The three-year budget: should we wait for stability?

Автор: Povarova Anna Ivanovna

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Development strategy

Статья в выпуске: 2 (14) т.4, 2011 года.

Бесплатный доступ

For the first time the Vologda oblast accepted the budget for three years. In the conditions of sharp means’ deficiency it is not an easy task to generate the main financial document in such a way so as to follow the social orientation and to list in the means for economic growth. In the article the basic results of the regional budget’s consideration (for the period from 2011 to 2013) having been carried out by the ISEDT RAS are represented. The main objective of the analysis was estimation of correspondence of the budgetary parameters to the prior problems of the area’s development, to the growth of its population’s well-being, to providing of the macroeconomic stability.

Regional budget, incomes, charges, budget deficiency, public debt, budgetary policy

Короткий адрес: https://sciup.org/147223246

IDR: 147223246 | УДК: 336.144.2(470.12)

Текст научной статьи The three-year budget: should we wait for stability?

Management of the processes of the financial resources’ creation, distribution and consumption is carried out with the help of the financial planning which object is money resources. Both at the national and territorial levels the financial planning is provided by the system of the financial plans, each of which solves the problems of the finance’s organization and management. The components of the plans’ system of the public finance are the federal and the regional budgets.

In the Budgetary Message of the President of the Russian Federation for the period from 2011 to 2013 one of the budgetary policy’s problems in the middle-term and long-term prospects is the issue on coordination of the long-term strategic and budgetary planning. The mentioned problem arose in the connection with the fact that the strategic planning remains poorly coordinated with the budgetary planning. The elaborated strategy of the socioeconomic development of regions frequently avoid financial providing the problems’ and parameters’ achievement within the framework of the mentioned strategy.

Long-term planning will enable to formulate the prior aims, to estimate the necessary resources for their realization and to determine the probable sources. It will allow leaving the inertial approach when the assignments are distributed on the indexing tendencies’ basis over the recent years.

Table 1. The change of incomes, regional budgets’ deficiency and public debt of the NWFD subjects in 2008 – 2010

|

Region |

Budget incomes, % to the total income |

Budgeted deficit, % to the home income |

Public debt, % to the home income |

||||||

|

2008 |

2009 |

2010 |

2008 |

2009 |

2010 |

2008 |

2009 |

2010 |

|

|

Karelia Republic |

60.0 |

57.1 |

61.6 |

3.2 |

25.3 |

5.0 |

23.3 |

44.0 |

55.3 |

|

Komi Republic |

84.5 |

72.2 |

79.6 |

3.5 |

5.5 |

0 |

8.3 |

20.2 |

16.9 |

|

Arkhangelsk oblast |

60.4 |

48.3 |

55.3 |

20.7 |

28.7 |

4.5 |

15.3 |

37.5 |

41.3 |

|

Vologda oblast |

87.1 |

60.8 |

71.7 |

0 |

34.1 |

27.3 |

3.8 |

39.4 |

73.0 |

|

Kaliningrad oblast |

56.9 |

42.2 |

60.7 |

0 |

0 |

12.0 |

31.4 |

54.8 |

63.8 |

|

Leningrad oblast |

79.5 |

78.4 |

81.9 |

0 |

9.8 |

0 |

10.5 |

12.0 |

18.0 |

|

Murmansk oblast |

64.0 |

63.6 |

73.9 |

0 |

7.9 |

0 |

2.4 |

22.0 |

19.3 |

|

Novgorod oblast |

68.5 |

62.0 |

70.0 |

13.0 |

9.4 |

24.9 |

17.0 |

29.4 |

58.3 |

|

Pskov oblast |

54.0 |

47.8 |

50.7 |

0 |

8.9 |

6.8 |

1.7 |

3.7 |

8.5 |

|

Saint-Petersburg |

84.5 |

77.5 |

81.1 |

5.8 |

2.7 |

4.1 |

0.1 |

0.7 |

2.3 |

|

NWFD |

78.5 |

70.0 |

75.6 |

4.4 |

6.5 |

4.0 |

5.5 |

13.8 |

16.7 |

|

The Russian Federation |

76.1 |

66.6 |

71.9 |

1.1 |

8.4 |

2.2 |

12.2 |

24.0 |

25.5 |

The first step on the way to the long-term indicative financial planning is the three-year budget. Prolonging the planning is necessary according to the macroeconomic reasons that all the participants of the budgetary process would be able to understand, what macroeconomic situation will develop depending on the budgetary policy throughout the following three years. The transition to the three-year budget has even greater value at a micro-level as it will allow the budgetary establishments to conclude long-term contracts on goods’ delivery, performing work and rendering services for the state needs.

The three-year budget should become not only the fundamentally new financial plan, but also the active mean of managing the economic development. In other words, the state has a real opportunity not only to collect incomes into the budget and to finance charges, but also to operate the development of the profitable potential of the budgetary system. It means the transition to a qualitatively new level of the public administration.

Providing the coordination of the strategic goals with the budgetary planning is especially actual now when in connection with the resources’ limitation both the federal budget and the overwhelming majority of the territorial budgets are reduced to the deficiency.

Misbalance of the public finances under the influence of the global crisis’ consequences was the key qualitative change in the budgetary sphere in 2009 and 2010. More than two thirds of the territorial budgets of the Russian Federation have been fulfilled with deficiency.

