Development of Instruments of State Support for ESG Projects in the Arctic Zone of the Russian Federation

Автор: Golovina T.A., Matveev V.V., Avdeeva I.L.

Журнал: Arctic and North @arctic-and-north

Рубрика: Social and economic development

Статья в выпуске: 56, 2024 года.

Бесплатный доступ

The Arctic zone of the Russian Federation is one of the key and promising territorial units of our country, which is of strategic importance not only for the national socio-economic system, but also for the world economy as a whole. For this reason, regional and federal authorities are continuously working on the issues of improving the efficiency of management of socio-economic development of this territory. One of the urgent directions is socio-ecological-economic development of the Arctic zone, which is impossible without appropriate support of public authorities and involvement of business structures and population in these processes. Special attention should be paid to the issues of resource support, including the stimulation of investment processes, in order to implement the ESG-agenda. The purpose of this study is to formulate scientific and practical recommendations for the development of the system of state support for ESG-projects, which are the driver of investment and environmental climate formation in the Arctic zone of the Russian Federation. The study proposes a toolkit of state support for ESG-projects, in which the key role is given to tax preferences for investors, as well as subsidizing the costs of residents at the expense of the regional and federal budgets and preferential conditions for attracting borrowed funds. The application of the proposed tools will not only allow business structures investing in the implementation of projects of socio-ecological-economic orientation in the Arctic zone to receive additional benefits, but will also become an incentive to reach full project capacity, which will achieve a synergistic effect in the form of profit for business entities and socio-economic effect for the authorities and the population in the form of new jobs, developed infrastructure and revenue to budgets at various levels.

Arctic zone of the Russian Federation, green economy, ESG-projects, investment projects, investment climate of the region, state support instruments, tax preferences

Короткий адрес: https://sciup.org/148329539

IDR: 148329539 | УДК: [332.1:338.2:330.322](985)(045) | DOI: 10.37482/issn2221-2698.2024.56.74

Текст научной статьи Development of Instruments of State Support for ESG Projects in the Arctic Zone of the Russian Federation

DOI:

00659,

Over the centuries, the growing needs of people in the process of population growth stimulated economic growth. This, in turn, created an environment favorable for the development of science and technology, contributing to the increase in production volumes, as well as human

* © Golovina T.A., Matveev V.V., Avdeeva I.L., 2024

This work is licensed under a CC BY-SA License well-being. The need to maintain and increase the pace of industrial production and everincreasing energy consumption has identified an acute problem of the dependence of economic growth on the extensive use of natural capital, primarily in terms of increasing the consumption of various natural resources, including mineral resources. The anthropogenic load on ecosystems has also become more noticeable, and climate change trends have emerged.

Discussions on the need to transition from resource-intensive to resource-saving (resourceefficient) type of economic development began. In this regard, industrialists, government agencies at all levels, and the scientific community in the modern economy should act as an integrated community that determines the directions of gradual transformation from a technogenic economy that extensively uses resources to management based on environmentally oriented approaches and ensuring a new quality of human life.

In turn, the current unstable macroeconomic situation caused by non-objective geopolitical challenges, together with the negative consequences of the weakening of the national economy by the coronavirus pandemic, force the state executive authorities to pay close attention to the search for relevant and more effective instruments of socio-economic development. At the same time, in the context of the national course (current national projects), the key vector for such progressive improvement is not just the achievement of some conditional superficial indicators, but, on the contrary, the creation of comfortable conditions for the effective management of the country and its territorial units, for the development of various multi-format entrepreneurial initiatives and for ensuring a decent standard of living for people, including the provision of guarantees of a favorable environment for them.

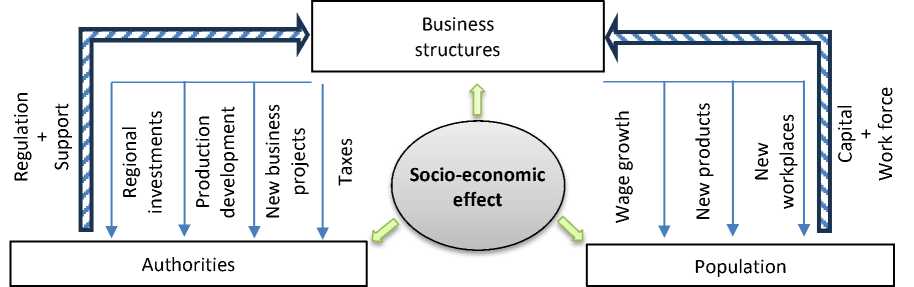

Separately, it should be noted that the state (represented by federal and regional government bodies) assigns a significant role in achieving the noted target welfare to the development of the entrepreneurial sector, including the improvement of the investment policy implemented by businesses. Such attention in practice is conditioned by many factors at the same time. However, the prospects presented in Fig. 1 can be noted as key ones.

Fig. 1. Advantages of activating the investment policy of business structures 1.

At the same time, it should be noted that the classical investment approach, along with the noted advantages, contains certain problems, for example, related to environmental pollution. An

Source: compiled by the authors.

