Types of investment strategy of machine-building enterprises and criteria for their identification

Автор: Romanovich Mikhail A.

Журнал: Вестник Академии права и управления @vestnik-apu

Рубрика: Вопросы экономики и управления

Статья в выпуске: 2 (67), 2022 года.

Бесплатный доступ

The article is devoted to the development of criteria for identifying the investment strategy of machine-building enterprises using the data of financial (accounting) statements. It is proposed to use a combination of three criteria to determine the type of investment strategy, including the share of the cost of modernization in the payments of the organization, the share of the cost of modernization in the value of fixed assets and the share of portfolio investments in the payments of the organization. Depending on the combinations of the values of these criteria, the author has identified seven types of investment strategy of machine-building enterprises. The advantage of the proposed approach is that interested users of external financial information on the activities of enterprises, including potential investors, will be able to independently assess the type of the current investment strategy of the enterprise and the direction of its possible change. The results obtained can be used in the development of programs for the development of investment activities at the regional level.

Type of investment strategy, identification criteria, financial statements, payments for investment transactions

Короткий адрес: https://sciup.org/14124556

IDR: 14124556 | УДК: 330.322.2 | DOI: 10.47629/2074-9201_2022_2_140_147

Текст научной статьи Types of investment strategy of machine-building enterprises and criteria for their identification

I ntroduction. The investment strategy is one of the tools to achieve the overall goal of enterprise development, formulated in the process of strategic management.

Currently, there is no unified classification of investment strategies, as well as a unified classification of the general strategy of an enterprise; various authors have proposed a number of classifications for various reasons [1-8]. The most famous of them do not have a strict gradation, are defined through vague verbal characteristics and are difficult for practical application. In addition, they are considered by the authors without taking into account the industry specifics of manufacturing enterprises, while there are fundamental differences between financial and manufacturing enterprises [9-13]. A separate difficult problemis the selection of criteriafor classifying an investment strategy, since in most selection problems there are quite a lot of criteria for evaluating decision options.

The main purpose of this study is to develop criteria for identifying the investment strategy of machine- building enterprises using financial (accounting) reporting data and determining the type of investment strategy based on these criteria. Research objectives:

• to study the feasibility of using various absolute and relative indicators of the activity of a machine-building enterprise for the purposes of classifying its investment strategy; • to determine the set of indicators calculated on the basis of the accounting (financial) statements of machinebuilding enterprises, and their values, on the basis of which it is possible to identify the type of investment strategy; • to highlight the types of investment strategy of machine-building enterprises, give their characteristics.

Main content of the article. the investment strategy plays animportantrolein ensuring the efficientfunctioning and development of machine-building enterprises. The absence of a developed investment strategy adapted to possible changes in the factors of the external investment environment may lead to thefact that the investment decisions of individual structural units will be multidirectional. This, in turn, will lead to a decrease in the efficiency of the investment activity of the enterprise in particular, and the entire enterprise as a whole [14].

In modern economic conditions, the investment strategy for the development (modernization) of a manufacturing enterprise should be understood as a set of target settings for investment activities and investment decisions that provide the required, or acceptable, level of provision with non-current assets of the enterprise to achieve strategic development goals, taking into account external andinternal conditionsfor the implementation of investment activities, which manifests itself in stable or unstable investment activity [15].

It is known that there are certain values of indicators of financial and economic activities of enterprises, the achievement of which is a necessary condition, the basis for the implementation of investment activities. These include, at a minimum, the availability of own funds or high financial stability and solvency, allowing to attract borrowed funds on a long-term basis. On the other hand, as a result of investment activity, the key characteristics of the activity of an economic entity change, according to which it is possible to draw a conclusion about the type of investment strategy implemented by the enterprise. The task of determining specific financial indicators, which can be criteria for the type of investment strategy at a machine-building enterprise, is quite relevant in modern conditions.

The problem of studying the investment strategy of enterprises using financial analysis according to finan-cial(accounting) statements was considered by various authors [16;17].As classification characteristics of the investment activity of enterprises in the real sector, including the machine-building industry, a number of absolute and relative indicators can theoretically be used, including:

• the absolute value of investment costs; • the ratio of investment costs to fixed assets (according to book value), non-current assets, total assets; • the ratio of investment costs to revenue, net cost, net profit, etc.

