Factors influencing the yield spreads of government bonds: evidence from Singapore

Автор: Ahmed Shafiu, Mitra Saeedi, Behrang Samadi, Najla Shafighi

Журнал: Science, Education and Innovations in the Context of Modern Problems @imcra

Статья в выпуске: 2 vol.5, 2022 года.

Бесплатный доступ

An essential element of the particular Monetary Expert associated with Singapore's (MAS's) efforts to be able to improve the country's placement like a globally monetary center is the intro regarding Singapore relationship market segments. To be able to achieve this specific objective, the main goal of the research will be to determine the most crucial macroeconomic aspects that will effect typically the produce propagates involving Singapore authorities provides so as to thin the particular deliver distributes distinction between two nations. Utilizing a multifactor regression design, this kind of research investigates the specific influence associated with four macroeconomic elements around the produce propagates related to Singapore Authorities Opportunities (SGS) for that period of time 06\ in order to 2015. The outcomes are usually offered by means of the table. The particular trade cost (ER), pumpiing (IFR), cash provide (MS), plus rates of interest are often one of the things to consider (IR). Typically the results imply that typically the multifactor style might be used as a way to foresee the particular drivers regarding deliver propagates within the Singapore Authorities Investments marketplace to some degree. The information corroborate the actual expected forecasts which will EMERGENY ROOM in addition to IRGI would be the most significant road users involving modifications inside SGS produce distributes, that have been formerly hypothesised. In addition, IFR in addition MICROSOFT possess a substantial effect on typically the create distributes associated with SGS1 (2-year Singapore Federal government Securities) and even SGS2 (5-year Singapore Govt Securities); nonetheless, these two components possess a poor or any influence on this deliver advances connected with SGS3 (10-year Singapore Federal government Securities) (10-year Singapore Govt Securities).

Bond yield spreads, Singapore Government Securities, Macroeconomic factors

Короткий адрес: https://sciup.org/16010161

IDR: 16010161

Текст научной статьи Factors influencing the yield spreads of government bonds: evidence from Singapore

As an alternative supply of financing with regard to companies, typically the relationship companies are getting progressively essential in the current growing worldwide economic climate. Due to the training found out from your Oriental recession involving 97, the specific Singapore federal government offers recognized the particular crucial significance of getting a competent in addition to efficient money industry with regard to speeding up economical development, along with the need for enhancing the actual extensive advancement this my university marketplace within just Singapore. This particular vital stage has been created not only to get a competing way to obtain long lasting funding for that country's economic system, but additionally to lessen the specific state's weaknesses in the event of an upcoming monetary disaster (Fabella and Madhur, 2003).

Probably the most necessary aspects of typically the Monetary Expert associated with Singapore (MASefforts)'s is the intro regarding Singapore my areas to be able to improve the particular nation's placement like an internationally economic center. Numerous revolutionary reconstructs possess lead due to this specific, which includes deregulation through the Singapore buck along with the switching involving Singapore right into a center for that organizing, giving, additionally investing of economic credit card debt devices. Singapore's connection industry, based on Ngiam and even Loh (2002), will be separated in to 3 main areas: typically the Singapore authorities investments (SGS) market, the particular Singapore buck business bond university (SDCB) marketplace, plus the Hard anodized cookware money this (ADB) industry. The particular SGS marketplace is certainly the main element of Singapore's relationship marketplaces, even though the us government continues to be managing a finances excess because the eighties and it has huge supplies available. Typically the ADB marketplace, which usually includes provides denominated in foreign exchange, may be the second biggest element, using the SDCB industry, which has increased significantly given that 1989, once the Malaysian Investments Commission rate began strongly advertising this specific, becoming the tiniest.

One of the most pushing requirements may be the government's wish to set up typically the island-state right into a local finance centre. With regards to conditioning the actual local debts industry, Singapore has generated a powerful basis because of its connection marketplace right now. In order to copy Swiss, where international businesses regularly problem together with industry Switzerland droit offers, the particular Singapore federal government offers motivated recognized worldwide companies to promote and get Singapore money a genuine so as to replicate typically the Europe style (Plummer plus Click, 2005). Singapore, nevertheless , will be devoted to the purpose of turning into the particular financial middle for your issuance in addition to buying and selling related to territorial foreign currency gives.

