Arctic’s knowledge economy: Spatial patterns of knowledge and technology production in the Arctic

Автор: Andrey N. Petrov, Salma O. Zbeed, Philip A. Cavin

Журнал: Arctic and North @arctic-and-north

Рубрика: Economics, political science, society and culture

Статья в выпуске: 30, 2018 года.

Бесплатный доступ

This paper focuses on ‘other,’ i.e. non-resource, non-public sector and non-subsistence economies of the Arctic. We investigate the geography and assets of the Arctic’s knowledge sector by examining both supply and output side of the knowledge production at the circumpolar and regional scales (using Alaska as a case study). In other words, this paper provides a first-cut analysis of the “Arctic variety” of the knowledge economy. We find that the Arctic has variable endowment with human capital engaged in new knowledge generation. Clusters of high knowledge potential tend to locate in larger cities and regional capitals. An analysis of patent registration in Alaska, confirms this pattern, but also reveals a complicated and evolving picture of localized innovation. Alaska demonstrates limited, albeit growing, variety knowledge-producing sectors, a strong role of individual inventors and a weak connectivity with outside knowledge clusters. It is also evident that knowledge production in the Arctic has underdeveloped circumpolar linkages, and thus requires urgent efforts to stimulate research cooperation between private and public sector inventors in the Arctic jurisdictions.

Knowledge economy, Arctic, patent, innovation, development

Короткий адрес: https://sciup.org/148318544

IDR: 148318544 | УДК: [911.3:33](98)(045) | DOI: 10.17238/issn2221-2698.2018.30.5

Текст научной статьи Arctic’s knowledge economy: Spatial patterns of knowledge and technology production in the Arctic

A textbook description of the Arctic economy traditionally refers to the three ‘pillars:’ resources, public sectors, and traditional sectors [1, Knapp G., Huskey L.]. However, as argued below, this notion is no longer valid due to the increasing diversification of the Arctic’s economy instigated by the evolving global and national economies of the Arctic states. In most regions of the Arctic, with the exception of Russia, the non-pillar industries produce 30-50% of GDP [2, Glomsrød et al]. There is a good argument that some of these emerging industries have higher productivity and lesser volatility than the resource sector, and therefore are more compatible with the notion of sustainable economic development in Arctic regions. Thus, a proper study of the modern Arctic economy cannot be conducted without examining ‘other’ economies.

Under ‘other’ economies we understand a broad range of economic activities, which are not (non-renewable/large scale) resource, public or traditional, although they may be connected to these through various linkages [3, Petrov A.]. ‘Other’ economies tend to be more endogenous and

embedded. As a result, they may have stronger internal linkages and multipliers, generate more local development, and serve as avenues to empower local communities. At the same time, these economies are not solely local [4, Huskey L.], but can also serve as a strong link between Arctic’s local economies and the global capitalist system. Examples of ‘other’ economies include knowledgebased industries, such as high-tech, arts and crafts, small-case custom manufacturing, professional and technical services, food, recreation, and local retail trade.

Recent studies demonstrate that despite strong impediments, peripheral communities can foster a diversified economy [7, Beyers W., Lindahl D.; 8, Boschma R.; 9, Gradus Y., Lithwick H.; 10, Selada C. et al.]. Investment in human capital has been identified as a key element in diversifying local economies [6, Megatrends; 11 Petrov A.]. Human capital in this context can be defined as a stock of knowledge and skills vested in the local population, while creative capital refers more specifically to the aggregate ability to generate ‘meaningful new forms’ (i.e. to innovate) that have economic value [12, Hirshberg D., Petrov A.; 13 Florida R.]. In order for peripheries to foster economic growth spurred by ‘other’ economies, there has to be a connection to localized knowledge and social capital that can be formed with institution-building and formation of civic society [14, Aarsaether N.].

A development based on knowledge economy is an integral part of a larger sustainable development strategy, especially for Arctic cities and towns [15, Pelyasov A.]. Bringing and sustaining knowledge and human capital-intensive industries provides a new opportunity for northern urban communities to avoid boom-bust cycles, reduce dependency on external economic and political actors, and improve the wellbeing of the local residents. Recent studies demonstrated that some Arctic cities have considerable concentrations of highly educated professionals [6, Megatrends]. These are predominantly administrative and economic urban centers. Albeit only some Arctic regions could strongly capitalize on ‘other’ economies, or high-tech specifically, it is certainly a possible ingredient for achieving sustainable development in northern urban communities.