However, in order to use the attribute for classifying the type of investment strategy, it is necessary that, on the one hand, it characterizes the quantitative side of investment operations, and, on the other hand, it allows comparing the intensity of these operations for assets of various sizes and volumes of economic activity of enterprises, i.e. should be a relative quantity. The source of information is also important, on the basis of which the classification model of the investment activity of the enterprise is built. Considering that information resources in relation to any enterprise are quite extensive, the effectiveness of management decisions in relation to this enterprise largely depends on the correct choice of the source of information.

The most important standardized, compact and professional source for quickly obtaining retrospective, operational andforecast information about an economic entity is accounting (financial) statements. The advantage of financial reporting is its public availability, i.e. it can be studied both by persons who have unlimited access to the financial information of a particular enterprise, and by persons who are external to the enterprise and therefore significantly limited in satisfying their information requests [18]. With this in mind, in this study, to identify the investment strategy of machine-building enterprises, data from the Statements of Cash Flows, as well as other financial statements (Balance Sheet, Statement of Financial Results, etc.)

The cash flow statement is the main source of information for cash flow analysis and is often preferred when evaluating the financial condition of a commercial organization. Analysis of this report allows you to significantly deepen and correct the conclusions regarding the financial condition of the organization, its future financial potential.

The cash flow statement consists of three main sections that reflect the cash flows received by the enterprise from current, investment and financial operations. Under IAS 7, investing activities are the purchase and sale of non-current assets such as property, plant and equipment and intangible assets, the purchase and sale of subsidiaries, associates or joint ventures, and the purchase and sale of financial assets available for sale or held to maturity (IAS 39“Financial Instruments: Recognition and Measurement”) [19]. Thus, information about the cash flows from investment operations contained in the cash flow statements can be used to identify the investment strategy of enterprises.

In this paper, to classify enterprises by the volume of investment in the process of researching investment activities, it was proposed to use the indicator of the share of investment payments in the total volume of payments by type of investment costs (di). At the same time, all investment payments were assigned by the author to one of two groups:

-

1) costs for the modernization of non-current assets (NCA), which included investment costs in connection with the acquisition, creation, modernization, reconstruction and preparation for the use of non-current assets;

-

2) portfolio investments (PI), which included total costsin connection with the acquisition of shares(stakes) in other organizations, with the acquisition of debt securities, with the provision of loans to other persons, and other payments for investment operations.

In total, these types of payments constitute payments for investment transactions according to the Statement of Cash Flows.

The share of modernization costs and the share of portfolio investment in total payments were defined as d 1 and d 2 , respectively:

,

-

1 р

, 1 р where d1 – share of modernization costs in payments, d2 – share of portfolio investments in payments, NCA – investment costs in connection with the acquisition, creation, modernization, reconstruction and preparationfor the use of non-current assets, PI – portfolio investments, P – the total amount of payments of the enterprise for all types of operations – current, investment, financial.

The main classification feature was the share of costs for the modernization of non-current assets due to the importance of these costs for enterprises in the engineering industry.

In the process of studying the quantitative values of the criteria for the share of investment payments in the total volume of payments by types of investment costs ( d 1 and d 2 ) and their combinations, it turned out that the use of only two indicators to identify the investment strategy of machine-building enterprises is not enough. Due to the fact that the share of fixed assets in the assets of enterprises in the real sector varies greatly, it is necessary to correlate the amount of costs for the modernization of non-current assets with the cost of the fixed assets themselves. For this purpose, the author proposed to use the following clarifying indicator:

, 1 FA where d3 – share of modernization costs in the cost of fixed assets, NCA – investment costs in connection with the acquisition, creation, modernization, reconstruction and preparation for use of non-current assets, FA – the average annual balance sheet value of fixed assets of the enterprise (hereinafter – the value of fixed assets).