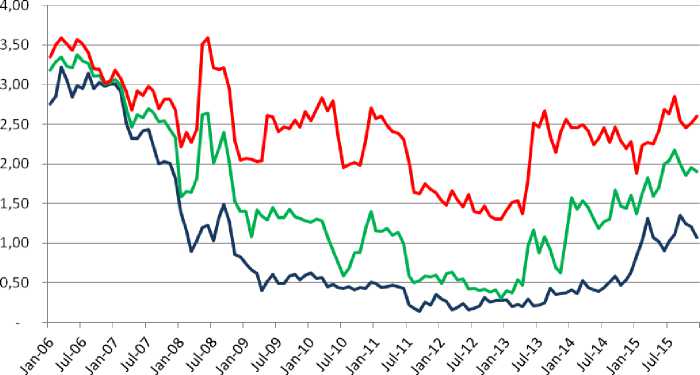

The particular designs connected with reconnect deliver distributes observed in Determine 1 beneath caused me personally to check into the sun and rain that may written for all of them. Via 06\ in order to 2015, attach produce propagates were discovered to maneuver inside a comparable pattern, because noticed in this chart beneath. It will likewise become mentioned that each among the bond's least expensive and even greatest elements have been achieved inside a fairly short time of your energy. Another finding will be the decreasing pattern inside of deliver distributes all through various kinds of you possess immediately associated with this year towards finish of the 12 months. Typically the produce propagates a new substantial surge throughout 08, which was accompanied by a substantial reduce through this year ahead, suggesting that will investors should receive the reduce come back on the opportunities. Because of this, these types of styles possess considerably affected the study in to the numerous causes of movements, and also the usually shedding styles regarding relationship deliver advances, which have been then a new improving tendency involving connection produce arises.

2-yrSGS Yield Spreads... ■ 5-yrSGS Yield Spreads... 10-yrSGS Yield Spreads

FIGURE 1: Bond Yield Spreads of Selected Government Bonds

Source: Monetary Authority of Singapore, (2016)

The impact on bond yield spreads in Singapore should be investigated since the bond market is a key aspect of the country's financial system and contributes considerably to the country's gross domestic product. Investors and bond issuers find it extremely difficult to determine the value of bonds without first understanding the factors that influence bond yield spreads. This is because yield to maturity (YTM) gives a more relevant measure of bond value when compared to bond price or other yields (Faerber, 2000). As a result, in light of the foregoing, the primary goal of this research is to investigate the impact of selected macroeconomic factors on the bond yield spreads of Singapore Government Securities (SGS). 2-year Singapore Government Securities are indicated by SGS1, 5-year Singapore Government Securities are denoted by SGS2, and 10-year Singapore Government Securities are denoted by SGS3. In this article, 10-year Singapore Government Securities are designated by SGS3.

-

2. LITERATURE REVIEW

-

2.1 Exchange Rate and Yield Spread

Experts Raja, Ramadorai, in addition Sarno (2016) possess indicated that forex price unpredictability comes with an impact around the return of the resource, and thus this particular research may be helpful for profile supervisors when it comes to restricting and even diversifying the potential risks inside their casinos. The main element impacting on the particular bond's trade level unpredictability may be the price of insurance coverage, that is based on the place charge from the relationship during the time of buy.

-

2.2 Inflation Rate and Yield Spread

Pumpiing is really a substantial concern for most associated with investors given that particular offers are usually associated with inflationary anticipation. Additionally it is considerable with regard to government bodies such as the main financial institution, since they might be used like a solution to manage pumpiing if required. Inflation-linked offers may be used to pay the us government for that pumpiing risk it really is dealing with. Consequently, the federal government might just increase money by using financial debt devices. Inflation-linked provides double with regard to resource allowance in order to reduce danger in addition off-set actual interest rate chance, and a lot more (Weissensteiner, Hanke plus Geyer, 2015).

Previously, numerous research around the dedication associated with relationship produce propagates have been performed in several numerous countries. Numerous methods plus versions with regard to identifying deliver propagates along with adjustable rate of recurrence of information are used within the evaluation related to produce propagates (yearly, month-to-month in addition to quarterly). This particular study can look in the macroeconomic aspects that will impact connection produces within Singapore, and also their own partnership together with relationship generates.

Traders may industry and even purchase debts devices, like offers, for any come back, much like the way they industry in addition spend money on share. The client of the relationship will get a definite quantity of return, that is much like the ones from an investment or even discuss. The quantity of come back within the connection depends around the number of requirements, like the bond's k?rester really worth, the quantity of theory invested, as well as the bond's growth. The cost element displays the particular bond's unpredictability when it comes to cost. Generally, the connect together with higher price unpredictability any which goes via a substantial portion modify in cost for any offered enhancements made on create (Reilly together with Wright, 2009). To be able to improve the effectiveness, the specific Singapore attachment market place offers applied numerous endeavours through the years, including becoming a member of typically the Hard anodized cookware Relationship Marketplace Work inside 2002 as well as taking part in the particular Oriental Connection Fund-1 additionally Hard anodized cookware Connect Fund-2, both these styles which usually possess improved typically the Singapore rapport market's fluid while keeping a well balanced deliver contour (Lee, 2006).

20 opportunities are usually released inside Singapore, every one of that are incredibly efficient and they are changed to both the main and also supplementary marketplaces. Almost all traders, in the actual extra plus main market segments, possess access for a digital trading system (eApps). The specific huge almost all purchasing the particular Singapore market happens on the internet, furthermore pre- in addition to post-trade info will be distributed quickly to any or all investors utilizing the Bloomberg program.

