The Decentralized Shariah-Based Banking System in Bangladesh Using Block-chain Technology

Автор: Oishi Chowdhury, Md. Al Samiul Amin Rishat, Md. Al-Amin, Md. Hanif Bin Azam

Журнал: International Journal of Information Engineering and Electronic Business @ijieeb

Статья в выпуске: 3 vol.15, 2023 года.

Бесплатный доступ

Shariah-based banking aims to apply Islamic finance while adhering to Shariah principles. The primary distinction between conventional and Islamic finance is that Sharia law explicitly forbids several of the activities and principles applied in conventional banking. According to Sharia law, “Paying or charging an interest (Riba)” lending with interest payments as an exploitative practice that benefits the lender at the expense of the borrower, “investing in businesses engaged in banned activities" like producing and selling alcohol or pork, “speculation or gambling(Maisir)” That means financial institutions are prohibited from participating in contracts where the ownership of goods depends on an unpredictable future event, and Participation in contracts with a high level of risk or uncertainty is referred to as "uncertainty and risk (Gharar)", which are strictly prohibited. As a result, consumers must be aware of whether they are taking Riba, Gharar, Maisir or if their money is invested in a halal firm. Because of its qualities, blockchain would be useful in this situation. This research tries to determine how blockchain technology can be used to make investments and profit or loss returns more transparent, more secure, Immutable and sharia compliant. Blockchain networks can be utilized in the financial industry, such as banking, to provide safe sharia banking.

Bank system, islamic finance, blockchain, smart contract, web 3.0, hyperledger fabric, defi

Короткий адрес: https://sciup.org/15018870

IDR: 15018870 | DOI: 10.5815/ijieeb.2023.03.02

Текст научной статьи The Decentralized Shariah-Based Banking System in Bangladesh Using Block-chain Technology

Published Online on June 8, 2023 by MECS Press

Generally, conventional banks are not based on religious principles and are profit-making organizations known as commercial banks[1]. On the other hand, the Islamic banking system is a non-interest bank that follows Sharia law based on the Quran and the Hadith. Sharing the profit and loss is the first fundamental principle of Islamic banking,and thesecond one is that it prohibits collecting interest,or ’Riba’[2].

Islamic banking is an ethical banking system, whereas conventional banking is unethical.Islamic Banking follows the law of Islamic Shariah, while conventional banking is based on Man-Made-Law, which is the significant difference between the Islamic and conventional banking systems.

Nevertheless, in the traditional banking system, loan costs,profit, and risk are fixed. In terms of growth, Islamic finance is growing at a rate 170 percent faster than conventional banks.Without them, there is no difference between Islamic finance and traditional finance[3].

According to Shariah, Islamic Finance should stress profit and loss sharing and ban interest[4]. The profit-sharing is dependent on shariah limitation. Bank does partnership type business it is the main activity of Islamic Finance. Making profit has been encouraged, and any form of fixed interest is prohibited. Money should be treated as a medium only. Just like profit, one should accept the loss. If a business faces a loss, investors have to share the loss according to their share ratio. Here, Gharar is banned. It means uncertainty, risk. It is prohibited to invest in something uncertain. Here the conceptof Musharakah and Mudarabah has been discussed.

-

• Musharakah: In this partnership structure, stakeholders share profits and losses. The partners also make the management decisions[3].

-

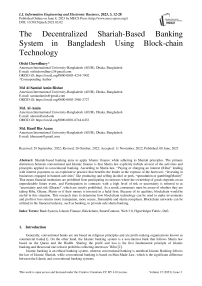

• Mudarabah: In Mudarabah, there is one member who shares the entire capital needed. He is called Raab-ulmaal. Another person gives his effort to run the business. They are called mudarib. Here, profit is distrusting according to the ratio. Nevertheless, in case of loss,only Raab-ul-maal bears it[3]

We are using Mudarabah to construct the system. Here, depositors are "Raab-ul-maal" and the bank is "mudarib" Figure 1.

Fig. 1. Mudarabah in Islamic bank

In theory, depositors are depositing money into the bank, and both the bank and the depositor agree upon a percentage share. Then the bank will invest the money in the business chosen by the user. After a certain amount of time, the business will return a profit or loss. According to Mudarabah, if the business returns a profit, the bank will share the profit according to the predetermined percentage. But if the business returns a loss, the Raab-ul-maal has to carry the loss.

Riba is haram for a Muslim person. Riba is an Arabic phrase that means "forbidden" or "illegal." In Islamic finance, Muslims are prohibited from investing in, acquiring, or otherwise engaging in transactions involving prohibited items and activities such as pork, alcohol, gambling, and pornography. Halal is the polar opposite of haram.

An Islamic bank system means a non-interest banking system that follows Sharia law based on the Quran and Hadith. Sharing the profit and loss is the first fundamental principle of Islamic banking, and the second one is that it prohibits collecting interest, or ‘Riba’[2].

A Islamic finance starting story

The origins of Islamic banking may be traced back to the Prophet Muhammad’s (Sm) practice of “mudaraba”. The Prophet (Sm) worked as a “mudarib” (agent) for his wife, who pledged her money or commodities to him for trade and received the principle plus a percentage of the earnings. As a “mudarib”, the Prophet (Sm) earned his portion of the same as a return for his labor and enterprise. The “mudarib”, on the other hand, was not accountable for losses incurred as a consequence of travel hazards or a failed business enterprise. The term "mudaraba" refers to this kind of collaboration. Another kind of partnership is “musharaka”, in which the “musharik” (agent) contributes to the capital and so is entitled to a bigger profit portion. Iraqi tax income was brought over the desert to Medina in the form of a mudaraba as early as the seventh century. Caliph Umar is said to have invested orphans’ money in the Medina-Iraq commerce business. During the eleventh century, Musharaka partnerships were used in the north-south commerce between Egypt and Jeddah. In the 17th century, the Turkish city of Busra used as many as 32 mudaraba contracts. Mudaraba was practiced in Tunisia, Indonesia, the Arabian Peninsula, and India[5, 6]. The ancient practice of a "three-tier mudaraba" gave rise to modern Islamic banking notions. The person, rab-al-mal, who seeks to invest money is on the first rung. The mudarib (agent) is the second tier, to whom the rab-al-mal entrusts his capital through a contract, and the entrepreneur is the third tier, to whom the mudarib forms a contract and delivers the capital initially given to him by the “rab-al-mal”[5].

