The role and position of the tax balance in the financial reporting system

Автор: Milojević I., Milanović A.

Журнал: Ekonomski signali @esignali

Статья в выпуске: 1 vol.20, 2025 года.

Бесплатный доступ

To understand the essence of the tax balance, one must start with the functions of a company within the economy of a country in general. The state demands financial resources from companies based on the profit earned, so each company is interested in minimizing the profit it achieves in the market in order to reduce the tax base upon which the state claims resources. Since the tax balance is a report that shows the amount of taxable profit, i.e., the tax base, the state is interested in its most accurate definition. It is also necessary to present the importance of understanding the tax balance in a way that is acceptable to the company's management, especially in economies that are in development, like ours. The paper presents the position of the tax balance within the financial system, the role, and place of the tax balance in the family of other financial statements. It particularly highlights the role of the risks that arise when preparing and controlling the tax balance, as well as the dependence of the tax balance on the form and structure of the company.

Balance, taxes, reporting

Короткий адрес: https://sciup.org/170209522

IDR: 170209522 | УДК: 336.226.14; 657.375 | DOI: 10.5937/ekonsig2501067M

Текст научной статьи The role and position of the tax balance in the financial reporting system

In this paper, a comprehensive analysis will be provided of the weaknesses in the current corporate income tax system, along with proposed solutions for overcoming these weaknesses from both accounting and normative perspectives. The corporate income tax represents one of the most substantial sources of budgetary revenue, with a tendency for continued growth. This form of fiscal revenue serves as an instrument through which domestic economic development can be indirectly stimulated, which will be emphasized throughout the paper.

By addressing the shortcomings of the current tax balance structure and deficiencies in tax control, the paper will highlight the necessity of adopting international accounting standards and ensuring their proper implementation (Dašić, B., 2023; Pušonja, 2024). The implementation of international regulations is of critical importance for the corporate tax balance, as this specialized financial report, included in the broader set of financial statements, is based on tax law aimed at protecting the state against tax evasion-a common issue associated with this type of tax. Both revenue and expense components within the tax balance will be analyzed, with special emphasis on certain revenue positions, despite the prevailing literature focusing predominantly on the expense side.

The comprehensive application of international standards-which cannot be applied selectively-will be presented, along with relevant experiences from developed countries adapted to the local context. During the research and preparation of this thesis, several scientific methods were applied to confirm the established hypotheses, including the analytical-synthetic method, inductive-deductive method, empirical method, descriptive method, comparative analysis method, normative method, and comparative legal method.

Society functions through permanent interrelations between the economic and non-economic sectors. Within these interrelations, tax policy occupies one of the most significant positions. Taxation is the process through which resources are collected from taxpayers and redistributed to the non-economic sector, requiring the adherence to certain essential principles (Tošić, 2023b).

The importance of profit is reflected in the fact that it is linked to numerous actions and procedures throughout the business year, and its relevance is reinforced by the wide array of users who rely on this metric (Pikelj, 2020; Janaćković & Pejčić, 2024). Users of profit-related data include owners, managers, employees, suppliers, the state, and others. From a theoretical economic standpoint, profit can be defined in various ways: as the difference between all revenues and expenditures affecting the performance of an accounting period; as an increase in value across successive periods; or as the excess of output value over the input value used to generate it (Vasić, 2022).

In this paper, profit will be observed in the context of a fundamental instrument for the distribution of gross domestic product. A practical example will demonstrate how a correctly determined tax base affects the distribution of GDP. To adequately understand the essence of profit, it must be clearly distinguished from capital (Metzger, 2019). While corporate income tax treats profit as a measurable amount, it is often mistakenly equated with capital. The relationship between capital and profit can be viewed as the relationship between state and changecapital being the state, and profit being the change. The concept of profit can be interpreted both economically and from an accounting perspective. Economically, profit repre- sents the incentive for rational behavior, defined as an increase in enterprise wealth during a period. However, for the purpose of this paper, the accounting concept is more relevant-defining profit as the positive difference between a company’s revenues and expenses.

The Need to Respect Taxation Principles and the Risks Arising in Tax Balance Reporting

The principles of taxation represent a significant factor in the process of preparing a corporate tax balance. These principles are categorized into several groups, among which four major categories are distinguished: financial, economic, socio-political, and legal-administrative principles. Another classification includes: financial (tax yield and elasticity), economic (appropriate choice of tax base and tax type), social (universality and equity of taxation), and technical (certainty, affordability, and convenience of taxation). Thus, the importance of these principles is diversified according to various factors. The role of taxation principles in the preparation of the corporate tax balance takes on a different character, as not all principles hold the same level of relevance in the context of corporate income tax (Malinić,

2013). For instance, economic principles are considered more significant than financial ones in the context of corporate income tax, and their role and importance will be emphasized.

