The mining industry in Colombia. A general overview

Автор: Restrepo Baena Oscar

Журнал: Горные науки и технологии @gornye-nauki-tekhnologii

Рубрика: Разработка месторождений полезных ископаемых

Статья в выпуске: 1, 2017 года.

Бесплатный доступ

An overview of the Colombian economy is presented and mining is made special between 2000 and 2016. The most important aspects of Colombian mining production are presented and the sector is characterized in terms of extractive industry and environmental components. It presents an historical evolution of the mining sector in terms of production and prices and presents a global picture of mining income, employment generation, reserves of the most important minerals, as well as foreign direct investment in mining. Finally, data on exports of the most important minerals produced in Colombia are presented.

Colombia, mining production, minerals, coal, gold, production of nickel, precious metals

Короткий адрес: https://sciup.org/140215885

IDR: 140215885 | DOI: 10.17073/2500-0632-2017-1-3-10

Текст обзорной статьи The mining industry in Colombia. A general overview

1. Colombian Context: the Colombian economy between 2000 and 2012

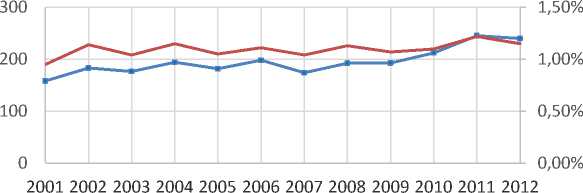

This was due to the increase in the economically active population (EAP) of more than four million people between 2001 and 2012; this good economic performance has allowed a considerable drop in the unemployment rate, from 15% in 2001 to 10.4% in 2012. Within this generation of employment, the non-renewable resource extraction sector (mines and Hydrocarbons) has represented about 1% of the total occupation generated in Colombia between 2001 and 2012, with about 200,000 people employed.

Similar to the trend shown by GDP, the mining industry in Colombia has been notable for its dynamism especially during the first part of the last decade. In general, the GDP of the mining sector has registered growth rates higher than the total GDP (Figure 1), with particularly high growth rates in 2001 and 2003, increasing its share of total GDP to 1.82% in 2000 to 2.32% in 2012. Within this dynamism, coal production has played an important role in representing about 60% of the national mining GDP, participation that has tended to grow during the period.

This greater dynamism of the sector has brought with it an increase of large proportions of the mining income for the national government as well as for regional and local governments. With regard to royalties, for example, its collection increased more than tenfold, from 144 billion Colombian pesos in 2000 to 1.6 billion in 2011. However, this increase, as well as the management of these resources, has was discussed at the national level not only among academics and control bodies, but also at the legislative level, resulting in changes to the management of royalties (Legislative act 05 of 2011).

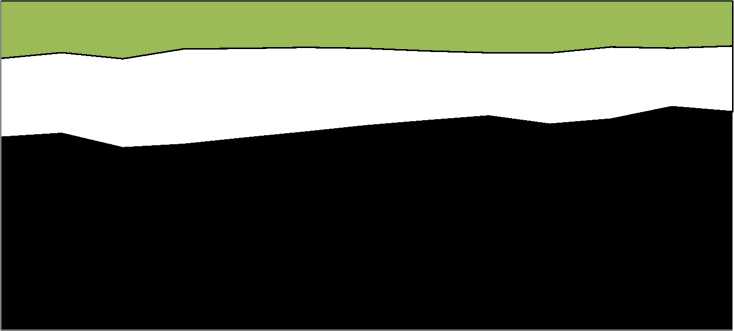

Much of the higher production in the mining sector was accompanied by a large increase in mineral exports, especially coal and gold, from about US $ 1.5 billion FOB in 2001 and 2002 to more than 12 billion dollars FOB in 2012. This behavior occurred within an international context marked by the rising trend of the prices of the main commodities in the last decade, growth that has been maintained despite the weakening of the international economy since 2008 (Figure 2).

Along with the increase in exports from the mining sector, Colombia has also seen a significant increase in exports from other sectors of the economy in the last decade. This increase in exports is explained in part by the greater access to international markets because of the different trade agreements signed by Colombia mainly with countries of the American continent.