Tatyana A. Golovina, Vladislav V. Matveev, Irina L. Avdeeva. Development of Instruments … increase in production capacity objectively leads to an increase in the amount of emissions, waste, radiation and other negative aspects that are dangerous to the population. This problem is associated with the desire of business community to save money (reduce production costs to maintain competitiveness) on specialized protective equipment.

The only exception is the so-called ESG-projects based on the principles of “green” investments (“green” economy). Such projects declare the development of production facilities that minimize the negative impact on the environment, the population (including employees), and the products of related enterprises as their basic goal along with obtaining and maximizing profits.

In this regard, in our opinion, government authorities should show an objective interest in implementing ESG-projects in the regions. On the one hand, they have all the desired advantages, and on the other, they mitigate the noted “classic investment problems”. This means that their implementation directly contributes to achieving the previously mentioned balanced socioeconomic development as a whole. At the same time, government authorities should pay special attention to the localization of such projects:

-

• firstly, in pristine areas of our homeland in order to preserve the ecological balance;

-

• secondly, in places where the environmental situation requires direct government intervention to mitigate accumulated local problems;

-

• and thirdly, in regions with relatively low socio-economic development.

In our view, one of the few locations with all the above aspects is the territory of the northern regions of our country, united geographically into the specialized Arctic zone of the Russian Federation. Its main economic purpose is the creation by federal and regional authorities of preferential conditions for business activities for the purpose of socio-economic development.

However, even a superficial analysis of the current support measures allows concluding that there is a complete absence of any specialized preferences designed to stimulate the development of ESG-projects in the zone under consideration. Therefore, the formulation and detailing of such scientific and practical proposals (recommendations) are of increased relevance and objective significance.

Purpose and objectives of the study

The purpose of the study is to develop instruments of state support for socio-ecological-economic projects in the Arctic zone based on the principles of environmental safety and balanced socio-economic development of the region.

The goal will be achieved by solving the following scientific tasks:

-

• study of theoretical and methodological features of organizing the implementation process of “green” projects;

-

• assessment of the investment climate of the Arctic zone;

-

• elaboration of scientific and practical recommendations for the development of instruments of state support for ESG-projects;

-

• predictive assessment of the effectiveness of the proposed instruments.

Literature and research review

The issues of ESG-projects implementation in the world practice have received close attention in the last decade. According to the research of scientists from Yale and Columbia Universities

-

2 , in 2022 the objective superiority in this sphere belongs to Denmark (environmental safety index — 77.90), Great Britain (77.70), Finland (76.50), Malta (75.20) and Sweden (72.70). At the same time, a study of the 10-year dynamics of the growth of this index shows that the leaders of this rating are Malta (+25.40), Afghanistan (+23.90), Great Britain (+23.00), Finland (+21.00), Trinidad and Tobago (+19.00). As for the Russian Federation, its index in this rating reaches only 37.50 (growth +1.60), which corresponds to 112th place out of 180 countries in the world. This level is conditioned by a rather large number of operating mining, processing, industrial, energy and other enterprises that have a negative impact on the environment.

Accumulating the results of the majority of studies, placed in popular international scientific databases, the conclusion can be made that the main promising source of financing “green” projects is capital placed on the open stock market [1, Kovalevich I.V., p. 1284]. In particular, a similar opinion is supported by: firstly, a group of researchers from Greece, Spain, France, whose work is aimed at revealing the features of specialized bond loans and “green” investment funds [2, Agorakia L. K., Aslanidis N., Kouretas G. P.]; secondly, Italian scientists studying the features of price formation for “green” bonds [3, Fatica S., Panzica R., Rancan M.]; thirdly, a representative of a Swiss financial institution, focusing on a decrease in the profitability of the issuer’s shares in case of issuing “green” bonds [4, Wu Y.]; fourthly, a group of researchers from Saudi Arabia and Egypt, assessing the impact of global risk factors on the nature and profitability of “green” bonds [5, Bil-lah M., Elsayed A. H., Hadhri S.].

The increased interest in the use of financial market instruments, according to Chinese researchers Linhai Zhao and Ka Yin Chau, is due to the “better economic benefit” [6] compared to conventional government support for the investment initiatives under consideration. In fact, the state does not spend limited budget funding on creating elements of a “green” economy, but only indirectly contributes to stimulating the interest of private investors in “green” topics.

The concept of a “green” economy is being studied by scientists from various countries. A group of Spanish researchers from the University of Zaragoza led by Jorge Fleta-Asina is studying the special influence of environmental principles on this issue [7], while scientists from Portugal are paying attention to detailing the indicators of the economic efficiency of “green” investment [8, Cortez M.C., Andrade N., Silva F.]; etc.

Attention should be paid to the results of Western researchers led by Ir. Fafaliu [9], as well as Chinese scientists Yunxi Yi and Yangyang Wang [10], which emphasize the role of the state (fed-

-

2 EPI Results. Environmental Performance Index. URL: https://epi.yale.edu/epi-results/2022/component/epi (accessed 15 February 2023).

