture of the chain by displacing small and medium-sized players.

At the same time, it is emphasized that GAFA tax is a temporary measure and it will exist before the adoption of unified rules of corporate taxation of digital activities in the EU. These rules are developed taking into account the concept of customer value creation, in the framework of which the above listed incomes will be taxed within the framework of a single corporate tax.

The initiative does not find enough supporters in the European Council. During the discussions in early December 2018, it was proposed to tax only the income from Internet advertising and to postpone the date of adoption of the tax to January 1, 2021, if the common rules of corporate taxation of digital activities in the EU and OECD are not adopted by this date. But even in its cut-down version, the draft tax was not supported by Ireland, Denmark, Sweden and Finland, and its discussion was postponed to March 2019, despite the statements of a number of countries (France, UK) about their readiness to adopt the tax in 2019, even in the absence of a European-wide consensus.

In 2018, the UK held an open discussion on the taxation of corporate income in the digital economy and considers it necessary to introduce an additional tax on digital business, for which the collection of data on users results from a broader and more active interaction with the business than just the formation of an operational database of customers. There are four channels within which users themselves become participants of the value chain: content creation, deep and long-term interaction with the digital platform, network and external effects from the participation of a large number of users, and the contribution of users to the brand10.

In March 2019, France announced a bill that introduces a tax on digital services beginning from January 1, 2019. In France, the tax is to be paid by companies with a global turnover on their digital activities of 750 million euros or more and by those making a turnover of over 25 million euros in France. The rate is differentiated depending on the turnover, and the maximum value is 5%. The tax on digital giants will affect a total of about thirty groups, most of which are foreign. GAFA tax amounts paid will reduce the taxable profit on corporate income tax. This reform will help reduce the base corporate tax rate from 33.3% to 25% for all companies by 202211.

The budget of Italy for 2019 introduces a similar indirect tax on companies whose domestic turnover exceeds 5.5 million euros at the rate of 3%. The tax base is formed by the amount of revenue obtained from digital services (net of value added tax)12.

Thus, vigorous tax competition between countries for the income from major taxpayers in the digital sphere leads to the promotion of a tax on digital services. In order to develop an effective and equitable international taxation of income from the provision of digital services, it is necessary to do the following:

-

1) recognize user participation as an important value factor in certain types of business;

-

2) develop a method for measuring user participation;

-

3) determine the system of criteria for classifying companies as payers in the business group;

-

4) grant the jurisdictions, in which users are located, the right to tax non-resident companies without permanent establishment;

-

5) develop a method for determining the share of these companies’ profits created by users, which should be distributed among the countries by the jurisdiction entitled to levy the tax13.

According to the study, developed countries are actively discussing the development of a new tax structure that will improve the fairness and efficiency of corporate taxation in the digital economy, in which Russia is not yet involved, although its economy possesses the tax potential in this field.

Indicator 2013 2014 2015 2016 2017 2018 Growth rate, % Yandex N.V. Revenue, including: 39502 50767 59792 75925 94054 127657 323 – revenue from the sale of online advertising; 38848 50147 58210 72579 87400 102737 264 proportion of revenue from Internet advertising in the total revenue 98.3 98.8 97.4 95.6 92.9 80.5 - – other revenue 654 620 1582 3346 6654 24920 3810 Group Revenue 31165 32708 37986 43285 56789 75260 241.5 – revenue from the sale of online advertising; 11486 12257 14630 18772 22975 31853 277.3 proportion of revenue from Internet advertising in the total revenue 42.4 37.5 38.5 43.4 40.5 42.3 - – other revenue 19679 20451 23356 24513 33814 43407 220.6 Compiled with the use of annual and quarterly reports for 2014– N.V. Available at: ; Group. Available at:

Analyzing financial performance and tax burden of the largest Internet companies of the Russian-speaking network segment

Mail.Ru Group and Yandex N.V. are the largest IT holdings that own Russian-language social media and messengers, Internet search engines and other products that allow them to generate big data about customers and use them to obtain revenue. As of December 2018, they rank first and second in the Top 10 holdings in terms of audience coverage in Russia (12–64 years): Mail.Ru Group covers 49,080 thousand people, Yandex N.V. – 48,727 thousand people on average per month14.

