Assessment of the performance of the region's agriculture

Автор: Anishchenko Alesya Nikolayevna, Selimenkov Roman Yuryevich

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Young researchers

Статья в выпуске: 5 (29) т.6, 2013 года.

Бесплатный доступ

The article presents the socio-economic characteristics of the activity of the region’s agricultural enterprises by the results of the questionnaire survey of enterprises’ managers conducted in 2013. The obtained information has been the basis for identifying problems in the functioning of the Vologda Oblast agriculture and proposes the ways to improve the current situation.

Agricultural production, labour potential, investment, innovation, world trade organization (wto), management in agriculture, agrarian policy

Короткий адрес: https://sciup.org/147223507

IDR: 147223507 | УДК: 338.43(470.12)

Текст научной статьи Assessment of the performance of the region's agriculture

Slackening of attention to agricultural development issues in the first decade of market transformations in Russia led to significant social losses. Moreover, the implementation of federal and regional target programmes did not provide quality changes in the region’s agriculture [2; 3; 5; 7].

Development of agriculture is still restrained by the number of consistent problems; in order to solve them it is necessary to carry out the monitoring of agricultural enterprises’ activity for the purpose of studying the dynamics of their leaders’ assessments concerning the state of labour potential, investment activity, cooperation with different institutions, readiness to modernization, and functioning in terms of open market.

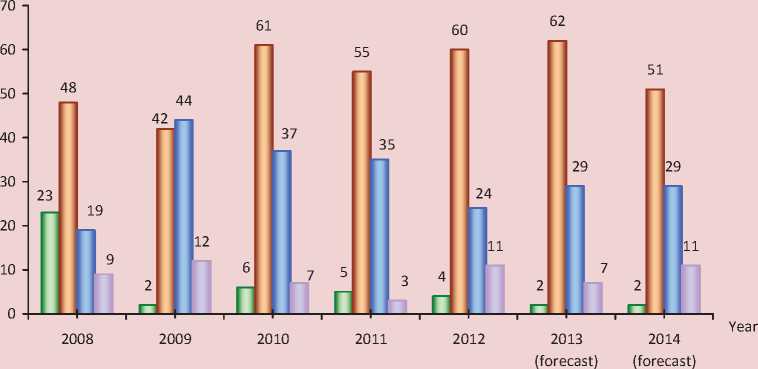

Figure 1. The Vologda Oblast agricultural enterprises performance assessment by their heads (as a percentage of the number of respondents)

□ High □ Average □ Low □ Very low

The questionnaire survey of agricultural enterprises’ managers in the Vologda Oblast1 conducted in 2013 revealed the main trends and problems in the agricultural sector. Besides, the survey’s results confirm the statistics concerning the difficulties existing in the region’s agriculture.

The survey results show that the majority of heads gave medium and low estimates (60 and 24% respectively) to their enterprises’ performance in 2012. In comparison with last year’s data2 we observe the increase in positive estimates and the reduction of negative estimates (fig. 1) .

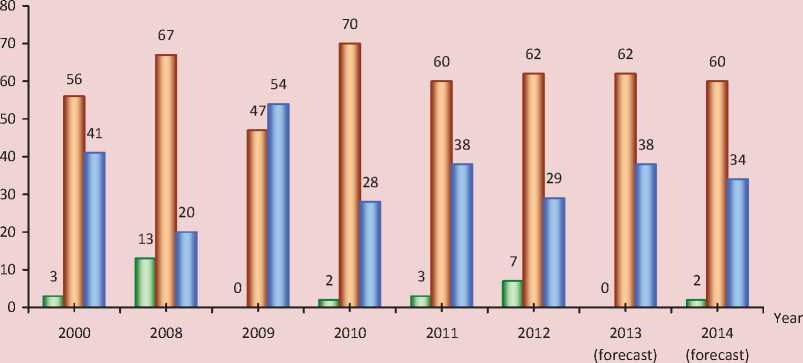

Moreover, the assessment of the agricultural enterprises’ financial condition improved in 2012: in comparison with 2011 the share of leaders evaluating the state of enterprise as good has risen (from 3 to 7% respectively; fig. 2 ), along with the reduction in unsatisfactory assessments (from 38 to 29%). At that, in perspective, according to the leaders’ opinions, the financial state of agricultural sector will stabilize, though bankruptcy threat will exist for 27% of enterprises in two coming years. Although more than half of respondents (55%; in 2011 – 48%) consider that the financial situation will allow agricultural enterprises to stay afloat in the future.

