Topical issues of the improvement of intergovernmental dealings in the system of local government

Автор: Pechenskaya Mariya Aleksandrovna, Uskova Tamara Vitalyevna

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Public finance

Статья в выпуске: 1 (19) т.5, 2012 года.

Бесплатный доступ

The intension of “intergovernmental dealings” is expounded in the article. It deals with the main problems of intergovernmental dealings in the system of local self-government, which is a fundamental element of the budget system in the Russian Federation. It is difficult to transform the budget sphere of the country without strengthening of it. It is shown that the real local self-government in Russia is determined by the provision of municipalities with their own financial assets. The authors have analyzed the actual state of the financial relationship between the bodies of state power and local self-government. They have outlined a set of measures aimed at the improvement of intergovernmental dealings at the municipal level.

Finance, intergovernmental dealings, municipal level of budget system, own revenue, transfers

Короткий адрес: https://sciup.org/147223317

IDR: 147223317 | УДК: 336.132.11(470.12)

Текст научной статьи Topical issues of the improvement of intergovernmental dealings in the system of local government

The essence of intergovernmental dealings

The Budget Code of the Russian Federation defines intergovernmental dealings as the mutual relations between the federal authorities, the public authorities of Federal subjects of Russia and the local self-government regulating budgetary legal relationships, organization and implementation of the budget process [1]. However, in our opinion, this definition has some serious shortcomings.

Many Russian and foreign scientists and economists study the problems of intergovernmental dealings. However, modern science hasn’t developed a generally accepted interpretation of this concept.

The discussion is revolved around the issues related to the participants of intergovernmental relations, the reasons for their emergence and the sphere of their activity.

Table 1. Interpretation of the subject structure of intergovernmental relations by various authors

|

Author |

Subjects if intergovernmental dealings |

|

A.M. Babich, L.N. Pavlova, A.G. Igudin, A.S. Kolesov, O.G. Bezhaev, V. I. Grishin, O.N. Gorbunova, A.D. Selyukov, Y. V. Drugova |

Federal authorities of Russia, public authorities of Federal subjects of Russia, local government |

|

N.I. Himicheva, A.I. Zemlin, Y.A. Krohina, M.V. Karaseva |

Official formations: the Russian Federation, Federal subjects of Russia, municipalities. |

|

Y.I. Lyubimtsev, O.Y. Skvortsov |

Budgets of all levels in their authorized representatives. |

|

It is drawn up by the authors [3, 5, 6, 7, 8, 14]. |

|

We have identified three approaches in examining of the current ideas about the subject structure of intergovernmental dealings (tab. 1) .

In our opinion, the first approach is true some more than others. Its followers mark out the public entities in their authorized representatives as the subjects of intergovernmental dealings. The concept of “intergovernmental dealings” defines itself that such relations must arise between the budgets and, therefore, between the subjects, which are the owners of budgetary funds. It is conditioned by the fact that many rights and powers in the budgetary sphere are the sovereign rights of the state but not of other subjects [6].

The question on the scope of intergovernmental dealings is highly controversial among scientists. It is not reflected directly in the legislation of the Russian Federation. Whereas, most of researchers consider that there are not only “vertical” but also “horizontal” intergovernmental dealings (A.G. Igudin, A. S. Kolesov, O. G. Bezhaev and others). We are holding with them in our research. In addition to this opinion, we think that intergovernmental dealings should be oriented to solve a twofold objective of vertical and horizontal budget balance.

Theoretical learning of intergovernmental dealings allows us to determine their essence as a complex system of economic and legal, vertical and horizontal interaction of public entities through their authorized representatives on the subject of the budgetary flows regulation in order to achieve an effective model of budget federalism1 to ensure deserved standard of living to every citizen regardless of his or her residence.

The role of intergovernmental dealings is increased in the conditions of limited financial resources and in the reform period because intergovernmental dealings are addressed to solve the most pressing problems of elimination of inter-territorial and inter-level disproportions. They should also perform the function of social guarantees.

In order to avoid extreme population inequality in the citizen’s opportunity to get necessary budgetary commitments, there are various channels of financial leveling:

-

1) Target transfers aimed at the implementation of their own expenditure authority. They include subsidies which are non-repayable budgetary funds which are extended without compensation to the budget of another level of the Russian Federation’s budgetary system on co-financing terms to realize its expenditure authority.

