The budget process as a tool for managing the public and municipal finances: theoretical and methodological

Автор: Avetisyan Ishkhan Artashovich

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Public finance

Статья в выпуске: 1 (19) т.5, 2012 года.

Бесплатный доступ

The article shows that the essential tools for managing the public and municipal finances are emerged from the organization of the budget process because this process permeates all areas of fiscal activity of public and municipal authorities. The author emphasizes that the changes in the economic, social and financial policy of the state at a particular stage of development of the country influence over the budget process. The author has focused attention on determining the place and the role of local budgets in the general system of the country's budget process. He considers some new methods in budget planning and forecasting.

The essence of budget federalism, forms and tools for its implementation, modernization of budget federalism

Короткий адрес: https://sciup.org/147223316

IDR: 147223316 | УДК: 336.143

Текст научной статьи The budget process as a tool for managing the public and municipal finances: theoretical and methodological

UDC 336.143

The budget process as a tool for managing the public and municipal finances: theoretical and methodological

The article shows that the essential tools for managing the public and municipal finances are emerged from the organization of the budget process because this process permeates all areas of fiscal activity of public and municipal authorities. The author emphasizes that the changes in the economic, social and financial policy of the state at a particular stage of development of the country influence over the budget process. The author has focused attention on determining the place and the role of local budgets in the general system of the country’s budget process. He considers some new methods in budget planning and forecasting.

The essence of budget federalism, forms and tools for its implementation; modernization of budget federalism.

Ishkhan A.

AVETISYAN

In globalization of the world economy an effective management of public and municipal finances becomes a fundamental value for all countries in terms of the sustainability of their national budget systems and their overall financial security and stable economic growth. In this regard the budget process is the axis around which the control system of public and municipal finance-mi.

This is what is due to the fact that the content of the budget process is very multifaceted and multidimensional. Theoretical and methodological basis of its organization is scientific concept on public finances, in particular on public and municipal finances the leading link of which is the budget system of the country.

The latter, in its turn, acts as a major financial base of public and municipal authorities in the areas of economic and social development. During the budgeting process one can identify some possible ways to improve the management of the entire fiscal system of the country by using new approaches and methods based on the system of current theoretical and methodological concepts of public and municipal finances. With regard to Russia, for example, the current stage of transition to a new quality of economic growth – modernization and innovation growth with the actual start of active government policies in the area of structural economic reforms (diversification) presents new progressive approaches to the budget process, respectively, and to the management of public and municipal financial system of the country.

The budget process is a set of consecutive phases (stages) of forming and executing the budgets, starting with the preparation of their projects prior to the approval of the reports on their implementation, subject to the objectives to create the centralized cash funds (public, municipal budgets and the budgets of state extra-budgetary funds) and to use them for financial support of the functions and tasks of the state and local authorities. In accordance with the Budget Code of the RF (Article 6) the budget process is an activity regulated by legislation of the Russian Federation, the activity of state authorities, local authorities and other participants of the budget process on preparing and considering the draft budgets, on approving and executing the budgets, on monitoring their performance, on implementing the budget accounting, on drafting, external audit, reviewing and approving the budget reporting.

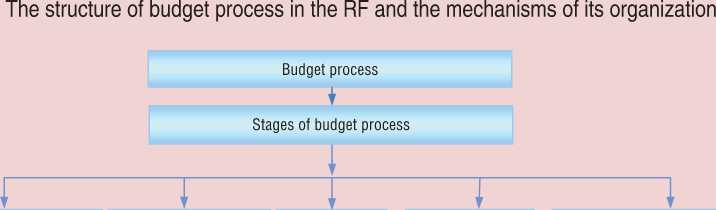

The overall structure of the budget process in Russia and the mechanisms of its organization are represented in the form of diagram in the figure below.

Each stage of the budget process has its purpose, and they must be kept during the legislation terms and designated sequence. The budgeting process can last more than three years from drafting the budget estimates to approving the accounts on their performance. This period is called a budget cycle . During the budgeting process the concept of fiscal year is practiced too, it means the time during which a specific budget is performed. It is theoretically possible any term: from one day to several years. There are monthly, quarterly, semiannual, nine-month, annual, three-year, five-year budgets, etc. However, in practice the annual budget of the state is the most popular one, when the fiscal year amounts to 12 months. At the same time this period can begin since any day of the month. For example, the U.S. fiscal year runs from October, 1 to September, 30 next year, in Japan and Canada – from April,

Drafting the budget projects

Drafting and approving the reports on execution of the budgets

Considering and approving the budget projects

Executing the budget projects

Monitoring the performance of budget projects

•

•

Mechanisms of organization of the budget process: organization and legal and procedural norms budget planning and forecasting operational management and regulating motivation budget accounting and budget reporting

•

•

•

1 to March, 31, in Sweden and Norway – form July, 1 to September, 30 next year, etc. In Russia the fiscal year equated to a calendar year and runs from January, 1 to December, 31.

