Theory and methodology of appraisal of enterprise economic potential

Автор: Nadvornaya Gyulnara Gazanfarovna, Klimchuk Svetlana Vladimirovna, Oborin Matvei Sergeevich, Gvarliani Tatyana Evgenevna

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Socio-economic development strategy

Статья в выпуске: 6 (48) т.9, 2016 года.

Бесплатный доступ

The functioning of an enterprise is based on building and use of its economic potential. The company's performance depends on the quality of these processes. Modern conditions of highly dynamic operating environment put demands on the search and application of new approaches to the building and use of economic potential of enterprises which provide opportunities for identifying and using internal economic growth reserves. An important economic parameter of the enterprise operation is the appraisal of economic potential formation and use effectiveness. Lack of economic control mechanisms scientifically proved for market management conditions and appraisal of the enterprises' state in terms of efficiency of economic resources formation and use diminish investment activity and the competitiveness of economic entities. This necessitates the search for new methods and models for appraising economic potential, which defines economic independence as a system of management impacts on the economic state and development of an enterprise...

Enterprise economic potential, building and use of enterprise economic potential, economic performance, enterprise resources, appraisal of enterprise economic potential

Короткий адрес: https://sciup.org/147223898

IDR: 147223898 | УДК: 338.31 | DOI: 10.15838/esc.2016.6.48.4

Текст научной статьи Theory and methodology of appraisal of enterprise economic potential

Economic systems function on the basis of the processes of formation and use of economic potential. Market economy development determines the need for a high level of effectiveness of these processes in all the sectors of the economy and at particular enterprises, which contributes to the resolution of the issue concerning the increase in performance efficiency by using economic growth reserves in the conditions of highly dynamic environment and limitations and high price of resources.

The solution to this problem substantiates the search and use of evidence-based methods and models for assessing the economic potential of enterprises in line with current economic conditions; it also makes it necessary to develop on this basis a range of administrative decisions for efficient development and use of economic potential of an enterprise.

The economic potential of an enterprise is a complex, multifaceted and multilevel category; this is why the regularities of its functioning (formation, use and development) can be disclosed only on the basis of a comprehensive systemwide research. This fact determines the need to clarify the terminology of the economic potential of an enterprise and to substantiate the approaches to its assessment and effective functioning.

Significant contribution to the development of scientific approaches to the economic potential of an enterprise was made by scholars such as L.I. Abalkin, A.N. Azriliyan, I.T. Balabanov, S.A. Boro-nenkova, I.A. Gunina, N.V. Zabolotskaya, Yu.V. Kindzerskii, A.N. Lyukshinov, K.M. Misko, T.F. Ryabova, and T.G. Khramtsova.

The following scientists: O.A. Bortnik, V.V. Kovalev, I.S. Kravchuk, E.V. Lapin, K.O. Magomedova, Yu.A. Makusheva,

R.V. Marushkov, L.E. Morozova, G.S. Merzlikina, L.S. Sosnenko, Yu.V. Timofeeva, and L.S. Shakhovskaya considered the structure and assessment of economic potential of an enterprise in their scientific works.

However, less attention was given to the systematicity of the economic potential of an enterprises, this feature implies the study of interaction and mutual influence of systemic elements that brings to the fore the tasks of further development of the conceptual apparatus of the economic potential of enterprises, formation of methodical approaches to its assessment and effective functioning.

The increase in performance efficiency based on identifying and using efficiently the reserves of economic growth is ambiguous and has two aspects:

– target aspect (satisfaction of needs on the basis of selecting a strategy for economic growth that provides economically efficient results);

– resource aspect (use of hidden, restricted and under-utilized resources aimed to diversify production).

This ambiguous interpretation defines the interdependence of the task and resource aspects. Target efficiency, i.e. achieving strategic goals and higher performance results, is directly proportional to resource efficiency, i.e. the efficiency of engaging and using the resources.

The problem presented here has its methodological roots of formation associated with the original sources of ideas about economic potential.

For instance, the Great Soviet Encyclopedia defines economic potential as “the total capacity of economic industries to produce industrial and agricultural products, to carry out capital construction, transportation of goods, to provide services to the population in a specific historical moment”.

The Economic Encyclopedia defines economic potential as an aggregate of economic capacities of a country. Its main indicators are the level of development of industry, agriculture and transport, availability of natural resources and the degree of their development, inventories and reserves, science and technology development level, number of working-age population, availability of skilled personnel, education and culture level, etc. The magnitude of economic potential, as this encyclopedia states, is characterized by the actual volume and structure of production of material goods.

The above definitions essentially reflect the total reproducing ability of economic resources available, produced and accumulated by the state, the aim of this reproduction is to satisfy the growing needs of the society in tangible and intangible goods; these definitions imply the presence of hidden potential contained in these economic reserves that can help increase the production of various goods. Thus resources are considered in close connection with their direct purpose – to ensure the output, system development, and achievement of production objectives.