-

2) Non-target transfers aimed at the implementation of their own expenditure authority. They include grants which are used to equalize budgetary capacity. They are non-repayable budgetary funds which are extended without compensation to the budget of another level of the Russian Federation’s budgetary system to cover current expenses.

-

3) Target transfers aimed at the implementation of delegated authority. They include subventions which are non-repayable budgetary funds which are extended without compensation to the financial provision of the state authority submitted by a higher level.

When budgets are unbalanced vertically, intergovernmental dealings are necessary to bring the extent of expenditure obligations of each governmental level to conformity with the potential of its revenue resources [8]. This situation is typical for Russia. Due to the unregulated fiscal system in Russia, about 40- 60% of budget revenues are sent firstly to the higher budgets and then they are sent to the lower budgets in the form of transfers. However, education expenditures, social policy and health budgets are financed mainly at the regional and local levels.

Horizontal imbalance of the budget system is associated with the uneven economic development of territories and the differentiation of their income, especially tax potentials [12]. The highest level of budget imbalance is observed at the municipal level.

Thus, according to the Federal State Statistics Service, the gap between the most and the least prosperous local territories is by 75.6 times in Russia, while it is 8.1 in Germany, 8.5 in the U.S. and 1.6 in Canada. It is defined by the budget tax revenues per person.

There are less than 2% of municipalities which have their own revenue. In these circumstances, the essence of intergovernmental dealings consists in the budget leveling between the territories in order to get a standard set of significant social services for the population [8].

In this sense, intergovernmental dealings for the vast majority of municipalities are not just a certain range of social obligations to the population, but the most important factor in the stability of the socio-economic development in general.

Reformation of intergovernmental dealings in 2003 – 2010

One more reforming period in the Russian system of intergovernmental dealings had been completed by 2009. It concurred with the implementation of municipal reforms which were planned by the Federal Law № 131-FL “On General Principles of Local Self-Government Organization in the Russian Federation”. Local territories were divided into three types (urban district, municipal district, settlement). Each type was provided with its own revenue and expenditure authorities. Several Federal subjects of Russia, including the Vologda Oblast, have been implementing the Federal Law in their territories since 2006. The declarations proclaimed that municipalities had got clear boundaries and independent revenue base. But there was a tax reform in 2005; according to it, the statutory amount of local taxes was reduced from 5 to 2 (personal property tax and land tax). In addition, the list and rates for federal and regional tax allocation to the local budgets had been reduced (tab. 2) .

These changes in the tax system during the reform of intergovernmental dealings were necessary to smooth the differentiation of income potential in the newly formed municipalities because they were extremely uneven in terms of economic development. The changes were necessary to align their budget capacity.

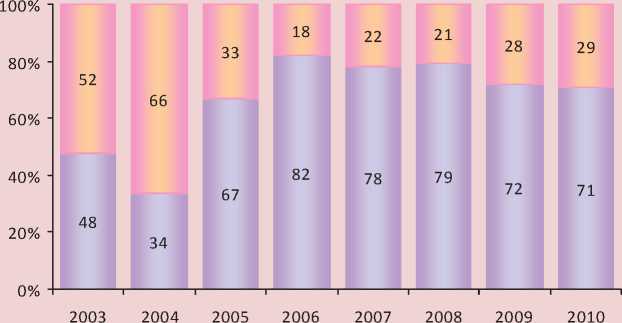

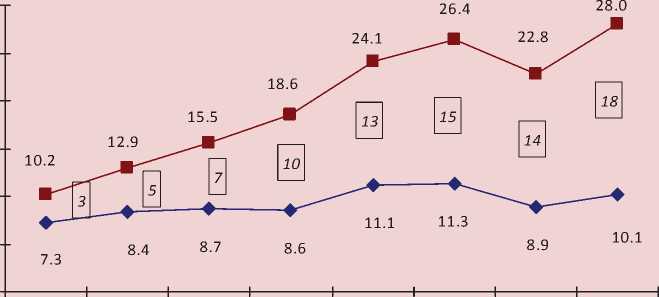

However, the result of this tax reform was a significant redistribution of tax revenues in favor of higher-level budgets. The flow of tax revenues to local budgets has declined in the Vologda Oblast from 52% in 2003 to 29% in 2010 (fig. 1) .

The taxes assigned to the local self-governments didn’t support the municipal treasury (only 3 – 4% of revenues in local budgets). Therefore, the Federal subjects of Russia were permitted to refer additional revenue sources to municipalities in order to increase the tax base.