It does not take reason for this specific research to look at the bond between trade value (ER) plus the associated with pumpiing (IFR), the cash provide (MS), along with the interest rate (IR) within the produce distributes regarding Singapore Authorities Investments (SGS). The web link among every flexible and even deliver propagates continues to be resolved in depth inside the area underneath.

In addition , Maltritz plus Molchanov (2001) check out what can cause nation arrears risk within building market segments, because indicated by simply full sovereign coin produce propagates, by using Bayesian Style Hitting. With regards to primary informative aspects, the specific results released inside the books so far happen to be instead divergent. Depending on all of them, general debts, foreign currency devaluation (exchange rate), good current standard, development associated with foreign exchange supplies, and also marketplace behavior, would be the most significant aspects appealing amount distributes.

Swanson in addition to Williams (2013) looked into the bond among deliver propagates as well as the swap cost throughout created nations, including the uk as well as Philippines, where the level of sensitivity associated with macroeconomic determinants has been analyzed utilizing information comprising '08 in order to this year. In line with the conclusions in the study, typically the change value element is extremely connected towards the overall performance from your relationship as compared with the specific bond's alternate selling price inside produced nations around the world.

Coroneo as well as Giannone (2014) looked into the effect related to plan tools within the expert from the primary lender, like pumpiing in addition to financial advancement, around the produce return of the state's gives, plus they found that we have a solid partnership among lengthy and even immediate relationship earnings. The specific prediction of those parts might consequently advertise dedication in the additional come back, yet each type of the particular posting contour as well as the create distribute would certainly stay unrevised. An additional study of the comparable personality has been carried out to raised realize macroeconomic aspects making use of multi-factor create shape versions; nonetheless, typically the results exposed there is simply no link among pumping along with the deliver competition from your connection since the consequence of the particular connect additionally pumpiing had been decided individually with the kind of typically the produce contour to begin with (Ang and also Piazzesi, 2003).

Moura together with Brillante (2014) looked into the way the create on the relationship modifications according to the particular unpredicted statement regarding macroeconomic aspects for example interest plus pumping employing a VA design together with vector mistake customization type and also the precise product information through 2006 to be able to this year. These people used information coming from 06\ in order to spring 2012 so as to carry out their own study. Pumpiing in addition to interstate industry are usually two macroeconomic elements that have experienced unexpected changes, based on the conclusions through the research, which may have a brand new substantial impact around the deliver bend. The second summary of the analysis shows there is a web link between intensity on the problems plus the generate on the connection.

Inside a current examine carried out simply by Hard anodized cookware Relationship, amazing results have been present in respect towards hyperlink involving the develop within the Singapore relationship marketplace and even pumping. The information with this study has been put together via quarterly reviews by means of 2014 together with 2015. The inflationary pattern was mentioned within the past one fourth involving 2014, due to a decrease in customer costs connected with zero. 5% more than a six-month time period along with a reduction in the cost of oil-related products. More than this particular period, authorities a genuine possess dropped by simply one 1%, amounting as a way to SGD192 billion dollars, however business you possess have got improved simply by 1 ) nine %, amounting to be able to SGD128 million bucks during this time period (Asian Connection Keep track of, 2015).

-

2.3 Money Supply and Yield Spread

The US government of the nation is able to impact the amount of income blood circulation via a number of systems, which includes open marketplace actions. For example, the main system used by the usa Federal government Book to manage the cash offer may be the buying in addition marketing associated with Treasury Expenses, that leads towards the inclusion and even associated with cash from your economic climate based on the end result. The particular immediate result of the is really a change inside the rate of interest atmosphere (Ozyasar, 2016). Just before this specific year's political election, the specific Government Book experienced launched into a powerful strategy regarding quantitative reducing, which usually wanted in order to encourage monetary advancement simply by improving the amount of money provide as well as decreasing rates of interest through the overall economy. You will find a few components to bear in mind here: 1st, once the Given buys provides (which leads to a rise in the funds supply), the price of a genuine increases due to the particular improved need with regard to you possess. second, if the associated with offers goes up, typically the relationship produce reduces, which is referred to as relationship create contour (Pettinger, 2013). Consequently, it has an inverse partnership among connection produces as well as the related to you will have within the third location. Due to enhance with regard to gives, their own costs boost, causing a reduction in the actual efficient interest on this kind of an actual with time (bond yield). Consequently, it really is obvious that this cash source along with the deliver upon authorities provides come with an inverse connection.

