Assessing the Impact of Innovation and Investment Activity on the Formation of an Export-Oriented Agricultural Economy

Автор: Derunova E.A., Vasilchenko M.Ya., Shabanov V.L.

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Branch-wise economy

Статья в выпуске: 5 т.14, 2021 года.

Бесплатный доступ

The issue concerning the formation of an export-oriented agricultural economy is associated with the need to assess its innovation and investment activity and analyze the quality of state policy to stimulate innovation and high technology products in agricultural production. High differentiation of Russian regions by natural and climatic conditions and the level of resource provision are factors that hinder the formation of new export positions, which predetermines the need to improve state investment policy, considering regional differences. The purpose of this study is to identify the dependence of the export level of agricultural products on the level of innovation and investment activity, the development of recommendations to improve innovation and investment activity of territorial and sectoral agricultural systems. We put forward the following hypothesis: one of the most important factors in increasing the volume of agricultural products exports of the region is the level of innovation and investment activity. As a methodological basis we use theoretical approaches of foreign and Russian authors to assessing the impact of innovation and investment processes on the increase of export potential, as well as the formation of balanced export-oriented agricultural systems in the territorial and sectoral sections. We develop a model estimating the relationship between investment in fixed capital in agriculture, gross output of the industry, and exports of agricultural products using methods of multivariate statistical analysis. We assessed the dynamics of regional innovation and investment development and compared the selected typological groups of Russian regions by their production and export efficiency, the resources used and the results achieved. The novelty and significance of the developed model lies in the possibility of its application for diagnostics and monitoring of the state of territorial sectoral and regional innovation and investment agrosystems. For each type of region we proposed differentiated strategies of state regulation aimed at overcoming the limitations of low innovation and investment activity in the formation of exportoriented agricultural economy. The results of the study are of practical value for the development and implementation of targeted mechanisms and tools to improve the efficiency of innovation and investment activities in order to ensure the leading position of the regions in exports of agricultural products.

Innovation and investment activity, agricultural economy, export, modeling, principal components analysis, typology of regions, state support, territorial and sectoral approach

Короткий адрес: https://sciup.org/147234810

IDR: 147234810 | УДК: 330.341.42:336.748.3:330.43 | DOI: 10.15838/esc.2021.5.77.6

Текст научной статьи Assessing the Impact of Innovation and Investment Activity on the Formation of an Export-Oriented Agricultural Economy

It is possible to enhance innovation development of the agricultural sector, increase the efficiency of agricultural production in the transition to an export-oriented agricultural economy is possible through the development of incentive mechanisms for innovation and investment activity. With the transition to digital, intelligent and robotic technologies, it becomes relevant to find new models of innovation policy, ensuring the effectiveness of the development of the innovation system, the effective organization of the dissemination and implementation of innovation [1]. According to the State Program for the Development of Agriculture and Regulation of Agricultural Products, Raw

Materials and Foodstuffs (as amended on March 31, 2020)1 and Scientific and Technological Development of the Russian Federation approved by Government Decree no. 642, dated December 1, 20162, problems of insufficient coordination of research institutes with economic sectors prevent the scientific and technological development of Russia. The increase in innovation reproduction efficiency in agriculture and agroindustrial complex as a whole is possible subject to congruence of interests of agribusiness, science and the state, taking into account diagnostics of the sectors’ need for targeted innovation, scientific-intellectual, financial and informational support, balanced distribution of resources, knowledge, information, competences and technologies at all stages of the innovation process [2].

The purpose of the study is to identify the impact of the level of innovation and investment activity on the export of agricultural products and to develop differentiated strategies of state regulation of innovation and investment activity of territorial and sectoral agricultural systems.

Degree of the problem development

The effective management of innovation processes in the agro-industrial complex (AIC) requires the elaboration of its balanced development directions, considering spatial and strategic approaches at the federal, territorial and sectoral levels. The increase in innovation and investment activity and the formation of balanced agro-innovation systems (AIS) at the territorial and sectoral levels is based on the concept of innovation systems. The dominant role in creating the model of export-oriented agrarian economy belongs to building relationships between science, state support institutions, agribusiness and innovation formations within the framework of implementation of innovation agrarian policy [3]. There are different interpretations of the term AIS [4; 5; 6]. Relationships between AIS actors are transformed in the process of its formation, reaching the necessary level of balance [7–12]. The formation of territorial AIS is influenced by economic, geographical, technological, social, regulatory and institutional factors. One of the factors increasing innovation and investment activity in AIC is the intensity of connections between individual elements of innovation systems and actors [13]. The transformation of socio-economic processes is reflected in various concepts: innovation clusters, triple helix [14] and quadruple helix of innovation [15; 16].

