Evaluating the Effectiveness of the Algerian Tax System and Its Challenges

Автор: Laggoun O., Aidi T.

Журнал: Science, Education and Innovations in the Context of Modern Problems @imcra

Статья в выпуске: 2 vol.8, 2025 года.

Бесплатный доступ

This research paper aims to assess the effectiveness of the Algerian tax system by analyzing its development, performance, and structure following the reforms adopted by Algeria since 1992, in light of the transformations witnessed in the international and domestic arenas. Despite these reforms, the Algerian tax system still faces a series of challenges and imbalances that hinder achieving the desired effectiveness. Therefore, appropriate measures must be taken to address these challenges with the aim of enhancing the system's ability to better adapt to changes in the global economy. A descriptive-analytical approach was adopted to achieve the objectives of this study .

Effectiveness, Algerian tax system, Tax revenue, Regular collection, Tax reform

Короткий адрес: https://sciup.org/16010473

IDR: 16010473 | DOI: 10.56334/sei/8.2.84

Текст научной статьи Evaluating the Effectiveness of the Algerian Tax System and Its Challenges

Citation. Laggoun O., Aidi T. (2025). Evaluating the Effectiveness of the Algerian Tax System and Its Challenges. Science, Education and Innovations in the Context of Modern Problems, 8(2), 1182-1196. doi:10.56352/sei/8.2.84. https://imcra-

Based on new data at the international and national levels, the tax system has undergone a series of structural reforms since independence, particularly in 1992, with the aim of replacing regular taxation with petroleum taxation. These tax reforms aim to give taxes a new role to adapt to the new economic system and use them as a tool to encourage and direct economic activity in line with the requirements of economic development, achieving efficiency, which is considered an indicator of the success of any system. Although the Algerian tax system has been reviewed several times through annual or supplementary financial laws, it still suffers from a number of shortcomings that limit its effectiveness. Therefore, in this study, we attempted to answer the following main question:

How effective is the tax system in Algeria in light of the current challenges?

The problem of the topic is based on a set of sub-questions:

-What are the most important developments that the Algerian tax system has undergone?

-How effective is the tax system in increasing tax revenue?

-What are the most prominent challenges hindering the Algerian tax system?

Significance of the Study

The importance of the study lies in its attempt to identify aspects related to the tax system, given that taxes are one of the state's most important resources for meeting its increasing expenditures, which requires the state to maintain high tax revenues. This is achieved by revealing the most important taxes introduced within the framework of the 1992 tax reforms, in addition to analyzing the most important of these taxes, their role in increasing the state's general budget, and assessing their effectiveness.

Study Objectives

This research paper primarily aims to clarify the following:

-Study the Algerian tax system through the laws, legislation, and tax procedures, and the most important amendments introduced by the reforms.

-Evaluate the progress of these reforms through a set of indicators.

-Highlight some of the challenges affecting the Algerian tax system.

Study Methodology:

In an attempt to answer the presented problem, we relied on a descriptive and analytical approach to review the structure of the tax system, the evolution of tax revenues, and their importance in financing the state's general budget. We also utilized some tools, including laws and legislation related to taxation and national statistics for the period from 2010 to 2021.

Study Structure:

To address the main problem and sub-questions, the study was divided into the following sections:

-Developments in the Algerian tax system.

-Evaluating the effectiveness of the Algerian tax system.

-Challenges facing the Algerian tax system .

Sci. Educ. Innov. Context Mod. Probl. P-ISSN: 2790-0169 E-ISSN: 2790-0177

Issue 2, Vol. 8, 2025, IMCRA

First: Developments in the Algerian Tax System

In the late 1980s and early 1990s, Algeria witnessed regional and local transformations that cast a shadow over its economic approach, forcing it to shift toward a market economy. Within this context, it was urgent to make fundamental changes to the laws and regulations governing the Algerian economy, in an effort to keep pace with new developments and address existing shortcomings. Among the most important systems requiring radical reform was the tax system.

-

1- Taxes introduced under the 1992 reform:

The Algerian tax system underwent a fundamental transformation in its structure, as direct taxes and similar fees were replaced by a tax on gross income (IRG), which affects natural persons, in addition to a tax on corporate profits (IBS), which targets legal entities. Regarding turnover taxes, the single gross production tax (TUGP) and the single gross service tax (TUGPS) were abolished and replaced by a new tax called the value-added tax (VAT)

-

1 -1 Gross Income Tax (GIT)

The GIT was established under Article 38 of the Finance Law of 1991 with the aim of pooling all types of income within a single tax base. This amendment was intended to limit the multiplicity of specific and supplementary taxes that characterized previous tax systems. According to Article 1 of the Direct Taxes and Similar Fees Law, the tax is defined as follows: "A single annual tax shall be established on the income of natural persons called the 'Gross Income Tax.' This tax shall be imposed on the total net income of the taxpayer, determined in accordance with the provisions of Articles 85 to 89 of the Direct Taxes and Similar Fees Law".( Ministry of Finance, General Directorate of Taxes, Direct Taxes and Similar Fees Law of 2024, p. 12.)

