Budgetary prospects in the region in 2014-2016: implementation of the president's social decrees or avoidance of default risks?

Автор: Pechenskaya Mariya Aleksandrovna

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Social finances

Статья в выпуске: 1 (31) т.7, 2014 года.

Бесплатный доступ

According to the Budget Code the budget process in the Russian Federation includes the following stages: drafting of a budget project; consideration and approval of the budget; budget execution; preparation of a report on the budget execution and its approval. The given stages are carried out in a strict sequence and are closely interlinked. The approved budget is in force during the budget period, which in the Russian Federation lasts 12 months from January 1 to December 31. The budget is adopted for the medium- term period of three years. On December 11, 2013 the Vologda Oblast Legislative Assembly members adopted the oblast budget for 2014 and for the planned period of 2015 and 2016 in the final reading. According to the Chairman of the Budget and Taxation Committee of the Vologda Oblast Legislative Assembly A.V. Kanaev, the project of the oblast budget is drafted in difficult economic conditions due to a negative impact of a significant public debt, a need to implement the May Decrees of the President and provision of local budgets balance...

Regional budget, inter-budgetary fiscal relations, regional debt, presidential decrees, deficit, transfers, programme budget

Короткий адрес: https://sciup.org/147223549

IDR: 147223549 | УДК: 336.143(470.12) | DOI: 10.15838/esc/2014.1.31.14

Текст научной статьи Budgetary prospects in the region in 2014-2016: implementation of the president's social decrees or avoidance of default risks?

Government regulation carried out within the state economic policy plays the leading role in formation and development of the economic structure of any modern society. One of the most important mechanisms of economic and social regulation is a financial mechanism in the financial system. Its main element is a state budget, with the help of which the state sets up centralized monetary funds and affects formation of decentralized funds, thus providing the opportunity to perform the functions assigned to the state bodies. The certain budget impact on the territory’s development is determined by the fact that the budget is the largest monetary fund, allocations of which crucially influence development directions and economic sustainability.

Recently there has been a regionalization of economic processes, developing in the transfer of the federal regulatory functions to the territorial level. This fact testifies expanding the use of regional budgets and strengthening their significance. The regional budget is an intermediate level of the budgetary system. Therefore, on the one hand, it has independent sources of revenues and areas of spending, and, on the other hand, receives financial assistance from the federal budget and allocates it to local budgets.

In accordance with the Budget Code of the Russian Federation, one of the principles of the budgetary system is budget independence which can be ensured only if the territory has its own revenue sources and the right to determine the direction of their usage and spending. That is why the budgeting issue and the budget process management on a regional level are very relevant.

For the last years the consolidated budgets of Russian regions have been forming under conditions of the crisis and post crisis consequences. In this regard, the provision of financial stability and a stable budget income base, enhancement and expansion of tax potential, optimization of budget expenditures are key tasks for the regional authorities.

To ensure the sustainability of the Vologda Oblast budget system in 2014–2016 the regional budget is based on the conservative scenario of socio-economic development. However, it promises a deceleration of economic growth under conditions of stagnating industrial production, weak growth in the population’s cash income, and consequently, consumer demand, as well as decline in investment activity ( tab. 1 ).

This economic base is not able to boost the budget’s own revenues noticeably, that’s why again the upcoming budget cycle expects deficit budget execution which is forecasted to drop by 2.3 times for 3 years and make 3.6% to the amount of own incomes ( tab.2 ).

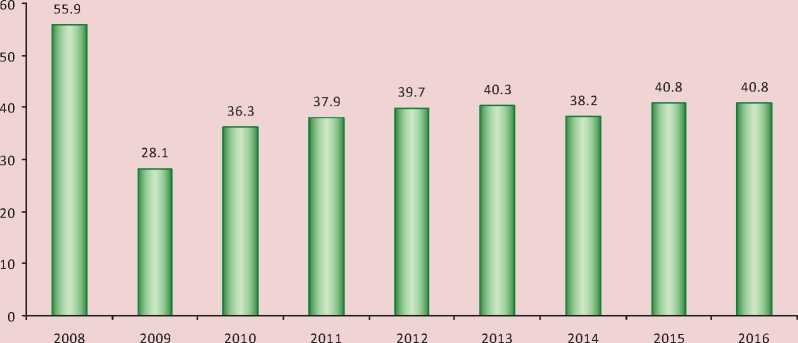

And although the predictive values of total and own revenues in current prices are to exceed the pre-crisis level, it can be noted that it will not be possible to reach the pre-crisis level (40.8 billion rubles in 2016 against 55.9 billion rubles in 2008; fig. 1 ) with current inflation.

