Various approaches to determining the essence and structure of the financial system of the state

Автор: Akhunova Ye.A.

Журнал: Экономика и бизнес: теория и практика @economyandbusiness

Статья в выпуске: 6 (64), 2020 года.

Бесплатный доступ

The article discusses various approaches to the definition of the concept and essence of the financial system of the state, presents the structure of the financial system of the state as a set of financial relations between the state, legal entities and individuals; financial markets, instruments and organizations; the totality of all economic entities and an excess or lack of cash.

Financial system, structure of the financial system, economic entities

Короткий адрес: https://sciup.org/170182844

IDR: 170182844 | DOI: 10.24411/2411-0450-2020-10525

Текст научной статьи Various approaches to determining the essence and structure of the financial system of the state

The state, legal entities and individuals in the course of their activities form various financial relations, the totality of which can be combined with the concept of “financial system”. Let’s consider the various definitions of the term "financial system". First of all, a number of authors describe the financial system as a set of financial relations of various economic entities (fig. 1):

-

1. Polyak G.B. and others propose that the financial system is a set of financial relations, acting in the form of interconnected and interacting categories, links, areas that distribute and use funds of funds of economic entities, households, the state, as well as special financial institutions [1, p. 33].

-

2. Podyablonskaya L.M. supposes the financial system is a combination of various spheres and links of financial relations, characterized by features in the formation, distribution and use of funds of funds, different roles in social reproduction, and the system of state and corporate financial bodies.

-

3. Romanovsky M.V., Vrublevskaya O.V. and others think, the financial system is a combination of financial organizations (institutions) and financial markets that, using var-

- ious financial instruments, ensure the formation and use of funds from the state, organizations and population.

-

4. Neshitoy A.S. and Voskoboinikov Y.M. under the financial system understand the totality of interconnected and interacting areas and links of financial relations, through which the distribution, formation and use of funds of funds. The financial system includes financial institutions serving the money circulation and regulation of financial activities. In the total set of finance that make up the financial system, these academic economists distinguish state and local finances, the finances of enterprises and organizations, insurance, the credit and banking system, and the system of state financial bodies.

-

5. Barulin S.V. believes that the financial system as a category of financial relations management has an object (a managed element of the system) and a subject (a controlling element of the system). The managed object of the financial system is the financial system, which operates on the basis of certain organizational principles.

Fig. 1. The structure of the financial system of the state depending on various economic entities

First approach to the essence and structure of the financial system shows it as a combination of various spheres and elements of financial relations, characterized by features in the formation, distribution and use of money funds.

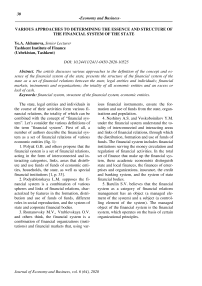

Foreign authors interpret the concept of the financial system from other points of view. In developed economies, the financial system is considered as a superstructure over the finan- cial system of market entities, created to meet their needs for financial resources to ensure their activities with the help of a variety of financial instruments.

According to Zvi Bodi and Robert C. Merton, the financial system includes markets, intermediaries, financial services firms, and other institutions through which households, private companies, and government organizations implement their financial decisions.

Fig. 2. The structure of financial system as a combination of financial markets, financial instruments and financial organizations

R. Goldsmith defines the financial system (using the term financial structure) as a combination of financial instruments, markets and institutions.

In their work, Reinhard H. Schmidt and Marcel Tyrell identify four main approaches to the study of the financial system:

-

1) institutional (institutional approach);

-

2) mediation (intermediation approach), a narrowly targeted version of the mediation approach – monetary (monetary approach);

-

3) functional (functional approach);

-

4) systemic approach.

-

F. Mishkin understands the financial system as a set of financial institutions (banks, financial companies, insurance companies, etc.).

Thus, second approach to the essence and structure of the financial system shows it as a combination of financial markets, financial instruments and financial organizations.

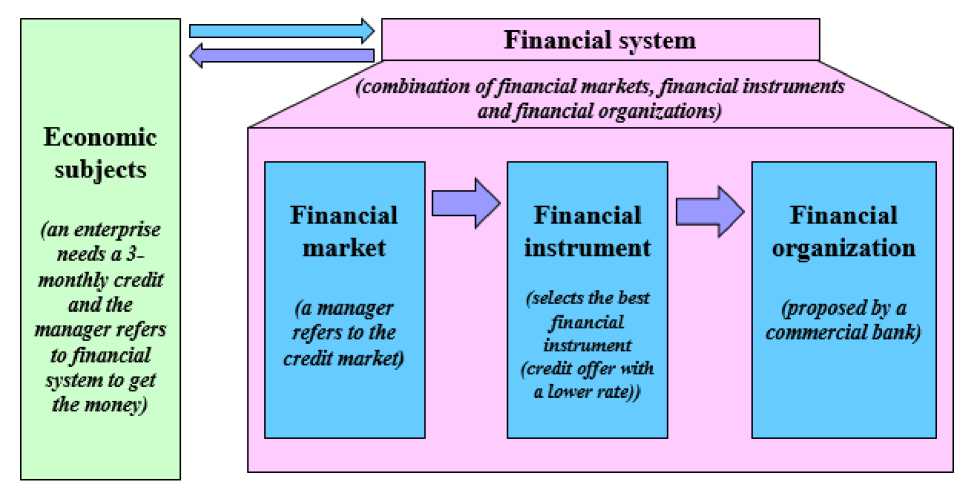

Ermolaev E.A., Zavyalov Yu.S. on the basis of a study of the opinions of foreign authors emphasize that the financial system is the totality of any participants in economic activity with a surplus (creditors) or a deficit of capital (borrowers) between whom financial relations arise related to redistribution financial capital through a targeted movement of exchange value using financial instruments, taking into account the risk / return ratio, through financial institutions (fig. 3).

Fig. 3. The structure of financial system as a totality of any participants in economic activity with a surplus (creditors) or a deficit of money resources (debtors)

Third approach to the essence and structure of the financial system shows it as a totality of any participants in economic activity with a surplus (creditors) or a deficit of money resources (debtors). Market entities are aggregated (entities with a deficit and entities with a cash surplus), on the one hand, and on the other hand. It provides the free movement of entities from one group to another, i.e. enti- ties with a surplus can transform into entities in a certain period with a cash deficit, and vice versa, which corresponds to the reflection of the market mechanism.

This is the description of the main three approaches to the definition of the concept and structure of the financial system of the state.