Corporate governance mechanism and financial statement fraud: the compliance to MCCG 2017 during COVID-19 pandemic

Автор: Nagasundari A/P Selvaraj, Vikneswaran S.O Manual, Dr. Dhamayanthi Arumugam

Журнал: Science, Education and Innovations in the Context of Modern Problems @imcra

Статья в выпуске: 4 vol.5, 2022 года.

Бесплатный доступ

Business governance is definitely a worrying issue within the worldwide level, since the incidences associated with business problems plus insolvencies are usually up surging quickly, particularly in the building nations such as Malaysia. Even though rules in addition to rules are usually created in order to motivate clear monetary confirming amongst businesses, the particular effectiveness from the execution is nevertheless something, given that the particular opportunistic behavior regarding professionals plus administration continues to be within the increase. With regards to the particular scams triangular design, the problem in the Covid-19 outbreak offers an additional chance for companies to do deceptive confirming in order to hide their own company deficits, therefore showing up a lot more lucrative with regard to traders. Consequently, the purpose of this particular research would be to evaluate the result associated with inner company governance system around the event of economic declaration scam throughout Covid-19 outbreak. The particular factors involving corporate and business governance are usually from the particular Malaysian Program code upon Business Governance 2017. Typically the supplementary information was extracted from the particular 2020 Yearly Reviews associated with 265 businesses which are on the Primary Marketplace regarding Bursa Malaysia. The program associated with SPSS has been utilized to carry out information evaluation with this examine. The outcomes uncover that this factors involving table self-reliance, panel sex plus review panel self-reliance possess an unfavorable organization along with economic declaration fraudulence. On the other hand, the particular factors associated with table age group, plank racial and even examine panel experience had been discovered to indicate an optimistic partnership together with deceitful confirming. Apart from, the outcomes furthermore highlighted that will panel period failed to possess any kind of partnership along with economical declaration scams that was contrary to a lot of literatures previously. In addition, underneath the evaluation associated with mediating parameters, review panel dimension has been discovered to possess a mediating impact on typically the organization among taxation panel self-reliance together with monetary assertion scams. Nevertheless, the particular adjustable associated with aboard sizing had not been capable to mediate the connection in between mother board period plus fiscal declaration scam. Lastly, within the facet of assessment among possible in addition to non-potential bogus companies, it had been identified of which each forms of businesses experienced various conformity towards the business governance factors. Therefore, in line with the results, this specific analyze has furnished a few suggestions plus recommendations for long term research to improve typically the books this place.

Company governance, economic affirmation fraudulence, Malaysia, MCCG 2017, mediators, complying, table self-reliance, panel payoff time, plank sexual category, plank age group, aboard racial, review panel freedom, review panel knowledge, table dimensions, exam panel measurement, prospective deceptive organizations, non-potential deceptive companies

Короткий адрес: https://sciup.org/16010215

IDR: 16010215 | DOI: 10.56334/sei/5.4.3

Текст научной статьи Corporate governance mechanism and financial statement fraud: the compliance to MCCG 2017 during COVID-19 pandemic

1.1 Background of the Study

Business governance (CG) could be denoted like a specialized system associated with checking plus danger evaluation of the company. The top functionality regarding CG would be to figure out plus keep track of the particular functional framework of the company, via conformity in the direction of rules specified to make sure efficiency effectiveness (Schäuble, 2019; Iqbal, Nawaz in addition to Ehsan, 2019). The particular governance framework within Malaysian companies is presented round the Malaysian Program code upon Business Governance (MCCG) 2017. Typically the MCCG 2017 provides assistance with regard to Malaysian businesses to excercise their own business tradition, along with focus on typically the openness of economic confirming (Security Commission rates Malaysia, 2017). This particular program code, comprising thirty-five methods was developed and even produced by Investments Commission rate (SC) Malaysia. The main obligation involving SOUTH CAROLINA would be to safeguard the eye associated with traders simply by keeping an effective monetary marketplace by means of safe plus clear economic confirming (Securities Percentage Malaysia, 2019).

Company governance could be additional categorized in to external and internal governance systems (Schäuble, 2019). Inner governance framework is generally related to within table associated with company directors, auditors together with inner constructions inside carrying out their own functions efficiently to improve company worth (AlQadasi plus Abidin, 2017). Exterior governance much more relevant towards the outdoors aspects associated with authorities’ treatment plus impartial body via legal guidelines to create the particular governance platform from the organization (Schäuble, 2019). Nevertheless, this particular research is going to be concentrating on both main matters associated with inner company governance buildings, that are table regarding company directors plus review panel (Amer, 2016).

Corporate and business problems are within the increase because of the issues plus problems throughout giving the particular restrictions plus guidelines. Based on Malaysian Division involving Bankruptcy, typically the record statement associated with Liquidation Figure Study since Dec 2019 mentioned that this count regarding instances involving organization turning upward, composed of each pushed in addition to non-reflex for that time period among 2015 in order to Dec 2019 will be 84, 805 (Malaysian Division associated with Bankruptcy, 2019). Business disappointments impact the sustenance regarding stakeholders along with the general economic climate from the nation generally (Yap, Munuswamy plus Mohamed, 2012). Appropriately, The particular Straits Occasions (2020) documented that will more than thirty, 500 companies experienced shut straight down right at the end associated with 2020 because of reduced company success, as a result of the particular manage methods enforced from the authorities to be able to suppress the particular distribute involving Covid-19 computer virus. Company disappointments are the primary motorists of economic declaration scams, because businesses often change their particular generating information because of the danger associated with bankruptcies (Aris ainsi que ing., 2015; Omar, Johari and even Hasnan, 2017). Consequently, typically the persuasive times during the downturn in the economy can pressure organizations to do innovative data processing together with intense income to outlive in the industry marketplace plus attract a lot more expense for their company. Typically the 2020 Worldwide Financial Criminal offense plus Scams Review shows that will economical declaration scams may be the 5th greatest kind of scams dedicated inside the 12 months regarding 2020, increasing through twenty percent within 2018 to some present report involving almost thirty percent (PwC, 2020). Monetary declaration scams may be considered like a planned take action associated with deliberately misstating or even omitting numbers from your fiscal claims, which is dispersed towards the stakeholders, in order to trick you. A strong which is related to monetary assertion scams will certainly develop quarrels concerning the dependability around the economic statement, since the high quality associated with confirming might be impacted. This particular scam considerably impacts companies, developing an unfavourable effect on the particular company’s brand name in addition to status, information, values associated with workers, partnership along with government bodies as well as the associated with business stocks (Kamal, Saleh and even Ahmad, 2016). Consequently, the organization governance set ups applied within businesses are necessary to manage together with impose efficient methods to avoid economical affirmation scams plus imaginative sales (Costa, 2017; Iqbal, Nawaz in addition to Ehsan, 2019; Li, 2018).

1.2 Problem Statement

Sendiri, Lambrinoudakis plus Alhadab (2020) pointed out that this take action associated with monetary information adjustment (creative accounting) within the worldwide viewpoint will be increasing amongst businesses within the focused marketplaces. This really is furthermore backed simply by Al-Dulemi in addition to Al-Shabatat (2018), Mirza, Malek and even Abdul-Hamid (2019) together with Akpanuko plus Umoren (2017), by which these people claim that will innovative data processing will be dealing with the particular limelight between building plus big companies, in order to overstate income plus property, plus understate deficits in addition to financial obligations to provide the company in order to outsiders inside a good way. This particular take action gets a lot more notable in recent years, because of the success scenario regarding companies throughout the difficult Covid-19 break out. Discovering in to imaginative data processing, it could be viewed as typically the lawful procedure for making use of manager’s view and even understanding within documenting economic claims (Remenaric, Mijoc together with Kenfelia, 2018). Nevertheless, supervisors often utilize them for their benefit simply by determining weaknesses inside sales rules in order to hide deficits and also to change the particular data to be able to appeal to traders having a “more attractive” company (Remenaric, Mijoc plus Kenfelia, 2018).

