The correlation of social capital, social trust and population’ entrepreneurial activity in the Arctic region (a case study of the Arkhangelsk oblast)

Автор: Maksimov Anton M., Malinina Kristina O., Blynskaya Tatyana A.

Журнал: Arctic and North @arctic-and-north

Рубрика: Social and economic development

Статья в выпуске: 40, 2020 года.

Бесплатный доступ

The article considers the relationship of social capital, institutional and interpersonal trust, and entrepreneurial activity on the data of the Arkhangelsk Oblast. The authors, following R. Putnam, analytically distinguish two types of social capital - bonding and bridging. The level of the former is measured by interpersonal trust indices, while the latter is measured by general and institutional trust indices. Based on the analysis of the sociological survey results, conducted by the authors of the article, it is shown that the level of bonding capital, based on trust in the nearest social environment, is quite high in the Arkhangelsk Oblast, but there is a shortage of bridging capital that based on trust in public institutions and civil solidarity. It is shown that the deficit of bridging social capital, associated with a low level of trust in institutions, increases the transaction costs of market agents like entrepreneurs, which negatively affects the implementation of the region's entrepreneurial potential. Thus, it is proved that the amount of social capital is a key non-economic factor that reduces the investment rating and entrepreneurial activity indicators in the region against the backdrop of low dynamics of gross regional product and population incomes and increasing government spending to stimulate small and medium-sized businesses.

Social capital, institutional trust, entrepreneurial activity, investment attractiveness of the region, bonding capital, bridging capital

Короткий адрес: https://sciup.org/148318377

IDR: 148318377 | УДК: [316.4(470.11)+33(470.11)](045) | DOI: 10.37482/issn2221-2698.2020.40.66

Текст научной статьи The correlation of social capital, social trust and population’ entrepreneurial activity in the Arctic region (a case study of the Arkhangelsk oblast)

It is difficult to imagine the comprehensive socio-economic development of the regions of the Arctic zone of the Russian Federation (hereinafter - the AZRF) without the active involvement of the population in forms of economic activity characterized by a sufficiently high level of investment risk. Such forms are remarkably diverse - from the use of numerous financial instruments available to citizens to the organization of their own business. A common feature of these forms of economic activity is the need to act in heightened uncertainty conditions. One of the factors that reduce this uncertainty is the quality (reliability and efficiency) of institutions that organize market interactions (including political and legal institutions).

∗ For citation:

The quality of institutions is reflected in formalized expert assessments and institutional trust indices, calculated based on mass survey data. At the same time, trust in institutions, both on the part of experts and among ordinary citizens, actually serves as the foundation for the viability of these institutions, since in the conditions of a deficit of such trust, economic actors “invent” alternative institutions functioning in the zone of informal interactions. Another factor influencing uncertainty is the volume and distribution of social capital within a certain community of people. Social capital is also associated with the phenomenon of trust - in this case, trust between members of a social group or local community. The higher the level of interpersonal trust, the stronger the horizontal (weak according to M. Granovetter) communication [1, pp. 303-305]. This, in turn, acts as a condition for the multiplication of social capital [2, p. 13], the economic effect of which is expressed in the reduction of transaction costs - mutual trust between counterparties reduces uncertainty and makes it unnecessary to turn to institutions that ensure control over the actions of market participants and forcing the latter to comply with the “rules of the game” [3, p. 60; 4, p. 33].

This article is devoted to analyzing the relationship between the regional economy's main parameters and the level of accumulation of social capital in a particular Arctic region (Arkhangelsk Oblast), measured by the indices of institutional and interpersonal trust.

Methodologial grounds for the concept of social capital

One of the first to systematically develop the concept of social capital was the French sociologist P. Bourdieu. In his view, social capital is a set of real or potential resources associated with the possession of a stable network of more or less institutionalized relations of mutual acquaintance and recognition [5, pp. 248-249]. In the interpretation of P. Bourdieu, such a network of informal connections is something like a closed “club,” thanks to membership in which individuals can convert their social capital into other types of capital, including economic. Support - both symbolic and material - from the network, whose members perceive themselves as a community (in other words, have a group identity), is achieved by the individual by maintaining trust in him as “his own,” which is reinforced by fulfilling yourself when entering a group, obligations concerning its other members and the group as a whole [5, pp. 249-250].

