Trends and Prospects of Attracting Foreign Investment in Arctic Megaprojects under Geopolitical Tension

Автор: Badylevich R.V.

Журнал: Arctic and North @arctic-and-north

Рубрика: Social and economic development

Статья в выпуске: 51, 2023 года.

Бесплатный доступ

The article analyzes the participation of foreign investors in the implementation of investment projects in the Arctic zone of the Russian Federation. The features of organizing foreign investments at the regional level are considered. The dynamics of indicators of attracting foreign investment in the Russian Arctic in 2016–2021 is analyzed. It is noted that in the last few years, the attraction of loans from foreign banks has decreased to a minimum, and the entire volume of investment was carried out at the expense of direct investments by foreign investors in large megaprojects of the Russian Arctic. The situation with the involvement of foreign investors in Arctic projects in the context of geopolitical tensions in 2022 is assessed. It is concluded that Western companies are currently withdrawing their assets from joint Arctic projects, while the potential for investment cooperation with Asian, Latin American and Turkish partners in the Arctic zone of the Russian Federation is increasing. It has been established that the withdrawal of Western investors from joint Arctic projects carries not only financial risks associated with the search for new sources of investment, but also technological risks that necessitate the development of alternative options for obtaining the necessary equipment. As ways to overcome the difficulties associated with the withdrawal of Western investors from Russian Arctic projects, it is proposed to intensify direct state financing of the implementation of infrastructure facilities based on the program method, as well as to direct efforts to create interstate mechanisms for financing large Arctic projects with friendly countries interested in the development of Arctic policy within the framework of existing BRICS and SCO associations.

AZRF, foreign investors, direct investments, Arctic megaprojects, sanctions, investment risks

Короткий адрес: https://sciup.org/148329293

IDR: 148329293 | УДК: [330.332:339.727.22](98)(045) | DOI: 10.37482/issn2221-2698.2023.51.5

Текст научной статьи Trends and Prospects of Attracting Foreign Investment in Arctic Megaprojects under Geopolitical Tension

H, ORCID:

The Arctic is an area of strategic interests of Russia, the importance of which has been steadily increasing over the past decades. A significant resource potential of our country is concentrated here, a complex of infrastructure projects is being implemented to ensure the functioning of the Northern Sea Route [1, Drozdova I.V., Alievskaya N.V., Belova N.E.]. At the same time, the Arctic territories are characterized by difficult conditions for economic activity and high cost of

∗ © Badylevich R.V., 2023

Roman V. Badylevich. Trends and Prospects of Attracting Foreign Investment … implementation of large-scale projects, which determines the particular importance of attracting investment resources to ensure the necessary pace of economic development of these territories. The high investment demand [2, Krasulina O.Yu.] and the presence of large-scale, technologically complex infrastructure and industrial projects increase the importance of attracting foreign capital to the Russian Arctic, which not only activates investment processes, but also contributes to the modernization of the technological base of the economy of the regions of the Arctic Zone of the Russian Federation (ASRF), as well as ensures the introduction of unique technologies and innovative solutions.

It should be noted that the Russian part of the Arctic, unlike the northernmost territories belonging to the United States, Canada, Denmark, Norway, has until recently been quite open to foreign investors. Other countries have never created attractive conditions for foreign investors in their Arctic territories (Svalbard, Greenland, Alaska, the northern lands of Canada). The main reason for this is the policy of protectionism and the desire to maintain control over the resource base of the Arctic, which in recent years has been considered by many non-Arctic countries (primarily China) as a zone of common international interests. The Russian authorities considered the attraction of foreign capital for the implementation of large projects on our territory as a favorable factor in the development of the Russian Arctic.

The high attractiveness of the Arctic territories for foreign investors has been repeatedly noted in various strategic documents and numerous scientific studies [3, Ryzhova A.V.; 4, Kudryashova E.V., Zarubina L.A., Sivobrova I.A.]. The increasing interest of foreign investors in the Russian Arctic is also facilitated by global processes that affect the demand for Arctic resources and infrastructure, including the growing importance of transportation along the Northern Sea Route in the context of melting polar ice and the modernization of the icebreaker fleet capable of year-round navigation in the northern seas, the emergence new oil and gas production technologies that provide the possibility of developing hard-to-reach fields, as well as the availability of unique natural resources, the demand for which will grow in the coming years. However, recent geopolitical events associated with the aggravation of international relations, as well as the sanctions war, can have a significant impact on the prospects for the participation of major international corporations in the implementation of Russian Arctic projects. Under these conditions, the state policy aimed at attracting foreign capital and increasing the investment attractiveness of the Russian Arctic is of particular relevance. It should ensure the inflow of the necessary investment and the introduction of advanced world-class technological solutions as well as provide a sufficient degree of financial security and an acceptable level of technological independence of our country in relation to the development of the Arctic territories.

Features of organizing foreign investment at the regional level

Foreign investment is one of the sources of investment financing in modern practice. According to Russian legislation, foreign investment is defined as the investment of foreign capital

Roman V. Badylevich. Trends and Prospects of Attracting Foreign Investment … carried out by a foreign investor directly and independently in an object of entrepreneurial activity in the Russian Federation in the form of objects of civil rights owned by a foreign investor, if such objects of civil rights are not withdrawn from circulation or are not restricted in the Russian Federation 1. Thus, the main criterion for classifying investments as foreign is the state affiliation of the entity making the investment, which is different from Russia.

The scientific literature devotes considerable attention to the issues of foreign investment. For foreign investments, as well as for investments in general, classifications and evaluation methods are used that allow analyzing the dynamics, structure and effectiveness of their implementation. Thus, according to the nature of participation in projects, there are direct and portfolio foreign investments; according to the period of implementation — short-term and long-term ones; according to the type of investment object — real investments, financial investments, investments in intangible assets.