The companies are represented in Russia by their branches: Yandex LLC and Mail.Ru LLC, being residents of other countries (respectively, the Netherlands and the British Virgin Islands). It is not possible to assess the performance of the branches in Russia due to the lack of publicly available financial reporting data.

In this regard, we will use the information of the consolidated statements of the holdings, according to which their revenue is growing rapidly every year.

According to Table 1 , in 2013–2018, the consolidated revenue of Yandex N.V. increased more than threefold (323%). In 2018, the growth compared to 2017 amounted to 136% – up to 127,657 million rubles (1,707 million euros).

Thus, the holdings’ turnover significantly exceeds the minimum threshold at which GAFA tax is planned to be levied in the EU (750 million euros worldwide). However, since holdings receive the main part of their revenue in Russia and in a number of its close neighbors, GAFA tax, if introduced in the EU, will not affect them.

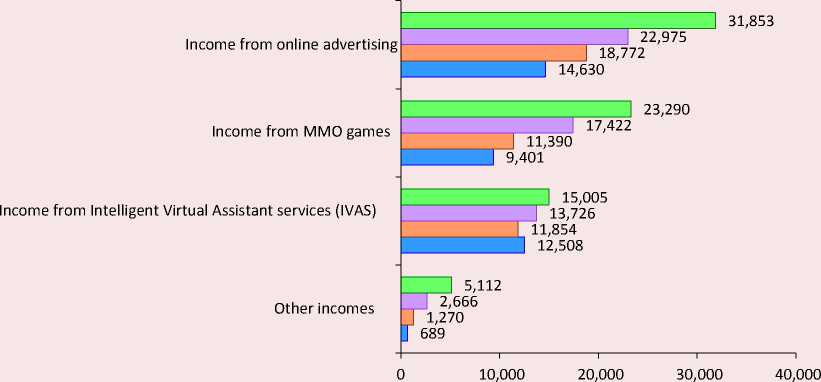

Figure 1. Revenue of Yandex N.V., broken down by service segments, mln rubles

□ 2018 ■ 2017 □ 2016 ■ 2015

Source: Yandex N.V. annual and quarterly reports for 2014–2018. Available at: ; Mail. Ru Group annual and quarterly reports for 2014–2018. Available at:

Online advertising, the revenue from the sale of which is growing annually, is the main source of income of IT holdings for the period under consideration. During the period under consideration, the share of advertising revenue of Yandex N.V. decreased by 15% against the background of the growth in other revenues from booking a taxi online, advertising, food delivery and experimental activities; nevertheless, it still brings more than 80% of revenue (Fig. 1).

According to Figure 1, while the share of revenues from Yandex search and portal in 2018 remained significant, there was a rapid increase in other revenues from booking a taxi online and food delivery services. For the period 2015– 2018, they increased 19.5-fold and amounted to a record 19,213 million rubles by the end of 2018. For comparison, revenues generated by the search and the portal increased only 1.9-fold. In fact, Yandex N.V. has entered the most profitable market of services, on which it initially participated only as a platform for online advertising. At the same time, the entry of digital platform services for booking a taxi online into the market of commercial passenger transportation has significantly transformed it, turning it into an oligopoly by consolidating and displacing small and medium-sized competitors. Thus, at the end of 2018, the taxi market in Moscow is represented by four major players: Yandex.Taxi – 56.5%, Citymobil – 24.5%, Gett – 9.4%, Vezyot – 5.3% of the total number of passenger traffic15. Yandex.Taxi is the leader on the Russian market of taxi services, and its share is estimated at 50%.

□ 2018 ■ 2017 □ 2016 ■ 2015

Source: Yandex N.V. annual and quarterly reports for 2014–2018. Available at: ; Mail. Ru Group annual and quarterly reports for 2014–2018. Available at:

Sale of online advertising brings three times less income to Mail.Ru Group compared to Yandex N.V. and averages 40% of its total value. The company considers the following areas as priority for 2019: promoting content consumption, expanding the advertising network and increasing the effectiveness of advertising through continuous development, new innovative advertising products, attracting new types of advertisers, such as small and medium-sized businesses and offline retailers16.

