Comparative analysis of trends in the development of finance of large corporations in the metallurgical and coal industries in Russia in the context of global challenges

Автор: Pechenskaya-polishchuk Mariya A., Malyshev Mikhail K.

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Branch-wise economy

Статья в выпуске: 1 т.16, 2023 года.

Бесплатный доступ

Since the beginning of the escalation of the Ukrainian situation, the Collective West has imposed an unprecedented number of sanctions against the Russian economy. Restrictions in international trade operations and, in some cases, their full termination have forced large domestic businesses to look for “friendly” markets and develop new logistics routes. And if at the end of the first half of 2022, the oil and gas industry has shown significant growth, some Russian corporations of metallurgy and coal industry were under a jeopardy. Despite favorable conditions in the first months of 2022, the financial results of the second quarter are expected to be much more modest. The fall in revenues of metallurgy and the coal industry from spring 2022 was influenced by higher transportation costs as a result of the turn to the East, insufficient capacity of the Baikal-Amur Mainline and Trans-Siberian Railway, sales of products at a large discount to Asian consumers, and lower export revenues due to the strengthening of the ruble. All these factors will have a negative impact on the volume of the taxable base and revenues of regional budgets. The article was written using methods of vertical and horizontal data analysis, methods of comparison and forecasting, and the method of expert evaluations. The information base of the study was the domestic and foreign literature on the development of metallurgical and coal industries; financial statements and operating results of the largest Russian corporations of ferrous metallurgy (PJSC Severstal), nonferrous metallurgy (PJSC Nornickel) and coal industry (JSC CC Kuzbassrazrezugol); data of the Federal Tax Service in the Vologda and Kemerovo Oblasts, and Krasnoyarsk Krai; information of Forbes.ru; data of information and news portals.

Sustainable development, ferrous metallurgy, nonferrous metallurgy, coal industry, global challenges, anti-russian sanctions, socio-economic development of territories

Короткий адрес: https://sciup.org/147240250

IDR: 147240250 | УДК: 339.92 | DOI: 10.15838/esc.2023.1.85.7

Текст научной статьи Comparative analysis of trends in the development of finance of large corporations in the metallurgical and coal industries in Russia in the context of global challenges

Introduction to the problematics

Sustainable socio-economic development of RF constituent entities is impossible without growth and stability of the revenue base of regional budgets. In turn, the key taxes in the formation of regional revenues are income tax and personal income tax from large corporations. And while personal income tax deductions from large industrial businesses are increasing due to periodic indexation of company management, the value of profit tax is extremely unstable. We should note that it is influenced by such factors as volume, price and currency of product sales, the level of production cost in revenue, commercial and management expenses, tax benefits and regimes. In addition, all lines of companies’ financial results depend on the presence or absence of sanctions.

We should say that since February 24, throughout 2022, the countries of the European Union and the United States, and their satellites, have imposed various economic restrictions and bans on Russia. The sanctions affected almost all economic spheres: cessation of international trade; withdrawal of foreign companies from the market; arrest of foreign exchange reserves; restrictions in the field of investment, etc. While in November

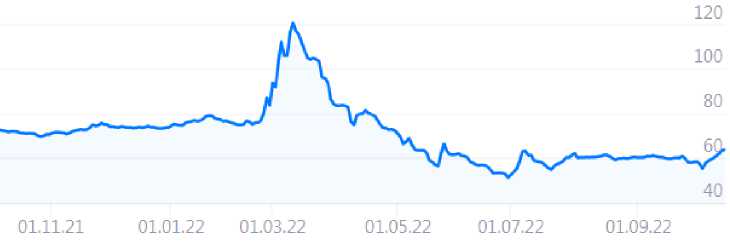

2021 – February 2022, the average dollar exchange rate was 73–77 rubles, by March 11, the price of the U.S. currency had risen to 120.38 rubles. However, no matter how much the Collective West would have wanted the dollar at 200 rubles1, by April 9, the dollar had already fallen to 74.85 rubles (-37.8%). The key reasons for the strengthening of the Russian ruble were: the ban on exports of currency from the country of more than 10 thousand dollars; gas trade with unfriendly countries in rubles; the obligation for exporters to sell up to 80% of foreign currency earnings ( Fig. 1 ).

After the April recovery, the ruble began to hit new records. Due to the loss of interest in and demand for the USD, caused by the impossibility to buy anything with it, and also due to the increased risk of holding this currency, because of Russia’s gold reserves arrest2, by June 30 the price of the

Figure 1. Dynamics of the USD/RUB exchange rate from November 2021 till September 2022

Source: USD – exchange rate of the Central Bank of RF. Available at:

USD fell down to 51.16 rubles, which is 57.5% lower than the April maximum. However, such a strong ruble is not profitable not only for exporters and the Russian budget, but also for import-substituting companies, which are afraid of losing market share due to the appearance of cheap goods from foreign countries3. According to Vice-Premier A. Belousov, the optimal dollar exchange rate is in the range of 70–80 rubles4.

The purpose of the article is to determine the prospects and directions of development of large corporations in the metallurgical and coal industries of Russia in the current context of global challenges. Accordingly, it is necessary to solve the following tasks:

-

1) to analyze the dynamics of financial results of large companies, to evaluate production efficiency, commercial, managerial and tax burden;

-

2) to determine the contribution of companies in the formation of revenues of the budget system through tax deductions (profit tax, VAT, personal income tax and property tax);

-

3) to identify key problems of effective combination of private and public interests;

-

4) to analyze the current situation in the metallurgical and coal industries in the new conditions of restrictions and market conditions;

-

5) to determine the prospects for the development of major companies in the face of sanctions and restrictions.