In addition, forecast estimates of business performance factors for 2013 are rather pessimistic: more than 80% of the leaders predict the increase in the prime cost of and prices for the products; more than one third suppose that the volume of capital investment will decrease or remain the same; according to 51% of leaders, the level of profitability at the end of 2013 will reduce; 51% of respondents claim that the indebtedness to banks will remain on the same level.

Figure 2. Assessment of financial condition of their enterprises by the heads of the Vologda Oblast agricultural organizations (as a percentage of the number of respondents)

□ Good □ Satistactory □ Unsatisfactory

In 2012 the enterprises’ managers most often pointed out the aggravation of prices disparity with regard to produced agricultural products (93%) and lack of budget support to agricultural commodity producers (89%; tab. 1 ) among the factors preventing sustainable functioning of agricultural enterprises. Difficulties in productive activity of agrarians in 2012 were also caused by the high taxation level. Nevertheless, in comparison with 2011, the ratio of leaders lacking current assets decreased by 14 percentage points (in 2011 – 30%).

It is necessary to note that the above factors have been relevant for a few years already. At the same time, in comparison with 2011, the share of managers who consider great indebtedness and underdeveloped social infrastructure to be the primary factors affecting the activity of agricultural enterprises has increased by 23 percentage points (almost twice and by 9 percentage points, respectively).

In order to adapt to the adverse economic conditions, agricultural organizations’ managers took active steps in 2012: more than one third of them carried out activities for enhancing labour discipline, 27% implemented innovation, resource-saving technologies. In comparison with 2011, the share of respondents, who consider it necessary to reduce the number of employees, has doubled. However, 18% of respondents have changed the structure of crops, 7% have changed the organizational structure, and 18% reduced the number of livestock (tab. 2).

The share of managers, who consider it necessary to use new technologies, amounted to 27% in 2012, which is almost half lower that the level of 2011. There has been a 2-fold reduction in the number of respondents planning to improve the quality of products (in 2011 – 70%, in 2012 – 38%) and working conditions (in 2011 – 45%, in 2012 – 13%). However, we consider it positive that in the future the agricultural enterprises’ managers intend to search for new sales markets – 40% (in 2012 – 27%), improve the quality of production – 42% (in 2012 – 38%), change the structure of crops – 29%, increase livestock population – 27%.

Table 1. Main factors preventing the development of agricultural enterprises in the Vologda Oblast (as a percentage of the number of respondents)

|

Factor |

2008 |

2009 |

2010 |

2011 |

2012 |

|

Aggravation of prices disparity with regard to produced agricultural products and industrial resources for the village |

90 |

96 |

95 |

90 |

93 |

|

Lack of budget support to agricultural producers |

83 |

93 |

84 |

98 |

89 |

|

Lack of personnel and a low level of their qualification |

38 |

41 |

65 |

48 |

38 |

|

Lack of working assets |

54 |

61 |

44 |

30 |

16 |

|

Poor condition of facilities and infrastructure |

50 |

46 |

44 |

38 |

38 |

|

Low level of labour remuneration (wages) |

35 |

23 |

44 |

50 |

16 |

|

High indebtedness and low paying capacity |

25 |

59 |

42 |

43 |

20 |

|

Underdevelopment of social infrastructure in the settlement where your enterprise is functioning |

44 |

21 |

42 |

20 |

11 |

|

High level of taxation |

- |

21 |

42 |

45 |

40 |

|

Absence of state control over the processors, intermediaries and trade organizations on the issues of pricing in agricultural production |

54 |

57 |

35 |

50 |

33 |

|

Adverse environmental conditions |

- |

0 |

33 |

15 |

16 |

|

Introduction of new standards for technical regulation of agricultural production quality |