The budget process in any country implies a certain order and sequence of entry in the budgetary relations of different subjects that are the participants of this process, according to their functional purpose and the objectives appointed by the budget legislation.

The basic objectives of the budgeting process are:

-

• identification of financial and material reserves in the country;

-

• determination of the total budget revenues and the size of their individual sources in accordance with the forecast of socio-economic development of the country;

-

• establishment of the total budget expenditure and their trends based on the funding requirements of the government socioeconomic programs and activities;

-

• reconciliation between the budget income and expenditure and the overall program of macro-economic and financial stability of the country;

-

• reduction and elimination of the budget deficit;

-

• regulating inter-budget relations for providing the balance of the budgets of all kinds;

-

• improving the scientific level of budget planning and forecasting;

-

• strengthening the control over the expenditure of budgetary funds for achieving their high performance;

-

• improving the management of the entire system of public and municipal finances of the country.

It is implied by the definition of the content of the budget process in the RF that it is regulated by the legislation. In this regard it should be noted that the general legal framework for the budgeting process in all countries of the world are fixed primarily in the Constitutions

(in Basic Laws) of their states, which identify the major participants in this process (Parliament, President, Government, Ministry of Finance) and their core powers. In addition, there are special legislative and legal regulatory acts governing the budget process. For example, in the RF the organization of the budget process is regulated by the Budget Message of the President of the RF, the Budget Code, the relevant federal laws of the subjects of the RF and the legal acts of local self-governance, etc.

The legislative and legal regulatory acts governing the budget process contain the norms of the budget law representing the rules of behaviour for its members set and protected by the state to comply them and expressed their powers (in their legal rights and responsibilities). By the nature the norms of the budget law governing the budget process are conventionally divided into substantive and procedural norms. The substantive norms of the budget law set the budget organization and the budget system, the composition of revenues and spending priorities of the budget system, the powers of the budget process participants in obtaining the revenues and financing the budget expenditures etc. The substantive norms form the basis of the budget law in the budgeting process. As for the procedural norms of the budget law, they serve a subordinate, auxiliary role in regard to the substantive norms of the budget law. However, it doesn’t detract from their practical importance, since they provide the correct application of substantive norms in the budgeting process in this country.

A distinctive feature of the procedural norms of the budget law is that they are procedural in nature and apply to all stages of the budget process. In addition, the procedural norms of the budget law play an important role, for example, in strict regulating the order of settlement of the differences arising between the legislative (representative) and executive authorities in reviewing and approving the budget estimates (creating the conciliation commissions composed of the representatives of parliaments and governments), as well as in implementing other procedural issues on organizing the budget process.

Experience in the budgeting process in different countries shows that it has both common features and specifics. The latter are predetermined by the forms of state government (presidential form of government, parliament form of government, etc.) and different forms of government (unitary state, federal state, confederate state), and respectively, by the differences of budget structure and budget system of the country. For example, the federal states are characterized by the unity of the budget process and at the same time by its decentralization. The unity of the budget process is defined by common principles of constitutional and legislative base of its organization.

The most important principle of the budgeting process, which is common to all countries with a variety of them in the organizational scheme is the requirement that all revenues and expenditures, respectively, public and municipal budgets must be approved by the parliaments and other legislative bodies of certain countries. The legislative norms in many countries at the same time emphasize the need for ensuring the unity of the budget revenue and expenditure and including the specified revenues and expenditures in the budget in full and ensuring their balance.