Table 2. Rates for federal and regional tax allocation to the local budgets, %

|

Tax yield |

Before the reform (2003 – 2005) |

After the reform (2006 – 2010) |

||

|

Municipal districts |

Settlements |

Urban districts |

||

|

Income tax (rate) |

7 |

0 |

||

|

Individual income tax |

50 – 70 |

20 |

10 |

30 |

|

Tax on gambling businesses |

50 |

0 |

||

|

Excise taxes on vodka |

35 |

0 |

||

|

Property Tax |

50 |

0 |

||

|

Personal property tax |

100 |

- |

100 |

100 |

|

Land tax |

50 |

100 |

100 |

100 |

|

Payments for the use of natural resources |

65 – 80 |

0 |

||

|

Single tax on imputed earnings |

45 – 75 |

90 |

- |

90 |

|

Charge for negative environmental impact |

54 |

40 |

- |

40 |

|

It is compiled by the authors according to the Federal Laws on the Federal Budget for 2003-2010. |

||||

Figure 1. The distribution of tax revenues between the levels of budget system in the Vologda Oblast, %

Regiona l Budget Loca l Budgets

Source: Authors’ calculations according to the Treasury of the Russian Federation.

In this regard, the following rates for federal and regional tax allocation to the local budgets were enacted in the Vologda Oblast in accordance with regional laws:

-

✓ individual income tax — 10%;

-

✓ individual transport tax and tax under the simplified taxation system based on the patent – in full;

-

✓ single agricultural tax — 30%;

-

✓ tax under the simplified taxation system – 50%.

The oblast provided local budgets with additional tax revenues amounted to 1.4 billion rubles in 2008 and about 2 billion rubles in 2010. There is no doubt that single rates for tax allocation create equal conditions and opportunities for all municipalities. They also stimulate managers to increase the tax base.

However, we should keep it in mind that additional tax allocation and the system of intergovernmental dealings aren’t the tools of own budgetary policy which is one of the most effective levers of public administration in the modern market economy. Local taxes have to regulate and stimulate municipal government some more than others.

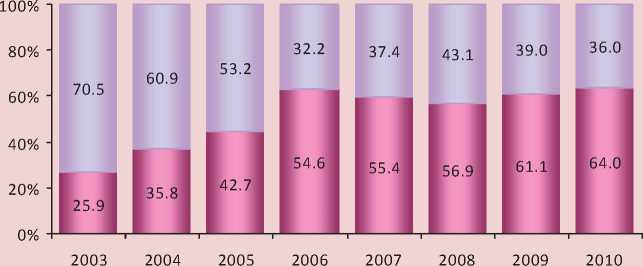

Figure 2. The structure of local budget revenues in the Vologda Oblast, in % to total revenue

□ Intergovernmental transfers □ Tax and non-tax revenues

Source: Authors’ calculations according to the Treasury of the Russian Federation.

However, the share of own revenues2 in total revenues of local budgets is reduced. Municipalities are increasingly dependent on financial support of higher-level budgets. The share of intergovernmental transfers in the revenue structure of the Vologda municipalities’ budgets increased from 25.9% in 2003 to 64.2% in 2010 (fig. 2) .

Increasing role of equalizing functions of intergovernmental dealings has a negative influence on the municipalities’ interest in steady raising of tax potential, as well as rational and efficient expenditure of budgetary funds.