In the subjects of the North-West Federal District there also was deterioration of the parameters determining the stability of the regional budgetary systems (tab. 1) . Thus the Vologda oblast was characterized by the high level of public debt, the budget’s deficiency and abrupt decrease of the profitable base.

The consequences of the financial crisis in Vologda oblast can be characterized by the fact that for the first time from the beginning of 2000 the region faced the problem of financial providing vital obligations to the population.

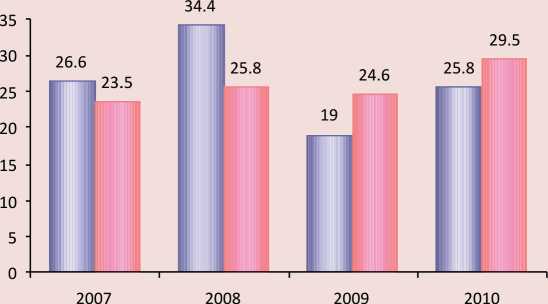

At the pre-crisis period Vologda oblast had a considerable stock of budgetary resources – own tax and non-tax incomes in 1.1 – 1.3 times exceeded prime charges1. In 2009 and 2010 the region did not have enough home means even for covering prime socially significant expenses (fig. 1) .

Figure 1. Home incomes and prime charges of the regional budget of the Vologda oblast in 2007 – 2010, billion rubles

Home income Prime charges

The profitable component of the regional budget was practically reduced twice at growing social obligations.

Under such conditions at the budget’s formation for the year of 2011 and the scheduled period of 2012 and 2013 the government of the region started with the charges’ and deficiency’s minimization. Thus the budgetary policy will be focused on the restraint of the public debt’s further growth and on providing steady functioning of the social sphere.

The forecast of the area’s macroeconomic parameters taken as a basis at the regional budget’s formation in 2011 – 2013, is developed on the basis of moderate-optimistic forecast variant of economy’s functioning in the Russian Federation, used at elaborating the federal budget’s project. The rates of economic growth in the Vologda oblast, according to this variant, are determined at the rate of 3.5 – 5% at the all-Russian growth rates of 3.9 – 4.5% (tab. 2).

At the period of 2011 – 2013 restoration of the positive dynamics of the basic macroeconomic and budget-forming parameters is predicted. At the same time, the considerable economic growth is not expected, and the gain of some parameters can be noticed only in comparison with the low base of the year of 2009.

The main source of growth – investment into the fixed capital - will reach the nominal level of the year of 2008 only in 2013. In many respects it is connected to the abrupt reduction of the regional budget’s participation in financing investments. Restoration of the enterprises’ pre-crisis profit level is taken out of the limits of the year 2013 that will considerably influence the profits tax, which makes the basis of the regional budget.

The gain’s rates of the wages’ fund will be far from the parameters of the year of 2008. It is caused by actual wages’ falling in 2009 – 2011. Thus the prognosis’ wage fund does not take into account the payments’ increases in the budgetary sphere. According to the calculations made by the Ministry of Economic Development of the Russian Federation, the real wages of state employees will decrease for 2.5 – 4% and even in case of indexation it will only make 55% from the average wages’ level across the country.

It is obvious that at the payment’s restraint in the budgetary sphere all the wage fund’s increase will fall to the commercial structures’ employees. The increase in actual available population’s incomes is not expected either (a gain 0.7 – 1.1% in 2012 – 2013). Thus, it is possible to conclude, that the rates of growth of the population’s incomes and wages concede to the rates of the economy’s restoration that will result in actual reduction of income tax’s takings.

Table 2. The basic macroeconomic parameters for making up he regional budget’s project, % to the previous year*

|

Point name |

In fact |

2010, estimation |

Prognosis |

|||

|

2008 |

2009 |

2011 |

2012 |

2013 |

||

|

GRP growth rates in comparable prices |

-3.9 |

-13.0 |

+5.0 |

+3.5 |

+4.0 |

+5.0 |

|

Investment growth rates |

-8.8 |

-29.3 |

+3.0 |

+12.9 |

+9.9 |

+10.3 |

|

Industrial production’s index |

95.8 |

87.5 |

108.5 |

103.5 |

103.0 |

104.5 |

|

Actual population’s incomes |

98.7 |

89.9 |

105.0 |

100.0 |

100.7 |

101.1 |

|

Actual wages’ growth rates |

+8.3 |

-5.9 |

-4.8 |

-1.6 |

+0.3 |

+0.7 |

|

Inflation, % |

15.2 |

10.7 |

6.6 |

7.9 |

5.7 |

5.4 |

|

Budget-forming parameters |

||||||

|

Profitable enterprises’ income, billion rubles |

99.5 |

22.6 |

47.6 |

53.0 |

56.4 |

60.4 |

|

Growth rates to the previous year, % |

+22.7 |

-77.3 |

+2.1 р. |

+11.3 |

+6.4 |

+7.0 |

|

Wages’ resource, billion rubles |

90.5 |

86.1 |

91.1 |

97.1 |

103.3 |

110.1 |

|

Growth rates to the previous year, % |

+24.5 |

-5.0 |

+5.8 |

+2.3 |

+6.4 |

+6.6 |

*Source: the Vologda oblast government resolution 18.10.2010 № 1208 «About the forecast of socio- economic development of Vologda oblast in 2011 – 2013».