For assessing the level of innovation activity there are different approaches and methods that are applied abroad. Among them are European Innovation Scoreboard, Technology Achievement Index, Innovation Capacity Index, World Innovation Index (GII BCG), World Innovative Index INSEAD (GII INSEAD), Global Innovation Factor Global Innovation Quotient. Internationally, the best-known and most widely used are the World Economic Forum ratings, the UNCTAD innovation capacity indices, the World Bank’s assessment of the level of development of knowledge economies, and the European ratings. The advantage of these methodologies is the possibility to assess both resources and results of innovation development on the basis of statistical data available in the regional and sectoral context. In Russian studies, the most famous are the ratings of RF constituent entities of the Higher School of Economics, as well as the ratings of innovation development of regions of the Association of Innovative Regions of Russia3. At the same time, the quality of innovation policy became the key to the success of breakthrough technologies. Assessment of functions of AIS actors and development of methods of monitoring, comprehensive assessment of efficiency and forecasting of regional innovation policy are of paramount importance [17; 18].

Key indicators to assess the innovation development level, taking into account the interregional differentiation factor, determining the pace of innovation development of the Russian economy, are the volume of physical production of gross agricultural output, the amount of public investment in the industry, labor productivity, capital-labor ratio, composition and the number of researchers in agriculture, the level of personal income. According to Yu.P. Bondarenko, the level of interregional differentiation in agriculture is influenced by factors of general and sectoral action. The factors of general, or external, impact include the rate of sustainable socio-economic development of regions, the level of their investment activity, the degree of provision and development of resource potential. Among the factors of intrasectoral action it is advisable to consider the level of innovation activity of a particular sector, the level of expenditure on technological innovation required to achieve the planned production performance [19]. Based on the assessment of factors affecting innovation activity, we propose mechanisms to improve investment policy [20].

In the study we make a hypothesis: the level of innovation and investment activity is one of the most important factors in increasing the volume of exports of agricultural products in the region.

In the global economics literature, when studying the connection between innovation and export, both the influence of enterprises entering the international market on their innovation activity and the influence of innovation-active companies on the expansion of export potential are studied. The research comes down to two fundamental theories describing the higher innovation activity of exporting companies [21]. C.L Leonidas in his works proves that the expansion of the market and export positions is an incentive for innovation, growth of production efficiency [22]. From another point of view, the innovative position of the firm determines the level of relationship between exports and productivity. This hypothesis is confirmed at the theoretical and empirical levels by W. Cassiman, E. Golovko, E. Martinez-Ros [23].

According to the self-selection hypothesis, innovatively active enterprises have higher profitability, which allows them covering the costs associated with entering foreign markets. In this key, innovation is the driving force for increasing productivity, reducing costs, increasing product quality, contributing to the entry of the enterprise to export positions [24].

The learning-by-exporting hypothesis orientation assumes that the enterprises focused on export, adopt the positive foreign experience [25] of introduction and distribution of organizational, technological, marketing innovations in manufacture for effective business and maintenance of leading positions in the market [26].

Having gained export positions, enterprises acquire new perspectives and opportunities to implement innovations and high technology products in manufacturing processes, thus creating a positive learning effect from international cooperation. According to this view, exporting acts as a reason for transferring positive foreign experience into the business processes of enterprises. The self-selection hypothesis has a significant number of empirical confirmations in contrast to the learning-by-exporting hypothesis [27–30]. At the same time, studies proving that the two hypotheses are complementary and do not exclude the effect of each other. The increase in the competitiveness of enterprises due to the introduction of innovations causes the growth of productivity due to the export effect. In turn, export activity contributes to productivity growth even taking into account the self-selection effect [31; 32].

We share the position of N.V. Linder, E.V. Arsenova [33] concerning the substantiation of mutual influence of exports and innovations, in which the investment decision in the field of export policy formation becomes a precondition and a condition for the investment decision in the field of innovation development, and vice versa. The effectiveness of the interaction of these processes is achieved due to the fact that both exports and innovations serve as potential drivers of new knowledge. Moreover, due to the potential interconnection of product and process innovations, the decision to produce an innovation precedes the decision to create an export-oriented development model. Further, revenues from export activities allow the company to implement more expensive process technological innovations aimed at increasing productivity and efficiency of manufacturing processes.

As a result of the complementarity of exports and innovations, the following gradation of enterprises is formed: the most effective enterprises are those that simultaneously participate in export and innovation activities, they are followed by enterprises engaged in either export or innovation activities, then those that do not participate in either export or innovation activities [34].

Despite the relevance and significance of the presented topic, comprehensive studies aimed at analyzing the dependence of innovation, productivity and exports are currently insufficient. Kozlov and Wilhelmsson tested the self-selection effect on the data of customs statistics [35]; De Rosa’s works substantiate the importance of studying the previous experience of work in foreign markets [36]. Yu. Gorodnichenko proved on the basis of data from surveys of firms in 27 transition economies (BEEPS), including Russia, that globalization enhances the level of innovation and investment activity of enterprises [37]. In the works of V.V. Golikova, K.R. Gonchar, B.V. Kuznetsova test hypotheses about innovation incentives formed when firms enter foreign markets, based on panel data obtained in the course of surveys of manufacturing industry enterprises, conducted by the Higher School of Economics [38].

According to M.Yu. Arkhipova, innovation activity (expressed both in the cost of research and development, and in the novelty of products, patents received, etc.) allows enterprises to expand their sphere of influence, to move from local to national and even international sales market. At the territorial and sectoral levels, the conclusion is confirmed that the most innovatively active enterprises, capable of supplying competitive products to markets and overcoming the costs of entering new global markets, become exporters [39]. The impact of digitalization processes on the development of technological exports was also considered [40].

