Direct vs indirect investments: the implications of a choice for a short-term private investor

Бесплатный доступ

The subject of this article is the implications of a choice between direct and indirect investments for a short-term private investor. The purpose of this article is to produce a review of scientific research, conducted on the topic, and with its help to define short-term private investors’ necessities and to examine money market instruments versus money-market mutual funds as tools for short-term private investors. The conducted analysis of the recent research publications has shown that theshort-term private investors require high liquidity low risk instrument and can tolerate comparatively low returns, and that the best tools for such investments are money market instruments. During the research, we noted the trade-off between the T-bills and commercial papers with regards to risk, liquidity and yield, and considered the benefits of indirect investments via MMMFs; however, we came to the conclusion that the riskiness of such investments outweighs their benefits.

Direct investment, indirect investment, short-term private investor, t-bills, commercial paper, mmmf

Короткий адрес: https://sciup.org/147232406

IDR: 147232406 | УДК: 330.322.4 | DOI: 10.14529/em190109

Текст научной статьи Direct vs indirect investments: the implications of a choice for a short-term private investor

In the modern times of a fast-paced globalized economy, every common person knows about the main features of inflation and money devaluation over time. That is why many people prefer to invest their money in order to make it “work”. Money can be invested either short term (one year or less) or long term (over one year), depending on the risk and liquidity appetite of the investors. Due to the economic instability and budget constraints, private (or personal) investors often choose to invest into money markets as the safest and the most liquid option. They also have a choice to invest directly or via financial intermediaries.

We attempt to have a closer look at the shortterm investment instruments and investment options. The purpose of this article is to produce a review of scientific research, conducted on the short-term investment within the last 5 years, and to:

-

- Identify main needs of short-term private investors.

-

- Analyse money market instruments and mutual funds as tools for short-term private investors.

-

- Make an argument on which investment strategy is more beneficial to a short-term private investor.

The remainder of this paper is organised as follows. Section 2 presents the methodology. Section 3 identifies main needs of short-term private investors. Section 4 analyses money market instruments as a tool for short-term private investors. Section 5 analyses money market mutual funds as a tool for short-term private investors. Section 6 makes an argument on which investment strategy is more beneficial to a short-term private investor. The last section summarizes the findings and states the conclusion.

Methodology

The analysis is exploratory in nature and is based on an extensive review of earlier relevant studies on the various aspects of the short-term investments. The basis of the analysis is a collection of articles, published in credible scientific journals within the last 5 years.

Short-term private investors’ necessities

As the question is asking about the “requirements of a short-term private investor”, let us see the definition of a private investor. According to the Financial Times, a private investor is “a person or a private company one, whose shares are privately held and not traded on a stock market that makes investments, rather than a public company one whose shares are traded on a stock market.”As this definition does not reflect the meaning of the question, let us consider the term “personal investor”. According to the same source, a personal investor is “a person who invests their own money in financial markets, and is not working for a financial institution or as a professional investor.” The latter definition is more suitable in the context of our question, so we will keep using the term “private investor”, but with the meaning of a person, who invests his or her own money, as opposite to the institutional investor, which invests someone else’s money.

The research on the decision-making process, used by private investors, is scarce. Feeney, Haines and Riding (1999) believe that private investors make investment decisions in a similar way that the institutional investors do with some differences in the scale and stage of investment and the nature of the agency relationships between investor and investee. However, private investors, investing their own money, “face the full consequence of their decisions at the personal level”, while the employees of institutional investors are not adequately rewarded for high profits, apart from their salary, and are not heavily penalized for losses.

Feeney, Haines and Riding (1999) list the needs of private investors, presented in Figure 1.

Private investors want an interest to be received as a risk premium, the gains to be easily realised, the risk to be adequate and manageable, and the opportunity to be there for improvement of the investment prospects.

Based on the aforementioned list and the nature of the short-term investments, we have derived the needs of short-term private investors, which are presented in Figure 2.

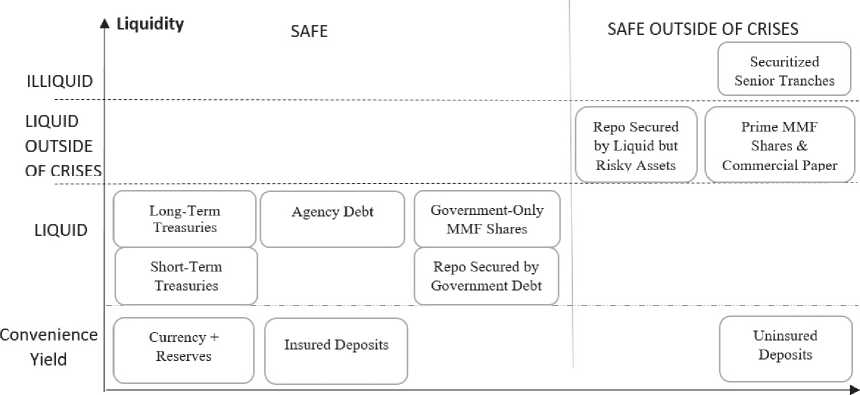

Secured by Liquid but Risky Assets from our analysis, because repurchase agreements, contracts in which the vendor of a security agrees to repurchase it from the buyer at an agreed price, are used mainly by central banks and not by private investors. In addition, we can exclude illiquid Securitized Senior Tranches. LongTerm Treasuries are not the target of a short-term investor either. Currency, Reserves and Bank Deposits can also be excluded from our analysis, as we do not

Potential for high profit

Reasonable exit plan

Security

Fig. 1 . Private investors' needs

Potential for high profit

Reasonable exit plan

Involveme

Security nt of the investor

Fig. 2. Short-term private investors' needs

As the figure implies, the focus of the short-term private investors is shifted towards the liquidity (reasonable exit plan) and lower risks (security) at the cost of potential for high profit and the opportunity of involvement. Indeed, short-term private investors normally experience a shortage of money, so they would like their investments to be easily withdrawn in the case of emergency. At the same time, such a shortage of funds presumes the absence of a back-up plan; thus, it is crucial for such investors to keep the risks low, and low risks mean low profits. Short term does not allow the time to get involved in the investee’s affairs.