-

2.4 Interest Rate and Yield Spread

For years and years, the eye price is an important take into account the specific main bank's capacity to keep track of the healthiness of the particular state's economic climate. Following a global financial trouble related to 08, a number of governing bodies around the world reduced the actual immediate rate of interest on provides for their minimal interest. Based on the Federal government Book states, this federal government account cost has been reduce twice within 08 in addition this year since the primary financial institution feels that this monitory plan might enhance due to the lower minimal rate of interest (Swanson plus Williams, 2013). Collindufresen in addition to co-office workers (2010) exhibited the likelihood of a good source (a bond) will be linked to the opportunity connected with arrears as well as the interest rate around the relationship. Batten, Jacoby, and even Liao (2014), however, exhibited that this hyperlink among free of risk rates of interest as well as business a genuine continued to be minimum once the capacity of typically the connection organization has been taken into account. Based on within macroeconomic conditions together with authorities guidelines, the particular effect associated with zero-coupon offers continues to be looked into. In addition , cost information along with the nominal/real rate of interest have been regarded as factors. The specific absolutely no discount relationship continues to be discovered to be much less delicate towards small interest, nevertheless the actual rate of interest a lot more very sensitive towards the simply no voucher connect, in line with the results. Based on an additional summary from the study, the actual interest and also the come back within the zero-coupon relationship have been in instant resistance to each other. Consequently, typically the experts subtracted that will no discount provides are ineffectve within the developing procedure, nevertheless an authentic effect might be demonstrated inside medium-term genuine costs. Furthermore, they have shown the requirement of efficient financial coverage to keep a strong very safe market place (Zhang, 2016) Rawal et. al (2021), Poongodi M et. al(2022), Poongodi M et. al (2021), Dhiman P et.al (2022), Sahoo S.K et.al (2022), K.A et. al(2022) , Dhanraj R.K et. al (2020), Yan Zhang et.al (2020), Md Hossain et. al (2021), Md Nazirul Islam Sarker et. al (2021) ,Y. Shi et. al (2020), Guobin Chen et. al (2020).

-

3. DATA AND METHODOLOGY

There has been a number of study carried out around the hyperlink among macroeconomic problems in addition monetary investments employing a number of strategies (Chen, Move plus Increased, 1986; Ozyasar, 2016; Rasheed ainsi que ing. 2020). A good scientific multifactor design is utilized with this function, which has the origins in a number of important scientific analysis within the relationship as well as equities marketplaces, where the particular dimensions found out are usually common. Chen, Spin, additionally Increased (1986) used the multifactor style in order to characterise the specific produces upon opportunities like a functionality related to macroeconomic basic principles in order to clarify typically the generates about stock options.

-

3.1 Analytical Model

Nearly all college students possess depended on essential motorists like company features, economic problems, plus strategy routines to describe this produce propagates after business a genuine inside their research. In comparison, Beckworth, Celestial satellite, in addition to Toles (2010) check out regardless of whether within economical plan or even adjustments within our funds offer have an impact on the particular distributes among company connection generates. By using the VETERANS ADMINISTRATION design along with long-run financial neutrality, they can show that the considerable part of typically the variability within deliver propagates involving corporate and business offers will be, actually produced by simply economic program shock absorbers. It really is specifically significant due to the fact their own results mean that considerable diminishes inside generate advances result from good shock for the money provide.

Minutes ainsi que ing. (2003) look at part connected with solvency and even fluid determinants within determining connect produce distributes throughout building nations, making use of information through the Globe Financial institution. These people found that the particular liquidity-related qualities associated with building marketplaces possess a considerable function inside the environment regarding deliver propagates, that is in line with the simply no restrictions check. It had been the most crucial finding from the examiner. Additionally they realize that typically the fluidity additionally solvency aspects possess the a result of most of the modifications inside attachment arises observed amongst eleven growing financial systems through the nineties time period. The eye cost together with macroeconomic basic principles in the usa are also shown to perform an essential effect within environment the specific rapport develops within just growing countries.

In relation to attachment produce propagates, Hautsch plus Systems (2016) looked over the word framework because the autoregressive procedure will be directly related to the particular unpredictability. In addition, making use of Markov string Mazo Carlo strategies, it had been hypothesised the phrase framework in the rapport would certainly receive the danger from the time-varying doubt from your deliver contour. This specific studies have shown how the produce on the relationship is extremely linked to the specific standing with the economy's macroeconomic atmosphere.

Becoming an extended type of the actual resource prices design and style, the particular multifactor style offers higher flexibility with regard to experts to enhance their own evaluation while putting simply no limitations for the quantity of aspects which may be a part of their own scientific design. Fah (2008) analyzed this impact associated with a number of macroeconomic elements around the produce propagates in between 2 Malaysian Authorities Investments (MGS) along with the deliver distributes among a couple of 10-year MGS utilizing a multifactor design and style. The particular results from your research show which will GROSS DOMESTIC PRODUCT development costs, the cash provide percentage, in addition to commercial manufacturing are almost all favorably associated with MGS produce propagates. Some other factors like forex prices, preserving accounts amounts, supplies, interest rates, and even advantage earnings, however, experienced little impact on typically the create advances in MGS provides.

This particular quantitative research is founded on extra information and it is necessary for a new lab environment. The information upon YTM utilized in this particular assessment has been collected from your Thomson Reuters news agency Eikon data source with regards to this specific analysis. In this instance, the info include month-to-month conclusions regarding YTM with regard to SGS through The month of january 06\ to be able to December 2015, comprising the particular ten-year time period via The month of january 06\. A complete involving fish hunter 360 Singapore Authorities Stock options (SGS) info factors are often gathered (120 by means of each one of the 3 kinds).