B Blockchain

Imagine a future where people can transfer money to someone without any third-party help. Also with high security and a lower transaction fee. That could be made possibleby blockchain technology.

Blockchain technology is distributing the ledger, which is making things decentralized. The technology can skip the intermediaries. It is also practically tricky to erase the information or adjust it. Every block in a complete blockchain has three sections: data, hash, and hash of its previous block. A hash is an identifier, and each square in the chain has its own hash, which is explicit to everybody. Two different courts will never have a similar case, just as a human has fingerprints. The hashes are made by the information put away in each block. That infers that if the data in a court is changed, the trade will change the hash. The reason why each block has a hash of its past block is so, no one can definitely change or delete the information, and another reason for a blockchain is how it is set up. It creates a distributed organization. Blockchain is an extraordinary innovation that engages people to exchange data through distributed exchanges and brings down delegates like enormous banks. [7]. Trust among peers is made conceivable through cryptography and a dependable organization of PCs that stick to a bunch of distinct principles or conventions. When a renewed individual registers with this blockchain organization, the person will get another duplicate. Everything being equal, the individual in question can check each impedes and can guarantee that each bit in the block is as of now legitimate.

Categories of Blockchain there are 3 types of blockchain.

-

• Public Blockchain

There are no restrictions on a public blockchain. Anyone with a web connection may join the organization and start accepting squares and sending messages. [8]. from a true standpoint

-

• Private Blockchain

A private blockchain network is a decentralized P2P network that is essentially identical to the public blockchain. However, one organization is in charge of the network, the members, the consensus procedure, and the shared ledger. The adoption of a private blockchain may boost participant trust and confidence dramatically. On-premises or behind a company firewall, the private blockchain is located.[8].

• Hybrid blockchain

2. Background Study

The most sensitive elements of both private and public blockchain technologies are combined in a hybrid blockchain. In an ideal scenario, a hybrid blockchain would allow for both controlled and unlimited access. In an ideal scenario, a hybrid blockchainwould allow for both controlled and unlimited access [8].

Islamic banks have played a significant role in Bangladesh’s economic growth and development. The Islamic Bank began operations in 1983. Oriental Bank Limited was thereafter taken over and renamed ICB Islamic Bank Limited in 1987. AL-Baraka Bank Limited was its previous name. AL-Arafah Islamic Bank Limited, the third Islamic bank, was formed on September 27, 1995. On November 25, 1995, the fourth Islamic bank, Social Investment, was established. After that, in 2001, the 5th Islamic bank, Shahjalal Islamic Bank limited[3], was created. As a result of the above, Islamic banks in Bangladesh are subject to the Bangladesh Bank’s regulation and supervision as part of the financial system. Bangladesh Bank, in general, has a policy of equitable treatment for all conventional and Islamicbanks.

The prohibition of Gharar (uncertainty) and Maysir (speculation/gambling) in general relates to one of money’s most important characteristics: liquidity. Zakat is a powerful form of Islamic generosity. If a person has saved enough to achieve Nisab, he or she must pay Zakat, and as a result, the investment will decline by 2.5 percent each year [9].

A Islamic Bank in Dubai

The Dubai Islamic Fixed Deposit Account offers the ideal blend of longand shortterm benefits to depositors seeking seductive and Halal returns on their savings. With a history of high profit payouts, the Dubai Islamic Fixed Deposit

Account is an excellent investment vehicle for depositors with redundant finances. By investing in the Dubai Islamic Fixed Deposit Account, the depositor (fundd provider or RabbulMaal) authorizes DIBPL (funded director or Mudarib) to invest his or her finances on thbasisse of an unrestricted

Mu-daraba contract according to the principles of Sharia. DIBPL invests these finances in its ubiquitous Mudaraba Pool with other deposits and the shareholders’ equity.

The profit on the Common Mudaraba Pool is distributed amongst the shareholders and depositors on thbasisse oagreed– upon weights that take into consideration the tenor, quantum of deposit, and profit payment frequency of the account[10].

B Decentralized Finance’s

Nowadays, defi has become very popular because of its innovative contract features and blockchain. [11] The core technology of Defi is ABCDS [11]"

-

• A stands for artificial intelligence

-

• B stands for blockchain

-

• C stands for cloud

-

• D stands for data, and

-

• S stands for "smart contracts.

Because of the security and safety it provides, many countries have begun to use Defi. Also, using the smart contract, there will be no illegal money transferred. Also, the systems are transparent and stateful. No one can change its function once a smart contract is developed using an algorithm. As a result, there will be no change for anyone engaging in illegal money transfers. Nevertheless, the users have to pay for the interaction[12]. Mainly on the widely used public blockchain. A public blockchain is transparent and also very fast. The security level on a public blockchain is very high. Blockchain technology uses a P2P network. When the transaction happens, the transaction is inserted into a blockchain, and if the owner conforms to the transition, the block notified of the transaction is created. The transaction data, or blocks, is sent to every person on a blockchain. Then the nodes validate the transaction, and the transaction is completed. Also,if the node is not verified, then nodes will reject the transaction.

C Hazard of Decentralized Finance

The consequences, difficulties, and hazards that come with the rise of consumer-facing Defi apps While Defi apps built on permissionless blockchain have the potential to revolutionize consumer-facing financial services, the dangers involved with using them must be considered. Prior to committing or allocating funding to Defi apps, future stakeholders considering engagement with these applications should analyze and evaluate significant risks. Scholars interested in Defi applications might take a variety of approaches to the topic, such as expanding on early research on the market design of Defi apps [13] or looking at governance tokens[14].

D History BlockChain

Blockchain technology started its journey in 2008 with a group of people or a single person known as Satoshi Nakamoto. This is a big mystery in blockchain technology; no one knows the truth. But at that time, blockchain was used on an online payment system without any third-party help. For this system, Bitcoin started its journey in 2009 [41]. Back then, the blockchain was only used to keep bitcoin running[15].

However, bitcoin now has a significant impact on security. Now, blockchain is used in every sector. The old generation of blockchains may have been sluggish and costly, but now blockchains are more affordable and accessible. Web3 will launch in 2022, and blockchain technology will becomemore adaptable[15].

Web3 promises to make it easier for people to create their own digital currency and transact online, as well as increase the security of personal data. For Web3, there are already functional products from the blockchain and cryptocurrency ecosystems. Peer-to-peer (P2P) payments and the acquisition of digital goods are two examples of what users can do with crypto wallets[16]. IN [17] There is briefly discussion about the background of the Islamic banking system.

