The nature of large-scale financial and economic crises and latent world management

Автор: Safonova Yulia Aleksandrovna

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Development strategy

Статья в выпуске: 4 (16) т.4, 2011 года.

Бесплатный доступ

The material presents in abbreviated form the contents of the report, made on the basis of collective research at the Center for Problem Analysis and Public Management Projecting and submitted at the standing Research Seminar in the Center (head - Doctor of Physics and Mathematics, General Director of the Center S.S. Sulakshin)

Короткий адрес: https://sciup.org/147223272

IDR: 147223272

Текст научной статьи The nature of large-scale financial and economic crises and latent world management

In the most general sense crisis (ancient Greek krisic – a turning point) is a sharp change in the dynamics of a process.

In economics, crisis is considered to be such a change in the dynamics of economic indicators, which have resulted in serious damage to the public and the national economic life.

However, the broad definition in public discourse is the cause of some confusion, when researchers and analysts pose varied effects of crises (bankruptcy, unemployment, economic recession, etc.) as their cause, which was well evident in media coverage of the global financial crisis in 2007 – 2009.

It should be noted that so far there are three basic explanatory models of world crises.

They are:

-

1. The model of stochastic instability of the global market.

-

2. The model of a cyclic wave resonance.

-

3. The model of manageable crisis.

The findings of the research held in the Center indicate in favor of the validity of the third model.

There is no convincing bind of market conditions to the phases of cyclical crises. Neither in the phase of its heating or cooling phase nor in a transition phase. They are statistically evenly.

This suggests that the market probably does not contain an implicit cause of stability disruption. In the last resort, it can create the conditions for this breakdown, but something has to be a trigger for crises.

According to the recent report of the U.S. Financial Crisis Inquiry Commission, promulgated at the end of January 2011, in the case of the last crisis “the actions and inactions of people, but not Mother Nature or negligently made computer models” served as the “rigger”25.

It should be noted that until recently the version of the handling of the crisis was the lot of conspirologists or of those who were heavily labeled as those. In public discourse, another explanatory model was widely replicated, namely the model of stochastic instability of the global market, according to which the global financial crisis of 2008 is explained by the following causal chain.

In the U.S. economy there was over loaning of consumer mortgage market which have exceeded the capacity of a recovery. There occurred an imbalance of the financial balance equilibrium. There was a chain of bankruptcies from Funny May and Freddie Mac. Large banks were drawn into the chain there, as a result the entire global financial system, and then economics.

But let us ask the question inconvenient for this explanatory version. Can a tiny in size fluctuation by itself lead to a global crisis? The total amount of write-downs of U.S. banks because of toxic mortgage assets according to the IMF is about 250 billion U.S. dollars63. When it is compared with the global GDP, which is estimated by the CIA about 62 trillion U.S. dollars74, or the assessment of the global financial working capital (600 trillion U.S. dollars) we can conclude that even if the entire U.S. mortgage “imploded”, then for the world’s financial system it would be similar to

-

5 The Financial Crisis Inquiry Report / The Financial Crisis Inquiry Commission: Official Government Edition. January 2011. URL: http://www. gpo.gov/ fdsys/pkg/GPO-FCIC/pdf/GPO-FCIC.pdf

-

6 Financial Market Turbulence: Causes, Consequences, and Policies/ Global Financial Stability Report // International Monetary Fund. World Economic and Financial Surveys. October, 2007.

-

7 The World Factbook / Central Intelligence Agency. URT: https://www . cia. gov/library/publications/the-world-factbook/geos/xx. html

that a butterfly fluttered and flew of an elephant. The volume of fluctuations amounts to a figure substantially (several times) less than 0.4%.

