Development of the lithium industry in Russia and China in the context of energy transition and achieving carbon neutrality

Автор: Ma H., Li Zh., Cheng X., Pechenskaya-polishchuk M.A., Malyshev M.K.

Журнал: Economic and Social Changes: Facts, Trends, Forecast @volnc-esc-en

Рубрика: Branch-wise economy

Статья в выпуске: 1 т.18, 2025 года.

Бесплатный доступ

Currently, the world community is united in the problems of sustainable development of territories and enterprises, achieving carbon neutrality and transition to environmentally friendly forms of energy. An important element in solving these problems is the greening of public and personal transport, the motive power of which is based on high-power batteries. At the same time, the key component in batteries is lithium, which has already received large-scale use in a number of high-tech industries. Despite the fact that Russia ranks 14th according to lithium reserves, with about 1 million tons (0.95%) in its territory, lithium is not mined in the Russian Federation, and until 2022 the raw material was imported from Latin American countries. Rising prices for lithium, as well as a growing demand from electric car manufacturers, have increased interest in development of lithium projects among Russian companies such as Rosatom, Gazprom and Norilsk Nickel. In China, on the contrary, lithium production has increased 103-fold over the past 30 years - from 320 thousand tons in 1994 to 33 million tons by 2023, and the share of China in global production has increased by 13 percentage points, from 5.2 to 18.3%. Jiangxi Province can be considered the richest province, with large reserves of lithium minerals. This article aims to elaborate on conceptual directions for lithium production development in Russia and China as a key industry in transition to a green economy and achieving carbon neutrality. The information base for the research includes publications of domestic and foreign authors on the following issues: greening of global industry; reducing carbon footprint; features of lithium mining and production, as well as its use in electric vehicles. When writing the article, scientific methods such as comparative analysis and generalization, analysis and processing of statistical data were used

Russia, china, lithium mining, lithium battery production, sustainable development, carbon neutrality, energy transition, batteries

Короткий адрес: https://sciup.org/147251337

IDR: 147251337 | УДК: 339.3 | DOI: 10.15838/esc.2025.1.97.8

Текст научной статьи Development of the lithium industry in Russia and China in the context of energy transition and achieving carbon neutrality

Issues of the global energy transition, use of environmentally friendly forms of energy for industry and transport and achieving carbon neutrality are relevant for the world community, in particular for Russia and China. To improve environmental situation in the world and some countries, it is important to develop the lithium industry as a key industry in transition to a green economy. Lithium is a key component in energy storage systems (batteries), which are widely used in environmentally friendly electric transport.

This article aims to design conceptual directions for development of lithium production as a driver of growth in the new energy industry. To achieve the goal, key trends in the lithium industry in Russia and China will be identified, indicators of lithium production and reserves by country of the world will be reviewed, development features of lithium battery production in China will be studied, analysis of industrial risks and prospects for development of lithium resources will be carried out, conceptual directions for development of lithium production will be presented.

We chose China as an object of research is due to the high importance of Chinese industry for the global economy, as well as the fact that China produces the largest amount of carbon dioxide emissions. Thus, by the end of 2022, the volume of CO2 emissions in China amounted to about 12.7 billion tons, which is 2.6 times more than in the United States (4.85 billion tons, second place in the world), and 6.6 times more than in Russia (1.9 billion tons, fourth place in the world)1.

Materials and methods

This work is based on use of systems and interdisciplinary approaches, involving analysis of new energy development in the context of lithium industry development. Research results are structured into four large sections:

The first one presents the dynamics of lithium production in the world and leading countries, shows the largest countries in terms of reserves of this raw material, reflects the imbalance of supply and demand in the lithium market, reflects basic information on development of the lithium industry in Russia and evaluates the development of lithium markets in China. The second section discusses development features of the lithium industry in China. The third section reflects development features of leading lithium battery production enterprises in Jiangxi Province as the region with the largest reserves of lithium minerals in China. Analysis of industrial risks and prospects for the development of lithium resources was carried out. The fourth section presents conceptual directions for development of lithium production.

The information base for the research included works of domestic and foreign authors on the following issues: greening of global industry; creating a green economy; achieving carbon neutrality and reducing our carbon footprint; features of lithium mining and production, as well as its use in electric vehicles

The following scientific methods were used: comparative analysis and generalization; literature review on research topic; analysis and processing of statistical data; presentation of results in tabular and graphical form.

Theoretical aspects

In publications of domestic and foreign researchers, the topic of the green transition, carbon neutrality and environmentally friendly economy of the ESG agenda has been relevant for quite a number of years. One of the main factors in transition to a green economy is the use of environmentally friendly transport, both public and personal. The problem that exists today is the fact that despite the absence of emissions and carbon footprint from electric vehicles, cars are charged with using electricity, which in more than 60% of cases is generated from combustion of carbon sources of raw materials: coal, oil and gas (Salibgareeva, 2016).

Growing demand for green energy is accompanied by increased interest in raw materials such as lithium, as it is a key component in the production of lithium batteries. In the 21st century this resource is gaining increasing popularity in the global energy sector; it is called “new oil”, and environmental damage from the use of batteries is significantly lower than from the use of hydrocarbons (Abdulkadyrov, Idrisov, 2022).