1-2 Corporate Income Tax (IBS)

In the context of tax reforms aimed at designing a tax system specific to companies, distinct from the system directed at natural persons, a tax specifically for legal entities (companies) was established under Article 135 of the 1991 Finance Law. This tax replaced the Industrial and Commercial Tax (IIC), with the objective of subjecting all legal entities, whether public or private, to taxation without exception. It also applies to foreign and local institutions in Algeria, ensuring the comprehensiveness of the tax system. This article stipulates that "an annual tax shall be established on the total profits or income generated by companies and other legal entities referred to in Article 136 (the Direct Taxes and Similar Taxes Law of 2024). This tax shall be called the Corporate Income Tax."

1-3 Value Added Tax:

Given the inability of the turnover tax system in place prior to the tax reforms, which comprised the single gross production tax (TUGP) and the single gross service tax (TUGPS), to achieve the specified economic objectives and its incompatibility with the country's modern economic orientation, Algeria was forced to make radical changes to its indirect tax system. In response, a new system based on the value added tax was created to replace the two taxes. It was established in the 1991 Finance Law (Official Gazette of the Algerian Republic, No. 57, dated December 31, 1990, op. cit., p. 1927)

Its implementation effectively began in 1992, with banking and insurance operations being included under the scope of the value added tax starting January 1, 1995, after having been subject to a special tax called the "Banking and Insurance Operations Tax" (Ministry of Finance, General Directorate of Taxes, Value Added Tax Implementation Guide, June). 2021, p. 4.)

Sci. Educ. Innov. Context Mod. Probl. P-ISSN: 2790-0169 E-ISSN: 2790-0177 Issue 2, Vol. 8, 2025, IMCRA

-

2- Legislative reforms after 1992:

2-1 Introduction of the Tax Procedures Law:

The Tax Procedures Law was issued pursuant to Article 40 of the 2002 Finance Law, with the aim of transferring and unifying provisions related to tax procedures from the five tax laws (the Direct Taxes Law, the Indirect Taxes Law, the Business Number Law, the Stamp Law, and the Registration Law). This reform aims to integrate and simplify the various tax procedures, in addition to improving the tax investigation process, providing solutions for tax collection, and reducing related disputes.

2-2 Introducing a single lump sum tax:

As part of simplifying tax procedures and reducing the tax burden, a single lump sum tax was introduced pursuant to Article 2 of the 2007 Finance Law. This system is directed at small taxpayers whose turnover does not exceed 3 million dinars, replacing the lump sum income tax assessment system. It replaces the gross income tax, value-added tax, and professional activity tax. The applicable rates at that time were 6% for sellers of goods and commodities and 12% for providers of services. This tax has witnessed numerous developments, the most recent of which was the 2024 Finance Law, which reduced the rate to 5% for production activities and the sale of goods and 12% for other activities (Ministry of Finance, General Tax Directorate, Direct Taxes and Similar Taxes Law of 2024, Article 282 bis 4, p. 96)

2-3 Amending Tax Systems:

The tax systems in force were amended in 2015, abolishing the simplified system. The controlled declaration system makes the tax system limited to a single lump sum tax and a real tax system. According to the 2022 Finance Law, natural taxpayers whose turnover does not exceed 8,000,000 DZD are subject to the single lump sum tax system. As for taxpayers whose turnover exceeds 8,000,000 DZD and who choose to be subject to the real tax system of their own free will, they are permanently bound by that choice. Some activities have also been automatically added to the real tax system, regardless of their turnover, as have legal entities.

2-4 Introducing a new form of investigation, "the corrective accounting investigation:"

This new form of audit was established under Article 22 of the 2008 Supplementary Finance Law and entered into force in 2010. The corrective accounting investigation is defined as: "A directed audit procedure that is less comprehensive, more rapid, and less extensive than the accounting investigation procedure. This form of audit includes the examination and audit of supporting and accounting documents for certain types of taxes for all or part of a non-expired period or for a group of transactions or accounting data for a period of less than one year." (Lawaj Mounir, Lawaj Abdel Rahim, 2022, p. 360)

-

2-5 Keeping pace with the financial accounting system:

Algeria has witnessed major developments in the field of accounting with the adoption of the financial accounting system inspired by the International Accounting Standards (IAS-IFRS). However, it has faced numerous challenges in adapting tax rules and accounting rules to overcome these obstacles. Algeria issued a set of legal provisions within the 2009 Supplementary Finance Law and the Finance Law. For the year 2010, with the aim of bridging the gap between the two systems.