100%

80%

60%

40%

20%

0%

1,8%

6,3%

7,9%

13,6%

27,3%

4,4%

11,6%

19,2%

7,9%

|

2,3% |

2 4% , :w% |

|

|

8,,0% |

73,,47%% |

|

|

13,8% |

14,1% |

|

|

26,9% |

26,7% |

|

|

5,2% |

5,8% |

|

|

11,6% |

12,0% |

|

|

19,2% |

19,1% |

|

|

8,5% |

8,8% |

2,3%

6,8%

13,0%

26,6%

6,4%

11,9%

19,5%

9,2%

2,3%

5,4%

6,2%

12,0%

26,1%

6,4%

11,9%

19,8%

9,9%

2003 2006

-

■ Impuestos y otros

-

■ Construcción

-

■ Agropecuario, silvicultura y pesca

Establecimientos Financieros

Servicios

Hidrocarburos

■ Comercio

■ Industria Manufacturera

II Minería

Figure 1. GDP c omposición in Colombia.

Source: DANE database.

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

■ Carbón □ Minerales Metálicos □ Minerlaes no Metálicos

Figure 2. Mining production in Colombia.

Source: DANE database.

2. Characterization of the Colombian extractive industry

In Colombia, the extractive industry covers two major sectors: hydrocarbons (oil and gas) and mining. The first one with more homogeneous techniques, sizes and producers, while the second one - mining - is much more diverse in products, techniques and processes (underground, open mining, alluvium, dissolution) and size of operations, small, medium and large mining).

2.1 Mining sector

The Colombian mining sector is characterized by its diversity, because it is developed in different parts of the country and consists of several products such as thermal and metallurgical coal, nickel, precious metals (gold, silver, platinum), emeralds, even a wide range of minerals Industrial and construction materials. However, to date a measurement of their production at the level of productive scale has not taken place, as this fact only materialized in October 2016, by Decree 1666 of October 21, 2016. Is added the Single Regulatory Decree of the Administrative Sector of Mines and Energy, 1073 of 2015, related to the mining classification. In the country, there have been several proposals for classification (to date, all repealed) regarding the size of mining or segmentation of producers or companies, from the Mining Code of 1988 until Law 1382 of 2010. However, this matter was rescued In the National Development Plan (Law 1753 of 2015, Chapter V. "Energy mining development for regional equity"), to advance "strategies and differentiated regulation for the different types of mining. According to the scale of production, groups of minerals, methods of exploitation and formality, classification that was recently adopted by the National Government through the aforementioned Decree.

2.1 Characterization of the environmental component in the Colombian extractive industry

3. Evolution of the mining sector3.1 Historical mining data in Colombia

3.2 Production and prices

In order to develop the activities of the extractive industry in the country, they must comply with the current environmental regulations. These regulations establish the responsibilities and obligations of the concessionaires in relation to permits and the environmental licensing of extractive projects and whose Institutional responsible is the Ministry of Environment and Sustainable Development (MADS), which exercises this work through the National Environmental Licensing Authority (ANLA) and regional autonomous corporations (CAR) (see http://www.anla.gov.co/funciones-anlaFunciones y competencias). Additionally, the law provides that, for non-licensed activities in the use of non-renewable natural resources, the respective environmental permit, authorization or environmental concession must be obtained from the competent environmental authority.

Currently the Colombian economy is the fourth largest in Latin America. The country's economic growth has been due, among other things, to the growth of the mining sector, particularly in the last decade. This extractive industry concentrates on the production of coal, gold, silver, iron, ferronickel and construction materials. The production dynamics of each of these resources is different but, for the most part, due to factors of the international context, and in certain cases to internal factors.

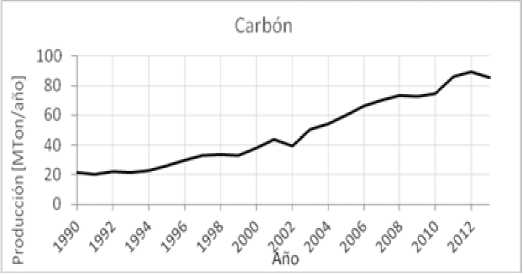

Coal production in Colombia has grown steadily in the last two decades. In fact, production in 2013 is four times greater than production in 1990 (Figure 3). This growth was mainly due to the mines located in northern Colombia, with a high flow of coal exports to meet the energy demands of emerging economies such as Brazil, Chile, China and Turkey and developed economies such as the United States and Netherlands. The high international demand for this mineral has been reflected in the rise of coal prices in its different types.