In addition, the great environmental danger of electric vehicles lies not in emissions of energy generation but in consequences of production processes and use of powerful batteries. During production of electric vehicles, 2 times more greenhouse gases are also released into the atmosphere, which is associated with increased energy consumption due to technological reasons (Kovalenko et al., 2022).

Scientists from the Faculty of Geography at Lomonosov Moscow State University are discussing the trend of Chinese dominance in the global lithium market. Data and forecasts for lithium production have been collected to describe the market structure. It is indicated that cartel agreements lead to higher prices in the lithium market and vehicle industry is becoming the leading driver of the lithium battery market. These are the determining factors of the lithium market for the future (Sinyugin et al., 2019).

By 2050, European countries plan to reduce greenhouse gas emissions by 80–95% from the 1990 level, which means a complete abandonment of vehicles with internal combustion engines. As a result of this, significant changes will occur in international trade – in the sales structure, maintenance costs, service specialists training (Zelenyuk, 2020).

Using renewable energy is a key part of energy transition as the world strives to achieve a zero-CO2 future, energy independence and security. At the same time, to produce a wide range of products for the renewable energy sector, it is necessary to use rare earth metals and elements. (Mingaleeva, 2023).

Currently lithium production in Russia is characterized by a lack of production of lithium raw materials and a serious dependence on imports of lithium carbonate. A steadily growing demand for lithium from battery manufacturers creates favorable conditions for the development of the Russian lithium industry. The revival of production of strategic lithium raw materials for the purpose of import substitution is possible through the use of hydromineral deposits of underground brines in infrastructures of existing oil and gas enterprises and other economic entities (Boyarko et al., 2022).

A publication by scientists from the Institute of Economics and Industrial Engineering, Siberian Branch of the Russian Academy of Sciences addressed issues of energy cooperation between Russia and China in connection with China’s “green transition”, its reaching peak emissions in 2030 and its course toward achieving carbon neutrality by 2060. The authors noted that in the near future the key area of energy cooperation between the countries will be the development of the gas sector, since it is gas that is considered as a “transitional” fuel on the way from coal to renewable energy sources. In turn, China is actively switching to the use of gas in the energy and residential sectors. However, given the scale of the Chinese economy, coal will be in demand for a long time, since technological and economic reasons make it difficult to quickly abandon this raw material in favor of less carbon-intensive types of energy resources (Kryukov, Kryukov, 2022).

Studies conducted at the Siberian Federal University touch upon the topic of the formation of rules for countering climate change. They analyze the formulation of problems and goal-setting in the process of institutional design of the ecological and climatic agenda, highlight the scientific and political-economic grounds for choosing the directions of the world community’s response to the threats of climate change and related institutional changes. The mechanisms of shifting the priorities of sustainable development toward addressing climate issues and bringing to the fore the tasks of reducing greenhouse gas emissions through the transition to renewable energy sources (Kurbatova, Pyzhev, 2023) are shown. It was also noted that with the implementation of the accelerated transition to low-carbon sources of electricity, achieved through the transition of consumers to electric vehicles, by 2050, the expected reduction in greenhouse gas emissions will amount to 14.08 million tons of CO2–eq, and 12.86 million tons if the current structure is preserved (Kolyan et al., 2023).

The studies provide an overview of an institutional project for the formation of new institutions for global response to the threats of climate change as a project to ensure the adaptation of economic activity to a new type of restrictions – climatic ones. It is considered in detail how it was replaced by the project of a low-carbon economy, that is, the creation of carbon neutrality restrictions for economic activity. It is shown that the response to the challenges of climate change is associated with the formation of intertwining institutional projects with different designers (at the global and national levels). Arguments are given in favor of the fact that, taking into account the inevitability of climate change, measures to adapt the economy and society to their consequences should come to the fore. It is recommended to intensify the formation of an institutional project that meets the national interests of creating competitive advantages of the Russian economy.

A researcher at the Center for Energy Research, Primakov National Research Institute of World Economy and International Relations (IMEMO) identified needs of lithium in electric batteries of various devices. Therefore, by 2025 the demand for lithium (relative to 2014) from mobile phone manufacturers will increase to 18.1 thousand tons (+2.2 times), in tablets – up to 16.8 thousand tons (+2.2 times), in laptops – up to 16.5 thousand tons (+2.2 times), in power tools – up to 15.8 thousand tons (+4 times), in hybrid cars – up to 55.7 thousand tons (+6.2 times), in electric vehicles – up to 360 thousand tons (+20 times). Global consumption of lithium in electric batteries will increase 8.6 times – from 55.8 to 480.5 thousand tons. The share of lithium demand for the production of electric vehicles will increase by 42.6 p.p. – from 32.3 to 74.9% (Sinitsyn, 2018).

