Accounting of multiplier effect as a required element in assessing the effects of social programs

Автор: Lavrikova Yuliya Georgievna, Suvorova Arina Valerevna, Kotlyarova Svetlana Nikolaevna

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Branch-wise economy

Статья в выпуске: 6 (42) т.8, 2015 года.

Бесплатный доступ

The article substantiates the importance of taking into account indirect effects of the programs, projects, activities (mainly social) when deciding on the need to implement them. The problem of providing society with decent living conditions is studied. The article proves that in spite of some positive trends in the Russian construction market the issues of housing availability do not lose their significance. It notes that a variety of approaches to solving this problem have been developed, that is why it is critical to assess the effectiveness of each solution in order to choose the most suitable one. One of the tools for alleviating this problem - a program of housing construction savings - is discussed in detail; by means of the specially designed universal computational model we determine fiscal effectiveness of this program application in the Sverdlovsk Oblast. The analysis shows that the accounting of multiplier effect reveals the full range of possible effects of the program that can significantly affect the adoption of the decision to initiate actions necessary for their implementation.

Assessment, social programs, multiplier effect, living conditions, housing capacity, budgetary efficiency, housing construction savings

Короткий адрес: https://sciup.org/147223777

IDR: 147223777 | УДК: 330.44:332.821 | DOI: 10.15838/esc/2015.6.42.7

Текст научной статьи Accounting of multiplier effect as a required element in assessing the effects of social programs

The provision of the population with worthy living conditions represents one of the most important factors in the development of contemporary society: high-quality and comfortable housing, access to all necessary amenities and developed infrastructure are indicators of the population’s material wellbeing, characterizing a degree of satisfaction of some basic social needs and defining its properties as a economic development resource.

However, one should take into consideration that the problem to ensure a comfortable living environment that best meets the society’s interests can not be solved with the application of slight effort and in a short time – it is characterized by complexity, multidimensional nature and requires a joint action of different actors (authorities, business structures, population), involvement of significant amounts of means (not only financial) and constant activity in the field of the existing system transformation (the living environment should be modifid in accordance with changing needs of the population; the creation of new elements is also dictated by the need to replace worn components). In the modern conditions of growing political instability and increasing risks of termination (significant lowering of intensity) of economic relations with a number of foreign partners, many problems (including of social nature) worsen, although attention to them (especially on the part of authorities) is abated due to the emergence of new serious threats to the development of the national socio-economic complex and its individual parts.

Thus, at present the urgency to solve the problem of providing the society with decent living conditions is not diminished, however, it is important to find the ways to alleviate this problem, characterized by maximum performance, but requiring the use of significant resources. In this regard, it is necessary to carefully assess the effects achieved due to the conducted measures: consideration of only direct impacts does not often allow us to make an adequate conclusion about the validity of subject’s implementation of the planned activity. As for socially valuable programs and projects (including, measures aimed at improving living conditions of the society), the measurement of indirect effects is particularly significant: the results are often difficult to quantify; however, the consideration of indirect effects helps evaluate the whole range of changes and identify, for example, how socially-oriented measures promote growth of economic potential of the system.

To illustrate the thesis about the significance of discussing all effects when characterizing the importance of measures (including addressing social problems) we should apply to the practice of estimating the effectiveness of measures aimed at raising the degree of satisfaction with living conditions.

* * *

The problem to increase the degree of satisfaction with living conditions is complex. To alleviate its urgency, it is advisable to carry out a significant number of tasks (meet people’s needs in housing, enhance quality of infrastructure facilities, render services for their repair and reconstruction timely, etc.), requiring their own sets of measures (although, obviously, the results of their use can influence the solution of other problems). Thus, we should consider one of the systemic problem aspects, identifying the implications of measures aimed at changing the situation in this sphere. In particular, the insufficient provision of citizens with housing can be one of the obstacles to increasing the degree of satisfaction with living conditions.