3. Problems of Islamic Finance

The Bangladesh Bank, however, has provided certain favorable conditions for growing Islamic banking in the nation due to the absence of Islamic financial markets and instruments in the country[1]. The following clauses are very important:

-

• Because Bangladesh has no profit-and-loss-bearing instruments, Islamic banks are permitted to maintain their statutory liquidity requirements (SLR) with Bangladesh Bank at a rate of 10% of their total deposit liabilities (Cash Reserve Requirement [CRR] at 5 percent and Supplementary Reserve Requirement [SRR] at 5 percent in approved securities). In Bangladesh, however, traditional banks must meet a 20% minimum [18].

-

• Under the indirect monetary policy regime, Islamic banks were given autonomous flexibility to set their profit and-loss sharing (PLS) ratios and markups in accordance with their policy and banking environment, resulting in greater profit. Islamic banks have been able to implement Shariah norms independently because to their independence in increasing PLS ratios and markup rates[18].

-

• On the part of their balances retained with Bangladesh, Bank, Islamic banks might be reimbursed for 10% of their proportionate administrative expenditures. This facility has allowed the company to expand its earnings base[18].

Dr Scott said, "IFN’s inaugural Bangladesh forum revealed how much expertise and worldwide experience there is to assist in promoting the growth of Islamic finance in Bangladesh—the future is bright."Dr. M. Kabir Hassan, a finance professor at the University of New Orleans’ Department of Economics and Financial Services, focused on the following difficulties affecting Bangladesh’s Islamic financeindustry[13, 19]:

-

• Communication Gap: Through awareness and advocacy programs, misconceptions, misunderstandings, and incorrect views regarding Islamic finance must be addressed[19].

-

• Trust Gap: To alleviate tensions among the Islamic financial industry’s stakeholders, social business and

impact investment should be promoted[19].

-

• Innovation Gap: The so-called "form vs. content" debate should be avoided by maintaining a balance

between macro and micro Maqasid (financial engineering)[19].

• Skill shortage: A new breed of academics must be developed who have a thorough understanding of Islamic law as well as secular funding procedures and processes[19].

• Regulatory Gap: To offer a fair playing field and rules and standards for Islamic finance sector players, a competent and efficient regulatory framework and legislation should be implemented[19].

4. Proposed Solution

However, Bangladeshi Islamic banking is having a lot of issues.

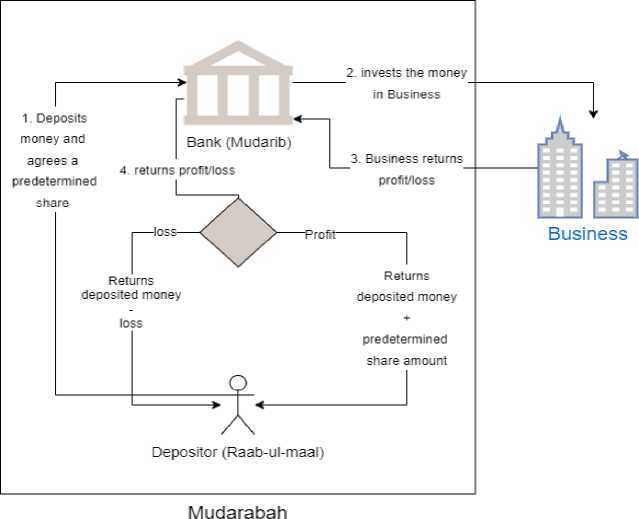

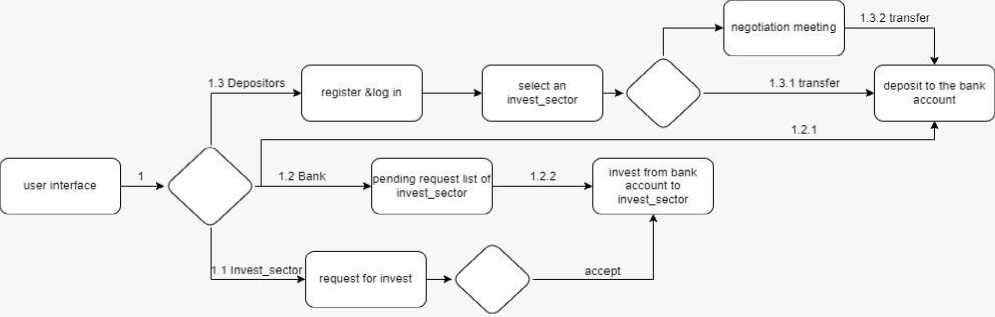

The high-level architecture of our proposed Islamicbanking system.

In Figure 2,

Investment Sector to Bank

Step 1: Investment_sector will register as a Invest Sectorand will send a request to the Bank for Invest.

Step 2: Bank will Received the request.

Step 3: Bank will analysis the Investment_sector if it is Halal or haram.

Step 4: Bank will send a Feedback message if it is Halal then it will send Accepted message with Attach Smart_Contract,or if it is haram then it will send Rejected message.

Step 6: Invest_Sector will able to access the Smart_Contract and if Agree with the Terms & Condition then use Digital_Signature and submit it to the Bank. If they do not agree,the bank will remove the investor sector from the list.

Depositor to Bank

Step 1: Depositors will find an Investment_Sector_List after successfully log in, if they don’t have any account then haveto verify first.

Step 2: Depositor will Choice one Invest_Sector from the list.

Step 3: If Depositor not agree with the profit/loss sharing percentage then they will call for a meeting to negotiate, & fixed everything.

Step 4: If everything goes okay and agree with the Smart_Contract then use Digital_Signature and Deposit Money to the Bank.

Step 5: After Receiving Money from the Depositors, Bank will provide money to the Invest_Sector as Depositors choice for a certain time.

Step 6: After a certain time Invest_sector will return money to the Bank with profit/loss as Mentioned on Contract paper. Step 7: Bank will receive money form Invest_sector and will distribute them to the depositors as their agreed condition about profit/loss percentage sharing.

Banks Make Money

As each depositor receives their money with a certain percentage of profit, for example, if someone deposited his money with a 60% profit percentage, that means that if the business made a profit, the depositor will receive his deposited money as well as 60% of the profit, and the bank will retain the remaining 40% profit. But in case it’s a loss, the bank is not going to share any amount. It will be paid bythe depositors.