The VolRC RAS journal Economic and Social Changes: Facts, Trends, Forecast has repeatedly published articles by colleagues from Jiangxi Academy of Social Sciences related to environmental issues and achieving carbon neutrality in this Chinese region. Deng Hong listed scientific approaches to environmental protection in underdeveloped areas of China, described organization’s experience during periods of economic recovery and rapid economic development of the country and also considered current issues of strengthening environmental protection at the present stage (Deng, 2013).

Gao Mei updated ways to develop low-carbon production in Jiangxi Province, including: increasing the share of the tertiary sector in the economy; intensifying low-carbon production in three sectors of the economy; development and creation of technological innovations in low-carbon industry; creating a low carbon energy mix; carrying out transfer of industrial production within the country and abroad with the condition of developing low-carbon production (Gao, 2015).

Zhang Yihong highlighted the directions of integrated economic and environmental development of Jiangxi Province, which consist in emphasizing the priority of environmental protection and creating a harmonious ecological system, importance of green development and building an effective ecological-economic system with low resource consumption, need for urbanization and expanding space for developing the integration of economics and ecology, introducing innovative solutions into the system for assessing and increasing performance of government bodies (Zhang, 2015).

In studies by foreign authors, as well as Chinese scientists, the issues of carbon neutrality, reducing atmospheric emissions and green economy are even more relevant. In response to climate change, the Chinese government has set a clear goal to reach its carbon peak by 2030 and achieve carbon neutrality by 2060, aiming to gradually reduce carbon dioxide (CO2) emissions to zero (Zhao et al., 2022).

A joint publication by researchers from China and Denmark raised the question of environmental friendliness in obtaining lithium from solid minerals and brines. It is noted that lithium production in China mainly depends on hard rock lithium ores, which has disadvantages in terms of resources, environment and economics compared with lithium extraction from brine. Lithium extraction from ores, calcination, roasting, refining and other processes consume more resources and energy. Their environmental impact is accompanied by pollutant emissions from fossil fuel use, which is 9.3–60.4 times higher than the impact of lithium extracted from brines (Gao et al., 2023).

A paper by scientists from India National Institute of Technology and Australia Queensland University of Technology argues that electric vehicles (EVs) are the future of the automotive industry in terms of reducing greenhouse gas emissions, air pollution and improving living standards around the world. With the introduction of electric vehicles, there is a reduction in greenhouse gas emissions but an increase in human toxicity due to increased use of metals, chemicals and energy to produce powertrains and high-voltage batteries (Verma et al., 2022).

A report by UNESCO International Center for Global Geochemistry, the Institute of Geophysical and Geochemical Research of China and the Chinese Academy of Geological Sciences identified 31 geochemical anomalies that are associated with four types of lithium deposits: granite-pegmatite and igneous, salt lake brines and underground brines, clay rocks and secondary weathering clays (bauxites). New discoveries of anomalies, especially associated with clay rocks and desert basins, may provide potential areas for new sedimentary lithium deposits (Wang et al., 2020).

Researchers from the Chinese Academy of Geological Sciences noted that since 2012, certain progress has been made in study of resources, metallogenesis and integrated use of lithium deposits in China. First, advances have been made in lithium exploration in the provinces of Sichuan, Xinjiang, Qinghai and Jiangxi (autonomous area). Lithium deposits are found not only in pegmatite rocks but also in granite rocks and sedimentary rocks. Second, there have been improvements in geological exploration techniques, geochemical and geophysical surveys, remote sensing technologies and even drilling technologies that allow ore bodies to be quickly identified. Third, mechanisms of lithium mineralization have been summarized by analyzing the relationship between lithium contentand types of geological phenomena (Wang et al., 2020).

Scientists from the Institute of Mineral Resources of China claim that China will fully electrify traditional internal combustion engine vehicles (ICEVS) by 2050. Rapid development of electric vehicles (EVs) has led to continuous increase in demand for traction lithium-ion batteries (LIB), which has triggered increase in demand for specific lithium materials (Qiao et al., 2021).

Thus, research on achieving carbon neutrality, transition to a green economy, ESG agenda, as well as active role of lithium as a driver of these areas is significant for the global community and countries seeking to improve the environmental situation.

Research results

Development features of the global lithium industry

For 1994–2023 average annual global lithium production increased 11.5-fold – from 10.5 to 120.3 thousand tons, while the share of the five largest countries producing lithium increased from 72.8 to 98.6% (+25.8 p.p.).

At the end of 2023 Australia produced 86 thousand tons of lithium, which is 50.6 times more than in 1994 – 1.7 thousand tons. Its share in the world reached 47.8% of the world level, in 1994 – 27.9%. The country’s strong industry development has been driven by a surge in investment activity in Australian lithium projects, highlighting Australia’s rapidly growing role in the global battery materials supply chain. Combination of rapidly growing demand and significant local reserves of the metal has caused the Australian lithium market to intensify. SQM, a lithium giant in Chile, has committed to invest approximately 13.9 million US dollars to acquire a 19.99% stake in Azure Minerals, which owns a large stake in the Andover lithium project in Pilbara region of Washington in Western Australia2.