The Dependence of the Tax Balance on the Legal Form and Structure of the Enterprise

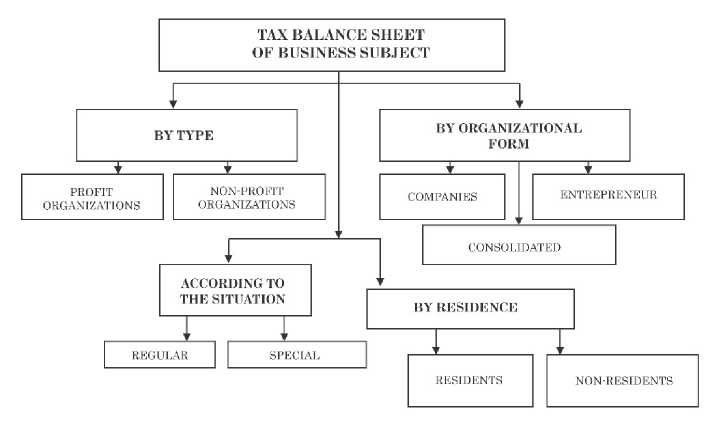

The family of tax balances is extensive, which is why it is necessary to explain each type of tax balance individually according to these classification criteria (Tošić, 2023). To highlight the specific features of each individual tax balance, we will begin with assumptions that are essential to each category.

In the previous section, we discussed the distinction between regular and special tax balances. Therefore, in this part, we will focus on the two groups of tax balances defined by the form and type of the business entity. A graphical presentation of the classification of tax balances is provided in the following example, which clearly illustrates the distinctions among the various tax balance groups.

Figure 1. Types of tax balances

A company, as the bearer of economic activity in a society, assumes different forms and possesses a different economic structure depending on the goals and tasks it seeks to achieve (Milojević et al., 2015).

The Role of the Tax Balance in the Tax System

The effectiveness of any system depends on the characteristics of its elements; if any component fails, the entire system may collapse. The functioning of the state, as a highly complex system, relies on the interplay of its various elements. One of the most critical elements for the functioning of the state is the budget (Auerbach, Gorodnichenko, & Murphy, 2020; Da-

šić, 2024). For the budget to fulfill its functions, it must be securely and stably supplied with fresh financial resources, meaning a continuous inflow of funds must be ensured.

Through this instrument, each business year is closed by allocating a portion of profit to the state in the form of corporate income tax. For the budgetary revenue system to operate in a stable manner, the state enacts tax laws that all taxpayers are obligated to follow. However, despite these measures, a certain level of tax avoidance in the form of tax evasion always persists (Schandlbauer, 2017).

The tax balance serves as a mirror of the state apparatus-an indicator of the government's ability to supervise its economic entities, encourage their development, and establish an appropriate redistribution of GDP. It is not appropriate to adopt the tax balance model of developed countries, nor to apply the models used by less developed countries (Jovanović, 2018). Every country should design its tax balance based on its own economic structure and modalities. Within the tax balance, priority should be given to those elements that align with the country’s strategic goals.

However, the substantive side of the tax balance depends on the specific tax regulations applicable in each country, resulting in significant differentiation (Lučić, Dašić, 2015). For example, even though Serbia is at a relatively lower level of economic development, it has adequately addressed corporate income taxation-both for residents and non-residents-thro-ugh appropriate tax regulations.

It can be concluded that the methodology and formal appearance of tax balances are largely consistent with international standards. However, their substantive application must be analyzed separately for each country, as individual states maintain local discretion with regard to tax rates, tax bases, depreciation methods, and deadlines for filing tax returns (Vr-žina, 2022).

The core elements that vary from country to country and reflect the differentiation in corporate income taxation include the definition of the taxpayer and the determination of the tax base. With regard to the taxpayer, it has been shown that most legal entities operating for profitexcluding partnerships-are subject to corporate income tax. These elements are defined with the aim of reducing tax evasion, which tends to occur as a result of growing corporate profits in developed countries, where the amount of tax owed is often substantial.

Conclusion

With the completion of the transition process in the Republic of Serbia, an increase in corporate income tax will inevitably become necessary, as this form of taxation will represent one of the key components of the national budget. The current situation reflects efforts to attract foreign investments, increase employment, and stimulate economic development, particularly in underdeveloped regions.

The application of balance sheet principles during the preparation of the tax balance is crucial, with special emphasis on acknowledging relevant risks that may arise during the tax reporting process. A clearly differentiated accounting profit and taxable profit form the basis for a correct understanding of the tax balance, wherein accounting profit is viewed in a narrower sense than taxable profit. This distinction plays a clear and unambiguous role in the redistribution of national income.

A secure budgetary revenue stream implies that the state must establish a tax balance that enables precise and accurate determination of each taxpayer’s liability. Stable revenue, on the other hand, depends on reducing tax evasion and ensuring that the state can effectively monitor and enforce compliance with tax laws by enterprises. The redistribution of national income concerns the balance between budgetary revenues and expenditures and refers to the equitable taxation of all corporate income taxpayers. The rate of tax evasion in this context should aim to approach zero in order to achieve a fair redistribution of national income.

To improve the theoretical and practical elements of tax balance reporting, we have highlighted key positions within the tax balance and suggested possibilities for relevant improvements in their presentation, which significantly contributes to the reduction of tax evasion.

It must be emphasized that, in the long term, taxation will gradually-but certainly-cease to exist as a primary instrument of state financing. In the future, the state will operate as a service provider for which citizens will pay specific fees, similar to paying for car servicing today. The state will lose much of the power it currently holds, as it will no longer manage such vast financial resources. In the future, all resources will become commodities, and their usage will be subject to payment. Consequently, services such as defense, healthcare, and education will become standard market commodities. These conclusions point toward the need for further expansion of this research, which will be presented in a future paper.