Analyzing Price Dynamics, Activity of Players and Reviews of Popular Indie Games on Steam Post-COVID-19 Pandemic using SteamDB

Автор: Araz R. Aliev, Tofig A. Aliyev, Rustam Eyniyev

Журнал: International Journal of Information Technology and Computer Science @ijitcs

Статья в выпуске: 3 Vol. 17, 2025 года.

Бесплатный доступ

This study thoroughly looks at how the prices and activity of players of popular indie games on Steam changed after COVID-19. It uses data from SteamDB, which has lots of info about game availability, sales, prices, activity of players, followers, positive and negative reviews on Steam and Twitch viewers. The goal is to deeply analyze how indie game makers and publishers set their prices and reactions of players to games which release date start from period before, during and after COVID-19. The focus is on how they changed their pricing models due to big shifts in market demand and consumer behavior because of the pandemic and how players reacted to these price changes in the context of wage cuts and layoffs. Reactions of players can be tracked not only by the statistics of the maximum or average online in the game, but also by the number of positive and negative reviews, because in difficult times it was important for players to correctly distribute their available funds and not to become disappointed in game and not to let other players become disappointed By studying these changes, the aim is to find out how the indie game industry responded to tough times and new chances in the digital entertainment world. Since the study is being conducted in the post-COVID-19 period, it is also aimed at helping developers choose the right strategy when pricing their new Indie games or changing the prices of their existing Steam Indie games. The main objects of research are indie games because this genre is one of the most popular in SteamDB, and to create such games requires less costs, therefore their price is acceptable for the average player.

Data Mining, Game Development, Software Engineering, COVID-19, SteamDB

Короткий адрес: https://sciup.org/15019817

IDR: 15019817 | DOI: 10.5815/ijitcs.2025.03.03

Текст научной статьи Analyzing Price Dynamics, Activity of Players and Reviews of Popular Indie Games on Steam Post-COVID-19 Pandemic using SteamDB

The phrase "Indiepocalypse" has acquired popularity within the independent game development community. It neatly summarizes the indie game industry's multitude of problems and transitions, which are caused by causes such as increased competition, market saturation, shifting customer expectations, and dynamic changes in digital distribution channels [1]. This statement emphasizes the tremendous challenges that independent developers face as they try to stand out in an increasingly competitive and crowded sector.

Indie games' exposure and popularity skyrocketed during the COVID-19 epidemic, as people all around the world sought for new and immersive forms of digital entertainment to break up the monotony of lockdowns. Indie developers, known for their agility, took advantage of the increased attention by providing unique gaming experiences that separated out from conventional offerings. This time emphasized the inherent advantages of smaller development teams, such as their ability to respond quickly to changing market conditions and customer preferences. The epidemic highlighted independent creators' resilience and inventive attitude, allowing them to swiftly change game features, adapt price methods, and overhaul marketing techniques to reach a larger audience [2]. Their quick response to the changing scenario exemplified the independent gaming community's resilience and ingenuity [3-5].

Throughout COVID-19, SteamDB was invaluable, providing creators with critical, real-time statistics to help them optimize their plans. SteamDB supplied gamers with fast information on game releases, pricing changes, and other relevant facts that improved the user experience and informed purchase decisions. Furthermore, researchers discovered SteamDB to be an important resource for investigating the influence of COVID- 19 on independent games on the Steam platform, providing detailed information into shifting gameplay behaviors and developer reactions [6].

During and after COVID-19, developers had several ways to retain players or attract players, such as discounts on games [7] or interesting mechanics [8-10].

Some notable independent titles that piqued the gaming community's interest include "Hollow Knight", "Lobotomy Corporation", "Touhou Luna Nights", "The Messenger", and "Katana Zero" [11, 12]. These games, along with others such as "Hades," "Stardew Valley", and "RimWorld", not only displayed distinct gameplay and creative originality, but also how independent games can effectively interact with their communities and survive even under difficult conditions [13, 14]. Each title is a case study in harnessing flexibility and community interaction to create success in the independent gaming industry, demonstrating how these games have carved out a niche that appeals to a varied range of gamers.

The rest of this paper is organized as follows. The next section reviews the literature related to finding graph structures for specific datasets. Section III details the serial ANG algorithm. Section IV is dedicated to describing all implementation of the parallel ANG. In the last two sections, the main results are presented followed by conclusions and future work.

2. Related Works

Many studies have shown that during COVID-19, interest in the gaming industry has increased and also many studies have discussed how developers can increase players` in games.

The paper [15] states that during COVID-19, interest in games has increased due to various reasons, including mental health issues such as anxiety. Schools have used online gaming environments to conduct effective and useful distance lessons. This article does not cover indie games, but they have low system requirements for user devices and low cost of the games themselves, so such games could be well suited for schoolchildren and students whose budget is limited.

The paper [16] provides the following economic statistics: at the beginning of COVID-19, many businesses (cafes, restaurants, clubs, etc.) began to suffer both financial losses and losses in attendance, but platforms such as YouTube and Twitch reported an increase in audience by at least 10%, and Steam reported the highest active user rate in 16 years. US telecommunications provider Verizon announced that online gaming activity had increased by 75%. This article also does not highlight indie games separately from other games, so the current study also considers the statistics of selected indie games on the Twitch platform.

After the end of the pandemic, some gaming tools that were used during COVID-19 continued to be used. The study [17] discusses the use of gaming technologies now, in the post-pandemic period and the future of these technologies. The article does not specifically mention indie games, but the fact that indie games are games that retain interest among a large audience not for decades like AAA, but for a much shorter period, makes it important that new indie games keep up with modern gaming technologies and capabilities.

The paper [18] gives information about using metaverse technologies, some games help people understand health consequences, and sometimes draws people's attention to public health campaigns, which also creates an environment for better understanding that you need to take care of your health. In this article, indie games are not discussed separately but choosing them for these purposes is possible and useful because their development does not require a lot of time and developers can quickly create a game to attract attention to urgent public health campaigns.

Articles [19, 20] present details about how games helped with remote work during COVID-19. The main benefit of games during remote work was in such problems as team building, problems with communication between team members, as well as with creative ideas and solutions. Indie games are not discussed separately, but as a solution they can be used for several reasons: ease of understanding and management (usually the rules and control of the character in indie games do not require remembering various keyboard combinations, unlike many AAA projects), ease of translation (indie games do not contain a lot of content and translating it into the required language will take much less time than even some programs), budget (as in the case of schoolchildren and students, the financial component must also be taken into account, because during COVID-19 there were layoffs or a decrease in income for all types of businesses).

The articles [21, 22] propose to use a mathematical approach for balancing Battle Royale and Roguelike games. Roguelike is one of the main genres of indie games, and there are also various indie games of the Battle Royale genre. Balance is one of the main tasks not only for indie games, but for games in general. However, if for AAA games a separate team of experienced developers and mathematicians can handle the balance, then in the case of indie games the development team is too small to be divided into smaller teams. These suggestions greatly help indie games developers to balance their games and speed up the development of their games.

3. Methodology 3.1. Abbreviations and Acronyms

The primary tool for data collection and subsequent analysis in this study will be SteamDB, an expansive resource that catalogues detailed information about games available on the Steam platform. This database is instrumental for selecting games based on genre and other relevant tags (see Figure 1):

Fig.1. Selecting game tags/genres

When you select tags, the corresponding games, their release year, rating and price are immediately displayed (see Figure 2):

|

Release 2016 |

Rating 97.51% |

Price $14.99 |

||

|

^ш^й |

Stardew Valley \ Я • Й •) |

|||

|

'■people* p^s.wk |

People Playground :: •> |

2019 |

97.47% |

$9.99 |

|

VAMPIRE 2 SURVIVORS ” |

Vampire Survivors Я « *) |

2022 |

97.33% |

$4.99 |

|

nApES |

Hades ЯН |

2020 |

97.19% |

$24.99 |

|

Terraria SS • A •) |

2011 |

96.85% |

$9.99 |

|

|

R 1 MW®R L D |

Rim Wo rid ।■■ • a « |

2018 |

96.77% |

$27.99 |

|

^Stltkmis (wIlECtianii I |

The Henry Stickmin Collection 1 » |

2020 |

96.74% |

$14.99 |

Fig.2. A list of some popular indie games on Steam

For each game, there is available infographic that can be downloaded in CSV and XLS formats for further data analysis using various methods (see Figure 3 and Figure 4):

The study attempts to investigate the pricing, activity of players and reviews trends of independent games before and after the COVID-19 pandemic by utilizing the acquired data. This research aims to evaluate the future market potential for independent games, analyze the activity of players and review patterns, and formulate forecasts on optimal pricing strategies.

-

3.2. Data Analysis Techniques

-

• Descriptive Statistics: Descriptive statistics such as mean, median, and standard deviation were computed for each game's activity of players, highest price, lowest price, and the number of positive and negative reviews over several time periods (before, during, and after COVID-19). These statistics were derived from the data

collected during the course of the data collection process. Additionally, these statistics were integrated into the study. A comprehension of the core tendency, as well as the various dynamics of player engagement and review patterns, may be attained via the utilization of these statistical data.

Fig.3. The price dynamics of Hades game

Fig.4. The ability to download as CSV and XLS files

-

• Trend Analysis: This approach depicts the price swings, activity of players, and review trends (positive and negative) of a wide range of independent games over time using line graphs or time-series diagrams. The graphical depiction is critical for detecting major patterns, trends, or anomalies in game prices, player engagement, and review trends throughout the pandemic. A time series graph, for example, might show whether changes in activity of players or the ratio of positive to negative reviews occur at certain periods or in response to global events such as the deployment of closure measures. This approach, which makes use of past data, not only improves visual understanding but also functions as a predictor of future variations in activity of players, review trends, and price dynamics. Understanding these trends enables stakeholders in the gaming industry to make more educated judgments about engagement strategies, pricing changes, and promotional efforts.