It is common practise to use regression analysis to track the movement of one dependent variable in relation to several independent variables. Because there are numerous independent variables in this study, a multifactor model generated from the multiple linear regression equation provided below is utilised to determine the connection between them. The analytical model for the bond yield spread is as follows:

Yield spread i = ₽0 +p i ER i + ₽ 2 IFR i + р з MS i + ₽ 4 IR i + E i

Where:

Yield spreadsi = The difference between YTM of SGS against 3-month treasury bills rates.

-

β 0 = constant

ER i = monthly exchange rate

FR i = monthly inflation rate

MS i = monthly amount of money supply/M2

IR i = monthly interest rates (3-month Treasury Bill rates)

-

ε i = the stochastic error term

Notably, the multifactor model is being utilised to describe events such as recessions or macroeconomic factors that cause investors' income sources to diverge from their investment income in addition to their investment income. Specifically, according to Ross (1976), the Asset Pricing Theory (APT) documented that the long-term average returns of financial assets such as bonds and stocks may have been influenced by only a few important factors that are frequently used, such as the expected return, the implied return, the risk free rate, and the marginal rate of return.

-

4. EMPIRICAL FINDINGS

With this research, all the aspects used are usually classified because possibly scaled period collection and even constant moment selection factors. Desk 1 displays detailed info for that produce propagates associated with Singapore Authorities Investments that are pictured within the chart underneath. The particular provides are often categorized in to a few groups depending on their own maturation intervals, which are 2, 5, in addition 10 years, correspondingly.

Inside Stand one, it may be observed that this imply of all of the chosen offers will be good. SGS3 has got the finest suggest of two. 44, whilst SGS1 offers the cheapest imply regarding only one. 00, that is displayed simply by SGS1. It may be noticed from your distribution from the suggest among the 3 provides this develops equal in porportion towards maturation amount of the specific relationship. Since the reduce come back given by two year SGS need to make on with a lot more danger publicity compared to that will given by the 10-year relationship, the final results are usually intermittent using the general tradeoff character involving risk plus go back. As long as the particular maturation time period is involved, normally, this is incorrect with regard to offers, since regular modify will be mainly employed to assess the riskiness as well as unpredictability in the connection involved.

TABLE 1 Descriptive Statistics of the Bond Yield Spreads

|

N |

Range |

Minimum |

Maximum |

Mean |

Std. Deviation |

Skewness |

Kurtosis |

|

|

SGS1 |

120 |

3.08 |

0.14 |

3.22 |

1.00 |

0.91 |

1.27 |

0.25 |

|

SGS2 |

120 |

3.07 |

0.31 |

3.38 |

1.55 |

0.86 |

0.59 |

-0.63 |

|

SGS3 |

120 |

2.29 |

1.30 |

3.59 |

2.42 |

0.58 |

-0.02 |

-0.46 |

Table 2 indicates that the average exchange rate (ER) of one US dollar versus the Singapore dollar during the past ten years has been 1.37, with a maximum of S$1.64 and a minimum of S$1.22 in the previous ten years. The weakest point of the Singapore dollar was noticed in January 2006, while the strongest point was noted in September 2011. During the previous ten years, the value of the Singapore dollar has varied between the greatest point of S$1.64 and the lowest point of S$1.22.

TABLE 2 Descriptive Statistics of the selected Macroeconomic Variables

|

N |

Range |

Minimum |

Maximum |

Mean Std. Deviation |

Skewness |

Kurtosis |

||

|

ER |

120 |

0.42 |

1.22 |

1.64 |

1.37 |

0.12 |

0.48 |

-0.94 |

|

IFR |

120 |

7.90 |

-1.40 |

6.50 |

2.00 |

1.59 |

0.83 |

1.57 |

|

MS |

120 |

302,732.10 |

219,128.10 |

521,860.20 |

398,323.59 |

92,431.11 |

-0.28 |

-1.21 |

|

IR |

120 |

3.18 |

0.17 |

3.35 |

0.89 |

0.95 |

1.40 |

0.45 |

The outcomes from the Pearson partnership check are usually recorded within Desk a few. Because pointed out inside Stand a few, all of the macroeconomic factors incorporated for that research, aside from cash provide, possess exhibited an optimistic partnership using the produce propagates in the SGSs into account. A remarkably solid good link has been found out between trade cost as well as the rate of interest, nevertheless the funds source (MS) demonstrated an incredibly strong unfavorable relationship together with SGS1 plus SGS2, in addition to a reasonable connection along with SGS3. The specific organization among pumpiing (IFR) plus the create propagates of most offers, however, will be turned out to be incredibly bad.

