The European economic slump: Between global reasons and country-specific causes

Автор: Sapir J.

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Global experience

Статья в выпуске: 3 т.18, 2025 года.

Бесплатный доступ

The European economy (in the sense of EU-27 and Euro-20) is currently experiencing a period of economic difficulties that are reflected in lower growth than that of the United States and Asian countries. It seems to be losing its relevance on the scale of the global economy. This is the immediate result of the sharp rise in energy prices induced by the sanctions taken against Russia, but also of structural factors in the EU (energy market) and the existence of the euro. To some extent, the process of economic integration pursued in the EU has contributed to spread and diffuse the energy crisis among EU members. This is in part explaining the current situation that worsen the new US policy about trade and tariffs. However, these general problems are added to crisis factors that are specific to each of the member countries, as shown by the study of the three main economies of the EU, France, Germany and Italy. These three economies are still weighting more than 50% of the EU GDP. They are facing specific crisis factors going from a strong deindustrialization, a loss in labor productivity and a strongly degraded fiscal situation for France to the combination of a weak internal demand and a long-standing crisis in Italy and to a crisis of the very model of the German economy caught between the energy crisis that hit harder a more industrialized base and a general dereliction of public infrastructures. But for Germany, the common currency – the euro – seems to have played a much negative role, particularly for France and Italy. The combination of these specific problems and general problems is proving difficult to resolve, the more so when the EU is facing President Trump’s new trade policy. One can wonder if the economic and monetary integration has not been pushed too far without a balancing global fiscal integration.

European Union, energy, economic forecast, euro area, investment, recession, re-localization, tariffs, Trump’s trade policy

Короткий адрес: https://sciup.org/147251528

IDR: 147251528 | УДК: 339.9 | DOI: 10.15838/esc.2025.3.99.3

Текст научной статьи The European economic slump: Between global reasons and country-specific causes

The European economy has been deeply affected by two external shocks, the COVID-19 crisis and armed conflict in Ukraine with all its consequences. After the post-COVID recovery the growth nearly stalled because of changes in geopolitical conditions. Anti-Russian sanction disorganized European industry and trade. This crisis has a strong and lasting impact on economic activity but has not hit equally all EU country members. Still, this crisis has overshadowed specific issues in the three most powerful EU economies (France, Germany and Italy). The combination of global reasons and country specific issues is at heart of the current situation. Now the EU is also facing Donald Trump’s protectionist offensive. But it is affecting countries in different ways. For some countries, like Germany and Italy, it is now an existential issue when France looks less affected.

This is also raising another question. Could economic, and partly monetary, integration – the pride of the EU – have played against the EU in spreading current difficulties?

Assessing the European union economic situation

The economy of the European Union is diverse given the heterogeneity of the EU. However, core EU countries have slowed down for several months. Symptomatically, the Eurozone, which concentrates the largest economies of the EU (France, Germany, Italy) and is the pride of the EU with its monetary integration, is slowing down even more. The outlook seemed better before Trump’s tariffs announcements. But this is likely to change downwards and the EU seems to be caught between

D. Trump’s hammer and energy anvil and could lead to a rise in what is called “euroscepticism” in many countries (Vasilopoulou, Talving, 2023).

The EU growth has never regained the pace it had before the “subprime crisis” of 2008 to 2010 ( Tab. 1 ). Between 2010 and 2023 (Artus, 2024), the EU and EZ accumulated considerable a lag toward USA and Asia. The current difficulties therefore date partly from before the current crisis period. However, the consequences of COVID-19 and of the conflict in Ukraine and sanctions have worsened the situation with a resurgence of what is called Euroscepticism (Szczerbiak, Taggart, 2024). The phenomenon is old and has always accompanied the European Union (De Vries, Hobolt, 2020). However, it is now spreading to parties in the center of the political spectrum and not just to the far right or the far left (Engler, 2020). It is this weakened EU that how has to face new D. Trump’s trade policy.

The context: is the European Union falling behind global growth?

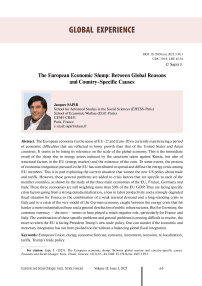

The EU is accumulating a significant gap to the Emerging Asia or ASEAN-5. Neither the European Union nor the Eurozone, are any longer the growth engine of the global economy ( Fig. 1 ). The same is true for the United States. The COVID-19 crisis has hit the different European countries unevenly (Sapir, 2021a), but the gap with Asia has also been significant (Sapir, 2021b). We can therefore wonder about the combination of crises, both global and local, that are currently affecting the EU (Schilin, 2024). A careful study of their combination could explain why this economic slump.

Table 1. GDP and unemployment growth estimates and forecasts for 2024–2026, %

Year GDP Unemployment EU-27 Euro Area EU-27 Euro Area 2024 0.9 0.8 6.1 6.5 2025 1.5 1.3 5.9 6.3 2026 1.8 1.6 5.9 6.3 Source: Autumn 2024 Economic Forecast: A gradual rebound in an adverse environment. Available at: eu/economic-forecast-and-surv...n-2024-economic-forecast-gradual-rebound-adverse-environment_en