So far, the economic literature has not developed a clear definition of “potential of an organization (company, enterprise)”. At the same time, one can see clearly a fundamental difference between the terms “resources” and “potential”. This difference lies in the fact that resources exist independent of economic actors, and the potential of an individual enterprise as a whole is inseparable from the subjects of activity. At that, the resources of an enterprise form the basis for the formation of its potential. The potential includes besides tangible and intangible assets the ability of individuals and society as a whole to make effective use of available funds and resources, i.e. the ability of the subject of activity to create various goods.

The resource-based approach to the category of “economic potential” is quite common among researchers. Its essence is to represent potential as a set of resources and their sources that support production and business activities at an enterprise. When exploring the resourcebased approaches, one can distinguish two main positions more clearly. The first position represents economic potential as a set of resources that do not take into account their interrelationship and participation in the production process. The second position considers economic potential as a set of resources capable of producing a certain amount of material goods and services and obtaining financial results.

In the studies by many contemporary authors the category of “economic resources” is used along with the category of “economic results”, which proceed from the use of economic resources.

We can distinguish two focus areas in the opinions of scientists about the concept of economic potential of an enterprise in the framework of the results-based strategy. According to the first one, the economic potential of an enterprise is viewed as the ability of the economic system to develop and process the resources in order to satisfy public needs and create a specific result. The scientists who support the second focus area believe that the concept of the economic potential of an enterprise must include final results of its financial and economic activities.

Retrospective evaluation and systematization of scientific and methodological approaches to the functioning of economic potential developed by foreign and domestic scientists is presented in Table 1 .

A retrospective analysis of scientific and methodological approaches to the economic potential of enterprises indicates a steady trend of shifting the emphasis from the resource concept of economic potential to the results-based concept.

The beginning of economic activity in a market economy is preceded by the business and financial planning, during which the number of necessary resources and their sources are determined. Efficiency of economic activity depends largely on the correct formation of the composition and structure of economic potential.

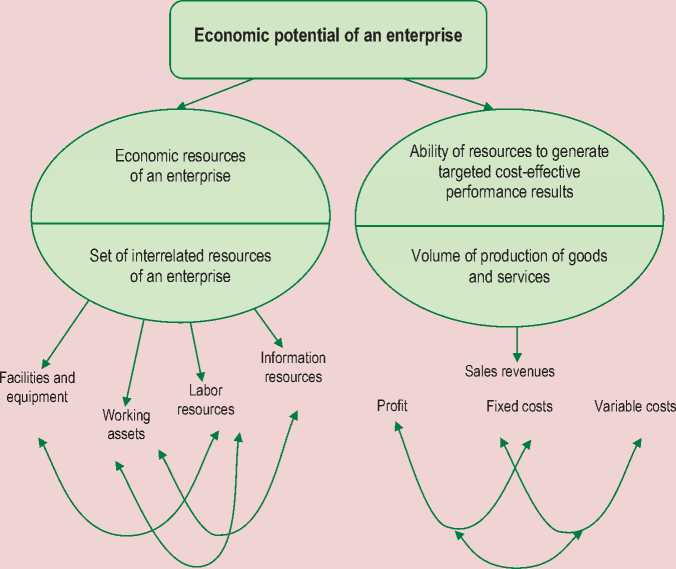

In other words, the economic potential of an enterprise, in our view, is a certain set of economic resources generated by the economic entity with the aim of creating targeted cost effective performance results. The main economic results of an enterprise, in turn, are the production output of goods and services, gross income (revenue) of an enterprise and its components – fixed and variable costs, and profit, all of these factors determine the effectiveness and performance efficiency.

From this viewpoint there is a need to distinguish between the concept of economic potential of a country, region, industry and other economic systems in which a set of economic resources is

Table 1. Scientific and methodological approaches to the economic potential of an enterprise

This approach helps explain and eliminate the differences described in economic literature and existing between the resource-based and results-based approaches to the concept of economic potential of an enterprise.

Thus, the concept of economic potential of an enterprise should include a purposeful process of formation of economic resources capable of generating the results consistent with the strategic goals of an enterprise. This very approach originally aimed to ensure performance efficiency of an enterprise.

In view of the above, the economic potential of an enterprise in terms of its assessment and opportunities for identifying economic growth reserves can be represented in the following figure (Fig. 1) .