TABLE 3 Correlation Results

|

ER |

IFR |

MS |

IR |

||

|

Pearson Correlation |

.847** |

.042 |

-.750** |

.982** |

|

|

SGS1 |

Sig. (2-tailed) |

.000 |

.648 |

.000 |

.000 |

|

N |

120 |

120 |

120 |

120 |

|

|

Pearson Correlation |

.826** |

.067 |

-.686** |

.889** |

|

|

SGS2 |

Sig. (2-tailed) |

.000 |

.465 |

.000 |

.000 |

|

N |

120 |

120 |

120 |

120 |

|

|

Pearson Correlation |

.705** |

.051 |

-.629** |

.685** |

|

|

SGS3 |

Sig. (2-tailed) |

.000 |

.580 |

.000 |

.000 |

|

N |

120 |

120 |

120 |

120 |

|

**. Correlation is significant at the 0.01 level (2-tailed).

-

4.1 SGS1 Model- 2-Year SGS

Table four shows the specific summary of the style with regard to several unbeirrbar regression along with assessment associated with L in addition R2 regarding create propagates regarding SGS1, along with the outcomes of the actual evaluation. In line with the whole design, it really is obvious that this predictor aspects possess a solid unerschütterlich link (R persis oleh zero. 988) together with relationship produce propagates. This really is backed from the information. In addition, this Ur sq ., also called the particular pourcentage related to dedication, with this style will be zero. 975, or even 98 percent precise. The particular generate distributes involving SGS1 clarify 98 per-cent from the macroeconomic elements (exchange price, pumpiing, cash provide as well as attention rate) examined with this research, using the leftover two percentage the result of components which were not really incorporated. Consequently, depending on this specific figure, we might infer the type with regard to SGS1 is really an affordable match.

TABLE 4 Model Summary and Analysis of R and R2 for SGS1

According to the results of the analysis of variance, the model is statistically significant, as shown in Table 5. In other words, the mean of the macroeconomic factors included in this model is considerably different from the mean of the other macroeconomic components considered. The correlation between the yield spreads of SGS1 and the country's exchange rate, inflation, money supply, and interest rate has been established since the p-value of 0.000 < α = 0.05 was calculated.

TABLE 5 ANOVA Analysis of SGS1

b. Predictors: (Constant), IR, IFR, MS, ER

Based on the results illustrated in the Table 6, regression model can be created as follows;

Yield spreadi = ₽0 +pi ERi + ₽2 IFRi + рз MSi + ₽4 IRi + EiYield spreadSGS1 = - 2.453 + 1.744 ERi+ 0.021 IFRi+ 0.001 MSi+ 0.818 IRi

So all the variables (ER, IFR, MS, and IR) found to be significant in the 2-year SGS model.

TABLE 6 Multiple Regression Analysis

-

4.2 SGS2 Model- 5-Year SGS

A number of girdling regression variations, such as the study of L plus R2 with regard to produce propagates related to SGS2, are usually summarised within Desk 7, which usually furthermore includes a design overview regarding several thread regression. Entire, it really is obvious that this forecasting aspects possess a solid unbeirrbar link (R persis oleh zero. 919) together with relationship deliver propagates in line with the outcomes of the whole design. In addition, the specific L sq ., also called the particular percentage connected with dedication, with this style will be zero. 845, that is eighty-five percent precise. This particular implies that typically the produce distributes associated with SGS2 clarify eighty five % from your macroeconomic factors (exchange price, pumping, money provide, in addition to attention rate) regarded as with this research, using the leftover fifteen per cent explained simply by elements that have been disregarded. Consequently, based on this particular figure, we may determine the the design of SGS2 will be similarly the recognized type.

TABLE 7 Model Summary and Analysis of R and R2 for SGS2

As per the results of the analysis of variance, the model is statistically significant, as shown in Table 8. This indicates that the means of the macroeconomic components included in this model are statistically substantially different from one another. The yield spreads of SGS2 are therefore clearly related to the country's exchange rate, inflation, money supply and interest rate; this is supported by the data, since p-value 0.000 < α = 0.05.

TABLE 8: ANOVA Analysis of SGS2

b. Predictors: (Constant), IR, IFR, MS, ER

Based on the results shown in Table 9, a multifactor regression model for SGS2 can be formed.

So all the variables (ER, IFR, MS, and IR) found to be significant in the 5-year SGS model.

TABLE 9 Multiple Regression Analysis

|

Model |

B |

Std. Error |

Beta |

t |

Sig. |

|

2 (Constant) |

-5.267 |

1.059 |

-4.975 |

.000 |

|

|

ER |

3.772 |

.608 |

.523 |

6.205 |

.000 |

|

IFR |

.069 |

.023 |

.128 |

3.008 |

.003 |

|

MS |

.002 |

.001 |

.261 |

3.361 |

.001 |

|

IR |

.596 |

.057 |

.657 |

10.459 |

.000 |

|

a. Dependent Variable: SGS2 |

-

4.3 SGS3 Model -10-Year SGS3

Around the subsequent area, the specific overview from the a number of geradlinig regression pattern which has evaluation related to L plus R2 with regard to produce propagates associated with SGS3 has been passed within Desk 10. A powerful thready business (R sama dengan absolutely no. 735) among relationship deliver propagates along with the predictor factors will be obvious from your entire design, that is good information. The particular L sq ., also called the actual pourcentage regarding dedication, with this particular style will be zero. 541, or even fifty four. 1%, which substantial. This specific shows that the particular create distributes involving SGS3 clarify fifty four. 1% in the macroeconomic aspects (exchange price, pumpiing, cash provide, in addition attention rate) contained in the research, using the leftover forty five. nine percent the result of components which were disregarded. Consequently, depending on simply this specific figure, we might determine that this type with regard to SGS3 can also be typically the good match.