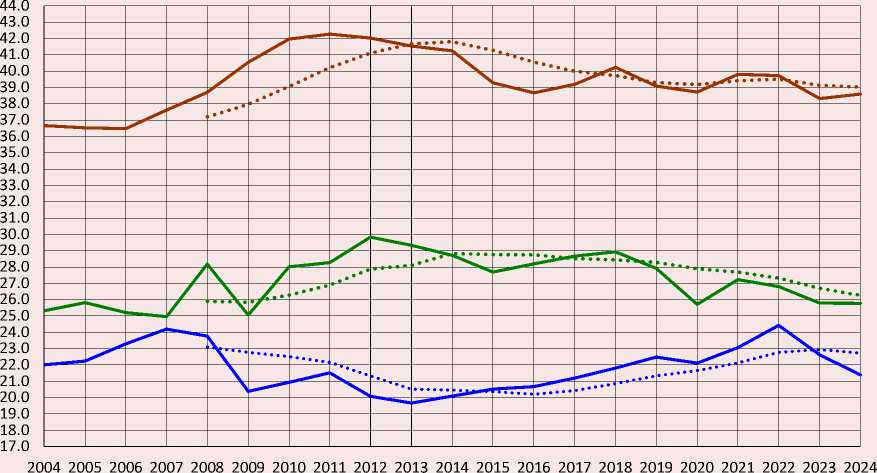

In recent decades, Europe has witnessed a significant intensification of economic and financial interconnectivity (Sidorova, 2021), driven by the expansion of trade, capital mobility, and coordinated policy frameworks among Member States, this deep integration was intended to facilitate substantial opportunities for economic growth (Sanchez-Garcia et al., 2024), to enable economies to capitalize on shared markets, efficient resource allocation, and technological diffusion. But it actually has failed to deliver a significant boost to growth. This is raising doubt about the economic efficiency of EU integrated institutions (Moiseeva, 2024). One major problem has been the failure of these integrated institutions to foster investment. A huge gap is emerging toward Asia, less large but significant with the ASEAN-5 countries, tends to increase again since 2023 (Fig. 2). That generated highly critical comments about the EU economic policy (Rogoff, 2024).

By the way, the recent economic crise underlined too negative effect of economic interdependence at the EU level (Rezaei Soufi et al., 2022), highlighting how a crisis in one country can quickly turn into a regional problem (Alessi et al., 2020). This is a kind of paradoxical effect as this interdependence was a conscious political goal to enhance EU economic competitiveness

Figure 1. Share of world GDP in PPP, %

European Union USA

Emerging and developing Asia

Source: IMF, World Economic Outlook database, October 2024.

Figure 2. Investment, in % of GDP

European Union — ASEAN-5 ^^^— Emerging and developing Asia

5 years average 5 years average 5 years average

Source: IMF, World Economic Outlook, October 2024.

(Krawczyk et al., 2023; Kuc-Czarnecka et al., 2023). As European economies become increasingly integrated, a number of studies have identified a wide range of macroeconomic, social, and structural indicators, such as government deficits, unemployment rates, and income inequality, as being relevant in assessing vulnerability to economic crises.

The shock of the energy crisis and its consequences

Armed conflict in Ukraine since February 2022 has triggered strong political reactions of the EU with several packages of sanctions against Russia (Batzella, 2024). But these sanctions have been taken without any thoughts given to a possible “Boomerang effect”, that they could do more damage to countries taking these sanctions than on the sanctioned country, Russia (Sapir, 2023). This was quite surprising considering that previous economic sanctions against Russia (2014–2016) has already given mixed results on this point (Bali, 2018; Bali, Rapelanoro, 2021; Giumelli, 2017). What is more, no attention seems to have been given to possible retorsion measures taken by Russia (Van Bergeijk, 2014).

Sanctions on energy were (and still are) a very sensitive point. Assessments have been made, mostly by the IMF (Albrizio et al., 2022; Bachmann et al., 2022), but also by the French government (Baqaee et al., 2022) and the Bank of Italy (Borin et al., 2022). Other have clearly identified direct and indirect links going from the German economy to other countries (Alessandri, Gazzani, 2023). It was quickly obvious that the destruction of Nord Stream gas pipe would lead to concentrate the shock on a gas price hike1. It had extended into a general rise in energy prices (Mingsong et al., 2024). The switch from direct gas pipe to sea delivered LNG with all the infrastructure needed has a cost (Bialek et al., 2023), a topic abundantly quoted in the EU literature on energy security (Knodt et al., 2024).

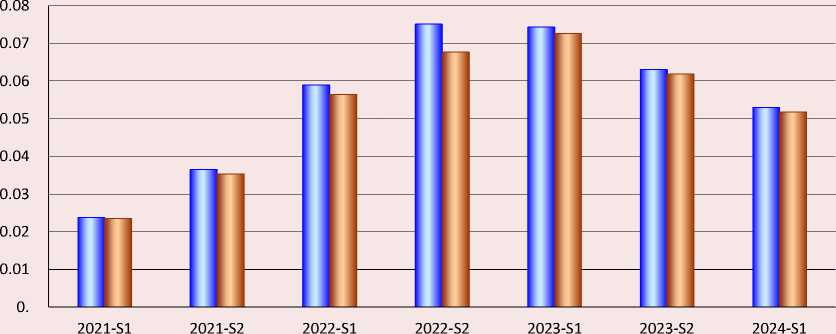

After an initial shock, prices receded a bit, but in the first semester 2024 they were still significantly higher (by 45–46%) than in the second semester of 2021 ( Tab. 2; Fig. 3 ). Of course, some countries, like France, subsidized their enterprises, but at a very high cost as far the public deficit was concerned2. The same apply also for residential use.