-

• Comparative Analysis: The activity of players, price changes, and the number of positive and negative reviews for each game are compared using this analytical technique across three different time periods: prior to, during, and following the COVID-19 pandemic. By contrasting these datasets, the study highlights any significant shifts in player engagement, review sentiment, or modifications to publishers' and developers' pricing strategies in reaction to the limitations imposed by the pandemic. Comparative analysis can reveal, for example, that prices were deliberately lowered to attract more players or increase engagement during periods of economic instability, or it can demonstrate that activity of players surged during the pandemic due to consumers' heightened need for digital entertainment while confined to their homes. This methodology is crucial to understanding both the direct and indirect consequences of the pandemic on the indie game sector.

-

3.3. Variables Considered

-

• Activity of players: The level of activity of players before, during, and after the COVID-19 pandemic serves as an indicator of engagement for each indie game.

-

• Price variation: The highest, lowest, and adjusted prices before, during, and after the COVID-19 pandemic are key variables for assessing pricing dynamics and strategies.

-

• Review sentiment: The number of positive and negative reviews across different time periods (before, during, and after the pandemic) is analyzed to gauge shifts in player perception and feedback.

-

• Release date: The release date of each game is considered to contextualize pricing trends and player engagement relative to the timing of the COVID-19 pandemic.

-

3.4. Analysis of Price Dynamics and Activity of Players

By applying these data collection methods and analysis techniques to the provided dataset, this study aims to offer valuable insights into the price dynamics, activity of players, and review sentiment of popular indie games on Steam post-COVID-19 pandemic.

This section delves into the price dynamics, activity of players and players feedback of popular indie games on Steam before, during, and after the COVID-19 pandemic (see Table 1, Table 2 and Table 3). It examines trends, patterns, and factors influencing price variations, providing insights into the evolving pricing strategies and consumer behavior in the indie game market. The main criteria for selecting indie games for each period were the following:

Table 1. Main information about different prices of selected indie games

|

# |

Name |

Release date |

Highest Price |

Lowest price |

|

1 |

Hollow Knight |

24.02.2017 |

9.99 |

3.99 |

|

2 |

Lobotomy Corporation |

09.04.2018 |

12.59 |

3.74 |

|

3 |

Touhou Luna Nights |

26.02.2019 |

9.89 |

5.59 |

|

4 |

The Messenger |

30.08.2018 |

10.49 |

2.09 |

|

5 |

Katana ZERO |

14.04.2019 |

8.49 |

4.24 |

|

6 |

Hades |

17.09.2020 |

12.49 |

4.24 |

|

7 |

Phasmophobia |

18.09.2020 |

10.49 |

5.99 |

|

8 |

Record of Lodoss War-Deedlit in Wonder Labyrinth |

27.03.2021 |

10.49 |

5.24 |

|

9 |

ENDER LILIES: Quietus of the Knights |

21.06.2021 |

12.49 |

4.99 |

|

10 |

Library of Ruina |

10.08.2021 |

14.49 |

4.92 |

|

11 |

Neon White |

16.06.2022 |

13.49 |

8.09 |

|

12 |

Stray |

19.07.2022 |

15.99 |

9.59 |

|

13 |

Vampire Survivors |

20.10.2022 |

3.49 |

1.97 |

|

14 |

SIGNALIS |

27.10.2022 |

19.99 |

10.49 |

|

15 |

Pizza Tower |

26.01.2023 |

10.49 |

7.02 |

Table 2. Main information about playing info of selected indie games

|

# |

Name |

Online max Players |

Max Followers |

Max Twitch viewers |

|

1 |

Hollow Knight |

20,324 |

371,629 |

178,299 |

|

2 |

Lobotomy Corporation |

7,928 |

11,551 |

65,373 |

|

3 |

Touhou Luna Nights |

1,368 |

50,057 |

103,098 |

|

4 |

The Messenger |

679 |

29,316 |

151,270 |

|

5 |

Katana ZERO |

1,575 |

94,171 |

151,340 |

|

6 |

Hades |

54,240 |

287,350 |

124,975 |

|

7 |

Phasmophobia |

112,717 |

390,691 |

256,449 |

|

8 |

Record of Lodoss War-Deedlit in Wonder Labyrinth |

848 |

31,307 |

90,881 |

|

9 |

ENDER LILIES: Quietus of the Knights |

6,332 |

102,444 |

65,885 |

|

10 |

Library of Ruina |

8,015 |

69,587 |

11,576 |

|

11 |

Neon White |

3,277 |

32,257 |

63,132 |

|

12 |

Stray |

62,963 |

351,881 |

284,027 |

|

13 |

Vampire Survivors |

77,061 |

116,999 |

139,186 |

|

14 |

SIGNALIS |

872 |

58,986 |

46,359 |

|

15 |

Pizza Tower |

9,074 |

49,460 |

80,350 |

-

• 1 game with maximum followers over 350,000, 1 game with maximum followers 110,000-350,000 and 3

games with maximum followers 25,000-110,000. This meant that the analysis used at least 1 very popular game, 1 game of average popularity and 3 games of low but not minimal popularity. This choice is justified by the fact that the analysis considers the choice of a sufficient number of players, and was not focused, for example, only on the popularity of the game in a region or country.

-

• The highest price, which does not exceed $20. This criterion selects games that could initially be available to users with an average income in many countries during COVID-19.

-

• The lowest price, which does not exceed $12. This choice was made because games with a price reduction could be accessible to users with a lower average income during COVID-19.

-

• The number of reviews should be more than 5,000. This criterion is necessary because it allows us to

understand what impression the game has created for enough people, because reviews of games are not written by every player, but only by a certain number of players.

-

• The number of positive and negative reviews should be much greater in favor of positive reviews. This criterion is chosen because this is one of the few ways to get an assessment from users about the game and if the number of positive reviews is much greater than negative, this means that most players are satisfied with the game and will play it on a regular basis and can recommend it to even more players.

Table 3. Information about reviews from players of selected

|

# |

Name |

Positive reviews |

Negative reviews |

|

1 |

Hollow Knight |

362,307 |

10,802 |

|

2 |

Lobotomy Corporation |

35,687 |

2,474 |

|

3 |

Touhou Luna Nights |

13,223 |

314 |

|

4 |

The Messenger |

10,220 |

720 |

|

5 |

Katana ZERO |

66,528 |

1,335 |

|

6 |

Hades |

264,002 |

4,551 |

|

7 |

Phasmophobia |

683,578 |

29,200 |

|

8 |

Record of Lodoss War-Deedlit in Wonder Labyrinth |

5,939 |

442 |

|

9 |

ENDER LILIES: Quietus of the Knights |

32,831 |

2,033 |

|

10 |

Library of Ruina |

27,261 |

1,839 |

|

11 |

Neon White |

15,704 |

281 |

|

12 |

Stray |

141,689 |

3,963 |

|

13 |

Vampire Survivors |

232,338 |

3,546 |

|

14 |

SIGNALIS |

20,384 |

677 |

|

15 |

Pizza Tower |

60,776 |

975 |

-

A. Overview of Price and Activity of Players Trends

The trends of popular indie games on Steam exhibited notable variations across different phases, both in terms of pricing and activity of players:

-

• Before COVID-19: Indie game prices remained relatively stable, with no significant fluctuations. Activity of players during this period was steady, with no major shifts in engagement or review patterns.

-

• During COVID-19: Some indie games experienced slight decreases in prices, driven by promotional activities and discounts to attract players during the lockdowns. Activity of players, on the other hand, saw a marked increase as more people turned to digital entertainment while staying home. Many games experienced surges in both positive and negative reviews, reflecting heightened engagement and feedback from a growing player base.

-

• After COVID-19: Post-pandemic, average prices tended to stabilize, with some games even experiencing slight price increases as demand normalized. Activity of players began to level off, though it remained higher than pre-pandemic levels for many games. Review trends also became more consistent as players returned to more regular gaming habits.

-

B. Impact of COVID-19 on Pricing and Activity of Players

The COVID-19 pandemic influenced both pricing dynamics and activity of players in several ways:

-

• Price Fluctuations: While some indie games maintained stable pricing throughout the pandemic, others introduced temporary discounts or promotions to attract players during lockdown periods, leading to noticeable price fluctuations.

-

• Player Engagement: Increased leisure time and a shift towards digital entertainment during lockdowns resulted in a surge in activity of players. This rise in demand prompted developers to adapt their pricing strategies to take advantage of the heightened interest, while also seeking ways to maintain player engagement through promotional activities.

-

C. Factors Influencing Price Changes and Activity of Players

Various factors contributed to the price changes and player engagement observed during different phases:

-

• Promotions and Discounts: Promotional activities, such as sales events, played a significant role in influencing pricing decisions. Many indie games offered discounts during the pandemic to attract more players and boost engagement.

-

• Seasonal Trends: Holiday sales and special events led to temporary price drops for numerous indie games, which helped attract a larger player base and increase the activity of players during peak periods.

-

• Game Updates and Content: Ongoing development support through regular updates and additional content releases (like DLCs) allowed developers to maintain higher prices for their games, ensuring sustained player engagement and continued revenue generation.

-

D. AAA Games for Comparison

To compare indie games with other games, one AAA game will be used for each of the time periods (See Table 4, Table 5 and Table 6). For the best results, AAA games were selected that meet the following criteria:

• The game belongs to the AAA category.

• The base price of the game is more than $25.

• One game released before COVID-19.