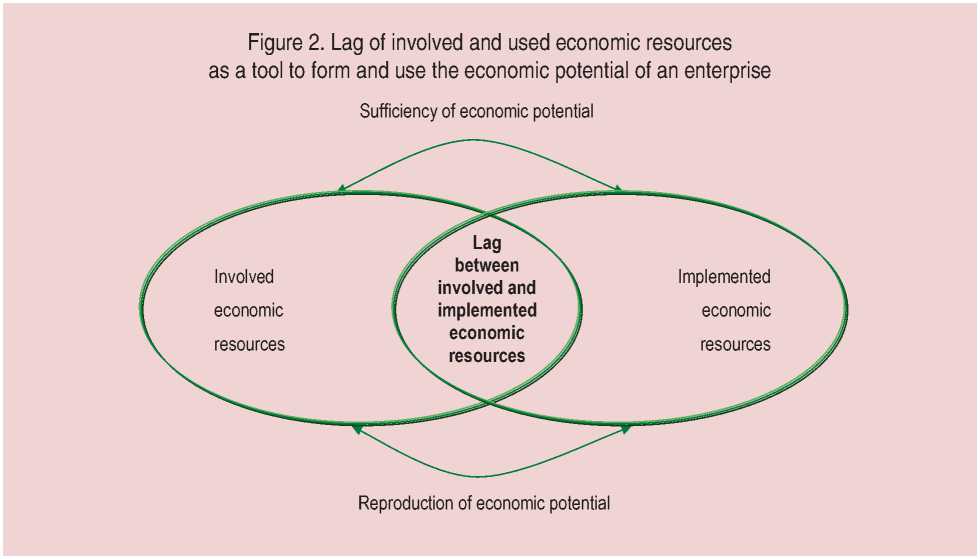

The performance of an economic entity is efficient when the amount of resources involved is less than the amount of resources used. The lag that emerges as a result of this comparison should cover the amount of resources involved and lay the groundwork for reproduction process. The lag aspect of the state of balance is based on the distribution in time of the costs of production factors and the effect achieved in their interaction.

Reproduction accumulates the economic resources required for modernization, technological upgrading and innovation development; in this case, management of a certain lag should be carried out depending on a business strategy chosen by the enterprise and it should also take into account the time period. Changing the lag of involved and used economic resources has to be coordinated in time and space. In our view, this approach will help identify economic growth reserves and use them efficiently (Fig. 2) .

Based on the lag aspect we propose two main principles of functioning (formation, use and development) of the economic potential of an enterprise: the principle of economic potential sufficiency that implies the presence of resources of sufficient amount and composition reflected in the enterprise’s balance sheet and necessary for the implementation of its goals and strategic objectives, and the principle of reproduction, which reflects the enterprise’s performance efficiency. These principles will act as core characteristics of the economic potential of enterprises.

Interaction of the economic resources of an enterprise, formed in a certain amount, structure and quality

Figure 1. Economic potential of an enterprise from the perspective of its evaluation and identification of economic growth reserves

Interaction of the economic resources of an enterprise in the context of the effectiveness of their utilization

In addition to the two main principles we propose other important principles of functioning of the economic potential of an enterprise, namely:

-

• completeness of coverage and involvement of economic resources (actual and credible assessment of resources of the enterprise in carrying out current control in the context of legal provision, accounting and valuation of the resources, i.e., on the basis of accounting and tax accounting rules);

-

• economical use (optimization of costs);

-

• regularity and budgeting (planning of economic potential and the policy of austerity with regard to financial resources);

-

• effective administration (costs of the use of a resource should not exceed the economic return from its use);

-

• innovation development (based on the interaction between economic resources and results, which involves the development of new methods of reproduction).

The principles will be fundamental for identifying key indicators for assessing the economic potential of an enterprise.

This study allows us to formulate the concept of economic potential: it is a system of interconnected processes of engagement, use and implementation (updates, savings) of economic resources that closely interact and aim to solve the existing contradiction of adequate quality and reproduction of economic resources.

An important economic parameter in the work of an enterprise is assessment of the efficiency of formation and use of its economicpotential.Thelackofeconomic mechanisms (scientifically-grounded for market conditions) for controlling and assessing the state of enterprises from the viewpoint of efficiency of formation and use of economic resources reduces investment activity and competitiveness of entities. This makes it necessary to search for new methods and models to estimate economic potential that defines economic independence as a system of management impacts on the economic condition and development of an enterprise. The quality of the validity of these effects can be crucial for the enterprise’s existence.

The most common and traditional methods for assessing the economic potential of enterprises in modern scientific and educational literature are as follows: methods for assessing the market value of an enterprise, methodology for comprehensive rating evaluation of economic potential, methodology for assessing financial activities of an enterprise.

The essence of traditional methods for assessing the economic potential of an enterprise is presented in Table 2 .

Table 2. Traditional methods of assessing the economic potential of an enterprise

|

Methods |

Essence of the method |

Source |

|

Methods for assessing the market value of an enterprise |

Includes 3 methods:

use;

of comparison with analogues;

|

Shcherbakov V.A., Shcherbakova N.A. [53], Averina O.I. [2], Tsybul’skaya E.I., Sotnik A.V. [48]. |

|

Methodology for comprehensive rating assessment |

The methodology includes:

|

Sheremet A.D., Saifulin R.S., Negashev E.V. [52], Kuvshinov D.A., Polovtsev P.I. [23]. |

|

Methodology for assessing the financial activity of an enterprise |

The economic potential of an enterprise is analyzed in the context of assessing the property potential and financial situation of the company. In this case: - different methods of evaluation of property and financial components of the potential are used; - the use of a specific set of financial ratios and performance indicators of an enterprise is substantiated. |

Sosnenko L.S. [39], Kovalev V.V. [20], Ionova A.F. and Selezneva N.N. [37], Efimova O.V. [14], Zhigunova O.A. [14], Grishchenko O.V. [12], Morozova L.E., Bortnik O.A., Kravchuk I.S. [32]. |

All traditional methods evaluate the economic potential of an enterprise by using the actual values of indicators characterizing the performance results of the economic system.