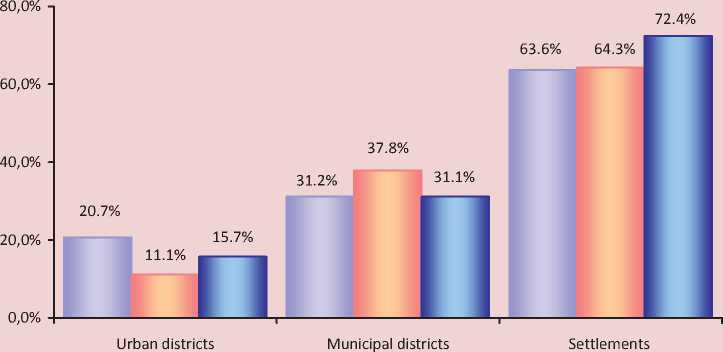

The tendency to diminish the possibilities of local governments to determine the spending priorities intensified after the Federal Law№ 63-FZ of April 26, 2007 “On Introducing Amendments to the Budget Code of the Russian Federation in the Part Concerned with the Budgetary Process and Agreeing Certain Acts of the Russian Federation” had come into force. The Law established additional (tighten) conditions for obtaining budgetary transfers (grants and subsidies) depending on the level of financial support provided by the municipality since 2008 (Article 136). In the Vologda Oblast the share of subsidies and grants in the amount of aggregate revenue in municipalities and settlements is more than 30% (fig. 3). In accordance with the new terms of transfers, it means that most regional administrations don’t have a right to establish and carry out expenditure commitments that are not mentioned in the Federal Law № 131. Accordingly, such municipalities couldn’t get subventions. However, a number of delegated state authorities, which must be implemented at the expense of these transfers, should be funded without fail (e.g. federal benefits to veterans).

With regard to the structure of transfer payments to local budgets of the Vologda Oblast, there was the reduction of subsidies from 41.6% to 19.8% in the period from 2003 to 2010 (tab. 3) . However, transfers aimed at the implementation of own expenditure authorities (grants and subsidies) amounted to 8 billion rubles or 77.4% of local budgets’ own revenues in 2010 (it is compared to 19% in 2003). The fulfillment of their own authorities by regional municipalities depends on the higher-level budgets. At the same time, during the studied period about 43-59% of funds were transferred in order to solve delegated authorities (subventions). Their total volume increased by 9 times in relation to 2003 and reached almost 10 billion rubles.

Figure 3. The share of intergovernmental transfers with the exception of subventions in the amount of aggregate revenues of various local budgets,%

□ 2008 □ 2009 □ 2010

Source: Authors’ calculations according to the Treasury of the Russian Federation.

Table 3. The structure of intergovernmental transfers of local budgets in the Vologda Oblast in 2003 – 2010

|

Indicator |

2003 |

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

||||||||

|

5° |

5° |

5° |

5° |

5° |

5° |

5° |

||||||||||

|

Intergovernmental transfers, including: |

2.5 |

100 |

4.6 |

100 |

6.4 |

100 |

10.3 |

100 |

13.8 |

100 |

14.9 |

100 |

13.9 |

100 |

18.1 |

100 |

|

grants |

1.1 |

41.6 |

1.1 |

23.5 |

1.5 |

22.8 |

2.9 |

27.8 |

2.5 |

18.1 |

2.6 |

17.5 |

3.5 |

25.1 |

3.6 |

19.8 |

|

subsidies |

0.3 |

10.4 |

0.7 |

15.6 |

1.6 |

24.9 |

2.0 |

19.8 |

3.9 |

28.4 |

4.7 |

31.7 |

2.8 |

20.4 |

4.2 |

23.5 |

|

subventions |

1.1 |

42.8 |

2.7 |

58.5 |

3.2 |

50.1 |

5.3 |

51.1 |

6.8 |

49.1 |

7.3 |

48.7 |

7.4 |

52.9 |

9.9 |

54.5 |

|

The amount of grants and subsidies in the amount of own revenues |

19.0 |

22.9 |

38.1 |

80.6 |

68.9 |

64.5 |

71.5 |

77.4 |

||||||||

Source: Authors’ calculations according to the Treasury of the Russian Federation.

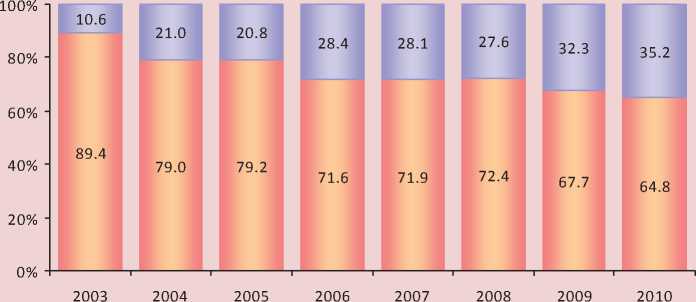

Touching upon the delegation of expenditure commitments, it should be noted that the federal government, declared the independence of local governments, did not create the system of control, power and property distribution which allowed these governmental bodies to carry out their functions. Municipalities were entrusted with the responsibility for solving of social and economic problems which fall within the competence of the Federation and the regions. The amount of delegated authority from the higher power levels increased annually in the period under our study (fig. 4).

A significant increase in the expenses of delegated authority (they have been amounting to almost a third of aggregate expenditures since 2006) afflict the execution of municipalities’ own expenditure commitments.