Tatyana A. Golovina, Vladislav V. Matveev, Irina L. Avdeeva. Development of Instruments … eral and regional authorities) both in direct budget financing of “green” projects and in the creation of new support instruments and the development of a preferential tax system. The need for an additional budgetary burden is explained by the authors as a consequence of the relatively modest profitability and payback of ESG-projects in comparison with their “harmful” analogues.

European researchers also actively support the ideas of developing ESG-projects through government participation. In particular, they suggest authorities to pay close attention to the key risks of implementation of environmentally friendly projects [11, Nagya R.L.G., Hagspiel V., Kort P.M.]; to improve the general structure of government support in favor of “green” investments [12, Bigerna S, Wen X., Hagspiel V., Kort P.M.]; and to develop direct socio-economic cooperation with the state through public-private partnership projects [13, Lu Q., Farooq M. U., Ma X., Iram R.].

Thus, there is currently no unified approach to organizing the processes of investing and supporting ESG-projects. In this regard, for the development of circular economy in the Arctic zone, it is advisable to use an integrated approach to state support for socio-ecological-economic projects. This choice is conditioned by a combination of the following factors: firstly, ensuring increased conservation of natural resources, including human capital; secondly, the creation and promotion of new investment initiatives based on “green” high-performance technologies; thirdly, the environmental diversification of existing production facilities with the production of qualitatively new products [14, Frolova N.N., p. 77]; fourthly, the actual attraction of “green” investment capital to the national and regional economies [15, Borkova E.A. p. 75; 16, Gurova I.P., p. 580]; fifthly, the retraining of personnel to attract them to work in new highly productive jobs; sixthly, the possibility of direct participation of government in the issues of environmental safety [17, Borkova E.A., Timchenko M.N., Markova A.A., p. 88]; seventhly, ensuring the return on invested budget capital through the inflow of tax revenues into the domestic budget system at all levels [18, Brukovskaya A.I., Domanova M.E., Dmitriev V.D., p. 341]; eighthly, achieving a balance between the environmental and socio-economic interests of residents, business community and government agencies.

Materials and methods

The study is based on fundamental works of foreign and domestic scientists in the field of development of the theory and methodology of the circular economy. To achieve scientific results, abstract-logical and retrospective methods were used (to assess the investment climate of the Arctic zone), as well as economic-statistical method (to develop scientific and practical proposals for the development of state support tools) and calculation-constructive and graphical methods (for predictive assessment of the effectiveness of the proposed tools).

The information and empirical base of the study includes the regulatory legislation of the Russian Federation, statistical and analytical data of the Federal State Statistics Service, as well as the results of the authors’ calculations.

Results of the study

The Arctic zone is a unique territorial, socio-economic and investment area, where various federal and regional measures of state support are concentrated. Thus, an assessment of the structure of investment initiatives in the Arctic zone suggests that the majority of projects being implemented are concentrated around the development of various deposits of natural resources (non-ferrous and ferrous metals, oil, gas, coal, diamonds and other critical factors of production for the economy and humanity as a whole). Other most demanded investment areas include the development of tourism infrastructure (medical treatment and health improvement, hotel complexes, food, entertainment and sports centers, and other similar services), agricultural and farming projects, marine fishing and related processing, sea/air terminals and transport services, as well as electric power generation.

An analytical review of information sources showed that, with the exception of the integration of advanced technologies (not necessarily environmentally friendly), there are no registered projects based on circular economy technologies that increase and/or at least partially preserve the environmental security of the Arctic zone. In our opinion, this situation is due to the lack of direct government support for this type of investment.

To involve business structures in the implementation of ESG-projects, it is advisable to use such investment instruments as special economic zones and territories of advanced social and economic development. A comparative description of the measures of preferential support for “green” projects in the Arctic zone is presented in Table 1.

Table 1

Comparative characteristics of preferential support measures for “green” projects in the Arctic zone

|

Preferential conditions of special economic zones |

Preferential conditions for the implementation of investment projects in the Arctic zone |

Preferential conditions for territories of advanced social economic development created in single-industry towns |

|

FEDERAL PART OF INCOME TAX |

||

|

2% for 10 years from the date of 0% for 10 years from the date of 0% for the first 5 years and the first profit the first profit 2% from 6th to 10th year |

||

|

REGIONAL PART OF INCOME TAX |

||

|

set by each region independently ≈ 0% for the first 5 years and 5% from 6th to 10th year, then — 13.5% until the end of the SEZ |

set by each region independently ^ ≈ 5% for the first 5 years and 10% from 6th to 10th year* |

set by each region independently ≈ 0% for the first 2 years, 3 5% from 3rd to 5th year 10% from 6th to 10th year |

|

INSURANCE PAYMENTS TO EXTRA-BUDGETARY FUNDS |

||

|

Not provided |

75% of regular payments (subsidies 7.6% for all new jobs for new jobs) |

|

|

MINERAL EXTRACTION TAX |

||

|

Not provided |

50% of the current rate (for new ^^ fields) |

Decreasing coefficient in the first 1 2 years — 0, then +0.2 p.p. every two years |

|

TRANSPORT TAX |

||

|

set by each region independently ≈ 0% for the first 10 years from the date of vehicle registration (up to 150 hp) |