The influence of innovation and investment activity on the dynamics of agricultural exports and the adjustment of public policy directions in regions of different types, considering the achieved level of innovation development, is not enough studied, which predetermined the choice of the topic of our work.

Harmonization of the policy at the federal and regional levels is the key to the implementation of the set task, while the mechanism of state support of innovative reproduction in the countryside should be built in such a way that it directly stimulates the procedure of changing technological modes. All of the above shows that there is the need to improve investment policy: the main direction should be investment promotion in priority sub-sectors of agriculture.

In this regard, it is relevant to develop theoretical and methodological approaches to the study of the impact of innovation and investment activities on the formation of export-oriented agricultural systems at the regional and sectoral management levels; evaluation and forecast tools to diagnose the relationship between investment in fixed capital in agriculture, gross output industry and export of agricultural products based on the classification of Russian regions by factors that aggregate these characteristics; directions for improving the state innovation and investment policy in the agricultural sector of the economy for different types of clusters.

Materials and methods

The article is a logical extension of research on the topic of innovation and investment development and the formation of an export-oriented economy. In previous studies, we searched for relevant indicators and effective tools for modeling the impact of innovation and investment development on the increase in production and export potential using the concept of open innovation at the regional level.

Continuation on the topics indicated in this work on the basis of synthesis of conceptual provisions of foreign and Russian theories of innovation and investment impact on export, we put forward the following hypothesis: the level of innovation and investment activity is one of the most important factors contributing to increasing the exports of agricultural products of the region.

We carried out an analysis of the impact of investment on exports in the territorial context, as well as diagnostics and monitoring of the concentration of innovation and investment activity at the sectoral level.

As an information matrix for the study we used empirical agricultural data for the regions of Russia for 2018–2019, for which the analysis of the spatial structure of production, investment and export potential, costs and results of innovation activity was carried out.

Statistical methods of multidimensional classification of the constituent entities of the Russian Federation were used to account for regional differences in the level of investment, production and export potential. The most widespread among them is the method of cluster analysis, the main feature of which is that the differences between the objects included in the selected group are insignificant, and the differences between the groups are significant.

The cluster analysis was conducted according to such indicators as export of food products and agricultural raw materials, proportion of food and agricultural raw materials export in total export, gross agricultural output per 1 ha of agricultural land, investments in fixed capital aimed at agricultural development per 1,000 rubles of gross output, export of cereals and legumes, export of meat (including by-products) and meat products, thousand tons in slaughter weight, gross yield of grain (in weight after processing), production of livestock and poultry for slaughter (in slaughter weight).

As a result of the cluster analysis, we conducted a classification of Russian regions with the allocation of groups with a high degree of homogeneity according to the available set of indicators. The dimensionality of the feature space was reduced by the principal component method of factor analysis.

In the process of dimensionality reduction correlated variables are combined into new ones – generalized and uncorrelated, which explain most of their total variance. Formally, generalized variables are represented by linear combinations of the original normalized variables, the coefficients in front of which reflect factor loadings varying in the range from –1 to 1 and characterizing the strength of influence of a particular indicator on the main component. As a result, the feature space is compressed and its axes are orthogonalized; the consequence is an increase in the efficiency of the subsequent multivariate classification on these axes [41].

The obvious advantage of using Ward’s hierarchical method with squared Euclidean distance is the possibility of achieving a fairly high homogeneity of clusters based on the construction of their step-by-step association tree. At the initial stage, each object is treated as a separate cluster, further the objects are sequentially combined based on the chosen proximity measure, until only one remains. The work of the algorithm is completed on a given number of clusters, set by expert way. If the number of clusters or belonging of particular objects to particular clusters is known a priori, methods “with learning” are used, among which the k-means clustering stands out [42].

The statistical base of the study includes data on 69 regions and constituent entities of the Russian Federation, for which there was available information on all selected indicators. The calculations were performed using the SPSS statistical information processing and analysis package.

Research results

Factor analysis was used for the original variables X1...X8, which were distributed over 69 regions of Russia and normalized according to the standard procedure, leading to a zero mean and unit variance. As a result, three principal components were obtained, explaining 78.3% of the total variance. Due to the rotation of the space of principal components using the Varimax method, a clearer distribution of the factor loadings of the initial normalized indicators on the principal components was achieved. The resulting matrix of factor loadings makes it possible to unambiguously correlate the initial indicators with the principal components.

Factor loadings which are the highest in absolute value (above 0.5) are determined by the indicators explaining the content of the main components. The first principal component (PC1) explains 33.6% of the total variance and is formed by three absolute indicators with high factor loadings – X1, X5, X7 and unidirectional dynamics. Export of food and raw materials is directly related to the production and export of grain, so PC1 can be characterized as “food and agricultural exports and its main factors”.

The second principal component (PC2) explains 30.2% of the total variance and includes three indicators with high factor loadings –

X3, X6, X8. The relative indicator of the value of gross agricultural output (per 1 hectare of agricultural land) has an indirect relationship with the absolute indicators of livestock and poultry production and export of meat products, so PC2 can be characterized as “efficiency of agricultural production and its main factors”.