At that, the income and comparative methods of market value, as well as comprehensive rating assessment, describe only the effective component of the economic potential of an enterprise, and the property (cost) method describes only the resource component.

An advantage of the methodology for estimating the financial performance of an enterprise lies in the fact that it assesses both components of the economic potential of an enterprise – resources (property potential) and results (financial situation). In this case some significant drawbacks can be pointed out:

– property and financial components are evaluated separately, without taking into account interaction factors;

– actual capacity is the only thing that is assessed, the perspective potential is not taken into consideration.

The purpose of assessing the economic potential of an enterprise, in our view, lies in its studying as an integrated complex, which includes not only available resources and current property and financial possibilities, but also potential opportunities. It is impossible to conduct a full analysis of the economic potential of an enterprise on the basis of any of its separate components. To achieve this goal it is necessary to build a model for the economic potential of an enterprise as an integral system that makes it possible to solve tasks such as identification of unused reserves and effective management of the formation and use of the economic potential of an enterprise. Traditional assessment techniques do not provide such an opportunity.

A specific feature of modern research consists in the fact that some scientists consider it possible to evaluate the use of the economic potential of an enterprise by comparing its prospective level with the actual value (achieved at the moment). In addition, having analyzed recent publications, we see that there is a search for the blocks of management of the economic potential at its differentiation into individual components (Tab. 3).

Modern assessment methods are based on allocating separate structural components in the economic potential of an enterprise; at that, structural components are defined differently by different authors. Evaluation is carried out also for individual components using different methods: point method, expert method, rapid assessment, evaluation with the use of financial indicators, i.e. based on the actual values of the indicators characterizing the company’s performance. Several authors, for example, E.V. Lapin, K.O. Magomedova, and R.V. Marushkov consider that the evaluation of the economic potential of an enterprise includes the assessment of its potential capabilities for the purpose of comparing the indicators achieved by the enterprise with the threshold indicators.

Russian scientific practice has already developed specific approaches to determining the potential capabilities of an enterprise and evaluating their use. In this regard, major importance is attached to the issue of economic measurement of available resources and results of their functioning; however, the problem of assessing the interaction between the structural elements of the economic potential recedes to the background.

Table 3. Modern methodological approaches to assessing the economic potential of an enterprise

|

Structural components of the economic potential of an enterprise |

Essence of the methodology for assessing the economic potential of an enterprise |

Author, source |

|

Market; production; financial |

Rapid assessment on individual components of the economic potential of an enterprise, then – the use of the score method |

Merzlikina G.S., Shakhovskaya L.S. [30] |

|

Personnel; production; innovation; organizational and managerial |

Rapid assessment of individual subsystems of the economic potential of an enterprise including the determination of threshold values of the indicators. The value of the total economic potential is defined as the sum of local potentials |

Lapin E.V. [24] |

|

Production potential (production, material, personnel components). Financial |

Evaluation of separate components of the economic potential of an enterprise using financial indicators, as well as the score and expert methods |

Fomin P.A., Starovoitov M.K. [46] |

|

Fixed capital; production staff; energy resources; technology for the implementation of services; information resource |

Use of normative values of various components of the economic potential of an enterprise needed for the production of one conventional unit of a particular kind of product or service. Based on that, the potential of each component of the enterprise economic potential is calculated. |

Magomedova K.O. [27] |

|

Labor; production; financial; transport; engineering; research-innovation |

Assessment of economic potential when using the technology for aggregating the indicators |

Syrov A.N. [41] |

|

Property; financial |

Economic potential of an enterprise is determined by the total value of property potential of the company’s financial position and financial performance |

Yankevich P.A. [54] |

|

Production and technological; marketing; labor; innovative; financial and investment |

Evaluation with the use of financial indicators and the system of inequalities, based on the “golden rule of enterprise economy” |

Tomofeeva Yu.V. [43] |

|

Financial resources; economic potential; production potential |

Evaluation of the use of the economic potential of an enterprise is based on the algorithm of application of the structural and target analysis and calculation of structural indices of economic activity using accounting forms. Evaluation of the effectiveness of the use of economic potential is performed by comparing the actually achieved values of indicators of economic activity of the enterprise to their potential values |

Marushkov R.V. [29] |

Thus, the current task is to create a methodology for determining both actual and potential capabilities of an enterprise and to do this not for its individual components but systematically, taking into account the interaction and interdependent effects of the structural elements.

In this regard, the basis for assessing the economic potential of an enterprise should contain the criterion of effective interaction between the indicators that evaluate the formation and use of economic resources and the indicators that evaluate economic performance. The nature of this interaction is determined by the transformation of internal and external environment of the enterprise in which the role of economic potential lies in the development and implementation of internal sources of self-development in order to ensure stable and efficient operation of the enterprise.