However, as it was noted, the fiscal year amounting 12 months in all countries and it can begin on any day of the month and coincide or not coincide with the calendar year. In addition, in some countries (Germany, Russia, etc.) the state budget is usually adopted in the form of a single legislative act, and in some countries (USA, UK, Canada) the separate legislative acts are developed and approved on the items of income and expenditure of the mentioned budget. In the countries with a presidential form of government, including Russia, in the budgeting process the priority belongs to the

President, who makes his annual Budget Message. The adopted budget laws must be promulgated (signed) by the Presidents of individual countries. In some countries (eg. Germany) a procedure of countersign, which provides for the promulgation of the budget law, then this law is published in the official gazette. Finally, the presidents have the right to suspensive veto, the use of which entails the return of the budgets for repeated review and approval by the parliaments.

One of the key procedural norms of the budget process is budget initiative. Under the law the right of the budget initiative belongs to the supreme body of executive power – the government (UK, Germany, etc.) or the President (USA, France, Russia and others). In no one country the Parliament has such right: its function is to amend and approve the budget bills proposed by the government of that country.

In most Western European countries the budget process in the central ministries begins 11 – 13 months before the start of the fiscal year. This means that, provided the fiscal year coincides with the calendar one, the budget process begins no earlier than December of the year t – 1 and no later than February of the year t. The draft budget for the year t + 1 is represented to the parliament 3 – 4 months before the start of new fiscal year, i.e. until early September and no later than early October. So, the governments, as a rule, spend 8 – 9 months on forming their budget estimates.

In Western Europe, where the fiscal year coincides with the calendar one, the government’s schedule of work on the draft budget is as follows in a very simplified form (tab. 1) .

In Russia the budget process begins 10 months before the next fiscal year (budget year). In accordance with the Budget Code of the Russian Federation the budget process takes place in Russia at the following approximate schedule (tab. 2) .

Forming the budgets begins with drafting their projects. Drafting the budgets as the initial stage of the budget process in all countries under the law is an executive prerogative, i.e. their governments. Organization and technology of this work in different countries have much in common, and above all a community is de-centralization of preparing the budget estimates. It involves all ministries and departments that work out their financial plans and their revenue and expenditure budgets. In this case all ministries and departments receive planned targets of possible budget allocations from the Ministry of Finance; within each body this activity involves such different subdivisions, proposals as ultimately they are summarized by the minister or the head of the department. By-turn the budget calls with specific proposals from the ministries and departments are aggregated by the Ministry of Finance of the country.

In the course of drafting the budget estimates, the traditional budget process means that the participants of this process (ministries, departments and other participants) solicit for - but require – as much funds for next year as in the current fiscal year, plus a correction for the rising prices and wages (according to the inflation level). Of course, it begs the additional funds for the next fiscal year (budget year) and planning period (under the conditions of drafting a three-year budget) by new activities. The participants of the budget process often represent these wish lists on obtaining some additional funds. Such order of the budgeting process gives rise to bottom pressure on the Ministry of Finance in their budget activity on the part of drafting the budget estimates and this process becomes an expenditure-oriented one. The experience of significant number of countries in the world shows that with such model of forming

Table 1. A simplified scheme of the budget process by the months of the year in the countries of OECD (Organization for Economic Co-operation and Development)

|

January |

The Ministry of Finance informs the schedule of work, formal instructions and macroeconomic preconditions. |

|

February |

The Ministry of Finance indicates the budget and policy objectives and restrictions. |

|

March |

The Government considers the priorities among the various fields of expenditure. |

|

April |

The branch ministries form the detailed budget proposals. |

|

May |

The detailed proposals are transmitted to the Ministry of Finance. |

|

June |

The Ministry of Finance considers the proposals. |

|

July |

Negotiations between the Ministry of Finance and the branch ministries. |

|

August |

Agreement within the government on the draft budget. |

|

September |

The draft budget is submitted the Parliament. |

|

The budget process as a tool of effective management. Government concept. – Stockholm, 2005. – P. 48. |

|

Table 2. The budget process in Russia by the months of the year

|

January |

Determination of macro-economic preconditions. |

|

February |

Proposals of the Ministry of Finance on the basic parameters of the federal budget (total revenue, apportionment of the expenses in general and the deficit / surplus) |

|

March |

The Budget Message of the President to the Federal Assembly of the Russian Federation (to the Parliament). |

|

April |

The Russian government takes the basic indicators of the draft federal budget (income, allocation of expenses according to the functional purpose and balance). |

|

May |

Apportionment of the expenses within the functional division by the budget-receivers and distribution into the categories of expenditure. |

|

June – July |

Overcoming the differences between the branch ministries and the Ministry of Finance of the RF, forming the detailed draft federal budget by the main administrators of income, by the main owners of expenditure. |