Fig. 2. Data Flow of System Architecture

5. Key Stone of This Paper

A Decentralized Islamic System:

The four client application users of the decentralized

Islamic finance is the depositor, investor, Bangladesh bank administrator, and Bangladesh police. A depositor will be able to view the list of investment sectors and select one to invest in. If he/she agrees with the profit/loss percentage, he/she will either call for a meeting to bargain with the profit/loss percentage and, in the same way, agree with the smart contract and deposit money into the bank. Then the bank will invest the money in the business and, after a certain time, the business will return the money with a profit or loss, and the bank will receive it and distribute the money with a profit or loss as agreed by the depositors.

On the other hand, the investment sector can send a request to the bank for business sharing after logging in. The bank will analyze the business to see if it is halal or not. After that, the bank will send feedback with the subject "Accept or Reject." If it is accepted, the business will be added to the list of investment sectors that is shown to the depositors. Then, if thatbusiness agrees with the terms and conditions and signs the smart contract by using a digital signature, the bank will provide money as the depositor’s deposited amount. After a certain time, the business will return the amount with profit/loss sharing terms as agreed with the bank. If this system follows Shari’a law and the Mudaraba banking system, the bank willshare the profit with depositors, but if it is a loss, the bank will not bear it.

B Hyperledger Fabrics

With Fabric v2.0, the first major release of Hyperledger Fabric since v1.0, users and operators alike will benefit from significant new features and improvements. These include support for modern application and privacy patterns, improved smart contract governance, and new options for operating nodes.

The Hyperledger fabric platform is permissioned, which means that, unlike a public permissionless network, members are known to one another rather than anonymously, making them completely untrustworthy. This implies that, even if the members do not entirely trust one another, a network may be run under a governance model based on the trust that does exist between them, such as a legal agreement or a framework for resolving disputes [22, 23]. So, using Hyperledger fabric, this paper proposed a solution for maintaining a proper shariah-based banking system. As a result, it gives security and transparency to the necessary transaction to maintain theproper shariah.

C Ordering service

Hyperledger Fabric is a blockchain network with permissions. The ordering service is the first and most important component, since it is responsible for separating transactions into different blocks and splitting blocks into additional blocks. Participants in the blockchain network, known as peers, may perform a variety of functions[24]. Those are Endorsers, Committers, Anchor peers, Ledger peers.

Our system has four types of endorsing peers for depositors, investors, Bangladesh bank administrators, and Bangladesh police. When a transaction is requested by Fabric SDK, endorsing peers will provide their approval. The transaction will be published to the blockchain along with the endorsement after it has been approved.

D Smart Contract(Chaincode)

Fabric uses general-purpose languages like Go, Node.js, and Java to create chaincodes. The chaincode contains all of the business logic. Transactions are defined and timerestricted when the Chaincode is installed [25]. The ledger cannot be updated if a transaction runs out of time. The alterations and number of world Genesis block increments are committed to the database once agreement on a block is reached. When peers can’t agree on anything, it’s discarded, and the database stays the same.

E Peer

The collection of peer nodes is a key component of a Hyperledger Fabric blockchain network (or, simply, peers). Because they oversee ledgers and smart contracts, peers are essential[26].

F The Ledger

A ledger in Hyperledger Fabric is made up of two separate but connected components: a world state and a blockchain. These each represent a set of details regarding a collection ofbusiness objects.

To begin with, world state: a database that contains the most recent values for a number of ledger states Instead of having to calculate it by going through the full transaction log, the world state makes it simple for a program to retrieve the current value of a state.

A blockchain is a public ledger of transactions that keeps track of every change that has contributed to the status of the world today. To understand the history of changes that have led to the current condition of the world, transactions are gathered inside blocks that are appended to the blockchain. Due to its immutability, the blockchain data structure differssignificantly from the current state of the world[26].

6. Algorithm

In Algorithm 1, an API first checks the user’s registration and login. If the user agrees with the profit-sharing percentage, then enter the amount you want to invest, but the amount should be less than or equal to the required amount of Invest_sector, otherwise it will not be accepted. But if users do not agree with the profit-sharing percentage, they will have a meeting to negotiate and then fix up and enter the amount in the same way. If everything goes properly and the transaction goes successfully, then it will generate a deposit release key and the ledger will be updated. Otherwise, it will show an error.

Algorithm 1 Deposit the money from user to bank

-

1: if (user agrees with the profit shearing:) then

-

2: Enter the amount (Deposit money)

-

3: if ( deposited money <= required money)// (moneythat is still required to invest) then

-

4: Confirm the deposit

-

5: end if

-

6: else if (Have a meeting ) then

-

7: Bank enters the amount

-

8: Confirm the deposit

-

9: if (successful transaction:) then

-

10: Create user deposit

-

11: generate deposit release key

-

12: Update Ledger

-

13: end if

-

14: end if

In Algorithm 2, if that business makes a profit, it will then divide it into equal parts and return the invested money and profit part to the bank account. If it makes a loss, it will also divide it into equal parts, return the invested money, and cut off the loss part to the bank account. It will also generate a return money release key and update the ledger if transactions goes successfully.

Algorithm 2 Investment Sector return money:

-

1: if (Investment Sector having profit ) then

-

2: Check equally divide the money

-

3: Enter amount (asset+profit) (note: in the bank account)

-

4: else if (Investment Sector having loss) then

-

5: Check equally divide the loss

-

6: Enter the amount (loss amount-asset)

-

7: end if

-

8: if (successful transaction:) then

-

9: Create Investment Sector return money

-

10: generate return-money release key

-

11: Update Ledger

-

12: end if

In Algorithm 3, an API first checks the invest_sector registration and login.If invest_sector sends a request to the bank for money, the bank will check if this business is halal or haram, and if it is halal, the bank will update the Invest_sector_list. Otherwise, the request will be declined and send feedback indicating "Rejected." If the user selects that invest_sector, the bank will check if the deposit is less than or equal to the required money for that invest_sector, and the bank will attempt to transfer money from the bank account to the invest_sector account. And if everything goes successfully and you complete the transaction, it will generate an investment release key and update the ledger.