It should be noted that on the basis of the new regional budget the income tax will not be able to regain leadership in the tax revenues structure (only 16% in 2014 against 60.5% in 2008). Moreover, the Oblast Government forecasts zero revenues of income tax from the enterprises of metallurgy and an agrochemical holding. On this background the value of individual income tax (38.5% of their revenues) and a property tax (26% of own revenues) rises. However there expected a slowdown of growth rates of individual income tax from 15.4% in 2014 to 9.9% in 2016 (against 20–26% in the pre-crisis period; tab. 3 ).

Due to the reasons stated above the backlog of the Vologda Oblast in the level of wages in comparison with the country in general is to increase from 5 thousand rubles in 2013 to 8.7 thousand rubles in 2016 ( tab. 4 ).

Table 1. Key macroeconomic indicators for budgeting of the Vologda Oblast in 2014–2016

|

Key indicator |

Fact |

2013, estimate |

Forecast |

||||||

|

2008 |

2009 |

2010 |

2011 |

2012 |

2014 |

2015 |

2016 |

||

|

GRP* |

6.7 |

87.1 |

105.7 |

05.8 |

102.0 |

100.0* |

102.7 |

102.0 |

103.5 |

|

Industrial production index* |

95.3 |

90.5 |

111.1 |

104.8 |

100.5 |

101.5 |

102.2 |

102.8 |

102.0 |

|

Permanent investment* |

85.9 |

71.5 |

96.9 |

153.4 |

120.3 |

61.3 |

104.6 |

69.3 |

119.8 |

|

Retail trade turnover* |

108.5 |

89.4 |

116.3 |

106.0 |

119.7 |

103.5 |

104.8 |

105.5 |

105.0 |

|

Real income of the population, % to the previous year |

98.7 |

90.4 |

108.6 |

100.2 |

111.0 |

107.6 |

102.4 |

102.4 |

104.4 |

|

Consumer price index, December to December, % |

114.3 |

107.2 |

109.2 |

105.7 |

106.0 |

106.0** |

104.5– 105.5** |

104.0– 105.0** |

104.0– 105.0** |

* In comparable prices, % to the previous year.

** According to the forecast of Ministry of Economic Development of the Russian Federation.

Table 2. Key indicators of the Vologda Oblast budget

|

Indicators |

Fact |

2013, estimate |

Forecast |

||||||

|

2008 |

2009 |

2010 |

2011 |

2012 |

2014 |

2015 |

2016 |

||

|

Revenues , total, bln. rubles |

39.5 |

31.2 |

36.1 |

39.3 |

42.4 |

41.2 |

40.9 |

41.8 |

45.1 |

|

In % to the previous year |

125.5 |

79.0 |

115.7 |

108.9 |

107.9 |

97.2 |

99.3 |

102.2 |

107.9 |

|

Including tax and non-tax (own) revenue, bln. rubles |

34.4 |

19.0 |

25.8 |

28.8 |

31.5 |

33.6 |

33.5 |

37.4 |

40.8 |

|

In % to the previous year |

128.9 |

55.2 |

135.8 |

111.6 |

109.4 |

106.7 |

99.7 |

111.6 |

109.1 |

|

Expenses, total. bln. rubles |

39.1 |

37.7 |

43.1 |

46.5 |

45.2 |

44.7 |

44.1 |

43.9 |

46.6 |

|

In % to the previous year |

121.0 |

96.4 |

114.3 |

107.9 |

97.2 |

98.9 |

98.7 |

99.5 |

106.2 |

|

Deficit (-), surplus (+) , bln. rubles |

+0.4 |

-6.5 |

-7.0 |

-7.2 |

-2.8 |

-3.5 |

-3.2 |

-2.0 |

-1.5 |

|

In % to the own income |

1.2 |

-34.2 |

-27.1 |

-25.0 |

-8.9 |

-10.4 |

-9.6 |

-5.4 |

-3.6 |

Figure 1. Tax and non-tax revenues of the oblast budget in real terms, in 2016 prices, billion rubles

Table 3. Dynamics of profit and payroll in the Vologda Oblast in 2012–2016

|

Indicators |

2012, fact |

2013, estimate |

Forecast |

||

|

2014 |

2015 |

2016 |

|||

|

Profit of enterprises, bln. rubles |

66.8 |

17.8 |

17.3 |

18.9 |

19.9 |

|

Profit tax, bln. rubles |

10.9 |

8.9 |

5.4 |

5.7 |

6.1 |

|

Growth rate, % |

-9.2 |

-18.3 |

-39.9 |

7.1 |

6.2 |

|

Payroll, bln. rubles |

116.1 |

126.4 |

137.8 |

150.7 |

164.4 |

|

Individual income tax, bln. rubles |

9.7 |

11.2 |

12.9 |

14.5 |

15.9 |

|

Growth rate, % |

10.2 |

15.5 |

15.4 |

11.9 |

9.9 |

|

Source: report of T.V. Goligina “On basic directions of budgetary and tax policy, on transition to the formation of the program based regional budget and approaches to the drafting of key characteristics of the regional consolidated budget for 2014 and for the planned period of 2015–2016”. Official site of the Department of Finance of the Vologda Oblast. |

