Влияние безналичной электронной платежной системы на гиперинфляцию в Бангладеш

Автор: Р. Т. Мукта, З. Райхан, О. Фарук

Журнал: Современные инновации, системы и технологии.

Рубрика: Управление, вычислительная техника и информатика

Статья в выпуске: 4 (4), 2024 года.

Бесплатный доступ

Увеличение электронных платежных методов, не связанных с использованием наличной валюты, преобразовало финансовые транзакции. Безналичные операции удобны, просты и быстры, среди прочих преимуществ. Более того, безналичные платежи оказывают влияние на управление валютой в Бангладеш. Практичность безналичных транзакций способствует увеличению скорости обращения денег. В обществе наблюдается снижение объемов наличных платежей, однако скорость обращения валюты значительно возрастает при использовании безналичных операций. Считается, что повышение емкости передачи денег может привести к гиперинфляционным последствиям. Цель данного исследования — выяснить, как безналичный метод оплаты влияет на гиперинфляцию. В исследовании использован аналитический подход и дополнительные данные, собранные с начала 2021 года по конец 2023 года через Бангладешский банк с использованием методов верификации. Методом исследования является множественный линейный регрессионный анализ. Результаты показали, что факторы, связанные с цифровой валютой, испытывают значительное негативное влияние; факторы, связанные с дебетовыми картами, кредитными картами, онлайн-банкингом и мобильным банкингом, имеют значительное положительное влияние; параметры, относящиеся к кредитным картам, оказывают незначительное неблагоприятное воздействие; а переменные, связанные с процентными ставками, имеют важное положительное влияние.

Безналичный расчет, Интернет-платеж, Электронные деньги, Гиперинфляция, Умный банкинг, Электронный банкинг

Короткий адрес: https://sciup.org/14131304

IDR: 14131304 | DOI: 10.47813/2782-2818-2024-4-4-0101-0124

Текст статьи Влияние безналичной электронной платежной системы на гиперинфляцию в Бангладеш

DOI:

The fast growth of technological advances has certainly had a profound influence on people's ways of living. A typical instance being the influence technological developments have upon the economic or financing segments. Innovation as well as financial transactions in terms of time, history and money is getting advanced [1]. The greater the importance of currency in commerce and finance, the less modernized a nation [2]. Bangladesh confronts issues in integrating digital options and actual currency, despite around $40 trillion of cash still in existence worldwide. Although the introduction of internet-based other options, issues related to knowledge of the internet and confidence regarding digital interactions remain, especially with seniors. The Bangladesh Bank is creating Central Bank Digital Currencies (CBDCs), which will marry the advantages of online purchasing alongside the safety and reliability of existing centrally issued money. Considering the beginnings of CBDC deployment in Bangladesh, the opportunity for increased prosperity, a reduction regarding government money, and more safety when weighed against encrypted digital currencies is enormous. Considerations include making sure equal access to CBDCs, mitigating funding issues, and traversing the legal framework. Society have begun to shift farther away from physical cash and toward electronic currency, which includes debit as well as credit card payments, electronic payments, and both internets along with physical e-wallets [3, 4, 5]. The idea is to create an energetic atmosphere that promotes financial integration and allows for frictionless deals, despite the manner. Without Cash activities, including credit and debit Cards, as well as emoney taking the power source type about chips as well as e-wallets, have taken ahead of banknotes. Physical payment issues as well as difficulties especially having to line at a financial institution or ATM for withdrawing money or having restricted financial assistance were causes why several consumers choose alternative payment methods.

The variety of methods for paying is expanding in tandem with technological advancements. Users may utilize an electronic wallet for each purchase. The current research uses a comprehensive digital scientific question approach to understand macroeconomic domains, with the aim of developing and issuing new, interesting indicators based on digital research databases. A high affinity towards cash, alongside shortages of money and limited internet banking facilities, has resulted in a priced framework with large surcharges for online transactions. This counteracts the advantages of mobile banking in underdeveloped nations. Policies from the government could explore lowering retailer adoption fees to promote broad usage of electronic payment mechanisms like debit card payments [6]. The concept of a world without cash developed long prior to discussions on the viability of electronic transactions. Financial infrastructure, shaped according to present and historical narratives, is always altering. These platforms, which use multiple payment methods, are experiencing considerable changes. The transition to the lack of money and various options for currency, checks, and cards are examined, with a focus emphasis the connection underlying payment method invention as well as sociocultural as well as corporate developments [7]. The result is currently a popular worry as well as an intriguing study issue. Regions like Sweden, China, Japan, the Netherlands, Finland, The United States and the United Kingdom have a chance to go cashless within the coming years. The absence of cash would benefit civilization. Without cash, operations, which are becoming increasingly common in the banking industry, have prompted safety issues. These applications, despite providing monetary incentives, are susceptible to assault and hacking. To safeguard the confidentiality and integrity of online money transfers, language proficiency is critical to find and fix possible safety concerns associated with the Digital Agreement While the structure area, which will lay the groundwork to quantify risks through basic safety measures [8]. The change is attributed to increased transparency in finances and lower costs for transactions, non-monetary money can also boost GDP. According to statistics from the Spanish Survey of Household Finances (SSHF), the main factors influencing the usage of credit cards as ways to pay instead of currency included prosperity, age, socioeconomic status, along with training. The research also looks at variability as well as plastic utilization perseverance, as well as the monetary impacts of a society without cash. [9].