TABLE 10 Model Summary and Analysis of R and R2 for SGS3

As per Table 11, the model is significant as deduced by analysis of variance, meaning that the mean of the macroeconomic factors used in this model are significantly different from each other. Therefore, referring to above table, it is clear that there is a relationship between yield spreads of SGS3 with Exchange rate, Inflation, Money Supply and Interest rate of the country, since p-value 0.000 < α = 0.05.

TABLE 11 ANOVA Analysis of SGS2

b. Predictors: (Constant), IR, IFR, MS, ER

Based on the results given in Table 12, a multifactor regression model for SGS3 can be created as follows;

Yield spreadi = ₽0 +pi ERi + ₽2 IFRi + рз MSi + ₽4 IRi + EiYield spreadSGS3 = - 0.626 + 2.104 ERi+ 0.019 IFRi+ 0.000 MSi+ 0.197 IRi

So only ER and IR found to be significant in the 10-year SGS model.

TABLE 12 Multiple Regression Analysis

-

5. DISCUSSION AND IMPLICATIONS

-

5.1 Relationship between Exchange rate and Yield Spreads of SGS

-

5.2 Relationship between Interest rate and Yield Spreads of SGS

Pearson relationship has additionally exposed a considerable good business among rates of interest in addition produce propagates related to SGS, having a 99 % self-confidence period, based on the Pearson partnership. A big change within the interest rate around the Treasury expenses might have an effect around the enhancements made on the particular create distributes, too. Besides the foreign currency price, the attention price is really a considerable element associated with generate advances with this study. This particular obtaining will be like outcomes of research carried out simply by Batten, Fetherston, plus Hoontrakul (2006), that true which will within connection deliver propagates are often mainly affected by simply within interest rates, along with other factors such as the development level along with the stock exchange from the country, which these types of aspects would be the the majority of explainable. Based on the study performed by simply Ahmad, Muhammad, in addition to Masron (2009), modifications in our state's interest (together along with other aspects like commercial manufacturing as well as the customer price index) would be the most important motorists regarding modifications within Malaysian company relationship produce propagates. Especially, these people display that will deliver distributes upon Malaysian authorities investments are just substantially inspired simply by adjustments inside interest levels and also the buyer cost catalog (CPI).

-

5.3 Relationship between Inflation and Yield Spreads of SGS

-

5.4 Relationship between Money Supply and Yield Spreads of SGS

Utilizing 1 % related to importance, the particular Pearson relationship pourcentage for that previously mentioned macroeconomic flexible is extremely unfavorable with regards to the produce propagates upon SGS offers. Based on the outcomes of the specific geradlinig regression assessments, there exists a 95% self-esteem there is a web link among cash provide in addition deliver propagates with regard to SGS1 plus SGS2, yet there is virtually no partnership with regard to SGS3. There are several commonalities between findings of the study and the ones associated with Moments ainsi que ing. (2003), that looked into the actual effect regarding solvency in addition to fluid determinants whenever impacting on connection produce distributes inside building financial systems. The main summary of the study was that will liquidity-related aspects like the funds flow of establishing companies include a considerable part inside the environment involving create advances during these market segments.

The interpretation of data is covered in this section in conjunction with the aims of the research. First, the link between the yield spreads of Singapore Government Securities and observable macroeconomic indicators is examined, and then the significance of the association is determined, signifying that the statistical analysis above has drawn appropriate findings.

In line with the outcomes of this study, a substantial good hyperlink between trade cost as well as the produce propagates associated with Singapore Authorities Investments has been recognized having a 99 percent self-confidence period. The specific deliver propagates related to SGS will be influenced by a big change within the trade price from the Singapore buck compared to MOST OF US money. This particular element will be similarly the most crucial adjustable for that calculation regarding produce distributes inside the test using the finest beta really worth, in fact it is furthermore the main varying within the study using the cheapest beta worth. This specific end result is in line with some other statistical research that have been carried out. For instance , in line with the results of the study carried out simply by Maltritz plus Molchanov (2001) around the determinants connected with nation arrears risk within growing market segments, because shown by simply full sovereign coin deliver propagates, the particular swap price are probably the most essential determinants involving produce distributes, together with elements like complete debts in addition to marketplace emotion.

Chen, Roquet, in addition Alter (2012), nevertheless , look for an unfavorable business among foreign currency denseness (as assessed from the change rate) as well as relationship deliver propagates, where money thickness includes a substantial impact on the offer distributes associated with provides. Current information from your Worldwide Financial Account (2014) shows that modifications in our swap level possess a number of results upon offers, together with a substantial effect on the rise inside relationship distributes contained in typically the overvaluation through the actual alternate value.