|||||

Table 4. Dynamics of average nominal accrued wages

|

Fact |

2013, estimate |

Forecast |

|||||||

|

2008 |

2009 |

2010 |

2011 |

2012 |

2014 |

2015 |

2016 |

||

|

Vologda Oblast |

16.1 |

16.6 |

18.5 |

20.7 |

22.6 |

24.9 |

27.1 |

29.6 |

32.5 |

|

Russian Federation |

17.3 |

18.6 |

21.0 |

23.4 |

26.8 |

29.9 |

33.1 |

36.9 |

41.2 |

|

The gap in the level of average wages between the Vologda Oblast and the Russian Federation |

|||||||||

|

Thousand rubles |

-1.2 |

-2.0 |

-2.5 |

-2.7 |

-4.2 |

-5.0 |

-6.0 |

-7.3 |

-8.7 |

|

% |

-6.9 |

-10.8 |

-11.9 |

-11.5 |

-15.7 |

-16.7 |

-18.1 |

-19.8 |

-21.1 |

|

Sources: data of the Federal State Statistics Service; forecast of socio-economic development of the Russian Federation and the Vologda Oblast for 2014–2016. |

|||||||||

Table 5. Provision of the population with own budgetary revenues

|

Fact |

2013, estimate |

Forecast |

|||||||

|

2008 |

2009 |

2010 |

2011 |

2012 |

2014 |

2015 |

2016 |

||

|

Vologda Oblast, thousand rubles |

37.5 |

22.9 |

29.9 |

33.5 |

36.5 |

39.7 |

38.5 |

42.1 |

45.8 |

|

Russian Federation, thousand rubles |

34.6 |

29.9 |

34.8 |

40.8 |

36.2 |

47.1 |

52.5 |

56.9 |

62.8 |

|

The gap in the level of budget sufficiency between the Vologda Oblast and the Russian Federation |

|||||||||

|

Thousand rubles |

+2.9 |

-7.0 |

-4.9 |

-7.3 |

+0.3 |

-7.4 |

-14.0 |

-14.8 |

-17.0 |

|

% |

108.4 |

76.6 |

85.9 |

82.1 |

100.8 |

84.2 |

73.4 |

74.0 |

73.0 |

|

Subsidies for equalization of budget sufficiency, million rubles |

0 |

0 |

0 |

737.9 |

1332.5 |

1619.4 |

1542.0 |

839.6 |

918.5 |

|

Sources: data of the Treasury of Russia; Rosstat; draft federal budget and regional budget of the Vologda Oblast for 2014–2016; report of N.R. Artamonova “On drafting the regional budget for 2014 and for the planned period of 2015– 2016”. |

|||||||||

Table 6. Key indicators of the federal budget and the budgets of the Russian Federation subjects

|

Indicators |

Fact |

2013, estimate |

Forecast |

|||

|

2011 |

2012 |

2014 |

2015 |

2016 |

||

|

Federal budget |

||||||

|

Revenue, bln. rubles |

11368 |

12854 |

12866 |

13486 |

14768 |

15908 |

|

In % to GDP |

20.8 |

20.5 |

19.1 |

18.2 |

18.0 |

17.4 |

|

Expenditures, bln. rubles |

10926 |

12891 |

13387 |

13847 |

15236 |

16452 |

|

In % to GDP |

20.0 |

20.5 |

19.8 |

18.7 |

18.6 |

18.0 |

|

Deficit/surplus, bln. rubles |

442 |

-37 |

-521 |

-362 |

-468 |

-544 |

|

Budgets of the Russian Federation subjects |

||||||

|

Revenue, bln. rubles |

7644 |

8064 |

8593 |

9332 |

10233 |

11342 |

|

In % to the previous year |

117.0 |

105.5 |

106.6 |

108.6 |

110.0 |

110.8 |

|

Interbudgetary transfers, bln. rubles |

1644 |

1624 |

1394 |

1309 |

1304 |

1309 |

|

In % to the previous year |

117.6 |

98.8 |

85.8 |

93.9 |

99.9 |

100.4 |

|

Expenditures, bln. rubles |

7679 |

8343 |

8787 |

9439 |

10285 |

11364 |

|

Deficit, bln. rubles |

-35 |

-279 |

-194 |

-107 |

-52 |

-22 |

Table 7. Information on the budget allocations for the Vologda Oblast in 2014 to 2016 Presidential decrees, mln. rubles

|

Decree |

2013, estimate Demand |

2014 |

2015 |

2016 |

||||

|

Planned |

Demand |

Planned |

Demand |

Planned |

Demand |

|||

|

On the long-term state economic policy |

4.9 |

4.1 |

4.1 |

4.2 |

4.2 |

4.4 |

4.4 |

|

|

On the activities for the implementation of the state social policy |

2587.6 |

4910.1 |

4171.8 |

6449.3 |

5473.7 |

8 760.3 |

7 347.1 |

|

|

On the improvement of state policy in health care sphere |

18.9 |

17.1 |

17.1 |

23.7 |

23.7 |

25.3 |

25.3 |

|

|

On the measures for the implementation of state policy in the sphere of education and science |