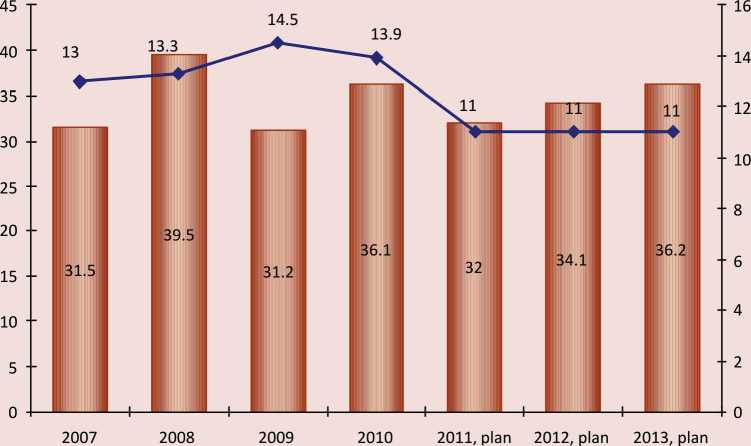

In such macroeconomic conditions it is clear that it is impossible for the region to reach the level of the year of 2008 in immediate prospects on the budgetary incomes’ volume. Moreover, the incomes’ falling is observed, and not only in comparison with the year of 2008, but also with the level of the year of 2010. So, in 2010 the profitable part of the regional budget only made 14% to GRP. In 2011 this ratio will decrease to 11% and remain constant in 2012 – 2013 (fig. 2). The real budget incomes will not exceed 80% of the pre-crisis level.

The structural peculiarity of the regional budget’s profitable part in the scheduled period is restoration of the tax revenues’ share in 2011 to the level of the year of 2008 and its further

Figure 2. The Vologda oblast regional budget’s incomes in 2007 – 2013

^ ”1 Budget's incomes, billion rubles - ♦ To GRP, %

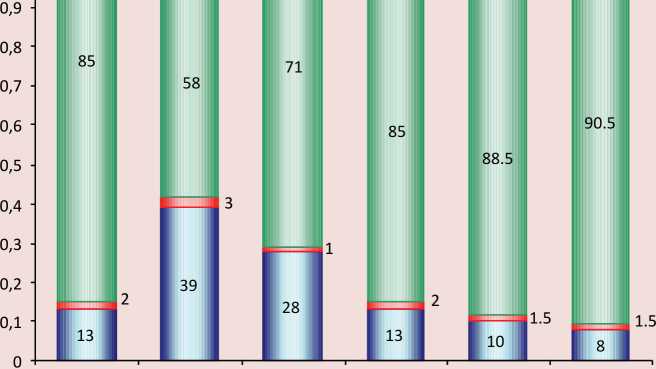

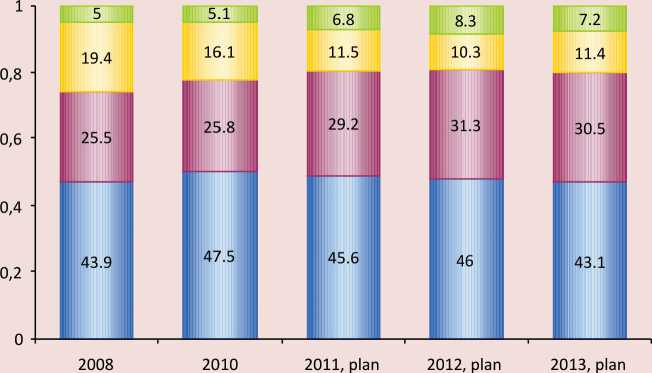

Figure 3. Structure of the regional budget’s profitable part of the Vologda oblast in 2008 – 2013, %

2008 2009 2010 2011, plan 2012, plan 2013, plan

□ Takings without compensation □ Non-tax revenue OTax revenue

increase to 90.5% in 2013. Simultaneously the decrease of the non-tax takings’ and gratuitous receipts’ role in the budget takings’ formation will occur (fig. 3) .

The basic sources of the regional budget’s taxes for the forthcoming three years still are the deductions from regulating taxes, providing to 80% of all receipts. Though profits tax will obtain its dominating role in the budget revenues’ formation, which was lost at the crisis’ time, still in connection with the abrupt profit falling in the real sector of the economy in 2009, nominal takings of the profits tax will make 60% of the pre-crisis level, and these takings’ position in the aggregate bud get’s revenue will make 35% on the average, comparing 53% in 2008 (tab. 3) .