The concept of social capital was developed in the works of the American researcher R. Putnam. He interprets social capital as a component of the social system, including established social networks, generally valid norms of behavior, and mutual trust between community members. At the same time, R. Putnam emphasizes that social capital is used to facilitate the coordination of collective activities for mutual benefit, including society's economic prosperity [6, pp. 66– 67].

Putnam R. builds his concept based on collective action theory that common norms formed by common actions lead to cooperation. Particular attention is paid to the norm of reciprocity (mutual exchange); it emphasizes the importance of cooperation's social contexts. The norms of

Anton M. Maksimov et al. The Correlation of Social Capital… generalized mutual exchange are combined with “hard commitments” and, accordingly, trust. He emphasizes that trust is generated primarily where agreements between people are woven into a solid structure of personal ties and social contacts [7, pp. 102-103]. In his discussion of mutual exchange, R. Putnam refers to intragroup affects - cooperation and trust.

In this regard, Putnam R. analytically divides social capital into “bonding social capital” and “bridging social capital” [8, p. 20].

“Bringing a group” (bonding) capital is characteristic of local contexts of collective action: for example, in a situation of combining and coordinating efforts within a local community (community) or work collectively to protect their narrow group interests. In this case, the indices of interpersonal trust can act as an empirical indicator of the value of social capital.

“Bridging” capital (bridging) capital is formed based on large-scale social networks, a large radius of trust (beyond the small group or local community), and shared norms and values in society. It contributes to creating broad public coalitions, the activities of which are impossible without relying on various public institutions - trade unions, business associations, religious associations, political parties, etc. The volume of social capital of this subspecies can be indirectly measured through the level of general trust (the tendency to trust people regardless of their belonging to an in-group) and the indices of institutional trust1.

However, it should be noted that, even though R. Putnam's concept of social capital belongs to the mainstream of modern Western sociology, not all researchers agree with his logic of reasoning. Thus, A. Portes and E. Vikstrom presented a convincing criticism of R. Putnam's theoretical constructions, showing that social capital does not so much determine civic solidarity and cohesion of society, but rather, on the contrary, is its product, while it is a source of social consolidation, of the universal market and democratic institutions [9, Portes A., Vickstrom E., p. 476]. But this criticism does not deny the possibility of measuring social consolidation through indicators used to measure social capital. This is especially justified in conditions of unfinished transit when the market and democratic institutions do not function fully and reliably, which is exactly the case in modern Russia.

An empirical study of social capital in the Arctic territories Arkhangelsk Oblast

In the spring 2018, under the guidance of the authors of the article, a mass survey in six municipalities of the Arkhangelsk Oblast, included in the AZRF, was completed2. Among the meas- ured variables were indicators of interpersonal and institutional trust, which are important in terms of determining the total amount of social capital in the surveyed territories.

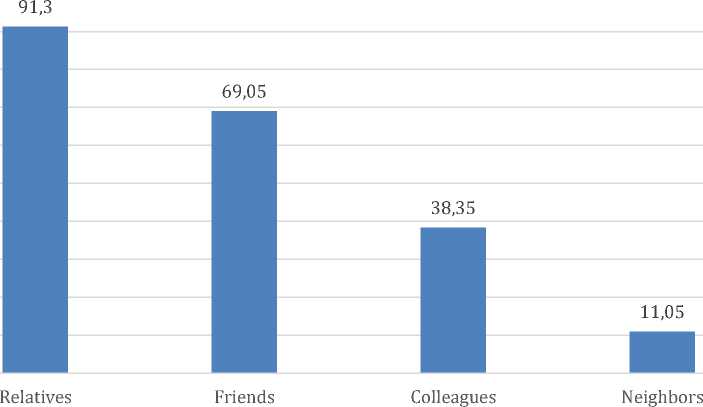

The values of the interpersonal trust indices, which we use to assess the value of bonding capital, show a tendency to a decrease in the level of trust as we move from primary small groups (relatives, friends), which are characterized by informal communication, to secondary ones, with more formalized and ritualized communications. Moreover, in the latter case, a gap in trust level is noticeable depending on the regularity of communications: the index of trust in colleagues at work is more than three times higher than the index of trust in housemates (Fig. 1). The presented data basically agree with the all-Russian indicators of the last decade [10, p. 31].

Fig. 1. Interpersonal trust level (non-dimensional values, range -100 to 100, n = 407).