In recent years the situation with housing construction in Russia been has changing for the better, as evidenced by the data describing the parameters of commissioning of residential real estate. According to the Ministry of Construction, Housing and Utilities of the Russian Federation, in 2014 the value of this indicator amounted to 81 million m2, almost by 15% higher than in 2013. Besides, the parameters of housing commissioning exceed the value of the 2014 target stipulated by the program “Provision of citizens of the Russian Federation with affordable and comfortable housing and communal services” (71 million m2) [5].

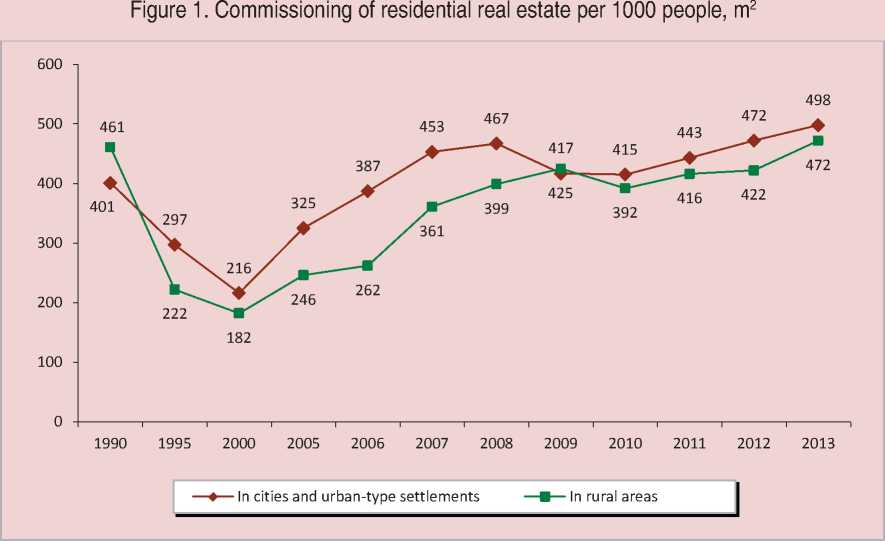

The analysis of the dynamics of residential real estate commissioning, expressed using a relative indicator (m2 per 1 thousand people) also testifies stable growth in this indicator ( fig. 1 ).

The intensification of construction activity has a positive impact on the supply of housing: the value of total area of residential premises per person has steadily increased ( tab. 1 ). However, the value of this index is still quite far from the global indicators: in accordance with the UN standards, one person should have no less than 30 square meters of housing area; however, in the largest European cities on average a person possesses about 30–40 m2 of housing area, in the USA – 70 m2 [2].

Moreover, the characteristics of some residential premises do not correspond to conventional ideas about quality housing. So, the wear rate of 37.5% of the units exceeds 31%, the share of housing with wear of more than 70% amounts to 1% of the total housing stock [6]. Although at first glance the proportion of old and dilapidated housing stock does not seem significant in the total area of all housing

Source: Stroitel’stvo v Rossii. 2014: stat. sb. [ Construction in Russia. 2014: Statistics Digest]. Rosstat [Federal State Statistics Service of the Russian Federation]. Moscow, 2014, p. 53.

Table 1. Total area of residential real estate per person (at the year end), total (m2)

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Total area of residential premises per person (at the year end) – total, m2 20.8 21.0 21.4 21.8 22.2 22.6 23.0 23.4 23.4 23.7 of it: in urban areas 20.4 20.7 21.1 21.4 21.8 22.1 22.5 22.9 22.9 23.3 in rural areas 21.9 22.0 22.5 22.9 23.4 24.0 24.5 24.8 24.7 25.0 Source: Osnovnye pokazateli zhilishchnykh uslovii naseleniya: ofitsial’nyi sait Federal’noi sluzhby gosudarstvennoi statistiki [Main Indicators of Housing Conditions of the Population: Official Web-Site of the Federal State Statistics Service]. Available at: ru/wps/wcm/connect/rosstat_main/rosstat/ru/statistics/population/housing/# stock (in 2013 the value of this indicator was 2.8% [10]), there is no gradual displacement of housing with a high level of deterioration: the volumes of new housing do not exceed volumes of dilapidated and hazardous housing stock (fig. 2).