To determine the limiting values of the criteria d 1 , d 2 and d 3 , which allow identifying the investment strategy of machine-building enterprises, the activities of Russian enterprises in the relevant industry of the Southern Federal District (SFD) were studied for 10 years (in 20102019). For the analysis of investment activity, a random sample was formed, including 15 enterprises of the machine-building industry of the Southern Federal District. It should be noted that certain difficulties arose in the formation of the sample, due to the fact that many enterprises in this industry in the Southern Federal District ceased to exist in the last 6-7 years for various reasons, mainly due to bankruptcy. Only a few were reorganized by joining other societies.

Most of the enterprises under study are jointstock companies formed during the reorganization in the 90s, or as a result of the merger of such enterprises. Thus, all enterprises have a long history of development, but not all of them are equally successful and carry out active production activities. At the same time, none of them, regardless of the size and scale of their activities, has approved an investment strategy (policy) as a policy document.

The sample included both profitable and unprofitable enterprises with different amounts of assets. The largest enterprises were the following (in descending order of total assets at the end of 2019): PJSC Rostvertol, PJSC TANTK named after G.M. Beriev, F. Among the enterprises with the smallest amount of assets were such as (in ascending order of total assets at the end of 2019): JSC Plant Mekhpromstroy, JSC Elevatormelmash, OJSC AOMZ.

-

5 enterprises out of 15 did not have net losses throughout the entire period under review, namely (in descending order of the absolute size of net profit in 2019): PJSC Rostselmash, PJSC Rostvertol, OJSC Krasnodar Plant Neftemash, OJSC Volgogradskoe Upravleniye Montazhavtomatika, OJSC Aksaikardandetal.

The analysis showed that, depending on the intensity of investment operations, machine-building enterprises can be distinguished:

• with a significant share of investment payments

( d i >10.01 %);

• with a moderate share of investment payments

(5.01%< d i <10.00 %);

• with an insignificant share of investment payments (1.01% < di < 5.00 %); • with a minimum share of investment payments

(0.01% < d i < 1.00 %);

• without investment payments (di =0 %).

Usually, for enterprises in the real sector of the economy as a whole, and machine-building enterprises in particular, payments for current operations prevail in payments. The value of payments for financial activities is often zero, in particular, if the enterprise does not re- sort to external financing. Practice shows that the share of investment payments in the payments of enterprises, as a rule, is small. If it exceeds 10% of all payments, then investment payments are already significant for the enterprise, and we can say that the enterprise is implementing an active investment strategy.

Depending on the amount of investment in the acquisition and modernization of fixed assets, thefollow-ing enterprises are singled out in the work:

• with a significant share of modernization costs in the cost of fixed assets (d3> 20.01 %);

• with a moderate share of modernization costs in the cost of fixed assets (10.01 % < d3 < 20.00 %);

• with an insignificant share of modernization costs in the cost of fixed assets (0.01 %< d3 <10.00 %);

• without investment payments (d3 =0 %).

Thus, to identify the investment strategy of machine-building enterprises, it is proposed to use three criteria:

-

• d 1 – the share of modernization costs in the payments of the organization, which is understood as the ratio of the investment costs of the enterprise in connection with the acquisition, creation, modernization, reconstruction and preparation for the use of non-current assets, to the total payments of the enterprise for current, investment and financial operations, expressed as a percentage;

-

• d 2 – the share of portfolioinvestmentsin the payments of the organization, which is understood as the ratio of the total costs of the enterprise in connection with the acquisition of shares (stakes) in other organizations, with the acquisition of debt securities, with the provision of loans to other persons, and other payments for investment operations, to total payments of the enterprise for current,investment and financial transactions, expressed as a percentage;

-

• d 3 – the share of modernization costs in the cost of fixed assets, which is understood as the ratio of the investment costs of the enterprise in connection with the acquisition, creation, modernization, reconstruction and preparation for the use of non-current assets to the average annual balance sheet value of the enterprise’s fixed assets, expressed as a percentage.

Depending on the ratio of the magnitude of these criteria, taking into account the characteristics of production activities and the obvious priorities of real investments for enterprises in the engineering industry over portfolio ones, it is proposed to distinguish the following types of investment strategy for them:

-

1. Type I – non-investment strategy – there are no costs for modernization, portfolio investments are absent or minimal. In the latter case, portfolio investments are one-time, to some extent “random”, which does not allow us to speak about the presence of any trends in the investment activity of the enterprise.