-

3- Reforming the Tax Administration Structures:

In response to international and national changes, the tax administration has adopted measures to update and modernize its organizational structures. New structures have been established, including: 3-1 At the Central Departments Level:

Sci. Educ. Innov. Context Mod. Probl. P-ISSN: 2790-0169 E-ISSN: 2790-0177 Issue 2, Vol. 8, 2025, IMCRA

The modernization program implemented by the General Directorate of Taxes includes the central departments, where the following were created:

Establishment of the Directorate of Information and Tax Documents (DIDF)

In light of the significant challenges facing the tax administration in accurately collecting and processing tax information that allows for understanding and determining taxpayers' income for accurate taxation purposes, and based on Executive Decree No. 03-194 of April 28, 2003, amended by Executive Decree No. 07-364 of November 28, 2007, which regulates the organization of the central administration at the Ministry of Finance, the Directorate of Information and Tax Documents was established. This directorate aims to establish a national data bank that cooperates with various departments and agencies, enabling the creation of communication channels that provide accurate and useful information about taxpayers. This information is then processed and used. And sorting them by central or external agencies in the tax field (Faris Bin Badir 2022, p. 120)

3-2 At the level of external agencies:

The structural reforms implemented by the state were not limited to reorganizing the central agencies only, but also included external agencies, making the tax system more flexible and adaptable to economic and social changes. Starting in 2002, the General Directorate of Taxes focused on establishing three new administrative structures for external agencies, including the Directorate of Large Enterprises, Tax Centers, and Neighborhood Tax Centers. Inspectorates and tax collectors were merged according to the nature of taxpayers, making these structures responsible for managing, monitoring, and investigating tax disputes. The following is the content of the structural reform at the level of external services:

Established pursuant to Article 32 of the 2002 Finance Law, it began operating on January 2, 2006. Its mandate includes managing tax files, monitoring, and collecting taxes for major foreign companies and institutions, companies operating in the hydrocarbons sector, and companies subject to corporate profits tax with a turnover equal to or exceeding 100 million dinars.

Tax Centers (CDI)

These centers are a new operational structure affiliated with the General Directorate of Taxes, specializing exclusively in managing the tax files of medium-sized taxpayers and collecting taxes due with an annual turnover exceeding 15 million dinars. This includes companies subject to the real tax regime that are not subject to the authority of the Directorate of Large Enterprises, as well as some sole proprietorships subject to the lump-sum tax regime. Taxpayers are selected according to the real tax regime. (Najat Nouy, 2021, p. 333.)

Neighborhood Tax Centers (CPI)

The establishment of neighborhood tax centers across various regions represents a pivotal step in completing the process undertaken by the General Directorate of Taxes to modernize and update the tax administration apparatus. These efforts began in 2006 by improving the performance of the tax administration, represented by the offices of major corporations. The first tax centers were launched in 2009. The neighborhood tax centers constitute a modern administrative model affiliated with the General Directorate of Taxes, entrusted with the task of managing tax files and collecting taxes due, particularly from categories covered by the single lump sum tax system. These centers were designed to implement the concept of advanced services, replacing traditional structures such as inspectorates and tax collectors. The primary objective of this step is to provide a more efficient and flexible experience for taxpayers by simplifying and standardizing procedures, in line with modern requirements, and ensuring the provision of high-quality services within the framework of tax procedures. (Abirat Lakhdar, 2018, p. 308)

Sci. Educ. Innov. Context Mod. Probl. P-ISSN: 2790-0169 E-ISSN: 2790-0177 Issue 2, Vol. 8, 2025, IMCRA

4-Simplifying and enhancing tax administration procedures:

The public authorities have adopted a strategic plan to simplify and enhance the efficiency of tax procedures to better meet taxpayer needs. The most prominent measures include the following: (Letter from the General Directorate of Taxes, "Simplified Procedures for the Service of Taxpayers," No. 69/2013, Algeria, p. 8.)

4-1 Simplified Procedures for Submitting Tax Documents: The General Directorate of Taxes has worked to simplify the procedures related to creating or closing tax files, as well as the submission of certain tax documents, with the aim of facilitating operations and improving the taxpayer experience.

4-2 The new numbering procedure (tax identification number): Under Article 41 of the 2006 Finance Law, the tax identification number was adopted as a prerequisite for completing any commercial or financial transactions to confirm tax registration. Starting June 1, 2013, a new decentralized administrative system was implemented, whereby provincial tax directorates issue numbering certificates, allowing the tax identification number to be granted within 48 hours of submitting the application.

4-3 The General Tax Directorate's website (an information window for taxpayers): The General Tax Directorate provides various tax and regulatory texts and laws related to taxation, including financial laws, on its website to facilitate access to information for taxpayers.

4-4 Launching the "Jibayatak" Electronic Portal

-With the aim of fully digitizing tax operations, the General Directorate of Taxes has created an electronic portal called "Jibayatak." This portal aims to improve the mechanisms for processing documents, develop the collection of tax information for the tax administration, and facilitate its circulation, making it a primary platform upon which tax centers rely to modernize and digitize tax procedures.