Algorithm 3 Investment Sector request for money:

-

1: if (Investment Sector request for money:) then

-

2: Check the Investment Sector is halal

-

3: Update Investment Sector list

-

4: end if

-

5: if (user select that Investment Sector) then Check

-

6: if (Investment Sector requested amount <= depositorsamount) then

-

7: Enter amount (Attempt to transfer money frombank account to Investment Sector)

-

8: end if

-

9: end if

-

10: if (successful transaction:) then

-

11: Create user deposit

-

12: generate invest release key

-

13: Update Ledger

-

14: end if

In Algorithm 4, at the final stage, if the return release key is true, the system will check if it is a profit or loss. If it is a profit, it will return depositors’ money with the profit percentage as mentioned and will update the ledger. If it is a loss, it will return depositors’ money with a cut-off loss percentage based on equal distribution and will update the ledger.

Algorithm 4 Bank return money:

1: if (invest release key == true) then

2: Check is it profit or loss

3: Enter amount (asset+profit) (note: in the bank account)

4: if (profit) then

5: profit = returned -investment;

6: profitRate = (profitinvestment)*100;

7: totalProfit = (deposited*profitRate)100;

8: depProfit = (totalProfit*parseFloat(share))100;

9: balaceReturn = deposited+ depProfit;

10: Update Ledger

11: else if (loss ) then

12: profitRate = (profit/investment)*100;

13: totalProfit = deposited*profitRate/100;

14: balaceReturn = deposited + totalProfit;

15: Update Ledger

16: end if

17: end if

7. User Interface of our System

8. Transaction Flow

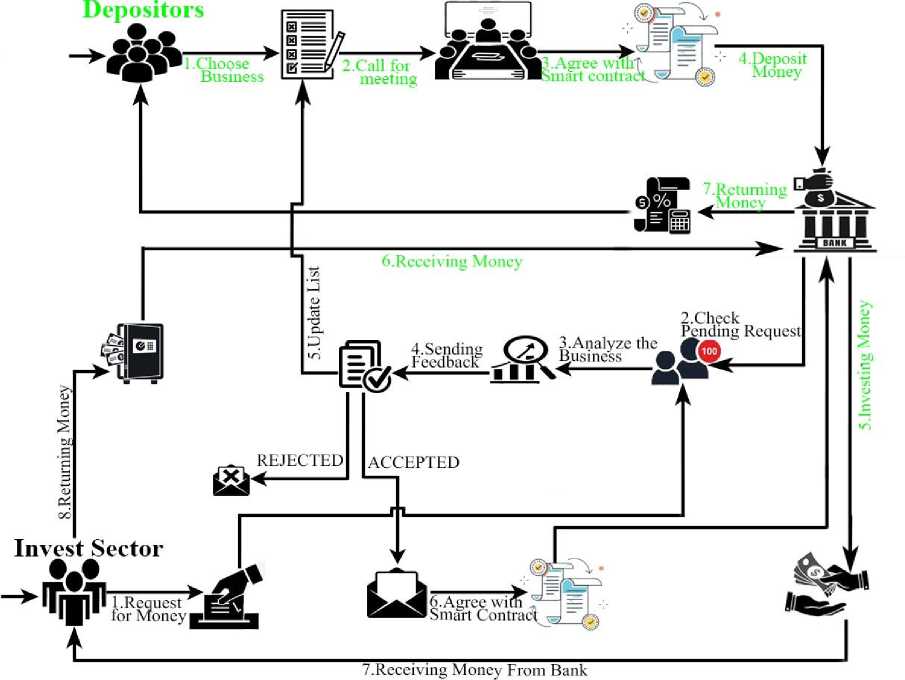

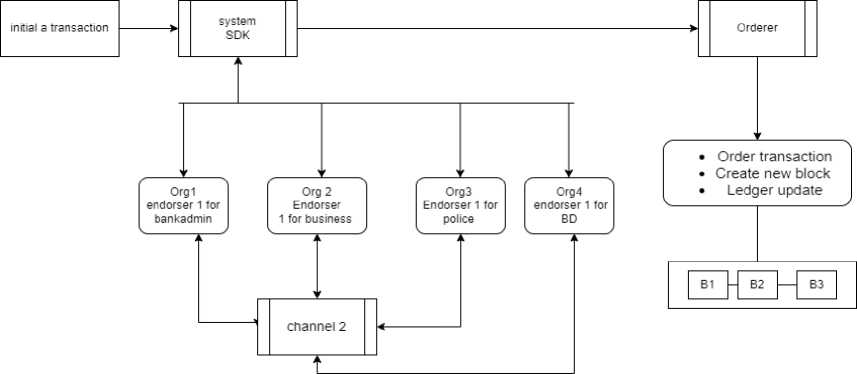

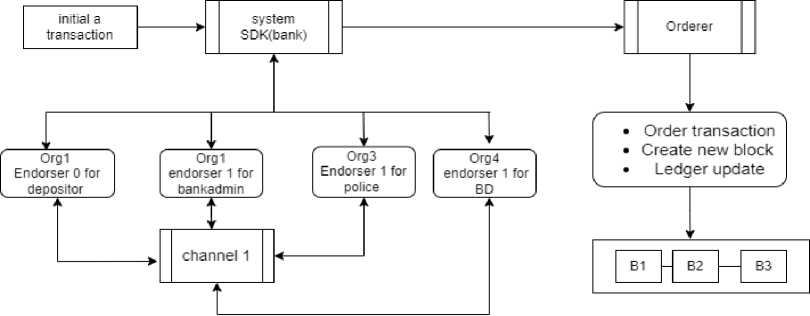

Login as a depositor, the user need to register and then log in to the account that exists. Then choose an investment sector. If they agree with the profit rate, the money will be deposited. If they do not agree with the profit rate, they can call for a meeting and fixed up and then deposit amount anddone Figure3.

Fig. 3. User interface

Login as an investor_sector, the invest_sector will be able to send request to the bank for invest their business with the business details and expected amount. After that, the bank validates the business. and update the investment sector. And will provide the amount depositor invested Figure3.

-

1. First initiate a transaction request to our Islamic systemSDK.

-

2. The Islamic SDK delivers a transaction proposal to endorsing peers after receiving a transaction request from you. There are 18 endorsing peers in our system: 10 endorsing peers for bank-Admin, 2 endorsing peers for business, 3 endorsing peers for police, and 3 endorsingpeers for Bangladesh banks.

-

3. Endorsing peers run chaincode to create a read-write set for the proposed transaction. The transaction response is then sent to the client application by the endorsing peers.

-

4. Endorsing peer verification: well-formed transaction proposals.

-

• If the suggestion is well-thought-out,

-

• Signature is valid even if it hasn’t been submittedbefore.

-

• The submitter (Client) has been given permissionto carry out the channel execution.