• One game released during COVID-19.

• One game released after COVID-19.

4. Discussion

Table 4. Main information about different prices of selected AAA games

|

# |

Name |

Release date |

Highest Price |

Lowest price |

|

1 |

Assassin's Creed Odyssey |

05.10.2018 |

46.89 |

4.94 |

|

2 |

Forza Horizon 5 |

09.11.2021 |

34.78 |

17.39 |

|

3 |

Hogwarts Legacy |

10.02.2023 |

49.99 |

14.99 |

Table 5. Main information about different prices of selected AAA games

|

# |

Name |

Online max Players |

Max Followers |

Max Twitch viewers |

|

1 |

Assassin's Creed Odyssey |

62,069 |

327,373 |

196,739 |

|

2 |

Forza Horizon 5 |

81,096 |

458,222 |

127,965 |

|

3 |

Hogwarts Legacy |

879,308 |

642,278 |

1,258,495 |

Table 6. Information about reviews from players of selected AAA games

|

# |

Name |

Positive reviews |

Negative reviews |

|

1 |

Assassin's Creed Odyssey |

143,829 |

17,664 |

|

2 |

Forza Horizon 5 |

174,109 |

23,143 |

|

3 |

Hogwarts Legacy |

262,494 |

27,010 |

The Python programming language is employed in the methodology to analyze fluctuations in the pricing of independent video games before, during, and after the COVID-19 pandemic. Tools like pandas are used for data processing, while matplotlib is applied for data visualization. This approach enabled a comprehensive examination of pricing trends alongside activity of players and reviews of indie games on the Steam platform. The analysis is divided into three crucial time periods aligning with the pandemic's timeline.

-

4.1. Data Collection and Preparation

-

A. Dataset Structure

The dataset was rigorously structured into CSV files for each independent game featured in the study. These files contained crucial data points such as DateTime (the date of data collection), Final pricing (the game's pricing on that precise date), and activity of players statistics. This systematic approach ensured all relevant information was available for analysis, providing a comprehensive view of market trends and behaviors over time.

The dataset was also supplemented with metadata that included details about each game's genre, developer, and other relevant features. This metadata enabled more complex analysis, allowing the identification of patterns and trends influenced by factors beyond price and activity of players.

-

B. Game Segmentation

-

4.2. Data Processing and Analysis

Pre-COVID-19, during COVID-19, and post-COVID-19 were identified as the three distinct phases for accurately assessing the pandemic's effect on the pricing, activity of players, and reviews of independent video games. This temporal segmentation allowed for a clear understanding of the pandemic's longitudinal effects and facilitated precise comparisons across these periods.

Pre-COVID-19 games were released prior to March 1, 2020; during COVID-19 games were released between March 1, 2020, and March 1, 2022; and post-COVID-19 games were released after March 1, 2022. These categories were established through a rigorous game selection process. By dividing market conditions into these periods, the analysis effectively captured the unique circumstances of each era.

-

A. Object-oriented Approach

For the study, a bespoke Python class called GameStats was developed. This class contained all the necessary properties and methods for effective data processing. The object-oriented approach simplified the handling of complex data structures while ensuring the code was modular and easy to maintain.

Within this structure, GameStats was responsible for computing essential data for each game, including activity of players, the highest price, the lowest price, and average ratings during the specified time periods. Additionally, the class featured advanced data filtering and aggregation capabilities, which enhanced the depth of the study's analysis.

-

B. Price Dynamics and Activity of Players Segmentation

-

4.3. Results Interpretation

-

4.4. Implications

The distinction between the three stages of price dynamics and activity of players — pre-COVID-19, during COVID-19, and post-COVID-19 — enabled a sophisticated analysis of how game pricing and player behavior responded to various market conditions. This temporal division was crucial for distinguishing the effects of the pandemic from other market forces.

Visualizations of these segments were created using line plots in Python, which displayed trends in pricing and activity of players over time. These visualizations made it easier to identify significant changes and patterns, providing a clear and accessible representation of complex datasets.

The core findings from the analysis were effectively communicated through detailed graphs generated via Python, illustrating price dynamics, activity of players, and reviews of selected indie games across different phases of the pandemic. These graphs highlighted both the resilience and vulnerability of indie game markets under pandemic stressors.

A comprehensive set of three graph categories was created, each corresponding to one of the distinct time periods — pre-COVID-19, during COVID-19, and post-COVID-19. These visual outputs synthesized the quantitative data, facilitating easier comprehension and discussion among stakeholders.

-

A. Informed Decision-making

The approach described provides valuable insights that empower developers, marketers, and industry stakeholders to make informed decisions about pricing strategies and player engagement. Understanding these insights is essential for navigating the complexities of evolving market conditions and shifting player preferences, which can be influenced by factors such as economic changes, competitive pressures, and technological advancements.

By leveraging data-driven analytics, individuals can forecast future market responses and optimize their pricing strategies to maximize revenue while staying competitive. The ability to adapt strategically is especially crucial in the fast-paced gaming industry, where player preferences and technology evolve rapidly.

Moreover, the insights gained assisted in making strategic decisions and mitigating risks, enabling firms to anticipate market trends and prepare for potential disruptions. This proactive approach not only improves operational efficiency but also provides a competitive advantage in a volatile market.

B. Adaptability to Market Dynamics

5. Results5.1. Price Dynamic and Activity of Players of Indie Games that Came Out before COVID-19

The flexibility of the methodology allows for its adaptation to future analyses and market studies, ensuring continued relevance in the dynamic gaming industry landscape.

In summary, the methodology employed a systematic and structured approach to analyze indie game price dynamics, activity of players, and reviews, providing a foundation for understanding market trends and informing strategic decision-making in the post-COVID-19 era.

In this section, we present the key findings derived from the analysis of popular indie games on Steam before, during, and after the COVID-19 pandemic. The investigation focused on the activity of players, review sentiment (positive and negative reviews), and price variations for selected indie games. Additionally, generated graphs using Python were employed to visually represent the price dynamics, player engagement, and review trends for indie games released in different periods.

