A Research on Operating Performance of Small and Medium-Sized S&T Enterprises—— Based On A Survey towards Zhejiang Province,China

Автор: ZHU Meng Jin, CAI Lei

Журнал: International Journal of Education and Management Engineering(IJEME) @ijeme

Статья в выпуске: 5 vol.1, 2011 года.

Бесплатный доступ

This paper researches into the influential factor affecting operating performance of small and medium-sized S&T Enterprises. It is found that the years of operating and the scale of net assets both have a positive effect on the performance, while registered capital has a negative effect. Though the category of industry doesn't exhibit a clear influence on the performance, different ways of financing do affect the performance considerably.

S&T enterprises, operating performance, influential factors, optimal-scaling

Короткий адрес: https://sciup.org/15013621

IDR: 15013621

Текст научной статьи A Research on Operating Performance of Small and Medium-Sized S&T Enterprises—— Based On A Survey towards Zhejiang Province,China

1.Literature Review

* Corresponding author.

Optimal-Scaling is the method to build the linear regression equation for categorical data. In most cases, it is really difficult to define a starting point for categorical data, neither to define the gap among all kinds of categories. Optimal-Scaling can automatically translate classified variables into numeric variables. It will obtain an optimized conversion variable of linear regression equation by using Optimal-Scaling

The 4 high-tech business incubators in Zhejiang Province are defined as the sources of samples’ enterprises. In this research, 90 questionnaires have been provided, and 74 questionnaires were taken back. Most of data obtained from investigation is not numeric but classified variable data, thus this paper would build the performance model by using Optimal-Scaling method. The research would be divided into two parts:

-

A. Influential Factors Towards Performance

According to the characteristics of incubated enterprises, hypothesis would be pointed out:

-

H1: The longer the enterprise has existed, the better the performance. Because it would not be allowed to stay in incubator for long term if the performance of enterprise is not good.

-

H2: The greater the registered capital, the better the performance will be.

-

H3: There is a positive correlation between performance and the change of the net assets scale. The reason is: according to models of Teal [2], enterprise’s strategy is a major factor to influence the performance.

-

H4: The industry background of the enterprise will influence its performance.

According to above hypothesizes, the model would be built as following:

JX = в о + в Х 1 + в 2 X 2 + в з Х з + в 4 X 4 + Ц (1)

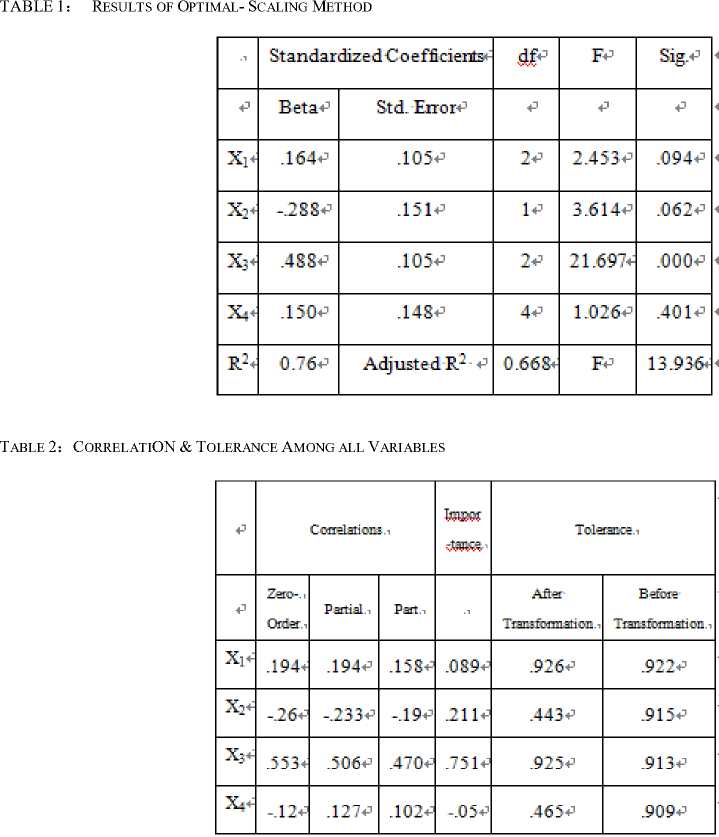

Thereinto, JX is performance, X 1 are years from established, X 2 is registered capital, X 3 is change of net assets, and X 4 is subordinate industry. The results would be output as follows from SPSS by using Optimal-Scaling method.