-

5. The application verifies the digital identity of the endorsing peer. The fabric SDK then delivers the transaction response to the ordering service, complete with digital signatures.

-

6. The ordering service is in charge of placing the order and establishing a new block. The block is prepared by the ordering peers and disseminated to the leading peers.

-

7. The peers will validate the blocks against the specified endorsing policy. The peers will mark the transaction as valid or invalid in their ledger after supporting the policy.

Fig. 4. Transaction flow for network 1

Fig. 5. Transaction flow for network 2

Data is read-only for permissioned users in hyperledgerfabric, and it is written to the ledger when the chaincode is executed by suitable users. In Hyperledger Fabric, consensus entails more than just agreeing on transaction sequences. It’s critical at every level of the transaction cycle, from proposalto order to validation to commitment.

-

A. Roll of all Entities

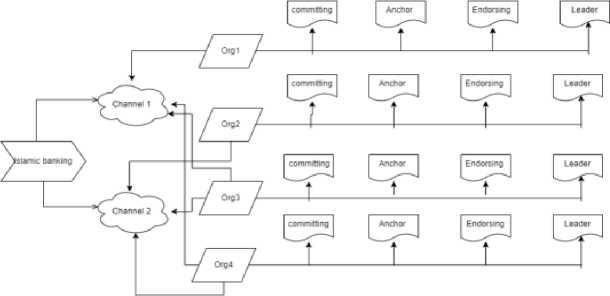

The three sorts of end users in Islamic banking are depositors, business team, and bank administrators.The Certificate Authority (CA) is in charge of managing user certificates, such as registration, enrolment, and revocation. A channel may only be queried (for information) or invoked (for a new transaction) by authorized users. The client’s ability to interact with the fabric network is determined by the rights, responsibilities, and characteristics of his certificate. Bangladesh Bank Admin (Org 3) and police (Org 4) checks transactions in our system.

Bangladesh Bank and police regulators may use portalsprovided by the Islamic bank provider (Org 1).

Bank administrators are in charge of network configuration. Endorsement policy is the fabric network’s consensus protocol. The chaincode may indicate the endorsers for a transaction in the form of a group of peers who must execute and approve the transaction using an endorsement policy. The various commercial groups will be regulated by Islamic bank experts. Depending on their roles, responsibilities, and privileges, client application users may initiate any transaction via channel 1. Channels are utilized as the communication mechanism for multiple organizations in the same consortium in a hyperledger network. The ledgers of peers in the same channel are comparable, and they may execute the same chaincodes. Each channel in a network has its own configuration (configtx). The ordering service node is also a component of channel 1, which is in charge of transaction ordering.

In figure 6, Bank (Org 1), Bangladesh Bank (Org 2), and the police (Org 3) are all members of channel 1, which keepstrack of all deposit data in its ledger.

On the other hand, Bank (Org 1), Bangladesh Bank (Org 2), and the police (Org 3) and the enterprise (Org 4) are all members of channel N, which maintains a record of all transactions. When a new enterprise takes place, a new channel is being created.

Each organization’s membership services provider (MSP) assigns each peer a digital identity for network user identification. Endorser peers are responsible for accepting proposed transactions from client applications, executing chaincodes, producing Read-Write sets, and issuing digitally signed transaction answers. In the context of our application, The orderer peer will order the transaction and create a new block containing ordered transactions whenever it gets a response from the client. The transaction is then disseminated to the most influential peers, including endorsing and committed peers.

The orderer’s transaction will be received by the leading peers from each organization in the same channel, who will then distribute the blocks to other committed peers in the same organization. Commending peers will receive transactions from leading peers and assess them as legitimate or invalid, according to the endorsement rules. Both the endorsing and leading peers serve as committed peers.

Organization 1 will have ten committed peers, whereas Organization 2 will have five. Other peer ledgers in the same channel are identified by an anchor peer. The peer may search for all other peers on the same channel who are from different organizations by querying anchor peers from the same organization. An anchor peer will be designated for each organization.

Fig. 6. Peer’s of our system

9. Discussion and Result Analysis

The suggested approach is implemented and evaluated using Hyperledger Fabric v2.0. Ubuntu 20.04 was used, with an Intel Core i5 9750H 2.6GHz CPU and 4 GB RAM.