Apart from, business in addition to construction scams is one of the data processing malpractices which are happening thoroughly inside the worldwide framework (Ramirez-Orellana, Martinez-Romero and even Marino-Garrido, 2017). Also this is additional maintained Azwin, Ali together with Ahmed (2019), Salleh plus Othman (2016), Yg, Jiao plus Buckland (2017) in addition to Mirza, Malek and even Abdul-Hamid (2019). Appropriately, there exists likelihood for that worth in order to increase additional within the 12 months involving 2020, because there exists an increased inspiration with regard to companies in order to carry out monetary declaration scams throughout eager outbreak occasions.

In addition, business problems plus collapses amongst big companies have grown to be a subject appealing between earlier literatures (Driel, 2019; Obert ainsi que ing., 2014; Lin plus Mabe, 2018; Abid together with Ahmed, 2014; Hassan plus Ahmed, 2012). From your situation associated with Enron in america, Olympus within The Japanese, GlaxoSmithKline (GSK) within The far east in addition to Air flow Mvuma, zimbabwe, company collapses happen to be distributing internationally, generating significant penalties and even jail phrases (Abid together with Ahmed, 2014; Obert ainsi que ing., 2014). ACCA (2018) also have outlined the particular fall associated with Carillion like a substantial session to avoid the particular event regarding huge intense human resources. Likewise, inside the Malaysian framework, corporate and business collapses will also be within the increase, observing instances like Sime Darby, Malaysia Air carriers plus Transmile (Sulaiman in addition to Ahmad, 2017; Yap, Munuswamy plus Mohamed, this year; Abdullah and even Ku Ismail, 2016). Consequently, throughout the Covid-19 circumstance within the 12 months involving 2020, numerous organizations had been having difficulties together with dealing with loss, because customer investing decreased greatly, especially in sectors like modern aviation, lodging, amusement, schooling, plus financial. Alareeni (2017) possess described that will businesses are usually extremely involved with economic declaration scams once the possibility with regard to business failing will be higher. Previous research true of which monetary marketplace stress throughout the initial phases associated with company disappointments inspires the particular exercise regarding income administration to enhance the particular self-confidence involving marketplace gamers. Salin, Zakaria in addition to Nawawi (2018) possess outlined that will efficient inner manage, by way of solid business governance provides a device regarding reduce business downfalls, excuse likelihood of economical assertion scams.

Therefore, the objective of these particular studies to be able to evaluate the effect associated with interior company governance system, sticking with MCCG 2017 inside affecting fiscal affirmation scams through the Covid-19 outbreak. This specific research is going to be carried out inside the Malaysian circumstance, simply by examining general public firms which are on the Primary Marketplace associated with Bursa Malaysia.

1.3 Research Objective

This particular research will be carried out having a try to be familiar with aspects of inner business governance system plus monetary declaration scams. Therefore, these types of goals were developed particularly in order to satisfy the objective of this particular research.

RO 1: To recognize the particular determinants associated with inner CG systems within affecting monetary declaration scams.

RO 2: To check into the particular mediating part associated with table dimension plus review panel dimension aboard period in addition to examine panel self-reliance towards effect on monetary declaration scams.

RO 3: In order to evaluate right after among inner CG systems upon possible plus non-potential deceptive outlined businesses.

2.0 LITERATURE REVIEW

2.1 Theoretical ReviewAgency Theory

Company concept is certainly the essential design which is used thoroughly in several literatures. Becoming originated from 70, company concept is all about the particular splitting up associated with possession plus manages within a company or even more typically referred to as the particular principal-agent design (Jensen in addition to Meckling, 1976; Juicio plus Jensen, 1983). With this feeling, typically the real estate agent, that is the particular administration is involved with managing and even controlling the company. However, the main, becoming typically the investors would be the proprietors from the company (Bzeouich, Lakhal plus Dammak, 2019). Since the investors are certainly not straight associated with operating the business enterprise, the particular supervisors may have access in order to info that will investors usually do not. This case is known as details asymmetry (Amer, 2016). Whenever this particular happens, administrators might have the particular inspiration to create choices of which advantages on their own within the cost from the investors. This really is referred to as company expenses (Diri, Lambrinoudakis together with Alhadab, 2020). Consequently, to lessen organization issues, investors might invest in checking charges to avoid brokers through performing actions that could reduce the particular well being in the investors. Table regarding company directors plus review panel will be strong systems within managing those activities with the brokers (Zwet in addition to Kroos, 2015). Therefore, efficient business governance is situated underneath the checking device founded from the investors to deal with typically the firm issue.

Stewardship Theory

This particular concept shows the contradicting ideology associated with Company Concept by which supervisors take action within the welfare associated with investors and they are worried about the particular wellbeing from the proprietors (Donaldson, 1990; Donaldson plus Davis, 1991). This particular concept disagrees that will supervisors are self-centred in order to advantage on their own whilst keeping expenses with regard to investors (Amer, 2016). Additionally, it presumes that this steward (managers plus directors) claims upon improving typically the overall performance from the company, along with an excellent focus is positioned on the particular extensive objectives in the company (Donaldson, 1990; Donaldson in addition to Davis, 1991). Apart from, stewardship concept is furthermore unique through company principle the kind of incentive which is anticipated from the supervisors. Inbuilt prize like self-satisfaction along with a feeling associated with satisfaction may be the traveling element that will desire typically the company directors to create higher success for that organization (Subramaniam, 2018). Because of the higher accordance regarding purpose among company directors plus investors, college students think that investors ought to slow up the regulates which are set up in order to administration. As a result, the expenses paid for from the primary may also be reduced. Furthermore, stewardship concept likewise offers that the lengthier period associated with directorship will certainly develop a higher devotion associated with owners towards company (Donaldson, 1990; Donaldson and even Davis, 1991).

Stakeholder Theory

Stakeholder concept shows the particular assistance of numerous stakeholders within traveling firm’s overall performance, interesting the particular company from the viewpoint associated with extensive partnership (Binh plus Anh, 2017). The main reason for this is the idea that will, the particular passions regarding companies as well as the community are usually connected, therefore, companies need to satisfy their own obligations inside helping the broader selection of team, besides the primary number of investors. The particular extended array of events are usually relating to the interpersonal, environment in addition to honest elements. Typically the stakeholders consist of workers, clients, providers, investors, government companies, non-for-profit organizations as well as the local community. Appropriately, it really is a good growth towards the fundamental company concept throughout putting an emphasis on the particular part performed simply by numerous events within attaining firm’s objectives. The essential theory which can be related to stakeholder concept is the idea of oneness (Amer, 2016). Correspondingly, every stakeholder that affects main making decisions and the ones that are important artists with regard to company’s development use in the bureaucratic obligations within making sure company governance will be nicely organized. The particular proficiency from the table and even review panel could be increased having a varied structure.

Fraud Triangle Theory

This particular concept has been initiated simply by Jesse Cressey, who had been a north american sociologist, that wanted to find out the reason why plus explanation of people within carrying out scams (Yusof, 2016; Awolowo, 2019). This individual found that 3 basic aspects of stress, chance in addition to justification are necessary for workers and even administration to do dishonest behaviours within a business (Yusof, 2016). Idea could be used broadly in most scam instances like Enron, Vw, Toshiba, Insane Eddie plus Bernie Madoff. In addition , Cressey experienced furthermore mentioned that will, getting just a solitary component of the particular fraudulence triangular will be inadequate within encouraging perpetrators to execute scams, while all of the 3 elements have to be there, even though level of impact one of the 3 factors could differ. The particular component of stress demonstrates the strain of which causes a person to behave past their own will certainly to become ethically incorrect. The particular element that triggers the strain could be each monetary together with nonfinancial. Apart from, the 2nd component of chance shows typically the good conditions that will stimulates someone in order to make plus hide a specific scam (Abdullah plus Mansor, 2015). Generally, it really is known the particular some weakness from the organs and circulatory system of which workers plus supervision make the most of, to help ease their own underhanded functions. Furthermore, the 3rd facet of justification entails the particular reason in addition to thinking given by the particular criminals inside protecting their own functions (Awolowo, 2019). This is often regarded as the mindset or even presumptions offered to use morally suitable great participate in the unethical take action.