Lithium production in Chile increased 22-fold – from two thousand tons in 1994 to 44 thousand tons in 2023. The country’s share in the global level, on the contrary, decreased by 8.4 p.p. – from 32.8 to 24.4%. Chile is the second largest lithium producer after Australia. Along with the increase in production at Albemarle, the largest Chilean mine, the number of workers is also growing3.

China ranks third in the world in lithium production, which in 1994 amounted to 320 tons, which is 103.1 times less than the level of 2023 – 33 thousand tons. The sharp increase in demand for lithium in the country is accompanied by an intensive increase in the production of electric vehicles, which is due to implementation of the Chinese Government’s policy toward greening the economy. For 2021–2022 sales of electric vehicles in China increased by 82% and reached 6.2 million units. In Europe, by comparison, sales growth over the same period was only 15% to 2.7 million tons. Currently the problem of the sharply increased demand for lithium is resulting in the fact that the largest Chinese mining companies are investing in lithium mining projects abroad. However, the model of pumping resources has exhausted itself: countries that control the largest share of lithium production in the world are demanding that China become more adaptable to needs of the development of national economies4.

In Argentina (4th place), active lithium mining began in 1998 by the American corporation Livent. This happened at a mine in Salar del Hombre Muerto – Catamarca province in northwestern Argentina5. During the period in question, lithium production in the country increased 1,200-fold and by 2023 amounted to 9.6 thousand tons. In January – February 2023, lithium exports doubled compared to the same period in 2022; in February, lithium supplies abroad were at a record level of 58 million dollars. A number of foreign companies operating in Argentina invest in lithium projects: Chinese Ganfeng Lithium and American Livent, which will send raw materials for production of batteries for BMW cars. Investments in Argentine lithium projects since 2020 amounted to 5.1 billion dollars6.

Lithium production in Brazil (5th place) showed an increase of 153.1 times – from 32 to 4,900 tons. A distinctive feature of Brazilian lithium, mined in the state of Minas Gerais, is its high degree of purity, which allows it to be used to produce more powerful batteries. Therefore, lithium from Brazil has a competitive advantage that allows it to optimize investments7. For 1994–2023 total lithium production in the five leading countries increased by 43.7 times – from 4.1 to 177.5 thousand tons (Tab. 1) .

Data from the U.S. Geological Survey indicate the presence of lithium mining in Russia in 1994– 2001 and in 2004–2006. In total, over these 11 years about 19 thousand tons or 1.73 thousand tons on average annually were produced.

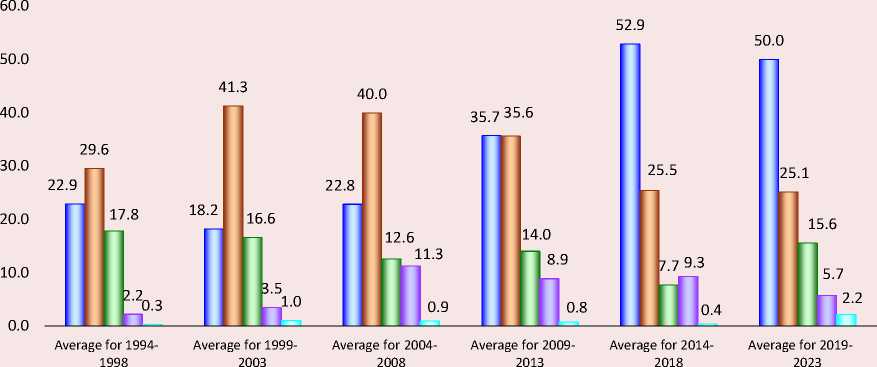

Changes in lithium production volumes predetermined structural shifts in the leading countries on a global scale. The average annual share of Australia increased by 27.1 p.p – from 22.9% in 1994–1998 up to 50% in 2019–2023. Chile’ s share decreased from 29.6 to 25.1% (-4.5 p.p.). The share of China also decreased – from 17.8 to 15.6% (-2.2 p.p.). The average annual contribution of Argentina and Brazil to global lithium production increased to 5.7 and 2.2%, respectively (Fig. 1).

In 2023 due to ongoing geological exploration identified lithium reserves around the world increased significantly (+7.2% by 20228) and amounted to about 105.1 million tons (Tab. 2) . Taking into account global production of 180 thousand tons, which is equivalent to the lithium reserves in Ghana (21st place), we can conclude that the level of lithium extracted from subsoil by all countries of the world is only 0.17% of proven reserves. The potential for development of the industry is enormous.

Table 1. Dynamics of lithium production in the 5 leading countries for 1994–2023

Period Australia Chile China Argentina Brazil Total World share World Tons % Tons 1994 1700 2000 320 8 32 4060 66.6 6100 Average for 1994–1998 2400 3100 1868 232 32 7632 72.8 10480 Average for 1999–2003 2638 5980 2400 501 149 11668 80.6 14480 Average for 2004–2008 5278 9232 2914 2604 213 20241 87.6 23100 Average for 2009–2013 10708 10686 4210 2664 238 28506 95.0 30000 Average for 2014–2018 28040 13500 4100 4940 212 50792 95.8 53040 Average for 2019–2023 60140 30220 18740 6872 2610 118582 98.6 120300 2023 86000 44000 33000 9600 4900 177500 98.6 180000 2019–2023 to 1994–1998 25.1 times 9.7 times 10.0 times 29.6 times 81.6 times 15.5 times +25.8 p.p. 11.5 times 2023 to 2019 50.6 times 22.0 times 103.1 times 1200 times 153.1 times 43.7 times +32 p.p. 29.5 times Source: own compilation based on USGS data. Lithium Statistics and Information. Available at:

Figure 1. Average annual share of the five leading countries in lithium production for 1994–2023, %

□ Australia □ Chile □ China □ Argentina □ Brazil

Source: Own compilation based on data from the U.S. Geological Survey.