Figure 4. Correlation of own and delegated authorities in the municipalities’ expenses in the Vologda Oblast, %

□ Expenses of delegated authority**

□ Expenses of own authority***

* Authors’ calculations according to the Treasury of the Russian Federation.

** They are calculated as a share of subventions in the total expenses of local budgets.

*** They are calculated as a difference between total expenses of local budgets and expenses on the execution of own authorities.

Assessing the overall balance of local budgets, it is necessary to mean that it is formal. The revenue sources, which are assigned legislatively to the local level of the budgetary system, are insufficient to finance expenditure authority of local self-government. Deficiency of municipalities’ own revenues in the financing of their aggregate expenditure authority increases annually (fig. 5) .

Inclusion of intergovernmental transfers in the structure of own revenues by the Budget Code creates the illusion of stable financial base in local budgets. However, most municipalities are subsidized. Only 6 territories from all 302 municipalities of the Vologda Oblast did not receive subsidies to equalize budget capacity in 2010 (Vologda, Cherepovets, Babaevo, Grjazovets Urban Settlement, Pogorelovskoe Rural Settlement of Totemsky District and Nelazskoe Rural Settlement of Cherepovets District). In such circumstances, the completeness of local government’s own authority is dependent on the amount of financial support, rather than on the quality of management.

The imperfection of intergovernmental dealings is also reflected in the inability to ensure equal access for the population to budget services throughout the region. The municipal differentiation in terms of budget capacity indicates this fact. Thus, the gap between the most and the least prosperous municipalities in terms of their own revenues per a resident amounted to 3 – 7 times in the Vologda Oblast (fig. 6) .

The largest gap index was observed in 2006 (6.7 times) due to the beginning of the local government reform and restructuring of the local budgets’ tax base.

Thus, the intergovernmental reform hasn’t reduced the dependence of local budgets on the financial support by the higher-level budgets. On the contrary, the revenue base of municipalities has been narrowed. Local governments are extremely limited to expand it. Formation mechanism of local budget revenues isn’t stimulating sufficiently. It couldn’t expand the volume of municipal services and improve their quality.

0,0

Figure 5. Dynamics of defrayal of aggregate expenses by own revenues of the municipalities’ budgets of the Vologda Oblast*, bln. rub.

30,0

25,0

20,0

15,0

10,0

5,0

2003 2004 2005 2006 2007 2008 2009 2010

« Aggregate expenditures

- ♦ Tax and non-tax revenues

3 Difference between aggregate expenditures and own revenues

* Authors’ calculations according to the Treasury of the Russian Federation.

Figure 6. Budget capacity by own revenues per a resident in the municipalities of the Vologda Oblast*, rub.

□ The least prosperous

□ The best prosperous 5,9 The gap, times

* Authors’ calculations according to the Legal acts of local budgets by local self-government in the Vologda Oblast.

This situation doesn’t contribute to the growth of life quality in most municipalities. It doesn’t help to overcome parasitical attitude and promote economic development.

Directions for the improvement of intergovernmental dealings

Based on the foregoing, it is clear that the system of intergovernmental dealings requires further improvement. In our opinion, the key directions of this process should involve the solution of the problems, which include the following measures:

-

1. The inventory of remaining unfunded mandates and providing them with the sources of financing. We believe that this measure could allow us to define clear goals in the assignment of subventions and clarify the method of their size analysis. Based on this, we can limit legislatively the amount of government authority delegated to the municipal level.

-

2. The adjustment of the conditions to obtain additional intergovernmental transfers by the municipalities which were prescribed by the article of law 136 BC RF in 2008 (it is reasonable to raise the standards up to 25, 50 и 75%).

-

3. The improvement of intergovernmental transfers structure, providing:

-

■ the transition from the transfers that have a narrow target orientation to the block wide-target transfers;

-

■ the reduction of subsidies and subventions role in intergovernmental transfers.

-

4. The improvement of temporary cash shortage financing by:

-

■ the transition to the treasury system of the local budget, based on the principle of cash unity;

-

■ cash shortage forecasting;

-

■ the development of an order to raise funds for temporary cash shortages during the execution of local budgets.

-

5. The development of inter-municipal cooperation forms, covering:

-

■ pooling of resources in the form of cofinancing expenditures;

-

■ service agreement (decrease in price for a service within the scope of inter-municipal agreement);

-

■ creation ofjoint administrations;

-

■ the development of associative forms of inter-municipal cooperation;

-

■ the formation of credit institutions, which are able to issue interest-free loans for several months.