Not provided |

Not provided |

|

CORPORATE PROPERTY TAX |

||

|

set by each region independently ≈ 0% for the first 10 years from the date of property registration |

set by each region independently ≈ 0% for the first 5 years and 1.1% from 6th to 10th year [19, Serova N.A., p. 170] |

set by each region independently ≈ 0% for the first 5 years and 1.1 % from 6th to 10th year [19, Serova N.A., p. 170] |

|

LAND TAX |

||

|

set by each region independently ≈ 0% for the first 5 years from the moment the right to each land plot arises |

set by each region independently ≈ 0% for the first 3 years and at the municipal rate from 4th to 10th year [19, Serova N.A., p. 170] |

set by each region independently ≈ 0% for the first 5 years and at the municipal rate from 6th to 10th year [19, Serova N.A., p. 170] |

|

SIMPLIFIED TAX SYSTEM |

||

|

Not provided |

set by each region independently - STS “Income” ≈ 1% for the first 3 years, 3% from 4th to 6th year 6% from 7th to 10th year - STS “Income — Expenses” ≈ 5% for the first 3 years, 10% from 4th to 6th year 15% from 7th to 10th year [19, Serova N.A., p. 170] |

Not provided |

|

CUSTOMS REGULATIONS |

||

|

possibility of applying the free customs zone procedure |

possibility of applying the free customs zone procedure |

Not provided |

|

LAND USE CONDITIONS |

||

|

may be stipulated by the regional legislation |

granting land plots for lease without tenders |

may be stipulated by the regional legislation |

|

TAX AUDIT |

||

|

Not provided |

only with the approval of the Ministry for the Development of the Russian Far East and within a shortened timeframe |

Not provided |

|

SPECIAL CONDITIONS FOR EXPERT EXAMINATIONS |

||

|

Not provided |

environmental and state expert reviews of the design and construction projects are carried out simultaneously |

Not provided |

|

* does not apply to mineral extraction projects |

||

The table shows that the key elements of preferential policies for Arctic zone residents are based on such support measures as reduced rates for insurance funds and property tax minimization. Minimization of income tax is of practical interest to business structures only after 2–4 years, since at the initial stages there is simply no profit (on average: registration, design, financing — from 0.5 to 1 year, construction and installation of equipment — from 1 to 1.5, commissioning, scheduled launches, reaching design capacity — from 0.5 to 1 year).

It is also worth noting the favorable conditions offered to small business participants: reduced tax rates paid under the simplified taxation system; personalized land use conditions (provision of state / regional / municipal land for lease without tenders); special procedures for organizing tax audits and permitting examinations.

In addition to the noted favorable conditions inherent in the preferential zone, residents can take advantage of other federal opportunities not listed in the table above. For example, reimbursement of expenses for the creation (development) of infrastructure facilities and techno- logical connection to them (20% of the total amount of declared private investments); subsidizing the interest rate on loans (one and a half times the key rate of the Central Bank of the Russian Federation, but not less than 2%).

According to the Ministry of Economic Development of Russia, despite the presence of certain contradictions, the set of state support instruments made it possible to attract more than 570 residents to the economy of the Arctic zone regions, who invested more than 800 billion rubles and created more than 22.7 thousand new jobs.

Thus, it should be noted that, firstly, residents of the Arctic zone have the right to use many advanced tax, financial and organizational measures of state support for the domestic economy; secondly, despite the variety of preferences, special attention should be paid to the actualization of some of them (for example, the preferential lending program); and thirdly, special support measures used to create and stimulate a “green” economy have not yet been formulated or established by state executive authorities. Consequently, the formation of the previously noted scientific and practical proposals for the development of a system of state support for ESG-projects in the Arctic zone in practice confirms its relevance.

We consider it appropriate to pay attention to the development of instruments of state support for residents of the Arctic zone in order to increase the investment attractiveness of this territory in the context of socio-ecological and economic development. The proposed key changes in preferences on the part of federal and regional authorities are shown in Fig. 2.

The choice of the proposed instruments is determined by such factors as:

-

• SPV-company’s access to the envisaged benefits during the period from the moment of registration until reaching the project capacity; the proposed change in the timeframe will not only provide additional preferences to businesses, but will also stimulate the earliest possible reaching of full project capacity (which guarantees the planned taxes, jobs, investments and other benefits for the region and the population);

-

• lack of free investor access to the necessary supporting infrastructure in all regions; the proposed change will financially emphasize the special priority status of ESG-projects for the regional and federal economy as a whole;

-

• problem of finding “cheap” financial resources for the implementation of relatively longterm, capital-intensive and unattractive for business ESG-projects; the implementation of the initiative will not only attract the necessary credit resources on a preferential basis, but will also increase the confidence of credit institutions in the considered types of business initiatives.