985.8 |

1423.2 |

0.0 |

1 333.2 |

46.5 |

1 429.3 |

44.3 |

|

|

On the measures for providing the citizens with affordable and comfortable housing and enhancing the quality of housing and communal services |

1030.7 |

1 923.4 |

967.2 |

3 498.1 |

403.0 |

1 605.4 |

100.0 |

|

|

On the main guidelines of improving the state management system |

182.9 |

747.7 |

69.3 |

428.2 |

27.1 |

229.4 |

27.0 |

|

|

On the measures for the implementation of demographic policy in the Russian Federation |

34.1 |

83.7 |

83.7 |

119.4 |

119.4 |

180.2 |

180.2 |

|

|

On the national strategy for the benefit of children |

1.6 |

517.3 |

5.4 |

673.4 |

7.7 |

861.9 |

10.6 |

|

|

On some measures on realization of demographic policy in the sphere of protection of children-orphans and children left without parental care |

12.4 |

177.3 |

112.1 |

211.6 |

177.3 |

252.7 |

248.0 |

|

|

Total |

4859.0 |

9803.9 |

5430.6 |

12741.2 |

6282.8 |

13348.8 |

7986.9 |

|

|

Lack of funds |

% |

55.4 |

49.3 |

59.8 |

||||

|

Mln. rubles |

-4373.3 |

-6458.4 |

-5361.9 |

|||||

Source: an annex to the explanatory note to the Oblast draft law “ On the regional budget for 2014 and the planned period of 2015–2016”.

Table 8. Public debt dynamics of the Vologda Oblast

|

Indicator |

Fact |

2013, estimate |

Forecast |

||||||

|

2008 |

2009 |

2010 |

2011 |

2012 |

2014 |

2015 |

2016 |

||

|

Size of state debt, bln. rubles |

1.8 |

10.4 |

18.5 |

25.8 |

29.2 |

32.2 |

34.2 |

36.2 |

37.7 |

|

In % to the own budget incomes |

5.1 |

54.5 |

71.6 |

89.7 |

92.6 |

106.5 |

102.0 |

97.0 |

92.3 |

|

Growth rate, % |

3.3 |

477.8 |

77.9 |

39.5 |

13.2 |

10.3 |

8.9 |

5.8 |

4.1 |

Table 9. The Vologda Oblast budget’s planned repayment of loans, million rubles

|

Indicators |

Forecast |

Budget forecast for 2013–2015 |

Budget forecast for 2014–2016 |

|||

|

2014 |

2015 |

2016 |

2014–2016 |

2014 |

2015 |

|

|

Loans, total |

8290 |

2172 |

8345 |

18807 |

9655 |

10462 |

|

- of a commercial bank |

5800 |

0 |

7465 |

13265 |

7566 |

5800 |

|

- of the federal budget |

2490 |

2172 |

880 |

5542 |

2362 |

4662 |

Provision of the population with own budgetary revenues will lag behind the average level. The gap will expand from 7.4% to 17 thousand, respectively ( tab. 5 ).

On that premise it can be concluded that in the coming three years the region remains subsidized and continues relations with the federal budget, aimed at obtaining subsidies for equalization of budget sufficiency. However, in

the new budget cycle the relations become more tensed due to decreased revenues of the federal budget (regarding GDP) and its deficiency (caused mostly by the shortfalls of petroleum revenue taxes and the imbalance of the pension system) ( tab. 6 ). In this regard, the reduction of the amount of interbudgetary transfers to regional budgets (minus 6% in 2014 compared to 2013) is forecasted.

The reduction of the federal financial assistance to the Vologda Oblast and its own revenues, caused by economic recession, threatens the financing of the presidential election programs embedded in the decrees of the President dated May 7, 2012. The additional expenditure burden on the regional budget in 2014–2016 is estimated at 35.9 billion rubles with the planned increase in own revenues of 7.3 billion rubles ( tab.7 ).

Judging by the mentioned estimates, the region is able to finance 54.9% of the demand in funds necessary for the presidential decrees implementation at the expense of its own sources. The similar situation is taking place in other Russian regions that sometimes propose to simplify goals and tasks. In this regard, Russian President Vladimir Putin spoke very negatively in his Address to the Federal Assembly on December 12, 2013: “...Decrees defined concrete measures to ensure the country’s dynamic development in all spheres... and urge of the Russian people to a better life”. The Head of State emphasized that it is inadmissible to delay the ongoing modernization (from May 2012), which is still

poorly felt by public services users. He urged regional leaders to intensify qualitative decrees execution instead of inefficient spending increasing and administrative apparatus expanding in the coming mid-term period.