Fraud Diamond Theory

Scams Gemstone Concept is definitely an expansion towards the scams triangular concept that was suggested simply by Wolfe plus Hermanson. This particular principle improves the present books associated with fraud-risk element design, simply by such as the component of ability as the 4th determinant regarding management’s inspiration within performing scams (Abdullah in addition to Mansor, 2015; Awolowo, 2019). Fairly, it really is considered that will however, littlest degree of scams can simply become carried out in case a person offers the best abilities in order to each make and even hide the particular scam. However may be a chance, offering the best conditions with regard to criminals, along with stress together with justification, supplying the with regard to criminals, in case people don’t have the ability to identify plus cash in around the chance, deceptive functions will never be executed. Wolfe plus Hermanson possess recognized 6 essential characteristics underneath the component of capacity, which usually describes the requirement involving including this particular element in to the current type (Yusof, 2016). The particular characteristics consist of energy, capability, self-confidence plus pride, intimidation, deceptiveness in addition to stress-handling. Each one of these characteristics have to end up being outfitted simply by someone to supply your pet typically the potentiality to do dishonest behaviors.

2.2 Empirical ReviewRelationship Between Board Independence and Financial Statement Fraud

Table associated with company directors’ glenohumeral joint the important obligation associated with checking the particular administration actions plus granting main choices from the organization. As stated within company concept, impartial company directors could be more efficient within supervisory administration routines to lessen opportunistic bureaucratic behavior (Bzeouich, Lakhal in addition to Dammak, 2019). This particular concept is backed simply by Bhatt (2017), Chancharat, Krishnamurti and even Tian (2012) together with Knyazeva plus Masulis (2013) that will displays an optimistic partnership among table self-reliance in addition to company overall performance. This specific indicates of which, whenever company overall performance will be improved, a larger concentrate on top quality monetary confirming is going to be existing and even company directors will certainly are certainly more careful inside discovering deceptive confirming. (Bhatt, 2017, Bzeouich, Lakhal plus Dammak, 2019 plus Busirin, Azmi plus Zakaria, 2015). Appropriately, study carried out simply by earlier literatures point out there is an adverse partnership in between table selfreliance together with economic declaration scams (Ibadin plus Ehigie, 2019; Razali plus Arshad, 2014; Anichebe, Agbomah plus Agbagbar, 2019; Nasir, Ali in addition to Ahemed, 2018). On the other hand, searching from your viewpoint associated with stewardship principle, additionally, there are options with regard to within owners to do much better, because they be familiar with company techniques and even path obviously when compared to outdoors administrators. Their own inner inspiration to enhance company’s placement on the market, to attain extensive objectives associated with business, and also to motivate the clear monetary credit reporting might allow the interior film fans to become a lot more aware plus responsible towards the info offered in order to stakeholders. Therefore, which means that inner movie fans can avoid the event regarding income adjustment together with economic declaration scam much better than exterior company directors? This too results in a much better company efficiency (Shan, 2017; Christensen, Kent plus Stewart, 2010). Classes higher research that will assistance typically the perspective involving organization concept, this particular analysis offers that will:

H1: There exists an unfavourable connection among Table Self-reliance (BI) plus Monetary Declaration Scams (FSF).

Relationship between Board Tenure and Financial Statement Fraud

Table period could be construed since the period of time the table movie director acts within a business. Several literatures assistance that will panel payoff time considerably impacts the particular overall performance from the company directors as well as the organization, influencing the particular exercise associated with income administration as well as the inclination of getting irregular earnings (Dikolli, Mayew plus Nanda, 2014; Livnat ainsi que ing., 2020). Research shown that the lifelong 6 many years is needed with regard to plank users in order to evaluate and also to obtain acquainted with typically the procedures plus companies carried out inside a company (Reguera-Alvarado in addition to Embravecido, 2017). Long-tenured aboard users will certainly type a feeling of possession towards company, and the activities is going to be more unlikely to become wondered simply by some other mother board people plus investors. Consequently, they may be more prone to become related to income adjustment plus scams (Koevoets, Maso and even Wal, 2017; Hu, Hao, Lu together with Yao, 2014; Setyawan plus Anggraita, 2018). This really is according to the particular scam triangular concept, through which the particular period offers an chance for owners to create a pleasant partnership using the supervisors, accountancy firm, in addition to workers, leading to these to become much less rigid within their checking obligations (Ahmadi, Nakaa and even Bouri, 2018; Koevoets, Maso together with Wal, 2017). On the other hand, table users having a brief period might not be capable to display their own complete possible within interesting using the company, creating these to end up being at fault within discovering possible misstatements economic reviews (Reguera-Alvarado plus Salvaje, 2017). Underneath the fraudulence triangular principle, brief tenured panel associates can also be within the stress to exhibit good revenue in order to investors, to produce believe in in addition to show their own abilities inside helping the business, growing likelihood of deceptive confirming. Apart from, previous correctly furthermore documented the Oughout form connection associated with plank payoff time along with monetary declaration scams (Hu ou ing., 2014, Koevoets, Maso and even Wal, 2017). Appropriately, inside the initial phases, administrators will be hesitant to control profits, yet because they obtain a lot more encounter, are going to antique in order to carry out innovative data processing. Nevertheless, following a substantial lengthy period, they are traditional within their cash flow credit reporting once again. Therefore, in line with the conversation through numerous viewpoints over, this particular research offers that will:

H2: There exists a good partnership among Table period (BT) together with Monetary Declaration Scams (FSF).

Relationship between Board Gender and Financial Statement Fraud

Sex variety within labor force is a significant problem which is becoming talked about thoroughly within the worldwide framework. A lot more experts have an interest to analyze the particular effect associated with sex variety upon business overall performance, like a higher quantity of ladies are actually within the table regarding company directors plus top-level administration (Ahmadi, Nakaa plus Bouri, 2018; Katmon ainsi que ing., 2019). Additionally they offer the expert to create basic choices for any company. According to typically the stakeholder concept, the particular panel associated with company directors are usually strongly suggested to become varied to create choices that could appeal to the requirements of most stakeholders. Fairly, improved sex range might include worth towards the company because trades associated with suggestions may possibly happen efficiently in addition to ladies are a lot more careful plus observant inside confirming actions (Ibadin plus Ehigie, 2019; Ahmadi, Nakaa and even Bouri, 2018; Katmon ainsi que 's., 2019). The danger hunger among women and men might also differ, which might impact the selections which are created by each sexes (Wei together with Xie, 2016). Woman company directors are even more risk-averse in comparison to man company directors when creating essential judgements relating monetary confirming. When you compare the result involving sex selection about innovative data processing, several experts believe ladies are usually more unlikely to get involved with economic declaration scams plus income adjustment (Kamarudin, Ismail plus Kamaruzzaman, 2018; Reguera-Alvarado in addition to Embravecido, 2017; Lakhal and even Aguir, 2015; Ing Azeez ou approach., 2019; Selahudin ain ing. 2018). This should also become mentioned that will research carried out simply by Hili together with Affes (2012), Rawal et. al (2021), Poongodi M et. al(2022), Poongodi M et. al (2021), Dhiman P et.al (2022), Sahoo S.K et.al (2022), K.A et. al(2022) , Dhanraj R.K et. al (2020), Yan Zhang et.al (2020), Md Hossain et. al (2021), Md Nazirul Islam Sarker et. al (2021) ,Y. Shi et. al (2020), Guobin Chen et. al (2020) plus Abdullah in addition to Ismail (2016) suggest that sexual category variety does not have any substantial effect on revenue administration plus economical overall performance associated with companies. Nevertheless, becoming encouraging from the main results with this element, this particular study offers that will:

H3: There exists an unfavorable partnership among Table sexuality (BG) and even Monetary Declaration Scams (FSF).