Requirements to the investment ESG-project:

> Use of resource-saving technologies (lean production technolo-

Requirements to the resident:

gies);

-

> Availability of practical and/or research experi

ence in realization of investment ESG-projects by the resident (general group of companies);

-

> Registration of a new legal entity responsible

solely for the implementation of a new ESG project;

-

> Presence of a legal entity intending to modernize

the existing/created production to modern standards of environmental safety;

-

> Other requirements for AZRF residents.

-

> The volume of pollutant emissions into the environment tending

towards zero and not lower than the world average level for each indicator;

-

> Self-implementing or participating in an environmental safety

training program(s) for employees;

-

> Ensuring regular monitoring of production facilities by employees

of authorities responsible for the enforcement of environmental legislation;

-

> Provision of electronic remote monitoring tools for environmental

safety of production;

-

> Other general requirements for investment projects of AZRF

residents.

-

Proposed benefits for the ESG-project and its investors

|

Federal and regional income tax incentives from the moment the project reaches its planned (maximum) capacity (feder. part 0% - 0 years; reg. 0% - 5 years; 10% - next 5 years). |

Direct subsidizing at the expense of the regional and federal budgets of the costs of capital investments by AZRF residents in the creation, development and/or reconstruction of supporting infrastructure facilities used for the implementation of ESG-projects. |

Subsidizing at the expense of the federal budget to a financial institution a part of the interest rate on a loan attracted by an AZRF resident for the implementation of ESG-projects. |

||

|

Goals:

to reach full capacity;

applying this tool to ESG-projects with different startup cycles. |

Goals:

the supporting infrastructure and providing ESG-projects with access to it;

projects from the authorities. |

Goals:

projects to borrowed re sources;

ESG-projects from the authorities. |

||

|

Conditions for receiving the benefit:

5 years of project launch;

from the project. |

Conditions for receiving the benefit:

and/or reconstruction of infrastructure facilities (10%);

expertized design and construction project. |

Conditions for receiving the benefit:

rates is covered by a subsidy from the federal budget. |

||

|

Stimulating the achievement of socio-economic interests of all participants on the basis of environmental safety |

||||

Fig. 2. Conditions for the implementation of the proposed instruments for stimulating ESG-projects in the Arctic zone3.

We consider it advisable to provide for the possibility of including in the list of potential applicants for incentives (in addition to the noted SPV-companies and existing business structures

-

3 Source: compiled by the authors.

planning to modernize their production) existing AZRF residents who have just started implementing projects and are ready to change the project concept to a more environmentally friendly one.

When implementing the noted investment initiatives, special attention should be paid not only to the state preferential policy, but also to the policy in the field of monitoring the environmental safety of the ESG-projects. It is advisable to determine unique indicators for each project based on an expert assessment that characterize the level of environmental safety for the munici-pality/region and its residents. In case of failure to achieve these target indicators, a full or proportional partial return of the received preferences should be provided.

Thus, a set of scientific and practical recommendations will ensure a socio-economic balance of interests, including in terms of ensuring environmental safety, for the population, business structures and government bodies of the Arctic zone.

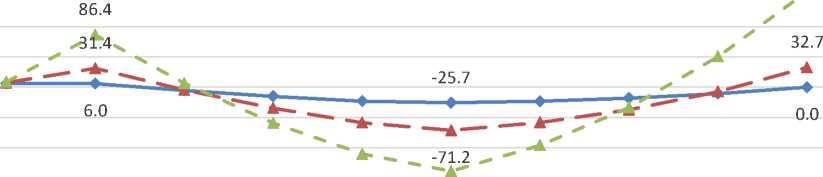

For the forecast assessment of the effectiveness of the proposed instruments of state support, the study builds a model of financial calculations (Table 2). The calculation is differentiated and offers three types of scenarios: first, a situation with the payback of invested budget allocations (at the 0% level); second, a situation with minimal financial and economic efficiency (at the level of 5%); and third, a situation with increased efficiency (at the level of 10% and above).

Table 2

Economic efficiency of the proposed instruments for stimulating ESG-projects in the Arctic zone

|

Indicators |

Years of project implementation |

|||||||||

|

2024 |

2025 \ |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

|

|

Scenario “0%” |

||||||||||

|

Number of residents implementing “green” projects, un. (+ 2 un. per year) |

1 |

3 |

5 |

7 |

9 |

11 |

13 |

15 |

17 |

19 |

|

Number of jobs created, units (+20 jobs per 1 company) |

20 |

60 |

100 |

140 |

180 |

220 |

260 |

300 |

340 |

380 |

|

Volume of investments, bln rub. (+0.1 bln rub. per 1 company) |

0.1 |

0.3 |

0.5 |

0.7 |

0.9 |

1.1 |

1.3 |

1.5 |

1.7 |

2.9 |

|

Monthly wages, thous. rub. (indexation 6.1% per year) |

70.0 |

74.3 |

78.8 |

83.6 |

88.7 |

94.1 |

99.9 |

106.0 |

112.4 |

119.3 |

|

Income tax receipts, mln rub. ( profit rate 20% ; regional tax exemption 0% for 5 years, 10% for the next 5 years) |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