This paper discusses emerging high-tech industries and uses two scales of analysis to provide insights in a knowledge-based economy of the Arctic. The general discussion of ‘other’ economies’ has been started in Petrov [3], and this paper serves to extend the earlier argument focusing on high technology (high-tech) economic activities, which are defined here as knowledge-producing sectors and activities reliant on codified technical knowledge, such as Information Technology and Professional, Scientific, and Technical Services. High-tech is not the only knowledge-generating segment of the economy, and other sources of innovation in the Arctic include cultural, social, and civic economies [16, Petrov A.]. However, high-tech is more vividly represented in the literature and in statistical dataset. One characteristic of the high-tech industries is the elevated share of STEM jobs, such as engineers, IT workers, designers, scientists, managers, etc. [17, BLS]. However, technology knowledge production is not confined to these sectors, but spreads across the entire economy involving all workers in creative technology-related occupations [13, Florida R.]. Thus, in order to examine (high-tech) knowledge economy one needs to consider knowledge workers in all industries, employment in technology firms, and knowledge production itself. Below, the analysis follows this logic by looking at three snapshots of the Arctic knowledge economy: through occupational and educational characteristics of labor force, employment in high-tech sectors, and patents output.

Circumpolar Knowledge Economy: Knowledge Workers in Arctic Cities

The data on knowledge economy in the Arctic are limited. However, several recent studies developed a system of proxies, which could be used to estimate the size and potential of the knowledge sector in peripheral jurisdictions, such as the Arctic [11, Petrov A.]. One way to measure knowledge production is to look at knowledge output (e.g., patents or other forms of innovations). Another option is to examine knowledge supply (e.g., the education/skills level of the labor force, and the number of employees in high-tech sectors and in knowledge-intensive occupations). The three main indices used here are supply-based and include: Talent Index (TI), Applied Scientists (“Engineers”) Index (ASI), and Tech Pole Index (TPI). The two first indices are based on information on workers occupations. The TI is defined as the location quotient (LQ) of adult population with a university degree, while ASI is the LQ of labor force with occupations in applied and natural sciences, computer science, and engineering. The Tech-Pole Index (TPI) is a LQ of the employment in high technology sectors (including Information and Professional, Scientific and Management, and Administration occupations in the national classifications). The data used in this study date between 2006 and 2010. Only the largest cities (population over 20,000) and the regional capitals are included.

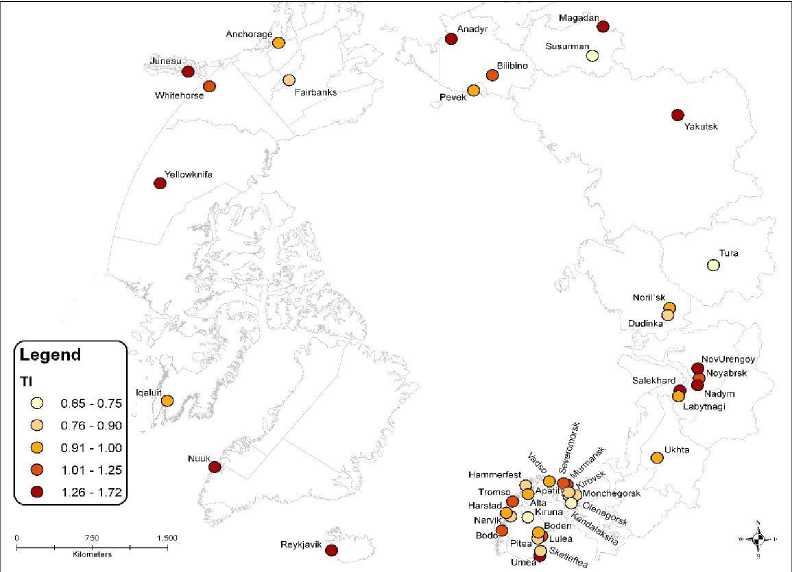

Figure 1 shows the Talent Index for the circumpolar cities. Most Arctic regions have relatively low educational attainment as described by the TI. As seen in Table 1, Arctic cities have varying degrees of ‘talent’ concentration. These clusters include regional and national capitals both in Russia and across the Arctic, such as Anadyr’, Salekhard, Yakutsk, Umea, Magadan, Juneau, Yellowknife, Tromsø, and Reykjavik. Another group of cities with highly educated labor force is located in Yamal-Nenets Okrug of Russia (most likely reflecting the influx of educated labor migrants in the last decades).