-

2. Type II – strategy for maintaining production potential – there are insignificant costs for modernization, there may also be portfolio investments (from minimal to moderate). With aninsignificant share of modernization costs in the cost of fixed assets, not exceeding 10 %, it can be argued that such costs actually only compensate for the depreciation of fixed assets, there is no significant renewal of the production base of the enterprise. At the same time, enterprises can carry out moderate portfolio investments.

-

3. Type III – modernization strategy – there are insignificant costs for modernization, which make up a significant share of the cost of fixed assets, there may also be portfolio investments. In this case, the share of modernization costs in the cost of fixed assets exceeds 10 %, however, in the total flow of payments for the enterprise, such costs are not burdensome and account for less than 5 % of all payments. The presence of portfolio investments is not mandatory for this strategy, but they can also be present in a small amount (up to 5 % of all company payments).

-

4. Type IV – strategy of modernization and financial growth – there are insignificant costs for modernization, which make up a significant share of the cost of fixed assets, as well as moderate and significant portfolio investments. If this strategy is implemented, in addition to significant modernization costs, the value of which exceeds 10 % of the cost of fixed assets, but not more than 5 % of the value of all payments of the enterprise, the enterprise makes moderate portfolio investments. This allows the company to receive already significant interest income and finance part of the modernization costs from investment income.

-

5. Type V – development strategy – there are significant costs for modernization, there may also be portfolio investments. In the event that the share of modernization costs in payments exceeds 5 % and they can be characterized as moderate and then significant, the share of these costs in the cost of fixed assets is already significant. Such investments make it possible to significantly upgrade the means of production, commission new machinery and equipment, build industrial infrastructure facilities, and so on. The amount of portfolio investment in the implementation of the development strategy can be both minimal and quite high, but in this case it is a secondary feature.

-

6. Type VI – financially oriented strategy – there are no costsfor modernization, there are portfolio investments (from minimal to moderate). As practice shows, despite the priority of real investments from enterprises in the engineering industry, their investment strategy may not be related to production activities, in which case the enterprise will only bear the costs in connection with the acquisition of shares (participatory interests) in other organizations, with the acquisition of debt securities se-

- curities, with the provision of loans to other persons, etc.

-

7. Type VII – non-production strategy (holding) – there are significant portfolio investments, there may be minimal costs for modernization. This strategy is implemented by enterprises that do not actually carry out production activities, it is concentrated in one or more subsidiaries. Accordingly, with minimal costs for the modernization of fixed assets, their portfolio investments will be significant (more than 10 %), often exceeding the amount of paymentsfor both current and financial transactions.

The values of the considered criteria for various types of investment strategy are presented in Table.

Under the influence of changes in internal and external factors and conditions for the formation of the investment strategy of enterprises, for example, when mobilizing additional investment resources, concluding long-term contracts, including with the possibility of budget financing, changing the strategic goal of in- vestment activity, etc., changes over time and the investment strategy itself, enterprises[20]. Among the changes in the type of investment strategy, positive and negative ones can be distinguished. Changes in the type of strategy can be evaluated positively in the following cases:

• transition from the non-investment strategy to a strategy of any other type;

• transition from the strategy for maintaining production potential to the modernization strategy, to the modernization and financial growth strategy, and to the development strategy; • transition from the modernization strategy to the modernization and financial growth strategy and to the development strategy; • transition from the modernization and financial growth strategy to the development strategy.

In general, taking into account the priorities of the sectoral affiliation of machine-building enterprises, any of the strategies of types II-V, which involve invest-

Table

Classification of the investment strategy types in machine-building enterprises (composed by author)

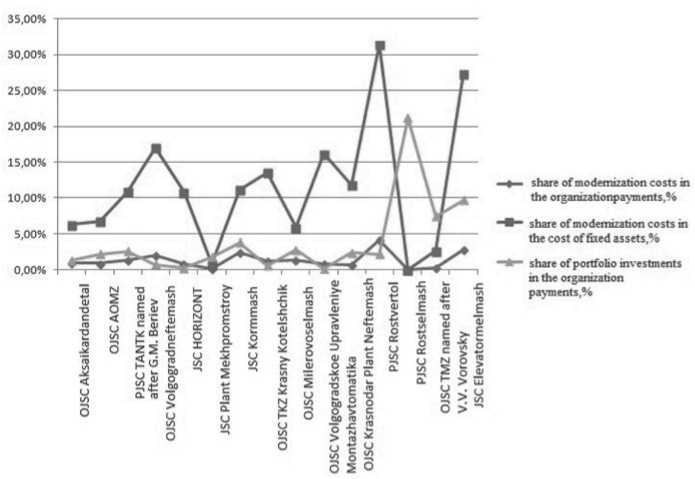

The results of assessing the type of investment strategy for the sample of enterprises under study are shown in Figure 1.