BACKGROUND STUDY

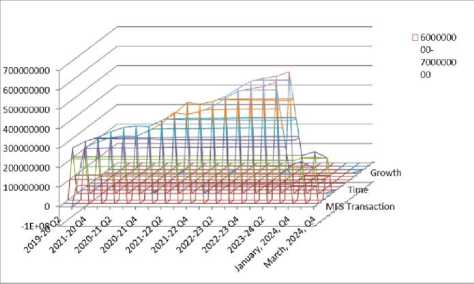

According to statistics given by Bangladesh's central bank between 2014 and 2024, the utilization of digital currency increased in regards to actual (TAKA) as well as the quantity of transactions. These phenomena may be observed in the chart is following. The statistics in the Figure 1, demonstrate shown usage of without physical money ways to pay grew annually between 2019-2024. The growing usage of without physical payment tools suggests the general public is accepting electronic money across all transactions. Electronic money transactions have exhibited reasonable rapidity, with substantial changes between 2019 and 2024. The following phenomena are substantiated by research undertaken. The objective of the next section is to investigate empirically the consequences of digital cash on the volume of dollars in transportation through different kinds of currency, incorporating note of numerous alterations that may have occurred in the banking industry, involving legislative modifications that involve a boost in consumer tax velocity along with the implementation of the financial institution ATM accusations [10]. Where attempted to investigate the basis of domestic demands for cash in Japan based on the adoption of digital payments. The findings indicate that as digital currency becomes more widely used, so does the need for cash. Financial technologies in Canada, including prepaid cards and digital currency cards on your own, are lowering spending on cash. Digital currency plans have grown throughout Asian as a result of rapid technological advancements and younger demographics. The increasing wealthy population as well as urbanization resulted in several e-money systems that outperform traditional debit and credit card transactions. Economies such as India, China, Indonesia, Malaysia, Singapore, and Thailand have experienced substantial development in electronic money transactions, while the People's Republic possesses the fastest mobile popularity internationally. The fast expansion of digital cash initiatives demonstrates the rising relevance of technological innovations in Asia [11]. Digital currency networks are largely utilized for of poor quality with value less than 10 dollars, whereas credit card accounts are mostly preferred towards medium purchases between $10 and $40 [12]. According to de Wet, Eben [13], physical currency will begin to lose significant foothold throughout the following years as digital currency becomes more generally recognized in different services. Advances in technology, especially within the cell-phone industry, may provide additional possibilities to enhance present electronic money payment methods in order to satisfy the demands of customers along with suppliers within the ever more interrelated economy. Electronic payments are more common among individuals. In addition to becoming easier, convenient, and rapid, electronic payments have an additional impact on Indonesian fiscal policy. Electronic payments have an influence on people's spending and their supply of cash. The overall convenience of going paperless results in a quicker flow of currency. The cash ratio being the typical amount about instances annually (also known as turnover) when a single piece of cash gets used when buying all items as well as commodities generated in the economic system [14]. Cash mobility remains excessive, despite the fact that the volume of payments activities cash among the particular local area having declined. Meanwhile, it is believed this enhanced effectiveness of the transfer of cash may result in an innovative consequence: hyperinflation. The presence about monetary without currency will motivate individuals to avoid payments in cash, causing individuals to retain their funds in their savings accounts the greater number of individuals whom maintain savings wealth in what they do. The effects influence the multiplier resulted in a greater amount of public funding within the way of cashless within financial accounts, which impacted capital build-up and required institutions to route those toward society to the power source shape of mortgages. The rules for the lowest legislative reserve level, while the utilization of mortgage rates shall have an influence overall currency laundering's exponential impact as well as the quantity of cash. Discovered extensive financial card acceptance improves trade effectiveness as well as currency mobility. It produces hyperinflation absent economic involvement [15, 16]. Financial sections, technical improvements, and caregivers are critical variables in Bangladesh's prosperity, promoting creativity, the creation of jobs, and wealth production. The investigation, which included, found substantial links across management, mathematical, and family collaboration, expertise, abilities, and financial factors [17]. At this point, we have shown an encouraging and substantial association between digital currency and hyperinflation [18]. Also demonstrate that cashless transactions have a positive and substantial impact on the financial flow. Hyperinflation can enhance the link between transactions that don't involve cash and the currency flow. Within the future, this analysis demonstrates a bilateral indirect link between liquidity and hyperinflation. Consequently, while immediate hyperinflation in Bangladesh may enhance the expansion if its currency availability, it might have a major impact upon the future hyperinflation [1 9]. The primary goal of research is to explore the relationship amongst the amount of cash as well as hyperinflation in Bangladesh employing data collected every month period 2010.05 until 2017.12. Using cooperation and Vertical Correcting Errors Mapping (VCEM) approaches, the research indicates that the currency flow has little impact on hyperinflation during the near term, while the reverse could be valid [20].