Table 2. Evolution of non-residential gas prices, semestrial average, %

|

Period |

EU-27 |

Euro Zone (EZ-20) |

|

2022-S1/2021-S2 |

161,6 |

159,6 |

|

2022-S2/2021/S2 |

205,8 |

191,2 |

|

2023-S1/2021-S2 |

203,6 |

205,1 |

|

2023-S2/2021-S2 |

172,9 |

174,9 |

|

2024-S1/2021-S2 |

145,2 |

146,3 |

|

Source: Eurostat. |

||

The energy shock was a direct result of sanctions against Russia. It exemplified too the nexus of divergent interests and the plays of Institutions inside the EU. It had considerable an impact on German industrial production and on French public finance. But the energy prices shock had deeper consequences. Seven countries like Czechia, Slovakia, Germany and Poland have prices above the EU average. Nevertheless, but for three countries, the general situation improved in comparison to Germany. German position globally degraded as far as non-residential gas prices were concerned, and gas, both as an energy source or a raw material in the industry is a very important factor of competitivity.

Still, the sanctions Boomerang effect was not the only reason behind the energy prices surge. As a matter of fact, the European “market for energy” was (and still is) deeply dysfunctional (Bureau et al., 2023) both in the way it transmits to different

Figure 3. Gas prices for non-household consumers

European union – 27 countries (from 2020) Euro area

Source: Eurostat, Gas prices for non-household consumers - bi-annual data (from 2007 onwards).

economies any external shock (Hidalgo Perez et al., 2022), and more generally in the way it computes energy prices.

The current crisis

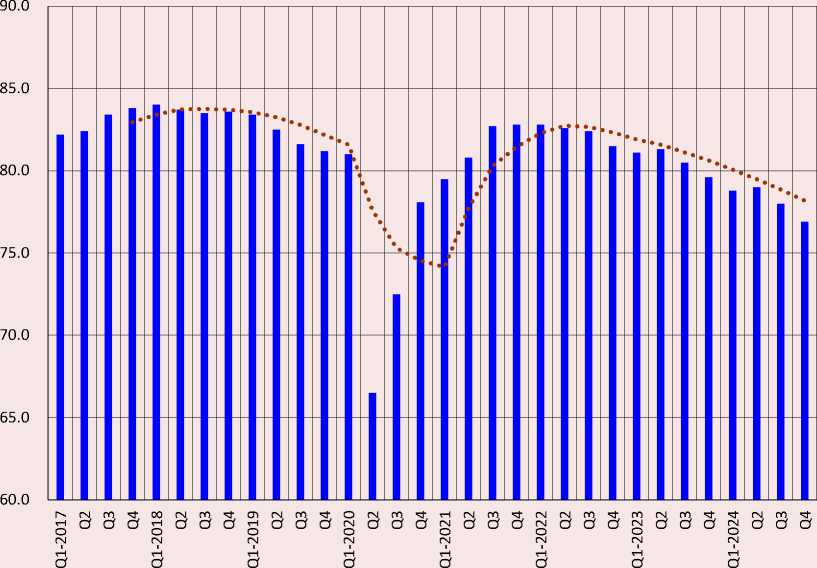

We will use the capacity utilization rate in manufacturing industry as a a reasonable proxy of the global activity. One can see in Figure 4 that the COVID-19 shock has been quite violent and recovery did not happen before the second quarter of 2021. The capacity utilization rate then peaked for the rest of 2021 year and the first 2022 quarter before the effect of the energy crisis could be felt and then began to fall till the fourth 2024 quarter where it reached a value of 76.9%, implying a decrease of -5.9%.

Of course, the EU economic heterogeneity implies that significant differences could exist among Member State. Three countries are displaying a significant increase of the capacity utilization rate in manufacturing industry: Cyprus, Greece and Malta (Tab. 3) to the contrary of the rest of the EU. This is neither a surprise nor a coincidence. These three countries have a manufacturing sector quite strongly dependent of shipbuilding or ship-repair and they are all known to have much benefitted from the shift from gas pipe to LNG travel. These countries are, to some extent and paradoxically, better off with sanctions because of their specific industrial specialization. Some other countries, like Romania and Bulgaria, have been shielded from the sanction-induced gas hike, and are also quite better off. But the same doesn’t apply for Nordic or Balt countries, which implies that the interruption of cross-border trade has also a strong negative impact on the capacity utilization rate.

Figure 4. Capacity utilization rate in manufacturing industry – Euro area, %

Source: Eurostat, European Commission – Directorate-General for Economic and Financial Affairs (ECFIN).