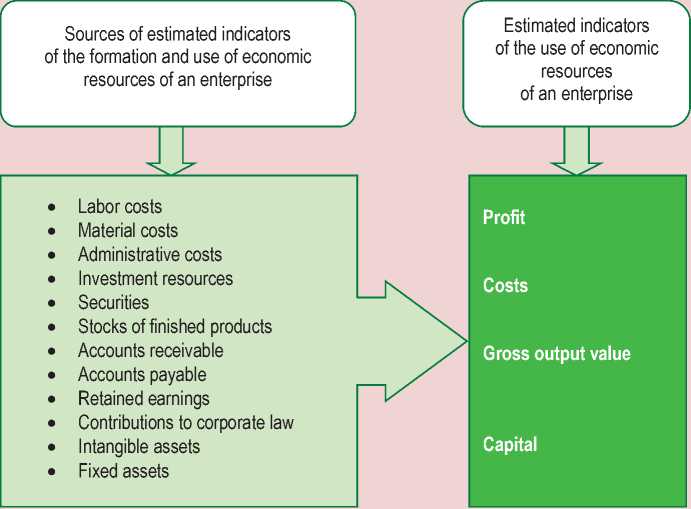

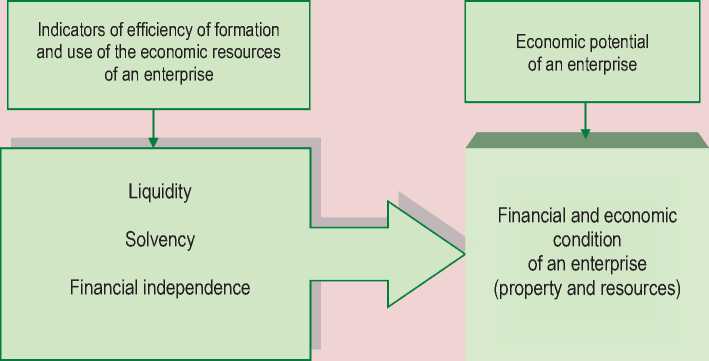

The structure of the elements of assessing the economic potential of an enterprise can be represented by the following blocks of indicators (Fig. 3).

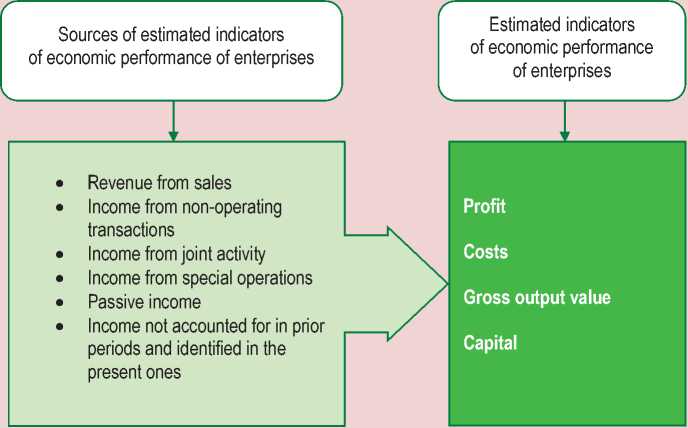

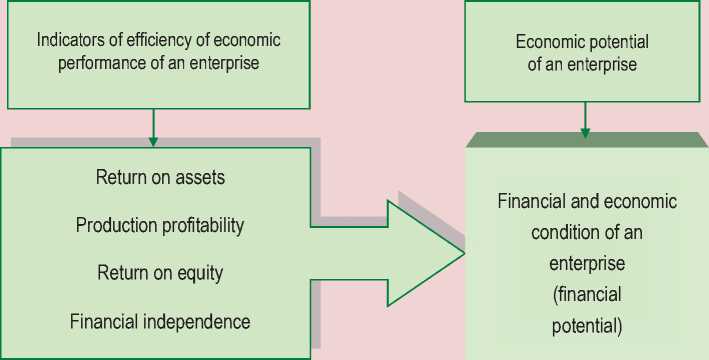

In the process of production and economic activity of an enterprise economic resources transform and acquire the value of economic results. Let us consider the main elements of the assessment indicators of economic performance (Fig. 4) .

Figure 3. Main elements of the assessment indicators of formation and use of economic resources in the system of economic potential of an enterprise

Figure 4. Main elements of the assessment indicators of economic performance of an enterprise from the position of formation and use of its economic potential

It is necessary to pay attention to the fact that from the standpoint of formation and use of economic potential for both economic resources and economic results the same performance indicators are used. However, if we evaluate the effectiveness of formation and use of the economic potential of an enterprise, then we see a contradiction between the assessment of the efficiency of economic resources and evaluation of the effectiveness of economic performance of the enterprise (Fig. 5) .

The use of the property-and-resource potential in the production-and-commercial activities entails the formation of financial potential (Fig. 6) .

The economic potential of an enterprise is determined not only by the volume of economic resources but also by their quality, structure, degree of balance between the components, and their rational use. The solution to the problem of providing performance efficiency at an enterprise largely depends on the rational use of all its potential capabilities.