- |

50 |

14 |

18 |

9 |

Table 2. Measures implemented by the heads of agricultural enterprises in the Vologda Oblast to adapt to the modern economic conditions (as a percentage of the number of respondents)

|

Activities |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 (forecast) |

|

Improvement of agricultural production quality |

28 |

66 |

51 |

70 |

38 |

42 |

|

Search for new market outlets |

35 |

18 |

40 |

43 |

27 |

40 |

|

Reduction in the number of livestock |

10 |

25 |

35 |

15 |

18 |

18 |

|

Introduction of innovation, resource-saving technologies |

70 |

50 |

33 |

53 |

27 |

33 |

|

Enhancement of labour discipline |

48 |

32 |

30 |

53 |

36 |

33 |

|

Increase in the number of livestock |

41 |

21 |

30 |

38 |

25 |

27 |

|

Improvement of labour conditions |

63 |

41 |

23 |

45 |

13 |

11 |

|

Reduction in the number of personnel |

21 |

11 |

21 |

10 |

20 |

18 |

|

Changes in the structure of crops |

21 |

9 |

14 |

23 |

18 |

29 |

|

Establishment of new non-agricultural productions |

19 |

7 |

14 |

5 |

4 |

9 |

|

Change of organizational structure |

2 |

7 |

12 |

15 |

7 |

9 |

|

Introduction of market mechanisms of relations between the structural units of an organization |

7 |

0 |

5 |

3 |

2 |

4 |

The labour potential of agricultural organizations is characterized by the optimal number and qualification of the workforce. So, according to the managers, the provision of agricultural enterprises with staff was satisfactory (53%) in 2012, compared with 2011. At the same time, the share of managers of agricultural enterprises, which in 2012 felt the shortage of highly skilled workers of leading occupations, increased by 5 percentage points (tab. 3) .

The provision of agricultural organizations with specialists and middle workers is estimated as satisfactory. In comparison with the results of a survey conducted in 2012, there has been an increase in the share of persons, who pointed out the necessity to recruit more specialists.

The survey shows that the problem concerning the lack of funds allocated by the majority of agricultural enterprises for investment purposes remains relevant. Their volume was assessed by agricultural organizations’

Table 3. Staffing of the Vologda Oblast agricultural enterprises (as a percentage of the number of respondents)

|

Personnel |

Provision with personnel |

||||||||||||||

|

Satisfactory |

Insufficient |

Very low |

|||||||||||||

|

о |

CD |

о |

5 |

Б |

о |

CD |

Б |

5 |

о |

CD |

о |

О |

|||

|

Agricultural workers in general |

76 |

65 |

49 |

43 |

53 |

24 |

30 |

44 |

53 |

33 |

0 |

2 |

7 |

5 |

9 |

|

Highly qualified workers of leading occupations |

22 |

17 |

16 |

25 |

9 |

59 |

55 |

51 |

55 |

60 |

17 |

29 |

26 |

15 |

22 |

|

Middle workers |

70 |

57 |

44 |

55 |

53 |

22 |

31 |

40 |

35 |

27 |

9 |

5 |

14 |

5 |

11 |

|

Specialists |

78 |

47 |

49 |

60 |

58 |

22 |

37 |

42 |

35 |

24 |

0 |

16 |

9 |

5 |

11 |

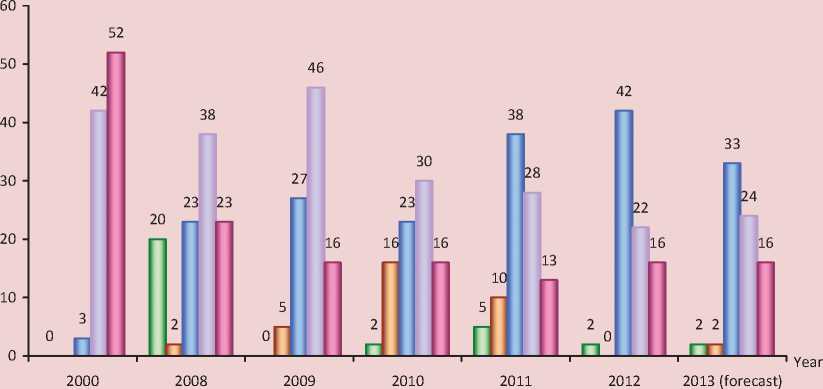

Figure 3. Assessment of the level of capital investments in the development of the Vologda Oblast agricultural enterprises (as a percentage of the number of respondents)

managers as insufficient for expanded reproduction. In 2012, only 2% of respondents thought that the level of capital investments was optimal (fig. 3) .