The third principal component (PC3) explains 14.5% of the total variance and consists of two relative indicators – X2, X4. Investment in agriculture (per 1,000 rubles of gross output) is directly related to the growth of the proportion of food exports. PC3 shows that investment in agriculture produces food exports: the higher the capital intensity of agricultural production, the higher the proportion of food exports. PC3 can be called “intensity of investment in agriculture and export of agricultural products”.

The average values of the principal components for each typological group are shown in Table 1 .

The table shows that the first, second and fifth typological groups have the highest values of the principal components. It should be emphasized that PC3 acts as a leading differentiating feature in the formation of the second and third groups; PC1 reflects the high level of production and export of grain and export of raw materials, as well as export of raw materials and food of the fifth typological group.

The result of the classification by Ward’s method based on the three selected principal components was the formation of five typological groups of regions. One should note that the Belgorod Oblast (group 1), the Rostov Oblast and Krasnodar Krai (group 5) joined the general hierarchical classification tree during the last iteration. These regions differ significantly from the others in their high specialization in the production and export of meat (Belgorod Oblast) and grain (Rostov Oblast and Krasnodar Krai), which is confirmed by high values of PC2 and PC1.

Table 1. Average values of the principal components in the typological groups

|

1 |

2 |

3 |

4 |

5 |

|

|

PC1 |

-0.213 |

-0.190 |

-0.299 |

-0.055 |

5.238 |

|

PC2 |

6.022 |

0.664 |

-0.358 |

-0.174 |

0.060 |

|

PC3 |

-0.962 |

1.568 |

0.403 |

-0.740 |

0.197 |

|

Source: own calculation. |

|||||

The other regions form three typological groups – 2, 3, and 4, comprising 11, 21, and 34 constituent entities of the Russian Federation, respectively. The group compactness coefficient was determined as the sum of the squared Euclidean distances, calculated in the space of three principal components, between all pairs of regions included in the cluster, divided by the number of these pairs. As a result, the compactness of the third group was 0.91, the fourth was 1.11, and the second was 4.30. One should note the most compact third group, which includes two sets of regions united at one of the first steps of clustering. The second group is the least compact due to the connection at one of the steps of rather isolated regions with significant features (Kamchatka Krai, Kaliningrad Oblast). The fourth group was also formed by combining two compact subgroups consisting of 28 and 6 constituent entities, the latter of which is characterized by high PC1 and PC2 values at one of the middle steps.

Calculations of statistical indicators characterizing the production, investment and export potential according to the current statistical data broken down by typological group are presented in Table 2 .

Table 2. Characteristics of typological groups by the level of production, investment, and export potential (2019)

Indicator Group 1 (Belgorod Oblast) Group 2 (11 regions) Group 3 (21 regions) Group 4 (34 regions) Group 5 (2 regions) Gross yield of grain (weight after processing), thousand tons 3473.1 1705.3 740.1 1664.6 12992.0 Production of livestock and poultry for slaughter (slaughter weight), thousand tons 1705.2 230.1 75.2 138.8 296.3 Gross output of agriculture per 1 hectare of agricultural land, thousand rubles 140.1 58.9 29.9 20.4 56.5 Investments in fixed capital aimed at the development of agriculture, per 1,000 rubles of gross output, rubles 44.0 153.1 110.7 70.7 53.5 Export of food products and agricultural raw materials, million dollars 384.9 344.6 166.0 105.2 3537.0 Proportion of food and agricultural raw materials exports in total exports, % 11.8 17.9 14.1 2.9 45.1 Grain export of cereals and legumes (including export), thousand tons 389.6 819.0 310.7 679.5 17056.9 Export of meat (including by-products) and meat products (including abroad), thousand tons in slaughter weight 1285.6 299.0 64.2 91.0 163.2 Calculations based on: Regions of Russia. Socio-Economic Indicators. Stat. Coll., 2020. Rosstat. Мoscow, 2020. 1242 p.; EMISS of federal statistics. Available at:

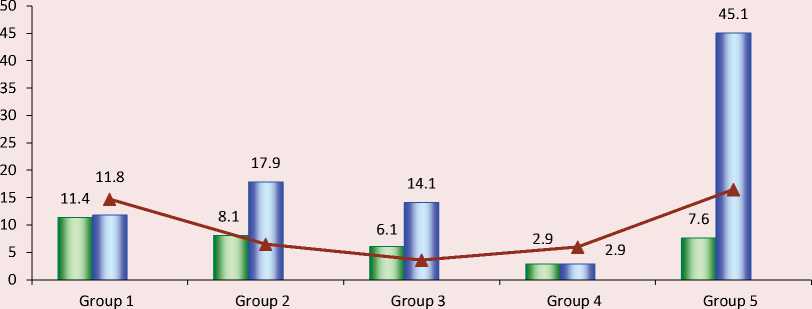

Relationship between food exports and agricultural innovation and investment development of typology groups (2019)

■ ■ Percentage of investment in fixed capital in agriculture in the total volume, %

■ 2 1 Percentage of raw materials and food exports in total exports, %

—A— Percentage of organizations implementing technological innovations, %

Source: own calculation.