Table 3. Capacity utilization rate evolution among EU countries, %

|

Country |

2022-Q2 |

2024-Q4 |

2024-Q4 – 2022-Q2 |

|

Malta |

64.6 |

81.4 |

16.8 |

|

Cyprus |

58.5 |

63.0 |

4.5 |

|

Greece |

76.4 |

78.4 |

2.0 |

|

Romania |

71.7 |

72.4 |

0.7 |

|

Bulgaria |

74.9 |

75.4 |

0.5 |

|

Czechia |

81.6 |

81.9 |

0.3 |

|

Portugal |

81.8 |

81.8 |

0.0 |

|

Luxembourg |

79.9 |

79.5 |

-0.4 |

|

Estonia |

68.5 |

66.5 |

-2.0 |

|

Poland |

80.0 |

77.9 |

-2.1 |

|

France |

82.2 |

80.1 |

-2.1 |

|

Spain |

80.0 |

77.5 |

-2.5 |

|

Latvia |

75.4 |

72.8 |

-2.6 |

|

Sweden |

85.0 |

82.0 |

-3.0 |

|

Croatia |

80.2 |

77.1 |

-3.1 |

|

Slovakia |

83.9 |

80.3 |

-3.6 |

|

Italy |

79.3 |

74.9 |

-4.4 |

|

Slovenia |

85.5 |

80.9 |

-4.6 |

|

Belgium |

80.0 |

75.3 |

-4.7 |

|

Lithuania |

77.2 |

71.7 |

-5.5 |

|

Hungary |

80.6 |

74.5 |

-6.1 |

|

Austria |

88.8 |

82.2 |

-6.6 |

|

Finland |

80.7 |

74.0 |

-6.7 |

|

Netherlands |

84.2 |

77.1 |

-7.1 |

|

Germany |

85.2 |

76.1 |

-9.1 |

|

Denmark |

85.4 |

76.0 |

-9.4 |

|

Average |

78.9 |

76.6 |

-2.3 |

|

Note: Ireland not included for lack of data. Source: Eurostat – European Commission – Directorate-General for Economic and Financial Affairs (ECFIN). |

|||

Countries have lost as high of 9% for Germany or Denmark which is considerable. Losses are highly significant too for countries quite linked to German economy, like Netherlands (7.0%), Austria (6.6%), Hungary (6.1%), Belgium (4.7%) or Italy (4.4%). Sanctions have then induced a strong negative economic effect on the EU and the Euro Area economies coming through the mechanism of energy prices or because of the disruption of cross-border trade. Both these combined effects are magnified by economic integration that foster deeper transmission of external shock.

A lesson can here be learned. But for countries either with a specific industrial specialization which helped them to benefit from the change of energy trade and the new relevance of maritime transportation or that have been relatively shielded from the sanctions boomerang effect, the loss in industrial production as an effect of sanctions has been quite severe. It was deeper for more industrialized economies than for other, but also deeper for more integrated countries than for others. For some, this effect was even amplified by a reduction in the local trade with Russia.

Industrial development and economic integration have then amplified the boomerang effect. Quite interestingly EU mechanisms supposed to boost economic activity have played in the reverse because the boomerang effect was largely concentrated on energy, and energy vital a factor in highly developed countries. An interesting point is the fact that for a lot of countries albeit their position relative to Germany improved in the wake of the energy shock their economic situation degraded to a significant point. It is possible that the decrease in demand coming from Germany has more than offset the relative improvement toward Germany for energy price. European internal trade was an important target of European integration. The single market institutions were supposed to foster this inter-EU trade. But in the current crisis they worked here against some countries. It’s quite possible this happened because we lack perspective on that point and this situation could be reversed in years to come. Nevertheless, in short term the demand effect seems to be greater than the relative prices one. It is an important fact to be kept in mind as far an EU global economic policy is to be worked on.

However, countries specific situations) are quite important to understand how they economically behave. The study of economic specificities is also important to understand the evolution of the three larger economies, Germany, France and Italy ( Tab. 4 ). Since the BREXIT, these countries are the biggest EU or Euro Area economies, but they display some interesting trajectory differences.

These differences are to play a significant role in the response to Trump’s new trade policies as the level to trade exposure is obviously not the same. Germany certainly is the most exposed country and the one that could suffer much from the announced tariffs hike. France is probably the less exposed and Italy is between both. This is giving a new dimension to the crisis as D. Trump’s tariffs are an existential threat to the German industry.

The three major EU economies: similarities and dissimilarities

France, Germany and Italy are all facing formidable economic problems, but for different reasons.

In France, also the decline in productivity coupled with deindustrialization and the drift of the public deficit are structural causes of the crises.

Italy, for its part, suffers from a mode of insertion in the EU and the Eurozone that prevents it from fully reaching its potential and adds to the old ills of Italian society. In this context, the energy price crisis has come to break the recovery that was announced once the COVID-19 crisis was over.

Germany as we seen was very hard hit by this energy price crisis, which has also been amplified by the behavior of some companies that have abused their market power, thus revealing a flaw in German regulation. By the way, the possibility that some major enterprises will reshore to the USA to benefit from low energy prices is quite real. However, this energy crisis has been added to structural crises. Germany has sacrificed infrastructure investments for too long to the dogma of balanced budgets and it is facing competition from Chinese companies which, in a context of high energy costs and aging infrastructure, is now becoming a worrying problem.

Table 4. France, Germany and Italy, as a % of EU-27 and Eurozone GDP

|

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

|

|

EU-27 |

56.5 |

56.4 |

55.9 |

55.5 |

55.0 |

54.8 |

54.3 |

53.3 |

53.1 |

|

Euro-20 |

65.2 |

65.1 |

64.8 |

64.4 |

64.0 |

64.0 |

63.6 |

62.7 |

62.6 |

|

Euro-12 |

66.9 |

66.9 |

66.6 |

66.2 |

65.9 |

65.9 |

65.6 |

64.7 |

64.7 |

Source: Eurostat, Gross domestic product at market prices.

Still, these countries are making more than half of the EU-27 or of the different Euro Area configurations.

The EU GDP is then quite concentrated. The next three countries, Spain, Netherlands and Poland, are making 19.3% of the total GDP, that is 36.3% of the first three countries. As a matter of fact, the 9 first countries are making 80.0% of the EU-27 GDP and the 13 first countries 90.0%. This concentration is giving us an idea of the importance of the first 3 countries in the EU economy, not just by the absolute weight but also by the links they have created with other countries through crossborder trade and the effect of European integration. However, it is also a fact that growth in France, Germany and Italy has been usually lower than the average growth of the EU-27 or the Euro-20.