Relationship Between Board Age and Financial Statement Fraud

Earlier literatures discovered a few accordance between element associated with table age group variety plus company concept (Ibrahim plus Hanefah, 2016; Shehata, Salhin, in addition to El-Helaly, 2017; Eulerich, Velte and even Uum, 2014). Once the requirement for checking occurs below company principle, the table along with varied age ranges might affect the particular cooperation among users in order to agree with a specific choice (Ibrahim plus Hanefah, 2016; Xu, Zhang together with Chen, 2018). Good organization in between age group variety and company overall performance furthermore interconnects towards the efficient capability associated with checking overall performance in order to reduce monetary declaration scams (Xu, Zhang plus Chen, 2018; Almashaqbeh, Shaari plus Abdul-Jabbar, 2019). More youthful panel users could be more centered on the particular extensive objectives, whilst wanting to set up on their own within the company. Therefore, because of the couple of self-reputation in addition to unsuspecting behavior, the possibilities of carrying out income adjustment is leaner with regard to more youthful company directors (Zwet and even Kroos, 2015; Girau ainsi que ing., 2019). Contrarily, whenever plank users are usually approaching age pension, they have a tendency to become a lot more easygoing whenever making sure that you comply together with guidelines. This really is known as myopic conduct (Dechow together with Sloan, 1991; Dechow, Sloan plus Sweeny, 1996). At this point, typically the panel regarding owners often concentrate on temporary objectives since the issue associated with status is just not associated with this kind of issue. This really is obvious via a study carried out upon nineteen companies who have been outlined about PSI-20 stock exchange catalog for those 12 months 2006 to be able to this year (Isidro in addition to Goncalves, 2011). The research figured there exists a good partnership involving CEO’s age group and even income administration. Therefore, this particular research plays a role in the particular books simply by suggesting that will:

H4: There exists a good partnership among Table era (BA) plus Monetary Declaration Scams (FSF).

Relationship Between Board Ethnicity and Financial Statement Fraud

The particular variety within cultural organizations amongst table users is important within offering competing benefit in order to companies (Fitzsimmons, 2013). Aiming along with company concept, the particular cultural range amongst table users will certainly improve the particular self-reliance from the panel, to help offer an efficient checking system. The particular unique ideology, mindset, values plus social history in the varied cultural groupings offer possibilities associated with healthful arguments with regard to high quality making decisions (Aggarwal, Jindal plus Seth, 2019; Gul, Munir in addition to Zhang, 2016). Typically the table may also be capable to be familiar with understanding around the methods and even best practice rules various ethnicities to improve the particular approval regarding choices simply by community. This really is good stakeholder concept. Table along with higher quantity of cultural organizations could be associated with much better checking, which may be related to reduce inspiration to do deceptive confirming plus income adjustment (Nasir, Ali together with Ahmed, 2018; Almashaqbeh, Shaari plus Abdul-Jabbar, 2019; Aggarwal, Jindal plus Seth, 2019). Nevertheless, it should furthermore become mentioned that will experts also available of which cultural variety is really a barrier for that company directors to attain general opinion upon issues questioned (Zwet plus Kroos, 2015). Particular discussed ethnic values involving group racial like individuality, selfsufficiency in addition to self-reliance might impact typically the choices and even activities from the plank to become rationalizing their own deceitful functions. Consequently, with this feeling, aboard selection induce the probability of bogus confirming, because company overall performance has a tendency to weaken below independent mother board associated with owners (Kamarudin, Ismail together with Kamaruzzaman, 2018; Gul, Munir plus Zhang, 2016; Talavera, Yin plus Zhang, 2018). Nonetheless, this particular present research desires the particular cultural variety inside table users to push supervising procedures, to lessen the possibilities of monetary declaration scams. Therefore, it could be hypothesised that will:

H5: There exists an unfavorable partnership among Table racial (BE) plus Monetary Declaration Scams (FSF).

Relationship Between Audit Committee Independence and Financial Statement Fraud

The particular component of self-reliance is important within a review panel to avoid biasness through impacting on their own checking responsibility. A completely independent review panel much more mindful plus aware within discovering mistakes plus scams economic claims (Toh, 2013; Estén ainsi que ing., 2016; Arslan, Zaman plus Malik, 2014; Yunos, Ahmad in addition to Sulaiman, 2014). Are going to capable to problem the particular management’s quotations and even conclusions freely, because they are usually more unlikely to get connections using the business. This really is like idea of company concept. They are going to become a lot more inspired when compared to non-independent company directors within finding deceptive actions, in order to support their own status together with popularity. Which means that the possibilities of income adjustment could be decreased in case even more impartial users can be found within the review panel (Kituku plus Ahmad, 2016; Razali in addition to Arshad, 2014; Salleh, 2014; Arslan, Zaman plus Malik, 2014). Nevertheless , highlighting from your viewpoint associated with stewardship concept, non-independent examine panel people might have a larger feeling regarding belongingness towards the corporation, which usually boosts the taxation high quality and even decreases the options involving innovative data processing. Similarly, several correctly also available that will self-employed exam panel users don’t have adequate details about typically the company, which in turn causes these to become unaware for the some weakness associated with inner regulates plus raises likelihood of not really uncovering deceitful confirming (Ahmad-Zaluki together with Wan-Hussin, 2010). However, earlier literatures furthermore believe simply no substantial partnership is discovered among review panel self-reliance plus income administration (Ibadin plus Ehigie, 2019; Oussii in addition to Taktak, 2017; Yew, 2013). In line with the numerous inconsistant outcomes over, this particular research offers that will:

H6: There exists an unfavourable partnership in between Review Panel Self-reliance (ACI) and even Monetary Declaration Scams (FSF).

Relationship between Audit Committee Expertise and Financial Statement Fraud

The help of review panel dominates within their capability to determine the particular dangerous places within the monetary claims and the ability within connecting a number of balances to check on with regard to accordance or even uncommon designs (Haji, 2015). Qualified examine panel can create high quality conclusions relating inner regulates and will also be capable to offer helpful information to talk about along with administration (Oussii plus Taktak, 2017). Therefore, numerous research assistance the requirement of economic literacy amongst taxation panel users to enhance checking functions in order to reduce the options associated with monetary declaration scams (Badolato, Donelson in addition to Ege, 2014; Cohen, Krishnamoorthy and even Wright, 2014; Toh, 2013). Nevertheless, scientific studies carried out simply by Al-Absy, Ismail plus Chandren (2019) plus Mansor ainsi que ing., (2013) discovered there is simply no substantial partnership among exam panel experience together with income administration. Feasible description for this outcome might be because of the demands associated with review panel users together with economic experience, who does need to spend lower effort and time within checking plus critiquing typically the economical claims regarding companies, in comparison to examine panel without fiscal knowledge (Jaafar ou ing., 2016). On the other hand, Prophet ainsi que 's., (2019), Mohammad, Wasiuzzaman in addition to Salleh (2016) and even Mohamad, Rashid together with Shawtari (2012) indicated that will taxation panel people with good degree associated with proficiency are usually related to income supervision methods. This really is good scams gemstone concept. Because exam panel associates using monetary knowledge plus encounter are capable to do in addition to hide scam, the probabilities in order to make deceptive confirming are higher. The particular contradicting outcomes presents troubles to be able to obviously make the connection between proficiency associated with review panel users and even economic declaration fraudulence. Consequently , this particular research will be suggesting that will:

H7: There exists an unfavorable partnership among Review panel experience (AE) together with economic assertion scams (FSF).

Mediating Role of Board Size on the Relationship between Board Tenure and Financial Statement Fraud

In relation to company concept, experts believe big planks makes an increased tendency associated with conversation issues plus issues, which usually helps prevent all of them through matching good tactical choices (Girau ainsi que ing., 2019; Kumar in addition to Singh, 2013). Consequently, this particular boosts the likelihood of deceptive confirming because workers might take a chance to get a new monetary information regarding scams triangular concept. In addition, whenever this really is combined with facet of table period, that is recognized to raise the particular self-confidence regarding company directors within carrying out innovative data processing, because they obtain as well acquainted and even confident with the interior manage methods, it might dual the result of economic declaration scam (Dikolli, Mayew together with Nanda, 2014; Livnat ainsi que ing., 2020). Consequently , earlier literatures demonstrated that will little planks tend to be more effective within carrying out checking plus managing actions, which usually decreases the probability of economic declaration fraudulence in addition to income adjustment (Girau ou 's., 2019; Afzal and even Habib, 2018; Anichebe, Agbomah plus Agbagbara, 2019). Rodriguez-Fernandez, Fernandez-Alonso together with Rodriguez-Rodriguez (2014) plus Razali in addition to Arshad (2014), also available away there is simply no substantial organization among table dimension as well as the overall performance from the company. Therefore, it might not really offer an inference upon economical declaration scams. Nevertheless, prior books carried out simply by Saggar and even Singh (2017) together with Ing Azeez ou 's., (2019) shows that the bigger panel dimensions are a lot more accountable within revealing dangers within the fiscal claims. This gives a good reason behind confirming high quality to enhance, due to a larger degree of checking plus examination. In addition, also this is additional maintained typically the addition involving long-tenured associate within the plank associated with owners, which can be good for they within knowing concerning the risk management program from your skilled associate in order to set up much better supervising regulates, therefore decreasing monetary declaration scam (Livnat ain approach., 2019; Betty, Mauldin plus Patro, 2014, Huang, 2013). This particular shows the particular unfavorable organization in between aboard dimension in addition to income administration (Rajeevan and even Ajward, 2019; Ing Azeez tout autant que way., 2019; Bzeouich, Lakhal plus Dammak, 2019; Hasnan, Razali together with Hussain, 2020). Therefore, in line with the conversation through numerous viewpoints over, this particular research offers that will:

H8: The connection among Table Period (BT) plus Monetary Declaration Scams (FSF) will be mediated simply by Table Dimension (BS).