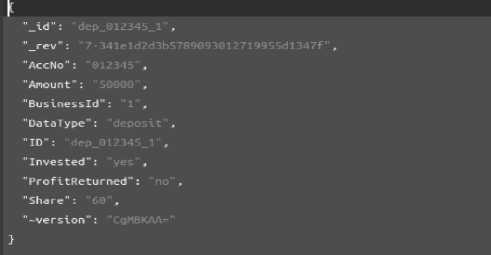

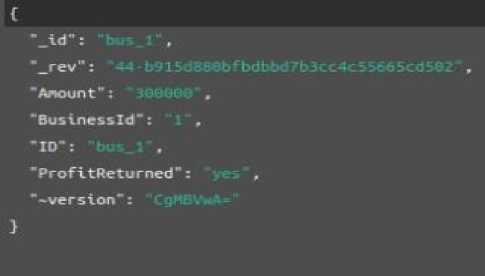

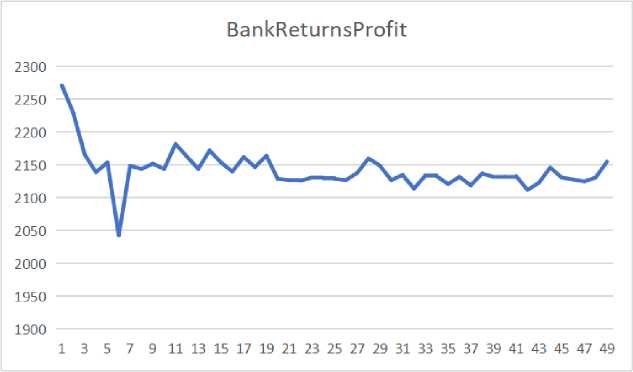

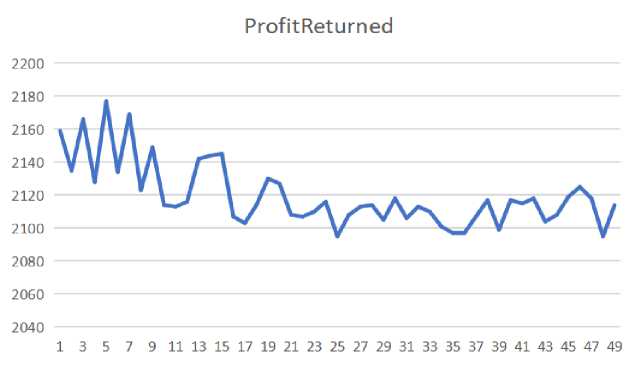

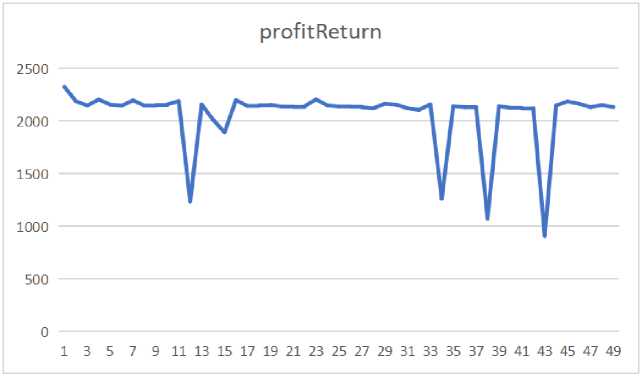

For world state Figure(7,8,9) and blockchain transaction monitoring, we employed Couch DB. We can view the current data snapshot in Couch DB.

-

7 represents the depositors’ portal from where a depositor can see business details, profit percentage, and conditions’, cancel the deposit, and open the account. There is also the functional prototype implemented of the business man’s,business portal 8. after a time the business returning the money to the depositor 9.

Fig. 7. Depositors depositing money

Fig. 8. Bank investing in the business

"_id":.

".rev": 390936

“AccNo": 1 C -15 ,

"Amount":,

"Businessld":,

"DataType": ' dep . t*, "ID": de _u - _ . , "Invested":,

"ProfitReturned":,

"Share":>0 ,

"-version":

Fig. 9. Business is returning the profit to the bank

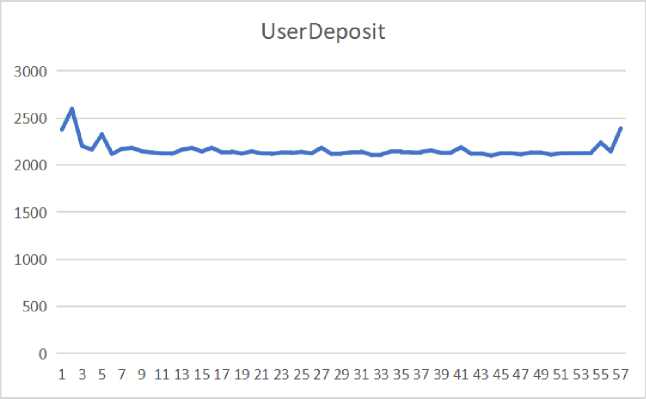

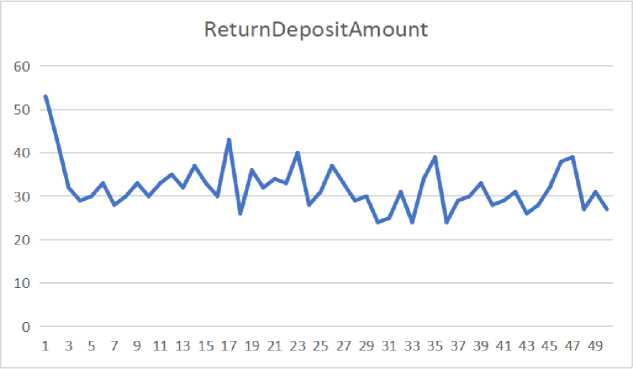

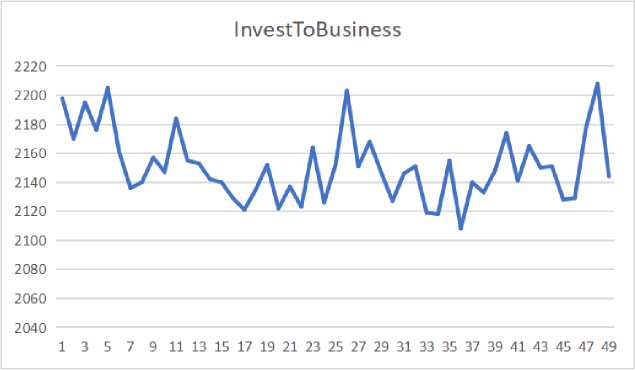

To analyze our prototype, we replicated a network performance test. 50 requests were produced for each method in chaincode, and the request processing time was recorded. Although request processing times are sluggish, every transaction in the performance test was completed successfully.

Fig. 10. Depositors depositing money

Fig. 11. Bank investing in the bus

Fig. 12. Execute time for Invest To Business

Fig. 13. Business is returning the profit to the bank

Fig. 14. Execute time for profit return to depositors

Fig. 15. Execute time for Profit Returned //(this function confirms if the profit has been returned or not)

Those graph’s[10-15] show the execution times of different methods in chain-code.

10. Calculate the profit and Loss

Bank will return the amount of profit/loss based on their deposited money and the predetermined profit share percentage. Imagine, the amount of deposited money of a user ‘A’ is ‘N’ taka and the predetermined profit share percentage is ‘P%’.

Also, the total invested money in the business is ‘I’ taka the amount of returned money by the business is ‘R’ taka. Now, The total profit

TP = R-I

If the TP is positive (it means the business was profitable)then, We will calculate the profit rate ‘PR’.

PR = — x 100

i

Now we can calculate the total profit ‘TP’ of the depositedmoney by A.

Tp _ (N)xPR

Finally, the total profit TP will be distributed among user A and the bank according to the predetermined percentage P. So, the amount that will be returned to the user will be

From,

ТРхР

ТРхР

> N +

N Х РR

ХР

>N +

N хТР

ХР

N х

> N +--

7-R 7 100

х 100 ---ХР

(7 - R) х Р7

> N + ----------

> 100

The final equation to calculate the profit return amountwill be:

N х (7 - R)

AR= 100

If the TP is negative (it means the business returned loss)then, We will calculate the loss rate ‘LR’.

