The investigation of U.S. dollar exchange rate dependence from Canadian dollar oil price

Автор: Dashkina A.K.

Журнал: Экономика и социум @ekonomika-socium

Рубрика: Основной раздел

Статья в выпуске: 3 (34), 2017 года.

Бесплатный доступ

This paper illustrates the method of calculation of the U.S. dollar exchange rate to the Canadian dollar, depending on the oil price of Brent.

U.s. dollar exchange rate to canadian dollar, least square method, univariate parabolic model

Короткий адрес: https://sciup.org/140122811

IDR: 140122811

Текст научной статьи The investigation of U.S. dollar exchange rate dependence from Canadian dollar oil price

^ = f (BRi)

where: Yt is the calculated value of the US dollar to Canadian dollar;

B R i - the price of oil.

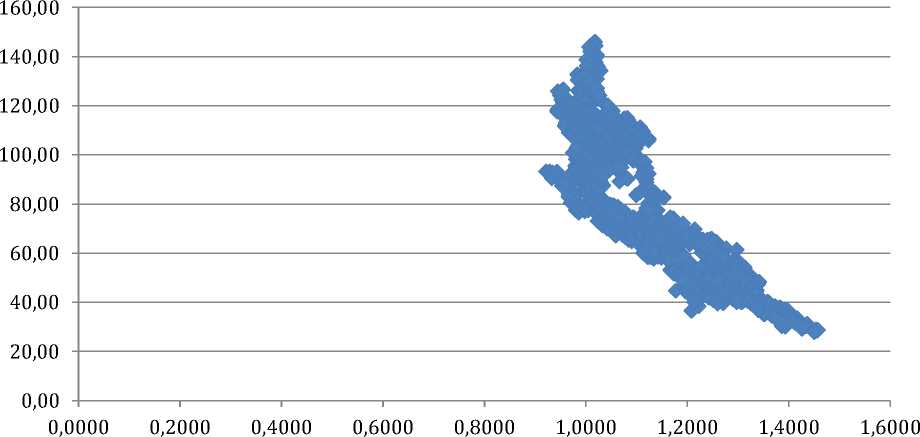

Figure 1. shows the field correlations of the US dollar exchange rate to Canadian dollar to the price of oil.

Based on the field correlation, (for the General combination) it is possible to hypothesize that the relationship between all possible values of the USD/CAD exchange rate (Y i ) and the cost of oil (BR i ) is parabolic in nature.

Then the estimated equation of the parabolic regression (built for sample data), modeling variation in the USD/CAD exchange rate (Y i ) depending on the cost of oil (BR i ), will be:

Yt = a0 + a1BRi + a2BRl where: Yt - the present value of the U.S. dollar exchange rate from Canadian dollar; BRi - is the price of oil;

a0 , a 1 - parameters of the equation.

Стоимость нефти ($/барр.) (BR)

Figure 1. The field correlations of the US dollar exchange rate to Canadian dollar to the price of oil.

•

In accordance with the method of least squares in which in the equation the sum of squares deviations should be minimal between the estimated and actual values.

After substituting the calculated data for the construction of parabolic models based on the USD/CAD exchange rate (Y i ) from the cost of oil (BR i ), the equation system of the parabolic regression has the form:

2623А0+22144А1+20823895,7А2=2861,605

224144А0+20823895,7А1+2059153616,3А2=238842,8

20823895,7А0+2059153616,3А1+213112290249,8А2=21825068,79

Solving the system, we obtain the coefficients of the parabolic regression:

a0 = 1,78255; a1 = -0,01393;a2 = 0,00063;

Thus, the parabolic model based on USD/CAD exchange rate dependence (Y i ) from the cost of oil (BR i ) has the form:

Y; = 1,78255 - 0,01393 * BR + 0,000063 * BR2

where: (Yi)- the present value of the U.S. dollar exchange rate from canadian dollar;

BR [ - is the price of oil.

