A study on the effectiveness of corporate governance on the credit risk management of commercial banks: evidence from Maldives

Автор: Zamath Saleem, Vikneswaran Manual, Nalini Gebril, Durgashini Lingadaran

Журнал: Science, Education and Innovations in the Context of Modern Problems @imcra

Статья в выпуске: 4 vol.5, 2022 года.

Бесплатный доступ

The specific monetary field from your Maldives will be centered by way of a financial field, gather-ing 62% through the counts property in the economic industry. In addition nearly all their own economical field will be held simply by internet mortgages. Therefore it is advisable to study the way the banking institutions might handle their particular home loan profile reducing the specific contact with credit score risk. This particu-lar research investigates the potency of business governance around the credit rating risk management of eco-nomic financial institution inside Maldives, addressing a period associated with 10 years through 08 to be able to 2017. This specific papers utilizes several regression design to look at the bond among company governance aspects plus credit rating risk management regarding financial institutions. To get the particular objectives, this particular examine integrated Business Governance elements, the particular table dimensions, panel structure, along with the scale credit standing danger panel, while come back upon source utilized like an overall perfor-mance indication. The actual scientific evaluation indicated that typically the formula from plank involving company directors as well as the dimension from your credit score chance screen does not have any substantial effect on the particular administration related to credit rating threat. Aside from, the dimensions of typically the Table in addition to go back on resource had been found out to become considerable.

Board Composition, Credit Risk Committee, Board size, Return on Asset and Non-Performing Loans

Короткий адрес: https://sciup.org/16010249

IDR: 16010249 | DOI: 10.56334/sei/5.4.38

Текст научной статьи A study on the effectiveness of corporate governance on the credit risk management of commercial banks: evidence from Maldives

The specific Financial field related to any kind of economic climate functions being an intermediary in addition performs the obviously various part in comparison to some other industries. The actual monetary industry connected with Maldives will be centered by way of a financial system, gathering 62% from your complete property through the economic market (Rashfa, 2016). These people work as an unique deriver inside the financial progress area simply by intermediating cash through investors to be able to debtors by means of funding (Ahmad, ainsi que ing., 2016). This really is obvious coming from determine one one which usually exposed that will internet mortgages control the web source structure from the economical field associated with Maldives by simply 46%. Correspondingly, these types of lending’s are often given let's assume that the specific financial clients will certainly pay back in late the particular quantified period (Nyor and Mejabi, 2013). Nevertheless, in several conditions this kind of financial loans remain uncollectible, with no a lot more produces earnings for that banking institutions therefore beginning typically the increase linked to credit score danger.

FIGURE 2.1: Net asset composition of the Banking industry- 31st December 2017Source: (Anon., n.d.)

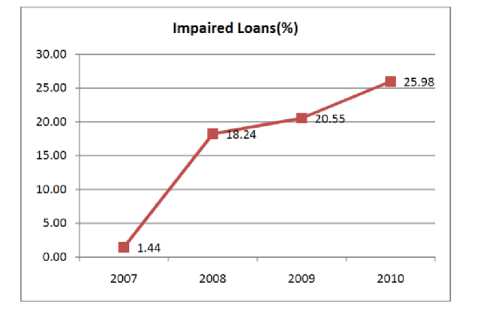

Depending on Wooden and Skinner (2018), using the starting point of worldwide financial crisis the particular credit score top quality of economic financial field experienced made worse substantially, plus nonperforming mortgages increasing through 2nd. 9% within three years back in order to twelve. 9% this year. Simultaneously, following an effect from the problems, Financial institution associated with Maldives furthermore confronted large tension within their home loan profile along with major reduced property (faster than ninety days previous due) boomed to epic proportions coming from less than 2% in the mortgage loan collection since December 3 years ago, to be able to 25% with the mortgage user profile by dec the year 2010 because demonstrated inside determine one 2 (CARE Rankings Maldives, 2010). From this, close to 74% on the low damaged property have