As we can see, the share of managers, who called the level of capital investments insufficient and completely insufficient, has decreased for five years by 23 percentage points, and in comparison with 2000 it has reduced twice. The decline in the share of negative assessments is connected with the fact that many agricultural organizations under the relatively favorable economic situation took long-term loans for the renewal of fixed capital. Forecast evaluations of managers regarding the volume of investments in 2013 remained at the level of 2012.

Despite this fact, capital investments have allowed the condition of the facilities and infrastructure base of agricultural enterprises to be stabilized. As the survey results show, in 2012 main assets of enterprises were worn by an average of 58%, which is 5 percentage points lower than the level of 2011.

It should be emphasized that, according to 73% of interviewed managers of agricultural enterprises, the promotion of investment activity over the last years has been constrained mainly by high prices for equipment and construction materials, high interest rate on bank loans (73%), the necessity to repay debts (53%), shortage of working capital (33%; tab. 4 ).

Attracted funds remain the main source of investment for agricultural organizations. The majority of managers of the region’s agricultural enterprises (76%) pointed out that they used bank loans in 2012 (in 2011 this figure was over 80%). 41% of respondents are satisfied with the terms of obtaining short loans, while a year ago this figure was 42% (tab. 5) . Banks granted long-term (investment) loans for the development of agricultural production on the terms that did not satisfy 36% of managers; meanwhile, almost half of respondents find it difficult to answer this question.

The main difficulties faced by the managers of surveyed organizations in the agricultural sector when obtaining a loan in 2012, were high interest rates – 82% (2011 – 67%), a long procedure of handling the necessary documentation – 38% and strict terms of obtaining loans against collateral – 27% (tab. 6) .

One of the positive changes in lending conditions over the past year can be found in a decline in the share of those who did not have difficulties in obtaining a loan.

However, the availability of credit resources has not influenced the innovation activity of enterprises. Their innovation activity, in the opinion of 20% of the managers, is reduced to the purchase of products tested in the foreign market (their share was 13% in 2011) [1, p. 130]. More than half of agricultural companies do not participate in innovation processes at all.

Table 4. Factors hindering the development of investment activity in agricultural enterprises of the Vologda Oblast (as a percentage of the number of respondents)

|

Factors |

2000 |

2008 |

2009 |

2010 |

2011 |

2012 |

|

High prices for equipment and construction materials |

32 |

84 |

71 |

62 |

75 |

73 |

|

High interest rate on bank loans |

19 |

72 |

55 |

61 |

48 |

78 |

|

Shortage of working capital |

25 |

70 |

64 |

58 |

55 |

33 |

|

Necessity to repay debts |

19 |

35 |

66 |

54 |

63 |

53 |

|

Untimely repayment of subsidies for the loans granted earlier |

- |

- |

64 |

23 |

18 |

29 |

|

Absence of necessary contractors to execute works |

0 |

5 |

0 |

2 |

0 |

7 |

Table 5. Degree of contentment of the agricultural organizations’ managers in Vologda Oblast with the terms of obtaining bank loans (as a percentage of the number of respondents)

|

Answer option |

2008 |

2009 |

2010 |

2011 |

2012 |

|

Short-term loan |

|||||

|

Yes |

6 |

8 |

0 |

3 |

3 |

|

Rather yes than no |

53 |

26 |

21 |

42 |

38 |

|

Rather no than yes |

31 |

47 |

33 |

30 |

29 |

|

No |

8 |

16 |

7 |

6 |

12 |

|

It is difficult to answer |

3 |

3 |

5 |

9 |

18 |

|

Long-term (investment) loan |

|||||

|

Yes |

0 |

0 |

0 |

3 |

3 |

|

Rather yes than no |

27 |

17 |

14 |

27 |

15 |

|

Rather no than yes |

39 |

33 |

19 |

27 |

18 |

|

No |

15 |

43 |

7 |

12 |

18 |

|

It is difficult to answer |

18 |

7 |

7 |

9 |

47 |

Table 6. Difficulties experienced by the heads of the Vologda Oblast agricultural enterprises in obtaining loans (as a percentage of the number of respondents)