|

August – September |

Final registration of the federal budget bill in the government of the Russian Federation. |

|

October |

RF government representation of the federal budget bill to the State Duma for consideration and approval. |

the budget it is difficult for the Ministries of Finance and the governments to resist this pressure for a long time. The budget process in which the initiative belongs to the budgetreceivers and their ministries (the participants of the budget process) leads to the rapid growth of budget expenditures and tax burden which by-turn lead to large budget deficits and instability in the perspective of public finance development. In such expenditure-oriented budget process the decisions on some certain details of the budgets go from part to whole. This budget process is usually called the model of forming the budget “bottom-up”.

Taking into account the existing fact of the above negative experience of tradition budget process, in recent years many western countries have introduced a new order of forming the national budgets. They reformed the budget process and instead of moving the «bottom-up» the budgets are formed “top-down”. It means that the governments start to organize the budget process, in particular the drafting of the budget estimates with determining the budget and policy objectives or restrictions – such as borrowing requirements, the level of taxes, inflation, the level of expenditures, etc. For example, since the mid 90-s of the XX century Sweden has used the budget process with distinct features of moving “top-down”. The Swedish government as well as the Parliament is guided by the restrictions calculated for several years and concerning both the financial saving (balance) and total expenditures of the state. This model of the budgeting process increases the role of state regulation in improving the public finance especially in crisis situations as it helps to keep public expenditure within reasonable limits, contributes to sustainable national economic development and provides timely on-budget flows of revenue.

It should be noted that in principle the model of budgeting “bottom-up” is suited more to the federal states. For example, in the Russian Federation in accordance with the RF

Budget Code the budget system of the country is three-level (the federal budget, the regional budgets and the local budgets), but at the same time all of them are independent, i.e. lower budgets are not included into the higher budgets.

It means that the regional authorities of state power and the local authorities form themselves and execute their budgets. However, drafting the federal budget requires that a copy of regional budgets and consolidated budgets must be represented without fail by the regions to the Ministry of Finance of the RF, that is, it seems that the budget process with a distinct model of “bottom-up” is used. But in fact, the use of this model of the budget process in Russia is a mere formality, since the regional budgets (budgets of the Russian Federation subjects) are formed in the depths of the Ministry of Finance and the local budgets – in the depths of the financial authorities of RF subjects. It is the Ministry of Finance that determines the accumulated by the subjects revenues of their budgets, the performed expenditure from these budgets, financial relationships between the federal budget and the budgets of RF subjects, etc. Actually in budgeting the model of “topdown” is used, consequently the financial dependence of lower authorities from higher authorities is obvious.

In connection with the foregoing it should be emphasized that no government is able to ignore the whole (macro-level), making decisions about the details on forming the budgets, respectively and cannot approve the budget and political restrictions, without convincing that within the framework of these restrictions it can be possible to perform the most necessary expenses. It means that no country doesn’t use the model of the budget process “bottom-up” or “top-down” in its purest form. In order to make the budget process survive in this political environment, the two approaches (two models) to forming the budget must come together in a kind of compromise point.

Forming the budgets doesn’t end only with drafting their budget estimates at the initial stage of the budget process. It gets its logical continuation at the second stage of the budget process – the stage of review and approval of the draft budgets , and after a long detailed discussion some special laws (resolutions) on approving the budgets for the next financial year (fiscal year) and for the medium term are taken. At the same time under the law the review and approval of the draft budgets are exclusively a legislative (representative) prerogative, i.e. the parliaments’ prerogative.

The parliaments’ adoption of the laws (resolutions) on approving the budgets gives them legal status (force of legal law) which means their obligatory performance in strict accordance with the adopted laws (resolutions). In forming the budgets an objective necessity of review and approval of their projects throughout the world is due to the fact that the initial stage of the budget process, i.e. drafting the budget projects means only to a little extent that in fact it is taken the resolutions on what budget revenue and expenditure will be, and that, accordingly, the result of their performance will be like that. In drafting the budget projects the most part of budget revenue, for example, tax revenues, is impossible to determine accurately in advance. One can make decision on the taxation rules and the rates of various taxes, but the tax base to which they will be applied is determined in general by the socio-economic development which has a multifactorial nature. The same thing though to a lesser extent concerns the budget expenditure. For the budget expenditure defined by the rules of fund provision, in particular the transfers to individuals, the same principle operates as for the tax: it is possible to determine the size of subsidies and the conditions of their obtaining, but it is difficult to determine the exact number of citizens eligible for subsidies in advance, i.e. in drafting the budgets.