Money market instruments as a tool for shortterm private investors

Having a closer look at the diagram, we can exclude Repo Secured by Government Debt and Repo consider them an investment, worth the analysis. Thus, we are left with Short-Term Treasuries (also called treasury bills, or T-bills), commercial paper and MMF shares. Let us compare the first two instruments.

Treasury bills are “a short-dated government security, yielding no interest but issued at a discount on its redemption price”. They provide owners with liquidity service benefits. In monetary terms, it is liquidity premium, strongly positively correlated with the short-term interest rate level. Thus, the higher are the interest rates, the higher is the opportunity costs of holding money, and the more T-bills the investors are willing to buy (Nagel, 2014). However, this is not the only one correlation: Nippani and Parnes (2017) found that political brinkmanship and the consequent delays in passing the debt limit reduce the T-bills’ price, which leads to increased yields. Thus, the more unstable the political situation in the U.S.A is, the better is for private investors, but worse for the taxpayers. Nevertheless, it is commonly agreed that as the T-bills are issued by the government, the risk of their default is almost nonexistent. At the same time, their premium is one of the lowest at the money market. Thus, T-bills are the best suitable for risk-averse investors.

Government

Issued

Government Guaranteed

Backed by Secured by Private Unsecured Risk Government Financial Collateral Private Debt

Fig.3. Liquidity and Risk of Assets

Commercial Paper is “short-term publicly traded, unsecured debt of large and well-established companies”. Commercial Paper is a popular investment instrument for those investors, who would like to receive higher returns and do not mind bearing higher risks. All the Commercial Paper issuers are rated by established rating agencies, depending on the risk of their default. The interest rate of the Commercial Paper reflects the assigned rating. Thus, the investors do not need to collect private information about the company – they just need to define their risk appetite (Kahl, Shivdasani & Wang, 2015). Both Commercial Paper and T-bills are issued at a discount, meaning that the price of the instrument is less than its par value, and the difference is the interest earned. Commercial Paper is considered low risk because of its short maturity;

Money-market mutual funds as a tool for short-term private investors

Parlatore (2016) has created a model to analyse the above mentioned risks and benefits and came to the conclusion that even in the absence of investor runs, the MMMF industry may be fragile. We agree with the researcher that the risks of the MMMF market far outweighs its benefits.

Conclusion

The conducted analysis of the recent research publications on the case of short-term private investment has shown that the short-term private investors require high liquidity low risk instrument and can tolerate comparatively low returns, and that the best tools for such investments are money market instruments. In the paper, we compared the T-bills with commercial papers and noted the trade-off between them with regards to risk, liquidity and yield. In addition, we considered the benefits of indirect investments via MMMFs; however, we came to the conclusion that the riskiness of such investments outweighs their benefits.

Список литературы Direct vs indirect investments: the implications of a choice for a short-term private investor

- Baghai R., Giannetti M., & Jäger I. (2017). Liability Structure and Risk-Taking: Evidence from the Money Market Fund Industry. DOI: 10.2139/ssrn.3093519

- Carlson M.A., Duygan-Bump B., Natalucci F.M., Nelson W.R., Ochoa M., Stein J.C., & Van den Heuvel S. (2014). The demand for short-term, safe assets and financial stability: Some evidence and implications for central bank policies. DOI: 10.2139/ssrn.2534578

- Definition of repurchase agreement. (n.d.). Retrieved July 24, 2018, from Financial Times: http://lexicon.ft.com/Term?term=repurchase-agreement

- Golec P., & Perotti E. (2017). Safe assets: a review (No. 2035). ECB Working Paper.

- Gordon J.N., & Gandia C.M. (2014). Money Market Funds Run Risk: Will Floating Net Asset Value Fix the Problem // Colum. Bus. L. Rev., 313. DOI: 10.2139/ssrn.2134995

- Kahl M., Shivdasani A., & Wang Y. (2015). Short-term debt as bridge financing: Evidence from the commercial paper market // The Journal of Finance, 70(1), 211-255.

- DOI: 10.1111/jofi.12216

- Nagel, S. (2016). The liquidity premium of near-money assets // The Quarterly Journal of Economics, 131(4), 1927-1971.

- DOI: 10.1093/qje/qjw028

- Nippani, S., & Parnes, D. (2017). Recent evidence on political brinkmanship and Treasury yields // Journal of Financial Economic Policy, 9(3), 324-337.

- DOI: 10.1108/jfep-01-2017-0001

- Parlatore, C. (2016). Fragility in money market funds: Sponsor support and regulation // Journal of Financial Economics, 121(3), 595-623.

- DOI: 10.1016/j.jfineco.2016.05.004

- Perotti, R. (2016). 1 The Commercial Paper Market.

- Sharma, U., & Varshney, A. K. (2018). Overview of Risk Analysis Subjected to Mutual Fund. Multidisciplinary Higher Education, Research, Dynamics & Concepts: Opportunities & Challenges For Sustainable Development ( 978-93-87662-12-4), 1(1), 436-440.

- ISBN: 9789387662124

- Wiggins, R., & Metrick, A. (2016). The Federal Reserve's Financial Crisis Response D: Commercial Paper Market Facilities.

- DOI: 10.2139/ssrn.2723547