Apparently the number of issues of socioeconomic development, not provided with regional or federal financial assurance, will be addressed by debt growth. The debt is estimated at 32.2 billion rubles in 2013 that corresponds to 106.5% of the amount of the budget tax and non-tax revenues ( tab. 8 ).

Obviously, in the coming years the Vologda Oblast Government will not be able to reduce debt load. Moreover, in 2014 it will exceed the amount of own revenues of the regional budget by 2%. In the coming period the return of previous loans can be a serious budget burden. The amount to be refunded exceeds the amount of three-year budget loans twofold ( tab. 9 ).

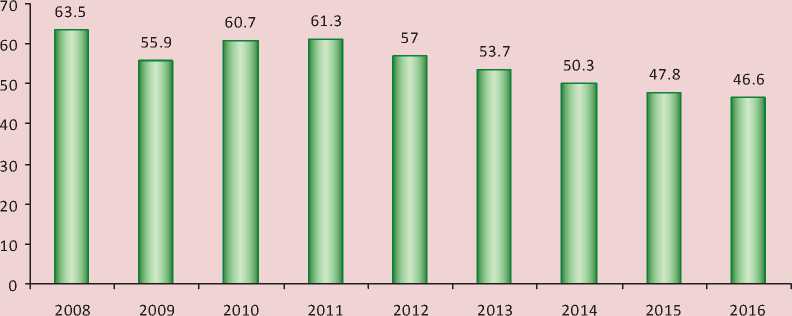

So the projected trend jeopardizes financing of expenditure obligations, which will rise to 1.9 billion rubles. However, in comparable prices the expenditures of the regional budget in 2016 compared to 2008 will reduce by 16.9 billion or 26.6% ( fig. 2 ).

Figure 2. The Vologda Oblast budget expenses in real terms, in 2016 prices, bln. rubles

The qualitative characteristic of the upcoming budget cycle is the formation of regional budget expenditures for 2014–2016 not only in a functional structure but also in a program one, based on the approved state programs. In 2013 six government programs were adopted, but in 2014 their number will increase to 21. The implementation costs amount 86.6% of total budgetary expenditures of the region in 2014, 86.3% – in 2015 and 85.2% – in 2016. In turn, the availability of 13–15% of non-program costs testifies incomplete colligation of the regional budget expenses with the purpose and objectives of the state policy to promote efficiency of public finances management.

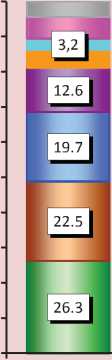

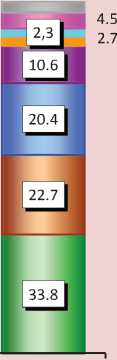

The most significant volume of budget assignations for the next three years will be allocated to state social programs such as education development (33–34% of the expenses), social assistance (22–23%) and health development (20%). About 11% of regional expenditures will be alloted to maintenance and development of road networks of common use and provision of transport service (fig. 3) .

In the upcoming budget cycle the Vologda Oblast budget is to retain its social orientation (70% of the costs). The change of priorities in spending on welfare is observed. The major financing in 2014–2016 are to be allocated to an item “Education” (28–29% of expenses) which will overtake an item “Social policy” (22–23%). Health expenditure is to take third place (17–18%), while the national economy financing is to decline (from 18% in 2012–2013 to 13–14% in 2014–2016; tab. 10 ).

Ongoing optimization of budget expenditures will still have the strongest impact on such spheres as physical training and sport1, housing and utilities infrastructure2, environment protection and national economy.

Taking into account the deficiency of the budget in the coming three-year period one cannot but note the following characteristics of the expenditure part of the Oblast budget.

Figure 3. Structure of the Vologda Oblast budget expenditures for government programs

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

4.3

6.2

5.1

3.1

5.3

2.9

4.4

2.8

-

□ Other (with the share of less than 1%)

-

□ Other (with the share of 1-2%)

-

■ Development of agro-industrial complex and consumer market

-

■ Provision of population with affordable housing and creation of comfortable living conditions

z Development of transport system

-

□ Development of health care

2013 2014 2015 2016

-

• Expenses for the section “National issues” are to grow in 2014 by 129.4 million rubles, or by 6.4%. The greatest growth was noted when financing the functioning of the supreme official of the RF subject (the reasons are not specified in the explanatory note which reduces the transparency of the budget planning).

-

• Each year the expenses on administration and governance comprise a quarter of expenditure on the national economy. For instance in 2014 21.6 million rubles or 65% from 33.3 million rubles, provided for the state program “Energy efficiency and gas infrastructure development” implementation, are to be allocated on the maintenance of the Department of Fuel and Energy Complex. Similarly almost 60% of resources allocated to the support of transport are to be used for managerial functions.