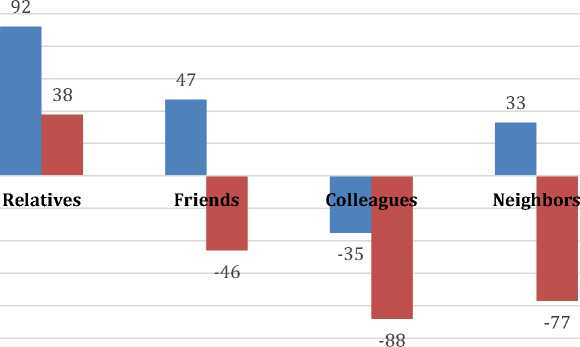

When a child and a loan are considered objects of trust, opinions were somewhat divided when clarifying questions. The respondents note that they could trust the child to their friends and acquaintances (index value = 473), but they are not ready to take financial risks with them (index value = -46). Thus, the respondents demonstrate trust in “friends, acquaintances” in personal relationships and distrust in financial (business) matters. This seemingly paradoxical situation can be partly explained through the data on self-assessment of the level of income, which showed that a significant part of the respondents classified themselves as people who only have enough income for food and clothing (47%). Accordingly, it can be assumed that people who are mostly occupied with the issues of survival, “making ends meet” in the modern unstable economic situation are focused primarily on how to get and keep finances, and the need to leave a child in the care of someone else, as a rule, is associated specifically with the need to go to work. Concerning the category of “relatives,” the trend is similar but less pronounced: in most cases, the child would be en- trusted (index value = 92), while they are willing to take on financial obligations with less desire (index value = 38) (Fig. 2).

■ Entrust the care of a small child ■ Apply for a loan for them

-20

-40

-60

-80

-100

Fig. 2. The level of interpersonal trust (indices based on answers about the willingness to entrust a child and obtain a loan for another person; values without dimension, range from -100 to 100, n = 407).

In general, it can be noted that in the Arkhangelsk Oblast, social capital is reproduced mainly through the maintenance of networks of kinship and friendship, while nominal belonging to a territorial group (housemates) does not lead to the formation of a stable network of mutual support and trust, does not form a group identity and, as a consequence, group cohesion, and therefore cannot serve as a source of social capital. It can be assumed that the low level of trust in neighbors prevents the emergence of networks of social interaction at the level of larger territorial communities – settlement and urban. As a result, in the surveyed territories of the Arkhangelsk Oblast, various projects of TPSGs (for their creation from below, and not within the framework of the planned work of local administrations), public urban spaces, local business projects requiring public support (or, according to at least loyalty to them).

Let us move on to the issue of the state of bridging capital in the Arkhangelsk region. As mentioned above, its indicators can be the general level of trust in fellow citizens and trust in key political and socio-economic institutions.

As for the general level of trust in the Arkhangelsk Oblast, although it is slightly higher than the average in Russia (the share of those who agreed with the statement “Most people can be trusted” was 28.6% against the all-Russian value of 22%), nevertheless, it is rather low in comparison with countries with a developed network of voluntary civic associations and grassroots public initiatives. So, in the United States, this figure is 34.8%, in Germany - 44.6%, in Sweden - 60.1% (World Values Survey, 2010–2014)4.

The values of the indices of institutional trust in the Arkhangelsk Oblast are reflected in the histogram5 (Fig. 3).

Mass media

Political

parties

Big business

Local government

Reg

ional autho

rities

The State Duma (lower house of pa

rliament)

Trade unions

Small and medium-sized businesses ouncil of the Federation (upper house of parliament)

-30,3

-29

-25,7

-20,55

-19,8

-12,2

-6,7

-4,45

-2,8

Prime Minister □1,95

Church3,75

Government4

Courts и 14,05

Police I 17,2

Secret service I 35,7

President

42,95

48,05

Army

-40 -30 -20 -10 0 10 20 30 40 5060

Fig. 3. Institutional confidence indices (non-dimensional values, range from -100 to 100, n = 407).