Study findings, the bank card volume of transactions, debit payment value, or electronic money worth of transactions all have a favorable effect on cashless transaction in Bangladesh. At this point, replacing cash with cashless indicates that the significance and worth of ATM/Debit payments have a favorable impact on M2. Irving Fisher's quantitative idea about currency describes how the cash flow affects the purchasing power of currency (hyperinflation). According to Fisher, hyperinflation arises due to a combination of the currency supplies, cash development, and fiscal policy [21, 22]. The following serves as the fundamental concept of investigating the cash communication flow of a currency flow. According to Keynes' concept, the curiosity ratio determines what individuals choose regarding spending levels. The mortgage rate, or BI Speed, constitutes a single of the tools employed by the banking system to affect hyperinflation via currency supplied. There is the community's inclination to invest as prices improve with the prospect on earning a larger profit [23]. Potential lack of research given this investigation may be observed because various prior investigations attempted to investigate the reasons of hyperinflation by employing transactional devices alongside a few payments, either entirely or substantially. Additionally, in this research, researchers sought to ascertain through integrating every one of payment gadgets, incorporating digital currencies, debit or credit cards, loan inflation, as among controls. According to legislation, Bangladesh Bank is mandated to reach and preserve the security of its TAKA worth. The security that applies to the TAKA in issue refers to that currency's worth in relation to products as operations. The primary component involves the overall evolution of inflationary rates along with the worth of currencies country' banknotes. Minimal along with steady hyperinflation constitutes a sign of long-term financial prosperity, benefiting the society. Excessive along with unregulated hyperinflation could have a negative influence on everyone's psychosocial situation; hence hyperinflation management is critical [24]. According to the earlier explanation, the purpose of these investigations seeks to assess the influence of this paperless currency system on hyperinflation. Digital currency, prepaid cards, along with charge cards serve provides digital transaction proxy in this research [25].

RESEARCH METHODS

The study adopted a statistical strategy, which is a politicized technique since it is founded on the positivist concept. This research will utilize the kind of information, specifically additional information. The information resources used for this investigation have been collected using documenting procedures. The proper information underlying this probe is additional information gathered by various associated individuals. Bangladesh Bank as well as Finance Authority operated during July 2014 until March 2024. The research's methodology is simultaneous regressive evaluation.

The mathematical formulation is probabilistic. The basic probabilistic expression structure is a mathematical system which involves errors and confusing factors alongside both distinct as well as contingent factors. Below is the mathematical strategy:

Υ = β 0+ β 1 Χ 1+ β 2X2+ β 3X3+ β 4X4+ ∈

In this equation, Y represents the cost of living, X1 represents digital currency, X2 represents debit cards, X3 represents credit cards, X4 represents BI rates, β0 represents stable, β1234 represents the correlation factor, and e : represents variance.

The standard hypothesis verification is a prerequisite for predictive models utilizing the ordinary least squares (OLS) estimate methodology. The traditional expectation to assumptions consists of multiple phases, such as: This test determines if the information provided follows a usual versus atypical transportation, allowing for proper statistical choice. A result of the collinearity is a situation where the predictors in a regression model are linearly dependent test determines if the predictor strategy has a strong or ideal relationship among standalone parameters [26]. The self-correlation test compares the oversight in sight to additional mistakes.

Self-correlation may take place in longitudinal data, although generally becomes more prevalent in longitudinal data. Within time-series information, hysteresis indicates a relationship among mistakes in a specific time frame along with a different [27, 28].

This test determines if there exists an imbalance within the variation between the remaining variables of one data point and a different in the outcome of the regression analysis. Whenever the disagreement between compliances differs, this is referred to as variability [29]. The test of hypotheses is a subset of inductive statistics which seeks to mathematically evaluate the validity or an idea in order to derive inferences. Its objective is to provide a foundation and gather numerous pieces of evidence along with information that may be utilized to decide whether to embrace the reality of any claims or premises produced. The idea verification requires multiple phases, including a portion of the regression evaluation (t-test), a coincident continuity testing (F-test), as a value of correlation (R2).

ANALYSIS AND RESULTS

Basic Hypothesis Testing

The traditional assumptions for analysis are a type of statistical analysis that ensures that the technique of ordinary least squares (OLS) is used throughout one analysis of regression to obtain the optimum estimate. This evaluation uses the Best Longitudinal Unfiltered Estimation (BLUE), which show indicate the recovery using regression cannot be troublesome.