|

Answer option |

2008 |

2009 |

2010 |

2011 |

2012 |

|

High interest rate |

78 |

90 |

47 |

67 |

82 |

|

Terms of obtaining loans against collateral |

62 |

42 |

40 |

52 |

27 |

|

Long procedure of issuing a loan |

56 |

68 |

21 |

36 |

38 |

|

Term of a loan |

33 |

8 |

14 |

6 |

9 |

|

There were no difficulties |

4 |

3 |

9 |

18 |

6 |

|

Refusal of a bank to grant long-term loans |

38 |

24 |

0 |

6 |

15 |

Only 4% of the surveyed agricultural organizations in the region had firm relations with scientific institutions and universities (in 2011 – 8%); 2% were involved in experiments and testing of innovations.

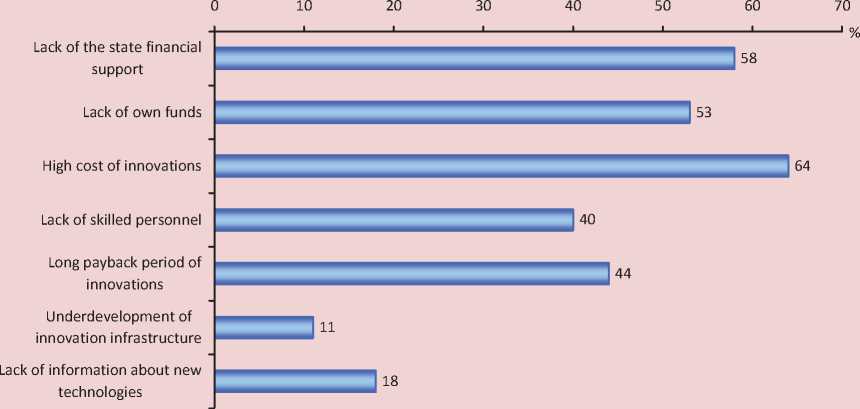

According to the producers, the key factors hindering innovation activities are the high cost of innovation (64%), lack of budgetary support from the state (58%) and lack of the required amount of own funds (53% of the interviewed managers, that is one-third below the 2011-level – 88%; fig. 4 ). Long payback periods of innovations (44%) and shortage of qualified personnel (40%) were also noted among the barriers hindering the innovation development of the region’s agricultural sector.

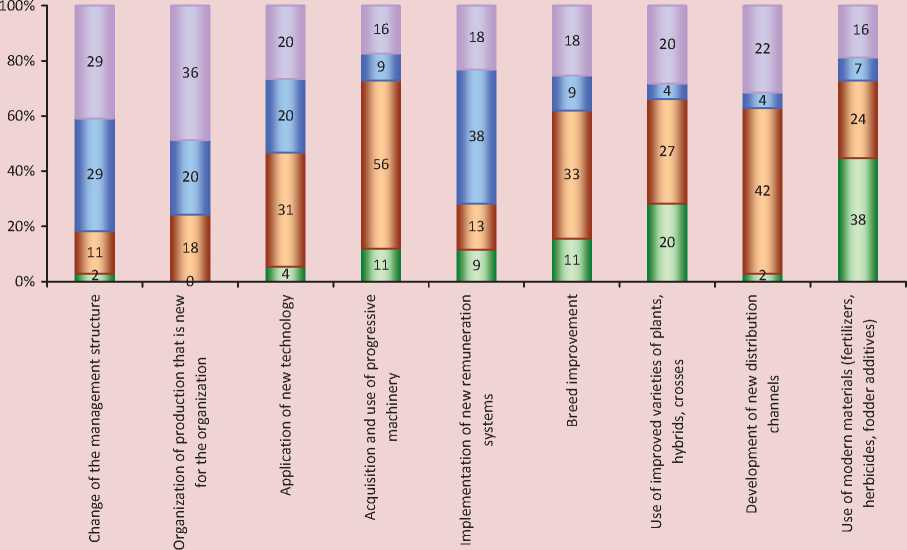

Survey data allowed defining the direction and frequency of the implementation of the various innovations in the region’s agriculture (fig. 5).