4-5 The Tax Journal: Established pursuant to Article 43 of the 2006 Finance Law, it provides a unified central file containing all information related to the tax status of taxpayers, their assets, and their activities. This file aims to ensure consistent use of information in all areas of tax work, such as the tax base, collection, disputes, and others, while striving to avoid any misuse or manipulation of this data.

4-6 Service Quality Reference: The Service Quality Reference project was launched pursuant to General Instruction No. 01 of June 7, 2012, issued by the Director General of Taxes. The project aims to improve the culture of reception and service quality by establishing internal and external standards for staff to adhere to, ensuring optimal handling of taxpayer complaints.

4-7 Tax Document: This is a crucial decision approved by the legislator pursuant to Article 47 of the 2012 Finance Law. This document serves as a final and clear response to the requests of taxpayers who wish to understand the tax provisions applicable to their situation in accordance with applicable laws, thus contributing to strengthening trust between the administration and taxpayers.

Second: Evaluating the Effectiveness of the Algerian Tax System

The primary objective of most financial systems is to achieve financial returns through the imposition of taxes to finance public expenditures included in the budget. To achieve this objective, tax systems must be efficient and effective. This requires a tax administration capable of understanding and controlling all legislative texts and implementing them in a practical and successful manner (Issa Samain, 2021, p. 163). Measuring the performance of the tax system in Algeria through financial

Sci. Educ. Innov. Context Mod. Probl. P-ISSN: 2790-0169 E-ISSN: 2790-0177 Issue 2, Vol. 8, 2025, IMCRA indicators related to tax revenues is one of the important means of assessing the effectiveness of this system and the extent to which it achieves the desired objectives. We have determined the following:

1-Development of the proceeds of regular and petroleum taxation:

Through the tax reform of 1992, the tax system in Algeria sought to improve the level of return on regular taxation at the expense of petroleum taxation, especially after the 1986 oil market crash. One of the most important objectives of the reform was to improve the financial return on regular taxation at the expense of petroleum taxation, which largely dominates the financing of the state budget.

Return on investment can be assessed through the following table.

Table 1: Development of revenues from regular and petroleum taxation in Algeria for the period 20102021

Unit: billion DZD

|

Percentage of |

Regular tax |

Total |

Petroleum |

regular |

Years/Stat |

|

petroleum tax |

rate on total |

collection |

taxation |

collection |

ement |

|

on total tax |

tax(%) |

||||

|

(%) |

|

53,98 |

46,02 |

2.782,19 |

1.501,70 |

1.280,49 |

2010 |

|

50,30 |

49,70 |

3.040,85 |

1.529,40 |

1.511,45 |

2011 |

|

44,28 |

55,72 |

3.430,25 |

1.519,04 |

1.911,21 |

2012 |

|

44,35 |

55,65 |

3.643,64 |

1.615,90 |

2.027,74 |

2013 |

|

43,02 |

56,98 |

3.667,50 |

1.577,73 |

2.089,77 |

2014 |

|

42,19 |

57,81 |

4.083,31 |

1.722,94 |

2.360,37 |

2015 |

|

40,31 |

59,69 |

4.174,54 |

1.682,55 |

2.491,99 |

2016 |

|

44,42 |

55,58 |

4.788,67 |

2.126,99 |

2.661,69 |

2017 |

|

46,41 |

53,59 |

5.062,85 |

2.349,69 |

2.713,15 |

2018 |

|

34,21 |

53,08 |

5.367,71 |

2.518,49 |

2.849,22 |

2019 |

|

41,10 |

65,79 |

4.076,93 |

1.394,71 |

2.682,22 |

2020 |

|

42,57 |

57,43 |

4.689,23 |

1.927,10 |

2.762,13 |

2021 |

Source: Prepared by researchers based on: Finance Laws and Budget Settlement Laws - National

Statistics Office.

It is clear that the contribution of regular taxation to tax revenues remains unconvincing. Despite the continuous increase in tax revenues in general during the period from 2010 to 2021, the contribution of petroleum taxation to public revenues recorded a significant decline, falling from 53.98% in 2010 to 34.21% in 2019. This decline is due to the decline in oil prices and their instability in global markets. On the other hand, regular taxation witnessed a gradual increase, reaching 2,849.22 billion Algerian dinars in 2019, representing 65.30% of total taxation. Despite this positive growth, regular taxation revenues did not reach the desired level, as this development was linked to the decline in oil prices. The weakness of regular taxation can also be attributed to several reasons, including: the spread of tax evasion due to the lack of tax awareness among taxpayers and the inability of the administration to combat it due to the lack of necessary capabilities, in addition to the lack of control over taxes imposed as a result of annual changes in laws. Taxes, in addition to increasing the size of tax exemptions granted as part of the state's policy to promote investment.