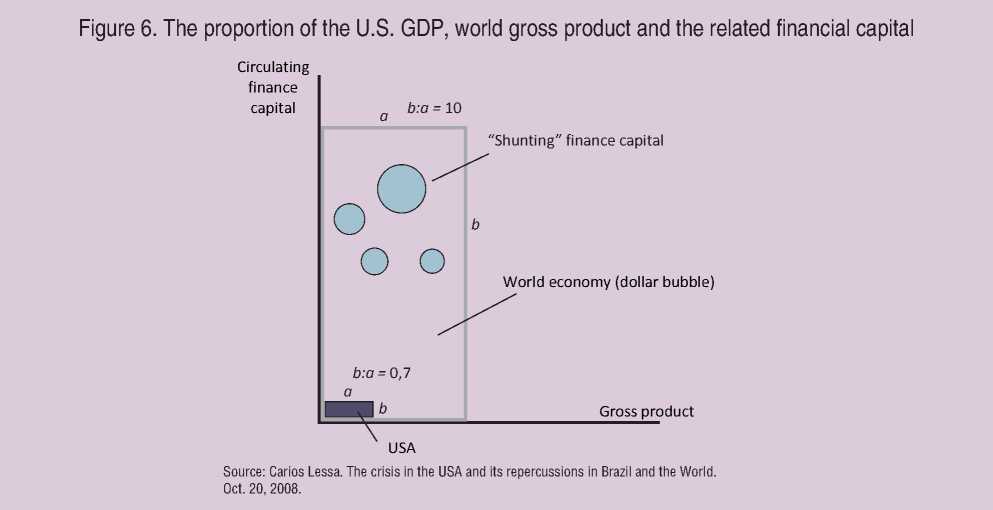

In fact, the financial crisis was the result of a significant imbalance between the real (physical) and virtual or financial economies. However, while many experts, including members of the above-mentioned U.S. financial crisis Inquiry Commission, reduce the imbalance to the financial performance of individual companies (“since 1978 to 2007 the amount of the financial sector debt increased from 3 to 36 trillion dollars, an increase of more than 2 times, if we estimate it in relation to GDP”)58, then from our point of view, the essence of this imbalance lies in the basic discrepancy between the proportions of GDP in the U.S., the world’s gross national product and relevant financial capital.

While senior government correlate emissions of the national currency with the real GDP.

Discrepancy of one to another on a global scale causes a crisis. The responsibility in this case lies with the global issuer of currency, the U.S., in the person of the independent Federal Reserve System (Fed).

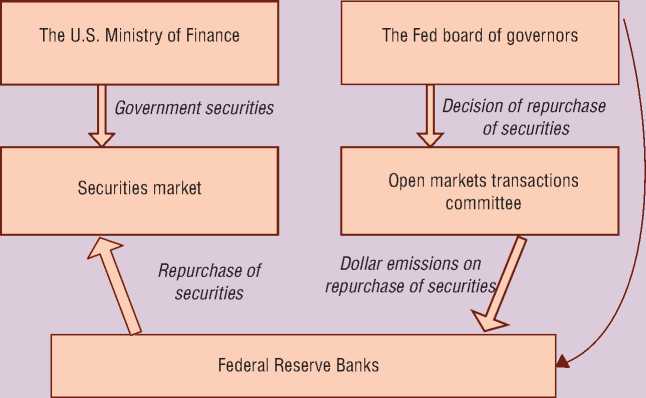

This is the Fed that regulates the amount of dollar emissions, making decisions on the issue of cash for the purchase of government securities, thus lending to the U.S. government with the money printed by it (fig. 7) . Interest payments on the bonds received by the Fed make hundreds of billions of dollars and do not appear in any reports. To be able to pay interest, the U.S. government issues additional bonds and sells them to the Fed. Thus, there is a typical financial pyramid scheme, and the United States themselves who are the debtors of its own Central bank are under an immediate threat of collapse.

It should be emphasized that the main beneficiaries of the system established by the Federal Reserve is not the state. In essence, the

-

8 The Financial Crisis Inquiry Report / The Financial Crisis Inquiry Commission: Official Government Edition. January, 2011. URL: http://www. gpo.gov/fdsys/pkg/GPO-FCIC/pdf/GPO-FCIC.pdf

Fed is a unique institution in the world practice combining the elements of private corporations and government structure.

Thus, the state has a definite influence on the activities of the American Central bank. The Board of Governors of the Federal Reserve is an independent government agency (its status is similar to the status of the CIA and NASA) 9.

All seven of its members are appointed by the President and confirmed by the Senate. Moreover, the law fixed the possibility of dismissal of the President of the Federal Reserve by the President10. The Fed Board of Governors annually report to the House of Representatives11. Public Administration of the U.S. General Accounting has the right to

Figure 7. The mechanism of the Fed dollar emissions

audit the activities of the Federal Reserve12. Profits earned by the Fed as a financial and issuing center of the U.S. is fully transferred to the Ministry of Finance, with the exception of the amount going to pay dividends to member banks of the System713. However, these levers of the state’s influence on U.S. Central bank are exhausted.