According to TABLE 1, R2 =0.76, F=13.936, it shows that the model has the feature of significant as a whole. Furthermore, it could be obtained that there are two results which conform to the above hypothesizes. Both of X 1 and X 3 has a positive correlation with enterprise’s performance. At the same time, according to TABLE 2, there are high index about influence and tolerance of X 3 . It means X 3 is important to the model, and the proportion which can’t be explained by the other variables is large.

According to the results from Optimal-Scaling method, X 2 has a negative influence towards the operating performance. That is to say, the bigger the registered capital is, the lower the performance obtains. Perhaps it is concerned with the characteristics of medium-sized S&T enterprises. At the beginning of founding, abundant

financial resources are not the biggest advantage for most medium-sized S&T enterprises. The important advantage is the patent or the research results. That is why enterprises want to enter incubates. Due to enterprises have both strong capital and research results; they can face to market directly instead of entering incubator. In addition, the high-tech development road is not appropriate for those enterprises which only have abundant financial resources, but lack of research productivity.

X 4 doesn't have remarkable influences on operating performance. That means there is no outstanding influence of the traditional industry competition towards the medium-sized S&T enterprises. Their products and services both have the significant advantages from high-tech and innovation, although they belong to different industries.

B Influence of Financing Method Towards Performance

The reason for the High-tech new venture enterprises enter incubators is that the incubators would provide some kinds of resources. The most important resource is convenient to solve the problem of financing. Incubated enterprises obtain financial support from government and bank loan, also it is easy to declare the scientific research project than non-incubated enterprises. Will that resources bring important influences to enterprise’s performance? According to enterprise’s evaluation in the questionnaires, it can be found out the rate of dependence towards different financing methods. The rate would be marked as in five degrees: 1 is very unimportant, 5 is very important, in sequence, 2,3,and 4 are on the borderline between 1 and 5. Due to each variable is categorical variable, the Optimal-Scaling method still would be adopted, and the model would be as following:

JX = в 0 + в 1 Z 1 + в 2 Z 2 + в Z 3 +......+ в . Z 7 + Ц (2)

JX is ‘management performance, Z 1 is ‘self-accumulating’, Z 2 is ‘bank loan’, and Z 3 is ‘borrow from relatives and friends’, Z 4 is ‘non-government investment’, Z 5 is ‘venture capital’, Z 6 is ‘financial allocation’, Z 7 is ‘non-government lending’. The results would be output by SPSS as following:

T ABLE 3 : R ESULTS OF O PTIMAL - S CALING M ETHOD

|

Standardized Coefficients*3 |

F*3 |

Sig.*3 |

|||

|

р |

Bett |

Std. Error*3 |

4-1 |

4-1 |

|

|

Zi^ |

-.281 3 |

.12S*3 |

2*3 |

4.83O*3 |

.013 |

|

z2^ |

.-35 |

172*3 |

3*3 |

6.3S7*3 |

.001 ’ |

|

Z^ |

403*3 |

14b3 |

3*3 |

8.117*3 |

ООО*3 |

|

4 |

-504*3 |

.158*3 |

4*3 |

10113*3 |

.ООО*3 |

|

Z5*3 |

-791*3 |

173*3 |

3-P |

20.S56*3 |

ООО*3 |

|

4^ |

.533 |

136*3 |

2*3 |

15.37D*3 |

ООО*3 |

|

z? |

.370*3 |

129*3 |

l*3 |

S.22S |

.ООО*3 |

|

R2 |

0.525*3 |

Adjusted R2*3 |

0.436*2 |

Sig |

.007*3 |

According to results of Table3, financing methods can be classified into four categories as Table4. Table4 describes the influences of different financing methods toward enterprises’ performance.