The low level of housing affordability is another serious problem. To assess this parameter we use a special coefficient – a housing affordability index, which shows how many years it takes a family to save up to buy an apartment using the entire amount of

Figure 2. Old and dilapidated housing stock, million m2

— ♦ — Dilapidated and emergency housing fund

— ■ — Commissioning oftotal residential area

—*— Disposal on decay and breakdown rate

Source: Stroitel’stvo v Rossii. 2014: stat. sb. [ Construction in Russia. 2014: Statistics Digest]. Rosstat [Federal State Statistics Service of the Russian Federation]. Moscow, 2014, p. 55.

received income for these purposes. Its value depends on the variables, such as average cost of one square unit, area of housing, average per capita family income, number of persons in the family [13, c. 336]. Housing is considered affordable if the value of this coefficient calculated for a family of three people interested in the purchase of a standard apartment with the area of 54 sq. m., is equal to 3 (i.e. for 3 years a family can save up and buy an apartment, not spending available means; in practice this means that it takes the average family about 10 years to buy an apartment, provided it uses about one third of income for this purpose). If the coefficient is equal to 3–4 years, the accommodation is considered

“not very affordable”, to 4–5 years – “acquisition of an apartment is seriously complicated”, and above 5 years – “housing is essentially unavailable”. The average ratio in Russia is 3.9 years, in Central Russia – 4.6, the Northwestern Federal District – 4.5, the Southern Federal District – 3.9, the North Caucasian Federal District – 2.9, the Volga Federal District – 3.3, the Ural Federal District – 2.9, the Siberian Federal District – 3.6, the Far East Federal District – 3.5. [2]

Thus, despite the revival of the Russian construction market, the annual increase in commissioned areas and the issues of housing are still relevant. However, we should take into account that due to the high social significance of this problem, the authorities are very interested in it, and the housing policy conducted in the country is a matter of high priority in the system of state regulation.

The issues of meeting the population’s needs in housing are widespread not only in the practice of management subjects of various levels (federal, regional, local), but also in the scientific literature. In particular, the specifics of real estate economics were studied by foreign researchers, such as J. Friedman, J. Daniell, G.S. Harrisson, J.D. Fisher and domestic experts, such as S.V. Ananskikh, L.V. Dolgova, N.Yu. Bogomolova, E.I. Tarasevich, S.A. Vaksman, N.B. Kosareva, R.Z. El’darov and others.

When addressing this problem, both the theorists and practitioners propose a wide range of mechanisms and tools to facilitate its solution. They suggest conducting the activities aimed at attracting funds for construction projects implementation (giving a real estate developer the right to obtain a preferential loan, issuance of securities, for example, housing bonds, formation of real estate funds – construction, development, etc.) that will help reduce construction costs and make housing more affordable for end users; material support of the population (provision of mortgage loans at a reduced rate, development of social housing, financing of some costs of consumers, etc.); provision of the conditions for the real estate market development. It is obvious that the use of any mechanism mentioned above requires the authorities’ active participation. Although their participation is not always is of financial nature (e.g. organizational assistance to the project), more often the implementation of activities in the framework of housing policy implies the involvement of quite substantial amounts of budgetary funds. In this regard, when selecting the most appropriate tool to influence the housing market the authorities consider a number of aspects:

– first, the socio-economic effect from conducted measures (it involves comparison of the results obtained and the costs incurred on the part of those entities that were somehow involved in the implementation process – developers, consumers, banking organizations). Its consideration is important due to the fact that the government’s key target is socio-economic development of the management object – a territorial complex and its elements;

– second, budgetary effect (it takes into account effects the budget has due to the implemented measures). Its calculation is reasonable due to the fact that if the budgetary expenditures incurred in the process of program or project realization exceed the revenues, the budget will lack funds and compensate them at the expense of other directions (for example, by reducing funding for other activities) that will have a negative impact on the parameters of socio-economic development of the territorial complex.

