The possible ways to use financial resources of the organization

Автор: Sherstobitova Anna Anatolyevna, Gudkova Svetlana Anatolyevna, Kadysheva Olga Vladimirovna

Журнал: Теория и практика современной науки @modern-j

Рубрика: Основной раздел

Статья в выпуске: 4 (10), 2016 года.

Бесплатный доступ

The article represents a summary of financial resources, possible ways of improving their use. Financial resources generated and used by businesses, organizations and government money funds. The efficiency of use of financial resources is characterized by the turnover of assets and profitability.

Finance, income, equity

Короткий адрес: https://sciup.org/140268717

IDR: 140268717

Текст научной статьи The possible ways to use financial resources of the organization

The concept "financial resources" in the Russian practice was first used in the preparation of the first five-year plan, one of the sections which were the balance of financial resources. Then this term became widely used in the economic literature and in financial practice, his interpretation was very different. Financial resources are the main source for the implementation of expanded reproduction, socio - economic development of society. Increasing financial resources is one of the main tasks of the state financial policy [1].

Table 1 presents the treatment of financial resources by various authors.

Table 1 - interpretation of financial resources by various authors

|

Author |

Interpretation |

|

S. V. Barulin |

Financial resources – the aggregate of the cash economy, which can be used and actually used for the implementation of financial operations and perform financial transactions by state authorities, local governments, and stakeholders [2] |

|

A. G. Gryaznova, E. V. Markina |

Financial resources – income, savings, and revenues that are owned by entities I and are used to expand reproduction, social needs, material stimulation of workers, the satisfaction of other social needs [3] |

|

K. M. Shermenev |

Financial resources generated and used by businesses, organizations and government money funds. |

|

V. K. Senchagov |

The financial resources involve a combination of cash savings and of depreciation in the process of formation, distribution and redistribution of gross social product |

|

S. I. Lushin, V. A. Slepov |

Financial resources - part of the money used by the owner for any purpose at its discretion [1] |

|

Financial and credit epicicloidali dictionary |

Financial resources – funds which are formed as a result of financial activity in the process of creation and distribution of gross national product (GNP) [4] |

As a rule, more funds are discussed in the academic literature on Finance and in the sphere of national economy. The greatest attention is paid, of course, financial resources of enterprises. The efficiency of use of financial resources is characterized by the turnover of assets and profitability. Consequently, management efficiency can be increased by reducing the period of turnover and to improve profitability by reducing costs and increasing revenue.

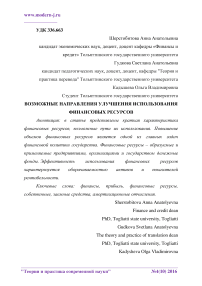

Acceleration of turnover of working capital does not require capital expenses and leads to increased production and sales. However, inflation devalues quickly enough working capital by enterprises on the purchase of all goods sent most of them, the non-payment of buyers employing a significant part of the funds from circulation. As working capital the company uses current assets. Funds used as working capital, undergo a cycle (figure 1).

Figure 1 - Funds used as working capital, held a cycle

Any funds which are not used for the needs of working capital can be used to pay liabilities. In addition, they can be used for the purchase of fixed capital. One of the ways of saving working capital, and, consequently, the increasing in turnover is to improve inventory management. Since the company investment in education stocks, storage costs are not only storage costs but also the risk of spoilage and obsolescence, as well as the time value of capital, i.e. the rate of return that could be obtained as a result of other investment opportunities with equivalent risk.

Economic and operational results from the storage of certain types of current assets in a particular volume are specific to this asset class in nature.

With a large inventory of products in stock reduces the possibility of formation of deficiency of the goods, if there is high demand.

The increase in working capital turnover is to identify the cost associated with storing reserves, and supplying of a reasonable balance of stocks and costs. To accelerate the turnover of working capital in the enterprise, we advise to mane the following steps: procurement planning, use of warehouses, demand forecasting.

The second way to reduce costs of working capital is the best use of cash. Cash represents a special case of investing in commodity-material assets (TMTS). Therefore, the applicable General requirements:

first, the main reserve currency money with the purpose of performing routine calculations;

-

- secondly, the necessary money that will cover unforeseen expenses;

-

- thirdly, it is necessary to have a certain amount of available funds that are necessary to ensure potential or expansion.

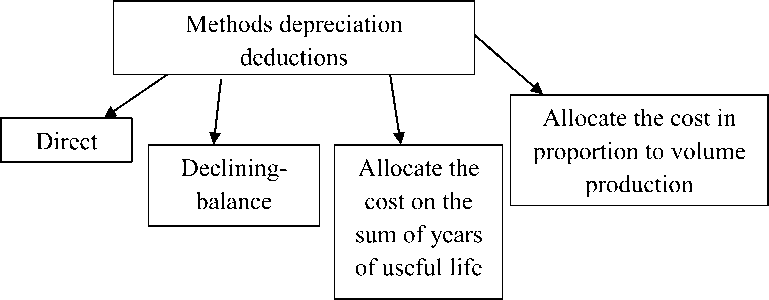

Another significant tool to improve the efficiency of use of financial resources is the management of the main production assets of the enterprise and intangible assets. The main issue in management is the choice of the depreciation deductions. Figure 2 shows how allocations of depreciation deductions.

Figure 2 – Methods of depreciation accrual charges

Let's look at each of them in detail.

-

1) Direct method charges depreciation charges – proportional allocation of the cost over the entire period. As the basis for calculating depreciation is the initial cost of the asset, the direct method allows fully attributed to the cost of the costs associated with the acquisition of the asset;

-

2) the declining-balance method based on the use of depreciation rates in relation not to the original, and to the residual value.

-

3) the method of writing off of cost on the sum of numbers of years - for each year of depreciation is determined by multiplying the initial value of the object on the corresponding factor. The coefficient implies itself a fraction, the numerator shall be marked with the number of years remaining to the end of its life, and in a denominator – the sum of years of useful life.

-

4) the method of writing off value in proportion to the volume of production – contributions are made on the basis of natural indicator of volume of production in the reporting period and the ratio of initial cost of property, plant and equipment and the estimated volume of production for the whole useful life [5].

Thus, an important tool of increase of efficiency of use of financial resources is the management of the main production assets of the enterprise and intangible assets.

Список литературы The possible ways to use financial resources of the organization

- Finance: a training manual. 4th edition, revised and expanded / S. F. Fedulova. - Izhevsk, Publishing house Institute of economy and management FGBOU VPO "Udmurt state University", 2014 - 425 p.

- Barulin S. V. Finance: Textbook/S. V. Barulin.-M.: KNORUS, 2010. P. 47

- Finance. Under the editorship of A. G. Gryaznova, E. Markina In: 2nd ed. Rev. and extra - M.: 2012. - 496 p.

- http://financial-dictionary.thefreedictionary.com/Financial and credit dictionary

- Gladkovsky E. N. Г52 Finance: textbook. The standard of the third generation. - SPb.: Peter, 2012. - 320 p.