Currently, the main issues of regulating the process of attracting foreign investment are referred to the federal level, but the Federal Law of July 9, 1999 N 160-FZ “On foreign investments in the Russian Federation” states that the constituent entities of the Russian Federation have the right to adopt laws and other legal acts regulating foreign investments on the issues falling under their competence, as well as the joint jurisdiction of the Russian Federation and the constituent entities of the Russian Federation, in accordance with the legislation. Despite the fact that the list of such issues is not fixed in the law, the analysis of regulatory practice shows that the regions are forming legislation specifying federal laws in the field of identifying priority areas for investment for a constituent entity of the Russian Federation, establishing a list of regional guarantees and benefits for investors, forming a set of mechanisms to increase attractiveness and improvement of the investment climate in certain territories. As a rule, benefits and preferences for investors include tax exemptions, certain conditions for the use of land plots and state property. However, as practice shows, regional investment legislation is generally not specified for foreign investors, but considers this category on an equal footing with Russian investors. Only in a small number of regions (for example, the Novgorod Oblast, the Republic of Tatarstan) provide specific conditions for foreign entities to carry out investment activities 2.

Despite the fact that federal legislation is focused on regulating the basic guarantees and rights of foreign investors on the territory of the Russian Federation as a whole, and most of the scientific research is devoted to the methodological basis for organizing foreign investment at the federal level, the issues of involving foreign capital in investment processes at the level of individ- ual regions, as well as increasing the investment attractiveness of specific territories for international actors are important and relevant. This situation is caused by the diversity of investment activities in various constituent entities of the Russian Federation, a significant differentiation in the investment attractiveness of certain territories, as well as a significant difference in indicators characterizing the effectiveness of attracting foreign capital into investment processes in certain regions. Under these conditions, it is necessary to take into account regional specifics and interests, which should be translated into clearly formulated sectoral and territorial priorities for stimulating foreign direct investment at the national and regional levels [5, Bashina O.E., Matraeva L.V., Alyabyeva A.V., p. 21].

A significant amount of scientific work is devoted to assessing the impact that foreign investment has on the development of individual territories. The attraction of foreign capital in the form of direct investment contributes to the formation of a sufficient financial base for the implementation of large-scale projects in the region, the creation of new jobs, the organization of high-tech joint ventures based on world leading innovative solutions, the increase in the overall financial potential of the territory. In recent years, studies have been published that have established a relationship between the volume of foreign investment attracted to the region and the economic growth rates (GRP) [6, Koroleva G.A., Titov A.V.], employment [7, Abdullaev G.S., Chernetsova N.S.], average wages [8, Khramchenko A.A., Kukhtinova A.A., Simakova A.A.].

However, attracting foreign capital to finance investment in fixed assets for the regions is associated with certain risks; the risks of increased financial and technological dependence on foreign corporations and states, which in the current environment can be used for economic and political pressure, should be primarily highlighted.

Foreign investments, on the one hand, are considered as a significant factor in the development of a certain territory [9, Olkhovik V.V., Lyutova O.I., Juchnevicius E.]. On the other hand, they act as a certain indicator characterizing the economic attractiveness of a particular region for an investor. As a rule, the higher the economic potential of the territory is, the more stable the conditions of economic activity are, the greater is the interest of foreign investors in making investments. Scientific literature distinguishes a large number of factors determining the attractiveness of the territory for foreign investors [10, Pozdnyakov K.K., p. 10; 11, Abdullina A.R., p. 1250], among which are:

-

• level and potential of economic development of the territory;

-

• nature and type of economic specialization;

-

• availability of large industrial enterprises and attractive investment projects;

-

• level of financial infrastructure development;

-

• development of private property institute and the degree of state participation in economic processes;

-

• stability of legislation, political and economic situation in the region;

-

• privileges and preferences granted to foreign investors;

-

• territorial location of the region, proximity to financial centers, main transport arteries, border position and involvement of the region in international relations.

The work of I.M. Drapkin and E.O. Dubinina [12] presents an appropriate classification of factors that determine the attractiveness of a particular territory for foreign investors and distinguish three groups of factors: economic factors, institutional factors and factors that define the similarity of territories (countries), determining the foreign investors’ ownership and the location of the investment object.

A significant number of factors affecting the attractiveness of the territory for foreign investors prevent the application of uniform standardized tools to attract foreign capital for all regions. When in most regions a large share of foreign capital is accounted for by several large investors participating, as a rule, in large regional infrastructure and industrial projects, targeted regulation of interaction with foreign entities and targeted measures to increase the investment attractiveness of a certain territory come to the fore [13, Izotov D.A.]. Typically, the system of such measures includes tools for forming benefits and preferences for foreign companies, providing state guarantees for investors, and achieving interstate agreements that contribute to the activation of interaction between business structures. In this regard, the synthesis of efforts of the state authorities of various levels and the largest Russian companies in the field of ensuring optimal interaction with foreign partners is of particular importance for the regional level to intensify the processes of attracting foreign capital.

Dynamics of foreign investments in the Arctic zone of the Russian Federation

Foreign investments as a source of formation of the financial base for the implementation of megaprojects in the Russian Arctic have been characterized by an extremely uneven character in recent years [14, Serova N.A., Gutov S.V., p. 85]. The dynamics of foreign investment was influenced by several macroeconomic factors, such as the increase in international environmental standards in the implementation of projects in the Arctic and, consequently, the imposition of restrictions on the participation of the largest credit institutions in financing many economically attractive projects, the outflow of international capital from the markets of developing countries, significant price fluctuations in key commodity markets and a decrease in interest in high-risk projects. Currently, Russia’s tense relations with Western countries and the sanctions that have been imposed are creating additional difficulties in attracting investment resources for large megaprojects in the Arctic.