The calculation of socio-economic effects is associated with certain methodological difficulties: it is necessary to consider both material and non-material consequences, the measures will have for every participant

(expressed as a quality characteristic or in measurable quantities). In turn, the calculation of the budgetary effect, at first glance, is a fairly simple task: it is necessary to estimate the volume of all budgetary funds, required for the conducted measures, calculate how the changes will affect the economic system (mainly the tax base), how much additional funds the budget will receive in the end. Meanwhile, the process to identify the scale of the budgetary effect also involves a number of difficulties: only the assessment of direct consequences of the implemented actions is not adequate and can not be used to decide whether it is necessary to implement a program (project) or not.

To justify this conclusion, we will consider the draft program aimed at improving housing affordability for the population, estimating the effect that its implementation will have for the budget, subsidizing funds for its realization, and describing how the forecast value of budget revenue can vary when calculating all indirect results.

As mentioned earlier, the problem of housing affordability is very acute in the Russian Federation. It determines the authorities’ constant interest in it. However, particular attention is paid to housing policy, focused on supporting the most vulnerable low-income citizens, i.e. those subjects, who can not improve their living conditions themselves. The proportion of households registered as in need of accommodation is quite large (as of 1 January 2013, the indicator value in the Russian Federation accounted for 5% of the total number of families [3]).

The program of housing construction savings (“Housing Construction Savings Bank”) is one of the programs currently implemented in several Russian regions (Krasnodar Krai, the Republic of Bashkortostan) in order to reduce this indicator. It is aimed at increasing the level of people’s provision with affordable housing and it requires natural persons’ involvement in target accumulation of funds for future mortgage lending at a preferential interest rate (with part of the funds accumulated in a bank account being subsidized from the regional budget). In particular, the main objectives of this program in the Republic of Bashkortostan, where it has been implemented since the beginning of 2014, are the following: development and support of targeted housing savings to promote housing loans and boost housing construction; attraction of alternative sources to finance housing construction; ensuring mortgage lending availability for low-and middleincome families [8]. Thus, the realization of the housing savings program is focused primarily on supporting families that have low income and are not ready to engage in the process of saving money to improve their housing conditions in normal conditions (although within a year after the launch of the program in the Republic of Bashkortostan, anybody who wanted to could take part in it).

The interest in the mechanism of housing construction savings banks on the part of those willing to buy an apartment (about 6 thousand people participated in the program in Bashkortostan [9]) and the revitalization of construction companies, forecasting growth in demand for housing, have encouraged other regions to consider the possibilities of implementing similar programs on their territories.

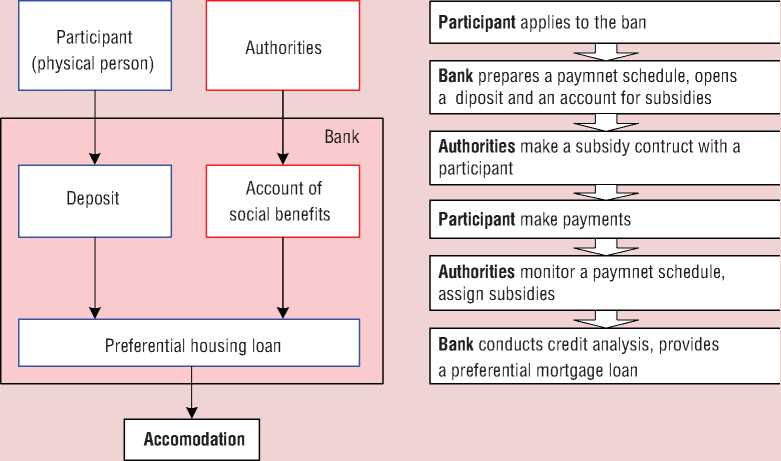

So, the Sverdlovsk Oblast, where the issues of providing families with housing are also relevant (the proportion of families registered as in need of residential premises amounts to 4.5% of their total number [3]), is currently evaluating the prospects to apply the tool of housing construction savings, similar to that used in the Republic of Bashkortostan. The following scheme is supposed to be implemented (fig. 3): a participant (natural person) opens a savings account at a bank, monthly refilling his/her account in accordance with the agreement with the bank; subsidies from the budget also arrive in the savings account every month (in the amount of 30% of the sum placed by the participant, but not more than 3 thousand rubles); the bank, in turn, raises the amount according to the values of basic parameters of the deposit (the deposit rate is 1–2% per annum). It is planned that this stage of funds accumulation will last 3–5 years on average, then the accumulated amount will be used to make an initial mortgage payment. The remaining funds (in the amount not exceeding the sum of an initial mortgage payment) will be assigned