Except advertising Mail.Ru Group receives revenues mainly from MMO games (massively multiplayer online game, MMO, MMOG) – network computer (or console) games, which engage a large number of players simultaneously: Hustle Castle, War Robots, Warface, etc.) and from the sales of virtual services in social networks (Vkontakte, Odnoklassniki) (Fig. 2) .

According to Figure 2, the revenue of Mail. Ru Group generated by MMO games increased 2.5-fold in 2015–2018. Warface Console, the most successful online game as of the end of 2018, ranked third among the free games according to Sony PS4 version for the United States and became widespread in Germany and Japan. Revenue from the sale of virtual services (IVAS) for the analyzed period increased by 20%, which is due mainly to new mobile products. In social media, this category of revenue is reduced. However, gross income from social media is growing rapidly. Since 2014, in which Mail.Ru Group gained control over Vkontakte social media, gross revenues generated by it increased fourfold in four years. Over the next three–four years, the holding expects a doubling of revenues from Vkontakte .

Indicator 2013 2014 2015 2016 2017 2018 Growth rate, % Yandex N.V. Profit before tax 16713 22475 13596 11107 13582 54464 325.9 Corporate income tax 3239 5455 3917 4324 4926 8603 265.6 Net profit 13474 17020 9679 6783 8656 45861 340 Effective tax rate 19.4 24.3 28.8 38.9 36.3 15.8 - Group Profit before tax 14492 14558 12597 14319 16362 16710 115.3 Corporate income tax 3253 3079 2753 3410 3111 2611 80.3 Net profit 11239 11479 9844 10909 13251 14099 125.4 Effective tax rate (according to management reporting statements) 22.4 21.1 21.9 23.8 19.0 15.6 - Compiled according to Yandex N.V. annual and quarterly reports for 2014–2018. Available at: ; and Group annual and quarterly reports for 2014–2018. Available at:

trade (Pandao international marketplace, in the future – AliExpress Russia), online education (GeekBrains), etc. For instance, in 2018, Delivery Club (mobile and desktop platform for food delivery) entered into a partnership with McDonald’s and KFC and is now the only platform in Russia, which has all the largest franchises for fast food restaurants.

Leadership positions in the market of online services and a wide range of activities allows holdings to increase profits annually and achieve high profitability (Tab. 2) .

According to Table 2, Yandex N.V. has higher rate of profit growth. The activity of the holding was most profitable in 2018. Its net profit increased by 430% compared to 2017 and amounted to 45.9 billion rubles (660.1 million US dollars), and net profit margin – by 35.9%. Of these, 27.5 billion rubles were obtained from Yandex market17. Growth rate of net profit obtained by Mail.Ru Group for the entire period under consideration amounted to 125.4%, and 106.4% in 2018 compared to 2017.

At the same time, profit tax in both holdings for the analyzed period increased with less progression than the amount of taxable profit. The effective tax rate on the holdings’ profit was the highest in 2016 (for Yandex N.V. – 38.9%; for Mail.Ru Group – 23.8%) and decreased in 2018, respectively, to 15.8% and 15.6%, despite the rapid growth of their revenue and net profit.

When assessing this dynamics, we should take into account that, as a rule, consolidated financial statements of holdings contain not only the amounts of taxes actually paid, but also the reserves formed to neutralize possible tax risks. Tax benefits on uncertain tax positions for profit tax are recognized in the financial statements only if there is a high probability that they will be confirmed by the tax authorities during the audit, including the resolution of relevant appeals or legal proceedings. So, according to Yandex N.V. its high value of the effective tax rate in 2016 is due to the impact of certain reserves recognized on the results of tax audits of previous years. Without these, the effective tax rate according to the holding’s estimates would be as follows: in 2015 – 22.7%, in 2016 – 23.4%, in 2017 – 24.3%, that is, 8–10% less than the officially declared values.