Discussion of the research results

A more detailed analysis of the indicators by typological groups reflects the multidirectional trends in the development of investment and export potential. The Figure shows the relationship between food exports and agricultural innovation and investment development.

One should note the absence of linear dependence between innovations, investments and export, which is especially noticeable in the first and the fifth groups. In the first group, the higher percentage of organizations carrying out technological innovations is combined with the level of investment corresponding to the scale of export. In the fifth group, on the contrary, the export potential exceeds the scale of investment and export.

In previous works the study of regional specifics of the provision of investment in fixed capital in agriculture, taking into account the specifics of innovation processes were carried out in the case of the Volga Federal District [43].

A more detailed study showed a significant degree of regional differentiation of production, investment-innovation and export potential in the highlighted typological groups. The first group, consisting of a single region – the Belgorod Oblast – is distinguished by higher indicators of efficiency of gross agricultural production, production and export of livestock products. In 2019, the Oblast ranked tenth in terms of investment in fixed capital in agriculture (11 688.9 million rubles). At the same time, the level of investment in fixed capital per unit of gross output in it is lower than in most regions of other groups – 44.0 rubles per 1,000 rubles (39th place out of 69 considered constituent entities of the Russian Federation). The situation of “underinvestment” can be explained by the effect of the scale of production: the Oblast ranks third in Russia in terms of gross agricultural output (265,693 million rubles), and investment is made at a lower rate compared to the volume of production. Based on the above, the Belgorod Oblast has high production potential and an export-oriented livestock sector, but investment activity does not correspond to the growth of production volumes, although the processes of modernization of fixed capital are quite active (in 2019, the proportion of investment in machinery and equipment in the total volume of investments in reconstruction and modernization was equal to 41% with the average value for Russia being 17.2%). Consequently, the implementation of major investment projects in the direction of diversification of production and exports will require the allocation of additional financial resources [44].

The second typological group is characterized by the highest investment activity, as evidenced by the index of investment per unit of gross output – 153.1 rubles. In such regions as the Kaluga, Moscow, Bryansk, Kaliningrad and Voronezh oblasts, the value of this indicator exceeds the average value for the group. Favorable opportunities for investment are also confirmed by the high investment attractiveness of most regions of the group. The Penza and Voronezh oblasts are implementing major projects in the pork sub-sector. In the Kaluga and Moscow oblasts robotization processes in dairy breeding are actively implemented [45]. At the same time, attention should be paid to the lower production efficiency (58.9 rubles) in comparison with the Belgorod Oblast, although the export potential of grain and meat is quite significant. Thus, the analyzed group of regions has high investment potential and export-oriented production of grain and meat, although there are reserves for increasing production efficiency. The growth potential of grain and meat exports is confirmed by indicators of the intensity of interregional supplies, and the innovative dominance of exports is associated with the production of mainly food products with high added value.

The third typological group is characterized by low potential of grain and meat production and food exports, the point nature of investment, which limits the possibilities of balanced development: 5 of 21 regions account for about 60% of total investment in fixed capital. Low investment activity does not allow increasing the efficiency of agricultural production and ensuring leading positions in the segment of food export. Studies have established limited opportunities for exports of high-technology goods, despite the significant percentage of food and agricultural raw materials exports (14.1%), which is associated with significant interregional differentiation.

The regions of the most numerous fourth group are characterized by low investment potential, poor development of meat industry and an insignificant percentage of food exports. Compared to the regions of the third group, there is a slightly higher innovation component in the pork and food production sub-sectors and an insignificant percentage of food exports (2.9%). Interregional differentiation is most characteristic of grain production and export. For instance, Stavropol Krai is one of the top ten exporters of wheat, having a higher investment potential than the average for the group. Further development of the region’s investment potential is connected with increasing the efficiency of the agrarian sector.

The fifth group, consisting of the Rostov Oblast and Krasnodar Krai, stands out for the highest export potential of raw materials and food, as well as the scale of grain production due to regional specialization. At the same time, the opportunities to improve production efficiency and strengthen investment activity have not yet been fully used, although the innovation potential of grain exports is quite high.

The specifics of the innovation development of Russia is determined by a significant unevenness of this process by regions, which can be further reduced as a result of diffusion of innovations from innovation centers to the regions of innovation periphery [46]. Due to the specifics of the Russian national innovation system – it is possible only with the implementation of an active state policy in the sphere of investment and innovation activity management, as well as with the increase in the number of private investors of innovation projects. However, in the coming decades a significant gap between the subjects – leaders of innovative development and the lagging regions will remain. The prevailing territorial approach in the modern innovation discourse actualizes the formation and implementation of differentiated types of regional innovation policy, adequately considering the available resources, their strengths and weaknesses, as well as the priorities of regional development with different measures of state support and ways of development of innovation competences. Sufficiently successful European experience in the development and implementation of regional innovation strategies in the framework of regional innovation policy allows distinguishing the following stages: analysis of innovation and investment activity at the territorial and sectoral levels, coordination of the main stakeholders of agrosystems, planning and coordination of their activities, monitoring and performance assessment, scientific and technological forecast, substantiation of priority needs, development of organizational, economic and financial mechanisms of state support.