Figure 3. General scheme of participation in the program of housing construction savings “Housing Construction Savings Bank”

Compiled by: Programma “Stroitel’nye sberegatel’nye kassy”: Tsentr investitsii i stroitel’stva [Program “Construction Savings Bank”: Center for Investment and Construction]. Available at:

by the bank at a special concessional rate, which will allow the program participants to take possession of residential property after completion of the funds accumulation stage. Over a thousand families (about 1,100) are expected to be involved in the program.

In order to determine how the region is interested in applying this program, it is required to assess the totality of arising effects, relating injections and results for each subject involved in its realization. It is obvious that the population (natural persons) as participants meeting their needs in housing benefit from the program realization: they receive a mortgage loan on preferential terms, and the part of an initial payment is provided from the budget (in this case, program participants do not provide additional injections). The program also has a positive impact on the construction industry (the program does not cover the fundraising side of business, however, increases the demand for housing under construction). For banking institutions and authorities the benefits from participation in the program are not so obvious.

To estimate the budgetary effect from the creation of housing construction savings banks, it is necessary to compare the amount of budgetary resources required for the successful implementation of this process with the volume of funds that the budget will receive due to boosted construction activity in the region. For these purposes the universal computational model is developed; it allows us to understand the difference between additional budget revenues and expenditures, which occurrence is caused by the program implementation: the change in key features of the program (timing of its implementation, conditions of participation, etc.) helps evaluate its effectiveness for different regions or compare different scenarios of its implementation with each other by selecting the most suitable option.

If we assume that each participant (of 1,100 involved) opens a savings account for 5 years, every month adding 10 thousand rubles to it, then the total volume of budgetary expenditure (for the five-year accumulation period) will amount to 199,800,000 rubles (monthly amount of subsidized budgetary funds is 3,300,000 rubles). The total amount of funds accumulated in each account (according to the savings conditions stipulated by the program) will be 800,154 rubles (i.e., each participant will be able to use this amount as an initial mortgage payment). Therefore, the similar sum can be allocated by the banks participating in the program as credit resources, and the total amount of funds to be spent on acquiring housing under the program will be equal to 1,776,342,000 ((initial payment in the amount of 800,154 rubles + sum of lent money in the amount of 800,154 rubles) * number of program participants). Thus, the regional construction complex will receive additional revenue in the amount of 1,776,342,000 rubles.

The construction sector development will lead to the growth of budgetary revenues (mainly, due to the increase in tax revenue from enterprises that are part of the building complex). The program implementation involves the use of regional budget funds;

therefore, when assessing the budget revenues it is necessary to consider those taxes, part of which goes to the RF subject budget. These include:

– revenue tax (a 20% rate, 90% of the received funds go to the regional budget);

– personal income tax (a 13% rate, 70% of the received funds go to the regional budget);

– property tax (a 2,2% rate, all collected funds go to the regional budget).

If we assume that the average profit rate is equal to 20%, then the obtainment of 1.7 billion rubles of additional income by the construction organizations will ensure the rise in revenue tax in the amount of 71,054,000 rubles (of which 63,948,000 rubles is revenues of the regional budget). Besides, there will be an increase in payments of personal income tax (assuming that the cost of labor remuneration accounts for about 30% of the total expenses incurred by construction companies, the regional budget will receive additional 38,795,000 rubles) and property tax (21,885,000 rubles).

Thus, the amount of receipts received in the budget (acquired by summing calculated tax deductions) will be 124,628,000 rubles (by 75 million rubles less than the volume of budgetary injections provided by the program).

On the basis of the estimated timing of the program and the indicators set during the assessment, we can consider the values of budget revenues and expenditures within each period, during which it is expected to fulfill the program ( tab. 2 ). However, we should take into account that the intensification of construction activities will be carried out at the stages, close to the time of accumulation of funds required for an initial payment.