E-Money transactions

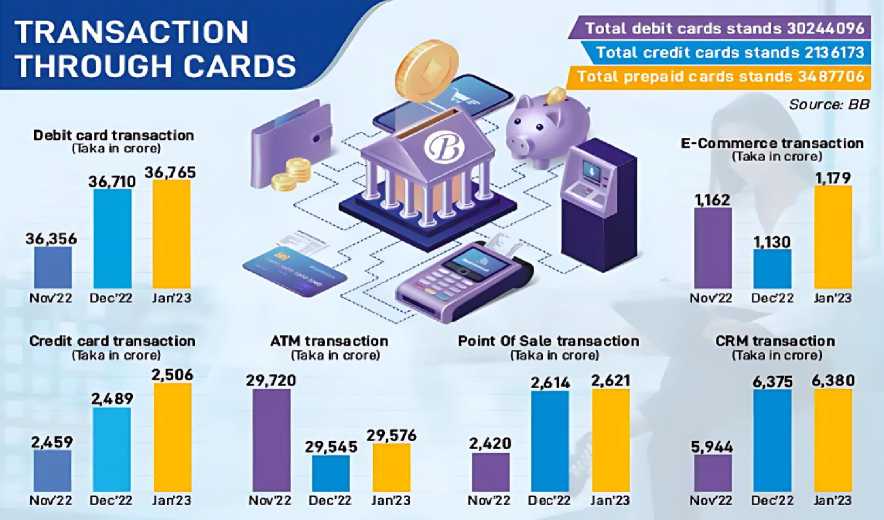

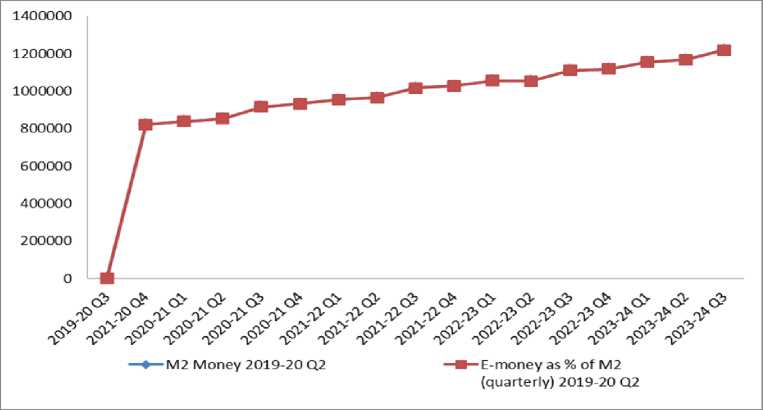

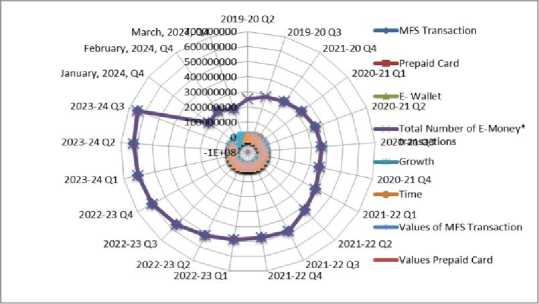

Electronic money refers to digital currency provided by banks or non-bank businesses to MFS accounts, prepaid credit cards, including e-wallets in exchange for legal cash deposits. The use of electronic money makes it easier for persons who are not banking or have restricted utilization of savings accounts to send money, make commerce settlements, pay bills, and so on while transporting actual currencies, shown in Figure 1. During the last few years, electronic money transactions have increased, propelling the financial system nearer a cash-lite culture. Total percentage of E-money as percentage of Broad money overview analysis has been shown in Figure 2.

Figure 1. Transection through cards scenario

Table 1. Trends of E-money as percentage of Broad money

|

Time |

M2 Money |

E-money as % of M2 (quarterly) |

|

2021-20 Q4 |

821473.1 |

5.1 |

|

2020-21 Q1 |

838114.2 |

5.27 |

|

2020-21 Q2 |

853185 |

6.06 |

|

2020-21 Q3 |

916378 |

6.54 |

|

2020-21 Q4 |

931523 |

6.19 |

|

2021-22 Q1 |

954054 |

6.92 |

|

2021-22 Q2 |

964822 |

7.54 |

|

2021-22 Q3 |

1016077 |

8.01 |

|

2021-22 Q4 |

1028700 |

7.54 |

|

2022-23 Q1 |

1056009 |

7.95 |

|

2022-23 Q2 |

1054113 |

8.57 |

|

2022-23 Q3 |

1109981 |

8.78 |

|

2022-23 Q4 |

1118895 |

8.55 |

|

2023-24 Q1 |

1155361 |

8.34 |

|

2023-24 Q2 |

1168579 |

8.65 |

|

2023-24 Q3 |

1219612 |

8.96 |

Figure 2. E-money as percentage of Broad money

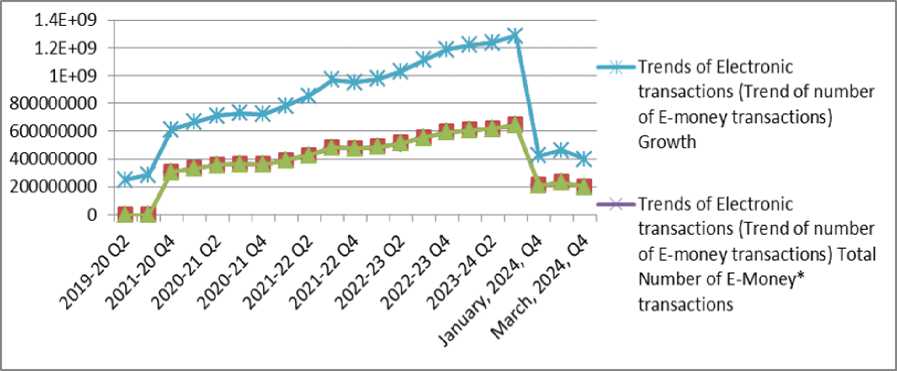

Following its inception in 2011, mobile financial services (MFS) are increasing rapidly in Bangladesh. By October 2023, the amount will be 21.77 crore. In December 2024, the amount among authorized subscribers is 32.04 million, up 0.21% since the same year in 2024. A great deal about activities using electronic payments has also expanded dramatically. The typical daily volume of transactions was Tk 4018 crore, as opposed to Tk 3989 crore in November 2023. Online payments served an important role in fostering prosperity throughout Bangladesh. Yet, the ownership has fallen during recent times, using 53% of individuals having registers alongside the banks or mobile wallets by 2021 [30]. In December 2023, there were 17.2 lakh licensees and an altogether transaction amount of 55.09 crore. Figure 3, displays the growth analysis, whereas Figure 4, depicts the overall transection growth and analysis. Table 1 shows the trends of e-money as a percentage of broad money.