To begin with, the “body” of the Fed, 12 Reserve Banks, through which the goes the infusion of issued dollars in the global economy, as well as buying and selling securities, are private organizations that is officially recorded by court decision14. Only one third of the members of their board of directors are appointed by the indirect participation of the State Board of Governors of the Federal Reserve915. 2/3 are elected by the shareholders. This means that the Fed is in fact a corporation.

Key decisions concerning the issue of dollars, buying or selling securities are made not by public agency – the Board of Governors but by the open markets transactions Committee, which, along with the members of the Governing Board includes the five Directors of the Federal Reserve Banks. Once a year, the Fed Chairman delivers a report to Congress, but this procedure is largely formal. The activity of the Fed is largely opaque. The formal right of its audit belongs to the U.S. State General Accounting Administration1016, but in making key decisions (Fed international activities and its financial policies) the Board of Governors and the open market transactions Committee virtually are not accountable to anyone. Nobody, not even the President has the right of veto on the Fed decision.

So we can conclude that the institution of financial system management, the Fed, formed in the United States since 1913 is actually a private entity. It includes the individual elements of state regulation, such as the appointment of the Board of Governors by the President, but the almost complete lack of accountability of the legislative and executive power, the extreme degree of opacity, and the fact that the banks constituting the Federal Reserve are joint stock commercial structures, clearly indicate the private nature of the Fed.

As a result, we can say that managing the current global financial system now (at least in terms of regulating the money supply) is made from a single center, which represents the interests of individuals. And over time, not taking into account the issues of global economic stability (an example of which were multiple crises), this group of individuals increases the rates of dollar emission.

However, the question arises: what is the interest of the Fed (and those “beneficiaries” who stand behind it) in creating crises?

To answer this question, we must recall that the Fed has its unprecedented liquidity commodities – the dollar. Accordingly, as with any seller, the Fed’s chief interest lies in profitability of business.

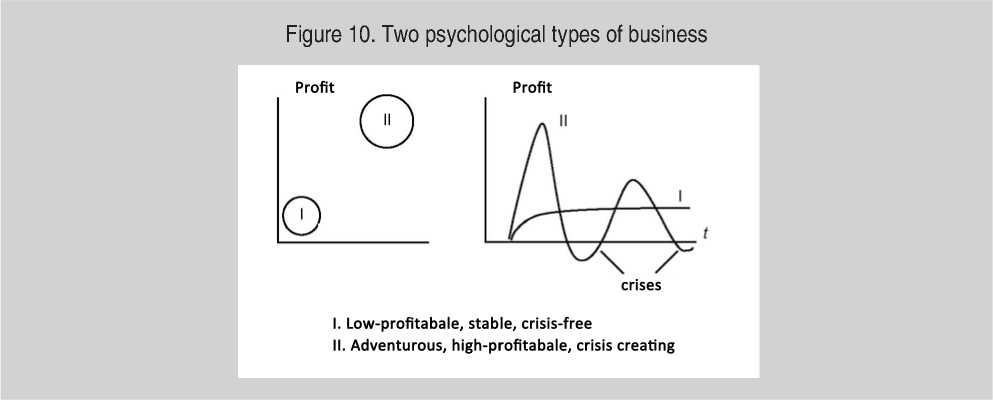

Historically, this rate of return depended on the psychological type of business (fig. 10) . Marx said, “provide 10% of profits and capital agrees to any application, 20% – it becomes lively, 50% – it is ready to break its head, 100% – override all the laws, 300% – there is no crime for which it would not risk even under threat of gallows”20.11

Looking at the dynamics of dollars emission (see above), and taking into account the profit rate (PR) of the Fed business that is easy to estimate, based on the fact that the issuer is spending 4 cents on printing of one hundred dollar note, and gets the real goods for 100 dollars, it is easy to define what type of business the members of the Federal Reserve and its “beneficiaries” have chosen for themselves:

PR = (100-0.04) / 0.04 x 100%.

Excluding the details (value of interest rate, regional dollar exchange rate, real-activated volume of the money supply) it is obtained by 250 000%!

-

20 Marx K. Capital // К. Marx, F. Engels. PSS. Vol. 23, P. 770.

As a result, the uncontrolled emission of dollars, carried out in pursuit of profit inevitably leads to the fact that there is too much of this “commodity” in the world market. This unbalances the supply and demand, leads to a drop in the value of “dollar” and therefore forces a “seller” to any actions by virtue of his genuine interest.

