The theory of investment activity and its role to boost economies

Автор: Talapova N., Yunusova S.

Журнал: Теория и практика современной науки @modern-j

Рубрика: Основной раздел

Статья в выпуске: 11 (53), 2019 года.

Бесплатный доступ

The article defines the term of foreign direct investments and describes how the flow of investments can contribute to the economic development of countries. There are given the reasons of investment activity and the description of competitive strategy of importers of foreign direct investments.

Investment activity, factors of production, product differentiation, raw material seekers, market seekers, multinational firm, production efficiency seekers

Короткий адрес: https://sciup.org/140274109

IDR: 140274109 | УДК: 330.101.22

Текст научной статьи The theory of investment activity and its role to boost economies

The internationalization process begins with international trade. The theory of comparative advantage, the theoretical foundation of trade has been heralded by many economists as if it was enough to facilitate economic growth. Only after highlighting the limitations of international trade is it possible to understand why firms move beyond the geographic boundaries of their home country in order to license or manufacture abroad; that is, to engage in Investment activity.

What is FDI? Much of the confusion about FDI emerges from misunderstandings about what is measured as FDI. FDI is defined as the increase in the equity position of a non-resident owner who holds more than 10% of the shares of the firm[1.]. It also includes the loans received by the local company from the parent foreign owner[2].

Market Imperfections: A Rationale for the Existence of the Multinational Firm. MNCs strive to take advantage of imperfections in national markets for products, factors of production, and financial assets. Imperfections in the market for products translate into market opportunities for MNCs. Large international firms are better able to exploit such competitive factors as economies of scale, managerial and technological expertise, product differentiation, and financial strength than are their local competitors. In fact, MNCs thrive best in markets characterized by international oligopolistic competition, where these factors are particularly critical. In addition, once MNCs have established a physical presence abroad, they are in a better position than purely domestic firms to identify and implement market opportunities through their own internal information network.

Why Do Firms Invest? Strategic motives drive the decision to invest abroad and become an MNC. These motives can be summarized under the following five categories.

-

1. Market seekers produce in foreign markets either to satisfy local demand or to export to markets other than their home market. FDI of this kind may also be employed as defensive strategy [1] ; it is argued that businesses are more likely to be pushed towards this type of investment out of fear of losing a market rather than discovering a new one [2] .This type of FDI can be characterized by the foreign Mergers and Acquisitions in the 1980’s by Accounting, Advertising and Law firms. U.S. automobile firms manufacturing in Europe for local consumption are also an example of market-seeking motivation.

-

2. Raw material seekers extract raw materials wherever they can be found, either for export or for further processing and sale in the country in which they are found — the host country. Firms in the oil, mining, plantation, and forest industries fall into this category.

-

3. Production efficiency seekers produce in countries where one or more of the factors of production are underpriced relative to their productivity. Labor-intensive production of electronic components in Taiwan, Malaysia, and Mexico is an example of this motivation.

-

4. Knowledge seekers operate in foreign countries to gain access to technology or managerial expertise. For example, German, Dutch, and Japanese firms have purchased U.S.-located electronics firms for their technology.

-

5. Political safety seekers acquire or establish new operations in countries that are considered unlikely to expropriate or interfere with private enterprise. For example, Hong Kong firms invested heavily in the United States, United Kingdom, Canada, and Australia in anticipation of the consequences of China’s 1997 takeover of the British colony.

These five types of strategic considerations are not mutually exclusive. Forest products firms seeking wood fiber in Brazil, for example, would also find a large Brazilian market for a portion of their output.

In industries characterized by worldwide oligopolistic competition, each of the previous strategic motives should be sub classified into proactive and defensive investments. Proactive investments are designed to enhance the growth and profitability of the firm itself. Defensive investments are designed to deny growth and profitability to the firm’s competitors. Examples of the latter are investments that try to preempt a market before competitors can get established there, or attempt to capture raw material sources in order to deny them to competitors.

In deciding whether to invest abroad, management must first determine whether the firm has a sustainable competitive advantage that enables it to compete effectively in the home market. The competitive advantage must be firm-specific, transferable, and powerful enough to compensate the firm for the potential disadvantages of operating abroad (foreign exchange risks, political risks, and increased agency costs).

Based on observations of firms that have successfully invested abroad, we can conclude that some of the competitive advantages enjoyed by MNCs are: (1)

economies of scale and scope arising from their large size; (2) managerial and marketing expertise; (3) superior technology, owing to their heavy emphasis on research; (4) financial strength; (5) differentiated products; and sometimes (6) competitiveness of their home markets.