Figure 1. Location quotient of adult population with a university degree (Talent Index) in Arctic cities

Table 1

Talent Index in Selected Arctic Cities

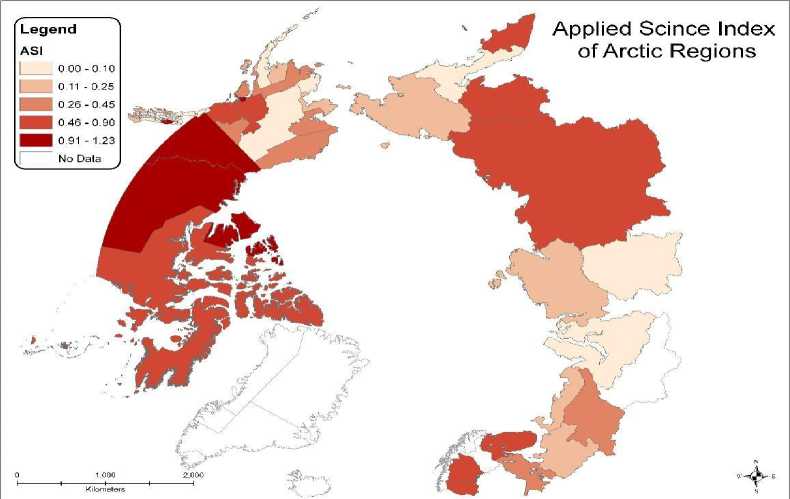

Figure 2. Location quotient of labor force in applied and natural sciences and engineering in the Arctic regions (ASI). Source: [3, Petrov A.]

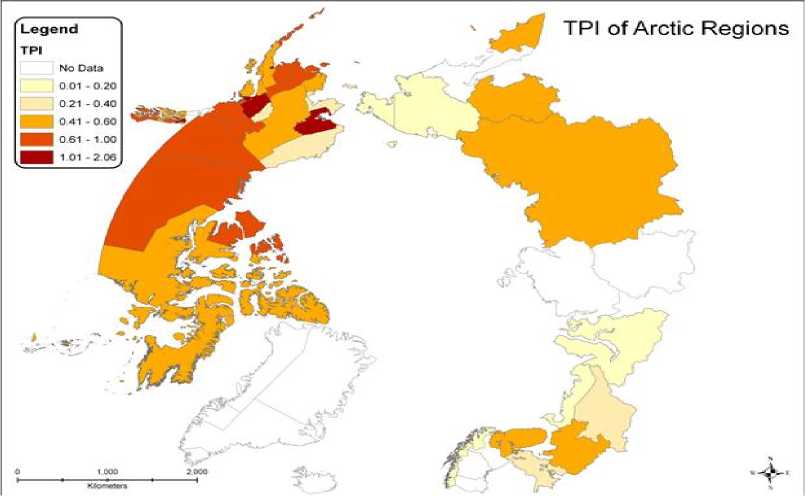

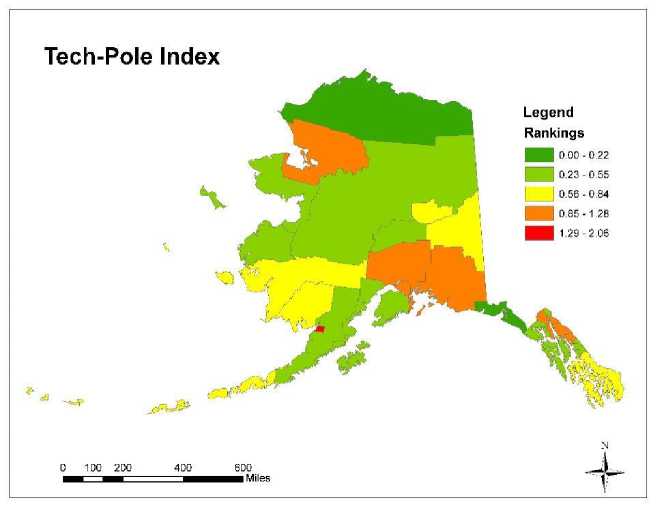

Finally, the Tech Pole Index assesses the employment in high-tech industries (Florida, 2002; Figure 3). It estimates the volume of knowledge-based economic activity in the Arctic regions relative to the country’s base. Not surprisingly, the TPI generally follows ASI and is larger in the Northwest Territories, Yukon, and selected regions of Alaska. The index is much lower in northern Eurasia. Remarkably, oil and gas-rich regions of the Russian Arctic have small high-technology employment: most engineers and technology workers (captured by the TI and the ASI) are employed in the extractive industry, which is not considered high-tech by the TPI.