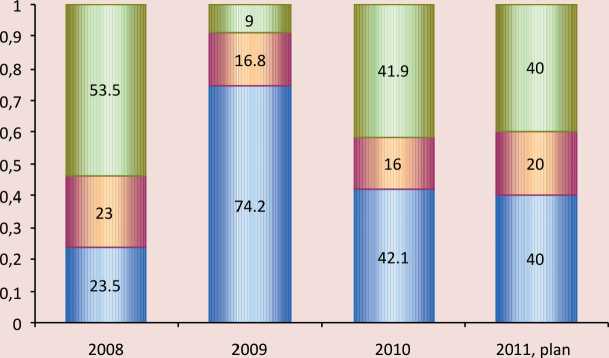

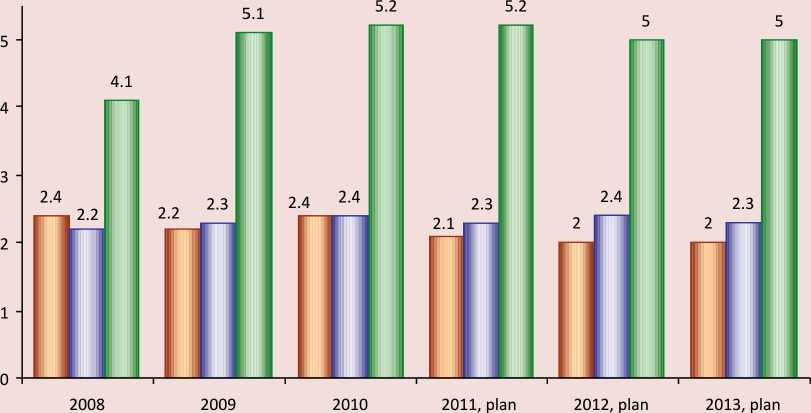

The absolute level of the regional budgets revenues and first of all the profits tax is predetermined by the price for metal products. According to the data of the Ministry of Economic Development of the Russian Federation the world forecast of growth on steel consumption in 2011 – 2013 will make approximately 5% a year; in this connec- tion the growth of the ferrous metals’ export prices can make from 510 USA dollars for a ton in 2010 to 617 dollars in 2013. The export incomes are supposed to form 40% of the profits tax. Hence, the tax base of the region will be still adhered to the metallurgical complex the following years (fig. 4).

Unfortunately, the three-year budget is not focused on the solution of the basic strategic problems of the soci0-economic development determined by the government of the area in the forecast for 2011 – 2013, that is, overcoming the mono-structural character of the economy.

One of the diversity’s directions of the regional budget’s tax base we should consider the increase of the regional payments’ role, first of all the tax to the organizations’ property. Though the share of the regional taxes in the formation of the budget’s incomes will increase about 6% in 2008 to 12% in 2011 – 2013, according to the international norms, the fiscal function of the regional taxes is still low (for example, in the European countries the territorial payments form about 40% of the budget).

Table 3. Tax revenues and the regional budget’s takings (Vologda oblast) in 2008 – 2013, million rubles

|

Point name |

Actual taking |

Prognosis |

||||

|

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

|

|

Total tax revenue |

33627.3 |

18243.5 |

25627.5 |

27257.5 |

30184.6 |

32714.9 |

|

Including |

||||||

|

Federal tax |

31285.3 |

15233.5 |

22605.5 |

23587.8 |

26087.5 |

28462.2 |

|

position, % |

79.2 |

48.7 |

62.7 |

73.8 |

76.5 |

78.6 |

|

– income tax |

20843.9 |

4807.0 |

10766.3 |

11410.5 |

12228.9 |

13269.9 |

|

position, % |

52.7 |

15.4 |

29.9 |

35.6 |

35.9 |

36.7 |

|

– income tax on individuals |

7805.9 |

7343.5 |

7889.8 |

8251.3 |

8825.4 |

9444.6 |

|

position, % |

19.7 |

23.5 |

21.9 |

25.7 |

28.4 |

26.1 |

|

– excise |

1897.1 |

2412.9 |

2989.6 |

3200.9 |

4003.2 |

4615.4 |

|

position, % |

4.8 |

7.7 |

8.3 |

10.0 |

11.7 |

12.7 |

|

Regional tax |

2342.2 |

3010.0 |

3022 |

3684.2 |

4112.3 |

4264.3 |

|

position, % |

6.0 |

9.6 |

8.4 |

11.5 |

12.1 |

11.8 |

Figure 4. Branch structure of takings into the regional budget of the Vologda oblast from the profit tax in 2008 – 2011, %

□ Other branches □ Chemical production □ Metallurgical production

The regional budget is greatly influenced by the changes in the federal tax laws. It is necessary to note, that the offered tariffs of the insurance payments are atypically high for the majority of the advanced countries.

The consequences of the growth of rates of the payments insurance can be:

-

- decrease of the taxes’ receipts paid within the framework of special modes, reduction of the taxation base;

-

- complication of the competitive situation in the regional markets;

-

- termination of a part of small enterprises’ activity;

-

- redistribution of incomes between the subjects’ budgets and the budgets of the system of the state off-budget funds for the benefit of the second ones that will complicate the uneasy situation with the incomes’ formation of the sub-federal budgets.

According to the forecasts, the outstripping growth of prices for the industrial output concerning the growth of selling volumes will be one of the negative reactions to this tax inno- vation. The enterprises have already started to increase the prices, thus reducing the efficiency of an anti-inflationary authorities’ policy. According to the data of the Department of Economy of the Vologda oblast, in December, 2010 the price index of the industrial goods’ manufacturers reached its maximum and made 130.3%.

As a whole the predicted tax modifications are directed on the growth of the indirect taxes’ share in the structure of tax loading that will inevitably result in the increase of the tax burden for the low-profitable layers of the population. The question on the transition to the progressive model of surtax in the considered period is not solved, and also there arises the question on the tax’s introduction for the real estate.

One of the main risks of the regional budgetary system’s functioning in the considered period the decrease of the gratuitous financial help from the federal budget is. The federal authorities continue to call regions to adhere to the policy of restriction of the budgetary charges’ growth, and also to search for ways of additional completion of the regional budgets, thus reducing their dependence on the federal support. The volume of inter-budgetary transfers in territorial budgets for three years will be reduced in 1.4 times. In this situation the social guarantees of the population all in the greater degree will depend on the sub-federal budgets, the overwhelming part of which is deficient. Meanwhile the regions have to solve the most part of problems. It is obvious, that in the conditions of reducing the financial support regions will have to reduce the long-term target programs.