The calculations reveal insufficient budget effectiveness of the program. They demonstrate that the regional authorities are not interested in its implementation. However, this assessment ignores the impact that the construction sector development stimulated by the program makes on the socio-economic territorial system. In turn, the positive transformation of the socio-economic system directly affects the amount of budget revenues (in this case, the

Table 2. Calculation of the budget effectiveness of the program “Housing Construction Savings Bank” (only direct effects), thousand rubles

|

2016 |

2017 |

2018 |

2019 |

2020 |

Total |

|

|

Regional budget expenses |

39,960.0 |

39,960.0 |

39,960.0 |

39,960.0 |

39,960.0 |

199,800.0 |

|

Regional budget revenues |

0.0 |

0.0 |

41,542.7 |

41,542.7 |

41,542.7 |

124,628.1 |

|

Difference between revenue and expenses |

-39,960.0 |

-39,960.0 |

1,582.7 |

1,582.7 |

1,582.7 |

-75,171.9 |

|

Discounted costs |

39,960.0 |

37,345.8 |

34,902.6 |

32,619.3 |

30,485.3 |

175,313.0 |

|

Discounted revenues |

0.0 |

0.0 |

36,285.0 |

33,911.2 |

31,692.7 |

101,889.0 |

|

Difference between discounted revenues and costs |

-39,960.0 |

-37,345.8 |

1,382.4 |

1,292.0 |

1,207.4 |

-73,424.0 |

regional authorities do not make any additional investment); therefore, the consideration of the scale of such effect can correct the conclusions about fiscal effectiveness of the program.

The estimation of the indicators to increase economic potential of the complex due to the grown scale of activities of one of its elements is closely connected with the phenomenon of multiplication.

A multiplier (from lat. Multiplicare – to multiply, increase, raise) is a factor that measures the multiplying impact of positive feedback on the output value of the controlled system [12], showing how the dependent variable increases when the independent variable increases by one.

The multiplier concept in economic theory is introduced by R. Kahn [14], who suggests that the boost in investment activity leading to increased revenue and job opportunities in one of the economy’s sectors contributes to the growth in aggregate consumer demand and, as a consequence, the transformation of the level of production and employment within the entire economic system. This concept is developed by J. Keynes, [4] who proves that there is a close relationship between the aggregate employment and profit, on the one hand, and the scale of investment, on the other hand. It is due to the fact that the part of revenues received in the course of business activity (triggered by the inflow of investment funds) is spent on consumption, i.e., becomes investment in related industries (which, in turn, increases revenues of these industries and provides dependent sectors with production resources).

Thus, the appearance of the multiplier effect due to the program implementation (accumulation of construction volumes) is caused by the revenue growth in the industries associated with the construction complex of the region. In order to make a quantitative assessment of this effect, it is necessary to calculate a multiplication factor, and this process can involve the use of various methods. In particular, to consider the scale of the impact of each evaluated object on the economy is possible by means of the method based on the analysis of “input-output” tables (based on the model proposed by Wassily Leontief, a Nobel Prize Laureate, and helping estimate inter-industry relationships formed in the national economy within the framework of the reproductive process [1]).

The researchers, calculating the multiplier effect by means of the system of “inputoutput” tables, are interested in section I of the table indicating the use of resources [11] and reflecting the formation of added value by economic sectors: the columns include the types of economic activity involved in the production process and the rows – the types of economic activity producing resources consumed in the production process; thus, the table cell reflects the value of goods and services (for each activity) spent for production needs (in terms of each activity). Having data on demand some activities have for the products of other activities, one can identify resource ratios. The quantities of resources of different types should be divided into the total cost incurred in the production process of each industry.

Relying on these data it is possible to assess the impact of changed costs in terms of one activity on the amount of product manufactured by related activities. For example, we can identify how the need for construction of an additional amount of housing in the region will affect the construction companies’ demand for construction materials and equipment. We should take into account that the growth in output in the industries that supply the construction sector with necessary resources will boost production in related sectors (thus, the multiplier factor value will increase; however, the consideration of interconnections at each successive stage of the calculation will ensure its growth at a smaller scale than at the preceding stage).