In this regard, it is the assessment of effectiveness that is the main criterion of the quality of formation and use of the economic potential of an enterprise. And if we fill the assessment of efficiency of formation and use of economic potential with a specific functional content, then we come to the conclusion that it is

Figure 5. Estimated indicators of the efficiency of formation and use of economic resources of an enterprise in the system of economic potential

Figure 6. Economic performance efficiency indicators for an enterprise in the system of economic potential

necessary to match two main assessment criteria:

-

• assessment of the effectiveness of formation and use of economic resources according to liquidity criterion (property-and-resource potential);

-

• assessment of economic performance efficiency according to profitability criterion (financial potential).

It is important to note that the indicator showing the financial independence of an enterprise is a link between the indicators selected.

Thus, if we consider the efficiency of using economic resources from the viewpoint of liquidity and if we consider economic performance from the viewpoint of profitability, then emerges a dilemma: profitability or liquidity. The essence of this problem is the following: if a company has high profit, it is highly profitable, but if the profit is entirely allocated for dividends (without considering the availability of funds as a factor), then it reduces its liquidity and becomes unstable. The rapid reinvestment of profits, increase in turnover, renewal of fixed assets and development of new markets are factors that reduce current liquidity. The resulting liquidity shortage is covered with additional loan resources, which reduces the stability (financial independence of an enterprise). We can conclude that if the entire net profit remains undistributed and the structure of liabilities changes in favor of equity capital, then the rate of growth of sales and earnings is limited to the level of net profitability of the assets. At a constant structure of liabilities a rate of growth that matches the growth in equity capital is considered acceptable.

Thus, in the pursuit of success, a company has to solve an important dilemma, called “the core dilemma of financial management”, and choose between profitability and liquidity and often to sacrifice one or the other in an attempt to combine dynamic development and a sufficient amount of funds and high purchasing power [40, p. 383].

Taking into account basic criteria – profitability and liquidity – that we have defined for the purposes of evaluating economic potential, we believe that the core element in assessing the economic potential of an enterprise should be the indicator of the optimal interaction between profitability and liquidity indicators. The contents of this indicator must present effective interaction of economic resources and economic results taking into account the “golden rule of enterprise economy”. Then the growth rate of total assets can be represented as an acceptable growth rate of liquidity:

Gr. liq. maximum permissible value (1), where Gr. liq. means growth rate of liquidity.

The maximum permissible value of liquidity should be combined with acceptable growth of profitability, which we can equate with the cumulative assessment of the growth rate of revenue and growth rate of profit:

Gr. profit. maximum permissible value (2), where Gr. profit. means growth rate of profitability.

Then we assume that:

Gr. liq. ≅ Gr. profit. (3)

Taking into account the practice of differentiation of the structural elements of economic potential, it is necessary to set the units of performance indicators needed to determine the rate of growth of liquidity and profitability.

The liquidity ratios can be as follows: current liquidity ratio, quick assets ratio, absolute liquidity ratio; the profitability ratios can be as follows: return on assets, return on equity, efficiency of using the assets for production, the share of borrowed funds in the total sources, the share of unobligated assets in mobile form, the share of accumulated capital, and production profitability.

For example, the values of growth rates of liquidity and profitability should determine the area of effective interaction of economic resources and economic results, which determines the area of effective functioning of economic potential.

When studying the economic potential of an enterprise as a set of resources capable of ensuring the achievement of intended results, one should consider each component of economic potential not in isolation by itself, but as a system. Only interacting with each other in a single system, the components of the economic potential of an enterprise will help obtain synergy that cannot be determined as the sum of the effects of functioning of individual components.

We have presented a methodological approach to assessing the economic potential of an enterprise, this approach helps ensure the implementation of the most effective forms of capital investment aimed to expand the economic potential of an enterprise, and has advantages relative to the existing and previously used forms of capital investment. This methodological approach will serve as the basis for further studies of the mechanism for effective formation and use of the economic potential of an enterprise. The two criteria that we have identified must operate in the efficient mechanism of formation and effective use of economic potential. The best technology for assessing the economic potential of enterprises should become a condition for their effective functioning.

Список литературы Theory and methodology of appraisal of enterprise economic potential

- Abalkin L.I. Dialektika sotsialisticheskoi ekonomiki . Moscow: Nauka, 1981. 352 p.

- Averina O.I., Davydova V.V., Lushenkova N.I. Kompleksnyiekonomicheskiianalizkhozyaistvennoideyatel'nosti: uchebnik . Moscow: KnoRus, 2012. 432

- Balabanov I.T. Osnovy finansovogo menedzhmenta: uchebnoe posobie . 3rd edition, revised and expanded. Moscow: Finansy i statistika, 2001. 526 p.

- Berezin O.V., Karpenko Yu.V. Teoriya i praktika obespecheniya effektivnogo ispol'zovaniya potentsiala torgovykh predpriyatii: monografiya . Poltava: Intergrafika, 2012. 203 p.

- Bogataya I.N. Strategicheskii uchet i audit: teoriya i praktika . Fundamental'nye issledovaniya , 2007, no.4, pp.42-45.

- Ryabova T.F. (Ed.). Bol'shoi kommercheskii slovar' . Moscow: Znanie, 1996. 399 p.