The reduction of inter-budgetary transfers for the Vologda oblast in the federal budget is calculated for three times, including grants (in 25 times).

So what is the reason of such hard inter-budgetary relations? The matter is that during all the period the federal budget will be carried out with deficiency, mainly because of lack of the oil-and-gas incomes (tab. 4) .

The pension system’s imbalance is the second factor of the federal budget’s deficiency. The support of the Pension fund will demand considerable budgetary bringing in on the background of the pension payments’ indexation. On financing the transfers to the Pension fund 9% of the federal treasury will be directed, and by 2013 their volume for the first time will exceed the volume of the financial help to the subjects of the Russian Federation.

The third reason of the federal budget’s deficiency is the beginning of the state arms program which will demand the increase in the defense cost from 13 to 19% of the gross national product.

It is possible to conclude, that the worsening in the regional budgetary systems’ work in 2011 – 2013 in many respects will be caused by the federal budget’s instability. So, on the results of the year of 2010 in three subjects of the NorthWest the budgetary proficiency was observed; in 2011 the regional budgets’ deficiency is expected in all the subjects of the District (tab. 5) .

The financial crisis which put the budgetary system of the Vologda oblast into the frameworks of rigid deficiency, forced the regional authorities to change their opinion on carrying out of the so-called soft budgetary policy, characteristic for the recent decade. The growth

Table 4. Key parameters of the federal budget for 2011 and the scheduled period of 2012 – 2013, % to gross national product

|

Parameter |

2008 |

2009 |

2010 (estimation) |

prognosis |

||

|

2011 |

2012 |

2013 |

||||

|

Total income |

22.4 |

18.8 |

17.4 |

17.6 |

17.0 |

16.8 |

|

Oil and gas income |

10.6 |

7.6 |

8.3 |

8.1 |

7.9 |

7.5 |

|

Total charges |

18.3 |

24.7 |

22.7 |

21.2 |

20.1 |

19.7 |

|

Deficiency (-), proficiency (+) |

+4.1 |

-5.9 |

-5.3 |

-3.6 |

-3.1 |

-2.9 |

|

Sources: data Finance Ministry of the RF. |

||||||

Table 5. The result of the regional budgets’ carrying out if the subjects of the NWFD in 2010 – 2011, (deficiency-, proficiency +)

|

Region |

2010, actual |

2011, prognosis |

||

|

million rubles |

deficiency to home income, % |

million rubles |

deficiency to home income, % |

|

|

Karelia Republic |

-768.4 |

5.0 |

-1035.3 |

6.8 |

|

Komi Republic |

+1359.8 |

0 |

-5100.7 |

15.8 |

|

Arkhangelsk oblast |

-1224.5 |

4.5 |

-4709.3 |

18.0 |

|

Vologda oblast |

-7048.9 |

27.3 |

-4172.1 |

15.0 |

|

Kaliningrad oblast |

-2140.2 |

12.0 |

-2620.8 |

13.9 |

|

Leningrad oblast |

+2573.6 |

0 |

-2409.7 |

5.8 |

|

Murmansk oblast |

+2212.2 |

0 |

-2290.4 |

7.6 |

|

Novgorod oblast |

-3177.3 |

24.9 |

-1597 |

10.9 |

|

Pskov oblast |

-627.9 |

6.8 |

-2767 |

27.0 |

|

Saint-Petersburg |

-11638 |

4.1 |

-29587 |

10.1 |

|

NWFD |

-20183 |

4.0 |

-57571 |

11.2 |

Figure 5. The Vologda oblast regional budget’s charges in 2007 – 2013

of tactical incomes provoked the acceptance of additional social obligations. As a result the increase in charges outstripped the growth of the budget revenues. Realizing the impossibility of the further annual escalating of the state obligations in the conditions of post-crisis development, the government of the area chose the course on their reduction. For the following three years the account part of the regional budget will decrease in 1.3 times at the tendency to the reduction of its share in GRP from 16.6% in 2010 to 10% in 20132 (fig. 5).

Judging by the basic parameters of the expenditure, the bulk of budgetary resources will continue to be spent on traditional functions. Most large-scale items of expenditure will

Figure 6. The structure of the regional budget expenditure of the Vologda oblast, %

□ Nationwide issues □ Economic infrastructure

Social sphere Intergovernmental transfers

Table 6. Regional budget expenditure of the Vologda oblast in sector “National Economy” in 2008 – 2013

It should be recognized that there are objective reasons for the persistence of such expenditures on social services.

Firstly, the negative demographics connected with the population aging requires additional measures to support specific categories of citizens. Secondly, the commitments in the sphere of education, health care, social benefits, indexation of salaries to state employ- ees are constantly pushing social spending to increase. Third, reducing current expenses is more difficult than any others: for example, it is easy to add additional allowances to state employees’ salaries, welfare benefits to needy categories of citizens, but it is practically impossible to eliminate or reduce them.

Maintenance of the necessary level of social commitments will be implemented primarily by reducing the share of the national economy expenditure, which is the most significant change in the cost structure of the regional budget.

In general, financing of sectors of the region’s economy is cut in half. Moreover, this reduction to the greatest extent accounts for the year of 2011 (tab. 6) .

