The inflation and unemployment processes during and after the COVID-19 pandemic

Автор: Romashkina G.F., Andrianov K.V., Skripnuk D.F.

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Social and economic development

Статья в выпуске: 3 т.16, 2023 года.

Бесплатный доступ

The article considers the features of the dynamics of the main macroeconomic indicators in related developing economies during the economic crisis and after it. Latin American countries (2020- 2022) are the object of the study. The aim of the work is to empirically verify the presence and closeness ofsignificantrelationships betweenthe processesofinflationand unemployment, includingthe possibility of taking into account other macroeconomic variables affecting the processes of inflation and unemployment during and after the COVID-19 pandemic. The relevance of the study is determined by the possibility of monitoring the development of the economic crisis. The analysis of linear regressions on pseudo-panel data was carried out. The general model took into account the size and features of the economy, economic policy, as well as some social effects (the dynamics of unemployment and inflation, specific mortality due to coronavirus, the size of the labor resources for the economy). The models constructed help to study the general crisis dynamics and show the rate of recovery for the trends. The novelty of the results includes an assessment of the effectiveness of management tools in the context of strong external shocks. It is empirically confirmed that there was no direct relationship between the processes of inflation and unemployment in Latin American countries during the period under consideration. A detailed analysis of the impact of macroeconomic factors and factors reflecting the behavior of state institutions may be useful for considering the risks of anti-crisis measures. Inflation is the most controllable process that can be influenced by tools. Unemployment, as a subject of regulation, is a more complex process involving various state institutions; at that, the success of decisions depends mainly on taking into account the country’s export specialization, the pace and severity of anti-crisis measures.

Inflation, unemployment, crisis, covid-19, macroeconomics, behavior, finance, modeling, regulation

Короткий адрес: https://sciup.org/147241604

IDR: 147241604 | УДК: 338.001.36 | DOI: 10.15838/esc.2023.3.87.11

Текст научной статьи The inflation and unemployment processes during and after the COVID-19 pandemic

In our opinion, the relevance of the research is conditioned by three interrelated factors, which can be designated as temporal, socio-political and scientific-theoretical. Unprecedented in its depth and catastrophic for the world economic system, the crisis associated with the consequences of the COVID-19 pandemic differs from previous ones in that it is not a purely economic crisis, but rather the result of active intervention in economic processes by state institutions (Mau, 2022). The experiences of different countries ranged from “pouring money” policies to “containing inflation and preventing unemployment” (Ohchr, Ocha, 2023). In the above context, we have articulated the need to empirically test the rationale of economic policies, typically relying on Phillips’ assumption that there is a tradeoff between inflation and unemployment that can be used to reduce unemployment (Phillips, 1958). The validity of policies to curb inflation is criticized in times of severe crises, the main risks of which are often cited as rising unemployment.

The World Bank in its Global Economic Report 2021 pointed out that the world economy is experiencing an exceptionally strong but highly uneven post-crisis recovery1. The reasoning that the economic shock caused by the spread of COVID-19 and the announced lockdowns brought many industries to a halt, disrupted supply chains, and shifted the global economy to a new employment model has been confirmed by authoritative studies both for the world as a whole and in terms of specific countries and regions (Takes, 2020). In order to maintain population and working capacity of economies, governments increased budget expenditures, removed a number of restrictions for monetary policy, which caused an increase in inflation in 2021 around the world (Bratersky, 2022).

There is an ongoing debate about how adequate the strongest restrictive and paternalistic measures have been and what their long-term effects have been. On the one hand, there is convincing evidence that coronavirus mortality rates are declining under strong restrictions, and it justifies any economic sacrifice by national governments. On the other hand, World Health Organization (WHO) reports and publications have indicated that excess mortality in developing and economically weak countries has more to do with restrictions for a variety of social, economic, and health reasons than with the coronavirus itself. Twenty countries, representing approximately half the world’s population, account for more than 80% of the estimated global excess mortality in the two years after January 2021. The first 15 are Brazil, Colombia, Egypt, Germany, India, Indonesia, Iran, Italy, Mexico, Nigeria, Pakistan, Peru, the Philippines, Poland, and Russia2. Moreover, the WHO referred the countries of Latin America to the most affected ones. According to E.G. Ermolieva, mass spread of infection and high mortality rates from COVID-19 in Latin American countries were caused by slow reaction of the authorities, especially in the first epidemic wave, underestimation of the disease risk, weakness of national health systems (Ermolieva, 2021).