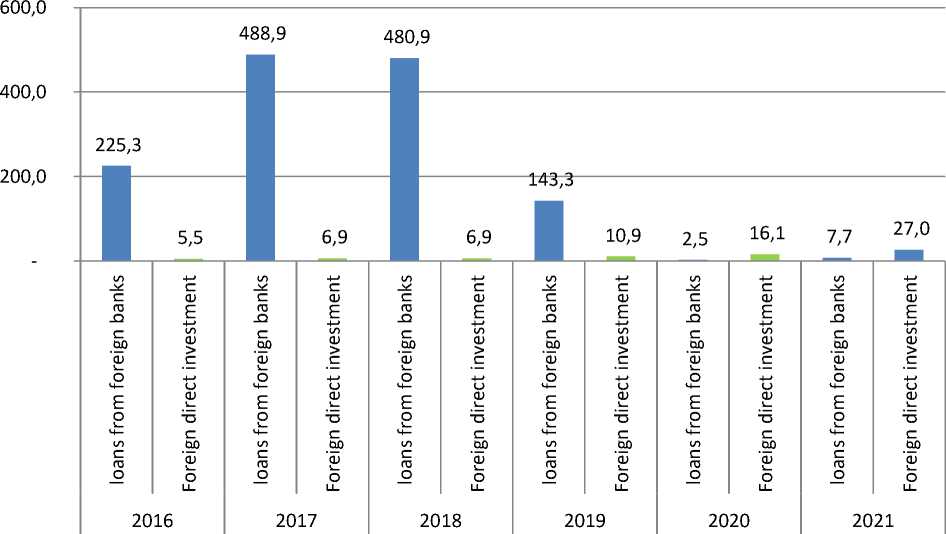

Fig. 1 shows the dynamics of foreign investments in fixed assets in the Russian Arctic.

Fig. 1. Dynamics of foreign investments in fixed capital in the Russian Arctic, billion rubles 3.

The presented data indicate several trends in the dynamics of foreign investments in fixed assets in the Russian Arctic.

First, the volume of foreign bank loans to finance investment in non-financial assets declined to a minimum in 2020-2021. The peak values of loans from foreign banks as a source of financing investments in fixed assets occur in 2017–2018. It should be noted that the share of this source in the overall structure of real investment financing in these years reached 33%, which was about 6 times higher than the average Russian level. It should be noted that more than 99% of the total volume of foreign bank loans allocated for investment purposes in these years accounts for the Yamalo-Nenets Autonomous Okrug, where a significant part of the Yamal LNG project was financed from this source (the project was actively financed by Asian credit institutions (Japanese Bank for International Cooperation JBIC, Export-Import Bank of China and China Development Bank) and European financial institutions (in particular, Italian bank Intesa Sanpaolo, European bank Intesa, French bank Coface). When the project was finished, the amount of foreign bank loans used as a source of financing for fixed investment decreased by more than 50 times by 2021.

Foreign direct investment as a source of funding in 2016–2021 has tended to increase steadily. Over six years, the volume of investments from abroad increased five-fold to 27 billion rubles. The share of this source of investment in fixed assets in the Russian Arctic increased from 0.4% in 2016 to 1.4% in 2021 (similar values for Russia as a whole in 2016 and 2021 were 0.8% and 0.4%, respectively). In general, the high diversification of the activity of foreign investors in certain regions of the Russian Arctic should be noted. In particular, the values of the indicator of direct

-

3 Source: compiled by the author based on Rosstat indicators: Rosstat. Official statistics for the Arctic zone of the Russian Federation. URL: https://rosstat.gov.ru/storage/mediabank/Calendar1_2022(4).htm (accessed 10 August 2022).

investment in 2021 for the Arctic regions of the Russian Federation differ by several orders of magnitude (Table 1).

Table 1

Inflow of direct investments into the Russian Federation: transactions by constituent entities where residents are registered (according to the balance of payments of the Russian Federation), USD mln

|

2018 |

2019 |

2020 |

2021 |

|

|

RUSSIAN FEDERATION |

140 079 |

185 547 |

206 907 |

188 711 |

|

including: |

||||

|

Republic of Karelia |

31 |

34 |

32 |

44 |

|

Komi Republic |

689 |

288 |

46 |

219 |

|

Arhangelsk Oblast |

30 |

28 |

852 |

64 |

|

Nenets Autonomous Okrug |

0 |

0 |

836 |

0 |

|

Arkhangelsk Oblast without data for the Nenets Autonomous Okrug |

30 |

28 |

15 |

64 |

|

Murmansk Oblast |

62 |

32 |

66 |

107 |

|

Yamalo-Nenets Autonomous Okrug |

9 763 |

9 253 |

7 710 |

6 524 |

|

Krasnoyarsk Krai |

5 897 |

5 751 |

12 691 |

3 625 |

|

Republic of Sakha (Yakutia) |

351 |

1 168 |

1 114 |

652 |

|

Chukotka Autonomous Okrug |

250 |

47 |

38 |

50 |

It should be noted that the data in Table 1 reflect the flow of direct investment in the regions according to the place of registration of the subject. The territorial distribution of investments in the Arctic differs significantly from the data presented. Thus, the largest share of investments from abroad in the AZRF accounts for the Yamalo-Nenets Autonomous Okrug (foreign investors take an active part in the implementation of large gas and oil production projects), the Murmansk Oblast (with the attraction of foreign investments, Novatek implements infrastructure projects on the western coast of the Kola Bay as part of the creation of the Murmansk transport hub), Chukotka Autonomous Okrug (foreign investments prevail in the region’s flagship project — the construction of the Baimskiy mining and processing plant based on the Peschanka deposit). The Krasnoyarsk Krai and the Republic of Sakha (Yakutia), which are characterized by significant amounts of foreign capital, are difficult to fully consider as Arctic regions, since a fairly large part of foreign investment in them falls on the southern territories.