For example, to create artificial scarcity of dollars that otherwise might be called a lack of liquidity, i.e., the financial crisis.

* * *

Thus, our hypothesis is based on the assumption of stable behavior archetype of the global issuer. It consists in an effort to maximize profitability. In this case the dominant model of the yield is as follows:

Yield ~ (nominal) x (physical) x (financial activities).

Nominal yield (Y) is determined by the refinancing rate (R) and the amount of money (M + AM). Here M is accumulated money. AM is current emission growth.

Physical yield is determined by the possibility of exchanging of unsecured “notes” for the real benefits. It characterizes the regional currency dollar exchange rate in countries and regions of exchange (E).

Financial activity takes into account that not all the issued and implemented in the global exchange money is “working”.

However, for creating a financial crisis as a shortage of working capital it is needed to manage the global money supply. For this purpose, the issuer has an instrument in the form of emission. But it is limited because it “works” only on a positive growth in money supply and can only reduce them to zero. Therefore, for the organization of crisis it is necessary to use the mechanism “freezing” the turnover of the money issued at the command of the latent center. Obviously, in the world there should exist major financial operators relating to the decision-making center, which withdrawing capital from the market or re-activate them at its command. The coefficient which describes these states can be called “financial activity” and its dynamics can be fixed by the world’s investment activity, the statistics of which are available (F).

We emphasize that the assumption of coherence of major financial operators does not seem too weird, because today there are many companies in the world, financial power of which is comparable to the state’s one. Thus, according to estimates by David Rothkopf, in 2008 in the list which included all the countries with GDP exceeding 50 billion dollars, and companies with similar annual revenues, only 60 positions were occupied by the states, and 106 by the large companies1221.

-

21 David Rothkoph. Superclass: The Global Power Elite and the World They Are Making. N-Y, 2008. P. 34.G.

However, according to Forbes, in 2007 there were only two dozens of financial institutions in the world whose assets exceed 1 trillion dollars. And the assets of the largest 50 institutions accounted for 48.5 trillion dollars, i.e. more than one third of all global assets. In other words, the possibility of “collusion” between the leaders of all 50 financial institutions (or parts of them) exists.

It should be borne in mind that all major financial corporations are the flagships of their industry, and their time-dependent behavior (for example, the sharp decline of financial activity) can easily provoke panic among the smaller players of the stock market, which further enhances the effect of a liquidity shortage.

As a result, the assessment of profitability of the issuer is as follows:

Y ~ R x (M + AM) x F x E.

It should be emphasized that the global issuer itself directly controls the rate of refinancing and emissions. Financial activity can be managed by the one who created the appropriate shunting financial institutions and capital in the world, bringing the network, for instance, by the clan principle. Dollar exchange rate in the regions can only be handled politically. Or as the market demand is controlled. The more the goods – the demand is saturated. The more expensive the goods –the demand is falling. The less the goods (a deficit is created) – the demand is growing. The price of the dollar-product is refinancing rate. The volume of the dollarproduct is the issue and the financial activities at the command.

In other words, the issuer, as well as the latent club of beneficiaries, which, as will be shown later, is behind it, can manage all these parameters somehow.

Those parameters which are controlled directly respond to the “commands” right away. Those that are managed indirectly must respond with a delay.

* * *

So, if we consider the dollar as a commodity, the supplier of this commodity is the U.S. Federal Reserve System, like any salesman, has three goals.

-

1. Sell as much goods as possible.

-

2. Sell goods as expensive as possible.

-

3. However, considering the special feature of this goods (it can be exchanged for real goods), there is another problem – how to make a dollar more expensive in terms of commercial content, i.e., that for a dollar one could buy as much real wealth as possible.

To achieve these objectives, the issuer and its beneficiary club have the management tools discussed above. It is necessary to raise the rates, the volume of emissions, the amount of active money in the world, to achieve growth of the dollar in regional currencies. And in the event of an uncontrolled fall of profitability (due to market saturation and falling demand for goods) it is necessary to arrange deficit, i.e., the global financial crisis.