A significant part of the respondents demonstrates trust in the president (the share of answers “I trust” - 41.9% and “rather trust” - 33.1%), the army (43.6 and 29.7%, respectively), and state security agencies and special services (28.4 and 38.8%, respectively). The respondents trust the media to the least degree (the share of answers “I don’t trust” - 36.7% and “I rather don’t trust” - 26.9%), political parties (32.5 and 25.2%, respectively) and big business (29.8 and 24.2%, respectively). The indices of trust in the institutions that, to the greatest extent, reflect the level of accumulation of bridging social capital - small and medium-sized businesses, trade unions, religious associations - are also distinguished by shallow values.

Thus, concerning the Arkhangelsk Oblast in terms of the level of formation of social capital in the region, the same conclusions can be drawn as researchers make concerning Russia as a whole: a combination of a relatively high level of bonding social capital with a shortage of bridging social capital6. Eloquent evidence of this is also provided by the data we obtained on the indicator of mutual understanding, which indirectly reflects the relative strength of various group identities (Fig. 4). However, we would like to draw your attention to the fact that the qualitative interpreta- tion proposed above, according to which the situation with social capital in the Arkhangelsk Oblast is a reflection of the all-Russian situation in miniature, does not cancel the quantitative differences of its key indicators in comparison with other regions. Moreover, the averaged all-Russian values of these indicators do not show a rather motley, differentiated picture, which opens up if you look at the situation in the regional context. So, according to data for 10 subjects of the Russian Federation (all federal districts are represented), given in a joint report of the Center for Strategic Research, the Russian School of Economics and the Institute of National Projects, the spread in the proportion of respondents agreeing with the statement that most people can be trusted7, is in the range from 18.2% (in the Yaroslavl Oblast) to 25.4% (in Moscow) with an average value of 21.7% 8. Obviously, even considering the sampling error, the level of bridging capital in the Arkhangelsk Oblast is slightly higher than in many other Russian region9. Simultaneously, it would be wrong to exaggerate the significance of these quantitative differences since the difference of several percentage points does not allow us to consider the Arkhangelsk Oblast as an atypical region, radically different from the rest of Russia in terms of trust and social capital.

Who do you have the most understanding with? (Multiple response, %)

Members of my family90

Friends61

Neighbors13

Colleagues2

People of the same nationality1

Co-believers1

0 10 20 30 40 50 60 70 80 90100

Fig. 4. Respondents' answer to the question:”Among what group of people do you meet the greatest mutual understanding?” (% of the number of respondents, n = 407).

It should be noted that the level of trust in society and the level of trust in individual public institutions are slowly changing parameter10. Thus, according to studies carried out by the Levada Center for over 20 years, mistrust towards fellow citizens, on average, remains quite high throughout the entire post-Soviet period of the country’s development, as well as a high level of declared trust in three especially significant symbolic institutions remains: to the head of state, church and army [9, pp. 43-45]. As a result, we can reasonably believe that our survey results reflect the medium-term state of affairs in the field of reproduction of social capital for the surveyed territories.

Dynamics of the economic situation in the Arkhangelsk Oblast and its relationship with social capital

Let us now turn to statistical indicators reflecting both the state of the regional economy (Table 1) and the dynamics of economic activity, which we associate - all other things being equal -with social capital dynamics (Table 3). In the latter case, we are talking about the entrepreneurial activity of the population and changes in the investment climate, since for these processes, social capital is an important prerequisite.

Table1

Selected indicators of the economic development of the Arkhangelsk Oblast in 2014-2018

|

Index / Year |

2014 |

2015 |

2016 |

2017 |

2018 |

|

Index of physical volume of GRP, % of the previous year index (in constant prices)11 |

101.1 |

100.1 |

99.2 |

103.8 |

102.9 |

|

Investments in fixed assets, % of the previous year index (in comparable prices)12 |

79.4 |

67.0 |

129.8 |

130.9 |

93.8 |

|

Real disposable cash income, % of the previous year index13 |

102.4 |

96.2 |

93.0 |

98.1 |

99.4 |

As you can see from the table. 1, in 2014 -2018, the relative indicators of the gross regional product and the population's monetary income did not show any significant growth - in general, a tendency towards their stabilization in the medium term can be noted. Fixed capital investments have shown unsustainable growth over a period of 5 years (clearly shown in Fig. 5). Their growth in 2015–2016 can be explained both by the general economic recovery after the recession in 2014 and by individual large investment projects implemented during this period (for example, the launch of a mining and processing plant at the V. Grib diamond deposit). Further growth of investments in the regional economy against the background of actual stagnation of production and the absence of signs of expansion of the consumer market is possible only by improving the investment climate by improving the institutional environment and infrastructure (including finan-

21.04.2020).