Й ® I

Sci. Educ. Innov. Context Mod. Probl. P-ISSN: 2790-0169 E-ISSN: 2790-0177

Issue 2, Vol. 8, 2025, IMCRA

2-Using the Achievements vs. Estimates Index:

There are several methods for assessing the effectiveness of the tax system, which often focus on functional performance and quantitative aspects. Using the financial approach, this effectiveness can be measured based on a quantitative analysis comparing actual tax deductions with the expected or estimated revenue from deductions.

This measure can be formulated as follows:

Implementation Rate = Actual Regular Collection / Estimated Regular Collection.

Therefore, we review the development of this ratio for the period 2010-2021 through the following table:

Table 2: Level of implementation of regular taxation compared to actual tax collection in Algeria for the period 2010-2021

Unit: Billion DZD

|

Implementation rate(2)/ (1) % |

(2) Estimated regular tax revenues |

(1) Actual regular tax revenues |

Years/Statement |

|

102,89 |

1.244,50 |

1.280,49 |

2010 |

|

102,58 |

1.473,50 |

1.511,45 |

2011 |

|

115,71 |

1.651,74 |

1.911,21 |

2012 |

|

110,72 |

1.831,40 |

2.027,74 |

2013 |

|

92,16 |

2.267,45 |

2.089,77 |

2014 |

|

90,22 |

2.616,37 |

2.360,37 |

2015 |

|

91,53 |

2.722,68 |

2.491,99 |

2016 |

|

93,54 |

2.845,37 |

2.661,69 |

2017 |

|

94,54 |

2.869,78 |

2.713,15 |

2018 |

|

93,68 |

3.041,42 |

2.849,22 |

2019 |

|

93,83 |

2.858,59 |

2.682,22 |

2020 |

|

104,80 |

2.635,61 |

2.762,13 |

2021 |

Source: Prepared by researchers based on: Budget Settlement Laws - Ministry of Finance Estimates.

It is clear that the implementation rate of the planned regular taxation in the financial laws and the actual taxation exceeded 100% during the period from 2010 to 2013, which indicates the existence of new tax bases resulting from the tax privileges granted to small and medium-sized enterprises by the state, as well as the good control of the tax administration over the provisions of the new system, in addition to the increase in tax bases through the investment programs carried out by the state in relation to the economic recovery program, in addition to the increase in the volume of foreign trade, led by imports, which reached 59.8 billion dollars (Bank of Algeria available at: . It witnessed fluctuations from 2014 to 2021, where the worst rate was recorded in 2015, where the implementation rate of regular taxation reached 90.22%, which indicates the poor assessment and implementation of the tax administration of regular taxation in achieving the approved budget. This is due to the inability of the tax administration to keep pace with the amendments issued in the financial laws, and on the other hand, the weakness of the collection process and the lack of control over it, in addition to the fact that the account The expected estimates were more administrative than

Sci. Educ. Innov. Context Mod. Probl. P-ISSN: 2790-0169 E-ISSN: 2790-0177 Issue 2, Vol. 8, 2025, IMCRA practical, and in recent years this has been due to the repercussions of the COVID-19 pandemic and its impact on the national economy.

3-Development of the proceeds of regular tax components:

Regular taxation represents the second most important resource in the state budget after petroleum taxation. It consists primarily of taxes that directly contribute to financing the state budget, such as the tax on gross income and the tax on corporate profits. In addition, regular taxation includes a group of other taxes and fees that are partially allocated to the state budget.

Table 3: Development of the proceeds of regular tax components in Algeria for the period 2010-2020

Unit: Billion DZD

|

Total regular collection |

Customs proceeds |

Indirect tax revenue |

The proceeds of various fees on the |

Registration and stamp |

Direct tax revenue |

|

|

1.280,49 |

184,57 |

1,43 |

494,42 |

39,65 |

560,42 |

2010 |

|

1.511,44 |

222,61 |

1,60 |

554,67 |

47,37 |

685,19 |

2011 |

|

1.911,21 |

336,98 |

2,00 |

653,24 |

56,09 |

90,862 |

2012 |

|

2.027,74 |

404,33 |

3,46 |

734,41 |

62,52 |

823,02 |

2013 |

|

2.089,77 |

369,88 |

1,68 |

765,27 |

70,77 |

882,17 |

2014 |

|

2.360,37 |

409,97 |

1,50 |

829,06 |

84,71 |

1.035,13 |

2015 |

|

2.491,99 |

387,70 |

6,61 |

891,68 |

95,78 |

1.110,22 |

2016 |

|

2.661,68 |

364,31 |

4,28 |

992,82 |

92,60 |

1.207,67 |

2017 |

|

2.713,15 |

323,99 |

4,18 |

1.092,93 |

88,40 |

1.203,65 |

2018 |

|

22.849,2 |

365,50 |

5,23 |

1.128,85 |

83,70 |

1.265,93 |

2019 |

|

2.682,22 |

338,75 |

6,19 |

1.060,10 |

72,67 |

1.204,51 |

2020 |

|

2.762,13 |

329,69 |

4,72 |

1.150,43 |

83,29 |

1.194,00 |

2021 |

Source: Prepared by researchers based on: Budget Settlement Laws

By analyzing the statistics in the table above, it appears that regular tax revenues witnessed significant growth during the study period. After in-depth study of its components, the following observations can be summarized:

Revenues generated by the turnover tax constitute the largest contributor to total regular tax revenues, due to the expansion of the scope of VAT and the increase in its rates.