Table 2. Rating of countries by proven lithium reserves for 2023 and their share in the world

No. Country Lithium reserves, thousand tons Share in the world, % No. Country Lithium reserves, thousand tons Share in the world, % 1 Bolivia 23000 21.9 13 Peru 1000 1.0 2 Argentina 22000 20.9 14 Russia 1000 1.0 3 USA 14000 13.3 15 Mali 890 0.8 4 Chile 11000 10.5 16 Brazil 800 0.8 5 Australia 8700 8.3 17 Zimbabwe 690 0.7 6 China 6800 6.5 18 Spain 320 0.3 7 Germany 3800 3.6 19 Portugal 270 0.3 8 Canada 3000 2.9 20 Namibia 230 0.2 9 Congo 3000 2.9 21 Ghana 200 0.2 10 Mexico 1700 1.6 22 Finland 68 0.1 11 Czech 1300 1.2 23 Austria 60 0.1 12 Serbia 1200 1.1 24 Kazakhstan 50 0.05 World total: 105078 100 Source: Own compilation based on USGS data (U.S. Geological Survey, Mineral Commodity Summaries, January 2024, lithium. Available at:

The five richest countries in terms of lithium reserves, having 3.4 of all world reserves, are: 1 – Bolivia (23 million tons / 21.9%); 2 – Argentina (22 million tons / 20.9%); 3 – USA (14 million tons / 13.3%); 4 – Chile (11 million tons / 10.5%); 5 – Australia (8.7 million tons / 8.3%).

As for China (6th place), the U.S. Geological Survey estimates its reserves at 6.8 million tons or 6.5% of the world’s reserves. With lithium production of 33 thousand tons in 2023 China uses only 0.49% of its potential.

Russia ranks 14th in lithium reserves, having about 1 million tons (0.95%) in the ground, while lithium is not mined in the Russian Federation and until recently all raw materials were imported from Latin American countries. In 2022 Argentina and Chile stopped supplies to Russia. They accounted for up to 80% of lithium purchases. In addition, for 2021–2022 lithium has risen in price on the world market by almost 8 times, so the profitability of its import compared to local production has begun to be questioned.

In this regard, Russia wants to begin industrial lithium production and companies such as Rosatom and Norilsk Nickel are planning to launch the first project at the Kolmozerskoye deposit in the Murmansk Region. The lithium project was also carried out by Gazprom and planned to extract it from the Kovykta deposit9.

Currently most lithium concentrate projects are scheduled to begin in 2024. Companies involved in the transportation and storage of raw materials, as well as enterprises involved in the production and distribution of energy batteries and electric vehicles, acquire exclusive rights to explore and mine lithium.

Many countries recognize strategic importance of lithium resources. In Chile, Bolivia and Mexico lithium is included in the list of national strategic resources along with oil. Control over the exploitation of lithium resources in the world is being tightened.

According to the China Nonferrous Metals Industry Association, in 2021 the demand for lithium in the world was 434 thousand tons and the supply was 485 thousand tons. Supply exceeded demand by 51 thousand tons. Table 3 shows the relationship between supply and demand for global lithium resources in 2020–2025, calculated taking into account the growth rate of the global economy.

Table 3. Demand and supply ratios for lithium in the world for 2017–2025, thousand tons

|

Period |

Demand |

Demand |

Supply |

Supply –Demand |

|

|

Cathode materials |

Other |

||||

|

2017 |

109.7 |

124 |

240 |

250 |

+ 10 |

|

2018 |

154.3 |

127 |

268 |

309 |

+ 41 |

|

2019 |

185.9 |

131 |

305 |

363 |

+ 58 |

|

2020 |

240. 9 |

128 |

369 |

422 |

+ 53 |

|

2021 |

298.9 |

135 |

434 |

485 |

+ 51 |

|

2022 |

369 |

137 |

507 |

533 |

+ 26 |

|

2023 |

460.9 |

140 |

601 |

624 |

+ 23 |

|

2024 |

577.7 |

143 |

721 |

730 |

+ 9 |

|

2025 |

731.6 |

146 |

877 |

854 |

-23 |

Source: China Nonferrous Metals Industry Association.

According to Canalys, an independent technology market research agency, global sales of electric vehicles totaled 6.5 million in 2021 or 109% year-on-year, accounting for 9% of total passenger car sales. As the global trend toward carbon neutrality continues, the annual growth rate of electric vehicle sales will exceed 40% in the next three years and global sales will reach 24 million in 2025. Considering that 230 thousand tons of lithium carbonate are required to produce 6.5 million electric vehicles, in 2025 demand will be about 880 thousand tons, which will lead to a long-term and permanent supply shortage.