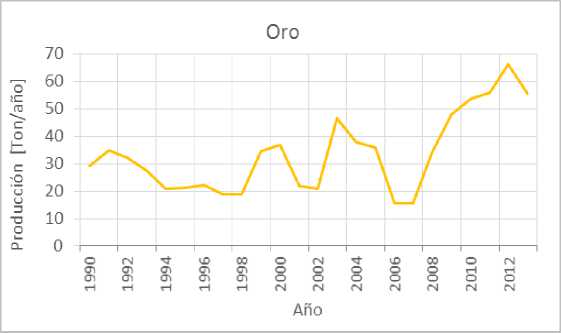

In Figure 4 is shown the production of gold from 1990 to 2013. The growth of gold production has occurred amid growing international demand for this metal, as it is one of the main assets refuge during the financial crisis. Most of this production comes from two companies: Gran Colombia Gold Corp. and Mineros SA. Like other commodities, the price of this precious metal rose sharply to quadruple its value in the last 10 years, going from less than 400 U$/Oz in the first half of the 2000s to more than 1600 U$/Oz in 2012.

The growth of the extraction of materials for construction, specifically limestone (Figure 5), is mainly explained by the dynamics of the construction sector in the last decade, which went from having a share in the GDP ratio of 4.4% in 2000 to more than 6.5% in recent years.

Figure 3 – Coal production in Colombia. 1990 - 2013.

Source: SIMCO database .

Figure 2 – Gold production in Colombia. 1990 - 2013.

Source: SIMCO database .

Figura 5 – Limestone production. 1990 - 2013.

Source: SIMCO database .

3.3 Mining income

Like the production and prices of the main minerals, the royalties settled by the mining companies to the Colombian state also increased in the last two decades. A clear example is the amount of royalties associated with coal, which grew rapidly between 1990 and 2009. However, between 2011 and 2012 there is a reduction of more than 50%. This last fact can be due to changes in the price, in turn linked to the substitution of coal for other energy, like gas shale. Many companies, however, may have increased their production independently of the current price, since they have pre-established commitments in previous contracts.

Currently, the settlement of royalties generated from the extraction of the different minerals is based on the percentages contemplated in Law 756 of 2002 (former royalty regime). The percentages expressed in this law are shown below in Table 1. However, some companies have contracts under contribution, and the percentages of royalties are different and agreed with the state. The collection for this type of contracts can amount to 80% of the royalties of coal.

Table 1. – Percentages for the payment of royalties. Law 756 of 2002.

|

Mineral |

% of payment |

|

Coal (more than 3 milions tons by year) |

10 |

|

Coal (less than 3 milions tons by year) |

5 |

|

Nickel |

12 |

|

Iron and Cooper |

5 |

|

Gold and Silver |

4 |

|

Alluvial gold |

6 |

|

Platinum |

5 |

|

Salt |

12 |

|

Limestone, Gypsum, clays and sands |

1 |

|

Radiactive minerals |

10 |

|

Metalic minerals |

5 |

|

Non metalic minerals |

3 |

|

Construction Materials |

1 |

Source: (Congreso de la República de Colombia, 2002)

3.4 Other information3.4.1 Jobs generated

In Figure 6 is shown the number of jobs generated by the mining sector in Colombia and its share of total national employment. It is observed that this percentage has varied little in the last decade, between 1% and 1.2%, but there was a greater increase to 60% in the total occupation generated in the sector. Most of these jobs come from coal, ferronickel and gold.

3.4.2 Reserves

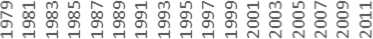

Currently, information on the historical evolution of mineral reserves in the country is limited. Some timed reserve data measured for coal are known, as shown in Figure 7, which shows a growth in coal reserves between 1979 and 1999, and an approximately constant behavior between 1999 and 2011. Table 2 presents the data of reserves in different years, according to the report of the mining companies in Colombia.