-

• Since 2014 financing of primary professional education establishments has stopped. They are to join secondary professional education establishments in the framework

of the restructuring. However spending on subsection “Secondary professional education” decreases by 1.2 times in 2015–2016.

-

• The role of the regional budget in financing of cultural activities the region decreases. Spending on culture in comparison with the pre-crisis levels is to be reduced by 1.6 times, threatening goals achievement, set in the Presidential Decree No 567 “On the activities for the implementation of the state social policy” dated May 7, 2012.

-

• In 2014–2016 the regional budget expenditure remains high (34–37%), connected with the necessity of providing grant financial aid to local budgets3.

-

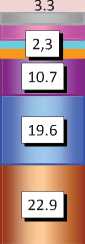

• The regional budget investment costs reduce rapidly amounting only 1.1 billion rubles, or 2.4% of expenditures by 2017 ( fig. 4 ).

Table 10. Structure of the Vologda Oblast budget expenditures in 2011–2016*

|

Sections |

2011, fact |

2012, fact |

2013, estimate |

2014, estimate |

2015, forecast |

2016, forecast |

||||||

|

Mln. rubles |

% |

Mln. rubles |

% |

Mln. rubles |

% |

Mln. rubles |

% |

Mln. rubles |

% |

Mln. rubles |

% |

|

|

Expenses, total |

46519 |

100 |

45182 |

100 |

44756 |

100 |

44093 |

100 |

43857 |

100 |

46617 |

100 |

|

National issues |

2053 |

4.4 |

1836 |

4.1 |

2020.3 |

4.5 |

2150 |

4.9 |

1865 |

4.3 |

1930 |

4.1 |

|

National security and law enforcement |

2449 |

5.3 |

493 |

1.1 |

445 |

1.0 |

420 |

1.0 |

326 |

0.7 |

317 |

0.7 |

|

National economy |

6698 |

14.4 |

8239 |

18.2 |

8202 |

18.3 |

6280 |

14.2 |

5720 |

13.0 |

5952 |

12.8 |

|

Housing and utilities infrastructure** |

1917 |

4.1 |

1848 |

4.1 |

393 |

0.9 |

1138 |

2.6 |

605 |

1.4 |

256 |

0.5 |

|

Environment protection |

236 |

0.5 |

164 |

0.4 |

145 |

0.3 |

185 |

0.4 |

149 |

0.3 |

146 |

0.3 |

|

Social sphere |

27421 |

58.9 |

30013 |

66.4 |

27651 |

61.8 |

30869 |

70.0 |

31209 |

71.2 |

32866 |

70.5 |

|

Education |

7043 |

15.1 |

8285 |

18.3 |

10180 |

22.7 |

12382 |

28.1 |

12616 |

28.8 |

13238 |

28.4 |

|

Culture, cinematography |

882 |

1.9 |

594 |

1.3 |

504 |

1.1 |

477 |

1.1 |

506 |

1.2 |

594 |

1.3 |

|

Public health service |

6643 |

14.3 |

10265 |

22.7 |

6598 |

14.7 |

7750 |

17.6 |

7726 |

17.6 |

8361 |

17.9 |

|

Social policy |

10870 |

23.4 |

10331 |

22.9 |

9924 |

22.2 |

9966 |

22.6 |

10177 |

23.2 |

10486 |

22.5 |

|

Physical training and sport |

1764 |

3.8 |

431 |

1.0 |

289 |

0.6 |

118 |

0.3 |

117 |

0.3 |

130 |

0.3 |

|

Mass media |

219 |

0.5 |

107 |

0.2 |

156 |

0.3 |

176 |

0.4 |

68 |

0.2 |

56 |

0.1 |

|

Debt service |

789 |

1.7 |

1310 |

2.9 |

1930 |

4.3 |

1919 |

4.4 |

1739 |

4.0 |

1697 |

3.6 |

* To compare data the expenditures for 2008–2010 are not given, as in this period intergovernmental transfers were not included in the structure of the functional sections of budget classification.

** In 2013–2016 uncompensated receipts are not included in housing and utilities infrastructure expenditures.

Figure 4. Dynamics of capital investments of the Vologda Oblast budget in 2008–2016

I----1 Million rubles =0=Share in budget expenditures, %

Summarizing the mentioned above, the key qualitative and quantitative features of the budget cycle, started in 2014, can be singled out:

-

1. A serious reduction of tax and non-tax revenues in real terms comparing to the precrisis level: in 2016 to 73% from the 2008 level.

-

2. A critical decrease of the companies profit and, accordingly, revenues from profit tax in the regional budget. They comprise 14.9% of the amount of own revenue in 2016 against 17.8% in 2009.