Development features of the lithium industry in China

According to the data released by the Ministry of Natural Resources of the People’s Republic of China, most of China’s lithium mineral resources are located in Qinghai, Tibet, Sichuan and Jiangxi, with Sichuan accounting for 98.1% of all proven lithium deposits in the country (Tab. 4). Qinghai and Tibet account for 73.1% of lithium brine deposits. Lepidolite minerals are mainly found in Jiangxi and Yichong. Although China appears to have a large reserve of all types of lithium ores, the concentration of lithium in the country’s salt lakes is less than 500 mg per liter, and the low quality of mineral formations and the high content of magnesium ions impurities make it very difficult to extract lithium from the mined raw materials. In addition, Qinghai Province and the Tibet Region are characterized by harsh water conditions, poor infrastructure, including transport and high-mountainous location, which greatly hinders the extraction of raw materials and the exploration of new deposits. Environmental regulations have also hampered the industrial exploitation of lithium resources, leading to supply shortages. As a result, Chinese lithium mining enterprises are still in dire need of importing high-quality lithium raw materials. Currently, dependence on imports is more than 70%.

In recent years, China has adopted a number of documents aimed, among other things, at developing the production of lithium batteries and markets for their subsequent use. Such measures create a favorable climate for development of the production of electric batteries and energy storage systems. Lithium battery industry will enter an upswing phase.

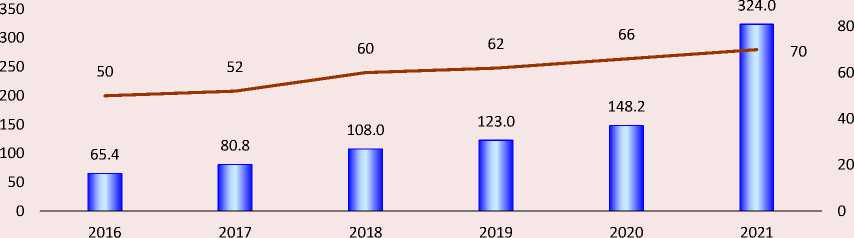

By the end of 2021 the global lithium battery market capacity was 545 GWh, the Chinese market was 324 GWh, accounting for 59.4% of the former. For five years, China has been the largest lithium battery consumption market with a market share of 70% (Fig. 2).

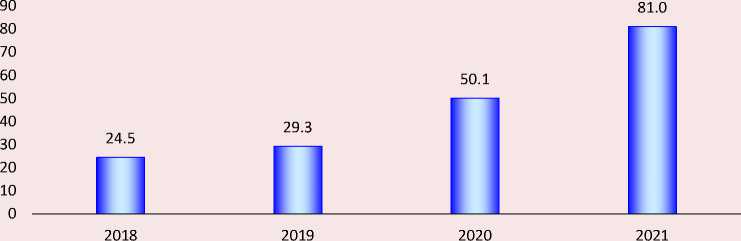

The annual profit from lithium battery production was 370.6 billion yuan or 125.5%. At the same time, imports of lithium carbonate increased over four years and in 2021 amounted to 81 thousand tons with an annual growth of 61.7% (Fig. 3).

Table 4. Distribution of proven lithium oxide resources in China, thousand tons

|

Territory |

Resources |

Type of minerals |

|

Qinghai |

1518 |

Lithium salts |

|

Tibet |

197 |

Lithium salts |

|

Sichuan |

217 |

Spodumene |

|

Jiangxi |

369 |

Lepidolite |

|

Total |

2345 |

- |

|

Source: China Mineral Resources 2022. |

||

Figure 2. China lithium battery market size and global market share of Chinese lithium enterprises, 2016–2021

400 100

■ ■ China’s lithium battery market (GWh)

^^^^^mShare of Chinese lithium enterprises on the global market, %

Source: Ministry of Industry and Information Technology of the People’s Republic of China.

Figure 3. Import of lithium carbonate to China for 2018–2021, thousand tons

Source: Ministry of Industry and Information Technology of the People’s Republic of China.

Experience in the development of lithium production in China with the example of industrial enterprises in Jiangxi Province with the largest reserves of lithium minerals in the country

Jiangxi is one of the four provinces with large reserves of lithium minerals. The main part of deposits is located in the Jiuling and Ugushan metallogenic zones. The city of Yichun is called the lithium capital of Asia, as it is home to the world’s largest polymetallic lepidolite mine. According to public information, the lithium oxide reserves in the city of Yichun and the surrounding areas amount to more than 2.58 million tons or 40% of the country’s lepidolite reserves, from which approximately 62.5 million tons of concentrate with a lithium oxide content of 4% can be obtained. Lepidolite mines of prefecture-level city of Yichun are located in 4 areas: Yifeng County, Fengxin County, county-level city of Gao’an and Yuanzhou District.