The largest investment projects currently being implemented in the Russian Arctic are the Vostok Oil production project, as well as two natural gas liquefaction projects, Yamal LNG and Arctic LNG-2. These projects are not only the largest in the Russian Arctic, but also in Russia as a whole 4, the total cost of implementing these three projects is estimated at about 13.5 trillion rubles. All three projects provide for the participation of the largest foreign investors along with Russian companies (Table 2).

Table 2

Participation of foreign investors in the largest investment projects in the Russian Arctic (as of 01.01.2022 01.01.2022)

|

Investm ent project |

Project content |

Cost of project implementation, trillion rubles |

Russian share of the project |

Share of foreign partners |

|

Vostok Oil |

Includes the resource base of the largest fields in the Vankor cluster (Vankorskoe, Suzunskoe, Tagulskoe and Lodochnoe), as well as promising oil fields in the north of the Krasnoyarsk Krai (Payakhskaya group of fields and Zapadno-Irkinskiy area). |

10.0 |

PJSC Rosneft (share - more than 51%) |

Trafigura (Singapore) — 10.0% Vitol S.A. (Switzerland-Netherlands) and Mer-cantile&Maritime Energy Pte. Ltd. (Singapore) — 5.0% |

|

Yamal LNG |

The second after Sakhalin-2 and the largest operating LNG project in Russia. The resource base of the project is the Yuzhno-Tambeyskoe field in the northeast of the Yamal Peninsula. |

2.0 |

PJSC Novatek (share -50.1%) |

CNPC (China) — 20% TotalEnergies (France) — 20% Silk Road Fund (China) — 9.9% |

|

Arctic LNG-2 |

Provides for the construction of three technological lines for the production of liquefied natural gas. The resource base is the Utrennee deposit located on the Gydan Peninsula in the Yamalo-Nenets Autonomous Okrug. |

1.575 |

PJSC Novatek (share -60%) |

CNODC Ltd (China) — 10% CNOOC Ltd (China) — 10% TotalEnergies (France) — 10% Mitsui and JOGMEC (Japan) — 10% |

It should be noted that most of the projects involving foreign investors are associated with the extraction of natural resources, or with the implementation of related projects for their transportation or exploration. Other industries in the Arctic remain unattractive to foreign partners. The reasons for this are the low level of development of the territories (lack of developed infrastructure and large markets, high delivery and energy supply costs) and remoteness from financial centers. Among all the Russian Arctic regions, the Murmansk Oblast has been characterized by the highest sectoral diversification of foreign direct investment over the past few decades. This is due to the region’s border location and its close links with Scandinavian countries. Thus, a number of projects with foreign investment were implemented in the early 2010s on the basis of a business incubator created jointly with the State Industrial Development Corporation of Norway SIVA. Since 2018, Italian investors (energy concern Enel) have been actively involved in the project to create a wind farm in the region (Italian participation was estimated at 273 million euros). However, in general, the Murmansk Oblast is rather an exception to the general rule, and so far, foreign direct investment in the Russian Arctic is almost entirely realized in projects related to the extraction of natural resources.

Attracting foreign investors to Arctic megaprojects amid geopolitical tensions

Undoubtedly, one of the key events that has had and will have an impact on attracting foreign capital to Russian Arctic projects in the coming years is the special military operation in Ukraine and subsequent imposition of sanctions and restrictions against Russia by a number of countries [15, Krasnopolski B.H.]. The events of February 2022 significantly changed the investment fund in the Arctic and led to a considerable change in the predicted dynamics and structure of financial support for the implementation of investment projects. Several major foreign corporations, primarily from Europe, announced their withdrawal from joint projects with Russian companies.

Let us present summary data on the prospects for the participation of the largest foreign partners in the implementation of the largest investment projects in the Russian Arctic (Table 3).

-

Table 3 Prospects for participation of the largest foreign investors in the Arctic projects

Foreign investor

Arctic projects involving an investor

Russian partners in the Arctic

Prospects for working in Russia

Equinor (Norway)

Development of the

Kharyaginskoe oil field

Zarubezhneft

Completely withdrew from all joint projects

British Petroleum (UK)

Vostok Oil, Taas-Yuryakh — Nefte- gasodobycha

PJSC Rosneft

Declared withdrawal from all Russian projects. As of September 2022, the withdrawal is incomplete

TotalEnergies (France)

Arctic LNG-2,

Yamal LNG, Development of the Kharyaginskoe oil field

PJSC Novatek Zarubezhneft

Withdrew from several large joint projects. Currently retains ownership of some Russian assets.

Trafigura international trader

Vostok Oil

PJSC Rosneft

Withdrew from the Russian projects

Vitol S.A. (Switzerland-Netherlands)

Vostok Oil

PJSC Rosneft

Declared a desire to sell the Russian assets, however, no buyer has been found

Wintershall Dea (Germany)

Development of the Achimovskiy deposits of the Urengoyskoe field

PJSC Gazprom

Continues to participate in projects

Mercantile &

Maritime Energy Pte. Ltd. (Singapore).