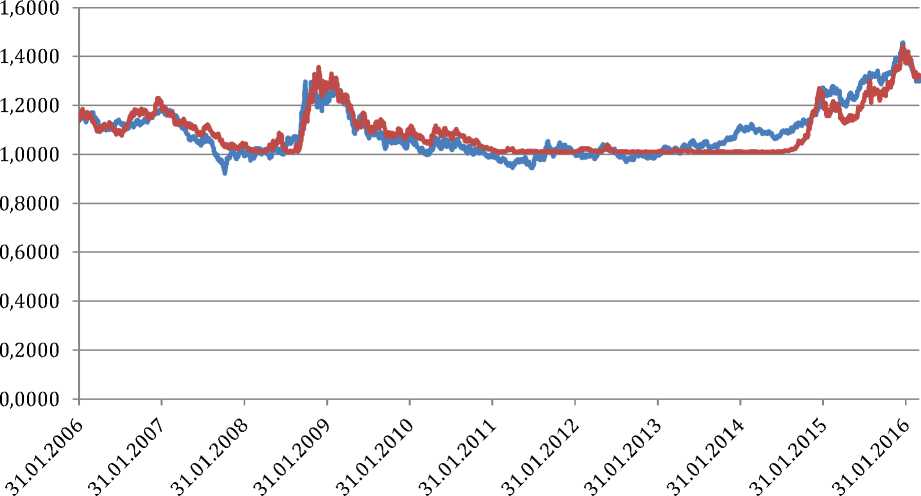

Figure 2 shows the graph of actual and estimated U.S. dollar exchange rate to Canadian dollar, it is built on the basis of the developed univariate parabolic model of the USD/CAD exchange rate dependence (Y j ) from the cost of oil.

КУРС USD/CAD (Y)

КУРС USD/CAD (Yр)

Figure 2. Аctual and estimated U.S. dollar exchange rate to Canadian dollar

Figure 2 shows a graph of calculated values of the USD/CAD exchange rate that follows the same general direction of movement of the actual value of the USD/CAD exchange rate.

Using the estimated data to conduct univariate parabolic models based on the USD/CAD exchange rate dependence (Y j ) from the value of the oil, we can determine:

-

1) correlation coefficient characterizing the U.S. dollar dependence from the Canadian dollar to the cost of oil:

r=F

Ш - Y p )2

Ш — YC p )2

= 0,9001

R = 0,9001 reflects suggests that changes in the oil price highly impact on the USD/CAD exchange rate .

-

2) the coefficient of determination, describing how the posted signs explain the obtained calculated result on the basis of the developed model:

R2 = 1 - -?(5—SL = 0,8102 ЭД - M

R2 indicates that in 81,02 % cases the changes in the cost of oil (BR i ) lead to changes in the USD/CAD exchange rate.

Thus, using the parabolic model based on the USD/CAD exchange rate dependence from the cost of oil, it is possible to determine USD/CAD exchange rate taking into account changes in the prices of oil. The fall in oil prices leads to the growth of USD/CAD exchange rate. Accordingly, the rising cost of oil leads to an increase of U.S. dollar exchange rate to Canadian dollar.

List of sources

-

1 .Bank of Canada official website Bank of Canada http://www.bankofcanada.ca/

-

2 .The Federal reserve system of the United States official website http://www.federalreserve.gov/

-

3 .Chen, S-S. Oil prices and real exchange rates / S-S. Chen, H-C. Chen // Energy. Economics. – 2007. - No 29(3).

-

4 .Dooley, M.P. Exchange Rates, Country Preferences, and Gold / M.P. Dooley, P. Isard, M. Taylor // NBER. Working Paper. Cambridge, MA – 1992. – October. – No4183. – 47 p.

-

5 .Трегуб И.В. Математические модели динамики экономических систем – монография, М.: 2009.

-

6 . Трегуб И.В. Investment project risk analysis in the modern Russian economy // research in empirical international trade. – Slovenia: working papers. June. 2012.

«Экономика и социум» №3(34) 2017

Список литературы The investigation of U.S. dollar exchange rate dependence from Canadian dollar oil price

- Bank of Canada official website Bank of Canada http://www.bankofcanada.ca/

- The Federal reserve system of the United States official website http://www.federalreserve.gov/

- Chen, S-S. Oil prices and real exchange rates/S-S. Chen, H-C. Chen//Energy. Economics. -2007. -No 29(3).

- Dooley, M.P. Exchange Rates, Country Preferences, and Gold/M.P. Dooley, P. Isard, M. Taylor//NBER. Working Paper. Cambridge, MA -1992. -October. -No4183. -47 p.

- Трегуб И.В. Математические модели динамики экономических систем -монография, М.: 2009.

- Трегуб И.В. Investment project risk analysis in the modern Russian economy//research in empirical international trade. -Slovenia: working papers. June. 2012.