- Azriliyan A.N. (Ed.). Bol'shoi ekonomicheskii slovar' . 2nd edition, revised and expanded. Moscow: Institut novoi ekonomiki, 1997. 864 p.

- Borzenkova K.S. Otsenka ekonomicheskogo potentsiala predpriyatiya i povyshenie effektivnosti ego ispol'zovaniya: avtoref. dis. … kand. ekon. nauk: 08.00.05 . Belgorod, 2003. 24 p.

- Boronenkova S.A. Upravlencheskii analiz . Moscow: Finansy i statistika, 2001. 384 p.

- Gogina G.N., Nikiforova E.V., Shiyanova S.L., Schneider O.V. Kompleksnyi ekonomicheskii analiz khozyaistvennoi deyatel'nosti: uchebnoe posobie . Saint Petersburg: Giord, 2008. 192 p.

- Gribovskii S.V., Barinov N.P., Anisimov I.N. O povyshenii dostovernosti otsenki rynochnoi stoimosti metodom sravnitel'nogo analiza . Voprosy otsenki , 2004, no.1, pp. 2-10.

- Grishchenko O.V. Analiz i diagnostika finansovo-khozyaistvennoi deyatel'nosti predpriyatiya: uchebnoe posobie . Taganrog: Izd-vo TRTU, 2000. 112 p.

- Gunina I.A. Ekonomicheskii potentsial predpriyatiya: sushchnost', soderzhanie, struktura . Mashinostroitel' , 2004, no. 11, pp. 24-28.

- Efimova O.V. Finansovyi analiz: sovremennyi instrumentarii dlya prinyatiya ekonomicheskikh reshenii: uchebnik

- Moscow: Omega-L, 2009. 350

- Zhigunova O.A. Teoriya i metodologiya prognozirovaniya ekonomicheskogo potentsiala predpriyatiya . Finansy i kredit , 2010, p. 21.

- Zabolotskaya N.V., Kozlova P.V. Otsenka ekonomicheskogo potentsiala predpriyatiya . Ekonomicheskii analiz: teoriya i praktika , 2009, no.5 (134), pp. 42-47.

- Ivanov V.G., Kokhas'O.M., Khmelevskii S.M. Potentsial predpriyatiya . Kiev: Kondor, 2009. 300 p.

- Karpenko L. Metodologicheskie aspekty analiza finansovogo sostoyaniya predpriyatiya . Torgovlya i rynok: tematicheskii sbornik nauchnykh trudov po problemam torgovli i grazhdanskogo pitaniya , issue 14, volume 2. Donetsk: DonDUET, 2002. Pp. 152-158.

- Kindzerskii Yu.V. (Ed.). Promyshlennyi potentsial Ukrainy: problemy i perspektivy strukturno-informatsionnykh transformatsii . Kiev: In-t ekonomiki i prognozirovaniya NAN Ukrainy, 2007. 408 p.

- Kovalev V.V. Finansy organizatsii (predpriyatii): uchebnik . Moscow: Prospekt, 2010. 352 p.

- Komarov V.V., Romanov A.N. Resursnyi potentsial ekonomicheskogo rosta . Moscow: Put' Rossii, 2002. 567 p.

- Krasnokutskaya N.S. Potentsial predpriyatiya: formirovanie i otsenka: uchebnoe posobie . Kiev: Tsentr uchebnoi literatury, 2005. 352 p.

- Kuvshinov D.A., Polovtsev P.I. Reitingovaya otsenka finansovogo sostoyaniya predpriyatiya . Ekonomicheskii analiz: teoriya i praktika , 2007, no.6, pp. 25-28.

- Lapin E.V. Ekonomicheskii potentsial predpriyatiya: monografiya . Sumy: Universitetskaya kniga, 2006. 310 p.

- Lukinov I.I. Evolyutsiya ekonomicheskikh sistem: monografiya . Moscow: Ekonomika, 2002. 567 p.

- Lyukshinov A.N. Strategicheskii menedzhment na predpriyatiyakh APK . Moscow: Kolos, 1999. 367 p.

- Magomedova K.O. Formirovanie sistemy otsenochnykh pokazatelei deyatel'nosti predpriyatii sfery uslug: dis. … kand. ekon. nauk: 08.00.05 . Makhachkala, 2009. 136 p.

- Makusheva Yu.A. Mekhanizm formirovaniya ekonomicheskogo potentsiala predpriyatii v sovremennykh usloviyakh: dis. … kand. ekon. nauk: 08.00.05 . Nizhny Novgorod, 2003. 212 p.

- Marushkov R.V. Otsenka ispol'zovaniya ekonomicheskogo potentsiala predpriyatiya (na primere predpriyatii pechatnoi otrasli): avtoref. dis. … kand. ekon. nauk 08.00.05 . Moscow, 2000. 39 p.

- Merzlikina G.S., Shakhovskaya L.S. Otsenka ekonomicheskoi sostoyatel'nosti predpriyatiya: monografiya . Volgogradskoe GTU, Volgograd, 1998. 63 p.