Table 2. Trend of number of E-money transactions

|

Time |

MFS Transaction |

Prepaid Card |

E Wallet |

Total Number of E Money* transactions |

Growth |

|

2020-21 Q1 |

333140300 |

152878 |

333293178 |

8.78 |

|

|

2020-21 Q2 |

356375381 |

167235 |

356542616 |

6.98 |

|

|

2020-21 Q3 |

364233458 |

176262 |

364409720 |

2.21 |

|

|

2020-21 Q4 |

360841179 |

178628 |

361019807 |

-0.93 |

|

|

2021-22 Q1 |

391791882 |

203309 |

391995191 |

8.58 |

|

|

2021-22 Q2 |

425646038 |

217473 |

425863511 |

8.64 |

|

|

2021-22 Q3 |

485060452 |

244268 |

485304720 |

13.96 |

|

|

2021-22 Q4 |

475671093 |

290190 |

475961283 |

-1.93 |

Современные инновации, системы и технологии // Modern Innovations, Systems and Technologies l/cci © 1 2024; 4(4)

|

2022-23 Q1 |

489263297 |

273357 |

489536654 |

2.85 |

|

|

2022-23 Q2 |

514365948 |

320765 |

514686713 |

5.14 |

|

|

2022-23 Q3 |

556497802 |

345990 |

556843792 |

8.19 |

|

|

2022-23 Q4 |

593776915 |

418224 |

594195139 |

6.71 |

|

|

2023-24 Q1 |

608105822 |

490903 |

608596725 |

2.42 |

|

|

2023-24 Q2 |

618462422 |

555333 |

87043 |

619104798 |

1.73 |

|

2023-24 Q3 |

642256571 |

739516 |

95116 |

643091203 |

3.87 |

|

January, 2024, Q4 |

211345500 |

210456 |

33868 |

211589824 |

1.2 |

|

February, 2024, Q4 |

231379578 |

251567 |

35359 |

231666504 |

9.49 |

|

March, 2024, Q4 |

199531493 |

277493 |

25889 |

199834875 |

-13.74 |

Figure 3. Trends of E-transactions growth

The research gathers weekly information on deposits, withdrawals, P2P, B2P, P2B, business reimbursement, and government settlement, including remittance activities completed using mobile banking apps. Table 2 shows the method (B-A) to obtain the yearly shift in cash beyond the financial institution as a consequence of MFS payments. Cash beyond the bank acts as a significant economic statistic since it reflects tangible wealth in an individual's coins, whose mainly goes on products and offerings. Should a lot of coinage enter people's wallets as a consequence of MFS interactions, they are more likely to spend additional funds on goods and services, perhaps leading to an increase in overall prices.

In contrast, if money without the institution drops primarily a result of MFS operations, consumers possess a smaller amount in the purses, forcing consumers to put lesser currency on things and services, thereby which could lower the rate of inflation. It computes various tight and wide cash factors as well as assesses the fluctuation within currencies within of the financial institution mainly a result of MFS exchanges. Basic annual fluctuations in specific and broad cash due to app activities are calculated following the procedures in Tables 2 and 3. The yearly magnitude of these movements may be estimated using the methods in Table 3 to establish the annual shifts in currencies that transcend banks' narrower capital as well as the wide finance caused by wireless payments across the country over the course of the academic year. The real hyperinflation depends on the number of transactions, the amount, and the category of amount; the whole potential analysis is illustrated in figures 5, 6, and 7.