-

3. A slowdown in the revenue growth from individual income tax – from 15.4% in 2014 to 9.9% in 2016 (against 20–26% in the pre-crisis period). A larger gap between average wages in the Vologda Oblast and the country in general – from 5 thousand rubles in 2013 to 8.7 thousand rubles in 2016.

-

4. Possible non-fulfilment of the Presidential decrees to rise wages of public sector workers due to the limited budgetary resources: 100% – (54.9% of own sources of +20% of Federal transfers) = 25.1% of the unsecured financial liabilities.

-

5. An extremely high level of debt load. Public debt, standing at 34.2 billion rubles in 2014, is to exceed the amount of the budget own incomes by 2%, confirming the failure of the regions’ debt4.

-

6. An increase in the cost of state debt servicing to 1.9 billion rubles.

-

7. Formation 85–87% of budget expenditures in the program structure, which indicates incomplete alignment with the objectives of the state policy, aimed at improving the public finances management.

-

8. An increased tension of the region’s interbudgetary relations with the federal center, which manifests in the annual decrease of financial aid to the regions. It is connected with the trends of the federal budget revenues reduction and its deficiency growth mentioned in the forecast.

Thus the challenge of the federal budget execution indicates that the main source of regional budgets incomes growth must be their own financial resources. However the trends of macroeconomic indicators do not speak of their significant growth. So the profit of the largest Vologda Oblast enterprise OAO Severstal is to be zero in the planned period, the profit of OJSC FosAgro-Cherepovet and CJSC AgroCherepovets is to decrease to 0.2 billion by 2017. The payroll fund increases by 1.3 times, however, the size of average monthly salary in 2013 prices grows only by 1.1 times by 20175.

The Vologda Oblast Government considers solution of systemic budgetary deficiency problems to a greater extent by means of sequestering the budget spending, but not boosting the territory’s profit potential. In our opinion, the drafting a profitable part of the regional budget should be guided by Article 32 of the RF Budget Code, taking into account all potential income sources. This requires a number of measures aimed at:

-

• enhancing the work to reduce existing accounts receivable in the budget;

-

• optimization of tax incentives policy;

Table 11. Calculation of the possible increase of the regional budget revenues through proposed improvements of the budgetary management tools*

|

Activity |

Real value |

Proposed option |

Additional revenue, bln. rubles per year |

|

Reduction of arrears on budget payments |

13.5–18% |

0 |

5400–6300 |

|

Liquidation of unfunded federal benefits |

55–69% of the calculated amount in the budget |

0 |

3650–6507 |

|

Ensuring completeness of target transfers use |

2–5% of the transfers amount |

0 |

212–457 |

|

Increase of the tax rate on dividends |

9% |

15% |

191–194 |

|

Enhancing management of budget funds surplus |

0 |

Deposit % |

12–55 |

|

Providing full financing of delegated powers |

95–99% |

100% |

5–69 |

|

Total |

9471–13582 |

||

|

* Calculations were conducted in 2010–2012 |

|||

Список литературы Budgetary prospects in the region in 2014-2016: implementation of the president's social decrees or avoidance of default risks?

- Artamonova V.N. Ob izmenenii mekhanizma mezhbyudzhetnogo regulirovaniya v Vologodskoy oblasti: doklad na soveshchanii s glavami munitsipal'nykh rayonov 10.10.2013 g. . Ofitsial'nyy sayt Departamenta finansov Vologodskoy oblasti . Available at: http://www.df35.ru/images/file/news/10.10.2013/Prezentazia_Artamonova_10102013.pdf

- Burlachkov V.K. Koordinatsiya byudzhetnoy i denezhno-kreditnoy politiki: opyt vedushchikh stran i ego ispol'zovanie v Rossii . Vestnik Rossiyskogo ekonomicheskogo universiteta imeni G. V. Plekhanova , 2012, no.10(52), pp. 20-26.

- Zaklyuchenie Schetnoy palaty Rossiyskoy Federatsii na proekt Federal'nogo zakona “O federal'nom byudzhete na 2014 god i na planovyy period 2015 i 2016 godov” . Ofitsial'nyy sayt Schetnoy palaty RF . Available at: http://www.ach.gov.ru/ru/expert/before/?id=1071

- Ilyin V.A., Povarova A.I. Problemy ispolneniya territorial'nykh byudzhetov v 2011 godu . Ekonomika. Nalogi. Pravo , 2012, no.5, p. 87.