The results of the empirical study show the presence of significant imbalances in the level of innovation and investment activity at the interregional and sectoral levels, which limits the scale of food exports. In order to eliminate disproportions, methodological approaches aimed to improve the mechanisms of state regulation of spatial innovation and investment development were developed. The developed typology of regions allows distinguishing differentiated strategies of state regulation for each group of regions, aimed at increasing innovation and investment activity in the process of export-oriented agricultural economy formation.

The Belgorod Oblast is a technological leader in the production of pork and food (the percentage of shipped innovative goods in pig breeding and food production is 11.2% and 17.5%, respectively), which predetermines the possibility of exporting products with a high degree of processing. Unlike other typological groups, the scale of meat production makes it possible to form the region’s export positions, the expansion of which should be expected in the near future, subject to state support. Given the high innovation activity in the production of certain types of livestock products and processing, with regard to this region it is advisable to use the strategy of maintaining technological leadership and expanding exports of livestock products with high value added, the strategy of increasing investment activity by promoting the development and implementation of investment projects using digital economy tools.

The second typological group has high investment activity and export-oriented production of grain and meat, although the innovation activity in the production of certain types of products is of a point nature, limiting the opportunities to increase efficiency. In this regard, it is recommended to use multidirectional strategies: the strategy to stimulate investment activity in the industries engaged in deep processing of raw materials, and the strategy to increase innovation activity in grain production.

The third typological group is characterized by low innovation and investment activity and limited food export opportunities. Localization of investment in a few regions acts as one of the main constraints to food exports, including the supply of high technology goods. Based on the above, the increase in innovation and investment activity can be achieved as a result of the recommended strategy of economic growth in grain and meat production, aimed at creating favorable conditions for improving the use of productive capacity through the implementation of new projects, including infrastructure; strategy to encourage the flow of knowledge to enhance the diffusion and use of innovation.

The fourth typological group is an outsider by the level of investment, production and export potential with a pronounced interregional differentiation of grain production and export. Institutional heterogeneity of the group’s regions predetermines the need for more active involvement of small businesses in innovation processes. It is recommended to use the strategy of integration of small enterprises into agro-innovative production chains and the strategy of promoting innovation transformation of small businesses on the basis of state support for the use of innovation resources.

The fifth group has in-depth specialization in grain production and export with relatively high innovation potential. However, the gap between the scale of investment and exports indicates the potential for further increase in investment and innovation activity. We recommend a strategy to promote infrastructural innovation transformation of the production potential of grain production.

The formulated strategies are applicable to specific types of regions and are aimed at forcing the processes of innovation and investment development in order to create a high-technology food export sector. Strengthening of innovation and investment activity in the agricultural sector is possible if the state policy measures are implemented in the direction of stimulating the creation, transfer and use of knowledge, technology and innovation; attracting investment in the implementation of high technology projects in order to overcome the differentiation of technological development at the territorial and sectoral levels. To address this issue, it is important to harmonize innovation and investment policy at the federal and regional levels. A significant role in the creation of a new technological basis for the agro-industrial complex and export sector is assigned to a wider application of such tools as the formation of portfolios of regional investment projects using the “investment standard”; redistribution of budget funds for the completion of construction and commissioning of capital projects; compensation of part of capital costs for export-oriented projects; providing benefits to investor companies in order to implement major infrastructure projects.

Conclusion

The problem of formation of export-oriented agricultural economy is associated with the need to assess its innovation and investment activity and monitoring the quality of state policy to promote innovation and knowledge-intensive products in agricultural production. Based on the developed model of the relationship between investment in fixed capital in agriculture, gross output of the industry and agricultural exports using the method of cluster analysis, we built our typology of RF constituent entities; we assessed the production, innovation and investment and export potential of the five typological groups.

The novelty and significance of the developed model lies in the possibility of its use for assessing and monitoring the state of territorial, sectoral and regional innovation and investment agrosystems.

The results of the empirical study reveal the presence of significant imbalances in the level of innovation and investment activity at the interregional and sectoral levels, hindering the increase in the scale of food exports. In order to eliminate the disproportions, differentiated strategies of state regulation aimed at overcoming the limitations of low innovation-investment activity in the formation of export-oriented agricultural economy and enhancing the processes of innovation-investment development were proposed.

The results of the study are of practical value for the development and implementation of targeted mechanisms and tools to improve the efficiency of innovation and investment activities in order to ensure the leading position of the regions in exports of agricultural products. The implementation of the formulated conclusions, developed approaches and methods will provide a comprehensive approach to the analysis and assessment of the effectiveness of regional agrofood systems.

Further development of research involves refining the set of indicators of the level of technological development of a region; implementation of methodological approaches to the assessment and forecasting of the optimal level of investment in the agricultural sector of Russian regions in order to increase export potential; adjustment of methodological approaches to the allocation of budgetary funds for the development of the agroindustrial complex, considering the priorities of export potential development.