The answers to the above and other questions in forming the budgets should be obtained if possible at the stage of review and approval of their projects. In addition, in the course of discussing the draft budgets before their approval they are amended and changed a lot by the indicators of the draft budgets, which resulted in making some of their specified parameters more exact. But these issues are not decided at once, and this requires a certain time. For the final solution of these issues, for example, in Russia reviewing and approving the federal bill on the federal budget for next financial year and planning period pass through three readings , the procedures and objects of which are regulated by the Budget Code (Articles 199, 205, 206 BC RF). All of this suggests that the ultimate goal of the review and approval of the budget projects is formation of well-structured and realistic budget, execution of which will also be the most feasible and effective.

It is no exaggeration to say that the stages of drafting, review and approval of the budget projects lay a solid formation foundation which is at the same time the focus of political and economical life of most countries. In a market economy no single decision of the state and no political person can affect the national economy to so extent as the government budget project and the decision on it. Therefore, the budgeting issues inevitably arouse great interest among the public, mass media, management system, financial markets, businesses, organizations, and, of course, political parties and their elected representatives who take the budget decisions in the parliaments.

It is not difficult to see that the drafting of budgets, their review and approval as starting points for the budgeting process are accepted for the practical implementation of important decisions regarding the definition of the volume size, distribution and use of public budget resources. That is why the subsequent stage of the budgeting process – the stage of budget execution has a very specific and important economic value, and it provides for full and timely receipt of all planned revenue and uninterrupted financing of budget expenditures. A well-functioning system of budget execution is designed to establish necessary balance between the control and the degree of freedom of improvement of revenue and expenditure transactions. Along with providing the results maximally close to the economic and political priorities of the state, it is the stage of budget execution that must ensure reliability and safety in working with public and financial resources.

The budget execution as a final stage of the budget process in different countries of the world is determined by a complex of national, historical, economic and political factors, including:

-

> the history and traditions of public administration;

-

> the organizational structure of the government of each country;

-

> budgetary and management philosophy, in particular the economic and political course of the country conducted by the authorities;

-

> functionality, efficiency and development of related functions of public administration (such as internal management control or external control system);

-

> kinds of problems being struggled with by the government of that country (corruption, weak governance, errors in the revenue payments and funding of the budget expenditures);

-

> development of the economy-related functions, such as the telecommunication system, banking system, etc.

In Russia a treasury system of budget execution has been established. The major role in the process of budget execution belongs to the Federal Treasury which enforces the principle of treasurer’s office unity – entering all revenues and receipts from the sources of deficit financing to a single budget account and implementing all expenditure allowances from this budget account. Implementation of the budget transactions through the accounts of the Treasury makes it possible to provide a complete accounting and control over each stage of the execution of revenue and expenditure budgets.

An important role in executing the budgets is played by the legislative base and the established appropriate mechanisms. The legislative base regulated the budget execution is often complicated and consists of a number of different levels. In some countries the national constitution contains the provisions regulated the general aspects of budget execution. For example, in the US Constitution contains a provision prohibiting the budgetary expenditure outside the appropriations approved by the law when executing the budgets (Article 1, Section 9). Similarly, the Australian Constitution contains a provision whereby all budget revenues are placed into a single pool of money of the state (Section 83, Article 81). The Russian Constitution contains a provision whereby the Russian government develops and submits the Federal budget to the State Duma and ensures its implementation (Article 114, Chapter 6). In addition to these constitutional provisions the ordinary practice is to take extra special laws and a number of normative by-laws governing the budget execution. As applied to Russia – first of all, it is budgetary legislation, in particular the RF Budget Code which has a special section on executing the budget (Section VIII).

It should be noted that among the legislative and legal normative acts regulating the process of budget execution, the basic legal act is the budget act (the main financial act). The act in various countries can have a different name, depending on the jurisdiction, but practically there is always a special act that requires mandatory to enforce the budget revenue and expenditure. The primary annual financial budget law or the legislation act equivalent to it, as well as any applicable ancillary by-laws (instructions, provisions, etc.) that govern the budget execution process determine the procedures that are required to perform when receiving revenue and authorizing the use of public budget funds (budget financing).