Sci. Educ. Innov. Context Mod. Probl. P-ISSN: 2790-0169 E-ISSN: 2790-0177 Issue 2, Vol. 8, 2025, IMCRA

Indirect taxes recorded gradual growth, but their contribution to total regular tax revenues remained within the average level.

Registration and stamp duties, however, did not show significant growth, recording their highest value in 2016, at 95.78 billion DZD. This is due to several reasons, including individuals' reluctance to register property transfers and failure to declare the actual amounts to notaries, in addition to the absence of a strong real estate market capable of accurately reflecting realistic and reported prices.

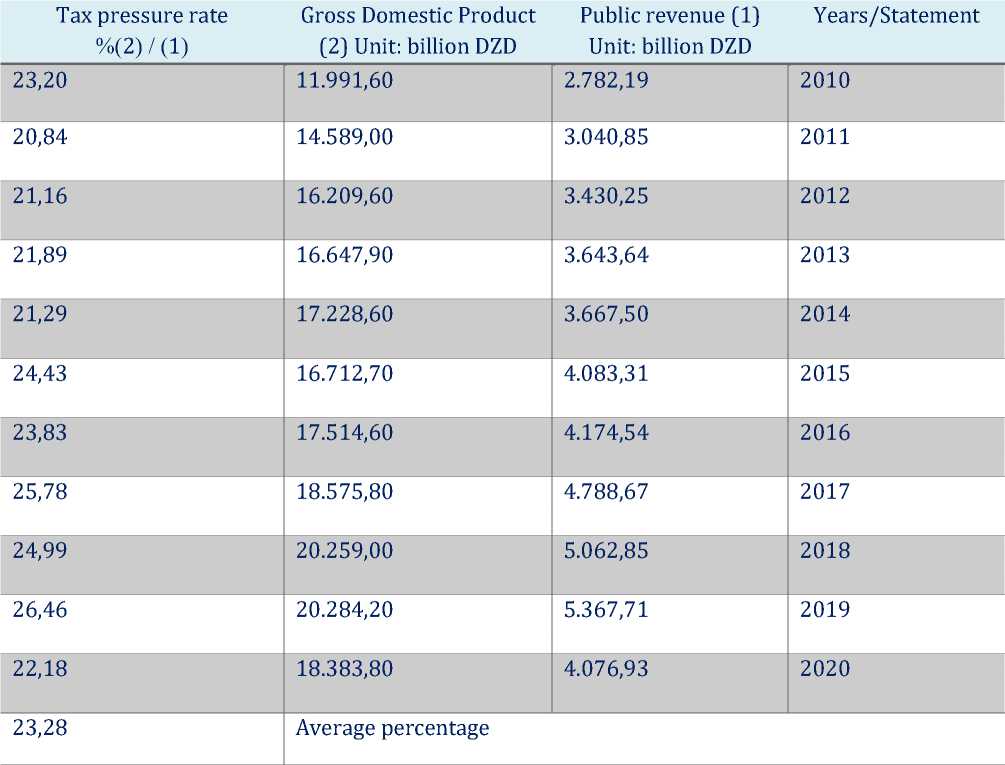

4-By measuring the development of the tax pressure index in Algeria:

One of the important quantitative indicators used to evaluate the tax system is the tax pressure index, which reflects the potential for tax deductions. Tax reforms primarily aim to increase the efficiency of the tax system, reduce the tax burden on taxpayers, and achieve a balanced tax pressure rate in line with the state's economic and social objectives. The non-hydrocarbon tax pressure rate is considered the most accurate expression of the burden borne by the national economy. To provide a clear analysis of tax pressure in Algeria during the period 2010-2020, this rate was calculated using two ratios: General tax revenues compared to GDP, on the one hand, and

Regular collections compared to GDP, non-hydrocarbons, on the other. The following table illustrates this:

Table 4: Development of the General Tax Pressure Index in Algeria for the period 2010-2020

Unit: Billion DZD

Source: Prepared by researchers based on:

General Directorate of Taxes, National Office of Statistics (ONS) Annual report of the Bank of Algeria.