Vostok Oil

PJSC Rosneft

Continues to operate in Russia

Mitsui (Japan)

Arctic LNG-2

PJSC Novatek

Continues to participate in

projects

JOGMEC (Japan)

Arctic LNG-2

PJSC Novatek

Continues to participate in projects

CNPC (China)

Arctic LNG-2, Yamal LNG

PJSC Novatek

Continues to participate in projects

Silk Road Fund (China)

Yamal LNG

PJSC Novatek

Continues to participate in projects

Oil India, Indian Oil, Bharat Petroresources (India)

Vankorskoe oil and gas field, infrastructure projects along the Northern Sea Route

PJSC Rosneft

Continues and expands cooperation with Russian partners

British energy company British Petroleum was one of the first to withdraw from Russian Arctic projects. On February 27, 2022, the company announced the termination of cooperation with PJSC Rosneft. Until February 2022, British Petroleum owned a stake in Rosneft (19.75%), and together with the Russian oil giant owned three companies operating in the Arctic zone of the Russian Federation: Taas-Yuryakh Neftegazodobycha (Republic of Sakha) (British Petroleum owned 20% of the shares), Kharampurneftegaz (Yamalo-Nenets Autonomous Okrug) (British Petroleum owned 49%), and Yermak Neftegaz (registered in Moscow; Arctic geological exploration) (British Petroleum owned 49%). The sale of shares in these companies led to the withdrawal of British Petroleum from one of the largest Arctic oil projects implemented by Rosneft, Vostok Oil, which is expected to account for about 1/5 of Russia’s total oil production by 2030. According to the company’s top management, the total losses of British Petroleum as a result of termination of operations in Russia could be up to 25 billion dollars.

At the end of February 2022, Norwegian companies announced their termination of participation in the projects in Russia. The largest Norwegian international energy company Equinor has suspended cooperation on joint projects with the Russian corporation Rosneft. The companies have been working together in the Arctic since 2012, when they signed an agreement on joint projects. During its work in Russia, Equinor participated in the development of fields in the Barents (Perseevskiy area) and Okhotsk (Lisyanskiy, Kashevarovskiy and the Magadan-1 areas) seas, the Severo-Komsomolskoe field in the Yamalo-Nenets Autonomous Okrug, the Kharyaginskoe oil field in the Nenets Autonomous Okrug. Despite the fact that some of the Russian Arctic projects, in which Equinor planned to take part, were never implemented for various reasons (noncompliance with environmental requirements, sanctions against Russia of 2014, low commercial attractiveness), the size of the company’s assets in Russia at the end of 2021 was estimated at 1.2 billion dollars, and the total losses due to leaving the Russian market, according to the company’s financial statements for the first quarter of 2022, amounted to 1.08 billion dollars (of which 251 million are fixed assets and non-material assets, and 832 million — investments) 6. At the begin-

SOCIAL AND ECONOMIC DEVELOPMENT

Roman V. Badylevich. Trends and Prospects of Attracting Foreign Investment … ning of September 2022, the company announced its complete withdrawal from all Russian projects 7.

In addition to Equinor, other major Norwegian investors announced their withdrawal from Russian projects and the suspension of investment projects. Thus, the Oil Fund of Norway, which has about $3 billion worth of assets in Russian Arctic projects, and Norges Bank Investment Management have started selling off Russian assets since March 2022.

Another major investor in Russian Arctic projects was the French energy corporation TotalEnergies. However, in March 2022, the company announced the gradual suspension of its activities in Russia and the termination of investments in Russian projects. As of September 2022, TotalEnergies sold its 20% stake in the Kharyaginskoe field to the state corporation Zarubezhneft (this allowed the French company to withdraw from its obligations to invest in the project), agreed to sell its 49% stake in Terneftegaz to Novatek (in August 2022, the deal was approved by the Government of the Russian Federation 8), and also completely abandoned new investments in the Arctic LNG-2 project. At the same time, the company maintains its participation in the Russian gas industry, where TotalEnergies currently owns 19.4% in the capital of the Novatek corporation and shares in joint ventures with it — Yamal LNG (TotalEnergies share — 20%), Arctic LNG-2 (TotalEnergies share — 10%), as well as shares in the LNG transshipment centers being created in Murmansk and Kamchatka 9. However, TotalEnergies does not eliminate the possibility of complete withdrawal from the Russian market and from joint projects in the future.

It should be noted that not all foreign partners involved in projects in the Russian Arctic have announced their withdrawal from Russia. So, unlike many of its European counterparts, the German oil and gas company Wintershall Dea stated that it has no plans to exit Russian assets at the moment. The company continues to cooperate with Gazprom in the development of the Yu-zhno-Russkoe gas field and holds a 15.5% stake in the Severnyy Potok operator, Nord Stream. Moreover, the company plans to maintain its stake in the joint ventures with Gazprom that are

SOCIAL AND ECONOMIC DEVELOPMENT

Roman V. Badylevich. Trends and Prospects of Attracting Foreign Investment … developing the Achimov deposits of the Urengoyskoe field (Wintershall Dea currently owns 50% of Achimgaz and 25% of AchimDevelopment) 10.

Unlike European and American corporations, after the events of February 2022, many Asian companies not only do not curtail investment activities in the Russian Arctic, but even intensify it. In July 2022, for example, it became known that Trafigura, which held a 10% stake in the Vostok Oil project, had been acquired by Nord Axis Limited, a company registered in Hong Kong 11. Interest in the implementation of joint projects with the largest Russian companies in the Arctic is shown by Chinese [16, Tulupov D.S.] and Indian [17, Vopilovsky S.S.] investors. In particular, the Chinese CNPC is already the main partner of the Russian company Novatek in the implementation of the largest Arctic projects Arctic LNG-2 and Yamal LNG, while India, represented by large companies Oil India, Indian Oil, Bharat Petroresources, cooperates with Rosneft in the development of oil and gas fields in Yakutia and the implementation of infrastructure projects along the Northern Sea Route (Indian Oil Corporation, ONGC Videsh Ltd., Oil India Limited, Bharat Petroresources own a 49.9% stake in Vankorneft, a subsidiary of Rosneft, which is developing the Vankor oil and gas field; IOC, Oil India Limited, Bharat Petroresources own about 30% in Taas-Yuryakh Neftegazo-dobycha). In addition, following the announcement of the withdrawal of Western investors from the Arctic projects, companies from these two countries were mentioned as potential buyers of their stakes in Russian projects 12.