Figure 3. Location quotient of the employment in high technology sectors (TPI). Source: [3 Petrov A.]

Regional Knowledge Production: Patented Innovations in Alaska

Patents are registered and recognized instances of product or process innovations. Patent production has been routinely utilized to characterize the knowledge economy’s output [18, Acs Z.J., Audretsch D; 19, Feldman M.]. In the United States, intellectual property right is granted and the patent is awarded by the U.S. Patent and Trademark Office (USPTO). The volume of patents registered to inventors in particular region is closely related to the knowledge economy output in the area [20, Archibugi D.; 21, Kogler D.].

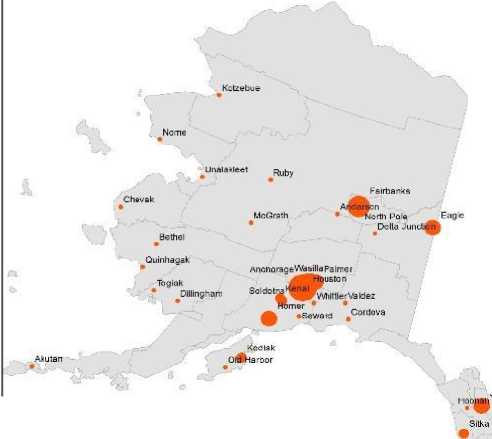

The total number of patents granted to Alaska residents between 1976 and 2010 was 1,959 (Figure 4). Over half of these patents were issued to residents of Alaska’s three largest cities: Anchorage (855), Fairbanks (191), and Juneau (73). Other towns with considerable innovation activity included Wasilla (117), Homer (64), and Palmer (58). A large concentrations of patents in urban Alaska is natural. However, if normalized by population, a more complex picture of knowledge production would emerge: many smaller areas emerged as visible hubs of innovation activity, although many of them are highly specialized and/or localized.

winerveidM

Legend

Number of patents • 1-12

Port Alexander Wenge I

• dbffrwnCove

Kla'^mie ««*,,,„

13-41

ф 42-118

119 - 193

Figure 4. Number of patents (left) in Alaska cities and towns. (Source: USPTO database)

It is interesting to compare the geography of innovation to the employment in the high technology sectors (Figure 5). The TPI for Alaska’s boroughs illustrates a similar picture, where Anchorage and its neighboring boroughs have the largest relative proportion of employees in the knowledge sector. Rural parts of the state with high TPI, such as the Northwest Arctic Borough, are associated with the areas of intensive resource-based activity with a relatively large knowledge labor force, but very few patents. In other words, these areas represent the end nodes of the knowledge production chain, where technology is being implemented (e.g., for mining) rather than developed.

Figure 5. Location quotient of the employment in high technology sectors (TPI) ( Source: Alaska Department of Labor and Workforce Development, 2009)