- Materialy ofitsial'nogo sayta deputata Gosudarstvennoy Dumy RF O.G. Dmitrievoy . Available at: http://www.dmitrieva.org/

- Ob ispolnenii byudzhetov sub”ektov RF i mestnykh byudzhetov za 2003-2013 gg.: otchetnost' Kaznacheystva Rossii . Ofitsial'nyy sayt Federal'nogo kaznacheystva . Available at: http://www.roskazna.ru/reports/mb.html

- O byudzhetnoy politike v 2014-2016 godakh: byudzhetnoe Poslanie Prezidenta RF Federal'nomu Sobraniyu . Ofitsial'nyy sayt Prezidenta RF . Available at: http://www.kremlin.ru/

- Ob oblastnom byudzhete na 2011-2013 gg., 2012-2014 gg., 2013-2015 gg., 2014-2016 gg.: zakony Vologodskoy oblasti . Konsul'tantPlyus: spravochno-poiskovaya sistema .

- O federal'nom byudzhete na 2014 god i na planovyy period 2015 i 2016 godov: Federal'nyy zakon ot 02.12.2013 №349-FZ . Available at: http://www.minfin.ru/common/upload/library/2013/12/main/FZ349-FZ_ot_021213.pdf

- O formirovanii proekta byudzheta na 2014 god i planovyy period 2015-2016 godov: materialy soveshchaniya s rukovoditelyami finansovykh organov munitsipal'nykh rayonov, gorodskikh okrugov i sel'skikh poseleniy Vologodskoy oblasti 03.09.2013 g. . Ofitsial'nyy sayt Departamenta finansov Vologodskoy oblasti . Available at: http://www.df35.ru/index.php?option=com_content&view=article&id=1835:2013-09-03-13-02-38&catid=34:demo-content&Itemid=134

- Pechenskaya M.A., Uskova T.V. Aktual'nye voprosy sovershenstvovaniya mezhbyudzhetnykh otnosheniy v sisteme mestnogo samoupravleniya . Ekonomicheskie i sotsial'nye peremeny: fakty, tendentsii, prognoz , 2012, no.1(19), pp. 136-146.

- Pechenskaya M.A. Problemy sovershenstvovaniya mezhbyudzhetnykh otnosheniy regiona i federal'nogo tsentra . Ekonomicheskie i sotsial'nye peremeny: fakty, tendentsii, prognoz , 2012, no.6, pp. 173-182.

- Pechenskaya M.A. Sostoyanie byudzhetov munitsipal'nykh obrazovaniy i napravleniya effektivnogo ispol'zovaniya ikh sobstvennykh dokhodnykh istochnikov . Problemy razvitiya territorii , 2012, no. 60, pp. 83-96.

- Pechenskaya M.A. Region i federal'nyy tsentr: sostoyanie i otsenka rezul'tativnosti byudzhetnykh otnosheniy . Audit i finansovyy analiz , 2013, no.5, pp. 397-404.

- Pechenskaya M.A. Problemy byudzhetnoy obespechennosti regiona i napravleniya povysheniya ee urovnya . Izvestiya vysshikh uchebnykh zavedeniy (Seriya “Ekonomika, finansy i upravlenie proizvodstvom”) , 2013, no.3(17), pp. 25-33.

- Povarova A.I. Trekhletniy byudzhet: zhdat' li stabil'nosti? . Ekonomicheskie i sotsial'nye peremeny: fakty, tendentsii, prognoz , 2011, no.2, p. 20.

- Povarova A.I. Oblastnoy byudzhet 2012: stabilizatsiya otkladyvaetsya . Ekonomicheskie i sotsial'nye peremeny: fakty, tendentsii, prognoz , 2012, no.3, p. 39.

- Poslanie Prezidenta Federal'nomu Sobraniyu 12.12.2013 g. . Ofitsial'nyy sayt Prezidenta RF . Available at: http://www.kremlin.ru/

- Poslanie Gubernatora Vologodskoy oblasti Zakonodatel'nomu Sobraniyu oblasti 30.10.2013 g. . Ofitsial'nyy sayt Gubernatora Vologodskoy oblasti . Available at: http://okuvshinnikov.ru/interview/byudzhetnoe_poslanie_gubernatora_oblasti_na_sessii_zakonodatelnogo_sobraniya_oblasti_30_oktyabrya_2013_goda/

- Prognoz sotsial'no-ekonomicheskogo razvitiya RF na 2014 god i na planovyy period 2015 i 2016 godov . Ofitsial'nyy sayt Ministerstva ekonomicheskogo razvitiya RF . Available at: http://www.economy.gov.ru/wps/wcm/connect/economylib4/mer/activity/sections/macro/prognoz/doc20130924_5

- Razdatochnye materialy k publichnym slushaniyam po prognozu sotsial'no-ekonomicheskogo razvitiya Vologodskoy oblasti i proektu zakona oblasti “Ob oblastnom byudzhete na 2014 god i planovyy period 2015 i 2016 godov” .

- Regiony Rossii. Osnovnye kharakteristiki sub”ektov RF . Federal'naya sluzhba gosudarstvennoy statistiki . Available at: http://www.gks.ru/wps/wcm/connect/rosstat_main/rosstat/ru/statistics/publications/catalog/doc_1138625359016