When executing the budget, the budgetary accounting and the budgetary reporting that are part of the budget process are kept. To ensure effective management of public and municipal finances on the basis of the laws (resolutions) on the budgets a decisive importance belongs to the availability of the necessary information at the right time and right place. In this context the budgetary accounting plays an important role in registering and providing economic information in a way that at all levels of public administration one could make reasoned decisions regarding further work on organizing the budget execution, as well as the implemented activity can be evaluated and analyzed to determine the extent of managers’ responsibility for its results.

Budgetary accounting is an accounting system of public and municipal budgets providing information on the actual state of revenue and expenditure execution of these budgets, enabling an analysis of decisions made in the tax and budget sphere. The main objectives of budget accounting are:

-

♦ forming a complete and accurate information about the revenue and expenditure budgets execution of different levels of budget system of the country;

-

♦ control over observing the legislation on the budget execution;

-

♦ providing a basis for compiling the budget reports for the executive and representative bodies and other participants of the budget process.

The results of budget accounting are used to make budget reporting in the form of various financial report documents which can have different content and structure in different countries. However, the financial reports on the budget execution usually have information on the results and desired effects reached by the economic entities (participants) of the budget process.

At the same time these financial reports are consolidated in a variety of documents compiled by the budget participants. In this regard an important financial document of the budget reporting among the different report documents is an annual report on the budget execution approved on a statutory basis .

The issues of improving the budget process requiring special study is of important scientific-theoretical, methodological, legal and practical interest. Nevertheless, it is necessary to draw attention to the key areas for improving the budget process, their implementation is aimed at improving the effectiveness and performance of management of public and municipal finances.

Improvement of the budgetary process in all countries of the world is constant and uninterrupted due to the changes in the priorities of economic and financial policy of the state at a particular stage of the country’s development. For example, in Russia an important step to improve the budget process was the Concept of budget process reform in the Russian Federation in 2004 – 2006 approved by RF Government Decree of 22.05.2004 № 249 “On the measures to improve the effectiveness of budget expenditures”. The core of this reform was a shift in focus of the budget process from “budgetary resource (expenses) management” to “performance management” by increasing the responsibility and enhancing the independence of the budget process participants and the budget funds administrators under clear medium-term targets. Reforming the budget process was offered to implement the following five areas:

-

1) reforming the budget classification and budget accounting;

-

2) allocating the budgets of existing and assumed obligations;

-

3) improving the medium-term financial planning;

-

4) improving and expanding the scope of the program-target methods of budget planning;

-

5) putting in order the procedures for drafting and reviewing the budgets.

Within the framework of the above Concept of budget process reform on the first area drafting and executing the budgets of all levels of the RF budget system since 2005 are carried out on the basis of new budget classification . The new budget classification is closer to the requirements of international standards taking into account the changes of structure and functions of executive authorities within the administrative reform, as well as the introduction of account card of budget accounting integrated with the budgetary classification and based on applying the new method and monitoring to improve the management of public and municipal finances in the Russian Federation.

In accordance with the implementation of the budget process reform in the Russian Federation in the practice of budgeting there were introduced new concepts such as “expenditure obligations”, “budget obligations”, “register of expenditure obligations” that are provided by the RF Budget Code according to the Federal Law “On amendments to the RF Budget Code in regard to regulating the budget process and bringing some RF legislation acts in line with the RF budget legislation” dated 26.04.2007 №63 – FL. In addition, in the light of implementing the second area of budget process reform such terms as “expenditure obligations currently in force” and “incurred expenditure obligations” and accordingly “budget of expenditure currently in force” and “budget of incurred obligations” are used.

In the structure of the RF budget process (see Figure) but the organizational and legal and procedural norms one of the important mechanisms of its organization is the budget planning and forecasting. There is a close inter-relationship between the organization of the budget process and financial and budgetary planning and forecasting, because with budget planning and forecasting in the course of forming the budgets, in particular drafting the budget projects, one quantitatively determines the amounts of budget revenue and expenditure, financial relationship between the budgets of different levels and other parameters of budgets, etc. The quality of budgeting process, and respectively the efficiency level of management of public and municipal finance depends largely on the degree of scientific budgeting and forecasting.