3.4.3 Foreign direct investment

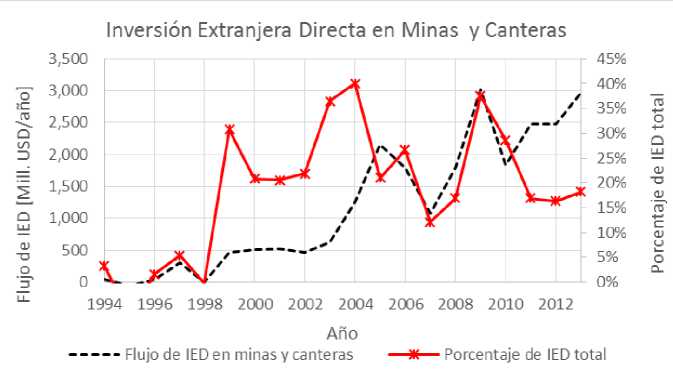

Within the behavior of foreign direct investment (Figure 8), investment directed to the mining sector has played an important role in the last 10 years, particularly in 2009, where investment exceeded US $ 3 billion. This investment flow was mainly directed towards the extraction of coal, ferronickel and gold.

Employment in the mining sector

^^^^ Empleos del sector minero

^^^^^^^^^^^e Participación en empleos nacionales

Figure 6. –Employment in the mining sector in Colombia. 2001-2012.

Source : DIAN database.

Figure 3 –Reserves in coal. 1979-2011.

Aho

Source : (MME & INGEOMINAS, 2004; UPME, 2012);

Table 2.– Reserves of different minerals.

|

Mineral |

Unid. |

Reserves in 1987 |

Reserves in 1993 |

Reserves in 1998 |

Reserves infered in 2013 |

|

Gold |

Ton |

930,93 |

1854,70 |

||

|

Silver |

Ton |

3830,39 |

|||

|

Platinum |

Ton |

5,03 |

4,39 |

||

|

Iron |

Mton |

195,00 |

|||

|

Copper |

Mton |

10,20 |

0,74 |

||

|

Uranium |

Kton |

40,00 |

|||

|

Phosphate minerals |

Mton |

12,81 |

|||

|

Magnesium minerals |

Kton |

54,00 |

|||

|

Salt |

Mton |

141,00 |

|||

|

Gipsum |

Mton |

2,47 |

|||

|

Limestone |

Mton |

994,03 |

|||

|

Clays |

Mton |

3,50 |

Source: (Anglogold Ashanti, 2011; ATICO MINING, 2013; ECO ORO, 2011; Gran Colombia Gold, 2014;

INGEOMINAS, 1987; MINATURA, 2014; SEAFIELD RESOURCES, 2014; Wacaster, 2012)

Figure 8. – Foreign direct investment (FDI) in mines. 1994-2013.

Source : (Banco de la República de Colombia, 2014a)

4. Mining production in Colombia

The mining basket in Colombia consists of more than 30 products; however, the most significant are coal, gold and nickel, which register important levels of production, as well as exports and, therefore, royalties payments.

Like the oil sector, mining exports also decrease; in this case, the drop is 32.65%, going from USD 9.496 million in 2014 to USD 6.395 billion in 2015. The main products of the mining basket decrease: coal (-33.8%), gold (-31.1) and ferronickel (-32.9).

4.1 Coal

Exports of coal represent 11.9% of Colombian exports, from USD 6.427 billion in 2014 to USD 4.257 billion in 2015, being this year (2015) the most critical in its history, since it has gone from exporting 87 , 1 million tons in 2014, to 72.8 million tons in 2015.

4.2 Production of nickel

Colombian nickel production represents approximately 1.7% of world production, with the only project being the operation of Cerro Matoso S.A., with average annual production of 45 thousand tons (2010-2015). However, there is a decline (figure 25) in production levels from 41,221 tons in 2014 to 36,671 tons in 2015 (down 11.04%).