Most large-scale reduction of state support will affect agriculture. Compared to the precrisis period the cost of this strategic sector will be reduced 4.2 times and to the level of 2010 – 3.4 times. We should add that the reduction in funding agriculture will occur against the background of two-fold load increase on the wage fund of agricultural producers.

In addition, we should not forget about the consequences of heat waves in summer 2010, which resulted in the agriculture of the region suffered a loss of about one billion rubles. Meanwhile, the volume of funds from the federal budget for the elimination of these effects did not comply with its compensating function (50 million rubles, including 30 million rubles of credits to be refunded).

The Vologda oblast, as well as other regions of the country, needs colossal investment in infrastructure, especially in transport development. However, the dynamics of budget costs for construction and operation of roads indicates their significant reduction not only in comparison with 2008, but with the crisis period too.

Such inflexibility of the regional budget expenditure structure hinders the solving of other economic problems due to budget allocations. The Russian government expects to receive additional funds for repairs and construction of roads by raising excise taxes on gasoline and running the road funds. However, the legal basis for the formation and sustainability of road funds has not yet been created that will create a risk of inefficient use of budget resources allocated for these purposes.

On the background of a high level of the housing stock wear it is projected to reduce the financing of the housing and communal services annually. The scarce investment in the housing programs implementation is being minimized (tab. 7) .

It turns out that the regional budget is gradually removed from participation in solving the housing problem, shifting it on the citizens’ shoulders, most of which are not able to do it. Co-funding of housing programs from the federal budget is provided only within the “Housing for young families” program at a rate of 40% of the total cost.

Speaking of the budget to support the economy, we cannot ignore the issues of financial security of strategic goals of modernization and innovation development. Resources provided by the main financial document of the Oblast for these purposes do not yet allow us to consider the budget as a tool for implementation of tasks assigned. For example, in 2011 – 2013 regional budget funding of the activities for the long-term targeted programs aimed at modernization and innovation development of economy, will be less than 5% of total expenditures (tab. 8) . Thus, three-year budget does not stimulate the structural shift in favor of innovative industries.

The federal budget provides up to 15% of total expenditure for innovative programs, which is also clearly not enough to implement the main idea put forward by the President. Obviously, the problem of modernization and innovation should be addressed through enhanced mechanisms of public-private partnership.

Table 7. Regional budget expenditure of the Vologda Oblast on programs on housing in 2008 – 2013, mill. rub.

|

Name of the program |

Actually executed |

Forecast |

||||

|

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

|

|

Providing housing for young families |

56.4 |

10.0 |

15.2 |

15.0 |

0 |

0 |

|

Affordable Housing |

72.1 |

17.4 |

249.9 |

80.0 |

80.0 |

80.0 |

|

Housing for orphans |

75.9 |

50.0 |

158.3 |

200.0 |

160.2 |

160.2 |

|

Social Development of Rural Areas |

90.7 |

20.1 |

0 |

78.4 |

40.0 |

0 |

|

Total expenses |

295.1 |

97.5 |

423.4 |

373.4 |

280.2 |

240.2 |

|

Share in total budget expenditures, % |

0.8 |

0.3 |

1.0 |

1.0 |

0.9 |

0.7 |

Table 8. Regional budget expenditure of the Vologda oblast on innovative development and modernization of the economy in 2011 – 2013, mill. rub.

|

Program |

Forecast |

||

|

2011 |

2012 |

2013 |

|

|

Development of flax complex of the Vologda oblast in 2009 – 2012 |

205.7 |

58.8 |

0 |

|

Comprehensive modernization of the city of Sokol in 2010 – 2012 |

146.8 |

240.7 |

0 |

|

Development and improvement of road network in 2009 – 2013 |

1008.2 |

1065.7 |

1123.3 |

|

Introduction of innovative technologies in the construction, reconstruction and maintenance of transport infrastructure, and in production of modern vehicles in 2011 – 2015 |

0.85 |

0.9 |

0.9 |

|

Energy saving and energy efficiency increase on the territory of the Oblast in 2010 – 2015 and up to 2020 |

96.1 |

101.6 |

107.1 |

|

Gasification of the Vologda Oblast in 2011 – 2013 |

43.2 |

48.0 |

48.8 |

|

Total expenses |

1500.9 |

1515.7 |

1280.1 |

|

To total budget expenditures, % |

4.1 |

4.8 |

3.9 |

We can conclude that the simultaneous solution of two major problems – modernizing the economy and social sphere – in the coming years will be extremely difficult. Federal and especially regional budgets are too small for this. It seems that the goal of modernization can be achieved through higher economic growth rates and search for extra-budgetary sources of financing.

For a number of years already, the regional budget of the Vologda oblast is positioned as a budget for social purposes. The share of allocations to social sectors and in the forecast period will not be reduced. From this perspective, the three-year budget fully preserves the status of socially-oriented. But if you follow the dynamics of nominal expenses to all priority sectors of the social sphere in 2011 – 2013, there will be an impression that they are being “frozen” (Fig. 7).

The regional government has set a target to increase life expectancy in the region up to 70

Figure 7. Regional budget expenditure of the Vologda oblast on priority sectors of the social sphere in 2008 – 2013, bill. rub.