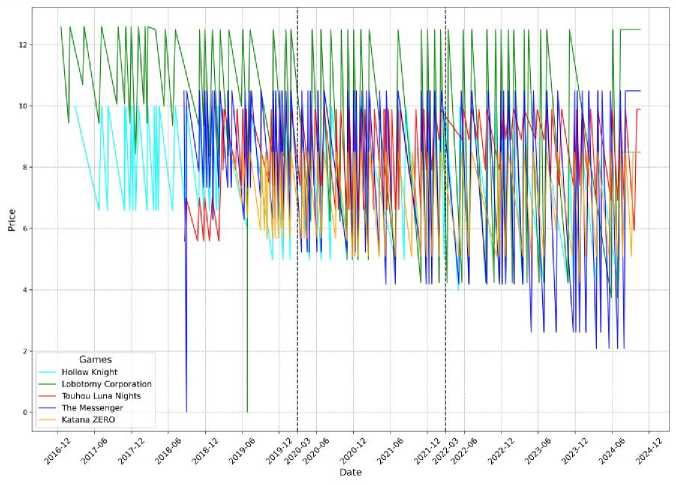

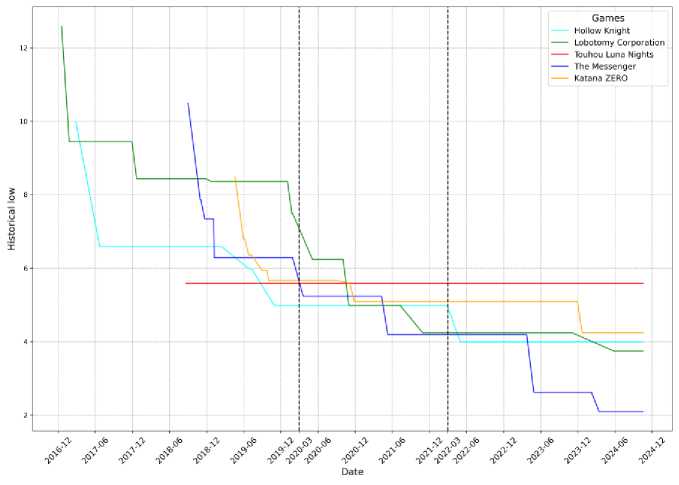

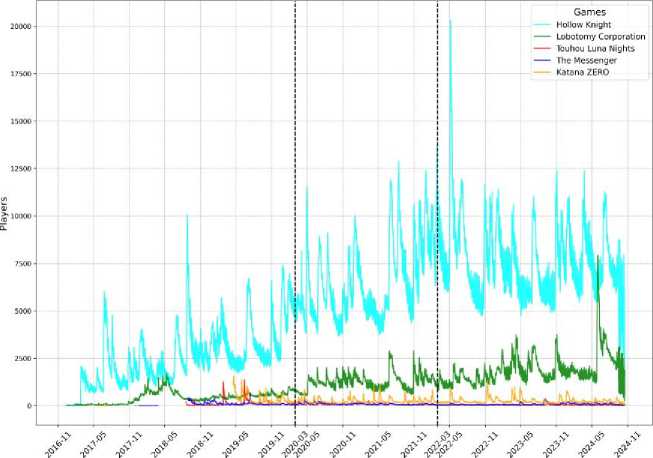

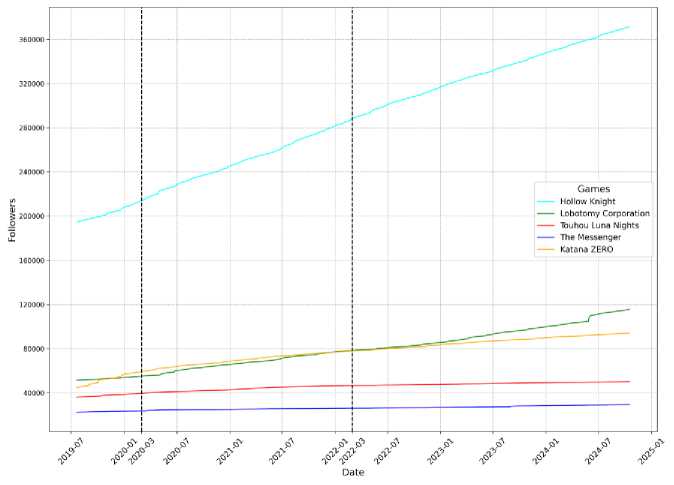

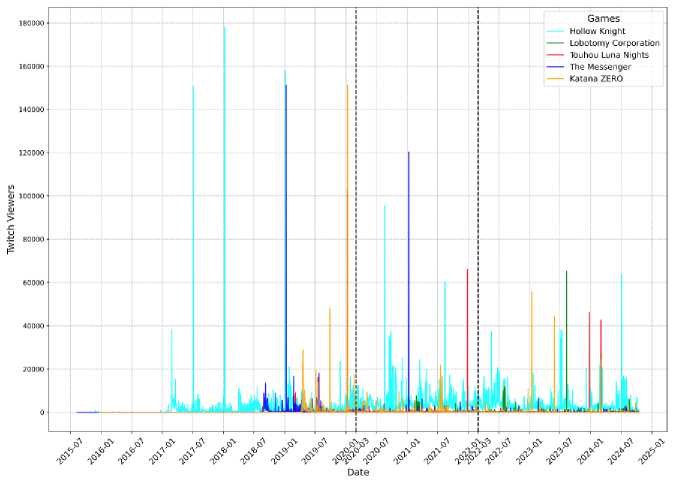

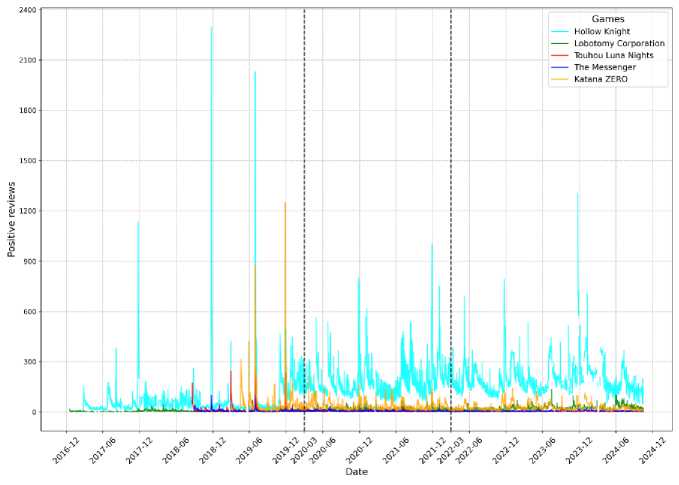

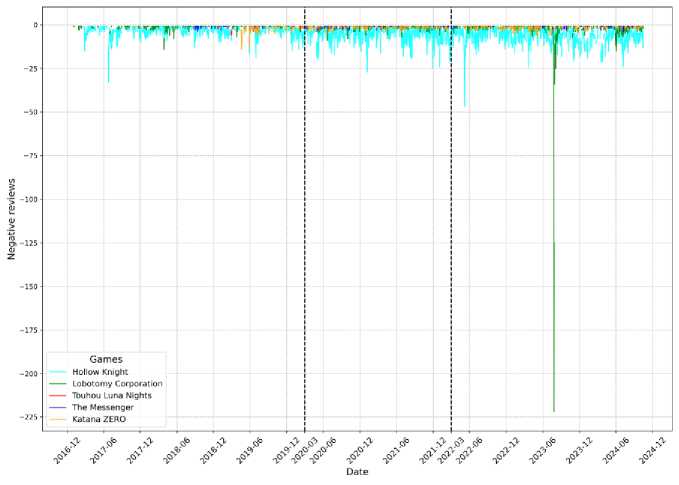

Indie games that were released before COVID-19: Hollow Knight, Lobotomy Corporation, Touhou Luna Nights, The Messenger, Katana ZERO. For these games, the results of various graphs of the relationship of date to the following values are needed: Price (see Figure 5), Historical Low (see Figure 6), Players (see Figure 7), Followers (see Figure 8), Twitch viewers (see Figure 9), Positive reviews (see Figure 10), Negative reviews (see Figure 11). Special black dashed lines are used to indicate the COVID-19 period. Using these results, you can understand how the situation developed for games that were released before COVID-19. Compare all the results in different periods of time and draw the necessary conclusions about how people reacted during these periods. In Figure 5, the values of Hollow Night and The Messenger seem to drop to 0, but this happens because SteamDB does not have information about the price of these games during that period, while other games have.

Fig.5. Price comparisons of indie games released before Covid-19

Fig.6. Historical low comparisons of indie games released before Covid-19

The results show that for:

• Price:

-

◦ Hollow Knight - there were regular discounts throughout the study period. In the post-COVID-19 period, the game's base fixed price decreased in January 2023.

-

◦ Lobotomy Corporation - there were frequent discounts before, during, and after the COVID-19 period, in addition to sales, there were several times when the game was discounted without a sale period. The base fixed price without discounts remained the same.

-

◦ Touhou Luna Nights - the game was regularly discounted, during COVID-19, before, and after. The base fixed price without discounts did not decrease or increase.

-

◦ The Messenger - there were regular discounts, both during sales and without sales throughout the study period. The base price remained the same.

-

◦ Katana Zero - there were discounts during and without a sale period in all study period divisions. The base price without discounts did not change.

Date

Fig.7. Players comparisons of indie games released before Covid-19

Fig.8. Followers comparisons of indie games released before Covid-19

• Historical low:

-

◦ Hollow Knight - changed 3 times before COVID-19, never changed during COVID-19, and changed 1 time after COVID-19.

-

◦ Lobotomy Corporation - changed 3 times before COVID-19, changed 3 times during COVID-19, and changed 1 time after COVID-19.

-

◦ Touhou Luna Nights - never changed.

-

◦ The Messenger - changed 3 times before COVID-19, changed 2 times during COVID-19, and changed 1 time after COVID-19.

-

◦ Katana Zero - changed 4 times before COVID-19, changed 1 time during COVID-19, and changed 1 time after COVID-19.

Fig.9. Twitch viewers comparisons of indie games released before Covid-19

Fig.10. Positive reviews comparisons of indie games released before Covid-19

• Average number of players per month:

-

◦ Hollow Knight - before COVID-19, there were often few players from a historical point of view and at some points minimal, however, during COVID-19 and after, there were no more such anti-records.

-

◦ Lobotomy Corporation - before COVID-19, a large peak value on average per month was only in the month of the game's release and 1 time in January 2020, the rest of the time before the first months of COVID-19 there were very few players. During COVID-19 and after, this number never again reached the minimum that was before COVID-19. In May-June 2024, it even reached peak values.

-

◦ Touhou Luna Nights - after 3 months from the start of release, it decreased and remains low throughout the study period.

-

◦ The Messenger - regularly decreased and sometimes increased.

-

◦ Katana Zero - the change in the number of players remained generally stable, sometimes increasing, sometimes decreasing.

Fig.11. Negative reviews comparisons of indie games released before Covid-19

• Number of subscribers:

-

◦ Hollow Knight - almost completely stable subscriber growth with a good pace throughout the study period

-

◦ Lobotomy Corporation - generally stable subscriber growth throughout the study period, but the period from April to May 2024 saw a noticeable increase compared to other periods

-

◦ Touhou Luna Nights - increased significantly during COVID-19 but overall has seen little to no growth since COVID-19.

-

◦ The Messenger - very weak increase.

-

◦ Katana Zero - before, during, and after COVID-19, the increase was weak, but the growth was stable.

-

• Number of viewers on Twitch. Hollow Knight had a lot more viewers at the start, with averages declining over time, occasionally increasing but not reaching previous highs. Lobotomy Corporation had a consistently low value and had 2 peaks, one small peak in August 2022 and one big one in August 2023. Touhou Luna Nights had a low value overall but had some momentary viewership spikes. The Messenger had a low value and a sharp increase in value. Katana Zero had only 2 peaks in viewership, once before COVID-19 in January 2021 and again in January 2021, and was consistently low the rest of the time.

-

• Reviews (positive and negative). Hollow Knight's overall review count was relatively stable throughout the study period, Lobotomy Corporation's was constantly increasing, Touhou Luna Nights' was constantly decreasing, The Messenger and Katana Zero were generally decreasing, but there were periods when they were increasing.