2.0 |

6.0 |

10.0 |

14.0 |

18.0 |

|

Personal income tax receipts, mln rub. (13%) |

2.2 |

7.0 |

12.3 |

18.3 |

24.9 |

32.3 |

40.5 |

49.6 |

59.6 |

70.7 |

|

Property tax receipts, mln rub. (0% for 5 years, 1.1% for the next 5 years) |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

1.1 |

3.3 |

5.5 |

7.7 |

9.9 |

|

Insurance premiums, mln rub. (22.5%) |

3.8 |

12.0 |

21.3 |

31.6 |

43.1 |

55.9 |

70.1 |

85.8 |

103.2 |

122.4 |

|

Subsidies for infrastructure construction, mln rub. (10% of investment volume) |

0.0 |

10.0 |

30.0 |

50.0 |

70.0 |

90.0 |

110.0 |

130.0 |

150.0 |

170.0 |

|

Subsidies for interest rate compensation, mln rub. (3% of industrial mortgages) |

0.0 |

3.0 |

9.0 |

15.0 |

21.0 |

27.0 |

33.0 |

39.0 |

45.0 |

51.0 |

|

Regional budget balance, mln rub. |

6.0 |

6.0 |

-5.4 |

-15.1 |

-23.0 |

-25.7 |

-23.1 |

-18.1 |

-10.5 |

0.0 |

|

Efficiency over 10 years |

0% |

|||||||||

|

Scenario “5%” |

||||||||||

|

Number of residents implementing “green” projects, un. (+ 5 un. per year) |

1 |

6 |

11 |

16 |

21 |

26 |

31 |

36 |

41 |

46 |

|

Number of jobs created, units (+25 jobs per 1 company) |

25 |

150 |

275 |

400 |

525 |

650 |

775 |

900 |

1025 |

1150 |

|

Volume of investments, bln rub. (+0.125 bln rub. per 1 company) |

0.1 |

0.8 |

1.4 |

2.0 |

2.6 |

3.3 |

3.9 |

4.5 |

5.1 |

5.8 |

|

Monthly wages, thous. rub. (indexation 6.5% per year) |

70.0 |

74.6 |

79.4 |

84.6 |

90.1 |

95.9 |

102.1 |

108.8 |

115.8 |

123.4 |

|

Income tax receipts, mln rub. ( profit rate 25% ; regional tax exemption 0% for 5 years, 10% for the next 5 years) |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

3.1 |

18.8 |

34.4 |

50.0 |

65.6 |

|

Personal income tax receipts, mln rub. (13%) |

2.7 |

17.4 |

34.1 |

52.8 |

73.8 |

97.2 |

123.5 |

152.7 |

185.2 |

221.3 |

|

Property tax receipts, mln rub. (0% for 5 years, 1.1% for the next 5 years) |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

1.4 |

8.3 |

15.1 |

22.0 |

28.9 |

|

Insurance premiums, mln rub. (22.5%) |

4.7 |

30.2 |

59.0 |

91.3 |

127.6 |

168.3 |

213.7 |

264.3 |

320.6 |

383.1 |

|

Subsidies for infrastructure construction, mln rub. (10% of investment volume) |

0.0 |

12.5 |

75.0 |

137.5 |

200.0 |

262.5 |

325.0 |

387.5 |

450.0 |

512.5 |

|

Subsidies for interest rate compensation, mln rub. (3% of industrial mortgages) |

0.0 |

3.8 |

22.5 |

41.3 |

60.0 |

78.8 |

97.5 |

116.3 |

135.0 |

153.8 |

|

Regional budget balance, mln rub. |

7.5 |

31.4 |

-4.5 |

-34.7 |

-58.6 |

-71.2 |

-58.3 |

-37.2 |

-7.1 |

32.7 |

|

Efficiency over 10 years |

4.9 % |

|||||||||

|

Scenario “10%” |

||||||||||

|

Number of residents implementing “green” projects, un. (+ 10 un. per year) |

1 |

11 |

21 |

31 |

41 |

51 |

61 |

71 |

81 |

91 |

|

Number of jobs created, units (+30 jobs per 1 company) |

30 |

330 |

630 |

930 |

1230 |

1530 |

1830 |

2130 |

2430 |

2730 |

|

Volume of investments, bln rub. (+0.145 bln rub. per 1 company) |

0.2 |

1.7 |

3.2 |

4.7 |

6.2 |

7.7 |

9.2 |

10.7 |

12.2 |

13.7 |

|

Monthly wages, thous. rub. (indexation 7% per year) |

70.0 |

74.9 |

79.8 |

85.0 |

90.5 |

96.4 |

102.6 |

109.3 |

116.4 |

124.0 |

|

Income tax receipts, mln rub. ( profit rate 30% ; regional tax exemption 0% for 5 years, 10% for the next 5 years) |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

4.5 |

49.5 |

94.5 |

139.5 |

184.5 |

|

Personal income tax receipts, mln rub. (13%) |

3.3 |

38.6 |

78.4 |

123.3 |

173.6 |

230.0 |

293.0 |

363.1 |

441.2 |

527.9 |

|

Property tax receipts, mln rub. (0% for 5 years, 1.1% for the next 5 years) |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