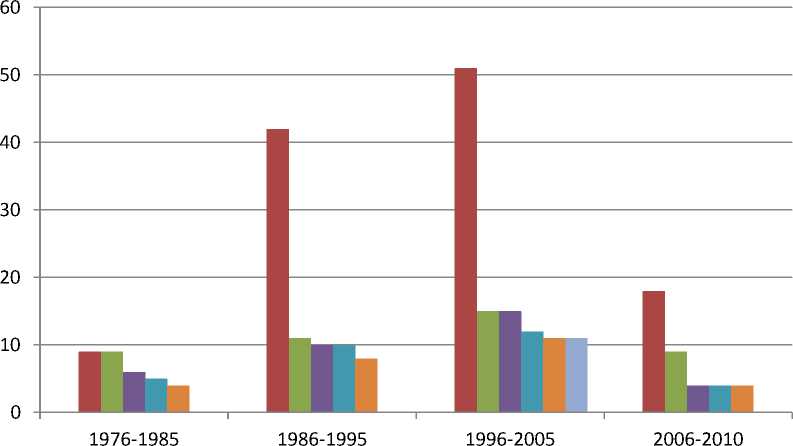

Alaska innovative activity changed over time (Figure 6). There were at least four distinct periods when the dynamics of innovation and mix of leading sectors differed. In the early years (1976-1985), corresponding to the Alaska pipeline construction and the beginning of the oil boom, the number of patents was relatively small and with no clear dynamic from year to year. The top five patent-producing producing industries were: fishing, trapping and related activities (a traditional area of Alaska knowledge specialization, i.e. an “old” industry), hydraulic and earth engineering, wells (both associated with the oil extraction), land vehicles and road structure (the latter two related to the intensive construction, exploration, and drilling). The picture had changed by the mid-1980s. In 1986-1995, the dominant sector was wells, joined by hydraulic and earth engineering, boring, and liquid purification/separation. In all of these areas inventors worked on improving design, efficiency, and productivity of oil wells, drilling processes, and extraction and transportation. Needless to remind that this was the period of low oil process, so investments were channeled to increase production and productivity. In the following decades, the role of the wells sector in knowledge production remained very high, and other oil-related industries increased their knowledge production. The innovative activity dipped during the financial crisis of 2008, although it later recovered. Since the 1990s, and especially in the 2000s, the new sectors of knowledge specialization also emerged, such as medical procedures / surgery, data processing, and amusement devices.

Figure 6. Leading sectors by patented innovative activity in Alaska (1976-2010) (Source: USPTO database)

Overall, between 1976 and 2010, the wells sector produced 11% of all patents created by 18% of inventors. Most patents went to organizations, not individual inventors (8% of patents). There were 20 organizations and companies that involved in patenting activities. The dominant company was Atlantic Richfield Company with 196 affiliated inventors who have created 64 patents, with about 129 inventors were from Anchorage alone. The second largest patent applicant was for Schlumberger Technology Corporation, followed by Baker Hughes Incorporated. This sector represents a company-driven innovation, characteristic of large, vertically and horizontally integrated firms, in this case in the extractive industry. Other similar sectors included liquid purification, boring or penetrating the earth, data processing, drug, bio-effecting, and body treating compositions, measuring and testing, multiplex communications, communications electrical, and marine propulsion.

A contrasting example of individual-based innovation activity is surgery. Although this sector accounted for only 2.7% of total patents, two-thirds of inventors were individuals, mostly from Anchorage. The co-authors were scattered from Florida to Australia. However, there were six organizations involved in the patenting process, such as AutoGenesis Corporation. Other sectors with more individual inventors than company inventors, were land vehicles, fishing, ships, animal husbandry, exercise devices, package, internal engines, amusement devices, material or article handling, and others.

Table 2 illustrates the sub-sectors of knowledge specialization in Anchorage, Fairbanks, and Juneau. It shows all industries, in which the locational concentration of patents in these three cities exceeded the national baseline. Anchorage specializes in 11, Fairbanks in 12, and Juneau in six sectors. The individual areas of expertise vary and include oil-related industries (e.g., wells, hydraulic, and earth boring), “old” Alaskan industries (e.g., fishing, marine propulsion, and animal husbandry), and to new sectors of intensive innovation (e.g., surgery, geometrical instruments, games, and packaging). In large cities, the portfolio of inventions was diverse with multiple inventors, sometimes out-of-state working together. In contrast, in smaller communities (such as Ketchikan, shown in Table 3), patented inventions were frequently produced by a few individuals (repeat inventors with a narrow area of specialization). Most were also confined to one or two main industries.

Sectors of knowledge specialization (1976-2010)

Table 2

|

Industry Sector |

Anchorage (municipality) |

Fairbanks North Star Borough (administrative district) |

Ketchikan Gateway Borough (administrative district) |

Juneau (city and administrative dis-trict) |

|

Wells |

x |

|||

|

Hydraulic |

x |

x |

||

|

Surgery |

x |

x |

||

|

Liquid purification or seperatron |

x |

|||

|

Land Vehicles |

||||

|

Boring or penetrating the earth |

x |

x |

||

|

Fishing |

x |

x |

x |

x |

|

Data-processing-measuring Calrbrating or tesing |

||||

|

Drug, bio-affecting and body treating compositions |

||||

|

Measuring and testing |

||||

|

Ships |

x |

x |

||

|

Animal husbandry |

x |

x |

x |

|

|

Supports |

x |

|||

|

Static Structure |

||||

|

Geometrical Instruments |

x |

x |

x |

|

|

Exercise devices |

x |

|||

|

Package and article carrier's |

x |

x |

x |

|

|

Multiplex Constructions |

||||

|

Communications: Electrical |

||||

|

Marine Propulsion |

x |

x |

x |

|

|

Internal combustion engine |

||||

|

Amusement Devices: |

x |

x |

|

games |

||||

|

Material or article handling |

||||

|

Fluid handling |

x |

|||

|

Refrigeration |

x |

(Source: USPTO database)

Two peculiar clusters of patents outside larger cities, in Homer and Palmer, at least partially resulted from activities of single inventors: Alexander Hills in Palmer was responsible for multiple patents in wireless technology, and James Thacker in Homer patented dozens of inventions in electrical engineering. This example supports the thesis about the key role of individual inventors in smaller community’s knowledge economy.