Sci. Educ. Innov. Context Mod. Probl. P-ISSN: 2790-0169 E-ISSN: 2790-0177 Issue 2, Vol. 8, 2025, IMCRA

Table 5: Evolution of the non-hydrocarbon tax burden index in Algeria for the period 2010-2020

Unit: Billion DZD

|

Tax pressure rate |

Gross domestic product excluding hydrocarbons |

Regular tax collection proceeds |

Years/Statement |

|

%(2) / (1) |

(2) Unit: billion DZD |

(1) Unit: billion DZD |

|

|

16,39 |

7.811,20 |

1.280,49 |

2010 |

|

16,17 |

9.346,50 |

1.511,44 |

2011 |

|

17,91 |

10.672,20 |

1.911,21 |

2012 |

|

17,36 |

11.679,90 |

2.027,74 |

2013 |

|

16,62 |

12.570,80 |

2.089,77 |

2014 |

|

17,38 |

13.578,40 |

2.360,37 |

2015 |

|

17,19 |

14.499,50 |

2.491,99 |

2016 |

|

17,89 |

14.876,10 |

2.661,68 |

2017 |

|

17,27 |

15.711,20 |

2.713,15 |

2018 |

|

17,40 |

16.374,10 |

2.849,22 |

2019 |

|

16,97 |

15.808,70 |

2.682,22 |

2020 |

|

17,14 |

Average percentage |

Source: Prepared by researchers based on:

General Directorate of Taxes, National Office of Statistics (ONS) Annual Report of the Bank of Algeria

We note above that non-hydrocarbon tax rates are modest compared to the typical tax rate set by Colin Clarke at 25%, not exceeding 17.89%, with an average estimated rate of 14.17%. This demonstrates the ineffectiveness of the tax system outside the hydrocarbon sector in achieving the objectives of the reforms pursued since 1992. This is due to the large number of exemptions granted, the widespread and increasing incidence of tax evasion and fraud, which contribute to rising inflation and the expansion of the parallel economy, in addition to the existence of weak-yielding taxes.

Third - Challenges Facing the Algerian Tax System

Despite the reforms Algeria implemented to its tax system in the early 1990s, the system still faces a number of challenges that lead to the emergence of shortcomings.

-

1- Internal Challenges of the Algerian Tax System:

1-1 Instability of the Tax System in Algeria:

The tax system in Algeria suffers from instability, as efforts have failed to achieve a balance that ensures its simplicity and effectiveness. This complexity is evident in the frequent amendments to the annual or supplementary financial laws, which has resulted in difficulty for taxpayers and tax administration employees in understanding and absorbing these changes. Furthermore, some legal texts suffer from vague wording, which has led to a lack of clarity and opened the door to multiple interpretations among the parties involved in the tax system.

1-2 Tax Evasion:

Tax evasion is a phenomenon that is witnessing a significant increase worldwide. It poses a major challenge to the tax administration and represents a significant loss of state revenue. However, it lacks a precise definition. Tax evasion is one of the most significant obstacles facing the tax system, as it

Sci. Educ. Innov. Context Mod. Probl. P-ISSN: 2790-0169 E-ISSN: 2790-0177 Issue 2, Vol. 8, 2025, IMCRA directly impacts the system's revenues and deprives the state of significant financial resources used to cover its various expenses. Tax evasion can be defined as "the partial or total avoidance, using various methods, of paying tax obligations owed to a natural or legal person. Tax evasion can also be considered a taxpayer's response to the state's financial pressures." (Ana Maria Comanadaru, Sorina Geanina Stanescu, Adriana Paduraru, The phenomenon of tax evasion and the need to combat tax evasion, The journal contemporary economy revistaeconomiacontemparana, Vol. 3, 2018, p. 125.)

1-3 Tax corruption:

Corruption is a negative phenomenon that significantly impacts systems in all their aspects, contributing to the disruption of their proper functioning. Transparency International defines corruption as: "The misuse of public power for private gain" (Rumaisa Bennadi, Al-Saeed Khouildi, 2020, p. 463). Here, we mean corruption related to tax administration, i.e., all administrative transgressions and violations committed by tax administration employees while carrying out their duties. Tax corruption has been defined as: "A form of financial corruption aimed at achieving personal gain at the expense of honest taxpayers, on the one hand, and at the expense of tax revenues intended to finance compensatory spending, on the other hand".

Tax evasion is also defined as "the taxpayer's total or partial evasion of paying a tax without transferring its burden to others, which affects the state's tax revenue and deprives it of its rights." (Khaled Al-Khatib, 2000, p. 160.)