1.7 |

18.2 |

34.7 |

51.2 |

67.7 |

|

Insurance premiums, mln rub. (22.5%) |

5.7 |

66.7 |

135.7 |

213.3 |

300.5 |

398.0 |

507.0 |

628.5 |

763.7 |

913.7 |

|

Subsidies for infrastructure construction, mln rub. (10% of investment volume) |

0.0 |

15.0 |

165.0 |

315.0 |

465.0 |

615.0 |

765.0 |

915.0 |

1065 |

1215 |

|

Subsidies for interest rate compensation, mln rub. (3% of industrial mortgages) |

0.0 |

4.5 |

49.5 |

94.5 |

139.5 |

184.5 |

229.5 |

274.5 |

319.5 |

364.5 |

|

Regional budget balance, mln rub. |

8.9 |

85.8 |

-0.4 |

-72.9 |

-130.4 |

-165.3 |

-126.8 |

-68.7 |

11.0 |

114.3 |

|

Efficiency over 10 years |

10.4% |

|||||||||

Thus, according to the proposed scenario approach, an investment ESG-project has the following initial parameters:

-

• the amount of investments (capital investments in fixed assets) ranges from 100 and 150 million rubles (average project size in the Arctic zone is 1.4 billion);

-

• the number of jobs created — from 20-30 new units (average number in the Arctic zone is 40 jobs);

-

• the rate of return on investment capital at a level of 20 to 30%;

-

• the application of the basic taxation system by residents.

200.0

158.5

150.0

100.0

50.0

0.0

These parameters, compared to the average values of investment projects in the Arctic zone, have a significant reserve of “calculated strength”, and are also optional. In particular, all indicators should be determined by each subject of the Russian Federation independently, on the basis of the current investment climate (in regions with high concentration of minerals and/or existing developed logistics corridors, model projects will be more capital- and labor-intensive).

At the same time, the proposed calculation is efficient (Fig. 3).

-138.9

2024 г 2025 г 2026 г 2027 г 2028 г 2029 г 2030 г 2031 г 2032 г 2033 г

-50.0

-100.0

-150.0

-200.0

Scenario "0 %" —*-Scenario "5 %"

— A- - Scenario "10 %"

Fig. 3. Estimation of budgetary efficiency of the proposed instruments for stimulating ESG-projects in the Arctic zone 4.

Estimation of budgetary efficiency of the proposed instruments for stimulating ESG-projects in the Arctic zone indicates the feasibility of implementing the proposed tools of state support. Moreover, the calculation has a financial safety margin due to the exclusion of transport and land taxes from the revenue part of the national budget system, which is due to the specificity of the application of production factors — objects of taxation in the context of stimulating projects of socio-ecological-economic orientation.

At the same time, the application of the proposed instruments is associated with a certain level of risk load. In particular, the main risks include: minimal interest of potential resident investors in the transport and logistics location and / or the updated investment climate of the Arctic zone; increase in the cost of construction / lease of production sites; decrease in the volume of financing, etc.

However, these threats can be reduced to almost zero in case of competent organizational and financial planning; for example, through an active advertising campaign, effective financial planning, additional incentives for municipalities and other methods [20, Polyanin A.V., Matveyev V.V., p. 198].

Conclusion

The implementation of scientific and practical recommendations in terms of improving the instruments of state support for investment projects of socio-ecological and economic orientation will increase the investment attractiveness of the Arctic zone and register up to 90 new business structures, attract up to 13.2 billion rubles of “green” investments to the national economy, guarantee budget revenues of up to 1.6 billion rubles over a 10-year period, and create up to 2.7 thou- sand new jobs with a high level of wages for the population of the Arctic zone. Achievement of the forecast results is possible only through the balanced work of all participants — business structures, government bodies and the population of this territory.

Improvement of the instruments of state support for the processes of investment in “green” projects will contribute to the creation and promotion of new investment initiatives based on “green” high-performance technologies; ecological diversification of existing production facilities with the production of qualitatively new products; attraction of “green” investment capital into the national and regional economy; creation of conditions for the preservation of natural resources, including human capital; direct participation of state structures in environmental safety issues; ensuring the return on invested budget capital through the inflow of tax revenues into the domestic budget system at all levels; achieving a balance of environmental and socio-economic interests of the population, business structures and state authorities.