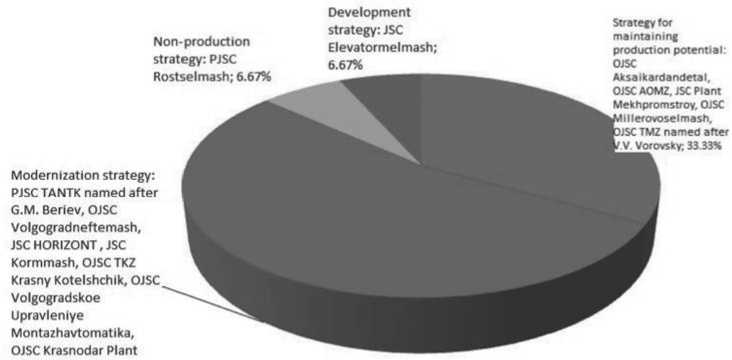

Despite significant fluctuations, in general, over the period, the ratio of modernization costs to the cost of fixed assets in most machine-building enterprises of the Southern Federal District exceeded 10.0 %. Together with other criteria, this made it possible to characterize the investment strategy of most of the machine-building enterprises of the Southern Federal District (namely, 8, or 53.3 % of the enterprises under consideration) as a “modernization strategy” (Figure 2).

-

5 enterprises implemented an investment strategy related to the maintaining production potential type. Only one enterprise had the development strategy, JSC Elevatormelmash. The annual changes in the type of investment strategy for most of the enterprises under consideration were quite significant. In recent years, a number of machine-building enterprises of the Southern Federal District have reduced to zero the costs of modernizing non-current assets, including OJSC TMZ named

Figure. 1. The values of criteria for the investment strategy type in enterprises, on average in 2010-2019

Neftemash, PJSC Rostvertol; 53.33%

Figure 2. Distribution of enterprises by type of investment strategy, on average in 2010-2019

after V.V. Vorovsky in 2015-2019, OJSC AOMZ in 20172019, OJSC Volgograd Upravleniye Montazhavtomatika in 2018-2019, OJSC Plant Mekhpromstroy in 2012-2019. The total volume of these costs for the sample in 2019 was the lowest in the last 8 years.

The financial indicators proposed by the author as criteria for determining the type of investment strategy can be calculated by external users of financial information using annual or quarterly reports, followed by averaging over several years when summing up the initial values. Determining the type of investment strategy in a shorter time interval seems redundant. The investment activity of the company is a rather lengthy process and therefore must be carried out taking into account a certain perspective, which is expressed in the development of an investment strategy, which, in turn, is based on the modern concept of strategic management.

There are no clearly established time intervals for grading investment policy and investment strategy. Thus, regulatory documents at the level of industries, regions, territories often contain an investment policy approved for several years, and at the level of individual enterprises, an investment strategy for the “reporting year” can be discussed. For portfolio investors, the investment strategy can generally change throughout the year. Thus, it can be argued that there are no common terms for the implementation of the investment strategy for all participants in economic activity, even within the same industry.

Conclusion. The use of three relative quantitative criteria to identify the investment strategy of machinebuilding enterprises, two of which characterize the volume and directions of investment, i.e. the investment activity of the enterprise, and the third criterion correlates the amount of costs for the modernization of non-current assets with the cost of the fixed assets themselves, allowed the author to build a classification of investment strategy types. When testing the constructed classification, during the study, it was concluded that most often Russian machine-building enterprises implement not the investment development strategy, but the strategies to maintain production potential and modernization. This allows enterprises to function and make a profit, but reduce their competitiveness.