Mediating Role of Audit Committee Size on the Relationship between Audit Committee Independence and Financial Statement Fraud

Previous correctly arranged the dimensions of review panel in to 3 types of little, moderate plus big (Alkdai in addition to Hanefah, 2012). Earlier literatures existing combined evaluations concerning the effect associated with examine panel dimension upon income adjustment. Big planks are usually believed to discuss varied experience and even understanding concerning the part of auditing together with confirming, which might result in a much better checking capability to identify any kind of misstatements or even mistakes effectively (Kituku plus Ahmad, 2016; Almasarwah, 2015; Yew, 2013). In addition, whenever this particular element will be backed using the addition associated with impartial company directors, it might increase the probability of discovering deceptive credit reporting, like a qualified plus aware taxation panel is going to be created. Which means that huge exam panel users that are not really prejudiced towards company tend to be more effective within avoiding monetary declaration scams (Anichebe, Agbomah plus Agbagbar, 2019; Nasir, Ali in addition to Ahemed, 2018). Apart from, a number of correctly exposed there is simply no substantial partnership among review panel dimension and even monetary assertion scams (Selahudin ainsi que ing., 2018; Ibadin together with Elijah, 2015; Chandrasegaram ainsi que 's., 2013). However, several studies also have discovered that will big planks may cause associated with revenue administration to improve (Fuad, 2016; Almasarwah, 2015). This is often associated with the idea of ability within the scam gemstone concept. The particular self-employed review panel users might be taking advantage of the chance of getting a big educated table inside preparing plus performing ways of carry out deceitful revealing along with consideration (Ibadin plus Ehigie, 2019; Razali plus Arshad, 2014). Therefore, with regards to this particular research, this speculation is suggested:

H9: The connection in between Review Panel Self-reliance (ACI) in addition to Monetary Declaration Scams (FSF) will be mediated simply by Review Panel Dimension (ACS).

Difference in The Compliance of Internal Corporate Governance Characteristics Between Potential and Non-Potential Fraudulent Companies

Several previous literatures possess true dominance within examining the particular effect associated with inner business governance features upon current deceptive businesses, that have been currently classified because businesses below high-risk regarding personal bankruptcy or even firms which have recently been captured to do monetary declaration scams (Nasir, Ali plus Ahmed, 2018; Kamal, Salleh plus Ahmad, 2016; Pamungkas ainsi que ing., 2018; Marzuki ainsi que 's., 2019). Within the framework associated with Malaysia, outlined businesses happen to be categorized in to categories of PN17 plus GN3, which usually signifies monetarily troubled businesses which are detailed underneath the Primary Marketplace plus EXPERT Industry associated with Bursa Malaysia (Bursa Malaysia Berhad, 2021). These businesses possess increased likelihood of carrying out monetary assertion scams, to get believe in in addition to self-confidence using their traders. In line with the results involving research relating deceitful businesses, it could be noticed these businesses often show various degree of approval towards guidelines associated with business governance (Zin, Marzuki and even Hj. Abdulatiff, 2020; Nasir together with Hashim, 2020; Nasir, Ali plus Ahmed, 2018). Consequently , in line with the earlier books evaluations from the variations among bogus companies plus non-fraud companies within sticking with the particular concepts associated with business governance, fake companies generally have much less impartial review panel users, smaller sized table dimension, fewer examine panel users along with economic experience, less review conferences and also have much less variety regarding table people (Nasir, Ali in addition to Ahmed, 2018; Kamarudin, Ismail plus Kamaruzzaman, 2018; Ibadin and even Ehigie, 2019; Zin, Marzuki plus Hj. Abdulatiff, 2020). Likewise, non-fraud companies are furthermore shown to have got much better faithfulness towards the company governance concepts, when it comes to getting a lot more impartial company directors, a lot more taxation panel people together with economic experience, higher cultural variety and bigger panel dimension. In addition, the particular correctly likewise demonstrated that will non-fraudulent businesses have got significantly less involvement of girls owners, plus falsified companies convey more ladies administrators within the panel (Kamarudin, Ismail together with Kamaruzzaman, 2018; Ibadin plus Ehigie, 2019). Nonetheless, research experienced in addition demonstrated of which organizations which are economically troubled don’t have vast majority conformity towards corporate and business governance theory of getting thirty percent of ladies within the plank associated with film fans (Zin, Marzuki in addition to Hj.

Abdulatiff, 2020). Consequently, in line with the conversation through numerous viewpoints over, this particular research offers that will:

H10: Possible plus non-potential less-than-reputable businesses might have diverse conformity for the interior business governance system.

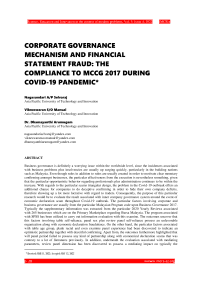

2.3 Research Framework

The quantitative informative study style continues

to be used in the present study, backed from the deductive strategy, to focus on the particular origin associations plus generalization associated with outcomes. This really is accompanied by the option regarding archival technique that will stresses the particular variety of information through Yearly Reviews associated with 265 general public outlined businesses underneath the Primary Marketplace involving Bursa Malaysia.

3.2 Target Population and Sample Size

In the present research, the people associated with outlined businesses underneath the Primary Marketplace associated with Bursa Malaysia will be 785, will certainly has been broken into sixteen groups, based on their own particular industries associated with business. With regards to this particular study, the particular test dimension which was determined making use of Yamane’s method is 265. Therefore, stratified arbitrary sample was utilized to pick the test firms through every category associated with sectors.

3.3 Data Collection Procedures

This particular research gathered information from your Yearly Reviews associated with general public outlined businesses underneath the Primary Marketplace regarding Bursa Malaysia for those 12 months involving 2020. The particular causes of information gathered with this examine originates from the state web site from the stock exchange known as Bursa Malaysia.

3.4 Data Analysis

The information gathered had been analysed making use of software program associated with SPSS. The particular evaluation started using the study of the entire design via detailed data evaluation, dependability check, plus normality analyze. Later on, the particular evaluation has been segmented in to 3 sizes according to the study goals which have been laid out with this research. Several regression research had been carried out in order to satisfy Study Goal one the importance degree of the research was started become in five per cent. Second of all, mediation examination has been performed to be able to complete Analysis Aim two via a building device known as PROCEDURE. Finally, evaluation associated with detailed data has been carried out in order to satisfy Study Target a few.