Risks and prospects of Arctic megaprojects under geopolitical tensions

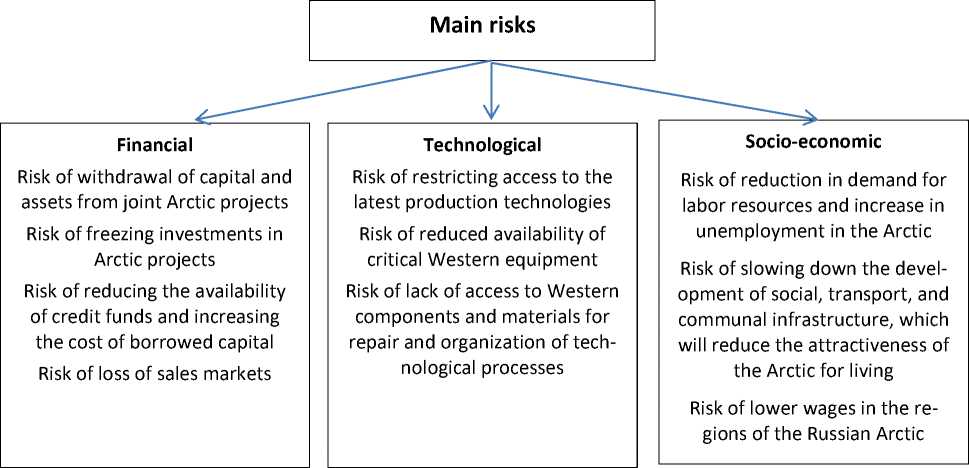

Undoubtedly, the imposition of sanctions by Western countries and the withdrawal of many foreign partners have led to a significant increase in the risks of implementing Russian Arctic megaprojects. The main risks associated with the sanctions against Russia by Western countries are shown in Fig. 2.

The first group of risks is financial ones. As practice shows, the development of the Russian Arctic and the implementation of major oil and gas and infrastructure projects on its territory are currently undergoing significant changes due to the withdrawal of major Western corporations from joint projects with Russian companies. According to the most conservative estimates, in the first half of 2022, foreign partners announced the curtailment of investment activities in the Russian Arctic and the withdrawal of assets worth more than 5 billion dollars. In order to mitigate the situation with the withdrawal of major investors from joint projects, the Government of the Russian Federation adopted a set of measures aimed at strengthening control over transactions with citizens and companies from non-friendly countries, as well as creating the possibility to seize shares or property of companies that are found to be contrary to Russian interests or threatening the energy or other types of security of our country 13. However, neither significant financial losses nor risks of initiating legal proceedings due to violation of Russian law could prevent the exit of the largest Western corporations and the withdrawal of invested capital.

Fig. 2. Main risks in the implementation of Russian Arctic megaprojects due to the withdrawal of the largest Western international corporations 14.

It should be noted that current efforts of the Russian Government and business community are aimed at replacing major Western corporations that have announced their withdrawal from Russian Arctic projects with Asian partners. This was stated, in particular, by the Deputy Chairman of the Security Council of the Russian Federation Dmitriy Medvedev 15, as well as the heads of Russian companies implementing projects in the Arctic. However, at the moment, the investment activity of the largest Chinese corporations in the Arctic is limited by expectations of further development of the geopolitical situation and the possibility of getting under secondary sanctions for cooperation with Russia 16. In any case, it will be possible to compensate for the outflow of funds from Arctic projects due to the departure of European and American corporations only if the role of the state is intensified by the framework of further building a system of preferences and bene- fits for companies investing in Arctic projects and direct financing of the development of the Arctic using program mechanisms of state regulation. At the same time, it should be noted that the prospects for the adoption of new measures of state support for Arctic projects largely depend on macroeconomic indicators, primarily prices in the commodity markets, the duration and intensity of the special military operation in Ukraine, as well as the degree of budgetary sustainability and economic growth potential.

It should be noted that the withdrawal of Western partners leads not only to a direct outflow of financial resources, but also exacerbates other significant risks of the implementation of Arctic megaprojects. In particular, they are technological risks and, above all, the loss of access to many technologies and unique equipment that were used in the implementation of Arctic megaprojects. However, it will be possible to fully assess the criticality of international corporations leaving Arctic projects only in the medium term.

In addition, the outflow of foreign capital has an indirect impact on the growth of socioeconomic risks. This is explained by the fact that large megaprojects significantly affect the socioeconomic processes in the Arctic regions, including employment, development of auxiliary industries, formation of a settlement structure, etc. The departure of foreign investors will negatively affect the development of infrastructure in the areas where projects are implemented, which, of course, will reduce the attractiveness of the Arctic territories for living.

It should be noted that the degree of influence of sanctions risks on the development of the largest Russian megaprojects varies significantly. The prospects for each of the three largest Arctic projects are presented in Table 4.

-

Table 4

Risks and prospects for the implementation of the largest megaprojects in the Russian Arctic

|

Project |

Foreign partners who left (announced their withdrawal) after 24.02.2022 |

Implementation risks |

Development prospects |

|

Vostok Oil |

Consortium of companies Vitol S.A. (Switzerland-Netherlands) and Mercan-tile&Maritime Energy Pte. Ltd. (Singapore). Trafigura international trader. British Petroleum (UK) |

Insignificant. Equipment for drilling in the Far North is produced in Russia. Withdrawal of capital upon exit of foreign partners is offset by interest from Asian investors (China / India / Qatar) |

Declared the preservation of the timing and pace of the project |

|

Arctic LNG-2 |

Departure of contractors - engineering companies Technip, Saipem, Linde, equipment supplier Baker Hughes |

Significant. Associated with the ban on the supply of equipment for large-capacity plants. Difficulties in the construction of gravity-type LNG lines and energy supply for the project |