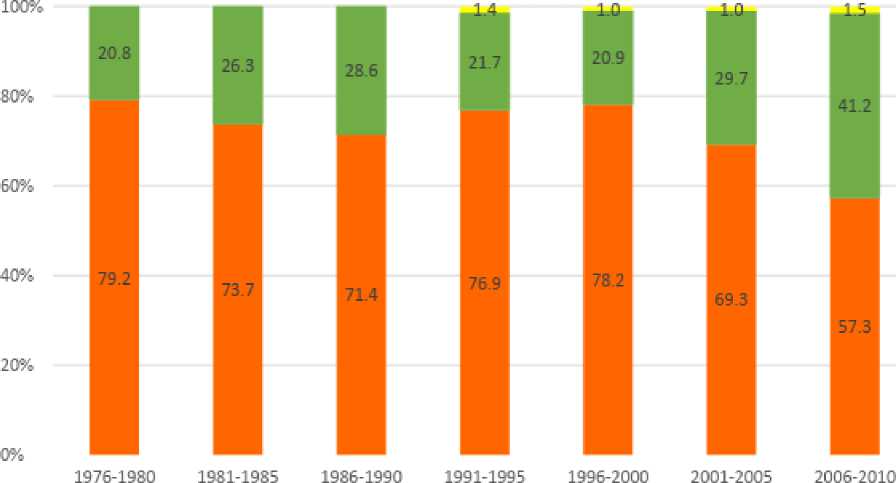

At the same time, most patents registered to Alaska residents, especially in engineering and electronics, were prepared in cooperation with authors from other states and countries. In other words, Alaska inventors were involved in the external innovation networks. Figure 7 shows the growth of non-Alaska co-inventors in time, and Figure 8 maps the network for Alaska-originated patents in 2006–2010. The global connectedness of Alaska innovators is evident, although their linkages are confined to a few regions. The most intensive co-invention took place with the U.S. counterparts, mostly based in Texas (oil industry patents). There are also a few Canadian, British, Asian, and Australian connections. Unfortunately, there are no co-inventor networks with other Arctic jurisdictions. In other words, innovators in Alaska are detached from other Arctic jurisdictions, with no co-invention taking place. This lack of linkages appears to be a considerable shortcoming and a missed opportunity for Arctic innovators to work together. Therefore, enhancing circumpolar research cooperation might create new opportunities for collaborative innovation in the Arctic.

■ Alaska ■ United states International

Figure 7. Distribution of the residence of the (co)inventors over between 1976 and 2010 (Source: USPTO database)

Figure 8. Global co-inventor networks of Alaska inventors in 2006-2010 Источник: База данных USPTO

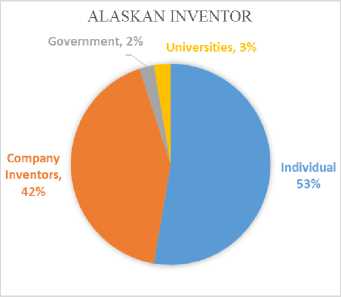

Figure 9 demonstrates the affiliations of Alaska inventors and their non-Alaska counterparts. A notable distinction is the prevalence of individual inventors (not affiliated with a larger company) among Alaskans compared to their outside co-inventors. Still, 42% of Alaska and 72% of collaborating patent producers were corporate (a company held at least some of the patent’s intellectual property). Government and universities played a modest role in the innovation process, although it was not insignificant.

Figure 9. Affiliation of Alaska inventors and non-Alaska co-authors (Source: USPTO database)

A first-cut analysis of the knowledge economy in Alaska as represented by patents shows that it gravitates to urban centers, demonstrates limited, albeit growing, variety knowledgeproducing sectors, strong role of individual inventor, and weak connectivity with circumpolar knowledge clusters. In other words, it retains the signs of a resource frontier, such as overreliance on resource sectors-based innovations, concentration of the knowledge production in a few urban centers, relative prevalence of individual inventors, and limited variety of inventions. At the same time, Alaska’s technology sectors have been evolving to increase external connectivity, collaborative networks, and knowledge production portfolios.