1-4 The Informal Economy:

The informal economy represents one of the most prominent modern issues that has received widespread attention from economic researchers. This phenomenon is widespread globally, in both developed and developing countries. The informal economy is defined as the hidden and undeclared economy that emerged within the framework of the standard systems established by countries to manage their national economies. It usually aims to evade taxes and avoid compliance with laws and regulations. (Nasreen Yahyaoui, 2016, p. 290)

-

2- External Challenges to the Algerian Tax System:

Tax systems operate within an open global economic context due to countries' ties to international organizations and institutions and their commitments to their directives, such as the International Monetary Fund and the World Bank. This interaction directly impacts the structure of tax systems and presents them with a set of challenges that hinder their ability to achieve their established objectives, including:

2-1 Double Taxation:

Double taxation is defined by many public finance experts as the imposition of two taxes of the same type on the same tax base or taxable income within a single period of time, resulting in the deduction of these two taxes from the same taxpayer's funds. This type of double taxation can occur both internally within a country and internationally between more than one country (Ben Shawan Fatih, Hashi Al-Nouri, 2022, p. 30.)

2-2 Tax Competition:

The OECD considers tax competition to lead to imbalances in trade and investment. By reducing taxable items, this shifts part of the tax burden toward less dynamic taxable items, such as labor or consumption, at the expense of employment and the fairness of the tax structure. (Abdelmajid Kadi, 2011, p. 197)

Sci. Educ. Innov. Context Mod. Probl. P-ISSN: 2790-0169 E-ISSN: 2790-0177 Issue 2, Vol. 8, 2025, IMCRA

2-3 E-commerce:

Tax systems face a new challenge as a result of the developments imposed by globalization in the field of information and communications, known as e-commerce. This is an innovative means of exchanging goods and services using modern communication methods.

The World Trade Organization (WTO) defines e-commerce as: "All sales or purchases of goods or services conducted over computer networks using methods specifically designed to receive or place orders, even if the goods or services are ordered electronically".

Organisation Worlde du Commerce, Le commerce électroniquedans Les pas en développement, p. 2, apart from the site:

2-4 Tax Havens:

Algeria, like many countries, suffers from the challenge of money laundering to what are known as tax havens. Although their initial aim was to attract foreign investment, they have evolved into a major means of international tax evasion. This shift has allowed individuals and companies to engage in irresponsible behavior, which can negatively impact the efficiency and effectiveness of the tax system (Rima Dhafri, Mohamed Saad Eddine Belkhiri, 2020, p. 79). The Organization for Economic Co-operation and Development (OECD) defines tax havens as: "Countries that have the ability to finance their public services without taxes on nominal income or at a low tax rate, making them a destination for nonresidents to evade taxes in their home country" (Nasreen Fayez Ahmed Badawi, 2022, pp. 173-174).

Tax havens cause significant losses to the global tax system, estimated at approximately $427 billion annually, according to a report by the Tax Justice Network issued at the end of November. In 2020, Algeria's losses associated with these tax havens can be estimated at more than $429.9 million annually due to international tax evasion. These losses represent the equivalent of 1.94% of total tax revenues collected. (Widad Bouklaa, Misbah Harrak, Issue 1, 2021.)

Fourth: Conclusion:

The desire to develop the Algerian tax system has crystallized through a series of successive reforms since independence, particularly those implemented in 1992, which aimed to replace petroleum taxation with regular taxation. These efforts focused on modernizing and simplifying the tax system and enhancing its transparency and effectiveness. While noting the recorded achievements and notable progress, the following conclusions can be drawn:

-

- An effective tax system requires achieving harmony between the various stakeholders in the tax system, represented by the tax administration and the taxpayer.

-

- Regular tax revenues in Algeria remain characterized by instability and weak performance due to the continued heavy reliance on petroleum taxation.

The continued dominance of petroleum taxation is due to the ineffectiveness and inefficiency of the tax system.

-

- The Algerian tax system suffers from numerous challenges, including a lack of consistency and clarity, due to the frequent amendments to the financial laws.

-

- The effectiveness of any tax system is not measured solely by the amount of taxes imposed, but rather by the actual revenue generated from those taxes.

Fifth: Recommendations:

Sci. Educ. Innov. Context Mod. Probl. P-ISSN: 2790-0169 E-ISSN: 2790-0177 Issue 2, Vol. 8, 2025, IMCRA

Based on the findings of this study, we propose several recommendations aimed at enhancing the efficiency of the tax system and enabling it to address the obstacles that hinder its effectiveness:

-

- Simplify tax payment procedures and expedite the resolution of tax disputes.

-

- Separate financial laws from tax laws, ensuring the stability of the tax system, providing clarity to the tax system, and limiting the exploitation of legal loopholes.

-

- Enhance tax awareness among taxpayers through media outreach and providing appropriate treatment by tax administration employees.

-

- Improve the efficiency of the tax administration to enable it to keep pace with rapid economic changes.

-

- Combating corruption and tax evasion by applying the principles of tax governance.

-

- Addressing the challenges of the parallel economy by reducing tax burdens for a specific period and providing incentives to attract tax evaders in ways that contribute to reducing the parallel economy.

-

- Strengthening the tax oversight system to ensure greater transparency and discipline.