TotalEnergies (France), CNPC (China), Mitsui and JOGMEC (Japan) remain involved in the project, however, they have refused new investments. Nova energies controlled |

|

by NIPIGAZ, Green Energy Solutions LLC (UAE), Karpowership (Turkey) were involved as contractors. Due to technological risks, the timing of the project implementation has been shifted |

|||

|

Yamal LNG |

Departure of Western process contractors, including equipment supplier Baker Hughes |

Medium. Associated with limited maintenance capabilities of the equipment used, a reduction in demand for LNG, as well as the refusal of Western partners to invest in new fields |

CNPC (China), TotalEnergies (France), Silk Road Fund (China) retain their participation in the project. Announced the preservation of the volume of production and shipment of LNG |

Sanctions and withdrawal of Western partners, according to the management of Rosneft, will not have a significant impact on the timing and pace of implementation of one of the largest Arctic projects, Vostok Oil 17. Currently, the project is being implemented as planned, and 98% of the equipment and resources required for it are produced in Russia. This information can be confirmed by the announcement of the start of production drilling at the Payakhskoe field of the Vos-tok Oil project, which was published in the official sources of Rosneft in July 2022 18. However, not all analytical agencies are so confident in the favorable prospects of the project. Thus, the consulting company Rystad Energy predicted that the Payakhskoe field would be launched only in 2029, and not in 2024, as planned 19.

In contrast to the Vostok Oil project, Novatek is experiencing considerable difficulties in supplying the necessary equipment for the Arctic LNG-2 project after Western partners and contractors left. Withdrawal of major engineering contractors Technip, Saipem and Linde, as well as the American equipment supplier Baker Hughes, led to difficulties in the supply of equipment for large-capacity plants and the construction of LNG lines, as well as problems with the project’s power supply. Currently, Novatek is looking for possible alternative options for the supply of equipment, including through cooperation with the Turkish company Karpowership and companies representing the UAE 20. However, in any case, according to experts 21, it will be almost impossible to carry out the earlier planned implementation of the project. The capacities of Nova

SOCIAL AND ECONOMIC DEVELOPMENT

Roman V. Badylevich. Trends and Prospects of Attracting Foreign Investment … energies, controlled by NIPIGAZ, are clearly not enough to fully replace the departed Technip and Saipem, and the parameters of the power equipment that Turkish partners are ready to supply are significantly worse than those of Baker Hughes. Despite Novatek’s statements that the share of Russian equipment at the Arctic LNG-2 project will be higher than at Yamal LNG, in practice, most facilities are built using equipment assembled in China from imported components, which, given complicated logistics, also does not help to maintain the planned project deadlines.

Conclusion

The events of February 2022 and the subsequent sanctions by Western countries led to a significant change in the investment climate in the Russian Arctic and the departure of Western partners and investors. While the outflow of financial resources from Arctic projects can still be partially compensated by the entry of new investors, ready to buy shares of American and European corporations leaving Russia, the technological risks associated with the unavailability of Western technologies and equipment remain high and can hardly be fully mitigated by supplies from Asian countries and import substitution programs without loss of reliability and productivity.

In recent years, there has been a shift in the emphasis of the state Arctic policy in Russia from direct financing based on the program method to creating conditions for increasing the investment activity of private companies. Today, in the context of increasing geopolitical tensions and sanctions pressure, when the resources of private investors are limited, it is necessary to strengthen direct state support for the Arctic territories. The level of public funding for the Russian Arctic, which has been declining in recent years, should be increased several times. Emphasis should be placed on the construction of infrastructure projects that can subsequently be transferred to the use of companies operating in the Far North. This will attract investors to the Arctic, the implementation of projects of which in the current conditions is limited by the impossibility of building related infrastructure (engineering networks, communication lines, etc.). In addition, by creating certain development clusters, the state can help increase the investment attractiveness of the Arctic territories for potential investors who are ready to invest resources not only in projects related to the extraction of oil and gas resources, but also in other industries that are currently, for objective reasons (high costs production, low market capacity, lack of access to facilities) are not of interest to foreign partners.

In the near future, we should expect further withdrawal of Western partners from Russian Arctic megaprojects. At the same time, the success of replacing Western capital by attracting partners from friendly countries will largely depend on the development of relations and agreements with countries such as China, India, Turkey at the state level. The continued risk of secondary sanctions against companies participating in Russian projects, as well as the high level of uncertainty in the Russian markets, could substantially slow down the processes of attracting investment from companies from friendly countries and even lead to their withdrawal from joint projects 24, 25. In this context, in our opinion, it is necessary to pay more attention to the development of investment mechanisms based directly on interstate agreements, in particular, the creation of joint state investment funds (Russia and China have experience in creating such funds). They can be formed on a bilateral or multilateral basis within the established and successfully functioning interethnic structures (BRICS, SCO). The activities of such funds, on the one hand, will attract the necessary investment resources to the Russian Arctic, and on the other hand, will ensure the participation in Arctic projects of countries that are territorially remote from the Arctic Circle, but wish to increase their energy security by developing relations with Russia.

Список литературы Trends and Prospects of Attracting Foreign Investment in Arctic Megaprojects under Geopolitical Tension

- Drozdova I.V., Alievskaya N.V., Belova N.E. Problems and Prospects for the Development of the Arc-tic Zone of the Russian Federation. Lecture Notes in Civil Engineering, 2022, no. 206, pp. 137–143. DOI: 10.1007/978-3-030-99626-0_15

- Krasulina O.Yu. Faktory investitsionnogo klimata Arkticheskoy zony RF [Problems of the Investment Climate of the Arctic Zone]. MIR (Modernizatsiya. Innovatsii. Razvitie) [MIR (Modernization. Innova-tion. Research)], 2015, vol. 6, no. 4, pp. 135–141. DOI: 10.18184/2079-4665.2015.6.4.135.141