Research problematic

Based on the above, we formulate the aim of the research – to empirically test the presence and closeness of significant relationships between the processes of inflation and unemployment, including the possibility of accounting for other macroeconomic variables affecting the processes of inflation and unemployment, during and after the pandemic COVID-19.

In accordan ce with the aim, the research problems are related to:

-

(1) the analysis of theory and empirically testing of the possible relationships between the processes of inflation and unemployment in a real economic system, which is exposed to crises;

-

(2) the identification of the drivers affecting the processes of inflation and unemployment, taking into account the features of economic development and socio-economic policy of state institutions in the context of the overall crisis dynamics;

-

(3) the choice of the research object – twelve Latin American countries, characterized by a great variety of approaches to macroeconomic and financial policies, especially in times of crisis; the justification of possible theoretical and empirical comparisons of the identified trends with other national economic systems, such as Russia.

We consider these relationships using twelve Latin American countries as examples. Choosing the research region is conditioned by a number of general and specific factors. First, these are developing countries with a high degree of interconnectedness of their economies and a strong influence of the large economy (USA) (Tolmachev, Nikiforova, 2021). Second, Latin American countries are characterized by the social and economic interconnectedness of national economies against the background of a great variety of approaches to macroeconomic and financial policies, especially in times of crisis. In addition, Latin American countries have specific trade specializations, which allows classifying the effects of the crisis depending on the countries’ position in the global specialization of labor.

Unemployment, as one of the macroeconomic indicators, belongs to the sphere of regulation on the part of government institutions related to the Ministry of Labor, the Ministry of Finance (represented by tax authorities), and sectoral ministries. When we talk about inflation, this is a group of indicators, which belong to the sphere of regulation by the institutions of the monetary system, with the main functional role of the regulator belonging to the central bank of the country (Central Bank). From the position of tasks of state management of the national economy, the financial system institutions and the monetary system institutions are in constant conflict of interests. The practice of the world economy knows various examples of optimal accounting of these interests, for example, the practice of weekly closed-door meetings of heads of the Ministry of Finance and the Central Bank of Japan.

We chose the following Latin American countries as the object of our research: Argentina (ARG), Brazil (BRA), Guatemala (GUA), the Dominican Republic (DR), Colombia (COL), Costa Rica (CR), Mexico (MEX), Panama (PAN), Peru (PER), Uruguay (URU), Chile (CHI), and Ecuador (ECV). The symbols are applied to Figures 1–4 and later in the text. We excluded Venezuela from the sample due to strong data outliers. The island states differ significantly from continental Latin America, both in size and type of economy, so we did not consider them in the analysis.

To achieve this goal, we built models of the relationship between the behavior of basic macroeconomic indicators (inflation and unemployment), taking into account the economy’s specialization and the current conjuncture in the development of crisis processes in the world economy. The novelty of this formulation of the problem is determined, first, by taking into account export specialization, and second, by expanding the sample of related developing economies in the crisis period from 2020 to 2022. The third aspect of the novelty is determined by the attempt to bring together in a single comprehensive model the behavior of various related economies during the global crisis. The theoretical significance consists in the analysis of the theory and empirical verification of the possible existence of relationships between the processes of inflation and unemployment in the real economic system, which is exposed to crises. Practical significance includes the identification of factors influencing the processes of inflation and unemployment, taking into account the features of economic development and socio-economic policy of state institutions under conditions of general crisis dynamics.

We use quarterly data covering the period from the 1st quarter of 2021 to the 3rd quarter of 2022 to build models. This interval allows studying the patterns of post-crisis recovery of the economies of the region under consideration without the direct influence of internal factors on the crisis processes. Our analysis is based on the fact that the export specialization of the countries affects the nature of economic relations within the economy, and hence the processes of adaptation of the economy in crisis.

The two parameters that characterize inflation and the unemployment rate, respectively, show the extent to which monetary policy and macroeconomic policy in a country, in a group of countries, can be linked and complement each other; or government institutions, while implementing their functions and achieving their set goals, interact weakly with each other. As a result, the relevant indicators turn out to be unrelated.

We have formulated the following hypotheses: (1) there is a mutual influence of the dynamics of the unemployment rate and the consumer price index; (2) the dynamics of the unemployment rate and the consumer price index (taking into account reciprocity) can be influenced by the specialization of the country’s export; (3) the dynamics of the unemployment rate and the consumer price index (taking into account reciprocity) can show the combined effect of the country’s export specialization, the severity of the COVID-19 pandemic, the characteristics of financial regulation and the functioning of the economy.

