The significance of increasing efficiency on using investment credits for further development of real sector of the economy

Автор: Sirojiddinov K., Hudayberdiyeva N.

Журнал: Теория и практика современной науки @modern-j

Рубрика: Основной раздел

Статья в выпуске: 11 (53), 2019 года.

Бесплатный доступ

One of the main ways of increasing economic effectiveness of the companies is to widen the investment credits of commercial banks. The article has looked through the role of investment credits of commercial banks in the development of economy and the issues of improving investment activity of banks.

Investment activity, economic growth rate, banking system, investment credits of commercial banks, optimal liquidity norm, main capital

Короткий адрес: https://sciup.org/140274088

IDR: 140274088 | УДК: 330.356.3

Текст научной статьи The significance of increasing efficiency on using investment credits for further development of real sector of the economy

The large-scale reforms serve for the development of all sectors and fields of Uzbek economy. Deepening the process of economic liberalization, modernization and diversification is playing an important role to stabilize macroeconomic growth and to keep the economic growth rate. Currently, the local manufacturers and the competition among manufacturers are going out of local and regional borders and moving to the world market. The issue of increasing competitiveness of the manufacturing companies in both national and world market depends on country’s investment climate, its attractiveness and investment politics of the government.

There are a number of reasons why investment plays an important role in an economy: first, investment increases a country’s productive capacity; second, investment expenditure induces shifts in the levels of employment and personal income by affecting the demand for capital goods; In the third place, investment, as part of the total expenditure of an economy, is substantially smaller than consumption but it often presents a much higher volatility, which causes serious fluctuations to economic activity. Meanwhile, investment is a very important determinant of the long term improvement of an economy’s competitiveness.

Company’s internal financial resources are not enough to provide investment activeness; there is need for the resources of other members of financial markets like commercial banks. In the condition of limited resources to carry out technological modernization, providing stable economic growth rates puts high demands for the banking system.

The completed reforms on five priority areas of Uzbekistan’s Development Strategy for 2017-2021 have improved the activities of banking system. In case, further development of money-credit policies and regulating the currency in the basis of leading foreign experience played a significant role in the solution of long- term problems [1].

During the past 2018 year the development of internal and external factors resulted stable increase in economic and investment activity in all sectors of economy. As for the end of 2018, the real growth rate of GDP was 5.1%, its nominal amount was 407,5 billion sum. GDP per capita consisted 12,3 million sum, and comparing to 2017 it increased 3,3%.

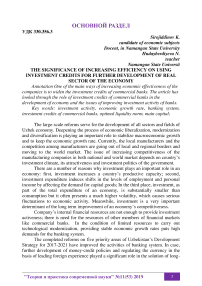

As the result of the growth of confidence to economic policy among companies, who act in all spheres of our economy, 44,5% of investments, directed to the main capital, consisted the funds of firms and citizens according to the statistics of 2018.

As the main source of investments, directed to the main capital, foreign investments(26,9) and bank credits (11) haven’t lost their significance.(1-picture) [2].

-

■ Funds of firms and citizens

-

■ Foreign investments and credits

-

■ Bank credits and other debt liabilities

-

■ government savings

-

■ Funds of Reconstruction and development savings

-

■ Funds of Government budjet

1-picture. The distribution of investments, directed to the main capital, according to sources, %

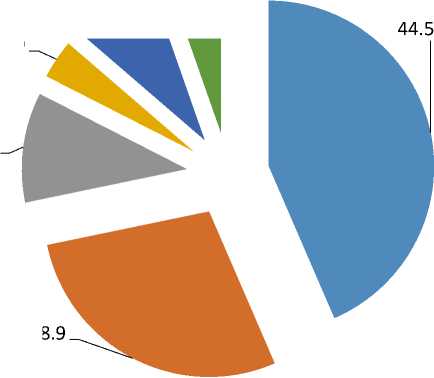

During 2018, about 36 billion sum was separated by commercial banks as investment credits in order to modernize real sectors of economy, to re-equip technologically and to diversify production. This amount is as twice more as 2017 year. In particular, 39,8 % of total investments was directed to Industry, 14% to agriculture, 8,9 % to transport and communication, 10 % to construction, 6,8 % to service and 20,5 % to other sectors.

-

■ Industry

-

■ Agriculture

-

■ Transport and communication

-

■ Construction

-

■ Service

-

■ Other fields

2-расм. Investment credits by sectors in 2018 (in %)

Banks mainly paid attention to government investment program which was planned for 2018 and they financed the projects which were directed to develop and modernize fundamental sectors and to socio-economic development of regions.

One of the main problems of investment credits is high investment risks of projects related to innovational activity. Central bank, by accomplishing its functions, should minimize those credit risks and provide liquidity and stability of banking system. In order to complete the functions, Central bank has been tested the liquidity of commercial banks.

One of the main issues related to bank activity is to increase bank resources regularly and choose optimal liquidity norm individually. In this case, one of the main objectives of banking system is to provide the requirements of International Basel template. According to International Basel requirements, main capital of commercial banks consists of the following sources:

-

- paid part of charter capital;

-

- additional capital ;

-

- non-distributed profit of past years;

-

- general reserves;

-

- income from selling non-cumulative preferential stocks

In our point of view, there should be new compulsory reserve norms determined by Central bank and these norms should be close to International standards. This will result in an increase in financial resources of commercial banks and it brings to achievements in investment activity of banks. Besides, commercial banks should offer tax preferences; they should take part in share and stock markets.

Список литературы The significance of increasing efficiency on using investment credits for further development of real sector of the economy

- Degree of the president of Republic of Uzbekistan PD-4947 on 7th of February,2017 on "5 priority directions of developing the Republic of Uzbekistan in 2017-2021 on "Actions of strategies". www.lex.uz

- Annual report on activity of Central Bank in 2018 www.cbu.uz