□ Education □ Health care □ Social policy

Table 9. Regional budget expenditure of the Vologda oblast on “Health Care” in 2001 – 2013

|

Sub-section |

2011 |

2012 |

2013 |

|||

|

million rubles |

% to 2010 |

million rubles |

% to 2011 |

million rubles |

% to 2012 |

|

|

Hospital medical aid |

741.2 |

97.7 |

587.0 |

79.2 |

587.0 |

100.0 |

|

Ambulatory aid |

182.5 |

102.9 |

160.0 |

87.7 |

118.8 |

74.2 |

|

Emergency |

146.9 |

105.9 |

131.0 |

89.2 |

57.6 |

43.9 |

|

Donor blood supply |

130.3 |

102.1 |

118.3 |

90.8 |

118.3 |

100.0 |

|

Insurance premiums for MHI of the unemployed population |

2793.2 |

114.6 |

2728.5 |

97.7 |

2875.9 |

105.4 |

|

Total |

5281.6 |

103.9 |

5298.7 |

100.3 |

5180.1 |

97.8 |

Table 10. The debt load of the regional budget of the Vologda oblast in 2008 – 2013

As can be seen 53% in the structure of health care costs are made up by premiums for compulsory health insurance for the unemployed population. The core public health functions will take the least part of the budget investments; besides, there is an explicit tendency of their reduction. Even in the outpatient treatment, where a person gets first medical care the costs for the three years are cut down 1.5 times.

Since mid-2012 a law on a new funding mechanism for public institutions should come into force in its entirety. It can be assumed that it is in advance of this law there is provided costs stagnation for the maintenance of budget network offices, which means reducing the availability of public services. Moreover, given the projected growth rates of natural monopo-lies3 and, adjusted for inflation, there will be a real reduction of expenditure allocated for the budget network development. In this regard, it is difficult to speak definitely of a socially oriented budget. Most likely, this is the budget of execution of necessary amount of social commitments made by regional authorities in the pre-crisis years.

Despite the fact that in 2000 – 2008 budget incomes of the Vologda oblast doubled every three – four years, in the region there haven’t been set up proper reserves, because the additional incomes were not sufficiently used for restructuring the tax potential4. Therefore, the regional government failed to conduct countercyclical fiscal policy without creating a risk of insolvency in crisis. To ensure the necessary amount of essential expenses they had to resort to debt financing. As a result, in 2009 – 2010, 15 – 18% of the costs were covered by bank and budget loans the interest on which laid a heavy burden on the budget system of the region (tab. 10) .

The aim of reducing the debt load will determine the strategy for the regional budget in the forecast period.

The amount of debt in 2011 will reach nearly 80% in the volume of own revenues.

Table 11. Regional budget expenditure of the Vologda oblast on maintenance the management apparatus in 2008 – 2013

|

Activities |

Actually executed |

Forecast |

||||

|

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

|

|

Expenditures, mill. rub. |

1694 |

1650 |

1532 |

1467 |

1333 |

1433 |

|

As % of total budget expenditures |

4.3 |

4.4 |

3.6 |

4.0 |

4.2 |

4.3 |

In 2011 – 2013 it is expected to attract 13 billion of loans. As a result, the cost of their services will grow 2.3 times and amount to over 3 billion rubles that will exceed the funding of many vital industries. The expected budget surplus in 2012 – 2013 will be directed not at the cost but the repayment of credits.

On the backdrop of interest costs swift increase the share of the cost of maintaining the state apparatus is not reduced (tab. 11) . Nominal spending on administration exceeds the destination authorized under other sectors, except education, health care and social policy.

At the same time it should be noted that the undoubted advantage of the new budget is the expansion of the program funding. The share of expenditures formed not in the basic functional but in the programmatic classification will increase from 10 to 15%. Noteworthy is the Government’s desire to balance regional fiscal system, for the first time since 2000-ies the budget is planned with a surplus in 2012 – 2013.

Of course, it is necessary to consider that in the short term most budgetary problems of the Vologda oblast which has not yet overcome the effects of the crisis will be determined by scarcity of the federal budget and the intensity of budgetary control.

In this situation it is required to have a new approach to the management of the regional finances. With low quality of institutional environment the most important measures to improve budget management, particularly budgeting by results, have remained unimplemented. Therefore, in the immediate cycle of fiscal policy it seems necessary to focus on the issues of restructuring the budget network, increasing innovation and transparency in the system of government procurement, optimization of individual budgetary procedures.

The most important reserves of strengthening the region’s fiscal capacity should be considered the following:

-

1) Increasing the level of tax collection. To this end, tax and financial services of the Oblast should make more active use of the rights to undisputed penalties of existing debt payments to the budget. Potential additional revenue of the regional budget by eliminating the aggregate debt to the budget is estimated at 1.9 billion rubles, including arrears in the amount of 0.7 billion rubles5.

-

2) Increase of regional taxes role in the formation of budget revenues by optimization of motivation tax policy both at the federal and regional levels. As a result of providing benefits on property taxes in accordance with regional laws the Vologda Oblast lost 7 – 11% of tax revenues with an average North-West performance of 5% in 2006 – 20096. In connection with this an urgent task now is to review regional legislation in the sphere of tax benefits. Reduction of benefits to the average North-West level will increase the budget revenues by 1.9 billion rubles or by 6%.

In the area of property tax benefits are granted not only by regional legislation, but in accordance with the RF Tax Code. Only for the period of 2008 – 2009 the Vologda oblast’s budget losses due to the benefits under federal law amounted for 1.5 – 3 billion rubles or 4 – 12% of tax revenues7. Cancellation of federal benefits for state and local taxes could provide an increase in income from property tax by more than 2 billion rubles; and from the land tax in the budgets of municipalities – by 0.2 billion rubles.