France in deep troubles

Notwithstanding political troubles, the French economy has been marked by a very slow and declining growth3 coupled to a poor fiscal policy which let the budget deficit out of control. The fall in inflation did not lead to a recovery in consumption, contrary to what was hoped for. Business investment and employment suffered greatly from the political uncertainties that grew from July onwards. In this context several facts are to be highlighted.

True, France resisted to the energy shock. The so-called “Energy shield” or “Prices shield” however cost the country around 60 billion euro, or nearly GDP 1,1% a year. It reduced the energy-induced inflation by around 2,2% (with an actual inflation rate of 5,9% in 2022 against a counter-factual 8,5% without the shield) (Lemoine et al., 2024). The Energy-price shield has then helped to limit inflation and supported economic growth (+0.3 pp of GDP over 2022–2023) when forecasts made at the beginning of the energy shock were quite pessimistic (Heyer, 2022). But, the relatively favorable results of the Energy-price shield were contingent on the temporary nature of the energy price shock. In the event of a persistent shock, it would only have postponed the increase in inflation, unless it was maintained in the long term, at a prohibitive budgetary cost.

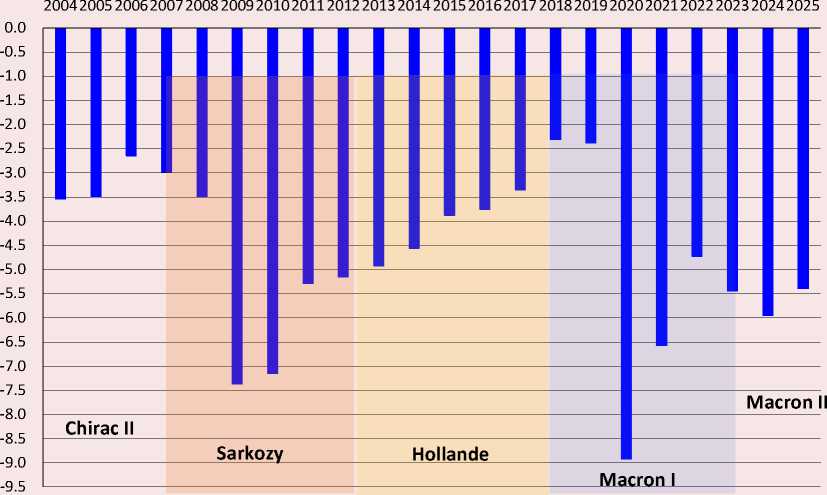

There was a clear budgetary slippage following the measures taken to support economic activity during the COVID-19 crisis. The so-called “emergency measures” taken in the COVID-19 pandemics and after had an important cost for the French budget and pushed both the budget deficit ( Fig. 5 ) and the debt to GDP ratio to new levels (Heyer, 2022). But budget deficit was also clearly structural. This is to be associated with a trend of overvaluation of the real effective exchange rate (REER) linked to the Euro since it was adopted by 1999 ( Tab. 5 ). Since then, it seems that French governments made a deliberate choice to pursue a growth target higher than what the French competitiveness allowed by running a budget deficit. French GDP growth has been higher than Germany’s one but it had a cost.

Not only has Euro considerably slowed down growth among Euro member countries (Bibow, Terzi, 2007), but for Germany, but it has induced considerable costs on countries like France and Italy (Gasparotti, Kullas, 2019). If we retain this structural explanation of budget deficit linked to the Euro (Sapir, 2016), one of the major problem the French economy is facing, could be that it had no room to maneuver when it had to face external shocks.

Consumption and investment have been quite disappointing since the COVID-19 crisis. If the inflationary episode seems to be over (Huber et al., 2024), households are only just beginning to perceive this improvement4. Despite solid gains in purchasing power their consumption has

Figure 5. Budget deficit (IMF standard), %

Note: Presidencies where the budget has been drafted are showed on the graph.

Source: IMF, World Economic Outlook database and public declaration of the French Minister of Finance in the French Parliament finance committee January 23 and 24 (see Reuters: “Le de ́ ficit 2024 devrait avoisiner 6% du PIB”, January 23, 2004).

Table 5. Gap with the German Real Effective Exchange Rate (REER), IMF computation, %

|

Country |

2017 |

2018 |

2019 |

2020 |

2022 |

2023 |

|

France |

19.0 |

15.5 |

15.1 |

17.2 |

14.9 |

10.8 |

|

Italy |

20.0 |

18.0 |

15.1 |

8.9 |

17.1 |

19.0 |

|

Euro Area |

11.0 |

10.0 |

8.2 |

7.4 |

15.8 |

5.8 |

|

USA |

27.0 |

22.0 |

22.0 |

17.4 |

16.8 |

13.3 |

|

India |

14.0 |

13.0 |

5.4 |

2.9 |

0.0 |

-2.4 |

|

China |

14.0 |

11.5 |

9.0 |

8.7 |

2.1 |

8.2 |

Note: year 2021 has been omitted as post-COVID 19 recovery is too much affecting data. Source: IMF, External Sector Report, various year.

disappointed in 2024. The “Olympic period” of 2024 has only slightly increased consumption5. The rise of the public sector consumption has quite probably avoided France to enter a recession by the end of 2023 but, as already said, to quite a high budget deficit cost. Investment contracted in 2024 (-1.5%) after a feeble growth in 2023 (+0.7%). As a matter of fact, 2024, investment declines significantly as mentioned (-1.5% after +0.7% in 2023), with a new, more pronounced decline in investment in construction (-2.5% after -0.9%), a sector that is experiencing a real crisis, and a sharp decline in investment in manufactured products (-4.5% after +3.8%)6.