-

5.2. Price Dynamic and Activity of Players of Indie Games that Came out during COVID-19

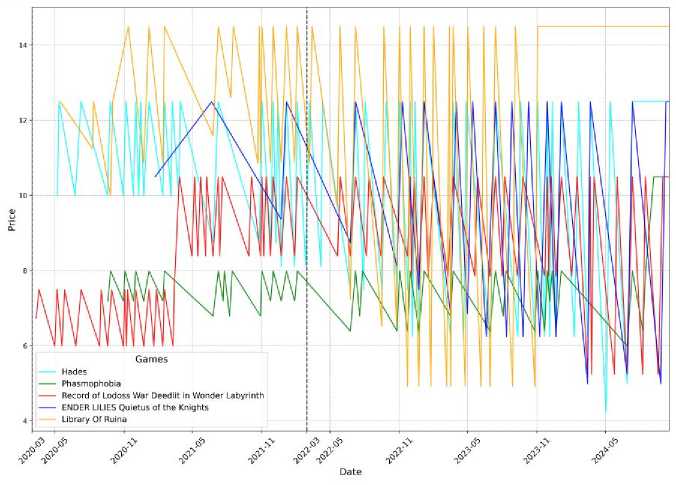

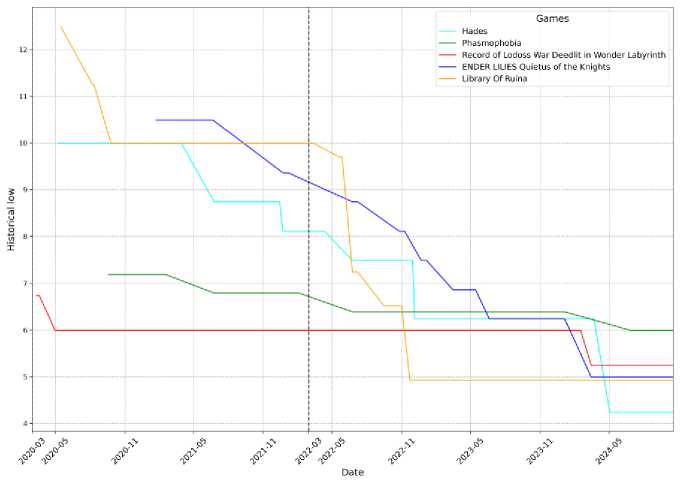

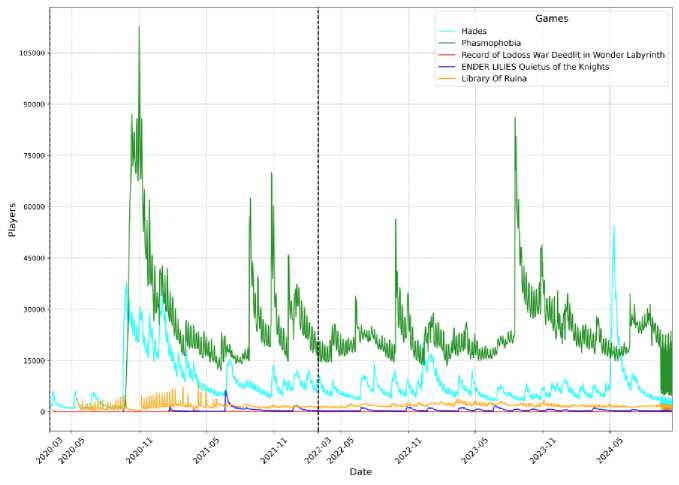

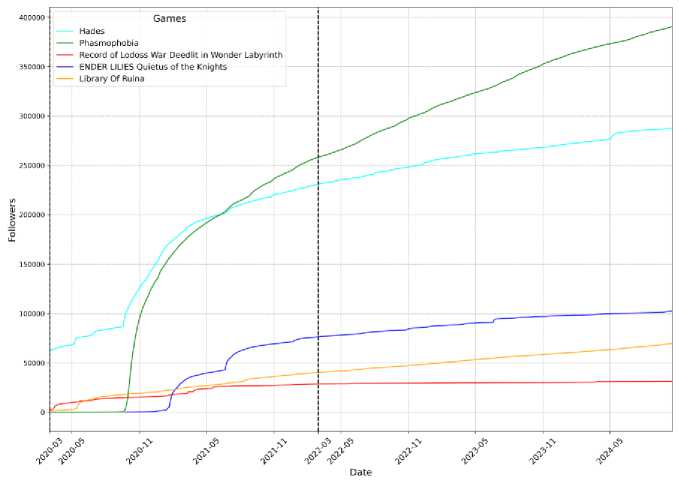

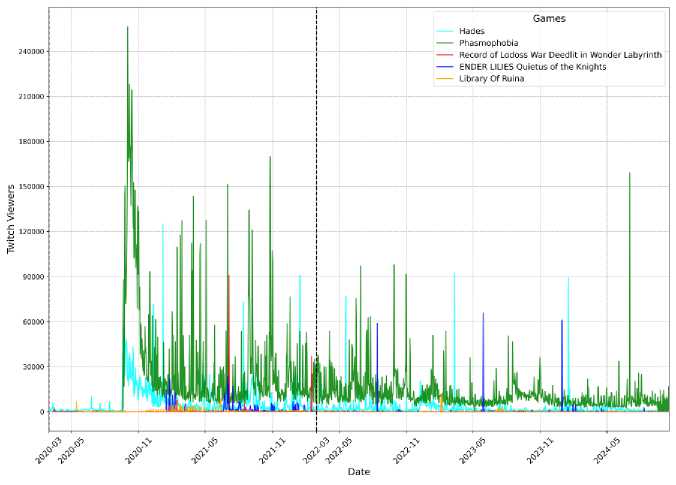

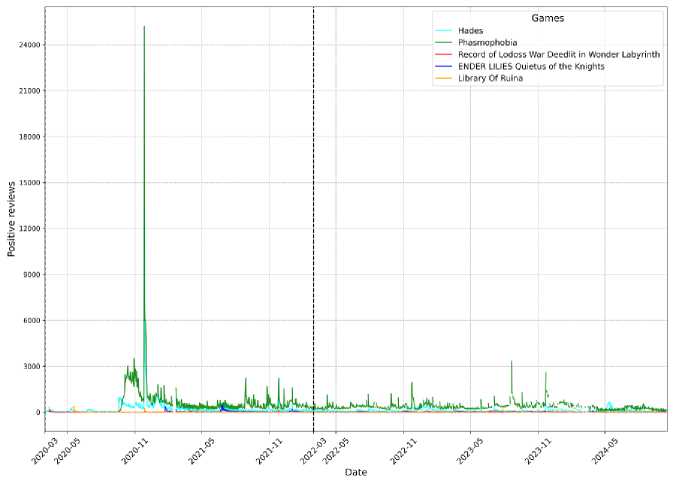

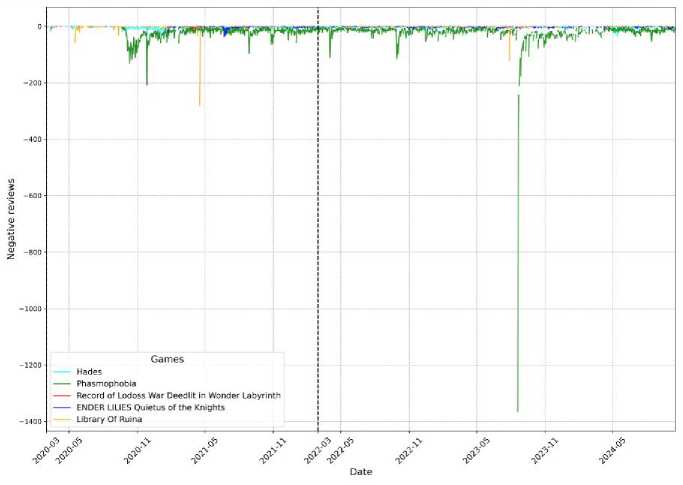

Indie games that were released during COVID-19: Hades, Phasmophobia, Record of Lodoss War-Deedlit in Wonder Labyrinth, ENDER LILIES: Quietus of the Knights, Library of Ruina. These games also require a date ratio to the same parameters that were used for games that were released before COVID-19 (see Figure 12, Figure 13, Figure 14, Figure 15, Figure 16, Figure 17, Figure 18). The difference is that due to the fact that the date during COVID-19 will be used as the starting date, then the main thing is that it will only be possible to track how the parameters changed after the end of COVID-19.

Fig.12. Price comparisons of indie games released during Covid-19

Fig.13. Historical low comparisons of indie games released during Covid-19

From these graphs, you can understand:

• Price:

-

◦ Hades - there were frequent discount periods. The base price of the game without a discount did not change.

-

◦ Phasmophobia - there were frequent discounts throughout the review period. The permanent price without a discount increased in September 2024.

-

◦ Record of Lodoss War-Deedlit in Wonder Labyrinth - there were periodic discounts. The price without discounts did not change.

-

◦ ENDER LILIES: Quietus of the Knights - discounts appeared regularly. The permanent price without discounts remained the same.

-

◦ Library Of Ruina - discounts were frequent. The original price did not change.

Fig.14. Players comparisons of indie games released during Covid-19

Fig.15. Followers comparisons of indie games released during Covid-19

• Historical low:

-

◦ Hades - changed 2 times during COVID-19 and 3 times after COVID-19.

-

◦ Phasmophobia - changed 1 time during COVID-19 and 2 times after COVID-19.

-

◦ Record of Lodoss War-Deedlit in Wonder Labyrinth - during COVID-19 there was one historical low

value and it never changed during this period and after COVID-19 it changed 1 time.

-

◦ ENDER LILIES: Quietus of the Knights - during COVID-19 it changed 1 time and after COVID-19 it changed 6 times.

-

◦ Library Of Ruina - during COVID-19 there was one historical low value and it never changed during this period and after COVID-19 it changed 4 times.

-

• Average number of players per month:

-

◦ Hades - during COVID-19, at the time of release and a little after there were on average a lot of players, however, soon it decreased, after COVID-19 it once reached a historical peak and this is due to the release of the second part of the game: Hades II.

-

◦ Phasmophobia - during COVID-19 it was high only in the first months of the game's release, then it dropped. Later, it would rise a little and then fall again. After COVID-19, this trend continued, but the value rose once in August 2023, after which it returned to its usual mode

-

◦ Record of Lodoss War-Deedlit in Wonder Labyrinth - after the release, it was at its peak, but then quickly decreased and remained small for the rest of the period

-

◦ ENDER LILIES: Quietus of the Knights - after the release, it was initially large, but then there was a sharp decrease. After a sharp decrease, the value regularly increases and decreases within certain limits, without reaching the peak values that were in the initial period after the release.