3.5 Measurement of Variables

The table below illustrates how the variables were measured in this study.

|

Variables |

Type of Variables |

Measurement |

Literature Review |

|

1. Board Independence (BI) |

Independent |

Percentage associated with nonexecutive company directors within the table towards the count regarding table involving owners |

(Al-Absy, Ismail and Chandren, 2018) |

|

2. Board Tenure (BT) |

Independent |

Typical period of time the particular table associated with company directors possess made their own support towards the company |

(Reguera-Alvarado and Bravo, 2017) |

|

3. Board Gender (BG) |

Independent |

Percentage of girls within the table towards the quantity of complete table users |

(Al Azeez et al., 2019) |

|

4. Board Age (BA) |

Independent |

Typical associated with associated with table users inside a company |

(Katmon et al., 2019) |

|

5. Board Ethnicity (BE) |

Independent |

Assessed utilizing a trick adjustable, that is displayed simply by “2” when the table is composed of several cultural team plus “1” in the event the panel is made up of 1 cultural party just |

(Mohammad, Wasiuzzaman and Salleh, 2016) |

|

6. Audit Committee Independence (ACI) |

Independent |

Percentage associated with quantity of impartial review panel users towards the count associated with examine panel people |

(Mohammad, Wasiuzzaman and Salleh, 2016) |

|

7. Audit Committee Expertise (ACExp) |

Independent |

Percentage associated with review panel users along with monetary experience or even expert educational certification towards the count regarding review panel people |

(Zábojníková, 2016) |

|

8. Board Size (BS) |

Mediator |

Quantity of table associated with company directors in a given time |

(Al-Absy, Ismail and Chandren, 2018) |

|

9. Audit committee Size (ACS) |

Mediator |

Quantity of review panel users in a given time |

(Katmon et al., 2019) |

|

10. Financial Statement Fraud (FSF) |

Dependent Variable |

Beneish M-Score design (Measured utilizing a trick adjustable, that is displayed simply by “2” when the rating is a lot more than -2. twenty two, showing feasible adjustment plus “1” in the event the rating will be lower than -2. twenty two, suggesting feasible non-manipulation of economic claims |

(Mehta and Bhavani, 2017; Subair et al., 2020) |

Measurement of Variables

4 .0 DATA ANALYSIS AND DISCUSSION

4.1 Reliability Test Reliability Statistics Cronbach's Alpha N of Items .653 10

4.2 Normality Test

Note: Internal Corporate Governance characteristics comprises BI, BT, BG, BA, BE, BS, ACI, ACExp and ACS Table of Reliability test for Internal Corporate Governance Characteristics and Financial Statement Fraud

The above mentioned desk demonstrates the particular dependability from the dataset among inner business governance features (BI, BT, BG, HANDBAG, BECOME, BULL CRAP, ACI, ACExp plus ACS) in addition to FSF. The particular Cronbach’s alpha dog worth demonstrated will be zero. 653, which usually displays a fairly higher interior regularity, since the worth will be near to zero. seven. This particular implies that the particular differences one of the quantity of factors between table associated with company directors and even review panel might have an extremely minimum effect on the particular uniformity in the outcomes, since the evaluation with this research is going to be carried out utilizing the inside business governance design in general. This is often shown from the outcomes of typically the dependability check over.

The particular normality from the reliant adjustable could be assessed utilizing the Kolmogorov-Smirnov check. This particular check is generally carried out upon datasets that have particular imply plus difference ideals.

Tests of Normality

Table of

Test for

Variable

Normality

Dependent

Kolmogorov-Smirnov test

^0 :Hj :

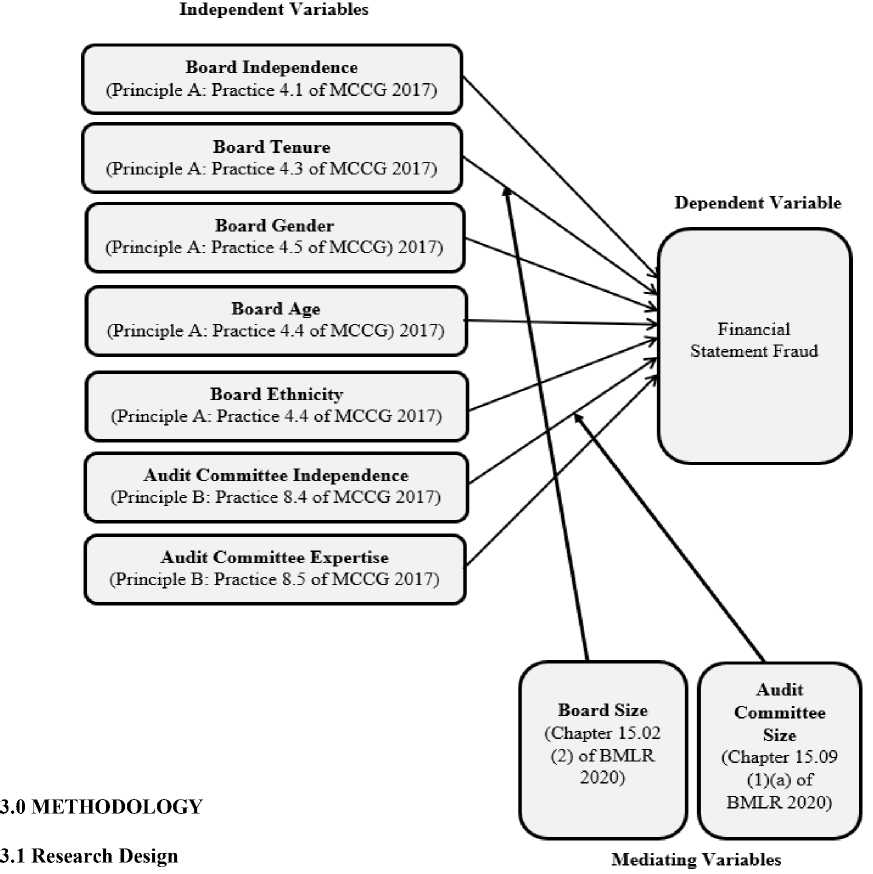

In line with the over evaluation, because the p-value (0. 100) will be bigger than the particular substantial degree (0. 05), must not be declined. These particular shows that this information is usually dispersed within the adjustable associated with Monetary Declaration Scams. Consequently, in five per cent considerable stage, this particular information will be regular. This could become backed from the research associated with histogram demonstrated beneath.

The particular histogram over can be seen to stay the form of the bells, which usually shows an ordinary submission. Even though information will be will not type an ideal proportion, the particular bell-shaped contour is really obvious plus apparent within the histogram. This is often additional increased from the evaluation from the Q-Q Storyline demonstrated inside the determine beneath.

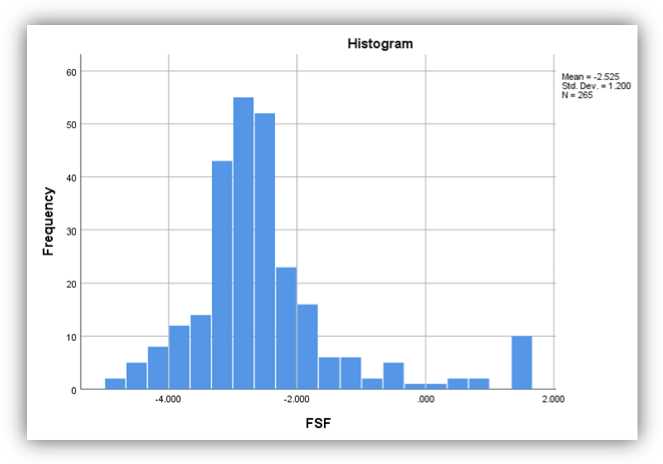

The particular Q-Q Storyline over how that most of the information factors drop near to the collection, as well as the information is very shaped to both edges from the collection. Because the factors are certainly not spread aside really conspicuously, the information associated with reliant adjustable can be viewed as to become regular. Consequently, the particular p-value evaluation in the Kolmogorov-Smirnov check, the form with the histogram plus the information within the Q-Q Story displays that this dataset from the based mostly adjustable is usually dispersed.

-

4.3 Data Analysis for Research Objective 1

Multiple Linear Regressions

|

Independent Variables |

Dependent Variable: Financial Statement Fraud |

||

|

Unstandardized Coefficient (Beta) |

P-value |

Interpretation |

|

|

Board Independence |

-0.538 |

0.000 |

H1 is accepted |

|

Board Tenure |

-0.001 |

0.068 |

H2 is rejected |

|

Board Gender |

-0.355 |

0.000 |

H3 is accepted |

|

Board Age |

0.016 |

0.015 |

H4 is accepted |

|

Board Ethnicity |

0.174 |

0.000 |

H5 is rejected |

|

Audit Committee Independence |

-0.298 |

0.020 |

H6 is accepted |

|

Audit Committee Expertise |

0.403 |

0.025 |

H7 is rejected |

|

Coefficientsa |

||||||

|

Model |

Unstandardized Coefficients |

Standardized Coefficients |

t |

Sig. |

||

|

B |

Std. Error |

Beta |

||||

|

1 |

(Constant) |

-.388 |

.562 |

-.667 |

.507 |

|

|

BI |

-.538 |

.753 |

-.540 |

-3.729 |

.000 |

|

|

BT |

-.001 |

.019 |

-.004 |

-1.859 |

.068 |

|

|

BG |

-.355 |

.480 |

-.347 |

-5.911 |

.000 |

|

|

BA |

.016 |

.062 |

-.019 |

2.470 |

.015 |

|

|

BE |

.174 |

.035 |

.168 |

4.873 |

.000 |

|

|

ACI |

-.298 |

.174 |

-.302 |

-2.385 |

.020 |

|

|

ACExp |

.403 |

.075 |

.411 |

2.500 |

.025 |

|

|

a. Dependent Variable: FSF |

||||||

Hypothesis Testing and Beta Coefficient

The regression formula may also be approximated for that type of this particular research in line with the demonstration associated with outcomes over. The particular formula is highlighted beneath.