In addition, effective tax rate reflects the gross tax burden on the profits of holdings, taking into account corporate tax rates in different countries of operation. For instance, Mail.Ru Group, its subsidiaries and affiliates, which are residents of the British Virgin Islands, are exempt from corporate income tax and capital gains tax. The holding’s subsidiaries and related companies registered in other countries are taxed at the following rates: 12.5% – in Cyprus; 20%, 15% or 5% (dividends) – in Russia; 25% – in The Netherlands; 35% – in the United States. Yandex N.V. has higher tax burden compared to Mail.Ru Group, due to the residence in The Netherlands with a base income tax rate of 25%.

The amount of the effective tax rate is also significantly affected by the non-taxable capital gains – the income of holdings from the sale of shares. Thus, the effective tax rate on Yandex N.V. decreased by 2.8% in 2013 due to the receipt of non-taxable profit from the sale of Yandex.Money in July 2013. In 2016, Mail.Ru Group received non-taxable one-time income due to the withdrawal of HeadHunter; in 2014 – due to the withdrawal of Qiwi and the acquisition of shares of Vkontakte . This explains the reduction in the effective rate due to the constant profit tax with a significant increase in profit before tax.

In this regard, it is possible to judge the fairness of taxation of holdings on the basis of the effective tax rate only with a certain degree of conditionality. At the same time, the abovedescribed facts allow us to assume that the actual tax burden on the profit of holdings is significantly less than it is stated in the consolidated financial statements.

This conclusion is supported by some well-known facts from the practice of taxation of income of holdings in Russia. Thus, a significant reduction in the tax burden on activities of Mail.Ru Group took place in 2016– 2017 in connection with the positive result of the holding’s litigation with the Federal Tax Service of Russia, which allowed the company to apply VAT exemption in respect of the profit generated by MMO games and the sales of virtual services in social media18. At the same time, the prices for services exempted from VAT were not lowered. This allowed the holding to receive an additional profit of about 342 million rubles from online games in the 4th quarter of 2016 and to increase the share of income from the IVAS community by 17.6% in 2017.

The incorporation of IT holdings abroad is explained by their senior management as a necessary measure to attract foreign investment rather than to optimize the taxes paid; nevertheless the tax burden on their activities in connection with this fact is significantly reduced. So, according to its own estimates, Mail.Ru Group generates most of its taxable profit and income tax expenses in Russia; as for profit and loss before tax (income from shares, revaluation of fair value, profit and loss in foreign currency, etc.) – in other jurisdictions in which they are usually not subject to tax.

The tax potential of companies can be estimated with the help of basic calculations of GAFA tax according to the scheme proposed by the EU at a rate of 3% of turnover, not including other incomes, which are usually generated from start-ups. In 2018, revenues of Yandex N.V. generated from the search, portal, booking a taxi online and online food ordering made up 123,577 million rubles, the notional amount of tax on which would have amounted to 3,707.31 million rubles; revenues of Mail. Ru Group generated from online advertising, MMO games and the sale of services in social networks amounted to 70,148 million rubles, the notional amount of tax would have been 2104.44.

A limited list of objects and payers will help avoid a significant impact of GAFA tax on the prices of digital services for the population. In particular, taxation covers a very limited list of advertising and intermediary services, the cost of which is created by the user of the digital interface rather than by its owner who receives income from their provision to third parties. In this regard, digital companies interested in attracting as many users as possible will retain free access to their digital interfaces for the latter. That is, the introduction of the tax will not affect the prices of services for users of digital interfaces that create value. For example, the probability of introducing fees for the registration and use of social networks or email services for users is almost zero. On the contrary, companies will continue to offer related free services, for example cloud data storage and others, in an effort to attract users. However, it is likely that GAFA tax payers, taking advantage of their dominant position, will raise prices for taxable services for third-party advertisers, for organizations that purchase data generated from user actions, etc. In this case, there will be a rise in the prices for advertising and intermediary services provided by the owner of digital interfaces to third parties. The result may be either a reduction in demand for taxable services or a partial shift of the tax burden on the end users of third-party products and services (not necessarily digital). The extent to which the burden will be shifted will depend on the specifics and market conditions, the firm’s market share, prevailing type of competition (price or nonprice), the price elasticity of demand for products and services, and other factors. In this regard, the impact of digital services tax on the prices will not be as directly proportional and unambiguous as, for example, the impact of VAT on services provided in electronic form (in Russia, the so-called Google tax). Assessing the effects of GAFA tax requires further research.