-

◦ Library Of Ruina - a stable change in the number of players, with a regular increase or decrease within certain limits.

Fig.16. Twitch viewers comparisons of indie games released during Covid-19

Fig.17. Positive reviews comparisons of indie games released during Covid-19

Fig.18. Negative reviews of games released during Covid-19

-

• Number of subscribers:

-

◦ Hades - during COVID-19, after the release, it increased significantly in the first year. Subsequently, the growth was not fast.

-

◦ Phasmophobia - has been growing steadily throughout the study period.

-

◦ Record of Lodoss War-Deedlit in Wonder Labyrinth - grew slightly during COVID-19, and after COVID-19, almost no growth

-

◦ ENDER LILIES: Quietus of the Knights - grows steadily, but not quickly.

-

◦ Library Of Ruina - grows steadily at a good pace

-

• Number of viewers on Twitch. Hades has a regular high number, constantly alternating with a low number. Phasmophobia regularly drops after peak viewers and sometimes rises a little, only in July 2024 there was a noticeable increase. Record of Lodoss War-Deedlit in Wonder Labyrinth had a low number the entire period, but during COVID-19, it reached a big peak 2 times, in January 2021 and February 2022. ENDER LILIES: Quietus of the Knights had an average number of viewers during COVID-19, but decreased after COVID-19, but reached peak values 3 times. Library Of Ruina has a relatively stable number but peaked once after COVID-19 in February 2023.

-

• Reviews (positive and negative). Hades has decreased over time and remains low. Phasmophobia has decreased over time and remains low. Record of Lodoss War-Deedlit in Wonder Labyrinth had a high number early after release, and then decreased at a certain point and stopped at a stable low level. ENDER LILIES: Quietus of the Knights has a peak in reviews for a short period after release, then decreases and stops, and then increases and decreases slightly within this value. Library Of Ruina has a stable number, sometimes decreasing or increasing, but not going beyond the limit.

-

-

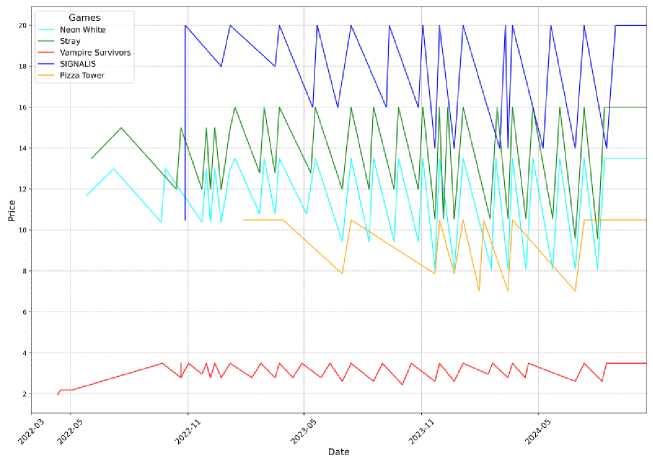

5.3. Price Dynamic and Activity of Players of indie Games that Came out after COVID-19

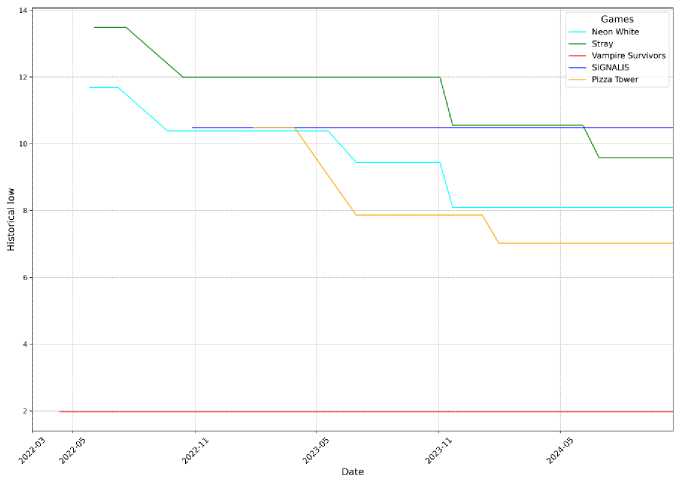

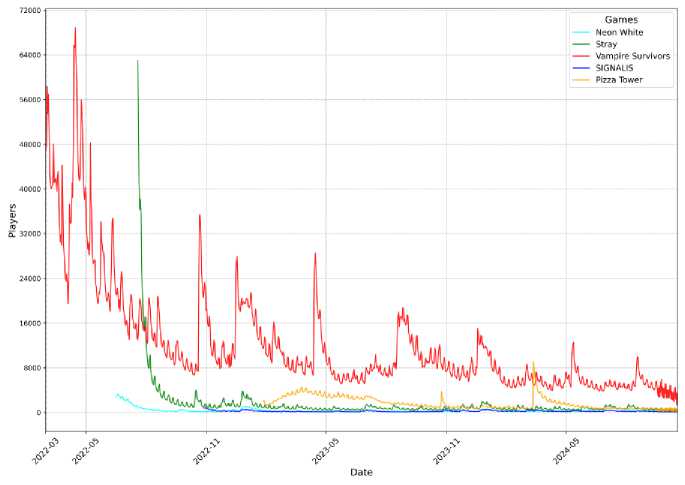

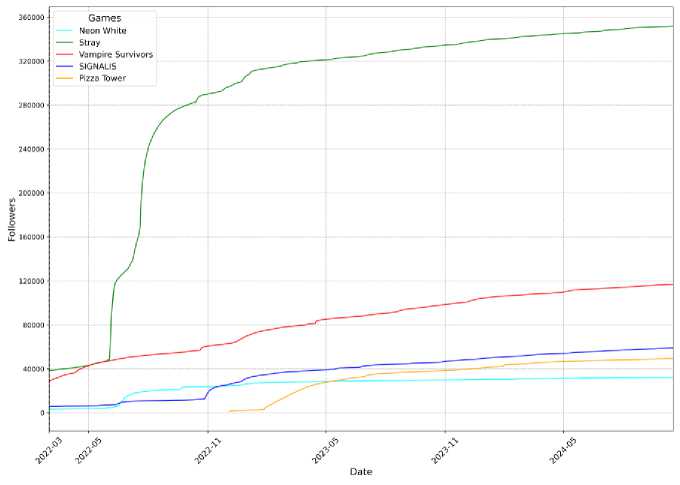

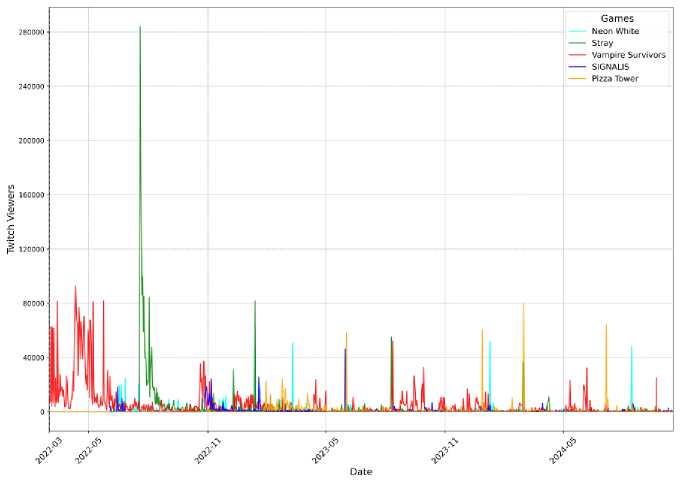

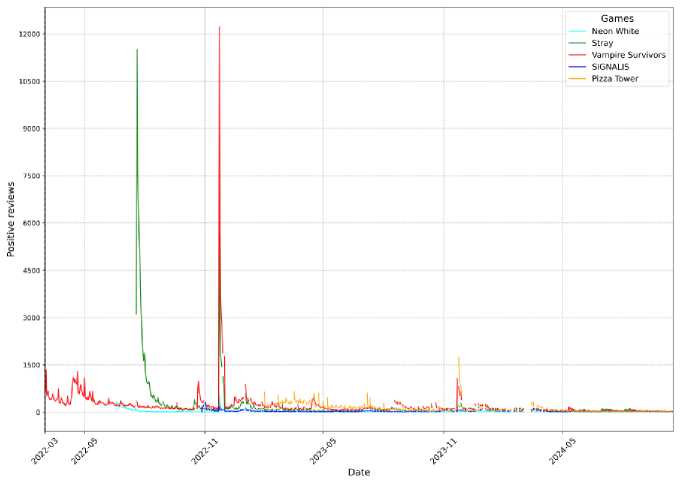

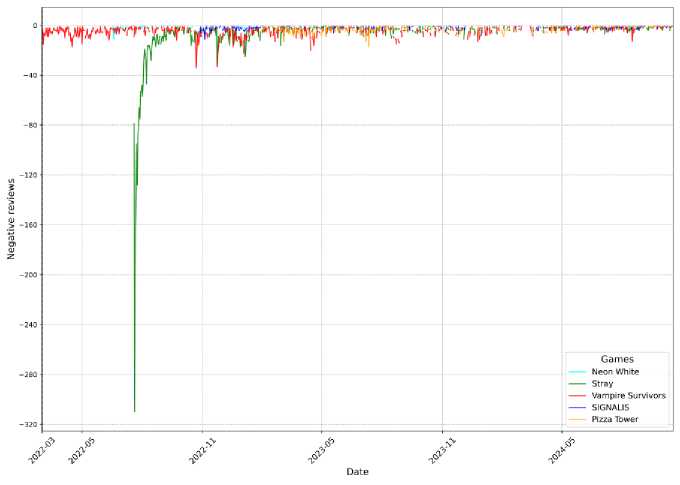

Indie games that were released after the end of COVID-19: Neon White, Stray, Vampire Survivors, SIGNALIS, Pizza Tower. The same parameters are also important for these games (see Figure 19, Figure 20, Figure 21, Figure 22, Figure 23, Figure 24, Figure 25). The starting point for all ratios will be the end date of the COVID-19 pandemic. A distinctive feature of these statistics is that it is impossible to compare with your own results from other time periods and this will be more useful for comparison with other games from previous periods.