Advantages of China’s Leading Lithium Battery Enterprises

-

1. Ganfeng Lithium – vertical expansion of production and creation of lithium circulation in industry. Founded in 2000, Ganfeng Lithium is a

-

2. CATL – horizontal expansion of production, storage devices and rapid replacement of batteries. Founded in 2011, CATL develops, manufactures and markets battery and energy storage systems for new energy vehicles. The company pays great attention to research and innovation, investing approximately 6% of profits in them. CATL has developed six technical development concepts: high energy density, long service life, fast charging (XFC) batteries, safety, automatic temperature control and intelligent control. The technical indicators of the batteries produced by the company are at a high level. For example, the cell density reaches 330 Wh/kg, the maximum service life is 16 years, the range is 2 million kilometers, and the battery itself is charged to 80% in 5 minutes. CATL is a leading Chinese manufacturer of batteries for new energy vehicles.

world leader in the production of lithium products (five main production lines and more than 40 lithium compounds and metals). As the product range increased and productivity improved, the company gradually invested in the mining of lithium raw materials and actively developed the production and processing of lithium batteries. The company created the industrial lithium cycle and took a leading position. Ganfeng Lithium owns rich metal deposits in Australia, Argentina, Ireland, Mexico, as well as in Jiangxi and Qinghai, with the help of which the company has formed a sustainable mining system for raw materials. Mount Marion and the Pilbara in Australia are the company’s main sources of lithium concentrates.

Risk analysis for lithium battery industry development

Driven by factors such as the new wave of the pandemic, deteriorating Sino-U.S. relations, European Union (EU) interventions and rising geopolitical tensions, lithium battery industry in Jiangxi still faces a number of risks hampering its development, including:

-

1. “The prisoner’s dilemma” and intensification of regional competition.

-

2. Insufficient number of enterprises producing final products.

Xinyu City’s “Thirty Articles on Lithium Batteries” talks about approaching leadership in the global lithium battery market. “Proposals for the Accelerated Development of the New Energy (Lithium Battery) Industry 2021–2025” of Yichun City notes expansion and strengthening of influence of the lithium capital of Asia in the new energy (lithium battery) industry. “Development Plan of the New Energy and New Energy Automotive Industry in Ganzhou (2021–2025)” proposes to promote expansion, development and strengthening of the new energy industry in accordance with requirements of all leading vehicle and lithium battery manufacturing enterprises.

Considering development trends of the lithium industry within the country and abroad, the main areas of application of lithium batteries include the production of household appliances, alternative energy sources and energy storage systems. However, most enterprises in the provincial lithium battery industry are involved in the extraction and processing of raw materials rather than the production of end products, which is a serious problem.

The policy of “double control” of energy consumption hinders industrial expansion

In the lithium battery industry of Jiangxi Province, the largest production volume comes from lithium ore smelting, anode material creation and graphitization. All this requires a lot of energy. In addition, local porcelain clay contains low quality oxide. The energy costs for its processing significantly exceed the costs of extracting lithium from lepidolite. Cost limits are set in energy consumption in the production of lithium salt. The “dual carbon” and “dual control” energy consumption policies are putting strong pressure on the development of new lithium battery projects in Jiangxi Province.

Conceptual directions for development of lithium production as a growth driver for the new energy industry

In connection with actualization of the issue of the new energy industry in different countries, the issue of development of lithium production is being raised at the state level. For example, Xi Jinping, General Secretary of the CPC Central Committee, notes: “Without a long-term strategy, shortterm achievements are impossible. Without full consideration, simple actions are not feasible”. Looking at lithium battery industry in its recovery phase, it can be said that it has a bright future ahead of it. Jiangxi is rich in natural resources and has advanced manufacturing. The province should use the “dual carbon” policy to accelerate emergence of a new clean energy industry and accelerate its development.

In the Russian Federation, there is a significant shortage of lithium, which is used primarily in nuclear power, energy storage systems and as a raw material in production of slag-forming mixtures for ladles, lubricants for mining industries, and creation of production of lithium-ion batteries. The Russian market is represented only by lithium processing facilities. Enterprises operate entirely on imported raw materials and capacity utilization level is estimated at 30%. Accelerated implementation of a set of measures to support development projects for extraction of lithium ores in 2023–2030. In areas of the Zavitinskoye, Polmostundrovskoye, Kovyktinskoye, Yaraktinskoye and Kolmozerskoye deposits will largely meet Russia’s internal needs for lithium raw materials10.

Based on the synthesis of experience of different countries and successful practices in development of lithium production in Chinese province of Jiangxi, research presents four directions for the development of lithium production.

-

1. Promoting joint development of enterprises.

-

2. Strengthening production, supply chain and creating a lithium battery industry ecosphere.

-

3. Using innovations.

-

4. Attracting qualified personnel, creating training infrastructure and promoting environ mental development of industry.