Список литературы Types of investment strategy of machine-building enterprises and criteria for their identification

- Baranov V.V., Baranova I.V., Zaitsev A.V., Karpova V.B. Investment potential management system as a factor in the effective implementation of the strategy of economic development of a high-tech enterprise. // Bulletin of the Tomsk State University. Economy. 2015. № 3 (31). Р. 5-17.

- Bronchenko V.A. Formation of an investment strategy as one of the factors for the successful functioning of an enterprise. // Economy and society. 2016. № 3 (22). Р. 1768-1772.

- Head V.V., Maksimov D.A., Sergeeva A.N. On some approaches to the innovation and investment policy of the enterprise. // Fundamental research. 2016. № 11-1. Р. 149-153.

- Kozlova L.A., Plotnikova S.N. Classification of strategies for the development of enterprises by the type of investment attractiveness. // Scientific almanac. 2015. № 8 (10). Р. 219-221.

- Kontorichev S.V. The influence of the investment strategy on the composition of the company’s non-current assets. // Bulletin of the St. Petersburg University of Economics and Finance. 2009. № 4. Р. 120-122.

- Pasko S.N. Investment strategy as a promising instrument of financial stability. // Scientific journal of KubSAU. 2013. № 86. Р. 607-620.

- Pronin A.S. Principles, goals and types of financial and investment strategy of a commercial organization. // Materials of the scientific-practical conference “Bakanov readings-2012”: “Actual problems of social and economic development of modern society.” – M .: Publishing house RGTEU, 2012.

- Cheremushkina I.V., Davydova E.Yu., Manilevich N.N. Innovative and investment strategies for managing the crisisstable development of firms. // Bulletin of the Voronezh State University of Engineering Technologies. 2015. № 3 (65). Р. 253-257.

- Stallions V.I., Gusev A.K. The principles of developing an investment strategy for an industrial enterprise. // Bulletin of the National Institute of Business. 2018. № 32. Р. 54-59.

- Karpov P.N. Identification of the type of financial strategy of a commercial organization. // Scientific and technical statements of the St. Petersburg State Polytechnic University. Economic sciences. 2012. № 6 (161). Р. 173-177.

- Ponkratov V.M. Methodology for constructing and applying target functions to assess the investment strategies of an enterprise. // Proceedings of the International Symposium “Reliability and Quality”. 2009. № 2. Р. 326-332.

- Pronnikova V.Yu. Development of an integrated classification system of investment resources of enterprises in order to increase the effectiveness of the strategy of their formation. // Financial research. 2015. № 4 (49). Р. 232-239.

- Rzun I.G., Khlusova O.S., Karitskiy A.A. The relationship between the investment potential and the investment strategy of the enterprise. // Natural and humanitarian research, 2018. № 19. Р. 52-60.

- Niroomand I., Kuzgunkaya O., Asil Bulgak A. Impact of reconfiguration characteristics for capacity investment strategies in manufacturing systems // International Journal of Production Economics. 2012. Volume 139. Issue 1. Р. 288-301.

- Romanovich M.A. Development of criteria for identifying the investment strategy of machine-building enterprises. // Engineering Bulletin of Don. 2015. № 2-1 (35). Р. 53-67.

- Kogdenko V.G., Krasheninnikova M.S. Features of the analysis of fixed assets and financial investments based on new reporting forms (explanations to the balance sheet and profit and loss statement). // International accounting. 2012. № 35 (233). Р. 44-57.

- Astanin D.Yu. Methodology for analyzing the formation and implementation of the investment policy of the enterprise. // Economic analysis: theory and practice. 2009. № 30 (159). Р. 38-48.

- Shulus A., Shulus V. Complex multidimensional approach to the assessment of investments in the form of capital investments // Investments in Russia. 2013. № 2. Р. 3-10.

- Ashaganov A.Yu., Khasieva A.S. Formation of a cash flow statement according to IFRS in comparison with RAS. // Economics and business: theory and practice. 2019. № 10-1 (56). Р. 19-22.

- Demyanova O.V., Fatkullova A.M. Principles and process of forming the investment strategy of the enterprise. // Science: society, economics, law. 2019. № 4. Р. 185-190.