Fig.19. Price comparisons of indie games released after Covid-19

Fig.20. Historical low comparisons of indie games released after Covid-19

The analysis yielded the following results:

• Price:

-

◦ Neon White - discounts are frequent. The main price of the game has not changed.

-

◦ Stray - discounts were regular. The main price without discounts increased in January 2023.

-

◦ Vampire Survivors - discounts are frequent. The price without discounts has not changed.

-

◦ SIGNALIS - sometimes there are discounts. The fixed price without discounts has not changed.

-

◦ Pizza Tower - discounts were regular. The price set at release has not changed anymore.

-

• Historical low:

-

◦ Neon White - changed 3 times after COVID-19.

-

◦ Stray - changed 3 times after COVID-19.

-

◦ Vampire Survivors - after COVID-19 there was one historical low value, and it never changed during this period.

-

◦ SIGNALIS - after COVID-19 there was one historical low value, and it never changed during this period.

-

◦ Pizza Tower - changed 2 times after COVID-19.

Fig.21. Players comparisons of indie games released after Covid-19

Fig.22. Followers comparisons of indie games released after Covid-19

• Average number of players per month:

-

◦ Neon White - in the initial period after the release, the value was peak and then decreased. Later it was small, a temporary increase occurred in December 2022 and January 2023 and after that it decreased again to a certain level and around this level they slightly decreased and slightly increased.

-

◦ Stray - the peak was within 2 weeks after release and then sharply decreased and remained at this small level, sometimes slightly increasing and decreasing, but not even close to returning to the peak results.

-

◦ Vampire Survivors - regularly decreased and increased, but with an increase, the peak point became lower and lower.

-

◦ SIGNALIS - during the release period there was a peak, but then there was a stable decrease and increase, not reaching the peak point itself, but being near the peak point.

-

◦ Pizza Tower - increased in the initial period after the release, then began to decrease, sometimes increasing, in October 2023 and March 2024 they increased significantly, but then there was a decrease again to a small amount.

Fig.23. Twitch viewers comparisons of indie games released after Covid-19

Fig.24. Positive reviews comparisons of indie games released after Covid-19

-

• Number of subscribers:

-

◦ Neon White - during the first six months after the release, growth was fast, but then the growth slowed down significantly.

-

◦ Stray - has been growing steadily well throughout the entire study period.

-

◦ Vampire Survivors - has been growing steadily and quickly.

-

◦ SIGNALIS - has been growing steadily at a fast pace.

-

◦ Pizza Tower - in the first six months there was a large increase, after which the growth rate decreased.

-

• Number of viewers on Twitch. Neon White had a certain number, sometimes reaching large values. Stray had a peak quantity in the period after the release and then the quantity began to decrease, but within six months after the release there were several small jumps, but then these jumps became very rare and the quantity decreased completely. Vampire Survivors had a steadily increasing and decreasing quantity, in August 2023 a peak point was reached. SIGNALIS had 3 large peak points, and then regularly decreased with several local peaks. Pizza Tower had regular jumps in quantity, the rest of the time without these jumps the quantity was small.

Fig.25. Negative reviews of indie games released after Covid-19

-

• Reviews (positive and negative). Neon White had a large quantity in June-July 2022 and then decreased and remained stable, only in November 2022 there was a temporary increase and then returned to the previous level again. Stray had a peak quantity in the initial period after the release and once a high value was in November 2022, the rest of the time the quantity was stably small. Vampire Survivors had a peak in November 2022, there were local peaks in August 2023 and November 2023, the rest of the time the number was small. SIGNALIS had a peak in the initial period after the release, and then decreased a little and remained stable, slightly increasing and decreasing. Pizza Tower had a stable average number for the first six months, sometimes slightly increasing or slightly decreasing, after which the decrease became more noticeable, but in November 2023 there was a peak point and after that there was a decrease again to the previous level.