The analysis of the “input-output tables”, aimed at uncovering links between sectors and determining their tightness, allows us to conclude that the multiplier factor value for the construction sector exceeds 4 (this suggests that the increase in output in the construction industry by 1 ruble leads to a rise in the output amount in other industries, where the increase value is not less than 3 rubles). Based on the assumption that about 75% of the construction companies’ costs on the purchase of goods (receipt of services) produced by other industries account for manufacturing industries, among which the share of the Sverdlovsk Oblast enterprises products amounts to about 78% (half of construction equipment and over 90% of construction materials come from local manufacturers, despite the fact that the ratio of fixed assets and working capital is 3 to 7), the correction factor (to adjust multiplication parameters) will be equal to 0.59. Thus, if we consider the rise in output volumes of the Sverdlovsk Oblast enterprises connected with construction, tax revenues, estimated in terms of the budgetary effect received due to the program implementation, will significantly increase.

To assess the increase in profit tax deductions to the regional budget due to the considered multiplier effect, it is necessary to calculate the value, the tax base will be changed to. For it, we should subtract the amount of return and the funds allocated for wages from the value of revenue received by the construction sector, then multiply this value by the identified multiplier factor characterizing changes in related construction industries, (3), the previously calculated correction factor (0.59) and the profit rate (0.2). The growth in the tax base due to the program implementation will be more than 349 million rubles, which will provide the regional budget with additional funds in the amount of 62,848,000 rubles. Similarly we can determine the value of corporate property tax deductions (38,407,000 rubles).

The value of personal income tax deductions to the budget will also be changed. The value of the employment multiplier for the construction industry is around 6–7 (creation of one job place in the construction industry involves the creation of 5–6 jobs in related industries) [7]. Taking into consideration

Table 3. Calculation of the budgetary effectiveness of the housing construction savings program “Housing Construction Savings Bank” (including the multiplier effect), thousand rubles

|

2016 |

2017 |

2018 |

2019 |

2020 |

Total |

|

|

Regional budget expenses |

39,960.0 |

39,960.0 |

39,960.0 |

39,960.0 |

39,960.0 |

199,800.0 |

|

Regional budget revenues |

0.0 |

0.0 |

116,114.6 |

116,114.6 |

116,114.6 |

348,343.8 |

|

Difference between revenue and expenses |

-39,960.0 |

-39,960.0 |

76,154.6 |

76,154.6 |

76,154.6 |

148,543.8 |

|

Discounted costs |

39,960.0 |

37,345.8 |

34,902.6 |

32,619.3 |

30,485.3 |

175,313.0 |

|

Discounted revenues |

0.0 |

0.0 |

101,419.0 |

94,784.1 |

88,583.3 |

284,786.3 |

|

Difference between discounted revenues and costs |

-39,960.0 |

-37,345.8 |

66,516.4 |

62,164.8 |

58,098.0 |

109,473.4 |

this parameter and the difference in wages between different industries (in the region’s construction sector average salary amounts to approximately 39.5 thousand rubles, in the sector of manufacturing construction equipment and building materials – 25 thousand rubles), we can assume that the wage fund (i.e. the tax base for calculating personal income tax) will increase by more than 1.3 billion rubles (in terms of related industries). As a result, the budget will receive about 122,460,000 rubles. Thus, the total receipt due to the program implementation (including the multiplier effect) will be 348,343,000 ( tab. 3 ).

The adjustment of the previously made calculations using the multiplier effect helps reflect non-obvious benefits from the program implementation and get a more accurate assessment of its possible outcomes (that radically changes the idea about its efficiency for the regional budget).

To further verify the program effectiveness indicators, it is possible to characterize other consequences of the conducted measures. In particular, one should take into account that the increase in demand for property will intensify the construction complex development at the scale greater than the change in consumer activity (the practice of the similar program implemented in the Republic of Bashkortostan shows that the growth of demand on the housing market due to its implementation resulted in the increase in supply, and the value of that increase exceeds the change in demand parameters by more than 3 times) that have a positive impact on the development of related industries.