ТР

LR = — х 100

After calculating the loss rate, we can calculate the totalmoney we have to return. Total returned money:

N + (N) х LR

We are using Mudarabah to construct the system. Here, depositors are “Raab-ul-maal” and bank is “mudarib”. In theory, depositors are depositing money to the bank and both bank and depositor agree upon a percentage share. Then the bank will invest the money in the business chosen by the user. After a certain amount of time, the business will return profit or loss. According to Mudarabah, if the business returns a profit, the bank will share the profit according to the predetermined percentage. But if the business returns loss, the Raab-ul-maal has to carry the loss. When we are actually trying to implement this system, it will be much easier to collect all the money for the same business and invest the total money. And when it’s time to return the profit/loss, it will be also easy to get the total profit and distribute it among the depositors according to the predetermined percentage.

11. Utilize

This system is applicable not only to Islamic banks, but also to all commercial banks as a depositing system known as Islamic Banking, Sharia Banking, or Profit Loss Share Banking.

12. Future

In this proposed system, we are concerned about whether the deposited money follows Sharia Law or not. As we are not concerned about whether the business is showing us the real ledger or not, the next step can start from here so that business cannot modify anything before returning profit or loss. On the other hand, we are focusing on explicating part of a banking system called deposits, but still in a banking system, there are other processes also, so the next step could be on loans. In the Islamic banking system, it is completely haram to take interest on loans. Like, if a bank lends money to any user, then no matter how much time it takes, the bank cannot take any interest from it. That’s why the bank does not lend fiat money to the user. What they actually do is basically sell something to the user and make a contract that user has to pay that amount at a certain time. But if any user could not pay that amount within that time, the bank could not set any extra amount for that or any extra percentage for that because it is haram and it is prohibited in Shariah Law.

13. Conclusion

Islamic banks aid financial frameworks that center on speculating in government assistance to society in their capacity as intervening establishments. These locations need maqasid shariah, which adapts workouts for human enjoyment, skill progress, and environmental consideration. To begin with, these findings suggest that a strong monetary framework should be adaptive, demanding, and stable. They must accept any change, overcome financial difficulties, and maintain their strength. Islamic banks mostly rely on the premium free-based framework to carry out their business objectives. Islamic banks also use things and rules based on Islamic law and government policy to balance corporate goals, social projects, and otherworldly goals in their procedures. Second, Islamic banks rely on premium-free and benefit-sharing as part of the Islamic monetary system. It has become a stumbling block to maqasid shariah’s achievement for charity misfortune sharing financing, such as Murabaha and ijarah since benefit enhancement isn’t a specific goal of Islamic bank development. However, we contend that in a Shariah-based baking system, both the user and the banks have an influence on each other and should grow cooperatively for long-term viability. The goal of this study is to conduct a thorough investigation into this topic and uncover the facts behind the transaction. We can tackle these kinds of issues using permission Blockchain. As a result, Islamic money will be widely used and very secure in the future.

We are trying to implement this system. It will be much easier to collect all the money for the same business and invest the total amount of money. And when it’s time to return the profit or loss, it will also be easy to get the total profit and distribute it among the depositors according to the predetermined percentage.

Список литературы The Decentralized Shariah-Based Banking System in Bangladesh Using Block-chain Technology

- Mr. Sheikh Mozaffar Hossain. The banking system of Bangladesh prospects challenges. PhD thesis, 2015.

- Faisal Ahmad. Islamic banks vs. conventional banks in Bangladesh: A comparative study based on its efficiency in operation, volume 4. 2020.

- Abdul Muhaymin Mahdi and Md. Saidur Rahaman. Islamic banking and finance in Bangladesh. 202.

- M. Moniruzzaman. Growth and prospect of Islamic finance in Bangladesh, volume 1. Jun.2018.

- Ed. D. M. Azraf. Islami Banking. 2021.

- Riazuddin Ahmed and Mohamad Saifullah Bin Mohamad. The practice of shariah governance in islamic banking and finance: A study of islamic banks in bangladesh. Technical Report 4, 2019.

- Syeda Nusrat. Use of blockchain technology in banking in bangladesh; usefulness, hurdles and recommendations. 3, 2006.

- Diego Geroni. Hybrid blockchain: The best of both worlds, 28 Jan 2021.

- Gapur Oziev and Magomet Yandiev. Crypto currency from Shari’ah Perspective. 2017.

- Dubai Islamic Bank.

- N. S. Tinu. A survey on blockchain technologytaxonomy, consensus algorithms and applications, volume 6. ACM, May 2018.

- Soumyaa RawatNov. Hybrid Blockchain: Working and Benefits. ACM, 24-Nov-2021.

- Mr Newton. Islamic Instruments In Decentralized Finance, volume 15. 07-Jun-2021.

- Ferdinando Giglio. Fintech: A Literature Review, volume 15. International Business Research, Canadian Center of Science and Education, January 2022.

- Lewis Popovski and Patterson Belknap Webb Tyler George Soussou. Brief History of Blockchain. ALM Media Properties, LLC, 2018.

- What’s the Relationship Between Blockchain and Web3? Updated Nov 11, 2022.

- Oishi Chowdhury and Rishat. Md.Al-Samiul Amin Md.Al-Amin Md.Hanif Bin Azam. The Rise Of Blockchain Technology In Shariah Based Banking System. ACM, 2022.

- M. Kabir Hassan Abu and Umar Faruq Ahmad. Regulation and performance of islamic banking in bangladesh. 49(2), March–April 2007.

- Md. Touhidul Alam Khan. ”brave new world: Islamic finance in bd. International IFN Roadshow Bangladesh2021, August 07,2021.

- Professor Dr. Muhammad Z Mamun. Prospects And Problems Of Islamic Banking From Bankers’ Perspective: A Study Of Bangladesh. November 2014.

- Alam Mohammad Monirujjaman Khan Minhaj Uddin Chowdhury Khairun nahar Suchana SyedMd Eftekhar. Blockchain application in banking system, volume 14. Jan 2021.

- Md. Al Amin Badhon Kumer Ghosh Md. Masudul Hasan Joarder, Towsif Refat and Saimazeba Esha. A blockchain-based decentralized escrow system for ecommerce platforms in bangladesh. 2020.

- Md. Wahid Sadik Samiur Khan Md. Al-Amin Hrittik Hossain, Nawshad Noor. A pragmatical study on blockchain empowered decentralized application development platform. 82:1–9, January 2020.

- Deeptiman Pattnaik. An ordering service in hyperledger fabric,. 17 Dec 2019.

- Shubham Chadokar. Are smart contract and chaincode same in hyperledger fabric? Online, 10 Jun 2019.

- Hyperledger Fabric. Updated Nov 11, 2022