- Misko K.M. Resursnyi potentsial regiona (teoreticheskie i metodologicheskie aspekty issledovaniya) . Moscow: Nauka, 1991. 94 p.

- Morozova L.E., Bortnik O.A., Kravchuk I.S. Ekspertnye metody i tekhnologii kompleksnoi otsenki ekonomicheskogo i innovatsionnogo potentsiala predpriyatii . Moscow, 2009. 81 p.

- Otenko I.P. Strategicheskoe upravlenie potentsialom predpriyatiya . Kharkiv: Khar'k. nats. ek. un-t, 2006. 256 p.

- Puzikov O.S. Sotsial'no-ekonomicheskoe prognozirovanie . Rostov-on-Don: Rost. gos. stroit. un-t, 2000. 124 p.

- Rushchak M.Yu., Dan'kiv N.V. Mnogoaspektnost' ponyatii "ekonomicheskii i resursnyi potentsial" predpriyatiya, ikh vzaimosvyaz' . Nauchnyi vestnik Uzhgorodskogo universiteta. Ekonomika , 2012, issue 36, pp. 182-186.

- Salikhova Ya.Yu. Konkurentnyi potentsial predpriyatiya: sushchnost', struktura metodika otsenki: uchebnoe posobie . Saint Petersburg: Izd-vo SPbGUEF, 2011. 52 p.

- Selezneva N.N., Ionova A.F. Finansovyi analiz. Upravlenie finansami: uchebnoe posobie . 2nd edition, revised and expanded. Moscow: YuNITI, 2006. 639 p.

- Simionov R.Yu. Stoimostnaya otsenka ekonomicheskogo potentsiala stroitel'nogo predpriyatiya: podkhody i metody . Ekonomicheskii analiz: teoriya i praktika , 2007, no. 2, pp. 14-19.

- Sosnenko L.S. Informatsiya ob ekonomicheskom potentsiale predpriyatiya . Vse dlya bukhgaltera , 2002, no. 23, pp. 2-8.

- Stoyanova E.S. (Ed.). Finansovyi menedzhment: teoriya i praktika: uchebnik . 6th edition. Moscow: Perspektiva, 2010. 656 p.

- Syrov A.N. Otsenka ekonomicheskogo potentsiala territorii .Regionologiya , no.2, 2008.

- Timofeeva S.A., Snegur N.Yu. Sravnitel'naya otsenka podkhodov k analizu ekonomicheskogo potentsiala predpriyatiya . Nauchnye zapiski Orel GIET , 2011, no. 1(3), pp. 108-114.

- Timofeeva Yu.V. Otsenka ekonomicheskogo potentsiala organizatsii: finansovo-investitsionnyi potentsial . Ekonomicheskii analiz: teoriya i praktika , 2009, no.1(130), pp. 43-53.

- Fedonin A.S., Repina I.M., Oleksik A.I. Potentsial predpriyatiya: formirovanie i otsenka: uchebnoe posobie . Kiev: KNEU, 2003. 316 p.

- Figurnov E.B. Proizvodstvennyi potentsial . Moscow: Delo, 1989. 201 p.

- Starovoitov M.K., Fomin P.A. Osobennosti otsenki potentsiala promyshlennykh predpriyatii . Antikrizisnoe i vneshnee upravlenie , 2006, no. 2, pp. 27-41.

- Khramtsova T.G. Metodologiya issledovaniya sotsial'no-ekonomicheskogo potentsiala potreb. kooperatsii: dis. … d-ra ekon. nauk.: 08.00.05 . Novosibirsk, 2002. 410 p.

- Tsybul'skaya E.I., Sotnik A.V. Teoreticheskie osnovy ekonomicheskogo potentsiala predpriyatii . Available at: http://archive.nbuv.gov.ua/portal/soc_gum/bi/2009_3/58-61.pdf.

- Chernikov D.A. Effektivnost' ispol'zovaniya proizvodstvennogo potentsiala i konechnye narodnokhozyaistvennye rezul'taty . Ekonomicheskie nauki , 1981, no. 10, pp. 25-27.

- Chimshit S.I. Upravlenie potentsialom slozhnykh sotsial'no-ekonomicheskikh sistem: monografiya . Dnepropetrovsk: Monolit, 2008. 363 p.

- Shevchenko D.K. Problemy effektivnosti ispol'zovaniya ekonomicheskogo potentsiala . Vladivostok: Izd-vo DGU, 1984. 156 p.

- Sheremet A.D., Saifulin R.S. Metodika finansovogo analiza . Moscow: INFRA-M, 1996. 172 p.

- Shcherbakov V.A., Shcherbakova N.A. Otsenka stoimosti predpriyatiya (biznesa) . Moscow: Omega-L, 2006. 288 p.

- Yankevich P.A. Ekonomicheskii potentsial predpriyatiya i metody otsenki . Gornyi informatsionno-analiticheskii byulleten' (nauchno-tekhnicheskii zhurnal) , 2006, no. 12. Available at: http://giab-online.ru/files/Data/2006/12/7_YAnkevich.pdf.