Thus, Russia has the potential to introduce a similar tax. However, in our view, it can be done in a medium-term perspective. Currently, it is advisable for tax specialists to intensify the research to develop the key theoretical aspects of the formation of fair taxation in the digital economy, and for the tax authorities – to assess the effective tax burden on major Russian and foreign IT-holdings that provide digital services that fall under the tax.

Conclusion

Summarizing the above, we note that the study allowed us to obtain a number of results containing the increment of scientific knowledge:

-

1) we have defined the features of big data as a factor of production in the digital economy (secondary nature; self-growth; economic benefit of production with high use and exchange value, zero marginal resource costs, as well as relatively low marginal costs of accumulation, processing and distribution; universality; inexhaustibility, preservation of properties in the process of consumption and the possibility of multiple usage to gain income; partial interchangeability with other factors of production, high mobility and ease of replication; specific income – information differential rent II, monopoly information rent, digital rent), which demonstrate the need for

a special approach to the taxation of income from this factor of production and which are important for the identification of the object of taxation;

-

2) we have considered the discussion within the framework of the European tax reform on the creation of a fair and effective tax system in the digital economy, including its polemical provisions, and the current practice on the introduction of a tax on digital services in the EU member states; this brings new data on foreign practice and helps attract the attention of Russian researchers to the problems of tax transformation in the digital economy;

-

3) we have considered the activities of Yandex N.V. and Mail.Ru Group and identified the tendency of outstripping growth of gross income and profit in comparison with the

amount of corporate income tax they pay; we have also found that the structure of income is dominated by the items that fall under the tax on digital services; we have identified factors contributing to the reduction of the effective tax rate on profits of IT-holdings, which in conditions of high profitability of their activities proves the violation of justice in the distribution of the tax burden between the digital and nondigital spheres of the economy.

Our contribution consists in the fact that we substantiate the need to increase the tax burden on the activities of major IT corporations in Russia, which have the ability to extract super profits from the processing of big data and the provision of digital services, by reforming the taxation of income in accordance with the concept of customer value creation.

Список литературы Taxation of digital services: theory, international practice and domestic prerequisites

- Arkhipova N.I., Rodionov I.I. Changes in the content and role of factors of production as a source of competitiveness in the modern world. Vestnik RGGU. Seriya: Ekonomika. Upravlenie. Pravo= Vestnik of the Russian State University for the Humanities. Series: Economics. Management. Law, 2015, no. 1 (1), pp. 9-16..

- Akhmadeev R.G., Bykanova O.A., Malakhova L.I. Digital content market: a new order of VAT collection. Azimut nauchnykh issledovanii: ekonomika i upravlenie=ASR: Economics and Management, 2017, vol. 6, no. 4 (21), pp. 43-46..

- L'vov D.S. The concept of national property management. Ekonomicheskaya nauka sovremennoi Rossii=Economic Science of Modern Russia, 2002, no. 2 (9), pp. 5-24..

- Kimel'man S.A., Pitelin A.K. Rent potential and rent taxation. Ekonomicheskaya nauka sovremennoi Rossii=Economic Science of Modern Russia, 2008, no. 2 (41), pp. 95-111..

- Kuklina E.A. Rent taxation of subsoil users and the myths of resource-based economy. Nauchnye trudy Severo-Zapadnogo instituta upravleniya=Scientific Works of the North-West Institute of Management, 2015, vol. 6, no. 2 (19), pp. 58-65..

- Chernyavskii S.V., Zolotarev N.A. Theories of natural (mountain) rent and system of its withdrawal (taxation) improvement. Vestnik Tomskogo gosudarstvennogo universiteta. Ekonomika=Tomsk State University Journal of Economics, 2017, no. 39, pp. 71-79..