In regard to improving the medium-term financial planning in accordance with the Concept of budget process reform in the Russian Federation (the third area of budget process reform) there was a task to extend its horizons and to move to drafting and approving a three-year budgets . With the adoption of the Federal Law of 26.04.2007 № 63-FL for a start the task was solved at the federal level. The first three-year federal budget for 2008 – 2010 was drafted and approved in 2007 in Russia. Since that time and up till now not only the three-year federal budget but the three-year budgets of the RF subjects and the three-year local budgets (for the next financial year and planning period) are drafted and approved. Moreover, any budget next fiscal year is a part of three-year budget that is annually updated and shifted forward by one year, on the one hand, this is ensured by the continuity of public policy and the predictability of budget allocations and, on the other hand, this makes it possible to amend it annually in a clear and transparent procedure in accordance with the priorities of the economic and social policy and the terms of their achievement.

Further, as noted above, the core base of the Concept of budget process reform in Russia was the transition from the “budgetary resources (expenditure) management” to “performance management” to improve the efficiency of budget expenditure. It is for this purpose that the RF Government Resolution № 249 22.05.2004 “On the measures to enhance the effectiveness of budget expenditures” was taken. In the light of implementing the require- ments of this regulation the country headed for improving and expanding the scope of application of program-target methods of budget planning (the fourth area of the budget process reform). The program-targeted budget planning is carried out primarily in the form of federal target programs. The target program is a set of measures inter-related by the terms, the performers and resources and directed to achieving certain target and objectives.

Before 2010 in the budget planning and forecasting when preparing the draft federal budget the estimate form of budget expenditure planning had prevailed, i.e. the mentioned budget was not formed on the basis of actual and expected results of budgetary expenditure, but it was formed by indexing and correcting the funds allocated in the previous year. The funds allocated to the most targeted programs were in fact a kind of additional “estimated” funding of expenditure and almost constantly subjected to changing, thus justifying the amorphous formulation of program targets and results and the lack of responsibility for their achievement.

In 2010 for the first time the RF Ministry of Finance submitted a draft federal budget for 2011 – 2013 to the Russian government, it had a new format under which the mentioned budget was formed according to the so-called program-oriented principle, i.e. the expenditures of each of the ministries and departments are argued by the purpose on which the government is going to spend them. This measure is designed to ensure a stronger link between the budget planning and the target achievement monitoring. The RF Ministry of Finance and the Ministry of Economic Development have prepared a list of programs which became the basis for forming the federal budget and its main provisions in 2011. In total there are 39 programs divided into such units as education, public health, housing and communal services (HCS), social support, industry, economic regulation, management of public finances, etc.

While in 2010 the financing of 73 target state programs included no more than 8% of total expenditures of the federal budget, the 39 target state programs for 2011 united 96.7% of expenditures of the mentioned budget, it means that the control of the RF Ministry of Finance over spending of the federal budget expenditures increased excessively1.

An important tool for the budgeting process in any country is regulation of intergovernmental fiscal (interbudget) relations which are an integral part of this process. The problem of improving the budget process and improving the quality of management of public and municipal finances depend on an efficient and fair system of intergovernmental fiscal relations to a large extent.

For example, today there is a rigid centralized system of intergovernmental relations in Russia and the budgetary resources continue to be redistributed in favor of the federal budget to the detriment of the regions’ financial interests. In practice the federal budget is essentially functioning as a centralized budget of unitary state , and so the principle of real fiscal federalism is violated. In the integrated financial processes the state-level priorities take precedence over the region priorities and the financial dependence of the region and municipality authorities on the federal center is very high. It seems that first and foremost solving the problem of even development of innovative economy in all regions and increasing their own tax capacity can contribute to creating an efficient and fair system of intergovernmental relations in the country2.

The issues of budgeting process in all countries, including Russia, are inseparably linked with the implementation of public and municipal financial control which is at the same time its integral par t (see figure).

It applies to all stages of the budget process and is one of the most important tools of management of public and municipal finances. In performing the authority’s administrative functions the public (municipal) financial control is also a way of establishing a “feedback”, since on the basis of data obtained as a result of this control, one justifies correcting the earlier decisions and plans, and most importantly, taking some effective measures to eliminate the offense in order to ensure the legality, appropriateness and effectiveness in forming and spending the public and municipal budgets.