However, the current slow growth and investment drop France is facing is also to be put into a more general context, one of continuous deindustrialization (Dufourcq, 2022; Fontain, Vigna, 2019). This deindustrialization is a consequence of REER overvaluation since 1999. This process was not a French specificity (Cowie, Heathcott, 2003) but is leading to a global impoverishment of the population and an increased vulnerability to external shocks. It also increases imbalance among regions, a considerable problem for France (Dalmasso, 2017).

Industrial production has been steadily declining as a share of GDP for more than twenty years (Mouhoud, 2006). Industrial production continued to grow until the eve of the 2008–2010 crisis. This crisis has never been overcome ( Fig. 6 ). Even more serious, production in volume, which was impacted by the COVID-19 crisis, has never returned to its 2019 level. The government’s various efforts to “reindustrialize” the economy, efforts that were regularly affirmed from the end of 2020 to 2022 (Allain, 2020), have largely failed to produce lasting effects (Chevallier, 2023). The fact that French industrial production has been unable to recover its pre-COVID-19 level is revealing another hidden story: the one of stagnant or declining labor productivity7.

Figure 6. France – industrial production (index 100 = January 2014)

^^^^^^^^^^в Industry ^^^^^^^^^^в Manufacturing industry

Source: INSEE.

Since 2019, labor productivity in France has fallen by 8.5% relative to the pre-COVID trend ( Tab. 6 ), and as a result job creation has outpaced GDP growth (Devulder et al., 2024). This could be a good point but turns into a sore one once impact of this productivity drop on enterprises competitiveness is figured out. By the way, this new trend is mostly unexplained (Heyer, 2023).

Different factors could explain this drop in labor productivity in 2023 (Askenazy et al., 2024). One important point is that the productivity drop during the COVID crisis was bigger in France than in other European countries and the recovery after the COVID crisis was much smaller and slower. This situation could be in part explained by a focus on employment but for another part is clearly not linked to this focus. This is the real issue. Unexplained factors can’t be addressed. Till they could be identified they will plague the French economy and its competitiveness.

Forecasts made for 2025 indicated that growth would remain weak but could increase in 2026 and 2027 ( Tab. 7 ). But they had been done before D. Trump’s tariffs announcement and their consequences on the global economy and the situation could be more degraded than what it seems.

The INSEE January 2025 note8 showed the impact of economic deceleration in the fourth quarter that could extend to the first quarter on 2025. The economic consensus was quite pessimistic

Table 6. Contribution to the loss of productivity per capita (as deviation from the pre-COVID trend, percentage points)

|

Apprenticeship |

1.2 |

|

Work force composition |

1.4 |

|

Permanent effects of the COVID crisis |

0.4 |

|

Posted workers and regularization of undeclared work |

0.1 |

|

Total permanent losses |

3.1 |

|

Labor hoarding in some sectors |

1.7 |

|

Job retention scheme |

0.1 |

|

Sick leave |

0.0 |

|

Total temporary factors |

1.8 |

|

Unexplained factors |

3.6 |

|

Grand total (%) |

8.5 |

|

Source: Devulder A., Zuber T., Ducoudre ́ B., Lemoine M. (2024), Explaining productivity losses observed in France since the pre-Covid period. Bulletin de la Banque de France, 251(1), March, p. 2. |

|

Table 7. Main macroeconomic indicators, %

|

Indicator |

Confirmed |

Expected |

Forecast |

||

|

2023 |

2024 |

2025 |

2026 |

2026 |

|

|

Real GDP |

1.1 |

1.1 |

0.9 |

1.3 |

1.3 |

|

CPI |

5.7 |

2.4 |

1.6 |

1.7 |

1.9 |

|

CPI, excluding energy and alimentation |

4.0 |

2.4 |

2.2 |

1.8 |

1.8 |

|

Unemployment rate (ILO methodology) |

7.3 |

7.4 |

7.8 |

7.8 |

7.4 |

Source: Projections macro e conomique - D e cembre 2024. Banque de France, Paris, December 16, 2024.

in 2025 early months9, and the French entrepreneur association, REXECODE, diffused among economists a forecasted figure of 0.6% for 2025 growth. A reduction in growth forecast from 1.1% to 0.9% made the French Minister of Economy and Finance, Mr. Eric Lombard, to move from a 5.1% to a 5.4% budget deficit target. If the growth is to sink deeper – to 0.7%–0.6% – the budget deficit could then reach 5.8% to 6.0%, a level not very different from the one of 2024.

French specific issues have interacted with the EU context to generate the current economic situation. The EU sanction generated energy crisis has been partly blunted by France through the “energy prices shield” but to a considerable budget deficit cost. This short-term issue was mixed with a long-term one, the budget deficit drift the Euro caused. Both of them are leading France toward major a fiscal problem. Still, in the medium term, France has to focus on its labour productivity problem to find solution at the current crisis. With labour productivity growth stagnating, there is no hope to regain competitiveness, to achieve cost reductions and to fund the social system and pensions. But, first of all, causes of this stagnation are to be completely understood.

In the long-term France has to reverse the deindustrialization process that is making it more vulnerable to external shock coming from the international situation. But to do so France has to recover its manoeuvre margins to be able to focus on its comparative advantages in cheap and green nuclear energy, in aeronautics and advanced technologies. This implies recovering the ability to depreciate the national currency. That could implies too deleting regulations, mainly but not only European ones, that limit the ability to focus on France comparative advantages.