Here is a brief description of the countries, starting in 1st quarter of 2020. Brazil, Mexico, and Argentina are the largest economies in the region (see Appendix). Brazil, with (as of 2019) an annual GDP of 1873.27 billion U.S. dollars, entered the global crisis with an annual inflation rate of 3.31% and unemployment at 11% (Fig. 1, 2) . Further,

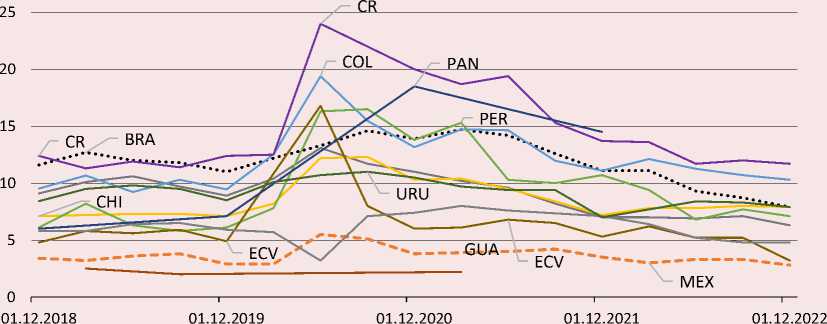

Figure 1. Unemployment rates in the countries under consideration

BRA MEX ARG CHI COL PER ECV GUA DR CR PAN URU

According to (Fig. 1–4): data from official websites of central banks and stock exchanges of the countries under consideration.

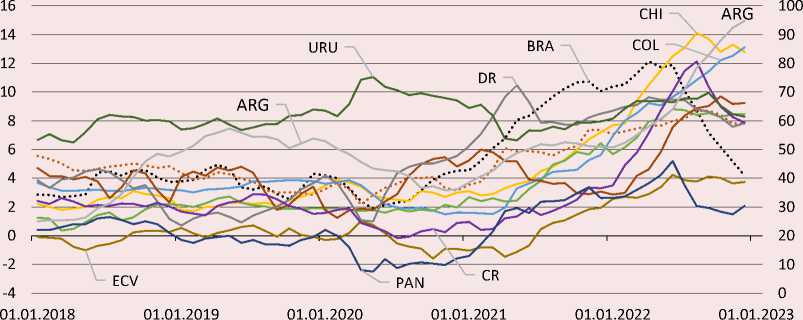

Figure 2. Inflation rates in the countries under consideration (Argentina is on auxiliary scale)

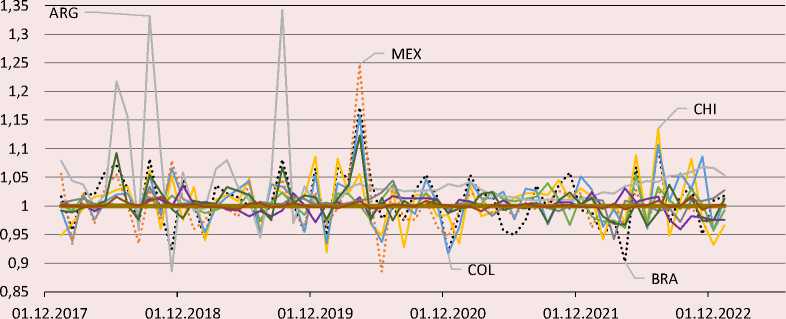

Figure 3. Index of exchange rates of the national currencies of the countries under consideration

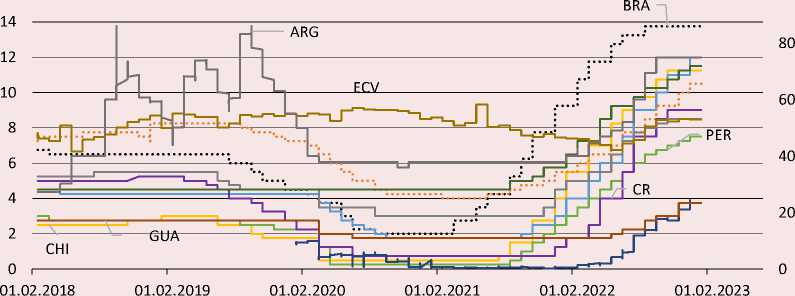

Figure 4. Dynamics of rates of central banks of the countries under consideration (Argentina is on the auxiliary scale)

Brazil failed to recover its GDP even by 2022 (see Appendix). By early 2020 its public debt was 74.44% of GDP. According to Spector’s conclusions, the Brazilian economy grew rapidly until 2020, after which it went into recession, accompanied by high inflation, which caused a decline in population’s solvency. Brazil’s economy is a good model to demonstrate the “middle-income trap”: stagflation, rising social inequality, production inefficiencies, declining production competitiveness and economic growth, and difficulties in implementing institutional reforms (Spector, 2022, p. 25). Brazil’s economy is very similar to Russia’s in a number of macroeconomic indicators (Spector, 2022).