As follows from the diagram, 62% of the agricultural companies – survey respondents, have annually or every few years applied modern materials (73% – in 2011), 57% have used progressive technology, 44% have mastered new distribution channels and 44% – have upgraded the cattle.

However, it is necessary to pay attention to the following negative results of evaluations: 56% of the agricultural enterprises have not used new remuneration schemes, 56% have not explored new kinds of production; 56% have not changed the management structure.

According to the majority of respondents (82%), the activation of innovation activity in agriculture is impossible without strengthening the state support. More than half of the respondents (58%) considered that the transition of agriculture to the path of innovation development requires the implementation of special target programmes in innovation sphere; 29% noted the importance of enhancing the integration of science with the production and changing its financing principles.

The positive point is the fact that during the last 5 years of observations the trend of the increase in the share of the respondents, highlighting the development of business relations between farms and the main AIC (agroindustrial complex) counterparties. The strengthening partnership was partly caused by the need to reduce the risks and the magnitude of the losses of agricultural enterprises as a result of worsening economic conditions.

As follows from the survey results, 58% of the interviewed managers of the farms in the region’s agricultural sector (70% – in 2011) were satisfied with the relationship with suppliers and contractors in 2012 (tab. 7) . There was no serious criticism in the sphere of cooperation with tax authorities (53%), buyers and customers (49%).

In 2012, the share of respondents, indicating the counterproductive character of relations between agricultural organizations and banks, increased from 33% to 60%, in comparison to 2011, with insurance companies – by 18 percentage points (33% in 2011).

Figure 4. Factors, restraining the innovation activities of the Vologda Oblast agricultural enterprises, 2012 (as a percentage of the number of respondents)

Figure 5. Frequency of the implementation of innovations in the Vologda Oblast agricultural organizations, 2012 (as a percentage of the number of respondents)

Table 7. Satisfaction of the Vologda Oblast agricultural managers with their relationship with single economic agents (as a percentage of the number of respondents)

|

Economic agents |

Answer |

|||||||||

|

Yes , rather yes |

No, rather no |

|||||||||

|

2008 |

2009 |

2010 |

2011 |

2012 |

2008 |

2009 |

2010 |

2011 |

2012 |

|

|

Suppliers and contractors |

65 |

74 |

58 |

70 |

58 |

35 |

26 |

40 |

18 |

36 |

|

Banks |

68 |

58 |

54 |

63 |

33 |

33 |

43 |

44 |

33 |

60 |

|

Buyers and customers |

65 |

47 |

54 |

68 |

49 |

35 |

53 |

35 |

13 |

44 |

|

Tax authorities |

52 |

68 |

49 |

53 |

53 |

48 |

32 |

51 |

43 |

40 |

|

Processing enterprises |

48 |

38 |

47 |

45 |

53 |

53 |

62 |

47 |

35 |

36 |

|

Agroservice enterprises |

71 |

84 |

33 |

50 |

36 |

29 |

16 |

47 |

23 |

36 |

|

Insurance companies |

- |

33 |

28 |

55 |

31 |

- |

67 |

58 |

33 |

51 |

Table 8. Places of the production distribution of the Vologda Oblast agricultural enterprises (as a percentage of the number of respondents)

|

Place of distribution |

2008 |

2009 |

2010 |

2011 |

2012 |

|

Regional market |

48 |

73 |

58 |

58 |

64 |

|

Markets of neighbouring regions |

46 |

48 |

51 |

25 |

44 |

|

Regional centre |

48 |

41 |

40 |

48 |

53 |

|

Markets of neighbouring oblasts |

28 |

16 |

35 |

28 |

9 |

|

Export to other RF oblasts |

35 |

11 |

12 |

15 |

22 |

As for the places of the production distribution of the Vologda Oblast agricultural enterprises, in 2012 the enterprises of the region’s agricultural sector sold their products primarily in the regional market (tab. 8) . The share of farms supplying products in the regional centre increased (in 2012 – up to 53%) and in the markets of neighbouring regions (from 25% in 2011 to 44% in 2012). The export of production to other Russia’s regions also increased (from 15% to 22%, respectively). As compared to the previous survey, the share of respondents selling its products in the markets of the neighbouring areas reduced almost 3-fold.