French difficulties are then part linked to the EU sanctions induced energy crisis and of the Euro Area straight jacket and part related to French specific issues.

Italy: the long and short crisis

Italy is in a curious situation. Current results look mildly disappointing, but less than German ones and on par with France. Still, Italy is in a deep crisis, but one that begun nearly twenty years ago. The factual causes of this long stagnation are quite disputed. Alberto Bagnai put it to economic consequences of the European Monetary Union and the Euro as in France (Bagnai, 2012; Bagnai, 2016). Other explanations have been raised. For example, some have argued that the Italian slowdown is due to the country’s continued specialization in traditional sectors and its inability to upgrade its sectoral specialization (Faini, Sapir, 2005). This argument however has been challenged by Pellegrino and Zingales (Pellegrino, Zingales, 2017). Other dimensions of supposed Italian “backwardness” are also frequently highlighted by the literature as the insufficient levels of human capital, a bank-centered financial system based on personalized relations, a centralized industrial relations system preventing adjustment of wages to local productivity levels, and a society prone to familism, as well as cronyism and corruption, a cumbersome bureaucracy with complex and non-transparent rules, and an inefficient court system (Toniolo, 2013). Given the long list of deficiencies, some economic historians have come to the paradoxical conclusion that what is in need of explanation is not the Italian decline, but the previous period of growth (Di Martino, Vasta, 2015). The main problem with this type of argument is that the negative features it concentrates on have been present for a long time, including when the Italian economy was growing faster than those of other countries, and there is no evidence that they have worsened after the 1990s. Logically, a time-invariant factor should not be invoked as a cause of a time-variant effect.

Another set of explanations are revolving around an insufficient economic liberalization10 (Pagano, 2019). But (Baccaro, D’Antoni, 2024) conclude to European origins of Italy’s stagnation, and some authors describe some structural reforms implemented because Italy could devaluate no more its currency (Daveri, 2012). The EMU has exacerbated difficulties coming from the Italian economy structure (Bagnai, Mongeau Ospina, 2014; Zezza, Zezza, 2020).

The current slump too was initiated through the “energy crisis” that reverberated among the EU (Canelli et al., 2024). This slump resulted in a strong contraction of internal demand that induced a strong reduction of imports and then an improvement of the trade balance. Without external demand the situation would be worse and Trade balance is expected to stay in the positive zone11. Capital formation was strongly affected but with a one-year lag. Unemployment slightly declined but stayed at a high level and the decline of inventories played to a negative role in growth. In 2024, GDP growth has been supported by net foreign demand while domestic demand decreased. D. Trump’s new tariffs are raising considerable a problem for Italy in 2025 as prospects for foreign demand, mainly in the EU are decreasing12.

Household private consumption will continue to be bolstered by the increase in real wages. Labor market improvements will contribute to a sharp reduction in the unemployment rate in 2024 (+6.5%, down from +7.5% in 2023), followed by a further slight decrease in 2025 (6.2%).

However, investment is still big a problem. Deletion of measures taken in the post-COVID 19 are taking their toll. Italy is then rejoining France in the investment slump.

The country looks more dependent on Foreign trade than France, hence more likely to be affected by the present turmoil. The Italian statistical office (ISTAT) has revised downward its estimates from 1.0% to 0.5% for 2024 and from 1.1% to 0.8% for 2025 expected results13. In a context where the economic situation is on a trend of degradation both in France and in Germany, the main Italian economy partners, even this revision appear to be quite optimistic and there is now a strong consensus among economists to put between 0.6% and 0.4% 2025 growth.

Specificities of Italian crisis, and particularly the long stagnation since the beginning of the 2000’s, are compounding its current problem mostly linked to the EU energy crisis and the negative effect coming from Germany. These specificities are adding their own drag on the EU stagnation

Germany: the collapse of an economic system?

Germany, once the heart of Europe’s industrial economy is turning into the “sick man” of the EU and is in recession for the second year in a row14. The main cause of the crisis is the huge rise in sanctions-induced energy prices. Of all EU countries, Germany certainly has been one the worst hit by the sanctions Boomerang effect. German industry, because of its specialization on sectors with a high energy consumption (metallurgy, chemicals, automobile industry) was particularly dependent of the cheap Russian gas flow coming by gas tubes. However, if energy prices clearly were major a crisis reason they were not the only ones.

First of all, the manufacturing industry is in crisis plagued by a rise of energy costs since 202215. It had direct consequence on the GDP growth ( Tab. 8 ). But it is not the only crisis factor. Particularly in the automobile industry, German enterprises are losing ground to their Chinese competitors (Schmitz, Matthes, 2024) because a lack of innovations. Furthermore, households have refrained from purchasing despite the increase in their income due to uncertainty about the development of the economic situation.

The surge in energy prices has led to severe a contraction in the energy-intensive sector’s production, while the non-energy intensive sector’s industrial production has remained resilient (Chen et al., 2023). Production of other industries saw limited declines during 2022, followed by a gradual increase in 2023 as pandemic-induced supply disruptions started easing and external demand recovered.

However, unit profit per real output has exceeded the historical trend and increased by almost 20 percent in the two years after the beginning of the Ukrainian crisis, and the average profit share was 2 percentage points higher than the 2019 average. A survey conducted by DIHK, but also academic researches, suggest that facing higher energy costs, three-quarters of manufacturing firms in Germany planned to pass high production costs onto end-users (Weber et al., 2024; Nikiforos et al.,

2024). Some companies have taken advantage of their or market power to increase their sales prices more than was indicated by the development of purchase prices (Ragnitz, 2022; Nabernegg et al., 2024).