Discussion and conclusions

New trends in the Arctic economy indicate that it is no longer exclusively dominated by the “pillar” sectors. Many other industries and services, the hallmarks of post-industrial era, occupy strong, and, in some areas, leading positions in regional economic systems. Given continuing globalization, urbanization, and growth of post-industrial sectors in the Arctic these ‘other’ will be gaining importance in the future. The urgent task is to improve our understanding of these economic activities and their relationships with the “pillar” sectors and sustainable development.

What do we know about the ‘Other’ economies in the Arctic as represented by the knowledge sectors and high-tech specifically?

‘Other’ economies, and especially high-tech, are predominantly urban. They emerge in cities (and towns) and constitute the integral part of these local economic systems, resulting from the application of local human capital and other factors of production.

‘Other’ economies are endogenous, i.e. embedded in local human capital, consumer market, and entrepreneurial environment. This is a sharp contrast with the oil sector that depends on external companies, global demand for fuels, and relies on non-local or highly-mobile labor force, and thus, is exogenous, and a subject to extraterritorial control. Although the knowledge sectors can be highly dynamic, and many technology inventions are reliant on external flows of information and demand, they are still entrenched in local communities, their social and economic institutions, creative capacities, and other localized factors. Embeddedness makes the ‘other’ sector a viable economic link between local socio-cultural models of production and modern capitalism, when ‘home-grown’ industries become a part of the global knowledge economy. Embeddedness also means knowledge transfer and exchange within the community (as opposed to the dominance to external flows), and works to further build local capacities.

‘Other’ economies in the Arctic are often less decoupled from other sectors and engage local labor force. At the same time, they are less prone to boom and bust cycles generated by the changes in resource markets. In fact, a Yukon case study found that nearly 60% of local knowledge workers reported no or limited impact of these cycles on their business [22, Voswinkel S.].

‘Other’ economies give the rise to the “new frontier,” a new Arctic economic system, where the importance of non-pillar sectors is poised to increase. Innovations, whether business, technological, civic, or social, often spur new economic activities in northern communities.

‘Other’ economies, and especially knowledge production in the Arctic, have relatively weak connections to the outside flaws of knowledge, and at the same time may lack internal connectivity within the region. Many inventions are completed by individual inventors, the “lone eagles,”

who lack strong linkages to either local or global networks. This lone inventor pattern is well illustrated in Alaska: the average number of innovators per patent in the 1980s was under 1.5, and, although it has increased over the decades, on average a single patent involved only a small group, 2 or 3 individuals, in 2009-2010 [23, Zbeed S., Petrov A.]. In the Yukon Territory, past research revealed that almost 60% of knowledge workers are self-employed and work predominantly with extraterritorial customers [22, Voswinkel S.].

Finally, ‘other’ economies have underdeveloped circumpolar linkages. The most troubling finding of this study is that Alaska inventors had no co-author relationship with innovators in the other Arctic countries. Although the tendency to be closely connected with the rest of the USA and a few other clusters of expertise pertaining to Alaska’s leading oil and natural gas sectors, is natural, the absence of circumpolar connectivity is likely to exert a detrimental effect on Alaska knowledge economy. International collaboration in innovation on aspects associated with northern environments, technological needs, and operational conditions seems to be a lost opportunity for Alaskan inventors. There is little doubt that the oil sector knowledge production in Alaska could benefit from cooperation with Norwegian experts, fishing — with Iceland and Norway, animal husbandry — with Greenland, Finland, Norway, Russia and Sweden, and so forth. In other words, creating a knowledge exchange and sharing among Arctic innovators is a key economic task that to be addressed without delay.

This paper provided a first-cut analysis of the “Arctic variety” of the knowledge based economy. Further studies are needed to improve our understanding of the ‘other’ economies and their sectors. In the recent years, the Arctic Council advanced an ambitious agenda on fostering circumpolar scientific cooperation. Science and educational organizations, such as the International Science Committee, University of the Arctic and International Arctic Social Sciences Association introduced concerted efforts to connect Arctic scientists [24, Berkman P. et al]. However, the new challenge is to build linkages between individual, corporate and government inventors outside the universities. Perhaps, the newly established Arctic Economic Council can take responsibility for completing it.

Acknowledgments

This research was partially supported by NSF PLR#1338850 and OISE #1545913.

Список литературы Arctic’s knowledge economy: Spatial patterns of knowledge and technology production in the Arctic

- Knapp G., Huskey L. Effects of Transfers on Remote Regional Economies: The Transfer Economy in Rural Alaska. Growth and Change, 1988, vol. 19, no. 2, pp. 25−39.