- Ponkratov V.V. Improvement of taxation of oil and gas production in the Russian Federation. Zhurnal ekonomicheskoi teorii=Journal of Economic Theory, 2014, no. 1, pp. 40-52..

- Maiburov I.A. et al. Nalogooblozhenie prirodnykh resursov. Teoriya i mirovye trendy: monografiya dlya magistrantov . Ed. by I.A. Maiburov, Yu.B. Ivanov. Moscow: YuNITI-LANA, 2018. 479 p.

- Yudina T.N. "Peeping capitalism" as "digital economy" and/or "digital society". Teoreticheskaya ekonomika=Theoretical Economy, 2018, no. 4 (46), pp. 13-17..

- Bloch F. and Demange G. Taxation and privacy protection on Internet platforms. Journal of Public Economic Theory, 2017, vol. 20 (1).

- DOI: 10.1111/jpet.12243

- Bourreau M., Caillaud B. and De Nijs R. Taxation of a digital monopoly platform: Bourreau et al. Journal of Public Economic Theory, 2017. Vol. 20 (1).

- DOI: 10.1111/jpet.12255

- Belleflamme P. and Toulemonde E. Tax incidence on competing two-sided platforms. Journal of Public Economic Theory, 2017, vol. 20 (1).

- DOI: 10.1111/jpet.12275

- Kind H.J., Koethenbuerger M. and Schjelderup G. Tax responses in platform industries, Oxford Economic Papers, 2010, vol. 62(4), pp. 764-783.

- Kind H.J., Schjelderup G. and Stähler F. Newspaper Differentiation and Investments in Journalism: The Role of Tax Policy, Economica, 2013, vol. 80(317), pp. 131-148.

- Shamim A., Tony S. W. The impact of sales taxation on internet commerce -An empirical analysis. Economics Letters, 2008, vol. 99, Issue 3, pp. 557-560,

- DOI: 10.1016/j.econlet.2007.10.001

- Pinskaya M.R. (Ed.). Mezhdunarodnoe nalogooblozhenie: razmyvanie nalogovoi bazy s ispol'zovaniem ofshorov: monografiya . Moscow: INFRA-M, 2015. 192 p.

- Sokolovskaya E.V. Indirect taxation of cross-border transactions in electronic commerce. Ekonomika i upravlenie=Economics and Management, 2017, no. 8 (142), pp. 37-47..

- Tikhonova A.V. Google tax: how not to take a step back in the near future? Mezhdunarodnyi bukhgalterskii uchet=International Accounting, 2018, vol. 21, no. 10 (448), pp. 1129-1139..

- Pokrovskaya N.N. Problems of taxation of innovative business models in the digital economy. In: Ekonomika Rossii v usloviyakh resursnykh ogranichenii sbornik nauchnykh trudov po itogam nauchno-prakticheskoi konferentsii molodykh uchenykh Sankt-Peterburgskogo gosudarstvennogo ekonomicheskogo universiteta . 2016. Pp. 170-173.

- Stepnov I.M., Kovalchuk Yu.A. Platform capitalism as the source of digital rentier's superprofit. Vestnik MGIMO Universiteta=MGIMO Review of International Relations, 2018, no. 4 (61), pp. 107-124..

- Zakharov A.V. Conditions of formation and types of information rent. Aktual'nye voprosy ekonomicheskikh nauk=Topical Issues of Economic Sciences, 2010, no. 11-1, pp. 39-42..

- Geliskhanov I.Z., Yudina T.N. Digital platforms: features and prospects of development. In: Sbornik materialov Sem'desyat pervoi Vserossiiskoi nauchno-tekhnicheskoi konferentsii studentov, magistrantov i aspirantov vysshikh uchebnykh zavedenii s mezhdunarodnym uchastiem . Yaroslavl: Izdatel'skii dom YaGTU, 2018. Vol. 3. Pp. 637-640..

- Koroleva L.P. IP-BOX Tax regime: main elements and trends of transformation in foreign countries. Natsional'nye interesy: prioritety i bezopasnost'=National Interests: Priorities and Security, 2016, vol. 12, no. 5 (338), pp. 152-164..