According to 76% (in 2011 – 78%) of the interviewed managers, processing organizations were the main consumers of the production of the enterprises of the agricultural sector in 2012. It can be noted that the distribution of the agricultural products by main consumers did not change significantly in 2012.

Over a third of the polled managers implemented measures on reducing the prime cost of production (43% of respondents – in 2011), and 29% were looking for new channels of distribution in 2012, in order to solve the problems concerning sales.

According to the survey results, 44% of the managers of the agricultural enterprises were only partially informed on the functioning conditions of the agricultural companies in the open market, a third of the respondents does not have the information concerning WTO at all.

To adapt to the working conditions imposed by WTO, one third of respondents is planning to assess potential benefits and losses, 24% – technical and technological re-equipment of enterprises, 13% – marketing research of market outlet, 11% is going to intensify the work on the standardization and certification of products; less than 10% – to organize production according to international quality standards and to train staff for WTO issues.

On the whole, 71% of the interviewed managers of agricultural enterprises consider they will have a number of negative consequences from the accession to WTO in the future, 22% of the respondents believe it will not affect the activities of the organization.

Table 9. Forms of budget support, provided to the Vologda Oblast agricultural enterprises (as a percentage of the number of respondents)

|

Form of support |

2008 |

2009 |

2010 |

2011 |

2012 |

|

Subsidies for purchasing combustive and lubricating materials |

80 |

88 |

84 |

73 |

77 |

|

Subsidies for the purchase of fertilizers |

75 |

81 |

72 |

80 |

72 |

|

Subsidies for partial compensation of expenses for paying interest on credits |

91 |

84 |

70 |

73 |

56 |

|

Subsidies for livestock production |

34 |

28 |

51 |

23 |

36 |

|

Subsidies o support livestock breeding |

64 |

30 |

33 |

20 |

21 |

|

Subsidies to support elite seed production |

30 |

16 |

33 |

18 |

31 |

|

Subsidies for partial payment of the insurance premium when insuring the harvest of agricultural crops |

30 |

21 |

9 |

5 |

0 |

|

Subsidies for the planting and handling of perennial vegetation |

2 |

7 |

0 |

0 |

0 |

One of the main directions of the state policy is the budget support of agricultural enterprises. The results of the survey indicate that in 2012 budget support was provided to 87% of the region’s agricultural enterprises – survey respondents (by 13 p.p. below the 2011 level), but 43% of the interviewed managers were not satisfied and the third of the respondents were extremely unsatisfied with the amount of the support. More than 70% of the managers in 2012 received grants for purchasing combustive and lubricating materials, 72% compensated the expenses for purchasing mineral fertilizers from the budget funds, 56% paid interest on bank loans (tab. 9) . The share of managers, who received subsidies for the support of elite seed production, increased (almost 2-fold, as compared with the 2011 level).

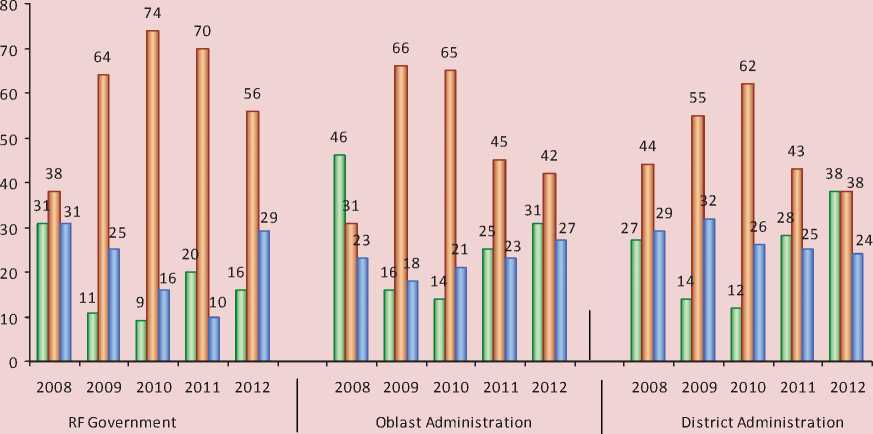

More than half of the managers of agricultural enterprises (56%) in 2012 considered the policy of the Russian Federation improper in relation to the agricultural complex (70% in 2011). However, the level of positive assessments in 2012 on the whole increased, as compared with 2011 (fig. 6) .