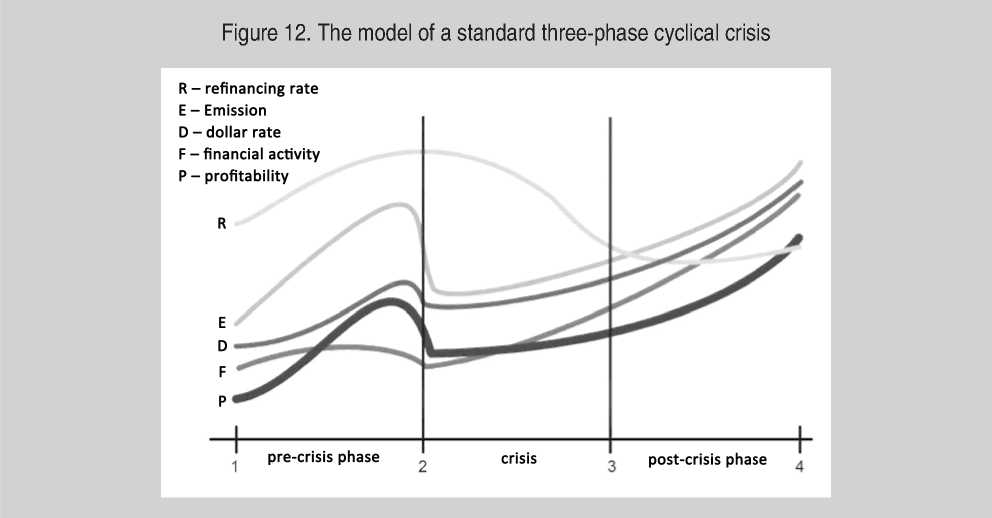

Figure 12 presents a logical model of how the events should develop.

The behavior of the Fed and its beneficiaries is modeled in a specially formed timeline of three phases. The first phase is pre-crisis. The second is the crisis itself, and the third phase is the post-crisis.

In the first phase of the issuer seeks to maximize its profitability. It increases the rate of refinancing, the volume of emissions and, in general, tends to increase the available factors increasing its profitability. As a result, this leads to the fact that the demand for the expensive and excessive commodity begins to fall. Dollar rate and financial activity with its use are falling. Accordingly, the yield begins to fall. The process has overheated. The issuer and its beneficiaries have a problem – to increase the demand, exchange rate and activity. For this purpose the crisis is organized. That is in the second marked phase:

-

1. The issue is abruptly reset (deficit is created, AM decreases).

-

2. A command to the shunting financial

-

3. The refinancing rate for the recovery of demand for dollar-product is reduced.

institutions to reduce financial activity is given (cash flow shortage is increased, i.e., the effective M is decreasing and F respectively). In fact the global crisis has begun.

In the second phase the measures taken have the result. The growth of rate and financial activity starts. Decrease in profitability is stopped. Its recovery begins.

In the third, post-crisis phase profitability is restored. And the standard cycle of crisis is ready to start warming up next return along the same lines. Moreover, statistics show that by the end of the third phase the issuer’s rate of return exceeds the pre-crisis phase.

* * *

It remains only to find out who the owners of the Fed are? Who are the real “owners” of the United States and the world? What is the beneficiaries club? And is there a way to prove his existence?

In this case, we have tried to reconstruct this club on circumstantial evidence, based on an analysis of biographies of chairmen, members of the Board of Governors and the heads of Reserve Banks of the Fed for the maximum available period of time.

We have already said that the U.S. Federal Reserve System is a non-state organization. It is not only independent from any of the powers of the country, but in its political weight in some ways excels even the U.S. President and other executive bodies.

In particular, it follows from the analysis of the actual timing of the duration of the tenure of U.S. presidents and chairmen of the Fed. De jure, in both cases the period is 4 years (with the right to re-election). However, in practice, since 1933, almost all (except one) chairmen of the Fed “outstay” the presidents of the United States, keeping their position even when changing the Democratic and Republican administrations.

High political significance of the Fed in comparison with other authorities in the U.S. is even more clearly demonstrated by the principle of the political appointment of members of the Board of Governors of the Federal Reserve. The term for which they are appointed is 14 years, which, in essence, makes the policy of the Board independent of the changes that occur as a result of a change of Presidents and the majority party in Congress.

Based on analysis of the career graphs of the Fed’s Board of Governors members, not the most highly qualified and experienced

specialists in the field of finance achieve such a high position. Unlike the presidents of 12 Federal Reserve banks, the career ladder of which is basically fairly long, and its stages are successive (e.g., from a mid-level employee at a bank in the district through a series of extended rises to the top managers of a major bank, and then the President of the Federal Reserve Bank), many members of the Fed Board of Governors cannot boast of solid experience. Their careers are often characterized by sharp jumps, as a result of which they suddenly find themselves on the top of financial Olympus.