TABLE 4: Influences of Different Financing Methods

|

Influences on । Performance п |

Highly Dependaicy & widely Used .1 |

Low Dependency , & Not Widely Used , |

|

Signific-ant Positive Influence * |

И ям к T. п яп . । .Financial АПосЛюп. |

Non-Government Lending. Borrow From Relatives л |

|

Significant П«И&ЗЙавк«85®' |

Self-Accumulating * |

Non-Gcvemmani Investment. Venture Capital * |

The method which is low degree dependency and not widely applied reflects potential relativity. For those preferable enterprises, favorable-earnings’ forecast is prompting them to accept high interest rate, such as non-public financing, borrowing from friends and relatives. Favorable-earnings’ forecast is also the reason for the enterprise willing to take on the risk of the debt of gratitude to their friends or relatives. Hence, the enterprises must have the favorable management performance once they would choose these two methods.

It prefers venture capital method and non-government investment method for the poor management performance enterprises. First, if adopt these two methods, the enterprises don't need to bear the pressure of repayment, due to they don't need to pay off the principal. Second, those poor performance enterprises are really difficult to apply the bank loan or the financial allocation. So they have to select these two methods. Third, comparing with those outstanding enterprises, the poor performance enterprises would not worry about the dividend-outflowing.

3.Conclusions

Through the analysis above, the following inferences can be got about enterprises in incubators:

-

• There is an outstanding positive influence of enterprises’ existing length on management performance. The longer the enterprises are incubated, the better the management performance of enterprises would be gained.

-

• The enterprises’ industries aren’t the important factor which influences management performance. There doesn't exist significant differences of performance among different industries’ new high-tech corporations.

-

• There is a negative influence of the initial registered capital scale towards enterprises’ performance. Certainly, the registered capital is really important for the common enterprises. However, the samples of this research are all high-tech enterprises which are in incubators, the development of these enterprises are much more depending on scientific and technical factors than on capital

-

• The developmental tendency of net assets makes an important positive influence on management performance. If the enterprises used the expansion strategy, basically, those enterprises would have a preferable performance.

-

• Three high degree dependency financing methods bring different kinds of influences towards the enterprises’ performance. If the enterprises unduly rely on the endogenous method of self-accumulating, it would lead to a negative influence on performance. On the other side, the method of bank loan and financial allocation are both bring the positive influences on improving performance.

-

• There are three financing methods which are not widely used. On the one hand, the methods of non-government lending and borrowing from friends or relatives are both suitable for those enterprises that have good management performance. On the other hand, non-government investment and venture capital are popular methods for those poor performance enterprises.

ACKNOWLEDGMENT

The paper is supported by Outsourcing Service Base of Ningbo Institute of Technology, Ningbo, China

Список литературы A Research on Operating Performance of Small and Medium-Sized S&T Enterprises—— Based On A Survey towards Zhejiang Province,China

- Sandberg.W.1984.The determinants of new venture performance: strategy, industry structure, and entrepreneur .Doctoral dissertation. University of Georgia

- Teal.E.1998.The determinants of new venture success: Strategy, industry structure, and the founding entrepreneurial team. Doctoral dissertation, University of Georgia

- Linqiang. A Research on High-tech Business Incubation Mechanism Based on the Determinants of New Venture Performance[D]. Ph. D. Thesis. Tsinghua University.2003:60-62.(In CHINA)

- Eisenhardt KM, Schoonhoven C B. Organizational growth: Linking founding team, strategy, environment and growth among U. S. semiconductor ventures, 1978—1988 [J]. Administrative Science Quarterly, 1990, 35:504-529.

- Tianli, Xuehongzhi. A Relationship between Previous Experiences and Commitment of Entrepreneurial Team & the Performance of New Technology Enterprises [J] Research and Development Management, 2009, 21(4):1-9. (In CHINA)

- Guyang. A Relationship between Technology Human Capital and the Performance of SME [J] Science & Technology. Management search, 2008, 7:338-340. .