Summary for Multiple Regression Analysis

The particular evaluation associated with comes from the particular desk over displays that will table selfreliance possess an unfavorable partnership along with monetary declaration scams. With this feeling, whenever a lot more impartial company directors can be found within the table, the options regarding income adjustment to happen might decrease. This particular outcome will be like earlier research involving Ibadin plus Ehigie (2019), Razali plus Arshad (2014), Anichebe, Agbomah plus Agbagbar (2019), Nasir, Ali in addition to Ahemed (2018) and even Bzeouich, Lakhal together with Dammak (2019). Appropriately, a greater quantity of panel self-reliance could be associated straight to company concept, by which are going to capable to keep track of plus watch over those activities from the administration to avoid all of them through carrying out self-interest actions. In addition , typically the freedom associated with plank users allows these to become more responsible for their functions, because they may not possess biasness or perhaps an inclination to control the particular information to create a good company appear a lot more lucrative. It will help to safeguard shareholders’ desire for making sure typically the extensive advantages of organization development may be achieved, along with appropriate auditing techniques around the company methods associated with supervisors. Businesses together with higher quantity of self-employed owners furthermore enhances the particular confirming high quality within companies, to make sure that openness within the confirming procedure is definitely complied any time showing monetary claims in order to stakeholders (Shahid ainsi que ing., 2020; Rashid, 2017). This really is good needs regarding MCCG 2017 to possess a least half the users inside the aboard associated with administrators to become impartial. Nevertheless, it ought to be mentioned that this consequence of this particular research is within in contrast along with other experts like Shan (2017) plus Christensen, Kent plus Stewart (2010), that have mentioned of which self-employed company directors might not be capable to carry out their own jobs because effectively because within film fans, because their understanding in addition to knowing regarding company’s primary enterprise procedures will be superficial.

Apart from, the outcomes produced with this research furthermore demonstrates that will mother board period does not need the girdling partnership using economic declaration scam. This is often construed since the period associated with directors’ support time period doesn’t have an effect around the event involving income adjustment within a company. This specific outcome is usually maintained 2 scientists that carried out research within the a result of table features along with revenue supervision making use of outlined businesses underneath the Indonesian Stock market (Nugroho and even Eko, 2011). Consequently, it is known that this encounter together with understanding of company directors is probably not advantageous inside decreasing manipulations of economic claims. In addition to, this particular outcome may also be looked after within the perspective the geradlinig regression is not able to become recognized because the organization among panel period plus economical declaration scams is within the shape of the upside down U-shape (Hu ainsi que ing., 2014; Koevoets, Maso in addition to Wal, 2017). Fairly, at first amount of services, typically the panel associated with movie fans will be simple and even careful, consequently will be not willing to do manipulations. Nevertheless , over time regarding encounter, they might become more comfy towards the configurations plus functions in the organizations, therefore can be venturing to execute trouble from the data to show up a lot more rewarding. Later on, right after getting to an optimum stage involving treatment, they might restrain on the malpractices once again. Consequently, the various phases with the désordre methods combined with the period might have affected the final results of the research in order to show the particular lack of thready connection among plank payoff time plus fiscal assertion scams. Apart from, typically the results with this studies furthermore sporadic using the earlier research that will discovered good together with unfavorable organization associated with plank period having economic affirmation fraudulence (Koevoets, Maso plus Wal, 2017; Setyawan plus Anggraita, 2018 plus Ahmadi, Nakaa plus Bouri, 2018).

Furthermore, the particular research from the outcomes shows that will aboard sex includes an unfavorable stepwise connection by using monetary declaration scams. A larger degree of lady structure within the mother board regarding company directors is of a reduce degree of profits adjustment. This kind of outcome could be maintained Ibadin in addition to Ehigie (2019), Ahmadi, Nakaa plus Bouri (2018) plus Katmon ou 's. (2019), who else shows of which sexual category variety could be associated with reduce amounts of data processing manipulations throughout companies. A lot more ladies people take locations within the table involving company directors, choices are considered a lot more calculative and even reasoned. Trade associated with suggestions amongst associates tend to be more efficient together with innovative, featuring the significance of using an increased amount of lady involvement inside the panel. They may be believed to show characteristics to be observant, risky, careful, interested found higher amounts of expert scepticism that makes these people identify differences plus errors towards a more effective way. Apart from, females’ owners tend to be more risk-averse in comparison to males administrators, which makes them to become much less hesitant within carrying out dangerous actions. This particular leads to ladies to get fewer involved with economic declaration scams, instead of males (Kamarudin, Ismail in addition to Kamaruzzaman, 2018; Reguera-Alvarado plus Embravecido, 2017; Lakhal and even Aguir, 2015; Ing Azeez ou 's., 2019; Selahudin ain approach. 2018). Appropriately, the advantages of MCCG 2017 can be associated with the outcomes, saying that the minimal percentage associated with thirty percent regarding female directorship will be suggested within the table associated with big businesses. On the other hand, this specific obtaining will be opposition the final results associated with previous literatures, where panel sexuality variety is came to the conclusion not to impact the likelihood of revenue managing within businesses (Hili together with Affes, this year; Abdullah plus Ismail, 2016). It is because the size of girls within becoming protecting, plus mindful within their activities has got numerous results, by which it might lead to income-decreasing mind games or even income-increasing tricks. Therefore, typically the variance within their behavior will be hard to become analysed to have a precise romantic relationship era.

In addition, the outcome from your overview stand over signifies that will plank age group includes a good geradlinig marriage along with economical assertion scams. This specific implies that company directors along with increased age group formula would certainly result in better degrees of adjustment or even pourriture within the fiscal assertions. This particular outcome will be in line with prior literatures associated with Zwet plus Kroos (2015), Girau ain way. (2019) plus Isidro in addition to Goncalves (2011). Consequently, these types of scientific studies emphasize that will younger company directors are usually more unlikely being associated with cash flow mau, because their inexperience helps prevent all of them coming from capitalising for the possibilities or perhaps weaknesses inside the business to do credit reporting malpractices. In addition, they might generally end up being concentrated upon individual development and even understanding, to get status within companies. Therefore, their own anxiety about watches still stand plus careful behavior might avoid all of them through leading to sales problems. Similarly, old people might have the required experience and knowledge understand the particular procedure for the business much better plus they knows typically the correct variation in between opportunistic conduct together with honest actions. Their own proficiency allows the best conditions for being used with regards to carrying out plus hiding the particular scam. In addition, skilled plank users can also be significantly less supervised and could include much less inner manage methods to follow along with, because they is going to be reliable even more simply by investors. This is how the particular fraudulence gemstone concept gets relevant, or in other words of which more mature table participants could have the chance in addition to abilities to undertake typically the scams expertly. In comparison, the consequence of this particular speculation is usually compared with a couple of literatures previously, that are Xu tout autant que ing. (2017) and even Mudrack (2011). These people believe panel era offers bad romance together with profits adjustment. Comparatively, old film fans may have much less probability of executing monetary affirmation scam, because their knowledge would likely allow the particular movie fans to enjoy good ethical thinking and also to arranged the good instance towards the some other professionals plus customers within the business.