The exporter of this product is Cerro Matoso S.A. (owner of the only nickel-producing mine in the country located in Montelibano, Cordoba), whose exports represent 1.20% of the total country and 6.72% of mining exports. As reported by DANE, its behavior has maintained since 2013 the same downward trend registered by most mining products and the value of their exports between

2014 and 2015 total an average of USD 535 million, with annual decreases in these years of -5 , 8 and -32.9 respectively. In volume represents 87,121 thousand tons (2014) and 72,791 thousand tons (2015).

4.3 Precious Metals

The Colombian production of gold, silver and platinum during 2015 was 59 tons, which compared to 2014 meant an increase of 3.84%. However, gold accounts for 84% of precious metal production. Its historical peak is recorded during 2012, with 66 tons of gold, a fact related to the highest price recorded in international markets that stood at USD 1,668.50/oz in the same year. The volumetric record of the country's gold production is quite irregular, coinciding with the behavior of the prices of this product and the representative market rate recorded by the country vis-a-vis our frontier countries, which, like Colombia, face the problem of Informality and illegality in this area.

Gold exports account for 3.0% of Colombian exports, from 47,962 kilos in 2014 to 36,535 kilos in 2015 (a decrease of 23.8%), equivalent to USD 1,582 million and USD 1,090 million, respectively.

Although domestic gold production is concentrated mainly in the departments of Antioquia, Choco, Nariño, Cauca and Bolívar. it is worth noting that the country's gold production has a high component of informality and illegality, from which it is estimated that production by recognized companies is close to 11-12%. On the other hand, the department that registers the 99% exports is Antioquia. This fact can be attributed to the fact that most exporters are international traders.

Список литературы The mining industry in Colombia. A general overview

- Banco de la Republica. (2009). Informe de la Junta Directiva al. Congreso de la Republica, marzo de 2009. Bogota, Colombia.

- Banco de la Republica. (2013). Informe de la Junta Directiva al. Congreso de la Republica, marzo de 2013. Bogota, Colombia.

- Bonilla, L. (2011). Diferencias regionales en la distribucion del ingreso en Colombia. In Dimension regional de las desigualdades en Colombia, Coleccion de Economia Regional Banco de la Republica (pp. 33-64).

- Cepal. (2011). Anuario estadistico de America Latina y el Caribe.

- Cepal. (2013). Latin American Mining Sector?: Review of Current Trends and Prospects.

- Cuellar, A. (2013). Por que es importante el ingreso a la OCDE. Portafolio.

- Echavarria, J. J. (2001). Colombia en la decada de los noventa: neoliberalismo y reformas estructurales en el tropico. Cuadernos de Economia, 20(34), 57-102.

- El Banco Mundial. (2013). Poblacion.

- Galvis, L. A., & Meisel, A. (2011). Persistencia de las desigualdades regionales en Colombia: un analisis espacial. In Dimension regional de las desigualdades en Colombia, Coleccion de Economia Regional Banco de la Republica (pp. 1-32).

- Garavito, A., Iregui, A. M., & Ramirez, M. T. (2012). Inversion Extranjera Directa en Colombia: Evolucion reciente y marco normativo. Borradores de Economia 713, Banco de l.

- Informe IETI Colombia. Vigencias fiscales 2014 -2015. Republica de Colombia. Ministerio de Minas y Energia. Marzo de 2017.

- Kalmanovitz, S. (2012). El impacto economico del conflicto interno colombiano y un escenario de paz.

- Martinez, A., & Aguilar, T. (2012). socioeconomico de la mineria en Colombia. Fedesarrollo, Bogota, Colombia.

- Ocampo, J. A. (2001a). Un futuro economico para Colombia. CEPAL.

- Ocampo, J. A. (2001b). Un futuro economico para Colombia. CEPAL.

- Perry, G. (2012). La decada perdida de Europa. EL TIEMPO.

- Ramirez, J., & Nunez, L. (1999). Reformas estructurales, inversion y crecimiento: Colombia durante los anos noventa. CEPAL. Serie Reformas Economicas 45.

- Rudas, G., & Epitia., G. (2013). Participacion del Estado y la sociedad en la renta minera. In Mineria en Colombia, Fundamentos para superar el modelo extractivista. (pp. 125-174).