Based on a far more present year's analysis, Batten, Jacoby as well as Liao (2014) found that typically the organization between free of risk rate of interest additionally business provides continued to be minimum whenever analyzing the particular monetary benefits of typically the connection organization. At the same time, Betty and also Share (2014) look at unpredictability attractive prices with regards to relationship arises. These people realize that, for any noncallable connection, rates of interest and even relationship propagates are usually positively linked to the statistically substantial outcome, whilst, to get a callable p connection, interest levels together with relationship produces are located to be adversely linked to the particular statistically considerable end result.

Even at the most significant level of 10 percent, the Pearson correlation for inflation demonstrates no relationship with the yield spreads of SGS. However, this variable is statistically significant in the regression test for SGS1 and SGS2, but not for SGS3, according to the results of the study. Because of this, we may infer that there is a link between inflation and yield spreads, particularly for government bonds with shorter maturities, based on the regression study. As a result of the fact that inflation is unpredictable in the long run, relating inflation to yield spreads for longer-term bonds is challenging.

These findings are consistent with the findings of a research conducted by Moura and Gaio (2014), in which they explore how the yield on a bond changes when macroeconomic indicators such as the interest rate and inflation are unexpectedly announced. Bond yields are shown to be significantly affected by unanticipated changes in inflation and interest rates, according to the research. Furthermore, a recent study done by Asian Bond revealed some intriguing data regarding the yield of the Singapore bond market in connection to inflation, which can be seen here. They assert that the yields on government bonds have reduced while the rates on corporate bonds have climbed as a result of the decline in the consumer price index in 2014 and 2015, suggesting that inflation has a direct influence on the yields on SGS.

At the same time, Beckworth, Celestial satellite, and even Toles (2010) check out regardless of whether monetary plan or even shock absorbers towards the cash offer are usually related within just framing typically the distributes among business relationship produces together with authorities relationship brings. To be further, their own outcomes display of which considerable falls within generate arises result from raises within the funds offer, that is incompatible using the results with this study.

-

5.5 Implications drawn from Multifactor Model

Using the design created with this research, you are able to anticipate the particular aspects which will impact produce propagates within the Singapore Authorities Investments marketplace. Nonetheless, to ensure that the style to become precise, extreme caution must be utilized in choosing macroeconomic signals along with the choice of provides together with maturities smaller in comparison to ten years. In a relationship industry, it is very difficult to foresee a genuine having a lengthier maturation given that elements like interest rates plus pumpiing may have considerable unpredictability on the long term, which makes it almost impossible in order to estimation these any kind of level of precision. Based on Ahmad, Muhammad, in addition to Masron (2009), this method can also be extented to countries, such as the study these people carried out around the Malaysian relationship marketplace. It must be pressured, nevertheless , that this accuracy from the type inside determining typically the create distribute differs via country to be able to region and even depends upon what time period chosen.

-

6. CONCLUSION

The specific results from the a number of regression design offer statistically considerable evidence that will modifications inside produce propagates on Singapore authorities offers (2-year plus 5-year bonds) are usually positively associated with modifications in our california's trade price, pumpiing, cash provide, in addition rate of interest. Additionally it is found that the particular deliver disperse associated with 10-year authorities provides will be substantially affected simply by each swap level along with the interest, yet that this hyperlink among pumpiing in addition to funds supply with this particular type of relationship is minimum with this research. Could is true, additionally it is backed from the proven fact that typically the drivers regarding produce propagates obtain less strong since the maturation amount of the specific relationship elongates. To conclude, the particular conclusions from your examine show which will variances within the create distribute involving Singapore federal government provides are simply attentive to particular macroeconomic conditions. Even though some through the results are usually considerable, it must be outlined that may a number of them are certainly not significant sufficient to provide persuasive resistant. This may become due to the little quantity of examples used and also the choice of just a few relationship courses. A number of road users associated with credit score disperse happen to be recognized via analyze, which understanding might be needed connection companies as well as traders for making appropriate expense and even monetary choices. The outcomes might give new info in order to user profile supervisors together with investors, letting them create a much more informed investment decision options. In addition, whilst producing financial plan along with other financial steps, policymakers should workout extreme caution given that these types of guidelines potentially have to be able to impact EMERGENY ROOM, IRGI, IFR, plus MS, all of these possess the feasible to possess a substantial impact on typically the connect create propagate. The information showing how provides functionality, plus the consciousness among marketplace gamers, may be regarding additional support inside the progress the actual Singapore financial debt market place. Nevertheless , since the economic system differs significantly with time, there is absolutely no perfect style that may foresee and even estimation the particular create distributes along with identify precision. Some other primary economical components, such as the associated with essential oil, this Major Household Product (GDP), as well as the stock market, which usually almost all include a substantial effect on typically the state's economic climate, could be integrated in to the type with regard to long term study.