Ibid.

cial). In turn, these factors of the region's investment attractiveness are the subject of the regional authorities' economic policy.

2014 2015 2016 2017 2018

GRP physical volume index to the previous year (%, at constant prices)

-

—■— Investments in fixed assets to the previous year (%, in comparable prices)

-

—*— Real disposable income, % of the previous year

Fig. 5. Dynamics of individual indicators of economic development of the Arkhangelsk Oblast in 2014-2018.

The regional state program “Economic development and investment activities in the Arkhangelsk Oblast (2014–2024)”, approved at the end of 2013,14 assumed the allocation of a total of 439,980.7 thousand rubles for the implementation of measures to create a favorable environment for the development of investment activities (subprogram No. 1), including the creation of favorable conditions for attracting direct investment in the region's economy and the development of public-private mechanisms partnership, and 2,109,791.6 thousand rubles for the development of small and medium-sized businesses in the region (subprogram No.2). At the same time, at the end of 2019, 245,932.2 thousand rubles of targeted funds (55.9% of the budget of the subprogram) were spent under subprogram No.1, and 1,318,480.6 thousand rubles under subprogram No.2, or about 62.5% of the budget of the subprogram (see Table 2). Even though both subprograms, considering the timing and budget expenditures, were implemented a little more than half. It is too early to give a final assessment of their effectiveness. Some positive effects from their partial implementation could be expected already by the end of 2019. However, we observe a different picture (see Table 3).

Table 2 Financing of subprograms No.1 and No.2 of the regional state program “Economic development and investment activities in the Arkhangelsk Oblast (2014–2020)” (by years, thousand rubles)

Year 2014 2015 2016 2017 2018 2019

|

Subprogram number 1 “Formation of a favorable environment for the development of investment activities” |

5 396 |

108 281.9 |

2 763.8 |

1 394.3 |

46 589 |

81 507.2 |

|

Subprogram number 2 “Development of small and medium-sized businesses in the Arkhangelsk Oblast” |

229 973 |

192 355 |

120 848.1 |

103 717.6 |

116 089.8 |

555 533.1 |

So, according to the National Rating Agency, the investment attractiveness of the Arkhangelsk Region following the results of the first five years of the implementation of the regional state program not only did not increase but also decreased (an increase in the rating at the end of 2019

means only a return to the position that the region occupied at the beginning of the program).

Table 3

Indicators of investment attractiveness and dynamics of small enterprises in the Arkhangelsk Oblast

|

Index / Year |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

|

Investment attractiveness (according to the rating of the National Rating Agency)15 |

No data |

IC516 (average investment attractiveness -second level) |

IC5 (average investment attractivness -second level) |

IC6 (average investment attractiveness -third level) |

IC6 (average investment attractivness -third level) |

IC5 (average investment attractiveness -second level) 17 |

|

The number of small businesses per 10,000 people, units 18 |

124 (144) 19 |

121 (152) |

126 (189) |

127 (188) |

122 (181) |

No data |

However, despite the alarming trends, it is quite possible to assume that budgetary expenditures aimed at creating conditions conducive to an increase in the region's investment attractiveness will nevertheless produce a long-term, albeit delayed, effect. At the same time, we are seeing a clear failure of the regional authorities in creating an institutional environment conducive to the inflow of investment. The low indicator of bridging social capital, which we recorded in the course of a survey of the population, reflecting, among other things, the distrust of the pop- ulation in political and law enforcement institutions (except for the President, special services, and the army), is consistent with the above thesis20.

The low position of the Arkhangelsk Oblast in the investment rating of Russian regions is, therefore, due to both the structural features of its economy and the general state of production factors, and an insufficiently effective policy to normalize the investment climate in the region. And if the structural parameters of the regional economy are largely determined by the historically established model of the economic development of the region, which makes their optimization a prospect by no means the nearest future, then improving the quality of institutions and trust in them from market agents is a task that can be implemented in a relatively short time due to competent political decisions21.

Following the logic that increased trust in public institutions leads to an increase in bridging social capital, which, in turn, reduces the scale of transaction costs and stimulates business activity, we can illustrate the validity of our hypothesis about the influence of the level of social capital on the implementation of entrepreneurial potential through the dynamics of the relative number of operating small enterprises. These data are especially indicative against the background of government measures to support small and medium-sized businesses, implemented by the Arkhangelsk Oblast authorities since 2014.