Список литературы Assessing the Impact of Innovation and Investment Activity on the Formation of an Export-Oriented Agricultural Economy

- E.A. Skvortsov et al. Transition of agriculture of digital, intellectual, and robotics technologies. Ekonomika regiona=Economy of Region, 2018, vol. 14, issue 3, pp. 1014–1028 (in Russian).

- Preobrazhenskiy Yu., Firsova A. Problem of forming balanced agroinnovation systems: Empirical evidence from Russian regions. Scientific Papers. Series Management, Economic Engineering in Agriculture and Rural Development, 2020, vol. 20, issue 4, рр. 89–100.

- Vasilchenko M.Ya., Sandu I. Innovative-investment development of agriculture in the conditions of formation of the export-oriented economic sector. System approach. Sci. Pap. Ser. Manag. Econ. Eng. Agric. Rural Dev., 2020, vol. 20, рр. 599–612.

- Pant L.P., Hambly-Odame H. Innovation systems in renewable natural resource management and sustainable agriculture: A literature review. African Journal of Science, Technology, Innovation and Development, 2009, vol. 1, рр. 103–135.

- Spielman D., Ekboir, J., Davis K. The art and science of innovation systems inquiry: Applications to sub-Saharan African agriculture. Technology in Society, 2009, vol. 31, pp. 399–405.

- Hall A., Clark N. What do complex adaptive systems look like and what are the implications for innovation policy? Journal of International Development, 2010, vol. 22, pp. 308–324.

- Leeuwis C., Van den Ban A.W. Communication for Rural Innovation: Rethinking Agricultural Extension. Oxford: Blackwell Science, 2004. P. 424.

- Röling N. Pathways for impact: Scientists’ different perspectives on agricultural innovation. International Journal of Agricultural Sustainability, 2009, vol. 7, pp. 83–94.

- Klerkx L., Aarts N., Leeuwis C. Adaptive management in agricultural innovation systems: The interactions between innovation networks and their environment. Agricultural Systems, 2010, vol. 103, pp. 390–400.

- Vanloqueren G., Baret P. How agricultural research systems shape a technological regime that develops genetic engineering but locks out agro-ecological innovations. Research Policy, 2009, vol. 38, pp. 971–983.

- Thompson J., Scoones I. Addressing the dynamics of agri-food systems: An emerging agenda for social science research. Environmental Science and Policy, 2009, vol. 12, pp. 386–397.

- Brooks S., Loevinsoh M. Shaping agricultural innovation systems responsive to food insecurity and climate change. Natural Resources Forum, 2011, vol. 35, pp. 185–200.

- Edquist C. Design of innovation policy through diagnostic analysis: Identification of systemic problems (or failures). Industrial and Corporate Change, 2011, vol. 20, issue 6, pp. 1725–1753. DOI: 10.1093/icc/dtr060

- Etzkowitz H. Troinaya spiral’: universitety-predpriyatiya-gosudarstvo: innovatsii v deistvii [Triple Helix: Universities – Enterprises – State. Innovations in action]. Translated from English. Tomsk: Izd-vo Tomskogo gos. un-ta sistem upr. i radioelektroniki, 2010. 237 p.

- Carayannis E.G., Campbel D.F.J. “Mode 3” and “Quadruple Helix”: Toward a 21st century fractal innovation ecosystem. International Journal of Technology Management, 2009, vol. 46, issue 3–4, pp. 201–234.

- Carayannis E., Rakhmatullin R. The quadruple/quintuple innovation helixes and smart specialization strategies for sustainable and inclusive growth in Europe and beyond. Journal of the Knowledge Economy, 2014, vol. 5, issue 2, pp. 212–239.

- Fritsch M., Mueller P. The persistence of regional new business formation-activity over time-assessing the potential of policy promotion programs. Journal of Evolutionary Economics, 2007, vol. 17, issue 3, pp. 299–315.

- Derunova E.A. Modeling the evaluation of scientific developments effectiveness in agriculture. Ekonomika regiona=Economy of Region, 2012, no. 2, pp. 250–257 (in Russian).

- Bondarenko Yu.P. Regularities and tendencies of the development of the structure of economic growth of Russia’s agriculture under conditions of interregional differences of development. Regional’nye agrosistemy: ekonomika i sotsiologiya=Regional Agrosystems: Economics and Sociology, 2019, no. 4, pp. 99–108 (in Russian).

- Vasilchenko M., Derunova E. Factors of investment attractiveness of Russian agriculture in the context of innovative structural adjustment. Scientific Papers Series Management, Economic Engineering in Agriculture and Rural Development, 2020, vol. 20, issue 2, pp. 511–522.

- Wagner J. Exports and productivity: A survey of the evidence from firm-level data. The World Economy, 2007, vol. 30, issue 1, pp. 60–82.

- Leonidas C.L. Export barriers: Non-exporters’ perceptions. International Marketing Review, 1995, vol. 12, issue 1, pp. 4–25.

- Cassiman B., Golovko E., Martinez-Ros E. Innovation, exports and productivity. International Journal of Industrial Organization, 2010, vol. 28, issue 4, pp. 372–376.