-

5.4. Price Dynamic and Activity of Players of AAA before, during and after COVID-19

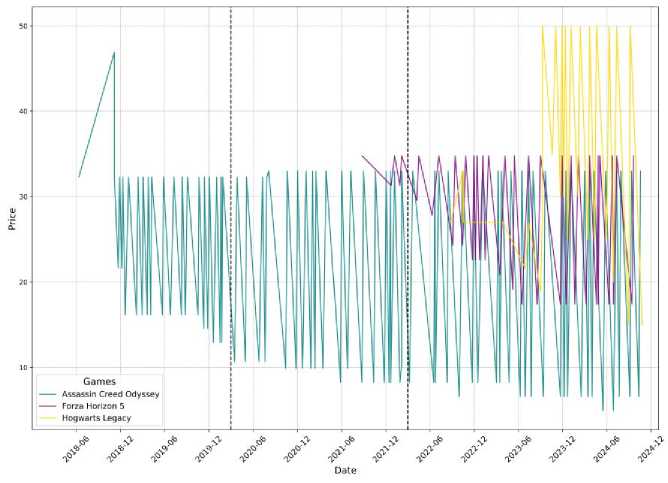

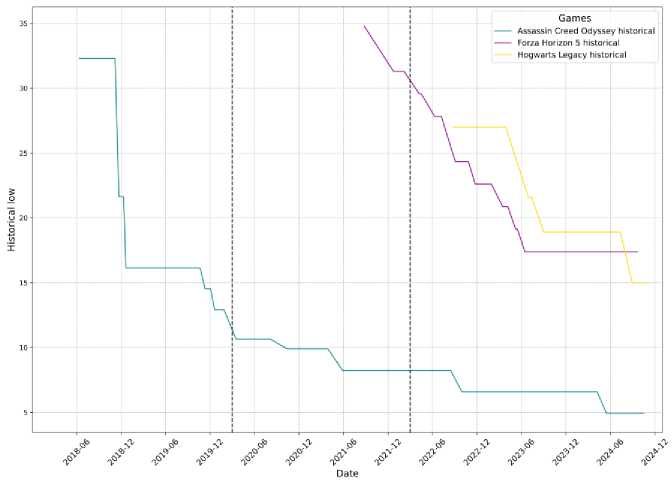

Fig.26. Price comparisons of AAA games

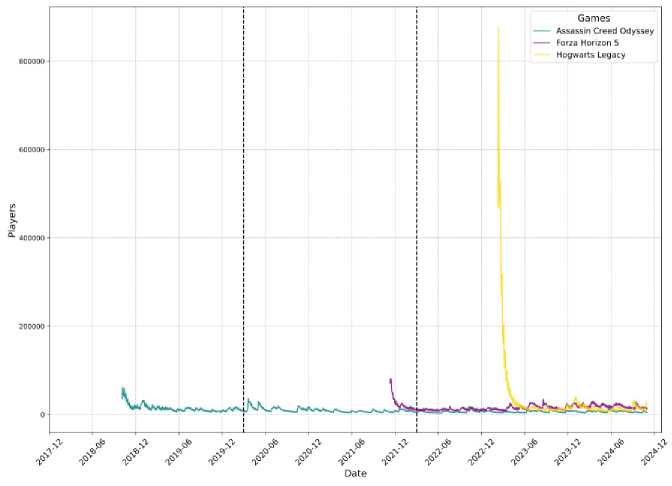

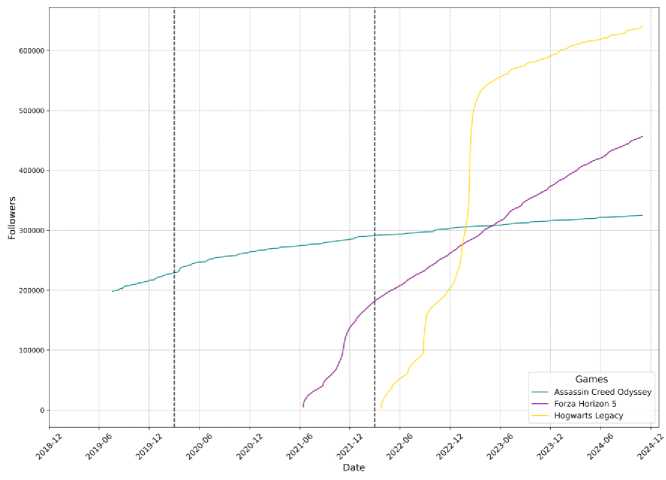

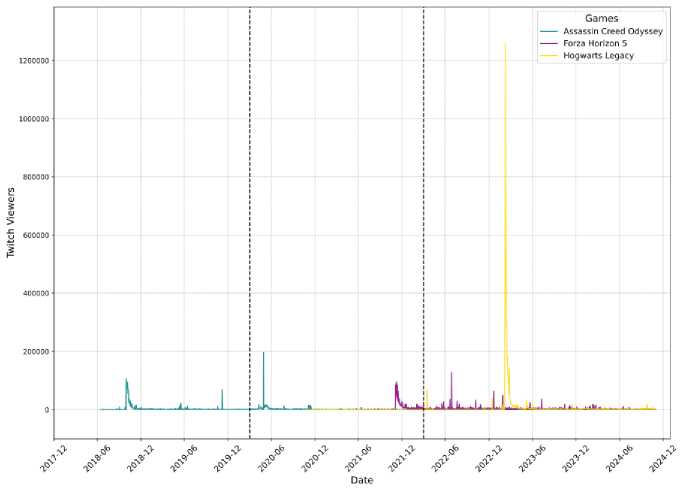

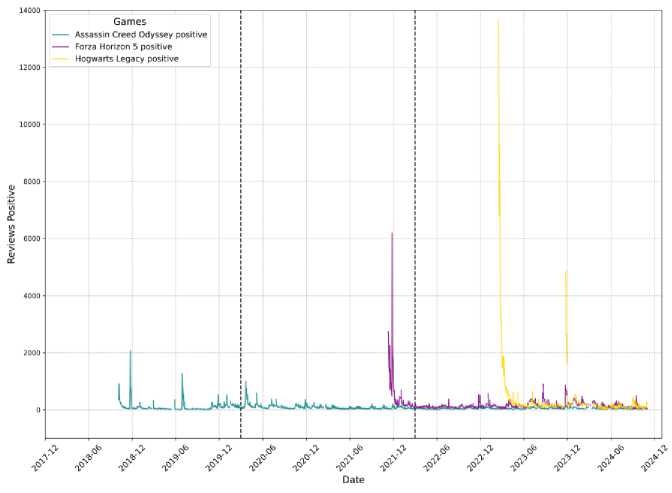

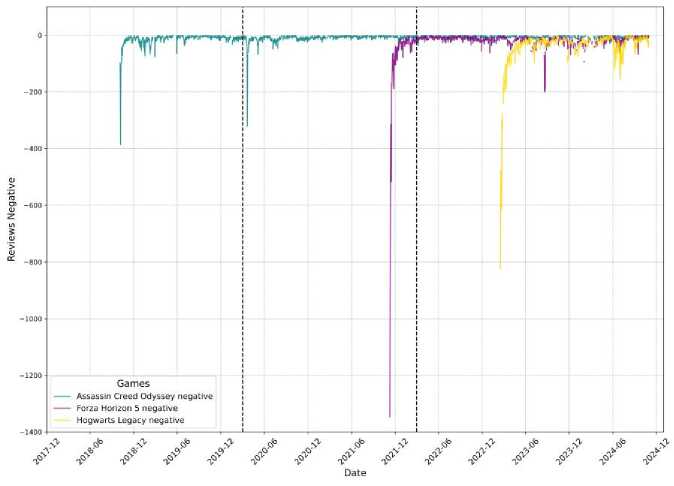

AAA games used for analysis: Assassin's Creed Odyssey, Forza Horizon 5, Hogwarts Legacy. These games are divided by periods as follows: Assassin's Creed Odyssey was released before COVID-19, Forza Horizon 5 was released during COVID-19, and Hogwarts Legacy was released after COVID-19. The same parameters are important for these games as for indie games (see Figure 26, Figure 27, Figure 28, Figure 29, Figure 30, Figure 31, Figure 32). Since in this case one game is used for analysis, it will be appropriate to show all 3 for each type of data in one graph, dividing the

COVID-19 period with a black dashed line. Taking all this into account, one category of information will have one graph with all three games for all periods: before, during and after COVID-19.

Fig.27. Historical low comparisons of AAA games

Fig.28. Players comparisons of AAA games

The following statistics were obtained:

• Price:

-

◦ Assassin's Creed Odyssey - discounts were frequent. The initial selling price without discounts did not change.

-

◦ Forza Horizon 5 - the game was regularly discounted on Steam. The base price for the game without discounts did not change.

-

◦ Hogwarts Legacy - in the first six months, there were discounts only 2 times, but then the discounts became permanent. The base price increased in September 2023.

Fig.29. Followers comparisons of AAA games

Fig.30. Twitch viewers comparisons of AAA games

• Historical low:

-

◦ Assassin's Creed Odyssey - before COVID-19, it changed 4 times, during COVID-19, it changed 3 times, and after COVID-19, it changed 2 times.

-

◦ Forza Horizon 5 - during COVID-19, it changed 1 time, and after COVID-19, it changed 7 times.

-

◦ Hogwarts Legacy - after COVID-19, it changed 3 times.

• Average number of players per month:

-

◦ Assassin's Creed Odyssey - the peak occurred in the initial period after the release but then decreased until the onset of COVID-19, with the onset of COVID-19, the number of players increased for a certain period and then began to decrease again, but with regular local increases.

-

◦ Forza Horizon 5 - the peak value was immediately after the release, then it began to decrease not very much and then began to increase and decrease slightly.

-

◦ Hogwarts Legacy - the peak period occurred in the period after the release but then fell sharply and then remained at this level, slightly increasing or decreasing.

Fig.31. Positive reviews comparisons of AAA games

Fig.32. Negative reviews of AAA games

• Number of subscribers:

-

◦ Assassin's Creed Odyssey - steadily growing at a low rate.

-

◦ Forza Horizon 5 - during COVID-19 and after COVID-19, it is growing steadily at a good rate.

-

◦ Hogwarts Legacy - the number has been steadily growing, not very quickly, after the game's release.

• Number of viewers on Twitch. Assassin's Creed Odyssey's number has been decreasing since release, but at the beginning of COVID-19 it increased sharply for a while and then decreased again, but there were also local peaks in November 2020 and October 2022. Forza Horizon 5 has seen a regular increase and decrease in viewers, but even with an increase, local peak values are constantly decreasing, the global peak result was updated in June 2022. Hogwarts Legacy's number was at its peak in the period after the game's release and then decreased to very small values, sometimes increasing locally, but then dropping again.

• Reviews (positive and negative). Assassin's Creed Odyssey's number of reviews was stable with several peak points. Forza Horizon 5 had a peak in the first month of release, then decreased and remained stable, sometimes slightly increasing or decreasing. Hogwarts Legacy had a peak in the first month after release and then immediately decreased to a small number and had a temporary increase in November 2023.

6. Overall Impact of COVID-19 on Pricing Dynamics and Activity of Players6.1. Observations

6.2. Conclusions

Price variations. During the pandemic, there were notable price variations, largely driven by short-term sales or promotions designed to attract gamers who were spending more time at home due to lockdowns. This tactic was widely used to maintain player engagement and drive activity in an increasingly competitive market.

Surge in activity of players. The global pandemic contributed to a significant rise in leisure time and a shift toward digital entertainment, including video games. This led to increased activity of players for independent games, prompting publishers and developers to adjust their pricing strategies accordingly. Many indie developers seized the opportunity to experiment with different pricing models, bundle offers, and promotional campaigns to capture a broader audience.

Market adaptation. Different games responded to these new market conditions in varied ways. Some games experienced higher player engagement and improved review sentiment due to strategic price adjustments, while others struggled to maintain visibility in a crowded marketplace. These dynamics highlight the importance of flexible and responsive pricing strategies in the digital gaming industry.

The investigation has provided a comprehensive understanding of how the COVID-19 pandemic has impacted pricing dynamics and player responses in the indie game industry on the Steam platform. This study effectively highlighted various trends by using Python for graphical representations, offering clear visual insights into how pricing strategies and player behavior evolved throughout the different phases of the pandemic. The visual data simplifies complex patterns, helping to clarify market changes and offering more accessible insights.

For developers, marketers, and industry stakeholders navigating the digital game sales landscape in the postpandemic era, these findings are particularly valuable. The study encourages these professionals to reassess and potentially adjust their business strategies in light of the changing market conditions brought about by the pandemic. Understanding these patterns is critical for tailoring strategies to meet shifting player preferences, which have shown a marked increase in engagement with indie games as people spent more time at home.

The data also underscores the importance of flexible and responsive pricing strategies in the ever-changing digital economy. The ability to quickly adapt to shifts in player demand and market conditions will be essential for maintaining growth and competitive advantage as the industry continues to evolve. How the developer market has adapted can be seen from the graphs. For example, some developers, on a way out, began to use frequent discounts and thus were able to maintain and increase the number of regularly playing players, such as Hollow Knight. Others also began to reduce the historical low price more often to encourage players to buy games, even after COVID-19 and thereby maintain or increase the number of consistently playing players, such as ENDER LILIES: Quietus of the Knights. Another option was the release of a second part, as in the case of Hades, when, simultaneously with the start of sales of Hades II, the popularity of the first part also increased. Some developers chose not to change their strategy and their games continue to acquire new players, but the speed of development of such games has decreased, and the number of players has decreased and is practically not increasing, as, for example, in Touhou Luna Nights, when the developers always made a discount of only 10-20% during the sales period and only by mid-2024 the discount percentage increased, but it was too late and the game lost its relevance and possible interest of users.

In conclusion, this study shows that in the post-COVID-19 period, developers are advised to set reasonable prices for games. Even though COVID-19 has passed, and most people have returned to a stable level of income, however, the number of users who have started playing Indie games and games in general has increased, as has the number of Indie games. If developers want users to play these games, they need to attract players with both competitive prices and not only competitive prices, but also interesting content within the game itself. Alternatively, they can use large price reductions/discounts during the winter sale and summer sale. This is justified by the fact that the winter sale falls at the end of December, when most people around the world celebrate Christmas or New Year and have a lot of free time, as in the times of COVID-19. The summer sale falls on the period from mid-June to mid-July, when most people go on vacation or their school year ends and they can choose games to spend a lot of free time. If you can’t find your audience right away, you can try to reduce the historical low to those prices that will attract a stable audience. You can also release the second part of a successful game, which can partially raise interest in the first part as well. If you do nothing for a long time, you can not only fail to acquire a new audience but also lose the existing one.