* * *

The correct assessment of consequences of the realized measures of any level and direction should include the obligatory consideration of all direct and indirect results and the calculation of the multiplier effect: the analysis of all possible outcomes of the implement set of actions helps understand how much they are necessary in the circumstances and how the results of these activities compare with the costs required for their conduct.

At the same time, the comprehensive approach to effectiveness assessment is of special importance for social programs and projects. Their implementation often involves obtainment of implicit benefits, so the economic evaluation of only direct effects can give a false impression of the significance of such measures (along with the social impacts, which are not always easy to compare with costs incurred, it is also necessary to estimate indirect results).

Using the universal computational model we have analyzed the effectiveness of one of the social program (programs of housing construction savings “Housing Construction Savings Bank”), which prospects are now being evaluated in the Sverdlovsk Oblast. The consideration of the consequences triggered by actions of the persons who are directly involved in the program implementation raises the quality of current assessment; this, in turn, allows the actors, whose resources are needed to implement activities, to make an appropriate conclusion about their necessity.

Список литературы Accounting of multiplier effect as a required element in assessing the effects of social programs

- Granberg A.G. Wassily Leontief v mirovoi i otechestvennoi ekonomicheskoi nauke . Ekonomicheskii zhurnal VShE , 2006, vol. 10, no. 3, pp. 471-491.

- Zhilishchnaya revolyutsiya: Izvestiya Tatarstana . Available at: http://www.tatarnews.ru/articles/8405

- Zhilishchnoe khozyaistvo v Rossii. 2013: stat. sb. . Rosstat . Moscow, 2013.

- Keynes J. M. Obshchaya teoriya zanyatosti, protsenta i deneg . Moscow: Gelios ARV, 2012.

- Monitoring ob”emov zhilishchnogo stroitel’stva i tsen na rynke zhil’ya: otchet Minstroya Rossii . Available at: http://www.minstroyrf.ru/trades/zhilishnaya-politika/8/

- Osnovnye pokazateli zhilishchnykh uslovii naseleniya: ofitsial’nyi sait Federal’noi sluzhby gosudarstvennoi statistiki . Available at: http://www.gks.ru/wps/wcm/connect/rosstat_main/rosstat/ru/statistics/population/housing/#

- Podgornov V.S. Stroitel’stvo platnoi avtodorogi: mekhanizm realizatsii, sotsial’no-ekonomicheskaya effektivnost’ (na primere proekta stroitel’stva yuzhnogo obkhoda g. Ekaterinburga) . Upravlenie ekonomicheskimi sistemami , 2013, no. 4. Available at: http://uecs.ru/index.php?option=com_flexicontent&view=items&id=2084

- Postanovlenie Pravitel’stva Respubliki Bashkortostan “O poryadke realizatsii na territorii Respubliki Bashkortostan meropriyatii po finansirovaniyu zhilishchnogo stroitel’stva s ispol’zovaniem sistemy zhilishchnykh stroitel’nykh sberezhenii”: ot 14.02.2014 № 56 . Konsul’tantPlyus .

- Programma “Stroitel’nye sberegatel’nye kassy”: Tsentr investitsii i stroitel’stva . Available at: http://centrinvest-ufa.ru/ipoteka/sberbank/s-01012014-g-strojsberkassy

- Stroitel’stvo v Rossii. 2014: stat. sb. . Rosstat . Moscow, 2014.

- Tablitsy “zatraty-vypusk”: ofitsial’nyi sait Federal’noi sluzhby gosudarstvennoi statistiki . Available at: http://www.gks.ru/wps/wcm/connect/rosstat_main/rosstat/ru/statistics/accounts/#

- Titov L.Yu. Sinergeticheskii i mul’tiplikativnyi effekt innovatsionnykh setei . Audit i finansovyi analiz , 2010, no. 2, pp. 120-126.

- Turtushov V.V. Raschet koeffitsienta dostupnosti zhil’ya dlya regionov Rossii i faktory, vliyayushchie na nego . Vestnik Chuvashskogo universiteta , 2013, no. 1, pp. 335-339.

- Kahn R.F. The Relation of Home Investment to Unemployment. The Economic Journal, 1931, vol. 41, no. 162, pp. 173-198.