The presence of two different principles of human resource recruitment within a single organization, as a result of which more experienced personnel are in the executive branch, and strategic planning (in the Board of Governors and the Federal Open Market Committee) is in the power of people giving rise to doubt about their age and professionalism (even in the expert community in the U.S.), indicates that may be having considerable powers de jure, de facto in decision-making the Board of Governors follows the directions coming to it from outside, say, from a certain latent decision-making center.

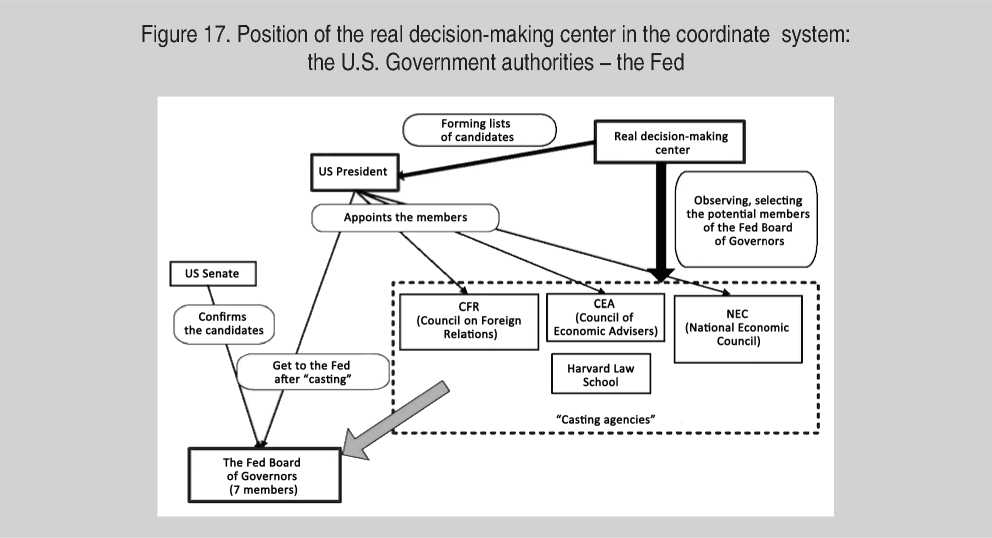

Logically reconstructing the position of this “real decision-making center”, in the coordinate system of the U.S. Government authorities – the Fed, we can assume that it has considerable political weight, which allows it to exert a decisive influence on the U.S. President in the selection of candidates for the Board of Governors of the Fed (the principles of this selection are nowhere clearly spelled out), and their appointments.

In this case, analyzing the biographies of the Board of Governors members having in common in their careers the fact of membership in a number of expert bodies of the President of USA (which immediately is followed by the appointment of the Fed Board of Governors), one can assume that these structures (CFR, CEA, NEC) are a kind of “casting agencies” (fig. 17) . And the selection is carried out by representatives of the “real decision-making center”. For a year or two they have time to look at potential candidates, test them, and, if the subjects will be tested, “advise” the President to appoint them to the Fed Board of Governors. The members of the Board of Governors owing their career to the representatives of the “real decision-making center”, remain loyal to their benefactors, and probably are willing to listen to their “advice” under the leadership of the Fed.

Staying in the shade, the latent “real decision-making center” controls the emission Fed policy, the activity of the shunting world financial operators and in the case of depreciation of the dollar and reducing the profitability of the entire system initiates financial crises. At the same time, the anger of the American and world public whose welfare suffers from these crises goes to a public figure of the Chairman of the Federal Reserve. And it is also an element of the structure.

The study of biographies of Federal Reserve chairmen since 1913 to date shows that in some cases due to financial crisis the Fed chairmen leave their posts, being blamed for the crisis in the eyes of the public. New chairmen came to their places, which lead the country out of the serious condition, but actually started exactly the same crisis cycles.

As a result, public figures at the helm of the Fed succeeded each other, but in practice they ensured continuity of the course chosen by the real decision-making center, which remained in the shadows, beyond the criticism and suspicion.

Therefore it is not surprising that in the future the public condemnation of those Federal Reserve chairmen “who failed to avert a crisis” practically had no effect. Despite their “shortsighted policies” at the Federal Reserve, retired chairmen of the Board of Governors and its members continued their successful financial career in the walls or the U.S. Treasury, or even “with a promotion” going into formal and informal international institutions such as the “Group-30”, World Bank, Bilderberg group, the Trilateral Commission.