Large private corporations PJSC Severstal (ferrous metallurgy, Vologda Oblast), PJSC Nornickel (nonferrous metallurgy, Krasnoyarsk Krai) and JSC CC Kuzbassrazrezugol (coal industry, Kemerovo Oblast) constitute the object of the study.

Список литературы Comparative analysis of trends in the development of finance of large corporations in the metallurgical and coal industries in Russia in the context of global challenges

- Allen S.H. (2022). The uncertain impact of sanctions on Russia. Nat Hum Behav, 6, 761–762. Available at: https://doi.org/10.1038/s41562-022-01378-8

- Bazhenov D.V. (2022). Impact of sanctions on dividends of Russian steel companies. Innovatsii i investitsii=Innovations and Investments, 7, 150–154 (in Russian).

- Beauregard P. (2022). International emotional resonance: Explaining transatlantic economic sanctions against Russia. Cooperation and Conflict, 57(1), 25–42. Available at: https://doi.org/10.1177/00108367211027609

- Budanov I.A. (2021). Working out social guidelines for the industry development of metallurgy. Ekonomicheskie i sotsial’nye peremeny: fakty, tendentsii, prognoz=Economic and Social Changes: Facts, Trends, Forecast, 14(5), 85–99. DOI: 10.15838/esc.2021.5.77.5 (in Russian).

- Degtyarev P.A. (2022). Sustainable development trends of domestic companies in the metallurgical industry. JER, 1, 88–99 (in Russian).

- Ilyin V.A., Pechenskaya-Polishchuk M.A., Malyshev M.K. (2021). Gosudarstvo i krupnye korporatsii chernoi metallurgii: tendentsii i osobennosti 20-letnego vzaimodeistviya: monografiya [Government and Large Corporations in Ferrous Metallurgy: Trends and Peculiarities of 20-Year Interaction: A Monograph]. Vologda: VolRC RAS.

- Ilyin V.A., Povarova A.I. (2019). Krupneishie metallurgicheskie korporatsii i ikh rol’ v formirovanii byudzhetnykh dokhodov: monografiya [Largest Metallurgical Corporations and Their Role in The Formation of Budget Revenues: A Monograph]. Vologda: VolRC RAS.

- Ivanter V.V., Klepach A.N., Kuvalin D.B., Shirov A.A., Yankov K.V. (2018). The priority action program for social and economic recovery of Kuzbass region. EKO=ECO, 11(533), 31–46 (in Russian).

- Khokhrina O.I. (2020). Kuzbass-2035: The territory as a driver of economic growth. Mir ekonomiki i upravleniya=World of Economics and Management, 4, 61–77 (in Russian).

- Kostyukhin Yu.Yu. (2022). Strategic management of Russian metallurgy in the context of challenges and risks. Upravlencheskie nauki=Management Sciences, 2, 21–32 (in Russian).

- Latipov O., Lau C., Mahlstein K. et al. (2022). The economic effects of potential EU tariff sanctions on Russia – a sectoral approach. Intereconomics 57, 294–305. Available at: https://doi.org/10.1007/s10272-022-1074-1

- Li Z., Li T. (2022). Economic sanctions and regional differences: Evidence from sanctions on Russia. Sustainability, 14(10), 6112.

- Mahlstein K. et al. (2022). Estimating the economic effects of sanctions on Russia: An allied trade embargo. The World Economy.

- Malyshev M.K. (2021). Consequences of the introduction of the consolidated tax-payers groups in the ferrous metallurgy. Ekonomicheskaya bezopasnost’=Economic Security, 4(1). DOI: 10.18334/ecsec.4.1.111172 (in Russian).

- Pechenskaya-Polishchuk M.A., Malyshev M.K. (2021b). Metallurgical corporations and the state: Trends in financial interaction of the last decade. Ekonomicheskie i sotsial’nye peremeny: fakty, tendentsii, prognoz=Economic and Social Changes: Facts, Trends, Forecast, 14(3), 150–166. DOI: 10.15838/esc.2021.3.75.9 (in Russian).

- Pechenskaya-Polishchuk M.A., Malyshev M.K. (2021а). Key factors affecting the corporate tax levied from Russian ferrous metallurgy corporations to regional budgets. Regionologiya=Regionology, 1(114), 10–36 (in Russian).

- Pechenskaya-Polishchuk M.A., Malyshev M.K. (2022). Financial and economic aspects of export-import activity of Russia’s nonferrous metallurgy for 2013–2020 and its further development trends. Ekonomicheskie i sotsial’nye peremeny: fakty, tendentsii, prognoz=Economic and Social Changes: Facts, Trends, Forecast, 15(4), 102–117. DOI: 10.15838/esc.2022.4.82.7 (in Russian).

- Romanova O.A., Sirotin D.V. (2022). Strategic vector for the development of Russian metallurgy in the new reality. Izvestiya UGGU=News of the Ural State Mining University, 3(67), 133–145 (in Russian).

- Sal’nikova E.B., Grineva M.N. (2022). Coal industry in Russia in the conditions of orientation to a carbon-neutral economy. Universum: ekonomika i yurisprudentsiya, 1(88), 16–19 (in Russian).

- Siegel D. (2022). From oligarchs to oligarchy: The failure of U.S. sanctions on Russia and its implications for theories of informal politics. World Affairs, 185(2), 249–284.

- Vasil’eva N.V. (2020). The Russian coal industry is the engine of the country’s economic development. Obrazovanie i pravo=Education and Law, 5, 99–104 (in Russian).