It appears then that energy-cost induced inflation in Germany was used as a tool by some companies to alter profit redistribution (Weber, Wasner, 2023). This is pointing to loopholes in German regulations that clearly are unable to prevent enterprises to implement a policy detrimental to the final consumer (Fletcher et al., 2024).

In manufacturing, as said, output was down and gross value added dropped significantly. Key sectors like the manufacture of machinery and equipment or the automotive industry saw a marked decline in production. Production remained at a low level in energy-intensive industrial branches16, the longstanding weak order situation coupled with high costs is leading a third of industrial companies to plan to reduce staff while only eleven percent expect to increase staff. Employment expectations in the automotive industry are particularly negative where this situation is coupled with a lack of innovation.

As consequence, from January to September 2024, the labor market deteriorated as economic output stagnated. The deterioration of the labor market is expected to be contained as economic growth resumes and ageing continues to weigh

Table 8. Gross domestic product of Germany

Indicator 2021 2022 2023 2024 GDP growth, price adjusted, % 3.7 1.4 -0.3 -0.2 GDP growth, price and calendar adjusted, % 3.6 1.5 -0.1 -0.2 GDP at current prices, billion euro 3.676.5 3.953.9 4.185.6 4.306.4 GDP per inhabitant, euro 44.190 47.183 49.525 50.836 GDP par person in employment, % 3.5 0.0 -1.0 -0.4 Source: Destatis .

15 German economy is losing ground. DIHK survey, fall 2024. Available at: german-economy-is-losing-ground-123310

16 German economy is losing ground. DIHK survey, fall 2024. Pp. 21–23. Available at:

on labor supply. Nominal wage growth has been decelerating, but as inflation fell more, real compensation increased by 2.3% y-o-y in 2024-Q217.

Problems in production and employment were not the only ones. The decline in investment was sharp for the fifth year in a row. In 2024, gross fixed capital formation in machinery and equipment declined even more than gross fixed capital formation in construction. When facing the stiff competition coming from China, it is not good news. German industry is losing what has once made its advantage, a highly effective capital base. Its energy sector is in shambles and it has to review its whole energy strategy.

Public investment in Germany was on the average quite low since the late 1990’s and enabled the German government to keep down budget deficit but put the country at the bottom of advanced economy for public investment18. This is raising a strong problem of labor productivity as noted by the IMF (Fletcher et al., 2024). Germany is now facing a major block-obsolescence issue, one that could imply expenditures as high as 2% GDP (at 2024 prices) for the next five to seven years in addition to investments needed for the “green transition” (a point that current economic difficulties have put into question) and to diversify energy sources. The budget deficit, now at GDP -2.8% in 2024, could increase to over 3.0% as Germany is facing a huge investment effort but also strong demands from the population for more social benefits. But the decay of infrastructures (road, railroad, bridges) is now looking like a serious crisis, which could imply a 500 billion euros (at 2024 value) till 2030. Note here that the future expansion of the public debt could have a strong eviction effect on French and Italian public securities (Strezhneva, 2025).

Consumption had ever been one of the weak points of German economy. The slowing pace of inflation was only able to encourage spending to a limited extent. The biggest increases in household final consumption expenditure (price adjusted) were in the area of health (+2.8%) and transport (+2.1%), which reflects also the age structure of the German society. By contrast, households spent considerably less on food and beverage service activities and accommodation services than in the previous year (-4.4%). In addition, less clothing and footwear were bought in 2024 than in 2023 (-2.8%), after adjustment for price effects19.

The growth in 2025 could be between -0.2% and +0.2%, that is well under IMF forecasts, and the total cumulated growth for 2025–2027 could not exceed 1.0%. Moreover, this extremely weak growth will be mostly supported by the service sector with its traditional low productivity. Risks of deindustrialization look severe in the context of D. Trump’s economic offensive.

The German economic slump is to be associated with the Boomerang effect of sanctions. But it has revealed much deeper weaknesses of the German economic model: a long-standing lack of investment, both public and private, had a detrimental effect on German competitiveness, despite clear a strong undervaluation of the REER. This is real an issue as China is stepping up its competitive power and Washington is trying to induce main German industrial producers to relocate in the US to benefit of much lower energy prices and to avoid newly implemented tariffs. The lack of a buoyant internal consumption is also a contributing factor of the German disease. Consequences of German illness are reverberating in the whole EU and notoriously in countries that were subcontractors of German firms (Czech

Republic, Slovakia), mostly – but not only – on the economic side. In that sense, Germany is also part of creating a toxic EU economic context.

Conclusion

The European Union is currently going through a period of great difficulties, which could easily turn into an open crisis in the coming months or years. The current difficulties stem largely from the boomerang effect of the sanctions taken against Russia since the end of February 2022. But they come too from the cumulative effect of individual crisis: deindustrialization, loss of labor competitivity and fiscal policies issues linked to the Euro for France, the long stagnation of the Italian economy also associated with the Euro, the decaying of the

German industrial model. Interactions between specific and general causes are complex. But quite clearly the level of economic integration achieved by the EU is playing against the EU by spreading local diseases to a general level. So, rise here several questions: was the EU overextended, both geographically and on the institutional side? Was the Euro a mistake? Would European economies be better off with different kind o grouping giving each country more flexibility in time of crisis? By the same token, it seems difficult to achieve a common EU position toward Trump’s tariffs and trade policies as divergences between EU countries are important. These questions are clearly existential ones for Europeans.