The described system is closed and, with experience in managing the U.S. finances and then global processes in the world, former members of the Board of Governors of the Fed join the ranks of the real decision-making center.

In any case, the system adjusted in such a way appeared to be very stable and incredibly efficient (in terms of the objectives of those who control it).

Despite the very extensive and harsh criticism, regularly sounding to the Federal Reserve, both within the U.S. and in the world, the position of this non-state organization is still quite strong.

* * *

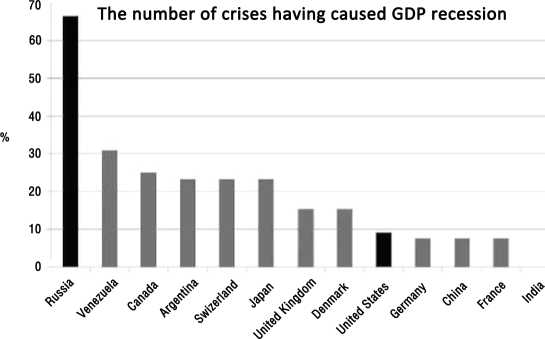

What else can prove the liability of the Fed and the latent beneficiaries club for the organization of the of world crisis? This is a well-known principle of “qui prodest”. The logic of the proof is obvious. If the author of crises is the U.S., then the least damage from the crisis should arise for them. The damage can be estimated from the known statistical series. One method included the assessment of decline in GDP of one or another country. Figure 20 shows that the U.S. had damage only in 9% of the crisis over the period 1960-2010. Russia, for example, experienced damage in 67% of cases during the years of its new economic model of the country.

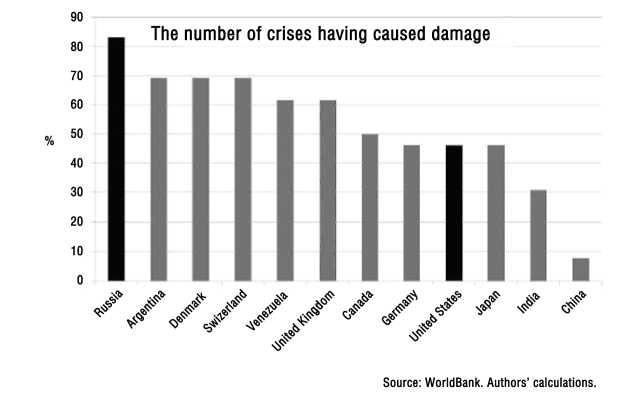

The second method included an assessment of the damage not only in GDP, but the total damage in GDP, inflation, unemployment and investment. Weight of the importance of these indicators assumed to be equal by experts. Result of the calculations is shown in figure 21 .

As we see, in this case, the U.S. in no way can be referred to the countries suffering the most from the crisis.

And finally, the most interesting evidence is given by the statistic of global crises and the separate American crises.

The crises in America are becoming increasingly rare, but the crises in the world are more often.

So let us once again ask the question: “qui prodest”? We believe that the answer is obvious, as well as the understanding of who is the source and the controlling power of the global financial crises.

* * *

In conclusion, let us focus on the issue of predicting the next large-scale crisis. It should be noted that the difficulty of predicting large-scale social systems is due to two factors.

Figure 20. Comparison of damage from global financial crises for different countries of the world in GDP

Figure 21. Comparison of total damage from global financial crises for different countries of the world in GDP, inflation, unemployment and investment

First of all, an incredibly large is the number of simultaneous ongoing processes that mask and noise the monitored result, making it almost a “random” process, which seems to be no pattern. This complexity is partly overcome by the methods of statistical smoothing, filtering, selection of dominants out of noise. Statistical mathematical methods are well known.

Second, in human relations there is always a “will” of people. It is fundamentally subjective. Regularity in space of will occurs when there are statistically many interacting people.

However, if it is about one “super governor” that may affect the macroeconomic and global dimensions of development, the subjectivity is of principle. There may be a group of “super governors”. And their decisions may be subject to whatever the logic of behavior that would seem impossible to predict.