As compared with the results of the 2009– 2012 survey, the share of managers, positively assessing the actions of the authorities, on the whole increased. It is necessary to improve the effectiveness of the already adopted measures for the development and implementation of new tools and mechanisms, promoting sustainable agricultural development.

According to the authors, the main steps that will improve the situation in the agricultural sector should be the reduction in prices for fuel and lubricants, mineral fertilizers and tax deduction. The same opinion is shared by the interviewed managers of agricultural enterprises (tab. 10) .

At that 27% of respondents note that the authorities should ensure the protection of the agricultural enterprises from monopolists, 24% believe it is necessary to take additional measures restricting the import of agricultural products and increasing the volume of procurement of agricultural products. 24% of respondents speak for the fight against corruption in the state structures, that is almost 2-fold lower than the 2011-level (43%).

Note, that the share of managers, who indicated the need for implementing the above measures of state regulation a year earlier, has also remained significant.

According to the authors, it is necessary to implement a complex of large-scale activities to ensure the sustainable growth of agricultural production in the region.

Thus, at the federal level it is necessary:

-

• to increase state control over the prices for fuel and lubricants, mineral fertilizers, equipment, electricity and other goods, acquired by agricultural enterprises (regulation of limit marked wholesale and retail prices);

-

• to conduct flexible customs-tariff policy to the benefit of national producers (rationalization of the import structure due to the

Figure 6. Distribution of the answers of the managers of the Vologda Oblast agricultural enterprises to the question: “Do you consider the modern economic policy with regard to the agrarian complex to be right?” (as a percentage of the number of respondents)

о Yes, rather yes □ No, rather no □ It’s difficult to say

Table 10. The measures of government regulation, which are most important for the Vologda Oblast agricultural enterprises (as a percentage of the number of respondents)

-

• to stimulate the development of integration ties of agrarian science and production (establishment of agro-technology park), etc.

At the regional level , the main state regulation measures concerning agricultural production are:

-

• increase in the volume of the budgetary financing of target programmes aimed at the development of agriculture and rural territories;

-

• activation of the works on agricultural staff retraining and professional development, including abroad training;

-

• increase of volumes of procurement interventions at guaranteed prices;

-

• organization of the activities of the services providing information about technical innovations and advanced experience to agricultural producers;

-

• adoption of additional measures on restructuring the debt of the agricultural organizations to creditors;

-

• development of relations between agricultural sectors, increase of the role of cooperatives in rural areas, etc.

However, the strategic directions for the stabilization and development of agriculture in the region, according to the authors, are the following:

-

• achievement of financial sustainability of AIC enterprises;

-

• technical and technological modernization of the agricultural sector;

-

• accelerated development of livestock and crop production;

-

• creation of highly skilled human resources and improvement of the staffing of agricultural production;

-

• increase in the volume of budget support.

Thus, the implementation of the given set of measures will bring the agriculture of the Vologda Oblast to the path of sustainable development. Otherwise, it may lead to the degradation of rural areas and food security decrease in the region.

Список литературы Assessment of the performance of the region's agriculture

- Anishchenko A.N., Selimenkov R.Yu. Assessment of the region’s agro-industrial complex functioning. Problems of development of territories. 2012. No. 6 (62). P.123-134.

- State Programme for Development of Agriculture and Regulation of Agricultural Commodities Markets in 2013-2020: Decree of the Government of the Russian Federation No. 717 dated July 14, 2012. Available at http://www.vologda-agro.ru/gprogramms.

- State Programme “Development of agroindustrial complex and consumer market of the Vologda Oblast for 2013-2020”: Decree of the Vologda Oblast Government No. 1222 dated December 22, 2012. Available at: http://www.vologda-agro.ru/gprogramms.

- Uskova T.V., Sychev M.F., Chekavinskiy A.N. Monitoring of the Vologda Oblast agroindustrial complex functioning: final research report. Vologda, 2010.