- Griliches Z. R&D and productivity: The unfinished business. Estudios de Economia, 1998, vol. 25, issue 2, pp. 145–160.

- Grossman G.M., Helpman E. Trade, knowledge spillovers, and growth. European Economic Review, 1991, vol. 35, issue 2–3, pp. 517–526.

- Greenaway D., Kneller R.A. Industry differences in the effect of export market entry: Learning by exporting? Review of World Economics, 2007, vol. 143, issue 3, pp. 416–432.

- Aw B.Y., Hwang A. Productivity and the export market: A firm level analysis. Journal of Development Economics, 1995, vol. 47, pp. 313–332.

- Bernard A.B., Jensen J.B. Exceptional exporter performance: Cause, effect, or both? Journal of International Economics, 1999, vol. 47, issue 1, pp. 1–25.

- Delgado M.A., Fariñas J.C., Ruano S. Firm productivity and export markets: A non-parametric approach. Journal of International Economics, 2002, vol. 57, pp. 397–422.

- Fariñas J.C., Martín-Marcos A. Exporting and economic performance: Firm-level evidence of Spanish manufacturing. The World Economy, 2007, vol. 30, issue 4, pp. 618–646.

- Love J.H., Mansury M.A. Exporting and productivity in business services: Evidence from the United States. International Business Review, 2009, vol. 18, issue 6, pp. 630–642.

- Van Biesebroeck J. Exporting raises productivity in sub-Saharan African manufacturing firms. Journal of International Economics, 2005, vol. 67, issue 2, pp. 373–391.

- Linder N.V., Arsenova E.V. Instruments to stimulate the innovation activity of holdings in industry. Scientific Works of the Free Economic Society of Russia, 2016, vol. 198(2), pp. 266–274.

- Liu X., Buck T. Innovation performance and channels for international technology spill overs: Evidence from Chinese high-tech industries. Research Policy, 2007, vol. 36(3), April, pp. 355–366.

- Kozlov K., Wilhelmsson F. Exports and productivity of Russian firms: In search of causality. Economic Change, 2007, vol. 40, pp. 361–385.

- De Rosa D. Do institutions matter for exporting? The case of Russian manufacturing. Applied Economics Quarterly, 2007, vol. 53, issue 2, pp. 119–164.

- Gorodnichenko Y., Svejnar J., Terrell K. Globalization and innovation in emerging markets. American Economic Journal: Macroeconomics, 2010, vol. 2, issue 2, pp. 194–226.

- Golikova V.V., Gonchar K.R., Kuznetsov B.V. Empiricheskie dokazatel’stva obuchayushchikh effektov eksporta [Empirical Evidence of Learning-by-Exporting Effects]. Moscow: Izd. Dom Vysshei shkoly ekonomiki, 2011. 52 p.

- Arkhipova M.Yu., Aleksandrova E.A. Study of the relationship between innovation and export activity of Russian enterprises. Prikladnaya ekonometrika=Applied Econometrics, 2014, no. 4(36), pp. 88–101 (in Russian).

- Andreeva E.L., Glukhikh P.L., Krasnykh S.S. Assessing the impact of the digitalization processes on technological export in the Russian regions. Ekonomika regiona=Economy of Region, 2020, vol. 16, issue 2, pp. 612–624 (in Russian).

- Shabanov V.L., Vasilchenko M.Ya, Derunova E.A., Potapov A.P. Formation of an export-oriented agricultural economy and regional open innovations. J. Open Innov. Technol. Mark. Complex, 2021, vol. 7, issue 1, p. 32. DOI: 10.3390/joitmc7010032

- Andryushchenko S.A., Vasil’chenko M.Ya., Shabanov V.L. The method of kmeans clustering as a tool for classification of regional agro-industrial complex, taking into account the special status of selected regions. Ekonomika sel’skokhozyaistvennykh i pererabatyvayushchikh predpriyatii=Economy of agricultural and processing enterprises, 2019, no. 11, pp. 36–41 (in Russian).

- Vasilchenko M., Derunova E. Assessment of the contribution of the investment potential to increasing the efficiency of agricultural production. Scientific Papers Series Management, Economic Engineering in Agriculture and Rural Development, 2021, vol. 21, issue 1, pp. 805–816.

- Derunova E.A., Ustinova N.V., Derunov V.A., Semenov A.S. Modeling of diversification of market as a basis for sustainable economic growth. Ekonomicheskie i sotsial’nye peremeny: fakty, tendentsii, prognoz=Economic and Social Changes: Facts, Trends, Forecast, 2016, no. 6, pp. 91–109. DOI: 10.15838/esc/2016.6.48.5 (in Russian).

- Semin A.N., Skvortsov E.A., Skvortsova E.G. Territorial aspects of robotization of agriculture. APK: ekonomika, upravlenie=Agroindustrial Complex: Economics, management, 2019, no. 3, pp. 35–46 (in Russian).

- Firsova A.A., Makarova E.L., Tugusheva R.R. Institutional management elaboration through cognitive modeling of the balanced sustainable development of regional innovation systems. J. Open Innov. Technol. Mark. Complex, 2020, vol. 6, p. 32. DOI: 10.3390/joitmc6020032