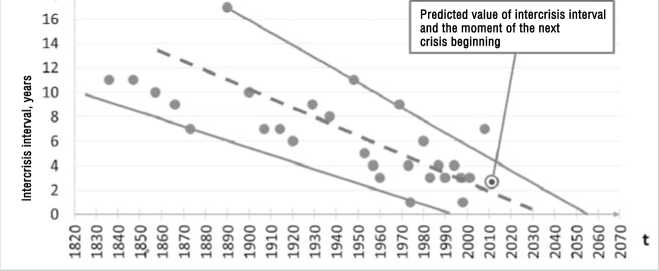

Figure 23 demonstrates the historical relationship of time intervals between crises. It’s just a statement of the known facts. But one important thing results from this showing a pattern that can be used to predict the next crisis.

Figure 23. Historical change of the time interval between crises

It is a probabilistic timing of the next crisis. Figure 23 shows that in recent years the interval between the beginning of a crisis and the beginning of the previous one was on average 3 – 4 years. Therefore, if the latest crisis began in 2008, the following should be expected at the turn of 2011 – 2012. This prediction follows from the history of world crises.

However, above it was mentioned, that the human will acts in world history, which can be not only malicious, but aimed to achieve benefits for people. In the context of prevention of new financial crises, it appears that this will should be aimed at creating a global mechanism responsible for the global issue of money, financial derivatives, their security, their taxes, etc.

Mandatory conditions for peace “discharge” of crises should be the following innovations:

-

• International monitoring and management of the global emission of the world’s reserve currency. Ensuring of this currency.

-

• Limiting the generation of quasi-money in the form of receipts or derivatives. For example, the requirement of their balance sheet accounting and taxation affecting enough.

-

• Reconstruction of the World Bank and the International Monetary Fund.

As for Russia, then in case of realization of the above conditions, it could also play a role in the new processes. However, in the current uncertainty on the further restructuring of the global financial architecture the country’s leadership should ensure its maximum preparedness to the probability of a crisis. To do this it must develop a plan of preparedness of businesses to the global financial crisis. For its part, the Problem Analysis Center is ready to make the following suggestions to create the plan.

Proposals to create preparedness plan of economic entities

-

1. Study in detail how the crisis of 2008 developed in Russian economy over time. What has changed for the entity in the demand side, government subsidies and investment plans. How changed the delivery, financial arrangements and conditions for the company as an employer. What other difficulties we had to encounter.

-

2. Restore the details of the company’s anti-crisis measures, its good and bad responses, study the experience of other companies.

-

3. On the basis of the audit there may be developed a preparedness plan of the company in a list and sequence of its anti-crisis measures in the event of a crisis.

-

4. In view of the obtained scenarios and the made preparedness plan it is necessary to create a “cushion” in the form of adequate resources (financial, material and otherwise) the list and volumes of which would result from the audit of the 2008 crisis.

-

5. On the basis of the established preparedness plan there may be hold “staff” studies for top management for its training and psychological stability in case of real crisis.

Список литературы The nature of large-scale financial and economic crises and latent world management

- World financial and economic crises and global latent world management : materials of the research seminar. -M.: Nauchny expert, 2011. -Issue 3. -168 p

- The Financial Crisis Inquiry Report/The Financial Crisis Inquiry Commission: Official Government Edition. January 2011. URL: http://www.gpo.gov/fdsys/pkg/GPO-FCIC/pdf/GPO-FCIC.pdf

- Financial Market Turbulence: Causes, Consequences, and Policies/Global Financial Stability Report//International Monetary Fund. World Economic and Financial Surveys. October, 2007.

- The World Factbook/Central Intelligence Agency. URT: https://www.cia.gov/library/publications/the-world-factbook/geos/xx.html

- The Financial Crisis Inquiry Report/The Financial Crisis Inquiry Commission: Official Government Edition. January, 2011. URL: http://www.gpo.gov/fdsys/pkg/GPO-FCIC/pdf/GPO-FCIC.pdf

- A-Z Index of U.S. Government Departments and Agencies//USA. gov. URL: http://www.usa.gov/Agencies/Federal/All_Agencies/Eshtml

- U.S. Code. Title 12. § 242.

- Federal Reserve Act, Sec. 10.

- Section 31 USC 714 of U.S.

- Federal Reserve Act, Sec. 7.

- Kennedy С Scott V. Federal Reserve Bank of Kansas City, et al, 406 E 3d 532.

- Federal Reserve Act, Sec. 4.

- Section 31 USC 714 of U.S.

- Marx K. Capital//К. Marx, F. Engels. PSS. Vol. 23, P. 770

- David Rothkoph. Superclass: The Global Power Elite and the World They Are Making. N-Y, 2008. P. 34.G