Figures 1–4 show the dynamics of key indicators for 2018–2022.

The size of Mexico’s economy for 2019 was estimated at 1269.01 billion U.S. dollars, annual inflation was 2.8%, and the unemployment rate by early 2020 was well below the Brazilian rate of 2.9%. The public debt level was 45.1% of GDP. During the crisis year of 2020 and the two next years, both economies were able to return unemployment to pre-crisis levels. Meanwhile, Brazil managed to stabilize inflation at 5.79% (by the end of 2022), while inflation in Mexico remains at a much higher (relative to pre-crisis) level of 7.82%. For Argentina, the region’s third-largest economy, the global crises have overlaid a dire economic situation caused by domestic causes. The country greeted 2020 with inflation at 53.8%, at the end of 2022 it was 94.8%, and at the beginning of 2023 the figure was already over 100%, with unemployment at its lowest values since 2015 by the beginning of 2023 (see Fig. 1, 2, Appendix).

The remaining nine countries can be classified as small economies, characterized by considerable variation in macroeconomic indicators (see Fig. 1–4). Chile, Colombia, Peru, and Costa Rica had the highest rates of inflation during the period under consideration. The next (in descending order of inflation rate) are Guatemala, Paraguay, Mexico, the Dominican Republic, and Ecuador.

For all of the countries under consideration except the Dominican Republic, there was a sharp jump in the unemployment rate in the 2nd quarter of 2020; Costa Rica was a kind of anti-leader with an unemployment rate of 24%. Further periods were characterized by a smooth decline in unemployment in all countries. By the end of 2022, the leaders in unemployment were Costa Rica (11.7%) and Colombia (10.3%; see Appendix). Figures 3, 4 show the indices of exchange rates and central bank rates in the countries under consideration. It is important to note how the speed of decision-making on financial regulation is significant in determining the nature of the crisis dynamics.

Thus, we form a sample of developing Latin American countries, which are in a period of high volatility in terms of unemployment and inflation, as well as other indicators of economic dynamics. At the same time, the countries differ significantly in the behavior of financial authorities and other national economic institutions, which allows empirically testing the above assumptions.

Список литературы The inflation and unemployment processes during and after the COVID-19 pandemic

- Addi H.M., Abubakar A.B. (2022). Investment and economic growth: Do institutions and economic freedom matter? International Journal of Emerging Markets. Ahead-of-print. DOI: 10.1108/IJOEM-07-2021-1086

- Albulescu C.T. (2021). COVID-19 and the United States financial markets’ volatility. Finance Research Letters, 38, DOI: 10.1016/j.frl.2020.101699

- Ball L., De Roux N., Hofstetter M. (2013). Unemployment in Latin America and the Caribbean. Open Economies Review, 24, 397–424. DOI: 10.1007/s11079-012-9248-2

- Bratersky M.V. (2022). The world in a pandemic: Main features of the world economy and the strategies of great powers. Aktual’nye problemy Evropy=Current Problem of Europe, 1(113), 10–29. DOI: 10.31249/ape/2022.01.01 (in Russian).

- Caldentey E.P., Perry N., Vernengo M. (2020). The return of Keynes and the Phillips curve in Latin America: Evidence from four countries. Review of Keynesian Economics, 8(1), 84–101. DOI: 10.4337/roke.2020.01.07

- Daniel S.U., Israel V.C., Chidubem C.B., Quansah J. (2021). Relationship between inflation and unemployment: Testing Philips curve hypotheses and investigating the causes of inflation and unemployment in Nigeria. Traektoriâ Nauki=Path of Science, 7(9), 1013–1027. DOI: 10.22178/pos.74-13

- De Vries K., Erumban A., Van Ark B. (2021). Productivity and the pandemic: Short-term disruptions and long-term implications. Int Econ Econ Policy 18, 541–570. DOI: 10.1007/s10368-021-00515-4

- Dmitrieva O., Ushakov D. (2011). Demand-pull inflation and cost-push inflation: Factors of origination and forms of expansion. Voprosy ekonomiki, 3, 40–52. DOI: 10.32609/0042-8736-2011-3-40-52 (in Russian).

- Ermolieva E.G. (2021). Preserving Latin America regional human capital in the midst of the Corona crisis. Mirovaya ekonomika i mezhdunarodnye otnosheniya=World Economy and International Relations, 65(10), 133–141. DOI: 10.20542/0131-2227-2021-65-10-133-141 (in Russian).