- Ryzhova A.V. Investitsionnaya deyatel'nost' v Rossiyskoy Arktike [Investment Activity in the Russian Arctic]. Arktika 2035: aktual'nye voprosy, problemy, resheniya [Arctic 2035: Current Issues, Prob-lems, Solutions], 2020, no. 3 (3), pp. 51–55. DOI: 10.51823/74670_2020_3_51

- Kudryashova E.V., Zarubina L.A., Sivobrova I.A. Cross-Border Investment Cooperation in the Arctic Region: Challenges and Opportunities. Economic and Social Changes: Facts, Trends, Forecast, 2019, vol. 12, no. 1, pp. 39–52. DOI: 10.15838/esc.2019.1.61.2

- Bashina O.E., Matraeva L.V., Alyabeva A.V. Otsenka vliyaniya pryamykh inostrannykh investitsiy na sotsial'no-ekonomicheskoe razvitie regionov Rossii: rezul'taty statistiko-ekonometricheskogo issle-dovaniya [Assessment of the Impact of Foreign Direct Investment on the Socio-Economic Develop-ment of Regions of Russia: Results of Statistical and Econometric Research]. Vestnik Akademii [Academy Bulletin], 2018, no. 3, pp. 14–22.

- Koroleva G.A., Titov A.V. Otsenka vliyaniya inostrannykh investitsiy na sotsial'no-ekonomicheskoe razvitie strany i regiona na primere Yaroslavskoy oblasti [Assessment of the Influence of Foreign In-vestment on Social and Economic Development of the Country and the Region Based on the Exam-ple of the Yaroslavl Region]. Vestnik Voronezhskogo gosudarstvennogo universiteta. Seriya: Ekonomika i upravlenie [Proceedings of Voronezh State University. Series: Economics and Manage-ment], 2022, no. 1, pp. 60–71. DOI: 10.17308/econ.2022.1/3742

- Abdullaev G.S., Chernetsova N.S. Vliyanie pryamykh inostrannykh investitsiy na razvitie regionov Rossii [The Impact of Foreign Direct Investment on the Development of Russian Regions]. Vestnik Penzenskogo gosudarstvennogo universiteta [Vestnik of Penza State University], 2020, no. 2 (30), pp. 31–40.

- Khramchenko A.A., Kuhtinova A.A., Simakova A.A. Razvitie ekonomiki regionov Rossii pod vliyaniem pryamykh inostrannykh investitsiy [Economic Development of Russian Regions under the Influence of Foreign Direct Investment]. Vestnik Akademii znaniy [Bulletin of the Academy of Knowledge], 2021, no. 6 (47), pp. 468–474. DOI: 10.24412/2304-6139-2021-6-468-474

- Olkhovik V.V., Lyutova O.I., Juchnevicius E. Economic Growth Models and FDI in the CIS Countries During the Period of Digitalization. Financial Journal, 2022, vol. 14, no. 2, pp. 73–90. DOI: 10.31107/2075-1990-2022-2-73-90

- Pozdnyakov K.K. Teoreticheskie osnovy mekhanizma privlecheniya inostrannykh investitsiy v regiony RF i obosnovanie ikh prakticheskoy primenimosti: monografiya [The Theoretical Basis of the Mecha-nism of Attraction of Foreign Investments in the Russian Regions and the Rationale for their Practi-cal Applicability]. Raleigh, LuluPress, 2015, 174 p. (In Russ.)

- Abdullina A.R. Inostrannye investitsii kak faktor ekonomicheskoy bezopasnosti Rossii [Impact of the Pandemic on Russia’s Economic Security]. Zdorovye — osnova chelovecheskogo potentsiala: prob-lemy i puti ikh resheniya [Health — the Base of Human Potential: Problems and Ways to Solve Them], 2021, vol. 16, no. 4, pp. 1249–1253.

- Drapkin I.M., Dubinina E.O. Ekonometricheskoe modelirovanie potentsiala regiona po privlecheniyu pryamykh inostrannykh investitsiy [Econometric Modelling of a Regions Potential to Attract Foreign Direct Investments]. Ekonomika regiona [Economy of Regions], 2020, vol. 16, iss. 1, pp. 310–324. DOI: 10.17059/2020-1-23

- Izotov D.A. Postuplenie pryamykh inostrannykh investitsiy v rossiyskie regiony: faktory potentsiala i riska [Inflow of Foreign Direct Investments in Russia's Regions: Potential and Risk Factors]. Ekonomicheskie i sotsial'nye peremeny: fakty, tendentsii, prognoz [Economic and Social Changes: Facts, Trends, Forecast], 2019, vol. 12, no. 2, pp. 56–72. DOI: 10.15838/esc.2019.2.62.3

- Serova N.A., Gutov S.V. Key Trends of the Investment Development in the Arctic Zone of the Russian Federation in 2008–2017. Arktika i Sever [Arctic and North], 2019, no. 34, pp. 77–89. DOI: 10.17238/issn2221-2698.2019.34.77

- Krasnopolski B.H. International Cooperation in the Arctic: New Challenges, Threats and Risks. Spa-tial Economics, 2022, no. 18 (2), pp. 183–191. DOI: 10.14530/SE.2022.2.183-191

- Tulupov D.S. Arctic Dimension of China’s Foreign Policy and Russia’s Regional Interests. World Econ-omy and International Relations, 2020, no. 64 (7), pp. 60–68. DOI: 10.20542/0131-2227-2020-64-7-60-68

- Vopilovskiy S.S. Foreign Economic Partners of Russia in the Arctic Zone. Arktika i Sever [Arctic and North], 2022, no. 46, pp. 29–43. DOI: 10.37482/issn2221-2698.2022.46.33

- Balashov A.M. Impact of Sanctions on Business Development of Oil and Gas Corporations in Russia. Gornaya Promyshlennost [Russian Mining Industry], 2022, no. 3, pp. 74–78. DOI: 10.30686/1609-9192-2022-3-74-78