Table 3. Trend of value of E-money transactions

|

Time |

Values of MFS Transaction |

Values Prepaid Card |

Values of E-wallet |

Total Value of E-money* |

Growth |

|

2020-21 Q1 |

44082 |

98.51 |

44180 |

5.51 |

|

|

2020-21 Q2 |

51556 |

105.08 |

51661 |

16.93 |

|

|

2020-21 Q3 |

59842 |

114.91 |

59957 |

16.06 |

|

|

2020-21 Q4 |

57454 |

247.03 |

57701 |

-3.76 |

|

|

2021-22 Q1 |

65840 |

140.09 |

65980 |

14.35 |

|

|

2021-22 Q2 |

72580 |

143.36 |

72723 |

10.22 |

|

|

2021-22 Q3 |

81202 |

153.79 |

81356 |

11.87 |

|

|

2021-22 Q4 |

77102 |

413.07 |

77515 |

-4.72 |

|

|

2022-23 Q1 |

83779 |

160.91 |

83940 |

8.29 |

|

|

2022-23 Q2 |

90180 |

195.41 |

90376 |

7.67 |

|

|

2022-23 Q3 |

97234 |

214.04 |

97448 |

7.83 |

|

|

2022-23 Q4 |

95365 |

280.06 |

95645 |

-1.85 |

|

|

2023-24 Q1 |

96107 |

257.79 |

96364 |

0.75 |

|

|

2023-24 Q2 |

100817 |

306.02 |

16.89 |

101140 |

4.96 |

|

2023-24 Q3 |

108920 |

368.04 |

33.66 |

109322 |

8.09 |

|

Jan, 2024, Q4 |

34976 |

106.11 |

10.91 |

35093 |

1.2 |

|

Feb, 2024, Q4 |

42236 |

145.46 |

12.74 |

42394 |

20.81 |

|

Mar, 2024, Q4 |

31708 |

116.47 |

10.01 |

31834 |

-24.91 |

Payments in cash throughout Bangladesh have expanded dramatically as a result of financial expansion and conventional illegal activities, which include fraud, graft, deception, drug selling, extortion today, sexual abuse, hundi, and slavery. According to Bangladesh Bank of International Cooperation (BFIU) authorities, cash transfers and withdrawals of Tk 10 lakh or larger are made in a few or many activities throughout just one day in bankers along with NBFIs. In the nation of Bangladesh, hyperinflation was lingering at above 9% throughout several months now, with the use of cash staying popular since a huge proportion of individuals living in rural areas along the periphery favor currency over digital payment systems [31].

Authorities have made attempts to prevent transactions in cash as well as promote the establishment of a monetary environment, yet the use of money has gone up as the marketplace has expanded. The biggest number of transactions in cash occurred in Dhaka division (57%), next to Chattogram division (16%). Sylhet and Barishal divisions apiece represented 2%, with the least at 2%. Overseas violence is now a major problem, with border areas serving as incubators for narcotics along with human slavery, as well as the illegal transportation of items and minor guns. The BFIU proposes that the government and Bangladesh Bank work together to avoid payments in cash, along with limiting the danger of money laundering. Appropriate steps can be adopted to reduce the significant number of transfers using corporate user accounts, as well as to improve supervision to reduce financial transactions in borders. Last season, about 80% of financial transactions were processed using corporate user accounts, with the remainder handled through personal accounts.

Figure 5. Total number and Value of E-

Figure 6. Maximum Number and Value of E-

money transactions analysis

money transactions analysis

Figure 7. Total of E-money broad transactions analysis

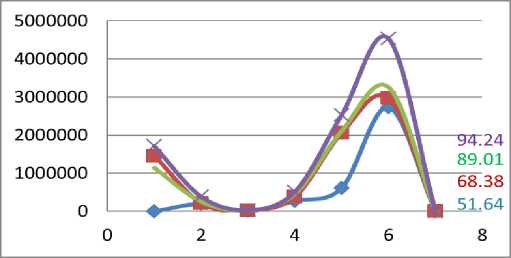

Correlation between Electronic Transactions and GDP

According to Table 4, electronic transactions as a percentage of GDP have grown by 18.24% during FY 2020-21 to about 94.01% in FY 2022-23 as a result of the implementation of the RTGS system in the nation. Because RTGS is a high-value settlement, the quantity exerts a substantial impact on the rate calculation, shown in Figure 13. If we remove the worth of RTGS, we can observe overall digital transactions in Bangladesh have progressively expanded over the years. The increased use of electronic currency payments reflects Bangladesh's steady transition onto a digitized monetary system.

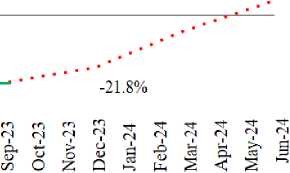

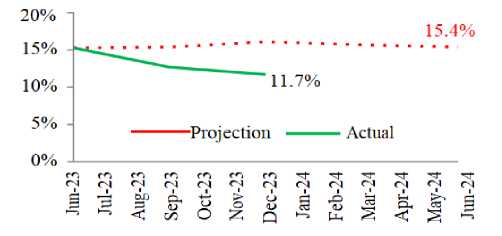

Figure 8. Twelve Month Average CPI Inflation Figure 9. Reserve Money (RM) Growth

20% -

10% -

0% -■

-10% -

-20% -.

-30% -

Figure 10. Broad Money (M2) Growth

"Projection Actual

' 4.7%

Figure 11. Net Foreign Assets (NFA) Growth

-

Figure 12. Domestic Credit Growth

Bangladesh Bank is putting in place an intermediate structure to keep hyperinflation under control along with enhancing ineffective lending. Considering persistent hurdles, the nation's financial prognosis continues favorable, with a 6.5% forecast for actual GDP expansion and 7.5% hyperinflation. Banks, governance, through investors, need to enhance business ethics and NPL control [32, 33]. Nationwide industrial production, an essential part of GDP, increased by 15.29% between July and September in fiscal year 24, indicated in table 4.