-

6. Timely distribution and remittal of intergovernmental transfers by executive bodies of local authorities, regional and federal governments. In order to solve this problem, it’s necessary to study the possibility to exclude the subsidies transferred to co-finance the programs for socio-economic development from the list of target transfers which should be returned in the case of undevelopment. It is also important to approve a monthly schedule of intergovernmental transfers to municipalities (with the exception of the transfers allocated on a competitive basis) in the appropriate application to the law of the regional budget.

As an application in prospect, it is necessary to address the renunciation of the principle of budget capacity leveling which is a base of intergovernmental policy now. The system of intergovernmental dealings in the Russian Federation evolved from a centralized type is searching for an optimal model. The most rational way in the present conditions in Russia is a gradual decentralization, based on joint decisions and coordinated actions of the governments.

It is possible to follow this way only by increase in economic growth and economic potential both of regions and municipalities when they could be more independent. In this regard, it is necessary to redistribute taxes for benefit of municipalities. At the same time, tax revenues dropping from the higher budgets will be indemnified by saving of the financial support to local self-government. Transfer taxes to the local level will stimulate the development of municipalities’ tax base and the expansion of priority development zones, while nonproductive counter financial flows (from the municipality to the higher-level budgets, and then from the higher-level budgets to the municipality in the form of transfers) will be excluded. Disproportionate financial security of most prosperous municipalities in the existing intergovernmental system will be aligned by negative transfer.

Using the basic approach in the improvement of the system of intergovernmental dealings, it is reasonable to raise the question about the development of a new model, which represents not a “lifeline” for the backward municipal territories but a set of measures for their economic growth based on the principle of sufficient financial resources and real possibilities of their effective use.

Список литературы Topical issues of the improvement of intergovernmental dealings in the system of local government

- Budget Code of the Russian Federation. Мoscow: Eksmo, 2011.

- Arumova E.S. Organization of Inter-municipal Cooperation: Russian and Foreign Experience. Problem Analysis and State Managerial Design. 2011. Nо. 2. P. 37-46.

- Baltina A.M., Volokhina V.A. Intergovernmental Dealings in the Region: A Model of Organization and Control. Orenburg: Orenburg State University, 2004.

- Buchwald E.M. Economic and Legal Problems of the Improvement of Budget System in the Russian Federation. Analytical Bulletin of the Federation Council. 2010. Nо. 13 (399). Available at: http://www.council.gov.ru/inf_sl/bulletin/item/358/index.html

- Grishin V.I. Regional Economic Policy and Intergovernmental Dealings. Finance. 2005. Nо. 4. P. 50-55.

- Karaseva M.V. Ownership of the budgetary funds. Finance. 2007. N6. Available at: http://www. href='contents.asp?titleid=9231' title='Финансы'>Finance-journal.ru

- Kolesov A.S., Gurov V.A., Revaykin A.S., Sigova S.V. Budgetary Policy and Intergovernmental Dealings of the Federal Subjects in Russia. Moscow: Finances, 2007.

- Kryzhanovskaya G.V. Russian and Foreign Experience in Intergovernmental Interaction. Federalism. 2010. Nо. 1. P. 149-160.

- Pechenskaya M.A. State and Problems of Intergovernmental Dealings in the Region and Municipalities (based on the materials of the Vologda Oblast). In: Management and Economics in Modernization: History and Modern Times: Scientific and Practical Conference. Vologda Branch of North-West Academy of Public Administration, 2011. P. 94-102.

- Real Federalism. Local Government. Intergovernmental Policy: Theses of the Program developed by the Expert Group No. 12 on the Renewal of the “Strategy 2020”. Official site the Strategy of socio-economic development of the Russian Federation until 2020. Available at: http://2020strategy.ru

- Russian Local Government: Results of Municipal Reform, 2003-2008.: Analytical Report. The official website of the Institute of Contemporary Development. Available at: http://www.insor-russia.ru/ru/programs/doc/3928

- Sokolova A.A. Forms and Mechanisms of Vertical Alignment in the Field of Intergovernmental Dealings. Finance and Credit. 2009. Nо. 6. P. 15.

- Uskova T.V. Sustainable Development Management in the Region. Vologda: ISEDT RAS, 2009.

- Himicheva N.I. Financial Law. Moscow: Yurist, 2008.