In this regard it should be noted that to create an effective system of public (municipal) financial control there is a number of unsolved issues and problems in today’s Russia. Conceptual approaches to forming a system of public financial control have not been developed yet; a common (unified) federal law on public financial control has not been adopted; there is no public (municipal) financial control of warning and preventive nature; there is a low level of realizing the materials of audits and inspections; there is a low level of executive discipline of control laws; there is no strict punishment for those who are responsible for the offense; unhealthy moral climate and other unsolved problems and issues of organizational and legal, methodological and practical nature reign in the country3. In view of the above unresolved issues and problems today in our country the public (municipal) financial control is imperfect, weak and poorly effective.

For example, because of low executive discipline of financial control by the RF Ministry of Finance over executing the basic financial law of the country, virtually all major sections of the federal budget have shortfalls.

According to the Federal Treasury’s data, the shortfall of the federal budget for 2010 made up 164 billion rubles. This amount is equal to the annual budgets of several RF subjects, since the average size of the budget of the RF subject is 60 – 80 billion rubles4.

Finally, the role and place of municipal finance, in particular the local budgets in the general system of budget process in Russia are worthy of attention too. In this area at present there are unresolved contradictions and problems of legislative nature. The essence of these contradictions and problems lies in the fact that local budgets (the budgets of municipalities) that constitute the foundation of the country’s budgetary system are also the main financial base of local self-governance which is not included into the government system in accordance with the RF Constitution (Article 12).

It turns out that the public budgetary funds (local budgets, as well as the funds received from the federal budget and the budgets of the RF subjects) are used by nongovernmental organizations (local authorities) and the local budgets are practically left out of the Russia’s budget system, and respectively out of the general system of budget process in the country.

On the other hand, for all types of budgets included in the RF budget system the budget legislation, in particular the RF Budget Code, set common principles and procedures under which the entire budget process is carried out in the country. This situation undoubtedly has a negative effect upon the entire budget process and the quality of management of public and municipal finances. In our opinion, without solving the above mentioned legislative contradiction it is impossible to solve the problem of ensuring the integrity of the budget process and the complete improvement of its organization in our country today.

Список литературы The budget process as a tool for managing the public and municipal finances: theoretical and methodological

- Avetisyan I.A. The budget federalism and intergovernmental relationships in the RF. Economic and social changes: facts, trends and forecast. 2011. Nо. 2 (13). P. 115-122.

- Avetisyan I.A. On the effectiveness of the public budget and budget expenditures. In: Economic and social changes in the region: facts, trends and forecast. Vologda: Vologda Scientific and Coordination Center, Central Economics and Mathematics Institute of RAS, 2005. Nо. 29. P. 9-19.

- Avetisyan I.A. On the public financial control in modern Russia. In Economic and social changes in the region: facts, trends and forecast. Vologda: Vologda Scientific and Coordination Center, Central Economics and Mathematics Institute of RAS, 2005. Nо. 34. P. 19-31.

- Avetisyan I.A. Fundamentals of financial management at the macro level (the theory methodology issues. Vologda: Poligrafist, 2001.

- The Budget Code of the Russian Federation as of October 1, 2010. Moscow: Prospect, KnoRus, 2010.

- The budget process as a tool of effective management. Government concept. Stockholm, 2005.

- Kadomtseva S.V. Public finance. Moscow: INFRA, 2010.

- Kovaleva T.M., Barulin S.V. Budget and fiscal policy in Russia. Moscow: KnoRus, 2005.

- The Constitution of the Russian Federation. Moscow: Joint Edition of MIA of Russia, 1998.

- The concept of budget process reform in the Russian Federation in 2004 -2006. Approved by the RF Government Resolution dated 22.05.2004, No. 249. Consultant Plus: reference legal system. Available at: http://www.consultant.ru

- Kuryatkova Yu.A. Public and municipal finances. Moscow: RIOR, 2005.

- Parygina V.A., Tadeev A.A. Budget law and process. Moscow: Eksmo, 2005.

- Rodin A.M., Goreglyad V.P., Podporina I.V. The budget system of the Russian Federation. Moscow: Dashkov&Co, 2009.

- Svishcheva V.A. Public and municipal finances. Moscow: Dashkov&Co, 2008.

- Suglobov, A.E., Cherkasova Yu.I., Petrenko V.A. Intergovernmental relations in the Russian Federation. Moscow: UNITY-DANA, 2010.

- Soviet Russia, 2011, April 26. P. 2

- Versiya, 2010. Nо. 38 (263). P. 9