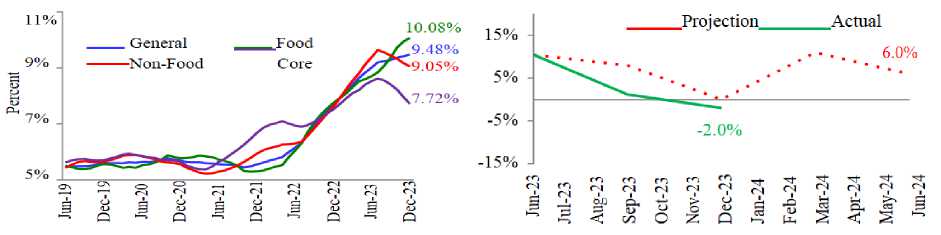

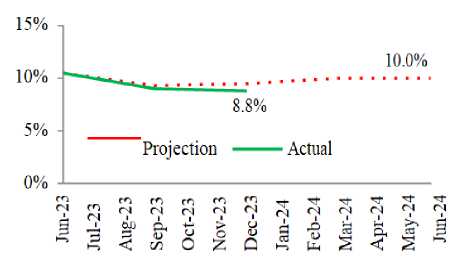

On the other hand, the IMF's International Financial Forecast anticipates that worldwide gross domestic product will decrease from 3.5% in 2022 to 3.0% in 2023, then to 2.9% in 2024. The rate of increase in GDP in wealthy nations is projected to slow, following an increasing pace in the United States but signaling a weaker-than-expected development in the Eurozone. Rising economies and emerging economic growth are likely to decelerate somewhat, owing particularly to China's prolonged property crisis. But in the region of South Asia, both Bangladesh and India are expected to sustain GDP growth rates of more than 6.0% in 2023 and 2024, respectively [34]. The analysis of Broad Money, Twelve Month Average CPI Inflation, Reserve Money (RM) Growth, Net Foreign Assets (NFA) Growth, Domestic Credit Growth shown in Figure 8, Figure 9, Figure 10, Figure 11, Figure 12.

Bangladesh's economy has grown at an exceptional rate, with real GDP increasing by 6.94% in FY21 and 7.10% in FY22. This increase is the result of strong domestic and worldwide consumer demand, which is bolstered by growth-friendly financial and monetary policies, as illustrated in Table 5. The aftermath of the pandemic witnessed great growth in the manufacturing as well as business industries, although farming contributed significant gains through increasing production. Nevertheless, expansion slowed somewhat to 6.11 percent in FY23 due to national costs surpassing wage inflation and continued currency impact on the Bangladesh Taka (BDT) [35].

Figure 13. Total Value of GDP overview

Lower-than-expected projections of development for major trading nations and emigration people, among them India, the Middle East, as well as the Eurozone, point to future concerns. The nation's economy, on the other hand, expects to benefit from solid consumer spending, stable improvement in Ready-Made Garments exports, and sustained infusions of contributions through wage earners, all of which will help to boost GDP [36]. Expectations indicate that economies will continue to develop at a solid rate of roughly 6.5% in FY24, backed by predictions from both domestic and foreign organizations, as well as Bangladesh Bank's internal evaluations, shown in table 6.

Table 4. Overview of Global Economic Growth as of October 2023 WEO (YoY % change)

|

Region |

Expansion Reality |

Estimate |

Changes with the April 2023 WEO estimate |

|||

|

2021 |

2022 |

2023 |

2024 |

2023 |

2024 |

|

|

Global |

6.3 |

3.5 |

3.0 |

2.9 |

0.2 |

-0.1 |

|

United States of America |

5.9 |

2.1 |

2.1 |

1.5 |

0.5 |

0.4 |

|

Euro-Area |

5.6 |

3.3 |

0.7 |

1.2 |

-0.1 |

-0.2 |

|

China |

8.4 |

3.0 |

5.0 |

4.2 |

-0.2 |

-0.3 |

|

Indonesia |

3.7 |

5.3 |

5.0 |

5.0 |

0.0 |

-0.1 |

|

Vietnam |

2.6 |

8.0 |

4.7 |

5.8 |

-1.1 |

-1.1 |

|

Bangladesh |

6.9 |

7.1 |

6.0 |

6.0 |

0.5 |

-0.5 |

*Total Value in Crore BDT. GDP Source: Bangladesh Bank (2024). Nominal GDP in local currency units. E-Money includes MFS, Prepaid Card and PSP transactions only.

Table 5. Global Inflation as of October 2023 WEO

|

Region |

Reality |

Estimate |

Changes with the April 2023 WEO estimate |

|||

|

2023 |

2024 |

|||||

|

2021 |

2022 |

2023 |

2024 |

|||

|

Global |

4.7 |

8.7 |

6.9 |

5.8 |

-0.1 |

0.9 |

|

Expanded Financial markets |

3.1 |

7.3 |

4.6 |

3.0 |

-0.1 |

0.4 |

|

New markets and growing countries |

5.9 |

9.8 |

8.5 |

7.8 |

-0.1 |

1.3 |

*Total Value in Crore BDT. GDP Source: Bangladesh Bank (2024). Nominal GDP in local currency units. E-Money includes MFS, Prepaid Card and PSP transactions only.