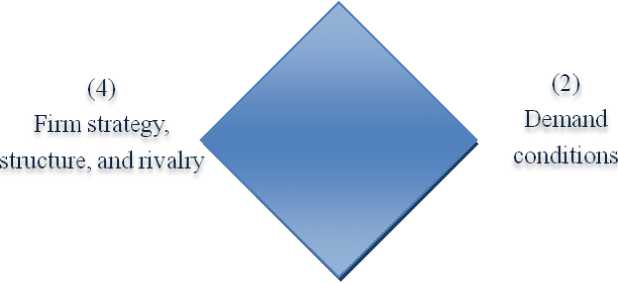

Competitiveness of the Home Market. A strongly competitive home market can sharpen a firm’s competitive advantage relative to firms located in less competitive home markets. This phenomenon is known as the “diamond of national advantage”. The diamond has four components, as illustrated in Figure 1.1.3.

Factor conditions

Related and supporting Industiies

Source: Michael Porter, The Competitive Advantage of Nations , London: Macmillan Press, 1990.

Figure 1.1.3.Determinants of National Competitive Advantage: Porter’s Diamond

A firm’s success in competing in a particular industry depends partly on the availability of factors of production (land, labor, capital, and technology) appropriate for that industry. Countries that are either naturally endowed with the appropriate factors or able to create them will probably spawn firms that are both competitive at home and potentially so abroad. For example, a well-educated work force in the home market creates a competitive advantage for firms in certain high-tech industries.

Firms facing sophisticated and demanding customers in the home market are able to hone their marketing, production, and quality control skills. Japan is such a market.

Firms in industries that are surrounded by a critical mass of related industries and suppliers will be more competitive because of this supporting cast. For example, electronic firms located in centers of excellence, such as in the San Francisco Bay area, are surrounded by efficient, creative suppliers and enjoy access to educational institutions at the forefront of knowledge.

A competitive home market forces firms to fine-tune their operational and control strategies for their specific industry and country environment. Japanese firms learned how to organize to implement their famous just-in-time inventory control system. One key was to use numerous subcontractors and suppliers that were encouraged to locate near the final assembly plants.

In some cases, home country markets have not been large or competitive, but MNCs located there have nevertheless developed global niche markets served by foreign subsidiaries. Global competition in oligopolistic industries substitutes for domestic competition For example, a number of MNCs resident in Scandinavia, Switzerland, and the Netherlands fall in this category. Some of these are Novo Nordisk (Denmark), Norsk Hydro (Norway), Nokia (Finland), L.M. Ericsson (Sweden), Astra (Sweden), ABB (Sweden/Switzerland), Roche Holding (Switzerland), Royal Dutch Shell (the Netherlands), Unilever (the Netherlands), and Philips (the Netherlands).

Emerging market countries have also spawned aspiring global MNCs in niche markets even though they lack competitive home country markets. Some of these are traditional exporters in natural resource fields such as oil, agriculture, and minerals, but they are in transition to becoming MNCs. They typically start with foreign sales subsidiaries, joint ventures, and strategic alliances. Examples are

Petrobras (Brazil), YPF (Argentina), and Cemex (Mexico). Another category of firms is those that have been recently privatized in the telecommunications industry. Examples are Telefonos de Mexico and Telebras (Brazil). Still others started as electronic component manufacturers but are making the transition to manufacturing abroad. Examples are Samsung Electronics (Korea) and Acer Computer (Taiwan).

After gaining its independence, Uzbekistan, along with the other Central Asian countries, took reforms towards reconstruction and modernization of its economy. In this sense, there were whole list of objectives to be achieved by Uzbekistan. With the initiatives of Islam Kasimov, the first President of Uzbekistan, there were conducted enormous economic changes in the beginning of the independence. Uzbekistan marked for itself its own way adjusted to market-oriented economy to be achieved through four steps. However, behind of all this reforms lies one underlying task – protection of national interest or simply security of national politics and economy.

Our president, ShavkatMirziyoyev,declared 2019 as “The year of actual investments and social developments”.This means that there will be more opportunities to attract foreign investments and it will serve to further economic growth in 2019.

Список литературы The theory of investment activity and its role to boost economies

- Knickerbocker identified this phenomenon in his ‘follow-my-leader' hypothesis in: Knickerbockers', F. T. (1973). Oligopolistic reaction and multinational enterprise.Boston(Mass.), Division of Research Graduate School of Business Administration Harvard University.

- Dunning, J. H. (1993).Multinational enterprises and the global economy. Wokingham, England; Reading, Mass, Addison-Wesley