Differentiated development is such because of different types of resources, location and different advantages. The Chinese province of Jiangxi is divided into eleven prefecture-level cities: Nanchang, Fuzhou, Ganzhou, Jian, Jingdezhen, Jiujiang, Pingxiang, Shanzhao, Xinyu, Yichun and Yingtan. For example, Yichun is characterized by the integrated development and use of lepidolite, the production of lithium carbonate, anode and cathode separator materials, aluminum film and lithium batteries. Xinyu produces lithium salt and aims to create a new industrial base for lithium batteries. Ganzhou is characterized by recycling and recycling of energy batteries and accumulators. Jiujiang focuses on the production of electrolytes. In Nanchang, Shanzhao and Fuzhou, special attention is paid to the production of lithium batteries for energy vehicles. It is necessary to promote integration and joint development of all areas of production by establishing cooperation between leading lithium battery enterprises, large automobile and photovoltaic companies, promoting the complementarity of resources, full use of advantages and joint development of enterprises.

It is necessary to use government support measures, strengthen production and ecosphere of lithium battery industry, to use resources of areas with rich lithium reserves to build a strong lithium industry. It is important to strengthen resource support and build a strong supply chain, as well as improve resource exploitation capabilities, accelerate comprehensive supply organization, build a lithium battery recycling system, build a competitive material and processing base, and carry out joint balanced, coordinated and environmentally friendly development of production of basic and auxiliary materials for production lithium batteries. It is necessary to optimize and improve conditions for industrial development and expansion of production areas.

It is important to promote innovative development of enterprises, help them create new projects and technology, conduct research and develop new electrode materials (lithium-manganese cathode materials, silicon-carbon anode materials, high-voltage electrolyte materials and separators), lithium-ion batteries with a new power system and all-metal blocks. It is necessary to implement a mechanism to stimulate technological innovation, encourage application of lithium products in related fields and encourage enterprises involved in the production of battery components, accumulators and vehicles to realize joint innovation and technical breakthroughs.

It is necessary to attract qualified personnel to work and produce lithium products, create thematic training programs in educational institutions for the development of the lithium industry. It is also necessary to establish educational institutions that will produce specially trained personnel. It is necessary to help large lithium enterprises implement the “dual carbon” policy, accelerate, simplify regulation and reduce carbon emissions, build an energy management system and create environmentally friendly production. It is important to carry out intelligent transformation of lithium battery production enterprises, support these enterprises in modernizing production through the use of AI (artificial intelligence).

Conclusion

-

1. Greening the global economy, transition to green energy and achieving carbon neutrality are becoming pressing issues for the 21st century. One of the key ways to achieve these goals is to reduce atmospheric emissions through increased production and the use of environmentally friendly public and personal transport. This type of transport includes electric vehicles whose engines run on high-power lithium batteries. However, despite

-

2. High potential for development of the lithium industry in the world has been identified. This is due to the fact that, according to the U.S. Geological Survey for 2023, there are approximately 105.1 million tons of proven lithium reserves worldwide. At the same time, just under 0.2% of the world’s lithium reserves are mined. The richest lithium reserves are Bolivia (23 million tons / 21.9%), Argentina (22 million tons / 20.9%), USA (14 million tons / 13.3%), Chile (11 million tons / 10.5%) and Australia (8.7 million tons / 8.3%). China ranks 6th in lithium reserves (6.8 million tons / 6.5%) and Russia ranks 14th (1 million tons / 0.95%).

-

3. It was determined that for 1994–2023 global lithium production increased 29.5 times – from 6.1 to 180 thousand tons. The top five in production for 2023 included countries such as Australia (86 thousand tons / 47.8%), Chile (44 thousand tons / 24.4%), China (33 thousand tons / 18.3%), Argentina (9.6 thousand tons / 5.3%) and Brazil (4.9 thousand tons / 2.7%). In total, they account for about 98.6% of global lithium production, and the greatest growth was observed in Argentina (+1200 times), China (+103.1 times), Australia (+50.6 times), Brazil (+32 times), Chile (+22 times). In Russia, despite the presence of reserves (about 1 million tons), lithium is imported from Latin American countries; however, the instability of the geopolitical situation and prices provoke the domestic industry toward development and independence.

-

4. Based on the analysis of development of lithium battery production under the new energy industry of the Chinese province, it was determined that most of China’s lithium mineral resources are located in Qinghai, Tibet, Sichuan and Jiangxi, with Sichuan accounting for 98.1% of all proven lithium deposits in the country. Qinghai and Tibet account for 73.1% of lithium brine deposits, and lepidolite

minerals are mainly found in Jiangxi and Yichong. For 2016–2021 the size of the Chinese lithium battery market has grown 5 times, from 65.4 to 324 GWh. The share of Chinese lithium enterprises in the global market increased by 20 p.p. – from 50 to 70%. The expansion of electric car production in China has led to increased imports of lithium carbonate into the country. In total for 2018–2021 purchases of these raw materials increased 3.3 times – from 24.5 to 81 thousand tons.

-

5. The following were highlighted as conceptual directions for the development of lithium production as a growth driver for the new energy industry: promoting joint development of enterprises; strengthening production, supply chain and creating a lithium battery industry ecosphere; using innovations; attracting qualified personnel, creating training infrastructure and promoting environmental development of lithium battery industry.

the environmental friendliness of these cars, production and disposal of batteries, as well as their charging, is associated with a significant environmental burden.