Table 6. Total Value of GDP Source

|

Time |

RTGS |

BEFTN |

NPSB |

E-Money |

Value of total ET |

GDP |

ET % of GDP |

|

2019-20 |

196247 |

12399 |

273499 |

616,145.23 |

2,732,863.70 |

94.24 |

|

|

2020-21 |

1459424 |

212103 |

18212 |

377760 |

2,057,498.62 |

2,975,815.40 |

89.01 |

|

2021-22 |

1143288 |

255022 |

22030 |

457573 |

2,108,914.21 |

3,250,500.00 |

68.38 |

|

2022-23 |

1716373 |

387909 |

30237 |

515533 |

2,538,052.58 |

4,536,200.00 |

51.64 |

*ET=Electronic Transaction

DISCUSSION

A Connection Between electronic money and Hyperinflation

Electronic money represents a community-wide method of payment that may be used through a smartphone app as well as a debit or credit card. When conducting an activity using electronic money, the consumer must first load funds onto their debit card or app. Recharge purchases tend to be completed via Mobile Banking, tellers, or ATMs. In addition, every single electronic money transfer has the potential to affect hyperinflation. As the number of people using electronic money to make purchases grows, the amount of currency in existence will rise, causing hyperinflation.

To utilize electronic money during exchanges, consumers must first complete a card as well as electronic money request employing topping upward. Therefore, a Recharge transaction will have an impact upon the financial flow. The purchase involves the conversion transferring currencies between monetary to non-monetary [37]. The development of various electronic money should be going to render things more feasible for the central bank to manage the amount of cash using a variety of mechanisms or policy designed to combat hyperinflation. This study, corroborated [38], found that electronic money effects hyperinflation throughout the immediate and future. The findings of show digital currency will add to the currency inventory, resulting in hyperinflation.

Impact of Debit/ATM Cards on Inflationary Pressure Accessibility

A connection between Bank Cards and Hyperinflation

A payment card represents a type of item that your accessibility in financial services. In light of the present situation, more individuals are beginning to utilize bank cards in everyday activities. Yet the majority of Bangladeshi prefers to utilize debit/ATM credit cards due to the convenience and other criteria. In this investigation, credit cards had no major adverse impacts. It is understandable when bank cards continue to cost less than debit/ATM wallets. The majority of Asians utilize debit/ATM wallets due to their convenience of usage.

A bank sets restrictions to debit card users, allowing it to regulate the funds inflow. This allows the financial sector to regulate the cash flow while simultaneously attempting to keep hyperinflation under check. Aside from the fact that the curiosity expenditure associated with credit card customers incur has an impact on society as a whole, therefore they avoid using their cards frequently. The results above confirmed studies, and they show that extensive utilization of credit cards gives advantages, increases currency acceleration, ultimately causes hyperinflation. Also states that card payments do not have a substantial impact on higher prices. Furthermore, analysis shows how debit card purchases have a favorable effect on hyperinflation.

Bank Rate's Correlation towards Growth

Hyperinflation rates being some among the implements underlying financial regulation within the country, and fluctuations from the BB Ratio might lead to potential hyperinflation. Hyperinflation may affect both the demand as well as the supply. These were outside Bangladesh Bank's management; thus, this reasoning may be adopted to support the BB Rate because the benchmark rate for Bangladeshi banknotes depending on how it impacts on inflationary pressures. In addition, the association between the pattern of hyperinflation and the rate of return is viewed as previous increases in inflation affecting how much inflation is happening now or present hyperinflation influencing interest rates to come. Considering transferring of fluctuations in adjustments, rates, it's completely understandable that previous hyperinflation will impact predictions regarding subsequent higher prices, hence influencing how much of variation in the present BB rate. Excessive rates of return are going to be unappealing for financial players and consumers if hyperinflation expands as well as remains excessive. This circumstance will have an influence on capital acceptance, leading the economy to slow marginally. Furthermore, insufficient credit uptake through the property industry may create chances for additional liquidity within banks, wherein independent investment develops but is not taken in through the overall market. Hence, it is critical to maintain hyperinflation consistent and moderate. Minimal along with constant price hikes will provide possibilities to boost the loan intake by means of reduced charges. Considering such circumstances, good credit reception is expected to prove successful, resulting in increased commercial development. The investigation was backed, who described how rates of interest influence hyperinflation. Here found comparable findings, indicating that rates of interest have a considerable impact on inflationary trends.

CONCLUSION

According to the evaluation as well as findings of study conducted on "The Effects on the Without Cash Transaction Method upon Rising costs," these findings emerged: On the present investigation, the power source electronic-money parameter possessed an enormous unfavorable effect upon the rate of hyperinflation contingent, the payment card factor experienced a major beneficial effect regarding the total growth variable, the credit card variable had a significant negative influence with known as prices factor, and the BB velocity attribute possessed a noteworthy beneficial effect on the power source an upsurge fluctuating. A society without currency may appear inevitable, as the proliferation of debit cards and digital wallets simplifies daily life and encourages increased consumption. This transition affects everyone; while individuals may occasionally find themselves in cashless situations, the longterm benefits are likely to outweigh any drawbacks. Although there is no definitive timeline for the complete transition to a cashless society, various indicators suggest that this shift may occur sooner than anticipated.

In the current cash-intensive environment, companies specializing in cash flow management can assist businesses in navigating financial complexities. It is essential to incorporate innovative ideas into strategic planning and to follow up with additional resources that can help organizations adapt effectively. Embracing a cashless future could lead to greater efficiency and convenience in financial transactions, ultimately promoting a more streamlined economic landscape.