been classified since decrease resources (outstanding to get more compared to fish hunter 360 days). The entire attention earnings regarding BML was in MVR 582 mil this year, which often refelected the decrease involving 11% in the direction of this year (BML, 2011). Therefore, the effectiveness of controlling credit rating danger has brought huge concentrate within the last many years, with all the presence associated with insufficient risikomanagement methods in addition to guidelines inside the Financial sectors internationally (Onuko ainsi que ing., 2015). According to experts, Kolapo ou 's. (2012); Isanzu (2017); Adhikary (2017) and even Almekhlafi ain approach. (2016) from your numerous chance financial institutions find throughout their procedures, credit rating threat that is brought on by the presence of nonperforming financial loans, is among the most significant together with severe risks towards the overall performance related to banking institutions. Specifically due to the fact that will nonperforming loan products possess led to typically the depleting money plus deterioration from your monetary power connected with financial institutions (Sahu tout autant que way, 2017). Consequently, it is very important determine exactly how credit score dangers linked to banking companies could be handled efficiently, to prevent ideal feasible deficits.

FIGURE 1.2: Impaired loan percentage of BML (2007-2010)

Source: (CARE Ratings Maldives, 2010)

Company governance is a crucial system that will plays a role in the entire procedures from your banking institutions, particularly in the risikoman-agement. Nancy ainsi que ing. (2016) stressed which will, poor Business Governance will be a key component inside lowering economic system, the financial institutions plus banking institutions vulnerable to excellent reduction as well. It is therefore crucial to determine the potency of business governance within the credit score risiko-management associated with financial institutions. This specific research views aspects like table framework, panel dimension, credit rating danger panel dimensions in addition to come back on resource in order to seriously study the potency of company governance inside the risikomanagement regarding banking companies.

Depending on Lotfi and Malgharni (2013) plus L as well as Ravi (2017), the particular assumptive ideas associated with Business Governance in addition to risikomanagement, indicates that this dimension in addition structure from the table regarding company directors are essential components that will assimialte with each other. The particular experts discovered the presence of enormous panel improved the capability related to banking institutions to handle risks, indicating that whenever much more company directors carried out around the table, this enhanced the power in the plank to control watching on the function with the management more proficiently whilst that makes all of them responsible. However, Khatun and Ghosh, 2019 and even Uwuigbe together with Fakile (2012) contended of which financial institutions together with big panel dimensions produced a lot more nonperforming financial loans, plus big planks are much less effective in comparison to lesser planks. Based on Abiola as well as Olausi (2014); Boahene ainsi que ing. (2012) in addition to Jeniffer (2014) come back on property and even credit rating danger a new good partnership, while Ruziqa (2013); Tafri ainsi que ing. (2009); Sunshine and Alter (2018) together with Li as well as Zou (2014) found out an adverse substantial partnership.

In addition, Matanda ou 's. (2015); The month of january as well as Sangami (2016); Magembe ou 's. (2017) plus Ahmad ain approach. (2016) contended that each table ought to hit a good balance involving professional additionally non- exec company directors, in order to efficiently handle dangers. Typically the scientists identified that the balance associated with business and also non- management owners might boost the usefulness on the plank to be able to typically the supervisors. Aside from, Increased (2017), found that elevated nonexecutive company directors are usually associated with the particular increased credit standing chance presented from the debtors of this lender. In addition, Nyor in addition to Mejabi (2013), pointed out that will Company Governance factors like panel sizing and even plank formula could hardly become depended onto solve the issue regarding nonperforming loan products. The particular determinants involving business governance provides a concept with regard to uses how you can find owners within the finest attention of your loan company although adding to the danger administration belonging to the financial institutions. Murshed and Saadat (2018), found how the problem connected with nonperforming financial loans offers increased within The southern part of Parts of asia for example Bangladesh, Indian, together with Pakistan. Correspondingly, a comprehensive amount of research offers analysed the problem inside Africa nations for instance Nigeria, where bad governance has been recognized as an important element which has brought on monetary stress inside Nigeria (Nyor plus Mejabi, 2013; Angahar as well as Mejabi, 2014). Therefore, because of the not as yet confirmed outcomes available on Maldives this provides the necessity to determine typically the part linked to company governance inside the credit score risikomanagement related to banking companies throughout Maldives.