Список литературы Development of Instruments of State Support for ESG Projects in the Arctic Zone of the Russian Federation

- Kovalevich I.V. “Green” Bonds — A New Instrument for Financing “Green” Projects. Journal of Econ-omy and Entrepreneurship, 2020, no. 11 (124), pp. 1284–1287. DOI: https://doi.org/10.34925/EIP.2020.124.11.257

- Agorakia L. K., Aslanidis N., Kouretas G.P. How Has COVID-19 Affected the Performance of Green In-vestment Funds? Journal of International Money and Finance, 2023, vol. 131, art. 102792. DOI: https://doi.org/10.1016/j.jimonfin.2022.102792

- Fatica S., Panzica R., Rancan M. The Pricing of Green Bonds: Are Financial Institutions Special? Jour-nal of Financial Stability, 2021, vol. 54 (8), art. 100873. DOI: https://doi.org/10.1016/j.jfs.2021.100873

- Wu Y. Are Green Bonds Priced Lower Than Their Conventional Peers? Emerging Markets Review, 2022, vol. 52 (1), art. 100909. DOI: https://doi.org/10.1016/j.ememar.2022.100909

- Billah M., Elsayed A. H., Hadhri S. Asymmetric Relationship between Green Bonds and Sukuk Mar-kets: The Role of Global Risk Factors. Journal of International Financial Markets, Institutions and Money, 2023, vol. 83 (2), art. 101728. DOI: https://doi.org/10.1016/j.intfin.2022.101728

- Zhao L., Chau K.Y., Tran T.K. Enhancing Green Economic Recovery Through Green Bonds Financing and Energy Efficiency Investments. Economic Analysis and Policy, vol. 76, pp. 488–501. DOI: https://doi.org/10.1016/j.eap.2022.08.019

- Fleta Asin J., Munoz F. When Bigger Is Better: Investment Volume Drivers in Infrastructure Public-Private Partnership Projects. Socio-Economic Planning Sciences, 2022, no. 86 (2), art. 101473. DOI: https://doi.org/10.1016/j.seps.2022.101473

- Andrade N., Cortez M.C., Silva F. The Environmental and Financial Performance of Green Energy In-vestments: European Evidence. SSRN Electronic Journal, 2022, art. 107427. DOI: https://doi.org/10.2139/ssrn.3889683

- Fafaliou I., Giaka M., Konstantios D., Polemis M. Firms’ ESG Reputational Risk and Market Longevity: A Firm-Level Analysis for the United States. Journal of Business Research, 2022, vol. 149, pp. 161–177. DOI: https://doi.org/10.1016/j.jbusres.2022.05.010

- Yi Y., Wang Y., Fu Ch., Li Y. Taxes or Subsidies to Promote Investment in Green Technologies for a Supply Chain Considering Consumer Preferences for Green Products. Computers & Industrial Engi-neering, 2022, no. 171, art. 108371. DOI: https://doi.org/10.1016/j.cie.2022.108371

- Nagya R.L.G., Hagspiel V., Kort P. M. Green Capacity Investment under Subsidy Withdrawal Risk. En-ergy Economics, 2021, no. 98, art. 105259. DOI: https://doi.org/10.1016/j.eneco.2021.105259

- Bigerna S., Wen X., Hagspiel V., Kort P.M. Green Electricity Investments: Environmental Target and the Optimal Subsidy. European Journal of Operational Research, 2019, no. 279, pp. 635–644. DOI: https://doi.org/10.1016/j.ejor.2019.05.041

- Iram R., Lan J., Lu Q., Farooq M.U., Ma X. Assessing the Combining Role of Public-Private Investment as a Green Finance and Renewable Energy in Carbon Neutrality Target. Renewable Energy, 2022, vol. 196, pp. 1357–1365. DOI: https://doi.org/10.1016/j.renene.2022.06.072

- Frolova N.N. Zelenaya standartizatsiya “zelenoy produktsii” [Green Standardization of “Green Prod-ucts”]. Vestnik Vserossiyskogo nauchno-issledovatel'skogo instituta zhirov [Bulletin of the All-Russian Scientific Research Institute of Fats], 2022, no. 1–2, pp. 76–78. DOI: https://doi.org/10.25812/VNIIG.2022.35.82.004

- Borkova E.A. Government Support for Green Investment (Renewable Energy). Administrative Con-sulting, 2020, no. 3 (135), pp. 73–79. DOI: https://doi.org/10.22394/1726-1139-2020-3-73-79

- Gurova I.P. Foreign Direct Investment in Green Economy. Journal of International Economic Affairs, 2019, vol. 9, no. 2, pp. 597–608. DOI: https://doi.org/10.18334/eo.9.2.40623

- Borkova E.A., Timchenko M.N., Markova A.A. Investments in Green Technologies as a Tool of the Russian Economic Growth. Business. Education. Right, 2019, no. 3 (48), pp. 87–91. DOI: https://doi.org/10.25683/VOLBI.2019.48.341

- Brukovskaya A.I., Domanova M.E., Dmitriev V.D. The Main Factors Stimulating and Limiting the De-velopment of Green Investments in Russia. Journal of Economy and Entrepreneurship, 2022, no. 5 (142), pp. 340–343. DOI: https://doi.org/10.34925/EIP.2022.142.5.064

- Serova N.A. Experience of Statistical Measurement of Transformations in the Industrial Structure of Investments in the Regions of the Arctic Zone of Russia. Fundamental Research, 2020, no. 11, pp. 167–172. DOI: https://doi.org/10.17513/fr.42893

- Polyanin A.V., Matveev V.V. Improvement of the Tools for Managing the Region: Creating Municipal Economic Zones. Modern Economics: Problems and Solutions, 2021, no. 9 (141), pp. 185–198. DOI: https://doi.org/10.17308/meps.2021.9/2682