- Fontana A., Scheicher M. (2016). An analysis of euro area sovereign CDS and their relation with government bonds. Journal of Banking & Finance. 62, 126–140. DOI: 10.1016/j.jbankfin.2015.10.010

- Frenkel R., Ros J. (2006). Unemployment and the real exchange rate in Latin America. World Development, 34(4), 631–646. DOI: 10.1016/j.worlddev.2005.09.007

- Garcia-Herrero A. (2021). Why are Latin American crises deeper than those in emerging Asia, including that of COVID-19? ADBI Working Paper 1221, Available at: http://dx.doi.org/10.2139/ssrn.3807136

- Gokal V., Hanif S. (2004). Relationship between Inflation and Economic growth. Working Paper 2004/004. Suva: Economics Department, Reserve Bank of Fiji.

- Juhn C., Murphy K.M., Topel R.H. (2002). Current unemployment, historically contemplated. Brookings Papers on Economic Activity, 2002(1), 79–116. DOI: 10.1353/eca.2002.0008

- King R.G., Watson M.W. (1994). The post-war US Phillips curve: A revisionist econometric history. Carnegie-Rochester Conference Series on Public Policy, 41, 157–219. DOI: 10.1016/0167-2231(94)00018-2

- Kostin K.B., Khomchenko E.A. (2020). Impact of the COVID-19 pandemic on the global economy. Ekonomicheskie otnosheniya, 10(4), 961–980. DOI: 10.18334/eo.10.4.111372 (in Russian).

- Mankiw N.G. (2001). The inexorable and mysterious tradeoff between inflation and unemployment. The Economic Journal, 111(471), 45–61. DOI: 10.1111/1468-0297.00619

- Mau V.A. (2022). Economic policy in times of the pandemic: The experience of 2021–2022. Voprosy ekonomiki, 3, 5. DOI: 10.32609/0042-8736-2022-3-5-28 (in Russian).

- Naude W., Bosker M., Matthee M. (2010). Export specialization and local economic growth. The World Economy, 33(4), 552–572. DOI: 10.1111/j.1467-9701.2009.01239.x

- Nijskens R., Wagner W. (2011). Credit risk transfer activities and systemic risk: How banks became less risky individually but posed greater risks to the financial system at the same time. Journal of Banking & Finance, 35(6), 1391–1398. DOI: 10.1016/j.jbankfin.2010.10.001

- Ohchr U., Ocha U. (2023). Content type. World Economic Situation and Prospects. Available at: https://unctad.org/system/files/official-document/wesp2023_en.pdf

- Phillips A.W. (1958). The relation between unemployment and the rate of change of money wage rates in the United Kingdom, 1861–1957. Economica, 25(100), 283–299.

- Polterovich V.M. (2022). Competition, collaboration, and life satisfaction. Part 1. The seven of European leaders. Ekonomicheskie i sotsial’nye peremeny: fakty, tendentsii, prognoz=Economic and Social Changes: Facts, Trends, Forecast, 15(2), 31–43. DOI: 10.15838/esc.2022.2.80.2 (in Russian).

- Spektor S.V. (2022). Competition in the Brazilian automotive market in 2011–2021. Latinskaya Amerika, 7, 21–34. DOI: 10.31857/s0044748x0019795-3 (in Russian).

- Takes I. (2020). Mitigating the COVID economic crisis: Act fast and do whatever. Available at: https://direitoentreciencias.com.br/wp-content/uploads/2020/06/Mitigating-the-COVID-Economic-Crisis-Act-Fast-and-Do-Whatever-It-Takes-Edited-by-Richard-Baldwin-and-Beatrice-Weder-di-Mauro.pdf

- Tobin J. (1995). Inflation and unemployment. In: Estrin S., Marin A. (Eds). Essential Readings in Economics. London: Palgrave. DOI: 10.1007/978-1-349-24002-9_12

- Tolmachev M.N., Nikiforova E.V. (2021). Economic development of the Latin American integration association: Trends and prospects. Statistika i ekonomika=Statistics and Economics, 6, 49–59 (in Russian).

- Vermeulen J.C. (2017). Inflation and unemployment in South Africa: Is the Phillips curve still dead? Southern African Business Review, 21(1), 20–54. DOI: 10.10520/EJC-8e0adf275

- Weitzman M.L. (1982). Increasing returns and the foundations of unemployment theory. The Economic Journal, 92(368), 787–804. DOI: 10.2307/2232668