The need for changes in budget legislation in order to strengthen the revenue base of lower budgets is specified in the budget message of the Russian Federation President, but the Russian government is in no hurry to implement them. Meanwhile, federal benefits are fairly evenly distributed across the country, so the result of their withdrawal will be noticed by most regions and municipalities.

-

3) Increasing the level of costs execution. ISEDT RAS studies conducted on the budget problems show that during the regional budget execution there has developed the practice of underfunding of the approved expenditure. This disorganizes the functioning of all spending units. Thus, for the period of 2008 – 2010 the amount of unused budget appropriations by chief administrators of loans amounted to more than 3 billion rubles. The region returned to the federal budget 700 million rubles of unused targeted transfers. Given that most of the untapped resources are related to subsidies transferred from the federal budget at the end of the fiscal year, a significant legislative correction of a refund order of targeted subsidies in terms of their possible remaining in sub-federal budgets is required. It is necessary to legally establish the threshold of acceptable change in the budget during the year.

-

4) Further optimization of the costs on the administrative apparatus. Despite a rather significant reduction in funding for the regional

state agencies in 2009 – 2010, not all administrative units found the opportunity to limit the costs on the operation of their bodies. For example, analysis of the departmental structure of the expenditure part of the regional budget has shown that in 2011 – 2013 there is provided increased funding for the Control and Audit Chamber, the Department for Magistrates, the Department of Civil Service and Personnel Policy, the Department of Employment.

-

5) Intensification of work on getting the federal budget loans. Out of the 13 billion rubles of credit funds, planned to bring in the regional budget in 2011 – 2013, the share of loans from the federal budget which are less burdensome in the size of interest payments, accounts for only 1 billion rubles. The forecast figures in terms of maintenance cost loans are 12.6 times cheaper than bank loans service. It is obvious that to reduce the debt burden of the regional budget system one must change the balance of borrowing loans in favor of federal budget credits. This will require additional work of the regional government with the RF Ministry of Finance.

Undoubtedly, the regional budget execution in 2011 – 2013 will be tight. Revenues of the regional budget system cannot grow as rapidly as in the pre-crisis period. This dictates the necessitates of a new fiscal relations ideology formation, the basic principles of which should be differentiated approach to increasing the tax burden, the implementation of programs to improve costs efficiency and tight control, including the public one, over the use of budgetary resources.

Список литературы The three-year budget: should we wait for stability?

- Analysis of the basic parameters of the Federal law draft “On federal budget of the RF for the period of 2011 -2013” //Official site of the Gaydar Institute. -Available at: http://www.iep.ru/ru/publikacii

- Dmitrieva, O.G. Forward into the quagmire! /O.G. Dmitrieva//The newspaper “Moskovsky Komsomolets”. -14.10.2010. -Available at: http://www.mk.ru/politics/russia

- Kudrin, A.L. Finance for modernization: report to the plenary session of IX All-Russia forum “Strategic Planning in the Regions of Russia” 19.10.2010 /A.L. Kudrin//Official Site of Finance Ministry. -Available at: http://www1.minfin.ru

- On the fiscal policy in 2011 -2013 : the Budget Message of the President of the Russian Federation//Reference Search System “KonsultantPlus”.

- On the regional budget for 2011 and planning period of 2012 and 2013 : the law of the Vologda oblast dated 14.12.2010, № 2433-OL//Reference Search System “KonsultantPlus”.

- On the regional budget for 2010 : the law of the Vologda oblast dated 17.12.2009 № 2187-OL/Reference Search System “KonsultantPlus”.

- On Regional Budget for 2011 -2013 : the conclusion of the Control and Accounts Chamber of the Vologda oblast. -185 p.

- On execution of the regional budget for the period of 2000 -2009. : the laws of the Vologda oblast//Reference Search System “KonsultantPlus”.

- On the execution of the budgets of the Russian Federation subjects for the period of 2008 -2010 : reports of the Treasury of Russia//The official website of the Federal Treasury. -Available at: http://www.roskazna.ru/reports/mb.html

- The main directions of tax policy of Russia for the period of 2011 -2013 //Official site of the RF Finance Ministry. -Available at: http://www1.minfin.ru

- On main directions of tax and budget policy in the Vologda oblast in 2011 -2013 : the decision of the Vologda oblast Government dated 27.09.2010, № 1101//Reference Search System “KonsultantPlus”.

- On the forecast of socio-economic development of the Vologda oblast in 2011 -2013 : The decision of the Vologda oblast Government dated 18.10.2010, № 1208. -50.

- Evaluation of the federal budget draft for 2011 presented by the Government of the Russian Federation : explanatory note to the alternative federal budget draft for 2011, presented by the faction “Fair Russia”//The official website of the political party “Fair Russia”. -Available at: http://www.spravedlivo.ru

- Message from the Governor of the Vologda oblast to the Oblast Legislative Assembly dated 02.12.2009 //Official website of the Vologda oblast Government. -Available at: http://vologda-oblast.ru/periodic

- Expert’s report of the RF Chamber of Accounts on the federal budget of 2011 -2013 //Official site of the RF Chamber of Accounts. -Available at: http://www.ach.gov.ru/ru/expert/before