Small businesses were chosen as an illustration because, for their managers, transaction costs are a more significant constraint on business activity than for medium and large enterprises. According to Rosstat, in the period from 2014 to 2018. the average annual relative increase in the number of small businesses amounted to -0.36%, i.e., the dynamics for this indicator were close to zero (for the same period, the average annual all-Russian indicator was about 6.4%). Obviously, state support measures for small and medium-sized businesses that can produce a positive effect in specific cases do not change the general situation with entrepreneurial activity in the Arkhangelsk Oblast (at least in the small business segment).

Conclusion

Macroeconomic and structural parameters of the regional economy cannot become an object of regulation by regional authorities due to the latter's limited resources and the long-term nature of the processes of changing these parameters. Consequently, increasing the investment attractiveness of the Arkhangelsk Oblast and ensuring economic growth, including due to an increase in the entrepreneurial activity of the population, is possible by improving the quality of the institutional environment and creating conditions for increasing the total volume of social capital, since it can significantly reduce transaction costs and reduce the level of uncertainty and risk for market participants. Moreover, the key role in this process is played by the possession of bridging social capital (closely related to assessments of the state of key institutions), since this allows relying on a wide network of social contacts based on mutual trust outside the primary groups (family and friends) and reducing risks in relations with market counterparties and regulators.

Acknowledgments and funding

This work was financially supported by the Ministry of Science and Higher Education of the Russian Federation (state registration of the project - АААА-А19-119020490098-1).

Список литературы The correlation of social capital, social trust and population’ entrepreneurial activity in the Arctic region (a case study of the Arkhangelsk oblast)

- Myshlyaeva T.V. Doverie v sovremennom obshchestve: podkhody k analizu [The Trust in the Con-temporary Society: Approaches to Analysis]. Vestnik Nizhegorodskogo universiteta im. N.I. Loba-chevskogo. Seriya: Sotsial'nye nauki [The Bulletin of the Nizhny Novgorod University named after N.I. Lobachevskiy. Series: Social Sciences], 2006, no. 1, pp. 301–307.

- Polishchuk E.A. Sotsial'nyy kapital i ego rol' v ekonomicheskom razvitii [Social Capital and Its Role in Economic Development]. Vestnik Sankt-Peterburgskogo universiteta. Seriya 5 [St. Petersburg Uni-versity Journal of Economic Studies], 2005, vol. 5, iss. 1, pp. 10–16.

- Milgrom P., Roberts Dzh. Ekonomika, organizatsiya i menedzhment: v 2-h tomah. T. 1 [Economics, Organization and Management. Vol. 1]. Saint Petersburg, Ekonomicheskaya Shkola Publ, 2004. 468 p. (In Russ.)

- North D.C. Institutions, Institutional Change and Economic Performance. Cambridge University Press. 1990. 160 p.

- Bourdieu P. The Forms of Capital. In: Richardson. J., ed., Handbook of Theory and Research for the Sociology of Education. Westport, CT: Greenwood, 1986, pp. 241–258.

- Putnam R.D. Bowling Alone: America's Declining Social Capital. Journal of Democracy, 1995, no. 6 (1), pp. 65–78.

- Blok M., Golovin N.A. Sotsial'nyy kapital: k obobshcheniyu ponyatiya [Social Capital: to a Generaliza-tion of the Concept]. Vestnik Sankt-Peterburgskogo universiteta. Teoriya, metodologiya i istoriya sotsiologii [The Bulletin of the Saint Petersburg University. Theory, Methodology and History of So-ciology], 2015, vol. 12, iss. 4, pp. 99–111.

- Putnam R.D. Bowling Alone: The Collapse and Revival of American Community. New York, Simon & Schuster, 2000. 541 p.

- Portes A., Vickstrom E. Diversity, Social Capital, and Cohesion. Annual Review of Sociology, 2011, vol. 37, pp. 461–479.

- Gudkov L. «Doverie» v Rossii: smysl, funktsii, struktura [«Trust» in Russia: Meaning, Functions, Structure]. Vestnik obshchestvennogo mneniya [The Bulletin of Public Opinion], 2012, no. 2, pp. 8–47.