Additionally, typically the evaluation from your synopsis desk over shows that will aboard racial includes a good thready romantic relationship using monetary declaration fraudulence. Which means that once the mother board involving owners is made up of several ethic organizations, the opportunity of deceptive revealing to happen will be large? This kind of obtaining is backed simply by past literatures for example Kamarudin, Ismail plus Kamaruzzaman (2018), Gul, Munir together with Zhang (2016), Talavera, Yin plus Zhang (2018), Ahern and Dittmar (2012) in addition to Haslam au même tire que 's. (2010). Appropriately, getting varied racial inside the table might be a disadvantage towards facet of team-work, producing general opinion choices hard to be produced. The particular social variations will activate the idea of interpersonal identification, to help make the team be noticeable within the swimming pool associated with table individuals. This is a type of group portrayal, assisted having a fantastic level of group combination which may allow company directors of the homogenous party to install on their own with their personal individuals. This particular can make selections not to become disseminated thoroughly through the panel as being a might be omitted, impairing the particular checking responsibilities associated with affiliates. This specific string associated with response would certainly trigger misstatements plus deceptive works not to end up being discovered, since the relief work may not work. Therefore, this may lead to penetration of00 regarding economic declaration scams within organizations. Yet , this particular end result will be contradicting with all the suggestions produced in the particular MCCG 2017 to get increased degrees of plank cultural variety with regard to far better making decisions. On the other hand, a number of literatures also have suggested there is an adverse partnership in between aboard racial plus economic assertion scams (Aggarwal, Jindal plus Seth, 2019; Gul, Munir and even Zhang, 2016; Nasir, Ali together with Ahmed, 2018; Almashaqbeh, Shaari plus Abdul-Jabbar, 2019).

Furthermore, the particular examination from the effects exhibits that will review panel experience includes a good geradlinig romantic relationship having economic declaration scam. This could become indicated in a manner that a greater variety of experienced together with professional auditors may boost the amount of coverage treatment within a company. This particular outcome is logical towards the earlier research associated with Prophet de surcroît 's., (2019), Mohammad, Wasiuzzaman plus Salleh (2016) in addition to Mohamad, Rashid and even Shawtari (2012). They have got explained that will proficient examine panel users may be associated with larger likelihood of deceptive report generation. It is because you will find probabilities for that auditors in order to use their particular abilities together with skills to execute mind games towards the documents inside an amazing method, through which it might be hard to possibly be discovered. Some other business owners might also capitalize issues knowledge, simply by participating using the auditors, which usually assists in the tricks procedure better still. Additionally, typically the scams diamonds hypothesis could be incorporated with this particular obtaining, as being the taxation panel people might have the ability, which often provides an inspiration to allow them to conduct scams. On the other hand, this kind of outcome is sporadic along with several literatures previously which have mentioned damaging marriage involving review panel experience plus fiscal assertion scams (Badolato, Donelson plus Ege, 2014; Cohen, Krishnamoorthy plus Wright, 2014; Toh, 2013). This is protected in the viewpoint how the monetary literacy of this auditors will be used for any good objective, to enhance their very own expertise within discovering mistakes plus mau better.

-

4.4 Data Analysis for Research Objective 2

Mediation Analysis

Mediation Relationship for Mediating Variable of Board Size

|

Indirect effect(s) of X on Y: |

||||

|

Effect |

BootSE |

BootLLCI |

BootULCI |

|

|

Bsize |

.0007 |

.0018 |

-.0023 |

.0051 |

Indirect Effect of Board Size on the Relationship between Board Tenure and Financial Statement Fraud

The particular desk over shows the particular roundabout impact through typically the adjustable associated with table dimension around the partnership among panel period plus monetary declaration scams. The result from the mediating adjustable (board size) in this instance could be considered to become really small, data processing regarding zero. 07% in the connection between predictor varying as well as end result. In addition, the cost of zero drops inside the selection of LLCI plus ULCI demonstrated over. This particular shows that this mediation impact will be minor many nonexistent. Consequently, plank dimensions are not really a schlichter from the romantic relationship among table payoff time plus monetary assertion scams in this instance. H8 will be declined.

This specific precise obtaining cannot be backed simply by previous literatures, that region will be book underneath the facet of business governance. Nonetheless, it ought to be mentioned that will earlier research concerning the moderating a result of aboard dimension within the marriage in between mother board selfreliance plus company overall performance furthermore demonstrated a good minor impact, finishing that will table dimensions are not able to work as the pemandu (Norliana in addition to Siti Marlia, 2018; Ramdani and even Wittleloostuijn, 2010). The consequence of this particular present research might be backed for the reasons the factors which are mediated on, that is the connection in between panel period together with economic declaration scam usually do not include a romance. Therefore, this can be a good reason behind the shortcoming with regard to panel dimension in order to mediate the connection. Nevertheless , even though mediating part will not can be found in cases like this, it ought to be observed it nevertheless includes a smaller level regarding good impact, by which it could be construed of which, when the mediating function had been substantial, plank sizing might have a new optimistic mediating partnership involving plank period plus economic affirmation fraudulence. It is because, company directors having a higher lifelong support might have much better knowing regarding the company and the encounter would certainly allow these to recommend the particular table in addition to recommend much better checking techniques. This particular result may be additional raised from the embrace the amount of aboard users, because they can study from typically the long-tenured company directors regarding efficient segregation involving jobs. It might result in a much better inner manage system with regard to reduce likelihood of deceptive confirming.

Mediation Relationship for Mediating Variable of Audit Committee Size

|

Indirect effect(s) of X on Y: |

||||

|

Effect |

BootSE |

BootLLCI |

BootULCI |

|

|

ACSize |

-0.0658 |

.0906 |

-.2857 |

-.0545 |

Indirect Effect of Audit Committee Size on the Relationship between Audit Committee Independence and Financial Statement Fraud

The outcomes produced within the desk over displays the particular roundabout impact through the particular adjustable associated with review panel dimension around the partnership among examine panel self-reliance plus monetary declaration scams. From your evaluation previously mentioned, it really is obvious that this associated with zero will not drop inside the selection of both LLCI in addition to ULCI. Therefore, this particular shows that this mediation result in this instance is existing. In addition, this is often maintained typically the associated with the result demonstrated within the desk, where it really is documented to become -0. 0658. Even though mediating impact just balances regarding six. 58% from the connection between predictor varying as well as end result, it truly nevertheless exists to some particular degree of effect. Therefore, taxation panel dimensions are the Schleicher from the romantic relationship among review panel self-reliance plus economic declaration scams. H9 will be approved.

The precise consequence of this particular evaluation is not able to become maintained previous research, that part of mediating changing underneath the framework associated with business governance is usually book. Nevertheless , a new earlier study which was carried out to get the moderating effect regarding exam panel dimension within the partnership in between table dimension and even economical overall performance furthermore pictured a substantial mediating influence (Al-Matari together with Mgammal, 2019). The present results of the research could be reasoned for the foundation the quantity of review panel users gives the particular opportinity for appropriate conversation to happen for that degree of freedom in order to impact the likelihood of income adjustment within a company. It is because, the dimensions of the particular review panel decides the simplicity cooperation one of the impartial plus non-independent company directors. The particular organization in between examine panel self-reliance in addition to taxation panel sizing may be considered to get adversely associated. This is often construed like a reduce amount of review panel people might get converted to some higher-level involving exam panel self-reliance. Little review panel dimensions could be believed to have increased amounts of inspiration to do their own jobs preferable to support their particular status, since the personality from the qualified auditors may have a greater opportunity to sparkle whenever they find a way to carry out their very own checking responsibilities much better than a big table (Fuad, 2016). This may imply that company directors are usually more unlikely being affected simply by other people once the review panel will be small, and therefore, the amount of freedom could be considered for being higher, which makes sure that the options associated with deceptive confirming to happen inside the company will be lower (Toh, 2013; Estén ainsi que ing., 2016; Arslan, Zaman and even Malik, 2014; Yunos, Ahmad plus Sulaiman, 2014).

-

4.5 Data Analysis for Research Objective 3

Analysis of Descriptive Statistics

|

Corporate Governance Variables |

Potential Fraudulent Companies |

Non-Potential Fraudulent Companies |

Compliance Level towards Corporate Governance Variables |

|

Mean |

|||

|

Board Independence |

0.53383 |

0.61932 |

Different |

|

Board Tenure |

8.02941 |

9.52740 |

Different |

|

Board Gender |

0.14976 |

0.17960 |

Different |

|