- Glomsrød S., Duhaime G., Aslaksen I., eds. The economy of the North 2015. Statistical analyses 151: Statistisk sentralbyrå, 2017. 168 p.

- Petrov A. Exploring the Arctic’s “other economies”: knowledge, creativity and the new frontier. The Polar Journal, 2016, vol. 6, no. 1, pp. 51−68.

- Huskey L. Globalization and the economies of the North. Globalization and the circumpolar north. Ed. by L. Heininen, C. Southcott. Fairbanks, University of Alaska Press, 2010.

- Glomsrød S., Aslaksen I., eds. The economy of the North 2008. Statistical analyses: Statistisk sen-tralbyrå, 2008. 102 p.

- Rasmussen R.O., ed. Megatrends. Copenhagen, Nordic Council of Ministers, 2011, 205 p.

- Beyers W.B., Lindahl D.P. Lone Eagles and High Fliers in Rural Producer Services. Rural Development Perspectives, 2001, vol. 11, no. 3, pp. 2−10.

- Boschma R.A. Social Capital and Regional Development: An Empirical Analysis of the Third Italy. Learning from Clusters: A Critical Assessment from an Economic-Geographical Perspective. Ed. by R.A. Boschma, R.C. Kloosterman. Netherlands, Springer, 2005, pp. 139−168.

- Gradus Y., Lithwick H. Frontiers in Regional Development. Lanham, MD, Rowman & Littefield, 1996, 288 p.

- Selada C., Cunha I.V., Tomaz E. Creative-based strategies in small cities: a case-study approach. Redi-ge, 2011, vol. 2, no. 2, pp. 79−111.

- Petrov A. Creative Arctic: Towards Measuring Arctic’s Creative Capital. Arctic Yearbook 2014. Ed. by L. Heininen. Akureyri, Iceland, 2014, pp. 149−166.

- Hirshberg D., Petrov A. Education and Human Capital. Arctic Human Development Report: Regional Processes and Global Linkages. Ed. by J. Larsen, G. Fondahl. Copenhagen, Nordic Council of Minis-ters, 2015, pp. 349−399.

- Florida R. The Economic Geography of Talent. Annals of the Association of American Geographers, 2002, vol. 92, no. 4, pp. 743−755.

- Aarsæther N., ed. Innovations in the Nordic Periphery. Nordregio Report 2004:3. Stockholm, 2004, 264 p.

- Pilyasov A. I poslednie stanut pervymi. Severnaya periferiya na puti k ekonomike znaniya [And the last shall be first. Northern periphery on the way to knowledge economy]. Moscow, Librocom Publ., 2009, 544 p. (In Russ.)

- Petrov A. Beyond spillovers: Interrogating innovation and creativity in the peripheries. Beyond terri-tory: dynamic geographies of innovation and knowledge creation. Ed. by H. Bathelt, M. Feldman, D.F. Kogler. London, Routledge, 2011, pp. 168−190.

- The high-tech industry, what is it and why it matters to our economic future? Beyond the Numbers, BLS, 2016, vol. 5, no. 8, pp. 1−7.

- Acs Z.J., Audretsch D.B. Patents as a measure of innovative activity. Kyklos, 1989, vol. 42, no. 2, pp. 171−180.

- Feldman M.P. Location and innovation: the new economic geography of innovation, spillovers, and agglomeration. The Oxford handbook of economic geography. Ed. by G.L. Clark, M.S. Gertler, M.P. Feldman. USA, Oxford University Press, 2000, pp. 373−394.

- Archibugi D. Patenting as an indicator of technological innovation: a review. Science and Public Poli-cy, 1992, vol. 19, no. 6, pp. 357−368.

- Kogler D.F. Intellectual Property and Patents: Knowledge Creation and Diffusion. The Handbook of Manufacturing Industries in the World Economy. Ed by J. Clark, V. Vanchan, J.B. Bryson. Cheltenham, UK, Edward Elgar, 2014, pp. 1−25.

- Voswinkel S. Survey of Yukon's Knowledge Sector: Results and Recommendations. Yukon Research Centre, Yukon College. Whitehorse, YT, 2012.

- Zbeed S., Petrov A. Inventing the New North: Patents & Knowledge Economy in Alaska. Arctic Year-book 2017. Akureyri, Iceland, 2017.

- Berkman P.A., Kullerud L., Pope A., Vylegzhanin A.N., Young O.R. The Arctic Science Agreement pro-pels science diplomacy. Science, 2017, vol. 358, no. 6363, pp. 596−598.